444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview: The truck and bus radial tire market holds a pivotal position in the automotive industry, providing essential components for commercial vehicles. These radial tires are designed to meet the specific demands of trucks and buses, offering durability, load-carrying capacity, and fuel efficiency. As integral parts of the transportation sector, these tires contribute significantly to the safety and performance of commercial fleets worldwide.

Meaning: Truck and bus radial tires refer to a specialized category of tires designed for use in commercial vehicles, including trucks and buses. Unlike bias-ply tires, radial tires have reinforcing layers that run radially from the center of the tire, providing enhanced stability, fuel efficiency, and tread life. These tires play a critical role in ensuring the safety and operational efficiency of large-scale transportation.

Executive Summary: The truck and bus radial tire market have experienced steady growth, driven by the expansion of the commercial vehicle sector globally. The increasing demand for efficient and reliable tires that can withstand heavy loads and long-distance travel has propelled the market forward. Manufacturers in this industry focus on innovations to meet the evolving needs of fleet operators, emphasizing factors such as tread design, fuel efficiency, and overall tire performance.

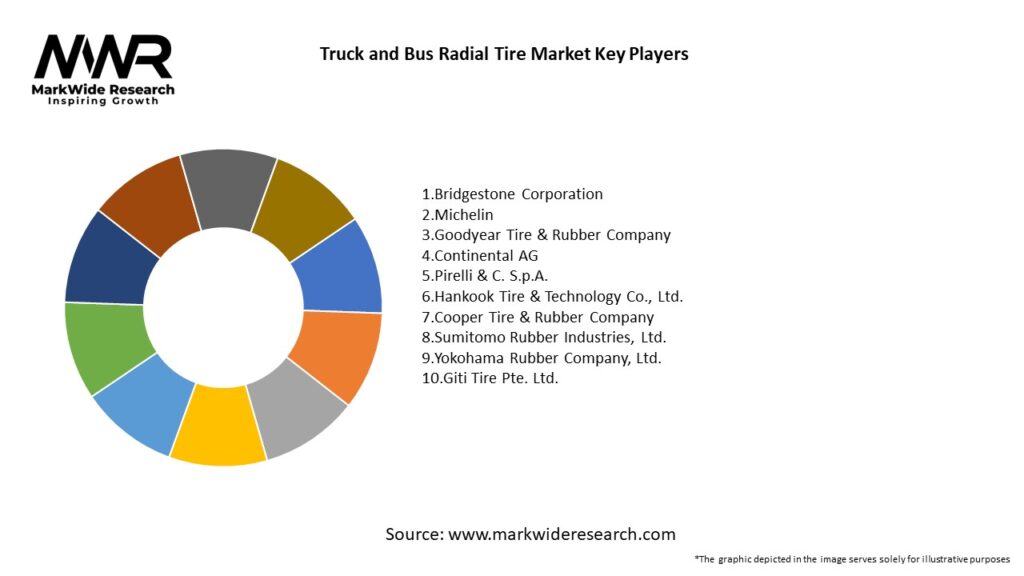

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The truck and bus radial tire market operate in a dynamic environment influenced by factors such as economic conditions, technological advancements, regulatory changes, and the evolving needs of the transportation industry. Understanding these dynamics is essential for industry participants to navigate challenges and capitalize on opportunities.

Regional Analysis: The market for truck and bus radial tires exhibits regional variations influenced by factors such as infrastructure development, economic conditions, and transportation needs. Key regions include:

Competitive Landscape:

Leading Companies in the Truck and Bus Radial Tire Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation: The truck and bus radial tire market can be segmented based on various factors, including:

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders: The truck and bus radial tire market offer several benefits for industry participants and stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the internal strengths and weaknesses and external opportunities and threats of the truck and bus radial tire market:

Understanding these factors through a SWOT analysis helps industry participants formulate strategies to leverage strengths, address weaknesses, capitalize on opportunities, and mitigate threats.

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic had a notable impact on the truck and bus radial tire market:

Key Industry Developments

Analyst Suggestions

Analysts recommend the following strategies:

Future Outlook: The future outlook for the truck and bus radial tire market presents a mix of challenges and opportunities:

Conclusion: In conclusion, the truck and bus radial tire market plays a crucial role in supporting the global commercial vehicle industry. As the industry navigates challenges and embraces opportunities, the focus on reliability, sustainability, and technological innovation will remain paramount. Manufacturers and stakeholders need to adapt to changing market dynamics and consumer expectations to ensure long-term success in this dynamic and essential segment of the automotive industry.

What is Truck and Bus Radial Tire?

Truck and Bus Radial Tire refers to a type of tire designed specifically for heavy-duty vehicles such as trucks and buses, featuring radial construction that enhances durability, fuel efficiency, and performance on various road conditions.

What are the key players in the Truck and Bus Radial Tire Market?

Key players in the Truck and Bus Radial Tire Market include Michelin, Bridgestone, Goodyear, and Continental, among others. These companies are known for their innovative tire technologies and extensive distribution networks.

What are the growth factors driving the Truck and Bus Radial Tire Market?

The growth of the Truck and Bus Radial Tire Market is driven by the increasing demand for commercial transportation, advancements in tire technology, and the rising focus on fuel efficiency and safety in heavy-duty vehicles.

What challenges does the Truck and Bus Radial Tire Market face?

The Truck and Bus Radial Tire Market faces challenges such as fluctuating raw material prices, stringent regulations regarding tire performance and emissions, and competition from alternative tire technologies.

What opportunities exist in the Truck and Bus Radial Tire Market?

Opportunities in the Truck and Bus Radial Tire Market include the growing trend towards electric and autonomous vehicles, which require specialized tire solutions, and the expansion of logistics and e-commerce sectors that increase demand for commercial tires.

What trends are shaping the Truck and Bus Radial Tire Market?

Trends shaping the Truck and Bus Radial Tire Market include the development of smart tires with integrated sensors for real-time monitoring, the shift towards sustainable materials in tire manufacturing, and the increasing adoption of retreading processes to extend tire life.

Truck and Bus Radial Tire Market

| Segmentation Details | Description |

|---|---|

| Product Type | All-Season, Winter, Highway, Off-Road, Performance |

| Application | Long Haul, Regional, Urban, Mixed Service, Construction |

| End User | Fleet Operators, OEMs, Aftermarket Providers, Dealerships, Logistics Companies |

| Distribution Channel | Direct Sales, Distributors, Online Retail, Specialty Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Truck and Bus Radial Tire Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at