444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Turkey commercial construction market represents a dynamic and rapidly evolving sector that has become a cornerstone of the nation’s economic development. This comprehensive market encompasses diverse construction activities including office buildings, retail complexes, hospitality facilities, healthcare infrastructure, and industrial developments across Turkey’s major metropolitan areas. The market has demonstrated remarkable resilience and growth potential, driven by urbanization trends, foreign investment inflows, and government infrastructure initiatives.

Market dynamics indicate that Turkey’s strategic geographical position between Europe and Asia has positioned it as a crucial hub for commercial development. The construction sector benefits from a growing population of over 84 million people, increasing urbanization rates of approximately 76% urban population, and expanding business activities across various industries. Major cities including Istanbul, Ankara, Izmir, and Bursa continue to attract significant commercial construction investments.

Growth trajectories in the Turkish commercial construction market reflect strong demand from both domestic and international investors. The market has experienced substantial expansion in recent years, with construction activities showing a projected compound annual growth rate of 8.2% CAGR through the forecast period. This growth is supported by favorable government policies, infrastructure development programs, and increasing foreign direct investment in commercial real estate projects.

The Turkey commercial construction market refers to the comprehensive sector encompassing the planning, design, development, and construction of non-residential buildings and infrastructure projects intended for business, commercial, and industrial purposes throughout Turkey. This market includes various construction activities ranging from office complexes and shopping centers to manufacturing facilities and logistics hubs.

Commercial construction in Turkey specifically involves the creation of structures that generate revenue through business operations, rental income, or commercial activities. The sector encompasses new construction projects, renovation and modernization of existing facilities, and infrastructure development that supports commercial activities. Key components include structural engineering, architectural design, project management, and specialized construction services tailored to commercial requirements.

Market participants include construction companies, real estate developers, architectural firms, engineering consultancies, material suppliers, and various specialized contractors. The sector also involves financial institutions, government agencies, and international investors who contribute to project funding and regulatory oversight. This comprehensive ecosystem supports Turkey’s position as a regional commercial construction hub.

Turkey’s commercial construction market has emerged as a significant driver of economic growth, supported by strategic government initiatives and increasing private sector investment. The market benefits from Turkey’s advantageous geographic location, skilled workforce, and growing demand for modern commercial infrastructure across various sectors including retail, hospitality, healthcare, and industrial development.

Key market drivers include rapid urbanization, population growth, expanding tourism industry, and increasing foreign investment in Turkish commercial real estate. The government’s focus on infrastructure development and urban renewal projects has created substantial opportunities for commercial construction companies. Additionally, Turkey’s membership in various international trade organizations has facilitated cross-border investment and technology transfer in construction practices.

Market segmentation reveals diverse opportunities across different construction types, with office buildings representing approximately 35% market share, retail and commercial complexes accounting for 28% market share, and industrial facilities comprising 22% market share. The remaining segments include hospitality, healthcare, and mixed-use developments that continue to show strong growth potential.

Regional distribution shows concentrated activity in major metropolitan areas, with Istanbul leading commercial construction activities, followed by Ankara, Izmir, and emerging secondary cities. The market outlook remains positive, supported by continued economic development, infrastructure investment, and Turkey’s strategic position as a bridge between European and Asian markets.

Strategic market insights reveal several critical factors shaping Turkey’s commercial construction landscape. The market demonstrates strong resilience and adaptability, with construction companies increasingly adopting modern technologies and sustainable building practices to meet evolving client demands and regulatory requirements.

Economic growth serves as the primary driver for Turkey’s commercial construction market, with expanding GDP and increasing business activities creating substantial demand for modern commercial infrastructure. The country’s strategic economic policies and business-friendly environment continue to attract domestic and international investment in commercial real estate development.

Urbanization trends significantly impact market dynamics, as Turkey’s urban population continues to grow, creating demand for office buildings, retail centers, and commercial facilities. Major cities are experiencing rapid expansion, requiring substantial commercial construction to support growing business activities and employment opportunities. This urbanization process drives approximately 12% annual increase in commercial space demand.

Tourism industry growth represents another crucial market driver, with Turkey’s position as a major tourist destination creating substantial demand for hospitality infrastructure, retail facilities, and entertainment complexes. The tourism sector’s contribution to GDP necessitates continuous investment in commercial construction projects that support visitor accommodation and services.

Foreign direct investment continues to fuel market expansion, with international companies establishing operations in Turkey and requiring modern commercial facilities. Government incentives for foreign investment, combined with Turkey’s strategic location and skilled workforce, attract multinational corporations seeking regional headquarters and manufacturing facilities.

