444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey property insurance market represents a dynamic and rapidly evolving sector within the nation’s broader insurance landscape. Property insurance in Turkey encompasses comprehensive coverage for residential, commercial, and industrial properties against various risks including fire, earthquake, flood, theft, and other natural disasters. The market has experienced substantial growth driven by increasing urbanization, rising property values, and enhanced awareness of insurance benefits among Turkish consumers.

Market dynamics indicate that Turkey’s property insurance sector is witnessing significant transformation, with digital adoption rates reaching 42% growth year-over-year. The integration of advanced technologies, regulatory reforms, and expanding middle-class demographics contribute to the market’s robust expansion. Insurance penetration in the property segment has shown remarkable improvement, particularly in metropolitan areas where coverage adoption exceeds 68% of eligible properties.

Geographic distribution reveals that Istanbul, Ankara, and Izmir collectively account for approximately 55% of total property insurance premiums, reflecting the concentration of high-value properties and commercial activities in these urban centers. The market’s resilience is further strengthened by Turkey’s strategic position as a bridge between Europe and Asia, attracting significant foreign investment in real estate and infrastructure development.

The Turkey property insurance market refers to the comprehensive ecosystem of insurance products, services, and solutions designed to protect property owners against financial losses resulting from damage, destruction, or theft of real estate assets. This market encompasses various insurance categories including residential property insurance, commercial property coverage, industrial facility protection, and specialized property insurance for unique assets.

Property insurance in the Turkish context provides financial protection against a wide range of perils including natural disasters such as earthquakes, floods, and storms, as well as man-made risks like fire, theft, vandalism, and civil unrest. The insurance framework operates through a network of domestic and international insurance companies, brokers, agents, and digital platforms that facilitate policy distribution and claims management.

Market participants include traditional insurance carriers, insurtech companies, reinsurance providers, and regulatory bodies that collectively ensure market stability and consumer protection. The Turkish property insurance market serves diverse customer segments ranging from individual homeowners to large corporations, each requiring tailored coverage solutions that address specific risk profiles and asset valuations.

Turkey’s property insurance market demonstrates exceptional growth potential driven by favorable demographic trends, economic development, and regulatory modernization. The sector benefits from increasing consumer awareness, technological advancement, and expanding distribution channels that enhance market accessibility and service delivery.

Key market drivers include mandatory earthquake insurance requirements, growing real estate investments, and rising income levels that enable broader insurance adoption. Digital transformation initiatives have resulted in 38% improvement in customer engagement and policy management efficiency. The market’s competitive landscape features both established domestic insurers and international players seeking to capitalize on Turkey’s emerging market opportunities.

Regulatory developments continue to shape market dynamics, with recent reforms focusing on consumer protection, solvency requirements, and digital insurance frameworks. The Turkish government’s emphasis on disaster preparedness and risk mitigation has created additional demand for comprehensive property insurance coverage, particularly in earthquake-prone regions.

Future prospects remain highly favorable, with projected growth rates indicating sustained expansion across all property insurance segments. The market’s evolution toward digitalization, personalized coverage options, and integrated risk management solutions positions Turkey as an attractive destination for insurance industry investment and innovation.

Market analysis reveals several critical insights that define the Turkey property insurance landscape and its growth trajectory:

Economic growth serves as a primary catalyst for Turkey’s property insurance market expansion. Rising GDP per capita and increased disposable income enable more Turkish citizens to invest in property ownership and subsequently seek comprehensive insurance protection. The country’s robust construction sector and urban development projects create substantial demand for both residential and commercial property insurance coverage.

Regulatory mandates significantly influence market dynamics, particularly the compulsory earthquake insurance law that requires property owners in designated risk zones to maintain adequate coverage. This regulatory framework ensures consistent market demand while promoting risk awareness and financial protection among property owners. Government initiatives supporting disaster preparedness and risk mitigation further strengthen the insurance market’s foundation.

Technological advancement drives market modernization through digital platforms, mobile applications, and automated underwriting systems that enhance customer experience and operational efficiency. The integration of artificial intelligence, big data analytics, and Internet of Things (IoT) devices enables more accurate risk assessment and personalized insurance solutions.

