444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The total station market has witnessed significant growth in recent years due to advancements in surveying technology and increased demand for accurate and efficient measurement tools. Total stations are electronic devices used in surveying and construction projects to measure angles and distances with high precision. They combine the functionality of electronic theodolites and electronic distance meters, making them a vital tool for professionals in the construction, engineering, and surveying industries.

A total station is an optical and electronic instrument used for surveying and construction applications. It integrates a theodolite for measuring horizontal and vertical angles, a distance meter for measuring distances, and a microprocessor for data processing. By combining these features into a single device, total stations enable surveyors and construction professionals to perform accurate measurements and collect precise data in real-time.

Executive Summary

The total station market has been experiencing steady growth in recent years, driven by the rising demand for advanced surveying equipment and the increasing number of infrastructure development projects. This report provides a comprehensive analysis of the market, including key market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, and future outlook. It aims to assist industry participants and stakeholders in understanding the current market trends and making informed decisions.

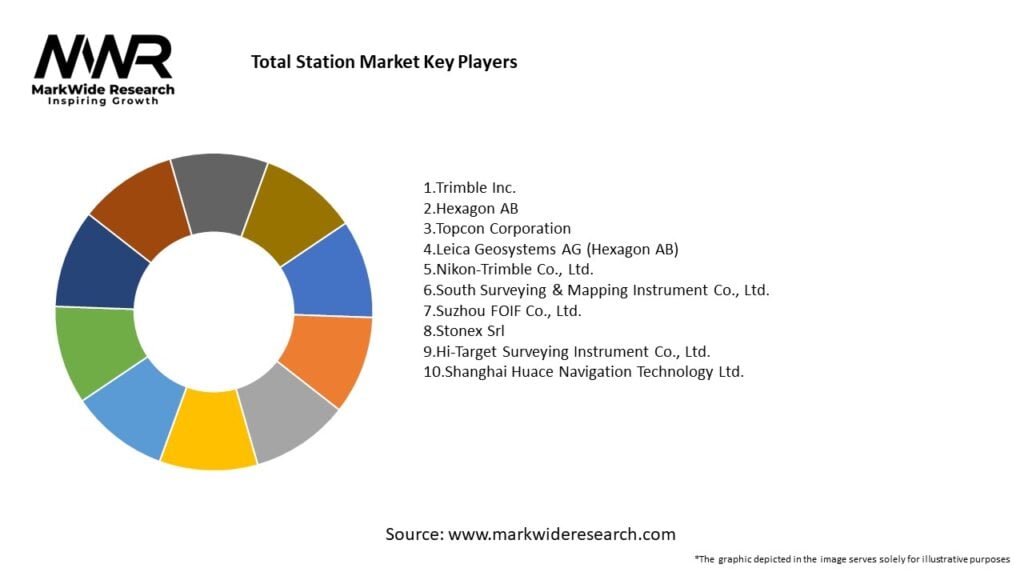

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

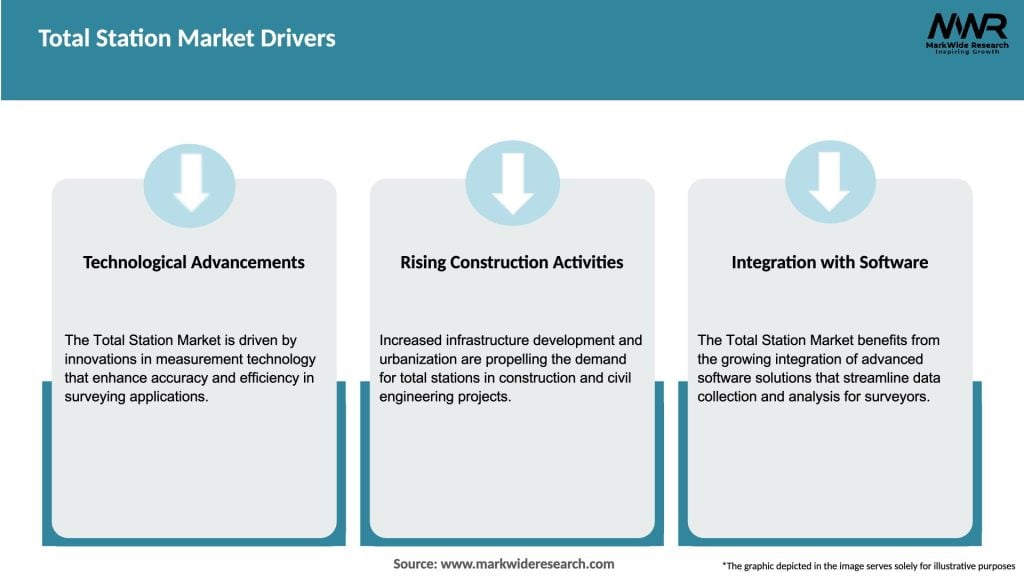

The total station market is driven by various factors, including technological advancements, infrastructure development projects, and the demand for accurate measurements. However, it also faces challenges such as high costs and competition from alternative surveying technologies. The market presents opportunities for growth, especially in emerging economies and through the integration of total stations with AR and VR technologies.

