444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The tokenization solution market has been witnessing significant growth in recent years, driven by the increasing adoption of digital payment methods and the need for enhanced security and data protection. Tokenization refers to the process of replacing sensitive data, such as credit card numbers or personal identification information, with unique identification symbols called tokens. These tokens are meaningless to hackers or unauthorized users, thus providing an added layer of security.

Tokenization solutions are widely used across various industries, including banking and financial services, healthcare, retail, and e-commerce, among others. The market is characterized by the presence of numerous solution providers offering a range of tokenization solutions to cater to the specific needs of organizations. This market overview provides insights into the meaning of tokenization, key market insights, market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, and other relevant aspects of the tokenization solution market.

Meaning

Tokenization is a data security technique that involves substituting sensitive data with non-sensitive data, known as tokens. These tokens have no inherent value or meaning and cannot be reverse-engineered to obtain the original data. The process of tokenization ensures that sensitive information remains protected even if it is intercepted or compromised. Tokenization is widely used in payment card industry data security standards (PCI DSS) compliance, where credit card numbers are replaced with tokens to minimize the risk of data breaches.

Executive Summary

The tokenization solution market is experiencing robust growth, driven by the increasing need for secure data storage and transactions. With the proliferation of digital payments and the rise in cyber threats, organizations are prioritizing data security and compliance with industry regulations. Tokenization solutions offer a viable solution by replacing sensitive data with tokens, ensuring that even if the tokens are intercepted, they hold no value for hackers. This executive summary provides a concise overview of the market, highlighting the key market insights, drivers, restraints, opportunities, and future outlook.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Global Tokenization Solution Market:

Market Restraints

Despite strong growth, the Global Tokenization Solution Market faces several challenges:

Market Opportunities

The Global Tokenization Solution Market presents several opportunities for growth:

Market Dynamics

The Global Tokenization Solution Market is shaped by several dynamic forces:

Regional Analysis

The Global Tokenization Solution Market is segmented by region, with key markets including:

Competitive Landscape

Leading Companies in Tokenization Solution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Global Tokenization Solution Market can be segmented by the following factors:

Deployment Type

End-User Industry

Application

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on various industries, including the tokenization solution market. The pandemic accelerated the shift towards digital payments and online transactions as physical distancing measures limited in-person interactions. This increased reliance on digital channels created a greater need for secure payment methods and data protection. Organizations that had already implemented tokenization solutions were better positioned to handle the surge in online transactions and ensure the security of customer data. The pandemic has underscored the importance of robust data security measures, driving the adoption of tokenization solutions.

Key Industry Developments

The tokenization solution market has witnessed several key industry developments in recent years. Solution providers have focused on developing innovative tokenization technologies, such as dynamic tokenization that generates unique tokens for each transaction. Partnerships and collaborations between solution providers and industry players have also been a prominent trend, enabling the integration of tokenization with existing systems and applications. Additionally, regulatory developments, such as the introduction of new data protection regulations, have influenced the adoption of tokenization solutions across industries.

Analyst Suggestions

Based on the analysis of the tokenization solution market, industry analysts provide valuable suggestions for stakeholders and businesses. Firstly, organizations should prioritize data security and compliance with industry regulations by implementing tokenization solutions. Secondly, investing in cloud-based tokenization solutions can offer scalability, flexibility, and cost-effectiveness. Thirdly, businesses should consider strategic partnerships and collaborations with solution providers to leverage their expertise and expand their product offerings. Lastly, organizations should stay updated with emerging technologies and trends in the tokenization space to stay competitive and ensure long-term success.

Future Outlook

The future outlook for the tokenization solution market is highly optimistic. The market is expected to witness continued growth due to the increasing demand for data security and compliance with regulations. The integration of tokenization with emerging technologies like blockchain and the adoption of cloud-based tokenization are expected to drive market expansion. The rise of digital payments, the growth of e-commerce, and the increasing awareness of data breaches will further fuel the demand for tokenization solutions. Overall, the future looks promising for the tokenization solution market, with ample opportunities for innovation and growth.

