444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Trade credit insurance is a specialized insurance product that provides protection to businesses against the risk of non-payment by their customers. It safeguards companies from financial losses that may occur due to insolvency, bankruptcy, or protracted default of their buyers. The trade credit insurance market has gained significant traction in recent years, as businesses increasingly recognize the need for risk mitigation in the current global economic landscape.

Meaning

Trade credit insurance, also known as credit insurance or export credit insurance, is a type of insurance that helps companies manage the credit risks associated with their trade activities. It offers coverage for both domestic and international transactions, ensuring that businesses can recover their losses in case of non-payment by customers. By transferring the risk to an insurance provider, companies can protect their cash flow, enhance their credit management practices, and confidently extend credit terms to customers.

Executive Summary

The trade credit insurance market has witnessed substantial growth in recent years, driven by the increasing demand for risk management solutions in the business ecosystem. With globalization and the expansion of international trade, companies face higher exposure to credit risks. Trade credit insurance acts as a financial safety net, allowing businesses to focus on growth while minimizing the impact of payment defaults. This report provides a comprehensive analysis of the trade credit insurance market, including key market insights, drivers, restraints, opportunities, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The trade credit insurance market is characterized by dynamic factors that shape its growth and evolution. Key dynamics include changing customer expectations, technological advancements, regulatory developments, and macroeconomic factors. The market is highly competitive, with a few dominant players and a significant number of smaller regional or specialized insurers. The market dynamics drive continuous innovation, expansion into new markets, and the development of risk management solutions that address the evolving needs of businesses.

Regional Analysis

The trade credit insurance market exhibits regional variations influenced by factors such as economic conditions, trade volumes, industry composition, and regulatory frameworks. The analysis of regional markets provides insights into market size, growth rates, market trends, and competitive landscape.

Competitive Landscape

Leading Companies in the Trade Credit Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

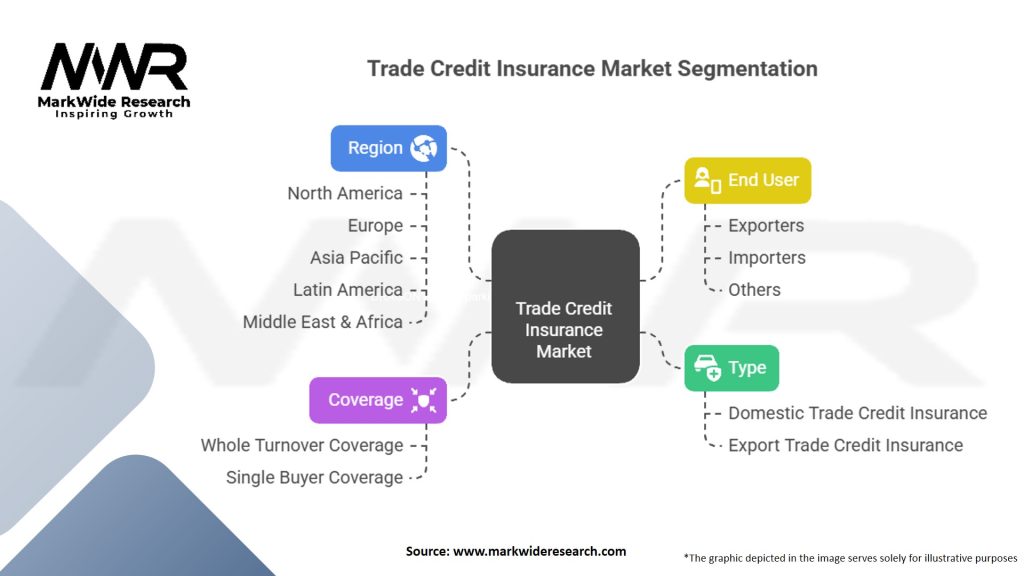

Segmentation

The trade credit insurance market can be segmented based on various criteria, including the type of coverage (domestic or export), industry verticals (manufacturing, construction, retail, etc.), and company size (SMEs or large enterprises). Segmentation enables a deeper understanding of market dynamics, customer needs, and growth opportunities within specific segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the trade credit insurance market. The global economic downturn, disruptions in supply chains, and increased credit risks led to heightened demand for trade credit insurance as businesses sought protection against payment defaults. Insurers had to assess and manage the risks associated with pandemic-related uncertainties, leading to adjustments in coverage terms, underwriting criteria, and pricing.

Key Industry Developments

Analyst Suggestions

Future Outlook

The trade credit insurance market is expected to witness steady growth in the coming years. The increasing globalization of trade, economic uncertainties, and the need for risk mitigation will continue to drive the demand for trade credit insurance. Insurers that can provide flexible, industry-specific solutions, embrace technological advancements, and effectively educate businesses about the benefits of credit insurance are likely to thrive in this evolving market.

Conclusion

Trade credit insurance plays a crucial role in managing credit risks and protecting businesses from financial losses due to non-payment. The market is driven by the need for risk mitigation, economic uncertainties, and compliance requirements. Although challenges such as premium costs and limited coverage exist, opportunities arise from emerging markets, technological advancements, and product innovation. The trade credit insurance industry is evolving, with increasing adoption of digital platforms, industry-specific solutions, and flexibility in policy customization. The Covid-19 pandemic has further highlighted the importance of trade credit insurance in managing payment risks. To succeed in this competitive market, trade credit insurance providers should focus on customer education, strengthen industry partnerships, embrace technology, and develop tailored solutions for different sectors. The future outlook for the trade credit insurance market is promising, with sustained growth expected as businesses recognize the value of risk management in today’s globalized economy.

What is trade credit insurance?

Trade credit insurance is a financial product that protects businesses against the risk of non-payment by their customers. It covers losses from unpaid invoices due to insolvency, protracted default, or political risks, helping companies manage credit risk effectively.

Who are the key players in the trade credit insurance market?

Key players in the trade credit insurance market include Euler Hermes, Coface, and Atradius, which provide various credit insurance solutions to businesses. These companies help mitigate risks associated with trade credit, among others.

What are the main drivers of growth in the trade credit insurance market?

The main drivers of growth in the trade credit insurance market include increasing global trade, rising insolvency rates, and the need for businesses to protect their receivables. Additionally, the growing awareness of credit risk management is contributing to market expansion.

What challenges does the trade credit insurance market face?

The trade credit insurance market faces challenges such as fluctuating economic conditions, which can impact the demand for insurance products. Additionally, the complexity of underwriting and the need for accurate risk assessment can pose difficulties for insurers.

What opportunities exist in the trade credit insurance market?

Opportunities in the trade credit insurance market include the expansion into emerging markets and the development of innovative insurance products tailored to specific industries. The increasing digitization of trade processes also presents new avenues for growth.

What trends are shaping the trade credit insurance market?

Trends shaping the trade credit insurance market include the integration of technology for better risk assessment and claims management. Additionally, there is a growing focus on sustainability and ESG factors, influencing how insurers evaluate risks and offer coverage.

Trade Credit Insurance Market

| Segmentation | Details |

|---|---|

| Type | Domestic Trade Credit Insurance, Export Trade Credit Insurance |

| Coverage | Whole Turnover Coverage, Single Buyer Coverage |

| End User | Exporters, Importers, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Trade Credit Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at