444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The transfection reagents and equipment market represents a critical segment of the biotechnology and pharmaceutical research industry, encompassing specialized tools and chemical formulations designed to introduce nucleic acids into cells. This rapidly expanding market serves diverse applications across gene therapy research, drug discovery, vaccine development, and basic biological research. Market dynamics indicate robust growth driven by increasing investments in genomic research, rising prevalence of genetic disorders, and expanding applications of gene editing technologies like CRISPR-Cas9.

Current market trends demonstrate significant adoption across academic institutions, pharmaceutical companies, and biotechnology firms worldwide. The market experiences particularly strong growth in regions with established research infrastructure, including North America, Europe, and Asia-Pacific. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 8.2% through the forecast period, driven by technological advancements and increasing research funding.

Key market segments include lipofection reagents, electroporation equipment, viral vectors, and microinjection systems. The market serves various end-users, from large pharmaceutical corporations conducting clinical trials to academic research laboratories exploring fundamental cellular mechanisms. Innovation trends focus on developing more efficient, less toxic transfection methods with higher success rates and improved cell viability.

The transfection reagents and equipment market refers to the commercial ecosystem encompassing specialized chemical formulations, instruments, and technologies designed to facilitate the introduction of foreign nucleic acids, including DNA, RNA, and synthetic oligonucleotides, into target cells. This process, known as transfection, enables researchers to study gene function, develop therapeutic interventions, and create genetically modified cell lines for various applications.

Transfection technologies encompass multiple methodologies, including chemical-based approaches using lipofection reagents, physical methods like electroporation and microinjection, and biological systems utilizing viral vectors. Each approach offers distinct advantages depending on cell type, nucleic acid characteristics, and experimental objectives. Market participants include reagent manufacturers, equipment suppliers, and service providers supporting research and therapeutic development activities.

Applications span fundamental research, drug discovery, gene therapy development, vaccine production, and diagnostic assay development. The market serves diverse sectors including academic research institutions, pharmaceutical companies, biotechnology firms, contract research organizations, and clinical laboratories. Technology evolution continues advancing toward more efficient, targeted, and less cytotoxic transfection methods.

Market performance demonstrates strong growth momentum driven by expanding applications in gene therapy, increasing research investments, and technological innovations improving transfection efficiency. The market benefits from rising demand for personalized medicine, growing prevalence of genetic disorders, and expanding pharmaceutical research and development activities. Regional distribution shows North America maintaining market leadership with approximately 42% market share, followed by Europe and Asia-Pacific regions.

Technology segments reveal lipofection reagents commanding the largest market portion due to ease of use and broad applicability across cell types. Electroporation equipment represents the fastest-growing segment, driven by improved protocols and enhanced equipment capabilities. End-user analysis indicates pharmaceutical and biotechnology companies account for 38% of market demand, while academic and research institutions contribute significantly to market growth.

Competitive dynamics feature established players focusing on product innovation, strategic partnerships, and geographic expansion. Market leaders invest heavily in research and development to improve transfection efficiency, reduce cytotoxicity, and expand application ranges. Future prospects remain positive, supported by increasing gene therapy clinical trials, expanding CRISPR applications, and growing investment in precision medicine initiatives.

Primary market drivers include the following critical factors shaping industry growth:

Market segmentation reveals distinct growth patterns across technology types, with chemical transfection methods maintaining dominance while physical methods gain traction. Application diversity spans therapeutic development, basic research, and diagnostic applications, each contributing to overall market expansion.

Technological advancement serves as the primary catalyst for market growth, with continuous improvements in transfection efficiency, cell viability, and ease of use driving adoption across research sectors. Innovation focus centers on developing next-generation lipofection reagents with enhanced delivery capabilities and reduced cytotoxicity, enabling more successful experimental outcomes.

Pharmaceutical industry expansion significantly contributes to market growth through increased investment in drug discovery and development programs. Major pharmaceutical companies allocate substantial resources to genomic research, requiring reliable transfection solutions for target identification, validation, and therapeutic development. Clinical trial growth in gene therapy applications creates sustained demand for specialized transfection equipment and reagents.

Academic research proliferation drives market expansion as universities and research institutions expand their genomic research capabilities. Government funding initiatives supporting basic science research, particularly in areas like cancer biology, neuroscience, and developmental biology, create consistent demand for transfection technologies. International collaboration in research projects further amplifies market opportunities.

