444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The trade surveillance market is witnessing significant growth due to the increasing need for regulatory compliance and the rising instances of market abuse and financial fraud. Trade surveillance refers to the process of monitoring, detecting, and analyzing trading activities in the financial markets to identify any potential violations of rules and regulations.

Meaning

Trade surveillance involves the use of advanced technologies and analytics tools to track and analyze trading activities in real-time. It helps regulatory bodies, financial institutions, and market participants to identify and prevent market manipulation, insider trading, fraud, and other illegal activities. By monitoring trade data, order flows, and communication channels, trade surveillance systems can detect suspicious patterns and behaviors, ensuring fair and transparent markets.

Executive Summary

The trade surveillance market is experiencing substantial growth driven by the increasing adoption of surveillance systems by financial institutions and regulatory authorities. The market offers sophisticated solutions that enable real-time monitoring, analysis, and reporting of trading activities across various asset classes and markets. These solutions help in improving market integrity, ensuring investor protection, and maintaining regulatory compliance.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

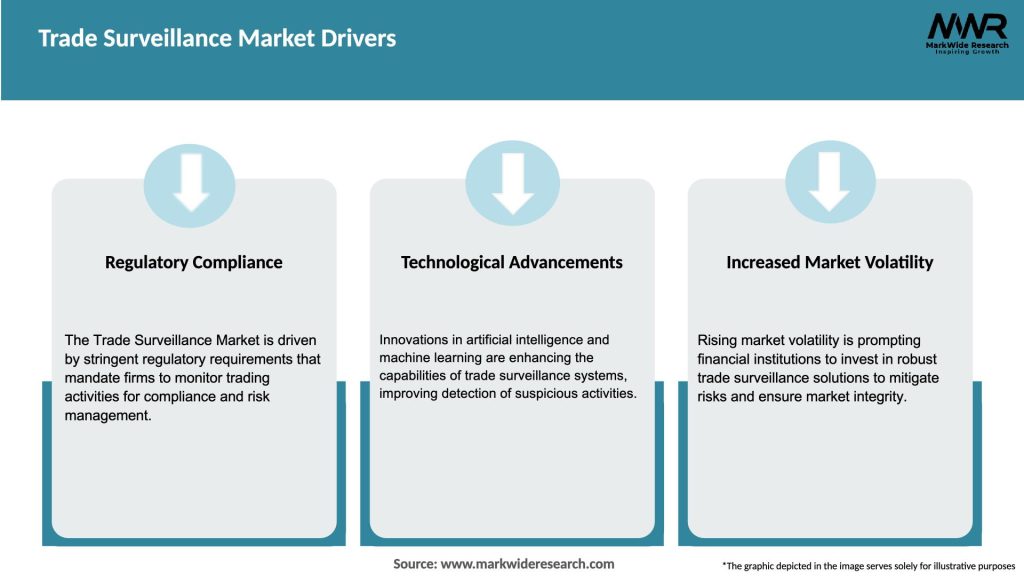

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The trade surveillance market is driven by regulatory compliance requirements, the need to combat market abuse, technological advancements, and the increasing complexity of trading activities. While implementation costs, data security concerns, and skilled workforce shortage pose challenges, opportunities lie in cloud-based solutions, emerging markets, advanced analytics, and partnerships.

Regional Analysis

The trade surveillance market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America dominates the market due to the presence of major financial centers, stringent regulatory frameworks, and high adoption of trade surveillance solutions. Europe follows closely, driven by regulatory initiatives such as MiFID II. The Asia Pacific region is experiencing rapid market growth due to the expansion of financial markets and increasing regulatory focus on market integrity.

Competitive Landscape

Leading Companies in the Trade Surveillance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The trade surveillance market can be segmented based on deployment mode, component, application, and end-user. By deployment mode, the market can be categorized into on-premises and cloud-based solutions. The component segment includes software and services. Applications of trade surveillance systems include market surveillance, compliance monitoring, insider trading detection, and others. Financial institutions, regulatory authorities, and brokerage firms are the major end-users of trade surveillance solutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the trade surveillance market. The market experienced a surge in trading volumes and increased volatility during the pandemic, leading to a higher risk of market abuse and fraudulent activities. Regulatory authorities intensified their monitoring efforts, and financial institutions accelerated the adoption of surveillance systems to detect and prevent any potential misconduct in the markets. The pandemic highlighted the importance of robust trade surveillance capabilities in ensuring market integrity and stability.

Key Industry Developments

Analyst Suggestions

Future Outlook

The trade surveillance market is poised for substantial growth in the coming years. The increasing need for regulatory compliance, rising instances of market abuse, and advancements in technology will drive the market expansion. Cloud-based solutions, emerging markets, and advanced analytics will provide significant growth opportunities. However, organizations need to address implementation costs, data security concerns, and the shortage of skilled professionals to fully capitalize on the market potential.

Conclusion

The trade surveillance market plays a crucial role in maintaining market integrity, ensuring investor protection, and regulatory compliance. The market is driven by regulatory requirements, the need to combat market abuse, and technological advancements. While challenges such as implementation costs and data security concerns exist, opportunities lie in cloud-based solutions, emerging markets, and advanced analytics. Continuous innovation, strategic partnerships, and collaboration will be key to staying competitive in this rapidly evolving market.

What is trade surveillance?

Trade surveillance refers to the monitoring of trading activities to detect and prevent market abuse, fraud, and other irregularities. It involves the use of technology and analytics to ensure compliance with regulations and maintain market integrity.

Who are the key players in the trade surveillance market?

Key players in the trade surveillance market include NICE Actimize, Nasdaq, and FIS, which provide advanced solutions for monitoring trading activities and ensuring compliance. Other notable companies include AxiomSL and S3 Partners, among others.

What are the main drivers of growth in the trade surveillance market?

The trade surveillance market is driven by increasing regulatory requirements, the need for enhanced risk management, and the growing complexity of trading environments. Additionally, the rise of algorithmic trading and the demand for real-time monitoring contribute to market growth.

What challenges does the trade surveillance market face?

Challenges in the trade surveillance market include the high costs of implementing advanced surveillance systems and the difficulty in keeping up with evolving regulations. Additionally, the integration of new technologies can pose operational challenges for firms.

What opportunities exist in the trade surveillance market?

Opportunities in the trade surveillance market include the development of AI and machine learning technologies to enhance surveillance capabilities. There is also potential for growth in emerging markets as regulatory frameworks become more stringent.

What trends are shaping the trade surveillance market?

Trends in the trade surveillance market include the increasing adoption of cloud-based solutions and the integration of big data analytics for improved insights. Additionally, there is a growing focus on automated surveillance systems to enhance efficiency and accuracy.

Trade Surveillance Market

| Segmentation | Details |

|---|---|

| Component | Solutions, Services |

| Deployment Mode | On-premises, Cloud |

| Organization Size | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| Application | Brokerage Firms, Exchanges, Investment Banks, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Trade Surveillance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at