Demographic trends including urbanization, population growth, and changing lifestyle preferences contribute to increased property ownership and insurance awareness. Young professionals and growing middle-class families represent key target segments driving demand for comprehensive property protection. Foreign investment in Turkish real estate also creates additional demand for specialized property insurance products.

Economic volatility presents significant challenges to the Turkey property insurance market, including currency fluctuations, inflation pressures, and interest rate variations that affect both consumer purchasing power and insurance company profitability. These macroeconomic factors can impact premium affordability and claims costs, creating uncertainty in market planning and growth projections.

Natural disaster exposure represents a fundamental constraint, as Turkey’s location in a seismically active region increases catastrophic risk exposure for insurance providers. High-magnitude earthquakes and other natural disasters can result in substantial claims payouts that strain insurance company reserves and potentially limit coverage availability or increase premium costs.

Regulatory complexity and frequent policy changes create operational challenges for insurance companies operating in Turkey. Compliance requirements, capital adequacy standards, and reporting obligations demand significant resources and expertise, particularly for smaller insurance providers or new market entrants seeking to establish operations.

Consumer awareness gaps persist in certain regions and demographic segments, limiting market penetration and growth potential. Traditional attitudes toward insurance, limited financial literacy, and preference for informal risk management approaches can restrict demand for formal property insurance coverage, particularly in rural areas and among older population segments.

Digital transformation presents exceptional opportunities for market expansion and innovation. The development of comprehensive digital insurance platforms, mobile-first customer experiences, and automated claims processing systems can significantly enhance market accessibility and operational efficiency. Insurtech partnerships enable traditional insurers to leverage cutting-edge technologies and reach previously underserved customer segments.

Product innovation opportunities include the development of parametric insurance solutions, usage-based coverage models, and integrated smart home insurance products that appeal to tech-savvy consumers. Customization capabilities through advanced analytics enable insurers to offer personalized coverage options and pricing structures that better match individual risk profiles and preferences.

Market expansion into underserved geographic regions and demographic segments represents significant growth potential. Rural areas, small businesses, and emerging middle-class consumers offer substantial opportunities for market penetration through targeted products, distribution strategies, and educational initiatives that build insurance awareness and adoption.

Strategic partnerships with real estate developers, banks, construction companies, and technology providers can create new distribution channels and integrated service offerings. Cross-selling opportunities with other insurance products and financial services enable comprehensive customer relationship development and increased lifetime value.

Competitive intensity characterizes the Turkey property insurance market, with numerous domestic and international players competing for market share through product differentiation, pricing strategies, and service excellence. Market consolidation trends indicate potential merger and acquisition activities as companies seek to achieve scale advantages and operational synergies.

Customer expectations continue to evolve toward digital-first experiences, transparent pricing, rapid claims processing, and personalized service delivery. Insurance companies must adapt their business models and operational capabilities to meet these changing demands while maintaining profitability and regulatory compliance.

Technology disruption reshapes traditional insurance value chains through artificial intelligence, blockchain technology, and predictive analytics that enable more efficient underwriting, claims management, and customer engagement. Data analytics capabilities become increasingly critical for risk assessment, pricing accuracy, and fraud prevention.

Regulatory evolution influences market dynamics through new compliance requirements, consumer protection measures, and digital insurance frameworks that shape competitive strategies and operational approaches. International standards adoption and best practices implementation enhance market credibility and attract foreign investment.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive surveys, interviews, and focus groups with key market participants including insurance companies, brokers, regulators, and consumers across different geographic regions and demographic segments.

Secondary research incorporates analysis of industry reports, regulatory filings, financial statements, and academic studies to validate primary findings and provide historical context. Data triangulation techniques ensure consistency and reliability across different information sources and research approaches.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting methodologies to project market growth, segment performance, and competitive dynamics. Qualitative insights from expert interviews and industry observations provide context and interpretation for quantitative findings.

Market validation processes include peer review, expert consultation, and cross-referencing with established industry benchmarks to ensure research accuracy and credibility. Continuous monitoring of market developments and regulatory changes enables real-time updates and refinements to research findings and projections.

