444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Trinidad and Tobago oil and gas market represents one of the Caribbean region’s most significant energy sectors, establishing the twin-island nation as a major hydrocarbon producer and exporter. With substantial offshore reserves and a well-developed infrastructure, Trinidad and Tobago has maintained its position as a leading energy hub in the Caribbean basin. The market encompasses both upstream exploration and production activities, as well as downstream refining and petrochemical operations that serve both domestic and international markets.

Natural gas production dominates the energy landscape, accounting for approximately 85% of total hydrocarbon output, while crude oil production contributes the remaining portion. The country’s strategic location and established liquefied natural gas (LNG) facilities have positioned it as a critical supplier to North American and European markets. Offshore fields continue to drive production growth, with deepwater exploration activities revealing promising reserves that could sustain long-term market expansion.

Government initiatives and regulatory frameworks have created an attractive investment environment for international oil companies, fostering partnerships that leverage advanced extraction technologies and exploration techniques. The market’s resilience has been demonstrated through various commodity price cycles, with operators implementing cost-effective production strategies and efficiency improvements that maintain profitability across different market conditions.

The Trinidad and Tobago oil and gas market refers to the comprehensive ecosystem of hydrocarbon exploration, production, processing, and distribution activities within the territorial waters and land areas of the Republic of Trinidad and Tobago. This market encompasses upstream operations including seismic surveys, drilling, and extraction from both onshore and offshore fields, midstream infrastructure such as pipelines and processing facilities, and downstream activities including refining, petrochemical production, and LNG liquefaction.

Market participants include national oil companies, international energy corporations, service providers, and government regulatory bodies that collectively manage the development and commercialization of the country’s hydrocarbon resources. The sector serves as a cornerstone of the national economy, contributing significantly to government revenues, export earnings, and employment opportunities while supporting related industries and services throughout the energy value chain.

Trinidad and Tobago’s oil and gas sector continues to demonstrate robust performance despite global energy market volatility, with natural gas production maintaining steady output levels and new exploration activities showing promising results. The market benefits from mature infrastructure, experienced workforce, and strategic geographic positioning that facilitates efficient export operations to key international markets.

Recent developments indicate renewed investor interest in deepwater exploration projects, with several international operators announcing expansion plans and technology upgrades. The government’s commitment to maintaining competitive fiscal terms and streamlined regulatory processes has attracted 15% more exploration licenses compared to previous periods, signaling confidence in the market’s long-term potential.

Production efficiency improvements have resulted in 12% higher recovery rates from existing fields through enhanced oil recovery techniques and advanced reservoir management. The LNG sector continues to perform strongly, with capacity utilization rates exceeding 90% and long-term supply contracts providing revenue stability for market participants.

Strategic market positioning reveals several critical insights that define Trinidad and Tobago’s competitive advantages in the regional energy landscape:

Multiple factors contribute to the sustained growth and development of Trinidad and Tobago’s oil and gas market, creating favorable conditions for continued expansion and investment attraction.

Energy demand growth in key export markets continues to drive production expansion, with North American and European customers seeking reliable LNG supplies amid global supply chain disruptions. The market benefits from long-term supply agreements that provide revenue certainty and support investment in production capacity enhancements.

Technological advancement enables access to previously uneconomical reserves through improved extraction techniques, enhanced recovery methods, and cost-effective deepwater drilling capabilities. These innovations have resulted in 18% improvement in overall field productivity and extended the economic life of mature assets.

Government support initiatives include competitive fiscal incentives, streamlined approval processes, and infrastructure development programs that reduce operational costs and improve project economics. Recent policy adjustments have attracted 25% more foreign direct investment in exploration and development activities.

Regional energy integration opportunities through Caribbean energy partnerships and cross-border pipeline projects expand market reach and create additional revenue streams. Strategic alliances with neighboring countries enhance market access and operational synergies.

Several challenges impact the Trinidad and Tobago oil and gas market, requiring strategic management and mitigation efforts to maintain growth momentum and operational efficiency.

Mature field decline presents ongoing challenges as older production assets experience natural depletion, requiring significant investment in enhanced recovery techniques and new field development to maintain output levels. This situation demands careful resource allocation and strategic planning to optimize production profiles.

