444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey poultry market represents a dynamic and rapidly evolving sector within the global food industry, characterized by increasing consumer demand for lean protein sources and sustainable meat alternatives. This comprehensive market encompasses various segments including fresh turkey meat, processed turkey products, and value-added turkey-based foods that cater to diverse consumer preferences across different regions.

Market dynamics indicate robust growth driven by health-conscious consumers seeking protein-rich alternatives to traditional red meat options. The turkey poultry industry has experienced significant transformation with technological advancements in breeding, processing, and distribution systems contributing to enhanced product quality and market accessibility. Current trends show the market expanding at a steady growth rate of approximately 4.2% annually, reflecting strong consumer adoption and industry innovation.

Regional variations in consumption patterns demonstrate the global nature of turkey poultry demand, with North American markets leading in per-capita consumption while European and Asia-Pacific regions show accelerating growth trajectories. The market benefits from turkey’s positioning as a healthier protein option, containing lower fat content compared to other poultry varieties and offering superior nutritional profiles that appeal to fitness-conscious demographics.

Industry consolidation has created opportunities for both large-scale producers and specialized niche players, with vertical integration strategies becoming increasingly prevalent. Modern turkey production facilities incorporate advanced automation technologies, sustainable farming practices, and enhanced food safety protocols that meet stringent regulatory requirements while optimizing operational efficiency.

The turkey poultry market refers to the comprehensive ecosystem encompassing the breeding, raising, processing, distribution, and retail sale of turkey-based products for human consumption. This market includes various product categories ranging from whole fresh turkeys and turkey parts to processed items such as ground turkey, turkey sausages, deli meats, and ready-to-eat convenience products.

Market participants include turkey breeding companies, commercial turkey farms, processing facilities, distributors, retailers, and foodservice operators who collectively form an integrated supply chain. The market operates through multiple channels including traditional grocery retail, specialty meat markets, foodservice establishments, and increasingly through e-commerce platforms that provide direct-to-consumer access.

Product differentiation within the turkey poultry market encompasses various attributes including organic certification, free-range production methods, antibiotic-free raising practices, and heritage breed varieties. These distinctions cater to evolving consumer preferences for premium, ethically-produced protein sources that align with health and sustainability values.

Strategic analysis of the turkey poultry market reveals a sector positioned for sustained growth driven by fundamental shifts in consumer dietary preferences toward healthier protein options. The market demonstrates resilience through diversified product portfolios that address multiple consumer segments from budget-conscious families to premium health-focused demographics.

Key growth drivers include increasing awareness of turkey’s nutritional benefits, expanding applications in processed food products, and growing adoption in international markets previously dominated by other protein sources. The market benefits from turkey’s versatility in culinary applications and its compatibility with various dietary restrictions including low-fat and high-protein eating plans.

Competitive dynamics show established players investing heavily in production capacity expansion, technological upgrades, and brand development initiatives. Market leaders are pursuing strategic acquisitions and partnerships to strengthen their market positions while emerging companies focus on niche segments such as organic and specialty turkey products.

Innovation trends encompass product development in convenient, ready-to-cook formats, enhanced packaging solutions for extended shelf life, and development of turkey-based protein ingredients for food manufacturing applications. These innovations support market expansion by addressing consumer demands for convenience without compromising nutritional quality.

Consumer behavior analysis reveals significant shifts toward protein-centric diets driving increased turkey consumption across demographic segments. The market benefits from turkey’s perception as a healthier alternative to red meat, with consumers increasingly incorporating turkey products into regular meal planning rather than limiting consumption to seasonal occasions.

Health and wellness trends serve as primary catalysts for turkey poultry market expansion, with consumers increasingly seeking protein sources that support active lifestyles and weight management goals. Turkey’s nutritional profile, featuring high protein content and essential amino acids, aligns perfectly with contemporary dietary preferences emphasizing clean eating and functional nutrition.

Demographic shifts including aging populations in developed markets create sustained demand for easily digestible, nutrient-dense protein sources. Turkey products meet these requirements while offering versatility in preparation methods that accommodate various dietary restrictions and preferences common among older consumer segments.

Foodservice industry growth significantly impacts turkey poultry demand as restaurants, cafeterias, and institutional food providers expand their protein offerings. The foodservice sector appreciates turkey’s cost-effectiveness, consistent quality, and menu versatility that enables creative culinary applications across diverse cuisine types.

Processing technology advancement enables producers to develop innovative turkey products with enhanced convenience features, extended shelf life, and improved taste profiles. These technological capabilities support market expansion by addressing consumer demands for high-quality, convenient protein options that fit busy lifestyles.