Western Turkey dominates the property insurance market, accounting for approximately 65% of total premium volume, driven by high property values, industrial concentration, and advanced insurance awareness. Istanbul serves as the primary market hub, hosting major insurance companies and generating substantial commercial property insurance demand through its role as Turkey’s financial and business center.

Central Anatolia represents an emerging growth region with increasing urbanization and industrial development creating new insurance opportunities. Ankara’s status as the capital city contributes to steady demand for both residential and commercial property coverage, while surrounding provinces show gradual market expansion.

Mediterranean and Aegean regions benefit from tourism industry growth and foreign property investment, particularly in coastal areas popular with international buyers. These regions demonstrate strong seasonal demand patterns and specialized insurance requirements for vacation properties and hospitality facilities.

Eastern Turkey presents significant untapped potential despite current low insurance penetration rates. Economic development initiatives, infrastructure investments, and growing awareness of insurance benefits create opportunities for market expansion, though challenges include lower income levels and traditional risk management approaches.

Black Sea region shows steady growth driven by agricultural and industrial activities, with particular demand for coverage against weather-related risks and natural disasters. The region’s economic diversification and urban development contribute to gradual insurance market expansion.

Market leadership is distributed among several key players, each leveraging distinct competitive advantages and strategic positioning:

Competitive strategies focus on digital transformation, product innovation, customer experience enhancement, and strategic partnerships. Market differentiation occurs through specialized coverage options, pricing models, claims service quality, and distribution channel effectiveness.

By Coverage Type:

By Property Type:

By Distribution Channel:

Residential Property Insurance represents the largest market category, driven by homeownership growth and mandatory earthquake coverage requirements. This segment benefits from standardized products, competitive pricing, and simplified underwriting processes that appeal to individual consumers. Digital adoption in residential insurance reaches 41% of new policies, indicating strong consumer preference for online purchasing and management.

Commercial Property Insurance demonstrates the highest growth potential with businesses increasingly recognizing the importance of comprehensive risk protection. This category requires sophisticated underwriting, customized coverage solutions, and specialized claims handling capabilities. Premium growth in commercial segments exceeds residential rates by 15% annually.

Industrial Property Insurance serves specialized manufacturing and processing facilities with complex risk profiles requiring expert underwriting and risk management services. This segment commands premium pricing due to high-value assets and specialized coverage requirements. Risk assessment technology adoption in industrial insurance has improved accuracy by 32%.

Agricultural Property Insurance addresses unique rural property risks including weather damage, equipment protection, and seasonal variations. This category presents growth opportunities through government support programs and increasing agricultural modernization. Coverage penetration in agricultural properties remains below 25%, indicating significant expansion potential.

Insurance Companies benefit from expanding market opportunities, diversified risk portfolios, and improved profitability through advanced underwriting and claims management technologies. Digital transformation enables cost reduction, operational efficiency, and enhanced customer engagement that drive competitive advantage and market share growth.

Property Owners gain financial protection, peace of mind, and access to risk management expertise that helps preserve asset values and ensure business continuity. Comprehensive coverage options provide flexibility and customization that match specific risk profiles and budget requirements.

Real Estate Industry participants including developers, brokers, and property managers benefit from increased property marketability, financing accessibility, and reduced liability exposure. Insurance availability supports property transactions and investment decisions by providing essential risk mitigation.

Economic Development benefits from a robust property insurance market through increased investment confidence, improved disaster resilience, and enhanced financial stability. Risk transfer mechanisms enable economic growth by protecting against catastrophic losses that could otherwise impede development.

Government and Regulators achieve policy objectives including disaster preparedness, consumer protection, and financial system stability through a well-functioning property insurance market. Regulatory frameworks ensure market integrity while promoting innovation and competition.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Approach dominates market evolution with insurance companies investing heavily in online platforms, mobile applications, and automated processes. Customer expectations increasingly favor digital interactions, instant quotes, and self-service capabilities that traditional insurance models struggle to provide efficiently.

Parametric Insurance Solutions gain traction as innovative alternatives to traditional indemnity-based coverage, particularly for earthquake and weather-related risks. These products offer faster claims settlement, reduced administrative costs, and improved transparency that appeal to both insurers and policyholders.