Regional Analysis

The total station market can be segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its own market dynamics influenced by factors such as economic development, infrastructure projects, and technological advancements. The Asia Pacific region is expected to dominate the total station market due to rapid urbanization, infrastructure investments, and expanding construction activities.

Competitive Landscape

Leading Companies in the Total Station Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

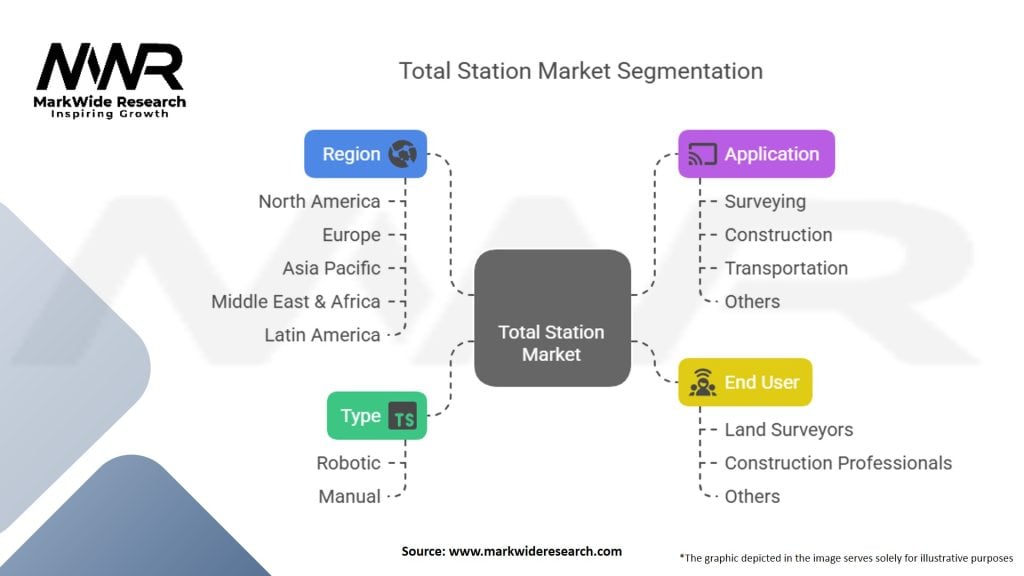

The total station market can be segmented based on product type, application, and end-user industry. Product types include manual total stations, robotic total stations, and motorized total stations. Applications of total stations range from land surveying and construction to infrastructure development and geological surveys. The end-user industries include construction, transportation, utilities, and agriculture, among others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The total station market experienced a temporary slowdown due to the COVID-19 pandemic, as construction and surveying activities were affected by lockdowns and restrictions. However, the market is expected to recover as construction projects resume and investments in infrastructure development increase to stimulate economic recovery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The total station market is expected to witness steady growth in the coming years, driven by increased infrastructure investments, technological advancements, and the demand for accurate measurements in various industries. The integration of total stations with advanced technologies such as AR, VR, and cloud computing will further enhance their capabilities and open up new opportunities for market expansion.

Conclusion

The total station market is experiencing steady growth, driven by factors such as technological advancements, infrastructure development projects, and the need for accurate measurements in various industries. Despite challenges, the market presents opportunities for industry participants to innovate, collaborate, and expand their offerings. By staying abreast of market trends and embracing new technologies, companies can position themselves for success in this dynamic and evolving market.

What is a total station?

A total station is an electronic surveying instrument that combines the functions of a theodolite for measuring angles and an electronic distance measuring device (EDM) to determine distances. It is widely used in construction, civil engineering, and land surveying for precise measurements and data collection.

Who are the key players in the Total Station Market?

Key players in the Total Station Market include Leica Geosystems, Trimble, Topcon, and Sokkia, among others. These companies are known for their innovative products and technologies that enhance surveying accuracy and efficiency.

What are the main drivers of growth in the Total Station Market?

The growth of the Total Station Market is driven by the increasing demand for accurate surveying in construction and infrastructure development, advancements in technology that improve measurement precision, and the rising adoption of automation in surveying processes.

What challenges does the Total Station Market face?

The Total Station Market faces challenges such as the high cost of advanced total stations, the need for skilled operators to effectively use these instruments, and competition from alternative surveying technologies like drones and GPS systems.

What opportunities exist in the Total Station Market?

Opportunities in the Total Station Market include the integration of total stations with software solutions for data analysis, the expansion of applications in emerging markets, and the growing trend of smart construction practices that require precise measurement tools.

What are the current trends in the Total Station Market?

Current trends in the Total Station Market include the development of compact and lightweight models, the incorporation of cloud-based data management systems, and the increasing use of total stations in geospatial applications and urban planning.

Total Station Market

| Segmentation | Details |

|---|---|

| Type | Robotic, Manual |

| Application | Surveying, Construction, Transportation, Others |

| End User | Land Surveyors, Construction Professionals, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Total Station Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at