International trade facilitation through improved cold chain logistics and regulatory harmonization opens new export opportunities for turkey producers. Enhanced transportation infrastructure and food safety protocols enable market expansion into regions with growing protein consumption and limited domestic turkey production capacity.

Production cost pressures present ongoing challenges for turkey poultry market participants, with feed costs representing significant operational expenses that impact profitability margins. Volatility in corn and soybean prices directly affects production economics, requiring producers to implement sophisticated risk management strategies and operational efficiency improvements.

Regulatory compliance requirements impose substantial costs and operational constraints on turkey producers, particularly regarding food safety standards, environmental regulations, and animal welfare protocols. These requirements, while necessary for consumer protection, create barriers to entry for smaller producers and increase operational complexity for established companies.

Seasonal demand patterns create challenges for production planning and inventory management, with traditional peak consumption periods around holidays creating capacity utilization inefficiencies. Producers must balance production capacity to meet seasonal peaks while maintaining year-round operations that optimize facility utilization.

Consumer price sensitivity in certain market segments limits premium pricing opportunities and constrains profit margins, particularly during economic downturns when consumers prioritize cost over premium attributes. This sensitivity requires careful product positioning and value proposition development to maintain market share.

Disease management risks including avian influenza outbreaks can significantly disrupt production operations and market supply chains. These biological risks require comprehensive biosecurity measures and contingency planning that add operational costs and complexity to turkey production systems.

Product innovation potential offers substantial opportunities for market expansion through development of value-added turkey products that command premium pricing. Opportunities include protein-enhanced convenience foods, turkey-based snack products, and specialized formulations targeting specific dietary requirements such as keto-friendly or paleo-compliant options.

Emerging market penetration presents significant growth opportunities as developing economies experience rising incomes and evolving dietary preferences toward higher protein consumption. These markets offer substantial volume potential for turkey producers capable of adapting products to local taste preferences and price points.

E-commerce channel development enables direct-to-consumer sales models that capture higher margins while building stronger customer relationships. Online platforms allow producers to showcase product quality, share preparation guidance, and develop subscription-based delivery services that ensure consistent customer engagement.

Sustainability positioning creates competitive advantages for producers implementing environmentally responsible practices throughout their operations. Consumer willingness to pay premiums for sustainably-produced turkey products offers opportunities for differentiation and margin enhancement in competitive markets.

Functional food applications present opportunities for turkey protein integration into health-focused food products including protein bars, meal replacement products, and sports nutrition formulations. These applications leverage turkey’s nutritional benefits while accessing higher-margin market segments focused on functional nutrition.

Supply chain evolution demonstrates increasing integration and technological sophistication as market participants seek competitive advantages through operational efficiency and quality consistency. Modern turkey production systems incorporate advanced genetics, precision nutrition, and automated processing technologies that optimize production outcomes while reducing operational costs.

Consumer preference shifts toward transparency and traceability drive market participants to implement comprehensive tracking systems that provide detailed product information throughout the supply chain. These capabilities enable premium positioning and support brand differentiation in increasingly competitive markets.

Competitive intensity continues increasing as established players expand capacity while new entrants target specialized market segments. This competition drives innovation in product development, marketing strategies, and operational efficiency improvements that ultimately benefit consumers through enhanced product quality and value.

Regulatory landscape evolution influences market dynamics through changing food safety requirements, labeling standards, and environmental regulations. Market participants must maintain compliance while adapting operations to meet evolving regulatory expectations that impact production methods and marketing approaches.

Technology integration transforms traditional turkey production through precision agriculture techniques, data analytics, and automated processing systems. These technological advances enable producers to optimize production efficiency, improve product consistency, and reduce operational costs while maintaining high quality standards.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights for stakeholders across the turkey poultry value chain. Primary research initiatives include extensive surveys of industry participants, consumer behavior studies, and in-depth interviews with key market players to capture current market dynamics and future trend indicators.

Data collection processes incorporate both quantitative and qualitative research approaches, utilizing structured questionnaires for statistical analysis and open-ended interviews for deeper market understanding. Research methodologies include supply chain analysis, competitive benchmarking, and consumer preference studies that provide comprehensive market perspective.

Market segmentation analysis examines various dimensions including product categories, distribution channels, consumer demographics, and geographic regions to identify growth opportunities and market trends. This segmentation approach enables targeted analysis of specific market niches and competitive dynamics within each segment.

Industry expert consultation provides valuable insights into market trends, technological developments, and regulatory changes affecting the turkey poultry industry. Expert interviews with production specialists, food scientists, and market analysts contribute to comprehensive understanding of market drivers and future outlook.