Smart Home Integration creates new opportunities for risk prevention and premium discounts through IoT devices, security systems, and monitoring technologies. Data analytics from connected devices enable more accurate risk assessment and personalized pricing models.

Sustainability Focus influences product development and underwriting practices as climate change concerns drive demand for green building coverage and environmental risk protection. ESG considerations increasingly impact investment decisions and corporate strategies within the insurance sector.

Customer Experience Enhancement through artificial intelligence, chatbots, and personalized service delivery becomes a key differentiator in competitive markets. Omnichannel approaches integrate digital and traditional touchpoints to provide seamless customer journeys.

Regulatory modernization initiatives include updated solvency requirements, digital insurance frameworks, and consumer protection enhancements that reshape market operations and competitive dynamics. Government support for disaster risk reduction and insurance awareness campaigns strengthens market foundations.

Technology partnerships between traditional insurers and fintech companies accelerate digital transformation and innovation adoption. Strategic alliances enable access to advanced capabilities including artificial intelligence, blockchain technology, and predictive analytics.

Market consolidation activities through mergers and acquisitions create larger, more efficient insurance groups with enhanced capital resources and operational capabilities. International expansion by Turkish insurers and foreign investment in domestic companies reshape competitive landscapes.

Product innovation includes launch of usage-based insurance, micro-insurance solutions, and specialized coverage for emerging risks such as cyber threats and climate change impacts. Distribution channel expansion through digital platforms and alternative partnerships increases market accessibility.

Claims processing automation through artificial intelligence and machine learning improves efficiency, accuracy, and customer satisfaction while reducing operational costs. Risk assessment enhancement using satellite imagery, drones, and predictive modeling enables more precise underwriting decisions.

MarkWide Research analysis indicates that insurance companies should prioritize digital transformation investments to remain competitive and meet evolving customer expectations. Technology integration across all business functions from underwriting to claims processing will determine long-term market success and operational efficiency.

Market expansion strategies should focus on underserved geographic regions and demographic segments through targeted products, educational initiatives, and accessible distribution channels. Partnership development with local organizations, government agencies, and community leaders can facilitate market penetration and trust building.

Product innovation opportunities exist in parametric insurance, smart home integration, and customized coverage solutions that address specific customer needs and risk profiles. Data analytics capabilities should be enhanced to enable more accurate pricing, risk assessment, and fraud detection.

Regulatory compliance requires ongoing investment in systems, processes, and expertise to navigate complex requirements and anticipate future changes. Risk management strategies must address both traditional property risks and emerging threats including cyber security and climate change impacts.

Customer experience improvements through omnichannel service delivery, personalized communications, and efficient claims processing will drive retention and growth. Brand differentiation should emphasize service quality, reliability, and value proposition rather than competing solely on price.

Long-term growth prospects for Turkey’s property insurance market remain highly favorable, supported by continued economic development, urbanization trends, and increasing insurance awareness. Market maturation will likely result in more sophisticated products, improved service delivery, and enhanced regulatory frameworks that benefit all stakeholders.

Technology adoption will accelerate across all market segments, with artificial intelligence, blockchain, and IoT devices becoming standard components of insurance operations. Digital natives entering the market as property owners will drive demand for seamless, technology-enabled insurance experiences.

Climate change adaptation will influence product development, risk assessment methodologies, and pricing models as extreme weather events become more frequent and severe. Sustainable insurance practices will gain importance as environmental considerations impact business strategies and customer preferences.

Market consolidation trends may continue as companies seek scale advantages and operational synergies, while new entrants including insurtech startups will challenge traditional business models. International partnerships and foreign investment will likely increase as Turkey’s market attracts global insurance industry attention.

Regulatory evolution will focus on consumer protection, digital insurance frameworks, and systemic risk management as the market grows in size and complexity. MWR projections suggest that successful market participants will be those who effectively balance innovation, compliance, and customer-centricity in their strategic approaches.

Turkey’s property insurance market stands at a pivotal juncture with exceptional growth opportunities driven by favorable demographics, economic development, and technological advancement. The market’s evolution from traditional insurance models toward digital-first, customer-centric approaches reflects broader industry transformation and changing consumer expectations.