Regulatory environment improvements facilitate market growth by providing clearer pathways for gene therapy development and approval. Streamlined regulatory processes encourage pharmaceutical companies to invest in gene-based therapeutic development, directly increasing demand for transfection solutions. FDA guidance on gene therapy development provides industry confidence and investment justification.

High implementation costs present significant barriers to market adoption, particularly for smaller research institutions and biotechnology startups. Advanced transfection equipment requires substantial capital investment, while specialized reagents command premium pricing. Budget constraints in academic settings often limit access to cutting-edge transfection technologies, potentially slowing market growth in educational sectors.

Technical complexity associated with transfection procedures creates adoption challenges, requiring specialized training and expertise for optimal results. Many transfection methods demand precise protocol optimization for different cell types and experimental conditions. Skill requirements may limit market penetration in facilities lacking experienced personnel or comprehensive training programs.

Cytotoxicity concerns with certain transfection reagents limit their applicability in sensitive experimental systems or therapeutic applications. Some chemical transfection agents cause cellular stress or death, compromising experimental validity and limiting their use in clinical applications. Safety considerations require careful evaluation and may restrict adoption in certain research contexts.

Regulatory complexity in therapeutic applications creates uncertainty and potential delays in product development. Stringent safety and efficacy requirements for gene therapy applications may limit the use of certain transfection methods in clinical settings. Compliance costs associated with regulatory requirements can burden smaller market participants and slow innovation cycles.

Emerging market expansion presents substantial growth opportunities as developing countries invest in biotechnology infrastructure and research capabilities. Countries in Asia-Pacific, Latin America, and the Middle East demonstrate increasing research activity and government support for genomic research initiatives. Infrastructure development in these regions creates new market segments for transfection technology providers.

Personalized medicine advancement offers significant market potential as healthcare systems increasingly adopt individualized treatment approaches. The growing understanding of genetic variations in disease susceptibility and drug response creates demand for specialized transfection techniques supporting personalized therapeutic development. Precision medicine initiatives require sophisticated cellular modification technologies.

Gene editing technology evolution continues creating new applications for transfection solutions, particularly in therapeutic development and agricultural biotechnology. Advanced gene editing systems like base editing and prime editing require efficient delivery mechanisms, expanding market opportunities. CRISPR applications in various fields drive sustained demand for reliable transfection methods.

Automation integration presents opportunities for market expansion through development of high-throughput transfection systems. Automated platforms enable large-scale screening applications and reduce manual labor requirements, appealing to pharmaceutical companies and research institutions. Workflow optimization through automation enhances productivity and experimental reproducibility.

Supply chain dynamics in the transfection reagents and equipment market reflect the specialized nature of products and the critical importance of quality control. Manufacturers maintain stringent quality standards to ensure consistent performance and reliability, as experimental success often depends on reagent quality. Global supply networks enable worldwide distribution while maintaining product integrity through specialized storage and shipping requirements.

Innovation cycles drive market evolution through continuous product development and technological advancement. Companies invest heavily in research and development to improve transfection efficiency, reduce cytotoxicity, and expand application ranges. Patent landscapes influence competitive positioning and market entry strategies, with intellectual property protection playing crucial roles in product differentiation.

Customer relationships in this market emphasize technical support, application expertise, and long-term partnerships. Successful companies provide comprehensive customer support, including protocol optimization, troubleshooting assistance, and educational resources. Scientific collaboration between suppliers and researchers often leads to product improvements and new application development.

Market consolidation trends reflect the specialized nature of the industry and the advantages of scale in research and development activities. Strategic acquisitions enable companies to expand product portfolios, access new technologies, and strengthen market positions. Partnership strategies facilitate technology transfer and market access, particularly in emerging geographic markets.

Market analysis methodology employs comprehensive primary and secondary research approaches to gather accurate and current market intelligence. Primary research includes extensive interviews with industry executives, research scientists, procurement managers, and end-users across various market segments. Survey methodologies capture quantitative data on market size, growth rates, and purchasing patterns while ensuring statistical validity and representativeness.

Secondary research components encompass analysis of scientific literature, patent databases, regulatory filings, and company financial reports. Industry publications, conference proceedings, and academic research provide insights into technological trends and application developments. Data validation processes ensure accuracy through cross-referencing multiple sources and expert verification.

Market segmentation analysis utilizes both top-down and bottom-up approaches to estimate market sizes and growth rates across different product categories, applications, and geographic regions. Statistical modeling techniques project future market trends based on historical data and identified growth drivers. Forecasting methodologies incorporate scenario analysis to account for potential market disruptions and emerging opportunities.