Infrastructure development programs initiated by the government create synergistic effects that boost commercial construction demand. Major transportation projects, urban renewal initiatives, and smart city developments generate opportunities for complementary commercial construction projects that serve growing communities and business districts.

Economic volatility poses significant challenges to Turkey’s commercial construction market, with currency fluctuations and inflation affecting project costs and investment decisions. Economic uncertainties can delay project approvals and impact financing availability for large-scale commercial construction developments.

Regulatory complexities sometimes create obstacles for commercial construction projects, particularly regarding environmental approvals, zoning regulations, and building permits. While the government has streamlined many processes, complex projects may still face bureaucratic delays that impact project timelines and costs.

Material cost fluctuations represent ongoing challenges for construction companies, with global commodity price variations affecting steel, cement, and other essential construction materials. These cost variations can impact project profitability and require careful risk management strategies.

Labor shortages in specialized construction trades occasionally constrain market growth, particularly for projects requiring advanced technical skills or specialized expertise. The construction industry competes with other sectors for skilled workers, sometimes leading to increased labor costs and project delays.

Environmental regulations while beneficial for sustainability, can increase project complexity and costs. Compliance with environmental standards, earthquake safety requirements, and energy efficiency regulations requires additional investment in design and construction processes.

Smart city initiatives present substantial opportunities for commercial construction companies specializing in technology-integrated buildings and infrastructure. Turkey’s commitment to developing smart cities creates demand for commercial facilities equipped with advanced building management systems, energy-efficient technologies, and digital infrastructure.

Sustainable construction represents a growing market opportunity, with increasing demand for green buildings and environmentally responsible construction practices. Companies that develop expertise in sustainable construction methods and green building certifications can capture premium market segments and meet evolving client requirements.

Industrial zone development offers significant opportunities as Turkey expands its manufacturing capabilities and attracts foreign industrial investment. Specialized industrial construction, logistics facilities, and manufacturing plants require expertise in complex commercial construction projects that support industrial operations.

Healthcare infrastructure expansion creates opportunities for specialized commercial construction companies, with growing demand for modern hospitals, medical centers, and healthcare facilities. Turkey’s developing healthcare sector requires substantial investment in medical infrastructure that meets international standards.

Mixed-use developments represent emerging opportunities that combine residential, commercial, and retail elements in integrated projects. These complex developments require sophisticated project management and construction expertise, offering higher-value opportunities for qualified construction companies.

Supply and demand dynamics in Turkey’s commercial construction market reflect the interplay between economic growth, urbanization, and investment flows. Demand for commercial construction services continues to outpace supply in many segments, creating favorable conditions for construction companies and supporting price stability across various project types.

Competitive dynamics show a market structure that includes large international construction companies, established domestic firms, and specialized contractors serving niche segments. Competition drives innovation in construction methods, project delivery, and client service, benefiting the overall market development and efficiency improvements of approximately 15% productivity gains.

Technology adoption is reshaping market dynamics, with digital construction technologies, automation, and advanced project management systems becoming standard practice. Companies that successfully integrate technology achieve competitive advantages through improved efficiency, quality control, and project delivery capabilities.

Financial dynamics involve complex interactions between project financing, construction costs, and market returns. Access to financing remains crucial for large commercial construction projects, with banks, development finance institutions, and international investors providing capital for major developments.

Regulatory dynamics continue to evolve, with government policies supporting construction industry development while ensuring safety, environmental protection, and quality standards. Recent regulatory improvements have streamlined permitting processes, reducing project approval times by approximately 25% efficiency improvement.

Comprehensive market analysis for Turkey’s commercial construction sector employs multiple research methodologies to ensure accurate and reliable market insights. The research approach combines quantitative data analysis with qualitative market intelligence gathered from industry participants, government sources, and market observations.

Primary research involves direct engagement with key market participants including construction companies, real estate developers, government officials, and industry associations. Structured interviews and surveys provide firsthand insights into market trends, challenges, and opportunities from industry practitioners actively involved in commercial construction projects.

Secondary research encompasses analysis of government statistics, industry reports, construction permits data, and economic indicators that influence commercial construction activities. This research includes examination of construction industry publications, regulatory documents, and economic data from Turkish statistical authorities.

Market data validation ensures accuracy through cross-referencing multiple sources and verification of key market metrics. MarkWide Research employs rigorous data validation processes to confirm market trends and eliminate potential discrepancies in market intelligence.

