444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The trade finance market plays a vital role in facilitating international trade by providing financial instruments and services to businesses involved in cross-border transactions. It encompasses various activities, including issuing letters of credit, trade guarantees, export financing, and supply chain financing. The market has experienced significant growth in recent years due to globalization and the expansion of international trade.

Meaning

Trade finance refers to the financing of trade activities, such as import and export transactions, through a range of financial products and services. It enables businesses to mitigate the risks associated with cross-border trade, including payment defaults, political instability, and currency fluctuations. Trade finance instruments, such as letters of credit and trade guarantees, provide assurance to buyers and sellers by facilitating secure and efficient transactions.

Executive Summary

The trade finance market has witnessed robust growth in recent years, driven by increasing international trade volumes and the need for financial solutions to mitigate trade-related risks. The market is characterized by the presence of both traditional financial institutions and non-banking financial intermediaries offering innovative trade finance products. With the emergence of digital technologies, the trade finance landscape is undergoing a transformation, enabling faster, more secure, and efficient trade transactions.

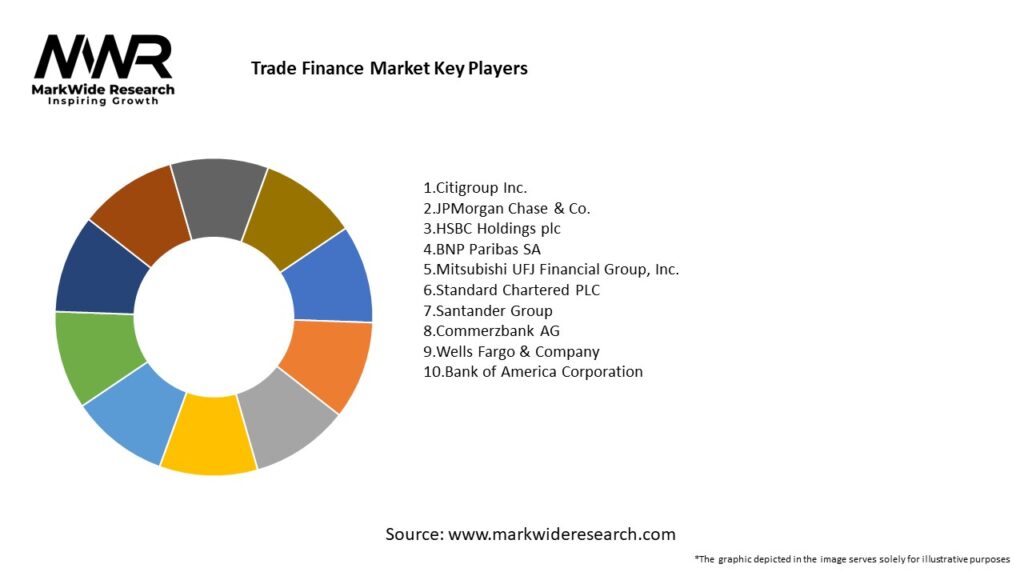

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

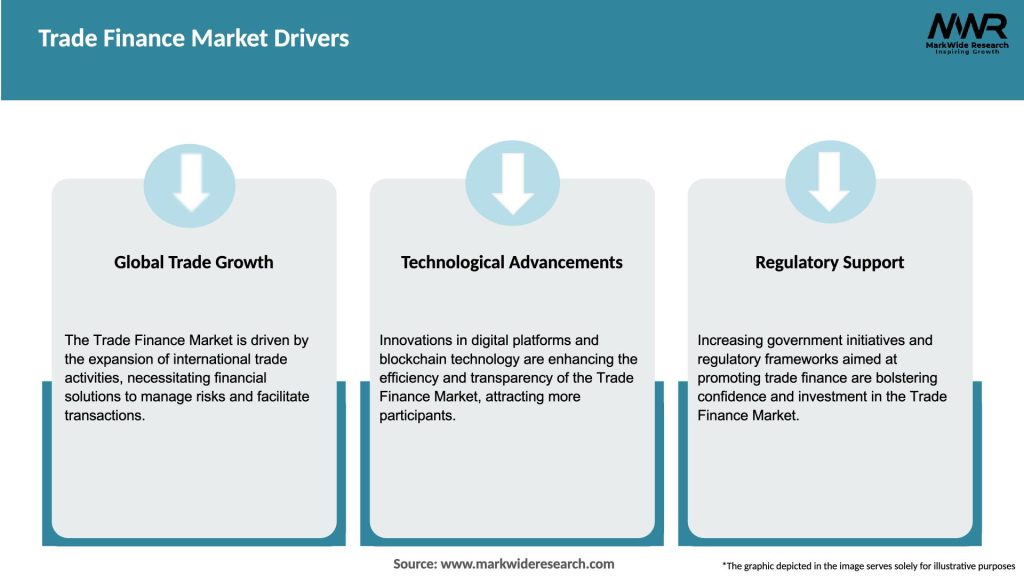

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The trade finance market is dynamic and influenced by various factors, including global economic trends, regulatory changes, technological advancements, and geopolitical developments. These dynamics shape the market landscape and impact the demand for trade finance services. The integration of digital technologies and the emphasis on sustainability are driving transformative changes in the market, creating opportunities for both traditional players and new entrants.