Quality assurance protocols maintain research integrity through systematic data collection, analysis, and reporting procedures. Independent verification processes validate key findings and ensure objectivity in market assessments. Continuous monitoring of market developments enables real-time updates to research findings and projections.

North American market leadership stems from robust pharmaceutical and biotechnology industries, substantial research funding, and advanced healthcare infrastructure. The United States dominates regional market share through major pharmaceutical companies, leading academic institutions, and significant government research investments. Market penetration reaches approximately 65% adoption rate among research institutions, reflecting mature market development and widespread technology acceptance.

European market dynamics demonstrate strong growth driven by increasing research collaborations, supportive regulatory frameworks, and expanding biotechnology sectors. Countries like Germany, the United Kingdom, and Switzerland lead regional adoption through established pharmaceutical industries and world-class research institutions. Regional integration facilitates technology transfer and collaborative research projects across European Union member states.

Asia-Pacific emergence represents the fastest-growing regional market, with countries like China, Japan, and South Korea investing heavily in biotechnology research and development. Government initiatives supporting genomic research and pharmaceutical industry development drive market expansion. Growth rates in this region exceed 12% annually, reflecting rapid infrastructure development and increasing research activity.

Emerging market potential in Latin America, the Middle East, and Africa presents significant long-term opportunities as these regions develop biotechnology capabilities and research infrastructure. Brazil, Mexico, and South Africa lead regional adoption through government research initiatives and international collaborations. Market development in these regions focuses on building local capabilities and establishing distribution networks.

Market leadership features several established companies with strong product portfolios and global distribution networks:

Competitive strategies emphasize product innovation, application development, and customer support excellence. Leading companies invest significantly in research and development to maintain technological advantages and expand application ranges. Market positioning often focuses on specific customer segments or application areas to achieve competitive differentiation.

Technology-based segmentation reveals distinct market categories with varying growth patterns and application focuses:

Application-based segmentation demonstrates diverse market utilization across research and therapeutic development:

Lipofection reagents category maintains market dominance through ease of use, broad applicability, and continuous product improvements. This segment benefits from extensive protocol development, wide cell type compatibility, and relatively low equipment requirements. Innovation trends focus on reducing cytotoxicity while improving transfection efficiency, with next-generation formulations achieving efficiency improvements of 35% compared to earlier products.

Electroporation equipment category experiences rapid growth driven by technological advancements and expanding applications in cell therapy manufacturing. Modern electroporation systems offer precise control, scalability, and improved cell viability compared to traditional methods. Market adoption increases particularly in pharmaceutical companies developing cell-based therapies and research institutions requiring high-throughput capabilities.

Viral vector category serves specialized applications requiring high transfection efficiency and specific cell targeting capabilities. This segment faces regulatory considerations but offers superior performance for certain applications, particularly in gene therapy development. Safety improvements and vector engineering advances expand application possibilities while addressing historical concerns.

Microinjection systems category targets precision applications in developmental biology, embryology, and single-cell studies. While representing a smaller market segment, this category maintains steady demand from specialized research applications requiring direct cellular manipulation. Automation integration enhances throughput and reduces technical skill requirements.

Research institutions benefit from access to advanced transfection technologies that enable cutting-edge genomic research and accelerate scientific discovery. Improved transfection efficiency and reduced cytotoxicity enhance experimental success rates and data quality. Cost-effectiveness of modern reagents and equipment reduces overall research expenses while improving productivity and research outcomes.

Pharmaceutical companies gain competitive advantages through access to reliable transfection solutions supporting drug discovery and development programs. Advanced technologies enable more efficient target validation, compound screening, and therapeutic development processes. Regulatory compliance features of established transfection methods facilitate clinical development and regulatory approval processes.

Biotechnology firms leverage transfection technologies to develop innovative therapeutic approaches and establish competitive market positions. Specialized transfection solutions enable unique research capabilities and product development opportunities. Scalability options support business growth from research-stage activities to commercial manufacturing applications.

Contract research organizations utilize advanced transfection capabilities to offer specialized services and attract pharmaceutical and biotechnology clients. Comprehensive transfection expertise enables service differentiation and premium pricing opportunities. Technology partnerships with transfection suppliers enhance service capabilities and market competitiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation integration represents a dominant trend as research institutions and pharmaceutical companies seek to improve throughput and reduce manual labor requirements. Automated transfection systems enable high-throughput screening applications and improve experimental reproducibility. Workflow optimization through automation reduces costs and enhances productivity, driving adoption across various market segments.

