444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The travel and entertainment cards market is witnessing substantial growth as consumers increasingly rely on these cards for convenient and secure payment options during travel and entertainment activities. Travel and entertainment cards, often known as travel cards or T&E cards, are specialized payment cards designed for use in the travel and entertainment industry. These cards offer benefits such as enhanced rewards, travel insurance coverage, and exclusive perks, making them popular among frequent travelers and individuals seeking unique experiences. With the rising demand for seamless and cashless transactions in the travel and entertainment sectors, the market for travel and entertainment cards is expected to expand significantly.

Meaning

Travel and entertainment cards refer to payment cards specifically designed for use in the travel and entertainment industry. These cards provide users with various benefits and features tailored to meet the needs of travelers and individuals seeking entertainment experiences. Travel and entertainment cards often come with rewards programs, offering points or cashback for eligible purchases. These cards may also provide travel insurance coverage, access to airport lounges, concierge services, and discounts or privileges at hotels, restaurants, and entertainment venues. Travel and entertainment cards aim to enhance the overall travel and entertainment experience while providing a secure and convenient payment method.

Executive Summary

The travel and entertainment cards market is experiencing significant growth as consumers increasingly embrace cashless transactions and seek enhanced travel and entertainment experiences. The market offers a wide range of cards from various financial institutions and card issuers, each with unique benefits and features. Key players in the market are continuously innovating to provide attractive rewards programs, improved security features, and seamless payment experiences. The market is expected to witness continued growth, driven by the increasing demand for convenient and rewarding payment options in the travel and entertainment sectors.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

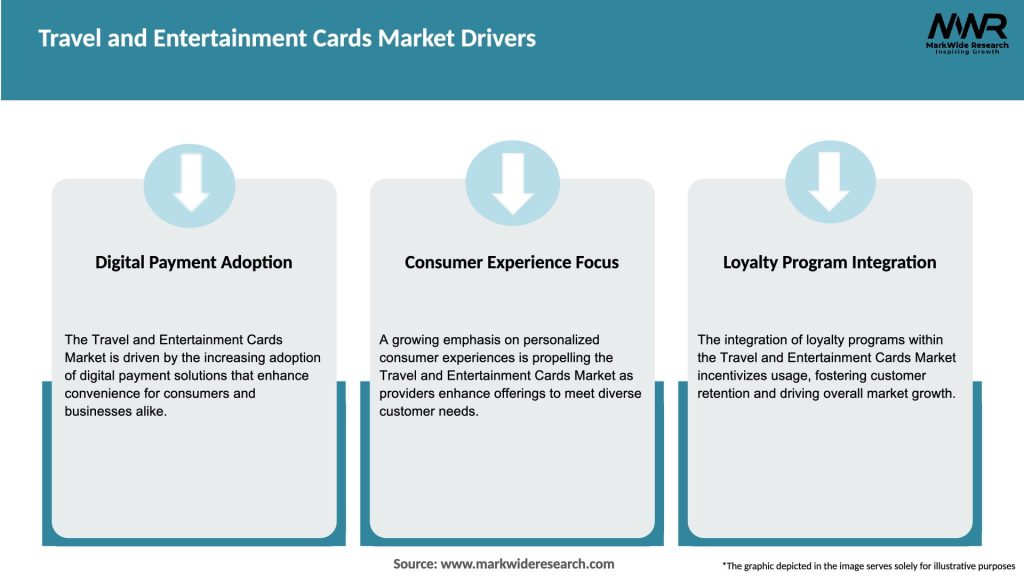

Market Drivers

The following factors are driving the growth of the travel and entertainment cards market:

Market Restraints

Despite the significant growth prospects, the travel and entertainment cards market faces certain challenges:

Market Opportunities

The travel and entertainment cards market presents several opportunities for growth and innovation:

Market Dynamics

The travel and entertainment cards market is dynamic and influenced by various factors, including technological advancements, changing consumer preferences, regulatory frameworks, and industry collaborations. The market dynamics are driven by the increasing adoption of digital payments, the desire for enhanced travel and entertainment experiences, and the need for secure and convenient payment options. Continuous innovation, strategic partnerships, and the integration of emerging technologies shape the market landscape.

Regional Analysis

North America: North America dominates the travel and entertainment cards market, driven by a robust travel and entertainment industry, high consumer adoption of digital payments, and the presence of major financial institutions and card issuers. The region’s well-established financial infrastructure and tech-savvy consumer base contribute to its market dominance.

Europe: Europe holds a significant share in the travel and entertainment cards market, supported by the region’s strong travel and tourism industry and the high acceptance of digital payments. European consumers value travel-related benefits and rewards, making travel and entertainment cards popular among frequent travelers.

Asia Pacific: The Asia Pacific region presents significant growth opportunities for the travel and entertainment cards market. Rapid economic development, increasing disposable incomes, and a growing middle class contribute to the rise in travel and entertainment activities. The region’s expanding digital payment ecosystem and the adoption of mobile technologies drive market growth.