Global price volatility affects project economics and investment decisions, particularly for capital-intensive deepwater developments that require long-term price stability for financial viability. Market participants must implement flexible operational strategies to manage commodity price risks effectively.

Environmental regulations and sustainability requirements increase compliance costs and operational complexity, particularly for offshore operations where environmental protection measures require specialized equipment and procedures. These factors can impact project timelines and development costs.

Infrastructure aging requires substantial maintenance and upgrade investments to ensure continued operational reliability and safety standards. Legacy facilities need modernization to meet current efficiency and environmental requirements, representing significant capital commitments for operators.

Significant opportunities exist within Trinidad and Tobago’s oil and gas sector, offering potential for market expansion, technological innovation, and economic diversification that can drive long-term growth.

Deepwater exploration presents substantial potential for major discoveries, with advanced seismic technologies revealing promising geological formations in previously unexplored areas. These opportunities could significantly expand the country’s proven reserves and production capacity.

LNG market expansion offers growth potential through capacity increases, new customer relationships, and value-added services that enhance revenue streams. Growing global demand for cleaner-burning natural gas creates favorable market conditions for Trinidad and Tobago’s LNG exports.

Petrochemical development opportunities leverage abundant natural gas feedstock to create higher-value products and downstream integration benefits. These initiatives can diversify revenue sources and create additional employment opportunities in related industries.

Technology partnerships with international service companies enable access to cutting-edge exploration and production technologies, improving operational efficiency and reserve recovery rates. Such collaborations can accelerate field development and optimize production performance.

Regional energy hub development positions Trinidad and Tobago as a central processing and distribution center for Caribbean hydrocarbon resources, creating additional business opportunities and strategic partnerships throughout the region.

Complex interactions between various market forces shape the Trinidad and Tobago oil and gas sector’s evolution, creating dynamic conditions that influence investment decisions, operational strategies, and long-term development planning.

Supply and demand balance reflects both domestic energy requirements and export market conditions, with natural gas production primarily serving international customers while crude oil output meets local refining needs and export commitments. Market dynamics respond to seasonal demand variations and long-term contract obligations.

Investment cycles demonstrate the sector’s sensitivity to global energy market conditions, with exploration and development activities increasing during favorable price environments and consolidating during market downturns. MarkWide Research analysis indicates that investment levels typically lag commodity price changes by 12-18 months, reflecting project planning and approval timelines.

Competitive positioning within the Caribbean region requires continuous improvement in cost competitiveness, operational efficiency, and service quality to maintain market share and attract new customers. The market benefits from established infrastructure advantages and experienced workforce capabilities.

Regulatory evolution responds to changing international standards, environmental requirements, and fiscal policy objectives, creating both challenges and opportunities for market participants. Adaptive regulatory frameworks support sustainable development while maintaining investment attractiveness.

Comprehensive analysis of Trinidad and Tobago’s oil and gas market employs multiple research approaches to ensure accurate, reliable, and actionable insights for stakeholders and decision-makers throughout the energy sector.

Primary research activities include structured interviews with industry executives, government officials, and technical experts who provide firsthand insights into market conditions, operational challenges, and strategic opportunities. These discussions offer valuable perspectives on current trends and future developments.

Secondary data analysis incorporates government statistics, industry reports, company financial statements, and regulatory filings to establish quantitative baselines and identify market trends. This approach ensures comprehensive coverage of all market segments and operational aspects.

Technical assessment evaluates geological data, production statistics, infrastructure capacity, and technological capabilities to understand the market’s physical foundations and operational constraints. Engineering analysis supports projections of future production potential and development requirements.

Economic modeling incorporates commodity price scenarios, cost structures, and investment requirements to assess project economics and market viability under various conditions. Financial analysis supports strategic planning and investment decision-making processes.

Geographic distribution of Trinidad and Tobago’s oil and gas resources and infrastructure creates distinct regional characteristics that influence operational strategies, development priorities, and market dynamics across different areas.

Offshore regions dominate natural gas production, with the Columbus Basin and surrounding deepwater areas containing the majority of proven reserves. These areas account for approximately 75% of total gas production and represent the primary focus for future exploration and development activities. Advanced subsea technologies enable efficient extraction from water depths exceeding 1,000 meters.