Regional Analysis

The trade finance market exhibits regional variations influenced by factors such as economic growth, trade volumes, regulatory environments, and market maturity. The Asia-Pacific region, including countries like China, India, and Singapore, is a prominent market for trade finance due to its robust trade activities and growing economies. Europe and North America also represent significant trade finance markets, driven by established financial systems and extensive cross-border trade relationships.

Competitive Landscape

Leading Companies in Trade Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

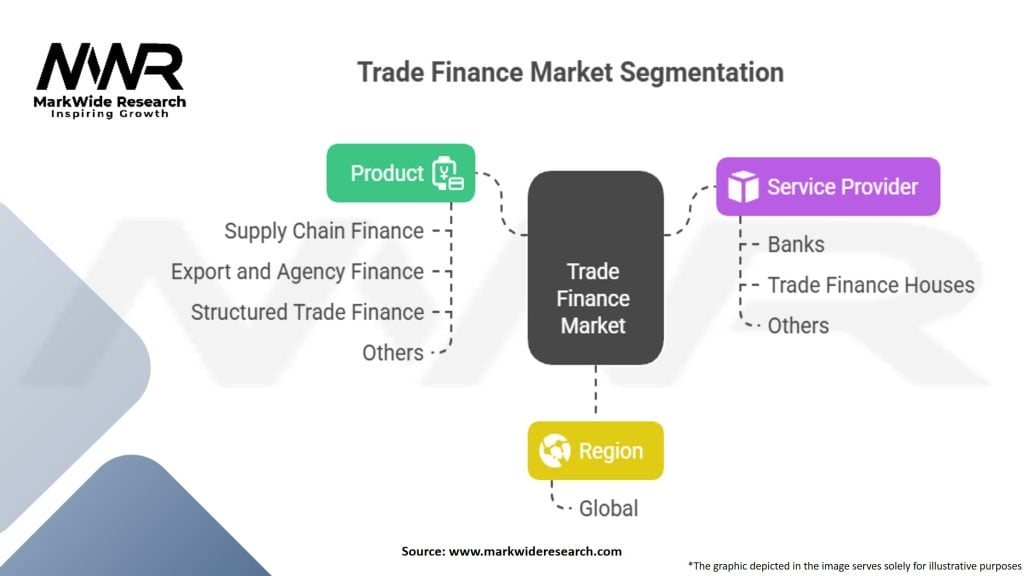

Segmentation

The trade finance market can be segmented based on various criteria, including product type, end-user industry, and geographic region. Product types include letters of credit, documentary collections, open account financing, and supply chain financing. End-user industries encompass sectors such as manufacturing, agriculture, energy, and retail. Geographically, the market can be segmented into regions such as Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the trade finance market can benefit from various advantages, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the trade finance market. Lockdown measures, supply chain disruptions, and reduced global trade volumes affected the demand for trade finance services. The pandemic highlighted the importance of resilient trade finance systems and accelerated the adoption of digital solutions to overcome physical limitations. The crisis also emphasized the need for risk mitigation and increased collaboration among stakeholders to support businesses in navigating challenging trade environments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the trade finance market appears promising, driven by factors such as the continued growth of international trade, advancements in digital technologies, and the increasing focus on sustainability. The market will likely witness further integration of digital platforms, expansion of sustainable trade finance solutions, and enhanced collaboration among stakeholders. However, challenges related to regulatory compliance, geopolitical uncertainties, and the need for continuous innovation will require market players to adapt and evolve to remain competitive.

Conclusion

The trade finance market plays a crucial role in supporting international trade by providing financial instruments and services to mitigate risks and facilitate transactions. The market is witnessing significant developments driven by digital transformation, sustainability considerations, and collaborative efforts among stakeholders. Although challenges exist, such as regulatory complexities and geopolitical uncertainties, the trade finance market is poised for growth, offering opportunities for industry participants to innovate, expand their offerings, and support businesses in navigating the dynamic landscape of international trade.

What is trade finance?

Trade finance refers to the financial instruments and products that facilitate international trade and commerce. It includes various services such as letters of credit, trade credit insurance, and factoring, which help mitigate risks and ensure payment between buyers and sellers across borders.

Who are the key players in the trade finance market?

Key players in the trade finance market include major banks like HSBC and Citibank, as well as financial institutions such as Standard Chartered and BNP Paribas. These companies provide essential services that support global trade transactions, among others.

What are the main drivers of growth in the trade finance market?

The trade finance market is driven by increasing globalization, the rise of e-commerce, and the need for businesses to manage cash flow effectively. Additionally, the expansion of emerging markets and the growing demand for cross-border transactions contribute to its growth.

What challenges does the trade finance market face?

The trade finance market faces challenges such as regulatory compliance, fraud risks, and the complexity of international trade agreements. Additionally, the lack of access to finance for small and medium-sized enterprises can hinder market growth.

What opportunities exist in the trade finance market?

Opportunities in the trade finance market include the adoption of digital technologies, which can streamline processes and enhance transparency. Furthermore, the increasing focus on sustainable trade practices presents new avenues for growth and innovation.

What trends are shaping the trade finance market?

Trends in the trade finance market include the rise of fintech solutions that offer alternative financing options and the integration of blockchain technology to improve transaction security. Additionally, there is a growing emphasis on sustainability and ethical sourcing in trade finance practices.

Trade Finance Market

| Segmentation Details | Details |

|---|---|

| By Product | Supply Chain Finance, Export and Agency Finance, Structured Trade Finance, Others |

| By Service Provider | Banks, Trade Finance Houses, Others |

| By Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Trade Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at