Analytical frameworks include market segmentation analysis, competitive landscape assessment, and trend identification using both historical data and forward-looking projections. The research methodology incorporates regional analysis, sector-specific insights, and technology impact assessment to provide comprehensive market understanding.

Istanbul region dominates Turkey’s commercial construction market, accounting for approximately 42% regional market share due to its status as the country’s economic and financial center. The city attracts substantial commercial construction investment in office buildings, retail complexes, and mixed-use developments that serve its large population and extensive business activities.

Ankara region represents the second-largest commercial construction market, comprising roughly 18% regional market share, driven by government facilities, administrative buildings, and commercial developments that support the capital city’s administrative and business functions. The region benefits from stable demand for government-related construction projects and growing private sector activities.

Izmir and Aegean region account for approximately 15% regional market share, with commercial construction activities focused on port facilities, industrial developments, and tourism-related infrastructure. The region’s strategic location and industrial base create demand for specialized commercial construction projects.

Antalya and Mediterranean region contribute about 12% regional market share, primarily driven by tourism infrastructure, hospitality facilities, and retail developments that serve the region’s significant tourism industry. Commercial construction in this region focuses on projects that support seasonal tourism and year-round business activities.

Other regions including Central Anatolia, Black Sea, and Eastern regions collectively represent 13% regional market share, with growing commercial construction activities supported by regional development programs and emerging economic opportunities in secondary cities.

Market leadership in Turkey’s commercial construction sector includes both domestic and international companies that have established strong market positions through expertise, project delivery capabilities, and client relationships. The competitive landscape reflects a diverse mix of large-scale contractors, specialized firms, and emerging companies serving different market segments.

Competitive strategies focus on technological innovation, project delivery excellence, and specialized expertise in high-value commercial construction segments. Companies compete based on technical capabilities, project management efficiency, and ability to handle complex commercial construction requirements.

By Construction Type:

By Project Size:

By Technology Integration:

Office building construction represents the largest segment in Turkey’s commercial construction market, driven by expanding business activities and corporate growth. This category benefits from increasing demand for modern office spaces that meet international standards and incorporate advanced building technologies. Major cities continue to attract office construction investment from both domestic and international companies.

Retail and commercial construction shows strong growth potential, supported by Turkey’s large consumer market and growing retail sector. Shopping centers, retail complexes, and commercial facilities require specialized construction expertise to create attractive and functional spaces that meet retailer requirements and consumer expectations.

Industrial construction benefits from Turkey’s expanding manufacturing sector and strategic location for industrial operations. This category includes specialized facilities requiring technical expertise in industrial construction methods, safety systems, and operational efficiency considerations.

Hospitality construction remains important for Turkey’s tourism industry, with demand for hotels, resorts, and entertainment facilities. This segment requires specialized knowledge of hospitality design, guest experience optimization, and operational efficiency in construction planning.

Healthcare construction represents a growing category as Turkey invests in modern healthcare infrastructure. Medical facilities require specialized construction expertise in healthcare design, medical equipment integration, and regulatory compliance for healthcare environments.

Construction companies benefit from diverse market opportunities across multiple commercial construction segments, enabling portfolio diversification and risk management. The market provides opportunities for specialization in high-value segments and development of expertise in emerging construction technologies and sustainable building practices.

Real estate developers gain access to growing demand for commercial properties across Turkey’s major cities and emerging markets. The market offers opportunities for large-scale development projects and mixed-use developments that combine multiple commercial functions for enhanced investment returns.

Material suppliers benefit from sustained demand for construction materials across various commercial construction projects. The market provides opportunities for suppliers to develop specialized products and services that meet the specific requirements of commercial construction applications.

Technology providers find substantial opportunities in Turkey’s commercial construction market through demand for building automation systems, construction technologies, and smart building solutions. The market supports technology adoption and innovation in construction methods and building operations.

Financial institutions benefit from financing opportunities for commercial construction projects, including project financing, development loans, and investment in commercial real estate. The market provides diversified lending opportunities across different construction segments and project sizes.

Government entities benefit from commercial construction activities through economic development, employment creation, and tax revenue generation. The construction sector contributes to urban development goals and infrastructure improvement objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping Turkey’s commercial construction market, with increasing adoption of Building Information Modeling (BIM), digital project management systems, and construction automation technologies. These digital tools improve project efficiency, reduce costs, and enhance quality control throughout the construction process.

Sustainable construction practices are becoming mainstream in Turkish commercial construction, with growing demand for green building certifications, energy-efficient systems, and environmentally responsible construction methods. This trend reflects both regulatory requirements and client preferences for sustainable commercial facilities.