North American markets maintain leadership in turkey poultry consumption and production, with the United States representing the largest single market globally. This region demonstrates mature market characteristics with approximately 68% of global turkey consumption occurring within North America, driven by established consumer preferences and well-developed distribution infrastructure.

European markets show steady growth in turkey consumption, particularly in Western European countries where health-conscious consumers increasingly adopt turkey as a regular protein source. The European market benefits from strong regulatory frameworks that ensure product quality while supporting sustainable production practices that align with consumer values.

Asia-Pacific regions represent the fastest-growing markets for turkey poultry, with countries like China, Japan, and Australia showing annual growth rates exceeding 8% as consumers diversify protein consumption patterns. These markets offer substantial long-term growth potential as economic development drives increased protein consumption and dietary diversification.

Latin American markets demonstrate emerging opportunities for turkey poultry expansion, particularly in Brazil, Mexico, and Argentina where growing middle-class populations seek premium protein options. These markets benefit from domestic production capabilities and increasing consumer awareness of turkey’s nutritional benefits.

Middle Eastern and African markets show developing interest in turkey products, particularly in urban areas where consumers have access to modern retail channels and exposure to international food trends. These regions represent long-term growth opportunities as infrastructure development and economic growth support market expansion.

Market leadership is characterized by several major integrated producers who maintain significant market share through vertical integration strategies and comprehensive product portfolios. These industry leaders leverage economies of scale, advanced processing capabilities, and established distribution networks to maintain competitive advantages in core markets.

Competitive strategies include product innovation, brand development, operational efficiency improvements, and strategic partnerships that enhance market positioning. Leading companies invest significantly in research and development to create differentiated products that meet evolving consumer preferences while maintaining cost competitiveness.

Product category segmentation reveals diverse market opportunities across fresh, frozen, and processed turkey products, each serving distinct consumer needs and distribution channels. Fresh turkey products maintain premium positioning while frozen options provide convenience and extended shelf life benefits that appeal to different consumer segments.

By Product Type:

By Distribution Channel:

By Production Method:

Fresh turkey categories demonstrate strong performance in premium market segments where consumers prioritize quality and are willing to pay higher prices for superior products. According to MarkWide Research analysis, fresh turkey products command approximately 35% higher margins compared to frozen alternatives while serving consumers who prioritize taste and texture quality.

Ground turkey segments show exceptional growth potential as consumers seek healthier alternatives to ground beef for everyday cooking applications. This category benefits from versatility in culinary applications and positioning as a lean protein option that supports health-conscious meal planning without sacrificing flavor or cooking convenience.

Processed turkey products represent the fastest-growing market segment, with deli meats, sausages, and ready-to-eat items capturing increasing market share. These products offer convenience benefits that align with busy consumer lifestyles while providing protein-rich options for quick meal solutions and snacking applications.

Organic and specialty categories demonstrate premium growth characteristics with consumers willing to pay significant price premiums for products that meet specific quality and production standards. These segments offer higher profit margins while serving consumers who prioritize environmental sustainability and animal welfare considerations.

Foodservice applications continue expanding as restaurants and institutional food providers recognize turkey’s versatility and cost-effectiveness compared to other protein options. This segment benefits from turkey’s ability to absorb flavors and adapt to various culinary preparations across different cuisine types and menu applications.

Producers benefit from turkey’s efficient feed conversion ratios and relatively short production cycles compared to other livestock options, enabling faster return on investment and more responsive production planning. Turkey production systems offer scalability advantages that allow producers to adjust capacity based on market demand while maintaining operational efficiency.

Processors gain from turkey’s high yield percentages and versatility in product development, enabling diverse product portfolios that serve multiple market segments. Advanced processing technologies allow for value-added product development that captures higher margins while meeting consumer demands for convenience and quality.

Retailers advantage from turkey’s strong consumer recognition and seasonal demand patterns that drive traffic and sales during peak periods. Turkey products offer attractive profit margins while serving as anchor items that encourage additional purchases and customer loyalty development.

Consumers receive significant nutritional benefits from turkey consumption, including high-quality protein, essential amino acids, and lower saturated fat content compared to red meat alternatives. Turkey products provide versatility in meal planning while supporting health and wellness goals through lean protein consumption.