Onshore areas primarily support crude oil production and processing activities, with mature fields in southern Trinidad providing steady output through enhanced recovery techniques. These regions benefit from established infrastructure and experienced local workforce capabilities that support cost-effective operations.

Eastern offshore blocks show significant potential for future development, with recent exploration activities revealing promising geological formations that could support long-term production growth. These areas represent approximately 30% of unexplored acreage and offer opportunities for major discoveries.

Industrial zones concentrate downstream activities including refining, petrochemical production, and LNG processing, creating integrated value chains that maximize economic benefits from hydrocarbon resources. These facilities serve both domestic markets and export customers throughout the Americas and Europe.

Market participants in Trinidad and Tobago’s oil and gas sector represent a diverse mix of national companies, international operators, and specialized service providers that collectively drive industry development and operational excellence.

Strategic partnerships between international operators and local companies facilitate technology transfer, capacity building, and risk sharing that support sustainable market development. These collaborations leverage complementary strengths and expertise to optimize project outcomes.

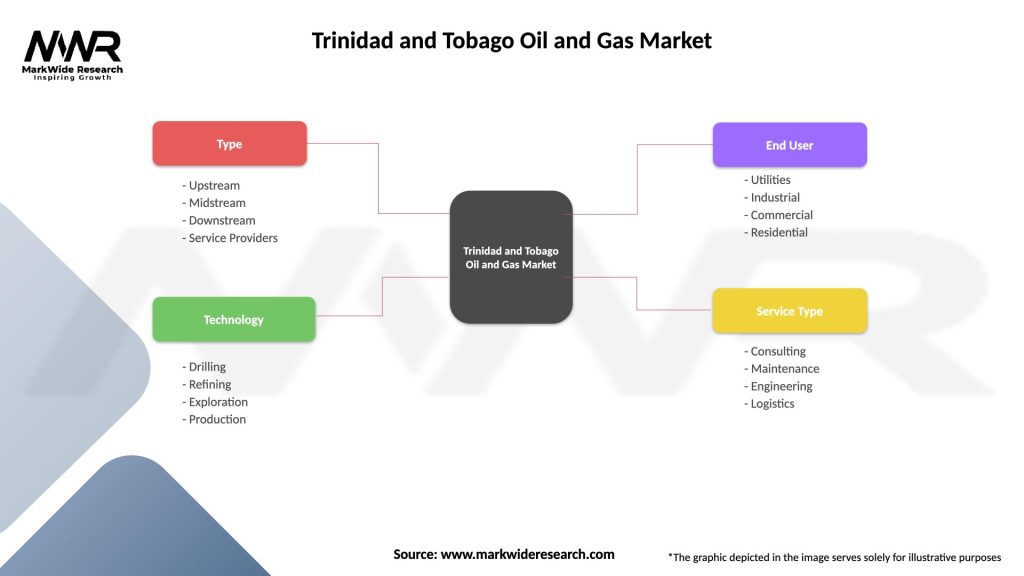

Market segmentation analysis reveals distinct operational categories that define Trinidad and Tobago’s oil and gas sector structure, each with unique characteristics, requirements, and growth potential.

By Resource Type:

By Operational Area:

By Value Chain Position:

Detailed analysis of market categories reveals specific trends, challenges, and opportunities that characterize different segments of Trinidad and Tobago’s oil and gas sector.

Natural Gas Segment: This category demonstrates the strongest growth potential with 8% annual production increase driven by deepwater field developments and enhanced recovery techniques. Advanced subsea technologies enable efficient extraction from challenging environments while maintaining cost competitiveness. Long-term LNG supply contracts provide revenue stability and support continued investment in production capacity expansion.

Crude Oil Operations: Mature production assets require strategic management to maintain output levels through enhanced recovery methods and selective redevelopment projects. MWR data indicates that improved reservoir management techniques have extended field life by an average of 15 years while maintaining economic viability.

Offshore Development: Deepwater projects represent the sector’s technological frontier, with water depths exceeding 1,000 meters requiring specialized equipment and expertise. These operations achieve 92% operational efficiency through advanced automation and remote monitoring systems that optimize production performance.