Mixed-use development represents a significant trend in commercial construction, with projects combining office, retail, residential, and entertainment functions in integrated developments. These complex projects require sophisticated planning and construction expertise while offering enhanced investment returns and urban development benefits.

Smart building integration is gaining momentum, with commercial construction projects increasingly incorporating advanced building management systems, IoT sensors, and automated building operations. This trend supports operational efficiency and tenant satisfaction in modern commercial facilities.

Prefabrication and modular construction methods are gaining acceptance in Turkish commercial construction, offering advantages in construction speed, quality control, and cost management. These methods are particularly valuable for repetitive building elements and standardized commercial facility components.

International collaboration continues to expand, with Turkish construction companies partnering with international firms to access advanced technologies, financing, and global market opportunities. This trend enhances the capabilities and competitiveness of Turkish commercial construction companies.

Technology adoption initiatives have accelerated across Turkey’s commercial construction sector, with major companies investing in digital construction technologies, automated equipment, and advanced project management systems. These developments improve construction efficiency and project delivery capabilities while reducing costs and enhancing quality control.

Sustainability certifications are becoming standard requirements for commercial construction projects, with increasing numbers of developments seeking LEED, BREEAM, or similar green building certifications. This development reflects growing environmental awareness and regulatory requirements for sustainable construction practices.

Infrastructure integration projects have expanded, with commercial construction developments increasingly connected to major transportation infrastructure, smart city systems, and urban development initiatives. These integrated approaches enhance the value and functionality of commercial construction projects.

International partnership agreements have increased between Turkish construction companies and global firms, facilitating technology transfer, financing access, and market expansion opportunities. These partnerships strengthen the capabilities of Turkish commercial construction companies in serving both domestic and international markets.

Regulatory modernization efforts by the Turkish government have streamlined construction permitting processes, updated building codes, and improved project approval procedures. These developments reduce bureaucratic obstacles and support more efficient commercial construction project delivery.

Workforce development programs have expanded to address skill requirements in modern commercial construction, with training initiatives focusing on digital construction technologies, sustainable building practices, and advanced construction methods. These programs support industry growth and competitiveness.

Strategic positioning recommendations for commercial construction companies include developing expertise in high-growth segments such as smart buildings, sustainable construction, and mixed-use developments. Companies should invest in technology adoption and workforce training to maintain competitive advantages in evolving market conditions.

Market diversification strategies should focus on expanding service offerings across multiple commercial construction segments to reduce dependency on single market areas. MWR analysis suggests that companies with diversified portfolios demonstrate greater resilience during economic fluctuations and market changes.

Technology investment priorities should emphasize digital construction tools, project management systems, and building automation technologies that improve efficiency and client satisfaction. Companies that successfully integrate technology achieve competitive advantages and higher profit margins in commercial construction projects.

Partnership development with international firms, technology providers, and financial institutions can provide access to advanced capabilities, financing options, and global market opportunities. Strategic partnerships enable Turkish construction companies to compete effectively in large-scale commercial construction projects.

Sustainability focus should become integral to business strategy, with companies developing expertise in green building practices, energy-efficient construction methods, and environmental compliance. This focus positions companies for growing demand in sustainable commercial construction segments.

Regional expansion opportunities exist in Turkey’s secondary cities and emerging markets where commercial construction demand is growing. Companies should evaluate expansion strategies that leverage their expertise while serving underserved regional markets.

Market growth prospects for Turkey’s commercial construction sector remain positive, supported by continued economic development, urbanization trends, and infrastructure investment. The market is projected to maintain steady growth with a 7.5% projected CAGR over the next five years, driven by diverse demand across multiple commercial construction segments.

Technology integration will continue to reshape the commercial construction landscape, with advanced digital tools, automation, and smart building systems becoming standard practice. Companies that successfully adopt and integrate these technologies will achieve competitive advantages and improved project delivery capabilities.

Sustainability requirements are expected to become more stringent, with green building practices and environmental compliance becoming mandatory for most commercial construction projects. This trend will drive innovation in sustainable construction methods and create opportunities for companies with environmental expertise.

International expansion opportunities for Turkish construction companies are likely to increase, particularly in regional markets and countries with similar development needs. Turkey’s strategic location and construction expertise position its companies well for international commercial construction projects.

Market consolidation may occur as smaller construction companies seek partnerships or acquisition opportunities to compete effectively in large-scale commercial construction projects. This consolidation could create stronger, more capable construction companies with enhanced service offerings.