Nanotechnology incorporation emerges as a significant trend with nanoparticle-based delivery systems offering improved targeting and reduced toxicity. Advanced nanomaterials enable precise cellular targeting and controlled release mechanisms. Innovation focus centers on developing biocompatible nanocarriers with enhanced delivery efficiency and minimal side effects.

Personalized medicine alignment drives development of specialized transfection solutions supporting individualized therapeutic approaches. Custom transfection protocols and patient-specific applications require flexible and adaptable delivery systems. Market adaptation focuses on providing personalized solutions for diverse genetic backgrounds and therapeutic requirements.

Sustainability emphasis influences product development toward environmentally friendly reagents and equipment with reduced environmental impact. Companies invest in developing biodegradable transfection agents and energy-efficient equipment. Green chemistry principles guide formulation development and manufacturing processes, appealing to environmentally conscious customers.

Recent product launches demonstrate continuous innovation in transfection technology, with companies introducing next-generation reagents offering improved efficiency and reduced cytotoxicity. MarkWide Research analysis indicates that new product introductions have increased by 23% annually over the past three years, reflecting intense competitive activity and rapid technological advancement.

Strategic partnerships between transfection suppliers and pharmaceutical companies facilitate technology development and market access. Collaborative agreements enable joint research programs, custom product development, and exclusive distribution arrangements. Partnership trends focus on combining complementary technologies and expanding geographic reach through local market expertise.

Regulatory approvals for gene therapy applications create new market opportunities and validate transfection technology safety and efficacy. Recent FDA approvals for gene-based therapeutics demonstrate regulatory acceptance and encourage further investment in related technologies. Regulatory progress provides market confidence and supports continued research and development activities.

Acquisition activities consolidate market participants and combine complementary technologies to create comprehensive solution providers. Strategic acquisitions enable companies to expand product portfolios, access new markets, and leverage synergistic capabilities. Market consolidation trends reflect the advantages of scale in research and development and global market coverage.

Investment priorities should focus on companies with strong research and development capabilities, comprehensive product portfolios, and established customer relationships. Market leaders with proven track records in innovation and customer support offer the most attractive investment opportunities. Growth potential appears strongest in companies serving emerging applications like gene editing and cell therapy manufacturing.

Technology focus recommendations emphasize next-generation delivery systems with improved efficiency, reduced toxicity, and broader applicability. Companies developing automation-compatible solutions and high-throughput capabilities position themselves advantageously for future market growth. Innovation investment in nanotechnology-based delivery systems offers significant differentiation opportunities.

Geographic expansion strategies should prioritize emerging markets with growing research infrastructure and increasing biotechnology investments. Asia-Pacific markets offer particularly attractive growth opportunities through government support and expanding pharmaceutical industries. Market entry approaches should emphasize local partnerships and technology transfer arrangements.

Customer relationship management requires emphasis on technical support, application expertise, and long-term partnerships. Successful companies invest in customer education, protocol development, and comprehensive support services. Service differentiation through superior customer support creates competitive advantages and customer loyalty in this technical market.

Market growth projections indicate continued expansion driven by increasing applications in gene therapy, personalized medicine, and advanced research techniques. MWR forecasts suggest the market will maintain robust growth rates exceeding 8% annually through the next decade, supported by technological advancement and expanding application areas.

Technology evolution will likely focus on improving delivery efficiency, reducing cellular toxicity, and expanding compatibility across diverse cell types. Next-generation transfection systems may incorporate artificial intelligence for protocol optimization and automated quality control. Innovation trends point toward more sophisticated, user-friendly systems with enhanced performance characteristics.

Application expansion into new therapeutic areas and research fields will drive market diversification and growth opportunities. Emerging applications in regenerative medicine, agricultural biotechnology, and industrial biotechnology create additional market segments. Market diversification reduces dependence on traditional research applications and provides stability through varied demand sources.

Regulatory landscape evolution will likely provide clearer guidance for therapeutic applications while maintaining safety standards. Streamlined approval processes for gene therapy applications may accelerate market growth and encourage innovation. Regulatory clarity supports investment decisions and facilitates product development planning across the industry.

Market assessment reveals a dynamic and rapidly growing transfection reagents and equipment market driven by expanding applications in gene therapy, personalized medicine, and advanced research techniques. Strong fundamentals including increasing research funding, technological advancement, and growing therapeutic applications support continued market expansion. Growth momentum appears sustainable through diverse application areas and geographic expansion opportunities.