Infrastructure Services: Supporting infrastructure including pipelines, processing facilities, and export terminals operate at high capacity utilization rates, demonstrating the market’s operational maturity and efficiency. Regular maintenance and upgrade programs ensure continued reliability and safety compliance.

Participation in Trinidad and Tobago’s oil and gas market offers numerous advantages for various stakeholder groups, creating value through operational excellence, strategic positioning, and economic contribution.

For International Operators:

For Local Companies:

For Government Stakeholders:

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shape the evolution of Trinidad and Tobago’s oil and gas market, reflecting technological advancement, changing market conditions, and strategic adaptations by industry participants.

Digital Transformation: Integration of advanced digital technologies including artificial intelligence, machine learning, and Internet of Things (IoT) systems enhances operational efficiency and predictive maintenance capabilities. These innovations have improved production optimization by 22% while reducing operational costs and environmental impact.

Sustainability Focus: Growing emphasis on environmental stewardship and carbon footprint reduction drives adoption of cleaner production technologies and waste minimization practices. Companies are implementing comprehensive sustainability programs that align with international standards and stakeholder expectations.

Enhanced Recovery Techniques: Advanced reservoir management and enhanced oil recovery methods extend field life and improve resource utilization from mature assets. These techniques have increased recovery rates by an average of 28% from existing fields while maintaining economic viability.

Strategic Partnerships: Increased collaboration between international operators and local companies facilitates technology transfer, risk sharing, and capacity building that supports sustainable market development. Joint ventures and strategic alliances optimize resource allocation and operational expertise.

Market Diversification: Expansion into new geographic markets and customer segments reduces dependence on traditional buyers and creates additional revenue opportunities. Long-term supply agreements with emerging markets provide growth potential and revenue stability.

Recent developments in Trinidad and Tobago’s oil and gas sector demonstrate continued investment, technological advancement, and strategic positioning that support long-term market growth and competitiveness.

Exploration Success: Major offshore discoveries in deepwater blocks have confirmed significant additional reserves that could support production expansion for decades. These findings validate continued exploration investment and advanced seismic technologies that enable identification of previously undetected resources.

Infrastructure Expansion: Completion of new pipeline connections and processing facility upgrades enhances production capacity and operational flexibility. These investments improve system reliability and enable efficient handling of increased production volumes from new field developments.

Technology Implementation: Deployment of advanced subsea production systems and enhanced recovery technologies improves field development economics and operational performance. Digital monitoring and control systems enable real-time optimization and predictive maintenance that reduces downtime and costs.

Regulatory Updates: Government policy adjustments including revised fiscal terms and streamlined approval processes attract increased investment and accelerate project development timelines. These changes demonstrate commitment to maintaining competitive investment conditions.

International Partnerships: New joint ventures and strategic alliances with global energy companies bring additional capital, technology, and market access that support sector expansion and capability development.

Strategic recommendations for Trinidad and Tobago’s oil and gas market participants focus on optimizing operational performance, managing market risks, and capitalizing on growth opportunities in a dynamic global energy environment.

Investment Prioritization: Focus capital allocation on high-return deepwater projects and enhanced recovery initiatives that maximize resource utilization and extend asset life. MarkWide Research analysis suggests that selective investment in proven technologies and established fields provides optimal risk-adjusted returns in current market conditions.

Technology Adoption: Accelerate implementation of digital technologies and advanced analytics to improve operational efficiency, reduce costs, and enhance safety performance. Companies should prioritize automation and remote monitoring systems that optimize production while minimizing operational risks.

Market Diversification: Expand customer base and geographic reach through new supply agreements and strategic partnerships that reduce dependence on traditional markets. Developing relationships with emerging market customers provides growth opportunities and revenue stability.

Sustainability Integration: Implement comprehensive environmental management programs and carbon reduction initiatives that align with international standards and stakeholder expectations. Proactive sustainability measures enhance market positioning and regulatory compliance.

Workforce Development: Invest in training and capacity building programs that maintain technical expertise and support knowledge transfer between experienced and emerging professionals. Local content development creates competitive advantages and operational sustainability.