Conclusion

In conclusion, the tokenization solution market is experiencing rapid growth due to the increasing need for secure data storage and transactions. Tokenization offers a robust data security solution by replacing sensitive data with tokens that hold no value to unauthorized users. The market is driven by factors such as the rising adoption of digital payments, stringent data protection regulations, and the growing awareness of data breaches. Despite certain challenges, such as implementation costs and interoperability issues, the market offers significant opportunities for solution providers. With the future outlook being optimistic, the tokenization solution market is poised for sustained growth and innovation in the coming years.

What is Tokenization Solution?

Tokenization Solution refers to the process of converting sensitive data into unique identification symbols, or tokens, that retain essential information about the data without compromising its security. This technology is widely used in industries such as finance, healthcare, and retail to protect sensitive information like credit card numbers and personal identification details.

What are the key players in the Tokenization Solution Market?

Key players in the Tokenization Solution Market include companies like Thales Group, TokenEx, and Protegrity, which provide various tokenization services and solutions. These companies focus on enhancing data security and compliance across different sectors, including banking and e-commerce, among others.

What are the main drivers of growth in the Tokenization Solution Market?

The main drivers of growth in the Tokenization Solution Market include the increasing need for data security due to rising cyber threats, regulatory compliance requirements, and the growing adoption of digital payment systems. Additionally, the demand for secure data handling in industries like healthcare and finance is propelling market expansion.

What challenges does the Tokenization Solution Market face?

Challenges in the Tokenization Solution Market include the complexity of implementation, potential performance issues, and the need for ongoing maintenance and updates. Furthermore, the varying regulations across different regions can complicate compliance for businesses looking to adopt tokenization solutions.

What opportunities exist in the Tokenization Solution Market?

Opportunities in the Tokenization Solution Market are driven by the increasing demand for secure payment processing and the rise of cloud-based solutions. As more businesses seek to protect sensitive customer data, there is significant potential for innovation and growth in tokenization technologies.

What trends are shaping the Tokenization Solution Market?

Trends shaping the Tokenization Solution Market include the integration of artificial intelligence and machine learning to enhance security measures, as well as the growing focus on privacy regulations. Additionally, the shift towards mobile payments and digital wallets is influencing the development of more advanced tokenization solutions.

Tokenization Solution Market

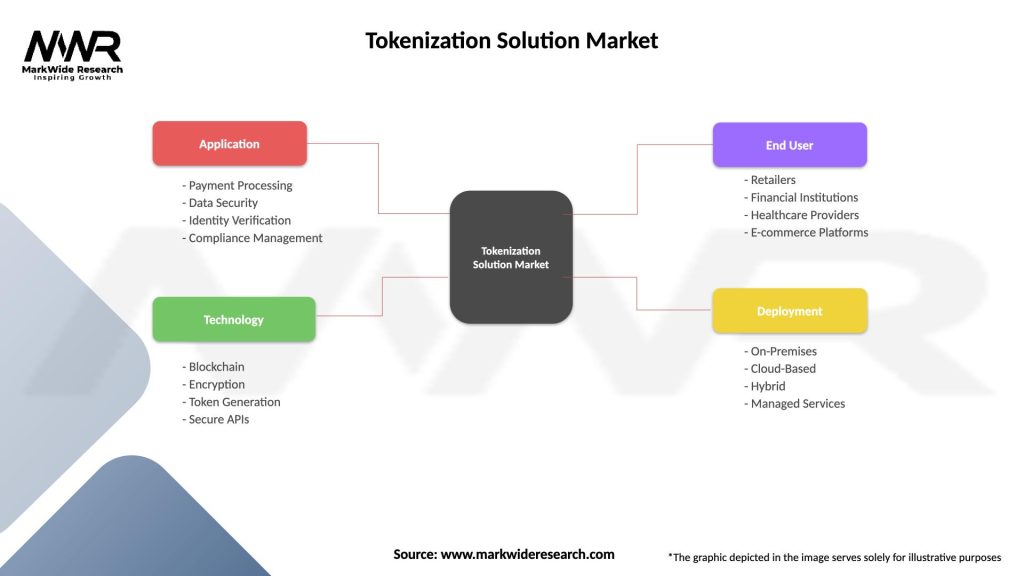

| Segmentation Details | Description |

|---|---|

| Application | Payment Processing, Data Security, Identity Verification, Compliance Management |

| Technology | Blockchain, Encryption, Token Generation, Secure APIs |

| End User | Retailers, Financial Institutions, Healthcare Providers, E-commerce Platforms |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Tokenization Solution Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at