Foodservice operators benefit from turkey’s consistent quality, competitive pricing, and menu versatility that enables creative culinary applications. Turkey products offer reliable supply availability and standardized specifications that support operational efficiency and menu consistency across multiple locations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Convenience-focused innovation drives product development toward ready-to-cook and pre-seasoned turkey products that reduce meal preparation time while maintaining nutritional quality. These trends reflect consumer lifestyle changes and increasing demand for convenient protein options that fit busy schedules without compromising health goals.

Sustainability emphasis influences production practices and consumer purchasing decisions, with producers implementing environmentally responsible farming methods and transparent supply chain practices. This trend creates competitive advantages for companies demonstrating genuine commitment to sustainable operations and environmental stewardship.

Premium product positioning shows continued growth as consumers demonstrate willingness to pay higher prices for products meeting specific quality, production, and ethical standards. Premium segments including organic, free-range, and heritage breed turkeys capture increasing market share despite higher price points.

International market expansion accelerates as producers seek growth opportunities in developing markets with rising protein consumption and limited domestic turkey production. Export opportunities benefit from improved cold chain logistics and international trade facilitation that enable market access expansion.

Technology integration transforms production and processing operations through precision agriculture, automated processing systems, and data analytics that optimize efficiency and quality consistency. These technological advances enable competitive advantages while supporting sustainable production practices.

Production capacity expansion initiatives by major industry players reflect confidence in long-term market growth and demand sustainability. Recent facility investments focus on advanced processing technologies and increased automation that enhance operational efficiency while maintaining product quality standards.

Strategic partnerships between producers and retailers create integrated supply chain relationships that ensure product availability and quality consistency. These partnerships often include exclusive product development agreements and joint marketing initiatives that strengthen market positioning for both parties.

Regulatory compliance advancement demonstrates industry commitment to food safety and quality standards through implementation of enhanced tracking systems and quality assurance protocols. These developments support consumer confidence while enabling market expansion into regions with stringent import requirements.

Product innovation acceleration includes development of functional turkey products with enhanced nutritional profiles and convenient preparation features. Recent innovations focus on protein-enhanced formulations and ready-to-eat options that serve health-conscious consumers seeking convenient nutrition solutions.

Sustainability initiatives encompass comprehensive environmental management programs including renewable energy adoption, waste reduction strategies, and sustainable packaging solutions. These initiatives respond to consumer environmental concerns while creating operational efficiencies that support long-term profitability.

Market positioning strategies should emphasize turkey’s nutritional advantages and versatility while addressing consumer education needs about year-round consumption benefits. Companies should develop comprehensive marketing campaigns that showcase turkey’s role in healthy meal planning beyond traditional seasonal applications.

Product development focus should prioritize convenience features and value-added formulations that meet evolving consumer lifestyle needs. Investment in ready-to-cook products, portion-controlled packaging, and innovative seasoning combinations can capture premium market segments while building customer loyalty.

International expansion planning requires careful market analysis and adaptation strategies that address local taste preferences and regulatory requirements. Companies should consider strategic partnerships with local distributors and gradual market entry approaches that minimize risk while building market presence.

Technology investment priorities should focus on production efficiency improvements and quality consistency enhancements that support competitive positioning. Automation technologies and data analytics systems offer opportunities for cost reduction while improving product quality and operational reliability.

Sustainability integration should become a core business strategy rather than a secondary consideration, with comprehensive environmental management programs that create competitive advantages. Companies demonstrating genuine sustainability commitment can capture premium market segments while building long-term brand value.

Long-term growth prospects for the turkey poultry market remain positive, driven by fundamental consumer trends toward healthier protein consumption and increasing global protein demand. MWR projections indicate sustained market expansion with annual growth rates of 4-6% expected over the next five years across major markets.

Innovation opportunities will continue expanding as food technology advances enable new product development possibilities and processing improvements. Future innovations may include enhanced nutritional formulations, extended shelf-life products, and novel preparation methods that further increase turkey’s appeal to diverse consumer segments.

Market consolidation trends are expected to continue as larger companies seek economies of scale and smaller producers focus on specialized niche markets. This consolidation will likely result in more efficient supply chains and enhanced product quality while creating opportunities for innovative companies to capture specific market segments.

International market development will accelerate as global trade facilitation improves and emerging markets develop stronger protein consumption patterns. Export opportunities will expand particularly in Asia-Pacific and Latin American regions where economic development supports increased protein consumption and dietary diversification.

Sustainability requirements will become increasingly important competitive factors as consumers and regulators demand environmentally responsible production practices. Companies investing early in sustainable operations will gain competitive advantages while those failing to adapt may face market share losses and regulatory challenges.