Competitive positioning favors companies with strong innovation capabilities, comprehensive product portfolios, and established customer relationships. Market leaders continue investing in research and development to maintain technological advantages and expand application ranges. Success factors include technical expertise, customer support excellence, and ability to adapt to evolving market requirements.

Future prospects remain highly positive, supported by increasing gene therapy development, expanding CRISPR applications, and growing investment in precision medicine initiatives. The market benefits from favorable regulatory trends, increasing research funding, and continuous technological advancement. Long-term outlook suggests sustained growth opportunities across multiple application areas and geographic markets, making this an attractive sector for continued investment and development.

What is Transfection Reagents and Equipment?

Transfection reagents and equipment are tools used to introduce nucleic acids into cells, facilitating genetic modification and research. They are essential in various applications, including gene therapy, vaccine development, and molecular biology studies.

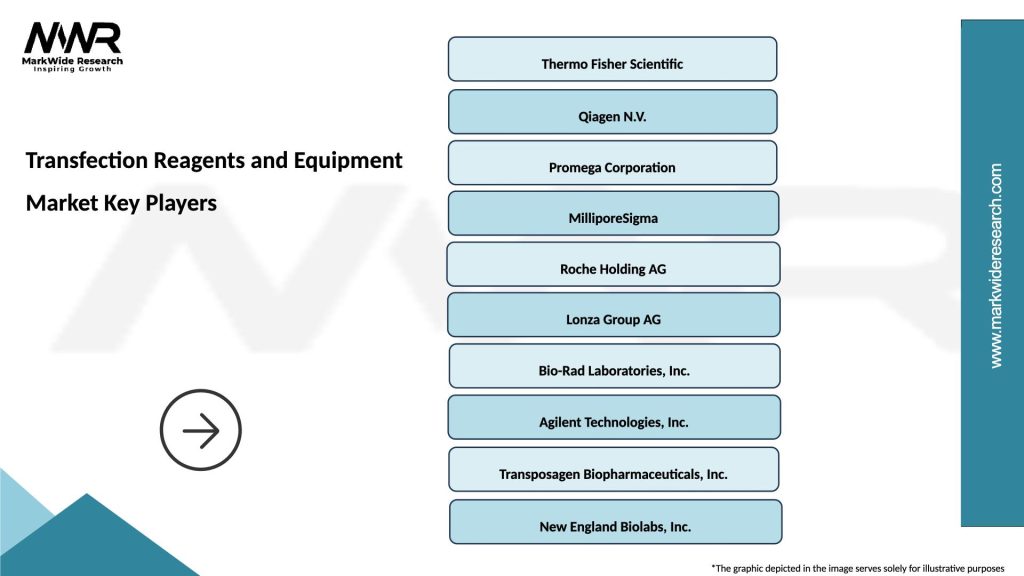

What are the key players in the Transfection Reagents and Equipment Market?

Key players in the Transfection Reagents and Equipment Market include Thermo Fisher Scientific, Promega Corporation, and Roche, among others. These companies are known for their innovative products and extensive research capabilities in the field of molecular biology.

What are the growth factors driving the Transfection Reagents and Equipment Market?

The growth of the Transfection Reagents and Equipment Market is driven by the increasing demand for gene therapies and advancements in molecular biology techniques. Additionally, the rise in research activities in biotechnology and pharmaceuticals contributes to market expansion.

What challenges does the Transfection Reagents and Equipment Market face?

The Transfection Reagents and Equipment Market faces challenges such as the high cost of advanced reagents and the complexity of transfection processes. Additionally, regulatory hurdles and the need for specialized training can hinder market growth.

What opportunities exist in the Transfection Reagents and Equipment Market?

Opportunities in the Transfection Reagents and Equipment Market include the development of more efficient and user-friendly transfection methods. The growing focus on personalized medicine and the expansion of research in genetic engineering also present significant growth potential.

What trends are shaping the Transfection Reagents and Equipment Market?

Trends in the Transfection Reagents and Equipment Market include the increasing use of CRISPR technology and the development of non-viral transfection methods. Additionally, there is a growing emphasis on sustainable practices and the use of biodegradable materials in reagent production.

Transfection Reagents and Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plasmid DNA, RNAi, Electroporation Devices, Lipid Reagents |

| Technology | Viral Vectors, Microinjection, Nanoparticles, Chemical Transfection |

| End User | Academic Institutions, Pharmaceutical Companies, Biotechnology Firms, Contract Research Organizations |

| Application | Gene Therapy, Vaccine Development, Cell Line Development, Functional Genomics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Transfection Reagents and Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at