Long-term prospects for Trinidad and Tobago’s oil and gas market remain positive, supported by substantial resource base, established infrastructure, and strategic positioning that enable sustained growth and competitiveness in global energy markets.

Production projections indicate continued growth in natural gas output driven by deepwater field developments and enhanced recovery from existing assets. Advanced extraction technologies and improved reservoir management are expected to maintain production levels while extending field life and optimizing resource recovery.

Market expansion opportunities through LNG capacity increases and new customer relationships support revenue growth and market diversification. Growing global demand for cleaner-burning natural gas creates favorable conditions for Trinidad and Tobago’s export-oriented production strategy.

Technology evolution will continue to drive operational improvements and cost reductions, with digital transformation initiatives expected to deliver 20% efficiency gains over the next decade. Advanced automation and artificial intelligence applications will optimize production performance while reducing environmental impact.

Investment climate remains attractive for international operators seeking stable, high-quality assets in established markets. Government commitment to competitive fiscal terms and regulatory transparency supports continued foreign direct investment and technology transfer that benefits the entire sector.

Regional leadership positioning strengthens through strategic partnerships and infrastructure development that establish Trinidad and Tobago as the Caribbean’s primary energy hub. Cross-border collaboration and market integration create additional growth opportunities and operational synergies.

Trinidad and Tobago’s oil and gas market demonstrates remarkable resilience and growth potential, establishing the nation as a leading energy producer in the Caribbean region with significant global market presence. The sector’s foundation of substantial hydrocarbon reserves, mature infrastructure, and experienced workforce creates sustainable competitive advantages that support long-term development and profitability.

Strategic positioning in key export markets, combined with advanced production technologies and efficient operational practices, enables Trinidad and Tobago to maintain market leadership while adapting to evolving global energy demands. The successful integration of international expertise with local capabilities has created a dynamic industry ecosystem that delivers value for all stakeholders.

Future success will depend on continued investment in technology advancement, infrastructure modernization, and workforce development that maintains operational excellence while meeting environmental and sustainability requirements. The market’s ability to attract international investment and foster strategic partnerships positions it well for sustained growth and regional leadership in the evolving global energy landscape.

What is Oil and Gas?

Oil and gas refer to natural resources extracted from the earth, primarily used for energy production, transportation, and manufacturing. These resources are crucial for various industries, including petrochemicals and power generation.

What are the key players in the Trinidad and Tobago Oil and Gas Market?

Key players in the Trinidad and Tobago Oil and Gas Market include bp Trinidad and Tobago, Petrotrin, and EOG Resources, among others. These companies are involved in exploration, production, and refining activities within the region.

What are the growth factors driving the Trinidad and Tobago Oil and Gas Market?

The growth of the Trinidad and Tobago Oil and Gas Market is driven by increasing energy demand, advancements in extraction technologies, and the country’s rich hydrocarbon reserves. Additionally, investments in infrastructure and exploration activities contribute to market expansion.

What challenges does the Trinidad and Tobago Oil and Gas Market face?

The Trinidad and Tobago Oil and Gas Market faces challenges such as fluctuating oil prices, environmental regulations, and aging infrastructure. These factors can impact profitability and operational efficiency for companies in the sector.

What opportunities exist in the Trinidad and Tobago Oil and Gas Market?

Opportunities in the Trinidad and Tobago Oil and Gas Market include the potential for offshore exploration, the development of renewable energy projects, and partnerships with international firms. These avenues can enhance resource management and sustainability efforts.

What trends are shaping the Trinidad and Tobago Oil and Gas Market?

Trends in the Trinidad and Tobago Oil and Gas Market include a shift towards cleaner energy sources, increased investment in technology for enhanced oil recovery, and a focus on sustainability practices. These trends reflect the industry’s adaptation to global energy demands.

Trinidad and Tobago Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Type | Upstream, Midstream, Downstream, Service Providers |

| Technology | Drilling, Refining, Exploration, Production |

| End User | Utilities, Industrial, Commercial, Residential |

| Service Type | Consulting, Maintenance, Engineering, Logistics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Trinidad and Tobago Oil and Gas Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at