Investment flows from both domestic and international sources are expected to continue supporting commercial construction market growth. Government infrastructure programs and private sector investment will provide sustained demand for commercial construction services across Turkey’s major markets.

Turkey’s commercial construction market represents a dynamic and growing sector with substantial opportunities for construction companies, developers, and related industry participants. The market benefits from strong economic fundamentals, strategic geographic location, and supportive government policies that create favorable conditions for commercial construction investment and development.

Market drivers including urbanization, economic growth, foreign investment, and infrastructure development provide sustained demand for commercial construction services across diverse segments. The sector’s resilience and adaptability have been demonstrated through various economic cycles, positioning it well for continued growth and development.

Future success in Turkey’s commercial construction market will depend on companies’ ability to adapt to evolving technologies, sustainability requirements, and changing client expectations. Organizations that invest in digital capabilities, sustainable practices, and workforce development will be best positioned to capitalize on emerging opportunities and maintain competitive advantages in this dynamic market environment.

What is Turkey Commercial Construction?

Turkey Commercial Construction refers to the sector involved in the building and renovation of commercial properties such as offices, retail spaces, and industrial facilities within Turkey.

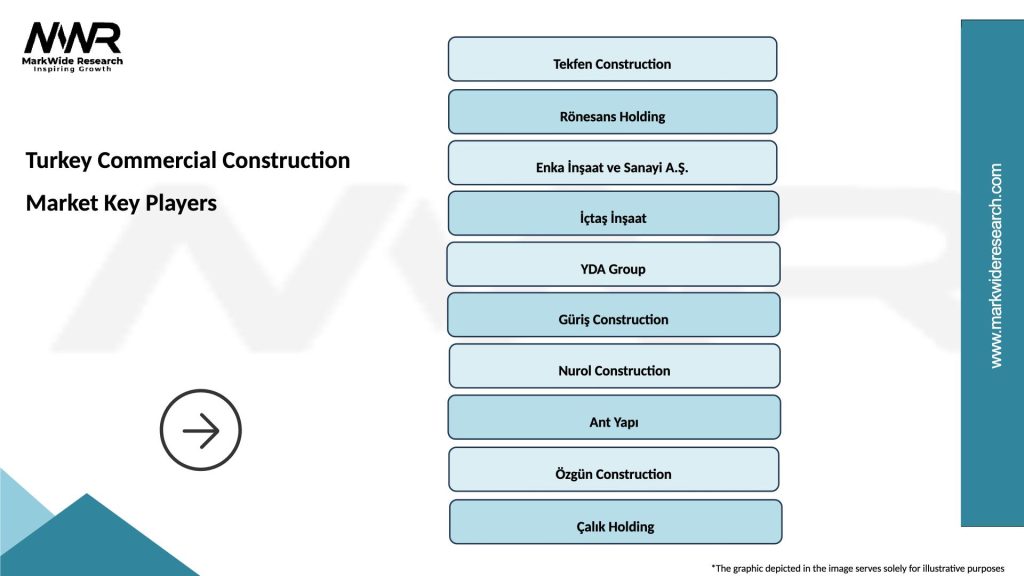

What are the key players in the Turkey Commercial Construction Market?

Key players in the Turkey Commercial Construction Market include companies like Rönesans Holding, YDA Group, and Tekfen Construction, among others.

What are the main drivers of growth in the Turkey Commercial Construction Market?

The main drivers of growth in the Turkey Commercial Construction Market include urbanization, increased foreign investment, and government infrastructure initiatives aimed at boosting economic development.

What challenges does the Turkey Commercial Construction Market face?

Challenges in the Turkey Commercial Construction Market include fluctuating material costs, regulatory hurdles, and economic instability that can affect project financing and timelines.

What opportunities exist in the Turkey Commercial Construction Market?

Opportunities in the Turkey Commercial Construction Market include the development of sustainable buildings, the rise of smart construction technologies, and the potential for public-private partnerships in infrastructure projects.

What trends are shaping the Turkey Commercial Construction Market?

Trends shaping the Turkey Commercial Construction Market include a focus on green building practices, the integration of digital technologies in project management, and a shift towards mixed-use developments that combine residential and commercial spaces.

Turkey Commercial Construction Market

| Segmentation Details | Description |

|---|---|

| Product Type | Concrete, Steel, Wood, Glass |

| End User | Government, Commercial, Residential, Infrastructure |

| Technology | Modular Construction, Green Building, Smart Building, Prefabrication |

| Service Type | Design, Project Management, Construction, Renovation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Turkey Commercial Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at