Competitive Landscape

Leading companies in the Travel and Entertainment Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

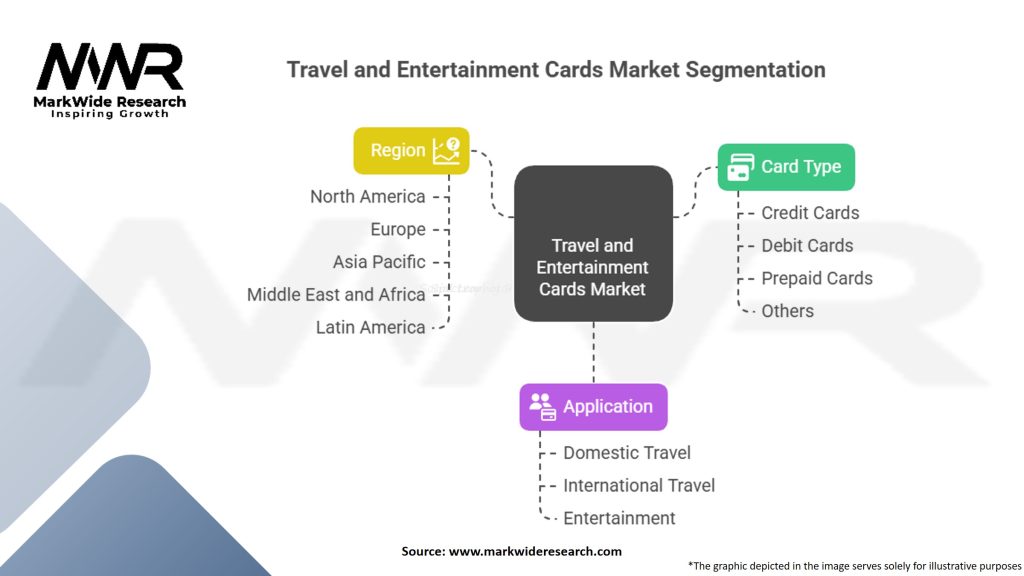

Segmentation

The travel and entertainment cards market can be segmented based on the following:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The travel and entertainment cards market offers several benefits to industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the travel and entertainment cards market. Travel restrictions, event cancellations, and lockdown measures have resulted in reduced travel and entertainment activities, affecting card usage and rewards redemption. However, as travel and entertainment sectors recover, the market is expected to regain momentum. Card issuers have adapted by offering flexible redemption options, virtual experiences, and enhanced safety and hygiene measures to address the changing needs and preferences of cardholders.

Key Industry Developments

Analyst Suggestions

Future Outlook

The travel and entertainment cards market is expected to witness significant growth in the coming years. The increasing adoption of digital payments, the desire for enhanced travel and entertainment experiences, and the need for secure and convenient payment options drive market expansion. Continuous innovation, strategic partnerships, and the integration of emerging technologies will shape the future of travel and entertainment cards.

Conclusion

The travel and entertainment cards market offers consumers convenient and rewarding payment options for travel and entertainment activities. These specialized cards provide benefits such as rewards programs, travel insurance coverage, and exclusive privileges. The market is driven by the increasing demand for cashless transactions, enhanced travel experiences, and attractive rewards. Card issuers and financial institutions play a crucial role in offering innovative features, personalized experiences, and strategic partnerships. The market is dynamic, with technological advancements and changing consumer preferences shaping the landscape. The future outlook for the travel and entertainment cards market is promising, with opportunities for growth, innovation, and partnerships in the travel and entertainment sectors.

What is Travel and Entertainment Cards?

Travel and Entertainment Cards are financial products designed to facilitate travel-related expenses and entertainment purchases, often offering rewards, discounts, and benefits tailored for frequent travelers and entertainment seekers.

What are the key players in the Travel and Entertainment Cards Market?

Key players in the Travel and Entertainment Cards Market include American Express, Visa, Mastercard, and Discover, among others. These companies offer various card options that cater to different consumer needs and preferences.

What are the growth factors driving the Travel and Entertainment Cards Market?

The Travel and Entertainment Cards Market is driven by increasing consumer spending on travel and leisure activities, the rise of digital payment solutions, and the growing demand for rewards programs that enhance customer loyalty.

What challenges does the Travel and Entertainment Cards Market face?

Challenges in the Travel and Entertainment Cards Market include intense competition among card issuers, regulatory changes affecting fees and rewards, and the impact of economic fluctuations on consumer spending habits.

What opportunities exist in the Travel and Entertainment Cards Market?

Opportunities in the Travel and Entertainment Cards Market include the expansion of travel-related services, partnerships with travel agencies, and the integration of advanced technologies like mobile payments and personalized rewards.

What trends are shaping the Travel and Entertainment Cards Market?

Trends in the Travel and Entertainment Cards Market include the increasing popularity of contactless payments, the rise of co-branded cards with airlines and hotels, and a focus on sustainability initiatives within the card offerings.

Travel and Entertainment Cards Market

| Segmentation | Details |

|---|---|

| Card Type | Credit Cards, Debit Cards, Prepaid Cards, Others |

| Application | Domestic Travel, International Travel, Entertainment |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Travel and Entertainment Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at