Strategic success in this dynamic market requires comprehensive understanding of local conditions, regulatory requirements, and customer needs while leveraging advanced technologies and innovative product solutions. Market participants who effectively balance risk management, operational efficiency, and customer experience will capture the greatest opportunities for sustainable growth and profitability.

Future market development will be shaped by continued digitalization, regulatory modernization, and evolving risk landscapes that demand adaptive strategies and innovative solutions. The Turkey property insurance market represents a compelling opportunity for both domestic and international players seeking to participate in one of the region’s most promising insurance sectors with substantial long-term growth potential.

What is Property Insurance?

Property insurance is a type of coverage that protects individuals and businesses from financial losses related to their property. This includes damage or loss due to events such as fire, theft, or natural disasters.

What are the key players in the Turkey Property Insurance Market?

Key players in the Turkey Property Insurance Market include Anadolu Sigorta, Axa Sigorta, and Allianz Turkey, among others. These companies offer a range of property insurance products tailored to meet the needs of homeowners and businesses.

What are the growth factors driving the Turkey Property Insurance Market?

The Turkey Property Insurance Market is driven by factors such as increasing urbanization, rising awareness of insurance benefits, and the growing frequency of natural disasters. These elements contribute to a higher demand for property insurance coverage.

What challenges does the Turkey Property Insurance Market face?

Challenges in the Turkey Property Insurance Market include regulatory changes, competition among insurers, and the impact of economic fluctuations. These factors can affect pricing and the availability of insurance products.

What opportunities exist in the Turkey Property Insurance Market?

Opportunities in the Turkey Property Insurance Market include the expansion of digital insurance solutions and the potential for tailored insurance products for specific sectors like tourism and agriculture. These innovations can enhance customer engagement and satisfaction.

What trends are shaping the Turkey Property Insurance Market?

Trends in the Turkey Property Insurance Market include the adoption of technology for claims processing and customer service, as well as a growing focus on sustainability in insurance practices. These trends are reshaping how insurers operate and interact with clients.

Turkey Property Insurance Market

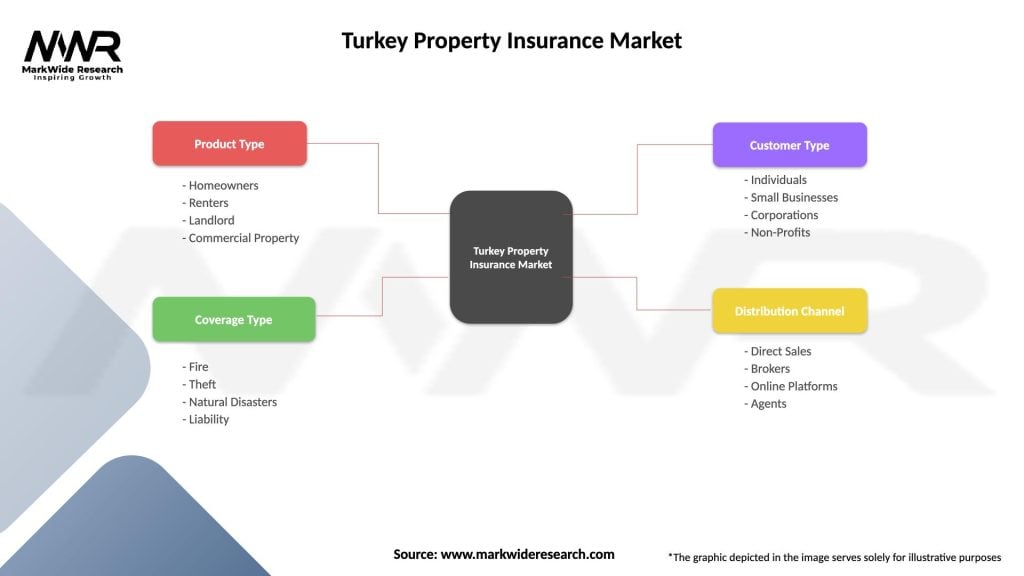

| Segmentation Details | Description |

|---|---|

| Product Type | Homeowners, Renters, Landlord, Commercial Property |

| Coverage Type | Fire, Theft, Natural Disasters, Liability |

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Property Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at