The turkey poultry market demonstrates strong fundamentals and promising growth prospects driven by consumer health consciousness, product innovation, and expanding international opportunities. Market participants who successfully navigate evolving consumer preferences while maintaining operational efficiency and product quality will capture the greatest benefits from this dynamic market environment.

Strategic success factors include comprehensive understanding of regional market differences, investment in technology and sustainability initiatives, and development of differentiated products that meet specific consumer needs. Companies that balance growth ambitions with operational excellence while maintaining focus on consumer value creation will achieve sustainable competitive advantages.

Future market leadership will belong to organizations that demonstrate adaptability, innovation capability, and genuine commitment to meeting evolving consumer expectations for quality, convenience, and sustainability. The turkey poultry market offers substantial opportunities for companies prepared to invest in long-term market development while maintaining focus on operational excellence and customer satisfaction.

What is Turkey Poultry?

Turkey poultry refers to domesticated turkeys raised for meat production, which is a significant segment of the poultry industry. These birds are known for their large size and are commonly consumed during festive occasions and holidays.

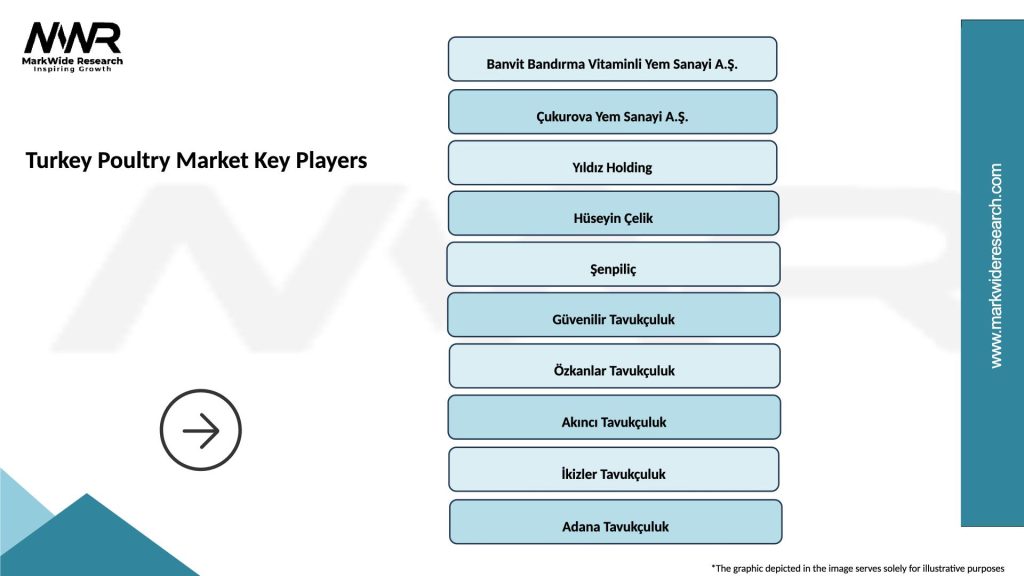

Who are the key players in the Turkey Poultry Market?

Key players in the Turkey Poultry Market include Butterball, Jennie-O Turkey Store, and Perdue Farms, among others. These companies are involved in various aspects of turkey production, processing, and distribution.

What are the growth factors driving the Turkey Poultry Market?

The Turkey Poultry Market is driven by increasing consumer demand for protein-rich diets, the popularity of turkey as a healthier meat option, and the growth of the food service industry. Additionally, rising awareness of the nutritional benefits of turkey contributes to market expansion.

What challenges does the Turkey Poultry Market face?

The Turkey Poultry Market faces challenges such as fluctuating feed costs, disease outbreaks affecting poultry health, and competition from alternative protein sources. These factors can impact production efficiency and profitability.

What opportunities exist in the Turkey Poultry Market?

Opportunities in the Turkey Poultry Market include the development of value-added products, such as pre-cooked and seasoned turkey items, and expanding into emerging markets where poultry consumption is on the rise. Innovations in breeding and farming practices also present growth potential.

What trends are shaping the Turkey Poultry Market?

Trends in the Turkey Poultry Market include a growing preference for organic and free-range turkey products, increased focus on sustainability in farming practices, and the rise of online sales channels for poultry products. These trends reflect changing consumer preferences and market dynamics.

Turkey Poultry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Whole Chicken, Chicken Breasts, Chicken Thighs, Chicken Wings |

| Distribution Channel | Supermarkets, Online Retail, Wholesalers, Convenience Stores |

| End User | Households, Restaurants, Food Service, Catering |

| Packaging Type | Vacuum Sealed, Tray Pack, Bulk, Canned |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Poultry Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at