444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview: The tissue level implant market is a segment within the broader dental implant industry, focusing on implants that are placed at the tissue level, beneath the gum line, to support prosthetic restorations such as crowns, bridges, or overdentures. These implants play a crucial role in restoring oral function and aesthetics for patients who have lost one or more natural teeth. The market for tissue level implants is driven by factors such as the increasing prevalence of dental conditions, advancements in implant design and materials, and growing demand for implant-supported restorations.

Meaning: Tissue level implants are dental implants designed to be placed at the level of the soft tissue (gums) and are used to support dental prostheses such as crowns, bridges, or overdentures. Unlike bone level implants, which are placed at or slightly below the level of the bone, tissue level implants are positioned deeper, allowing for optimal support and stability of the prosthetic restoration. These implants are commonly used in cases where there is adequate soft tissue volume and quality to achieve esthetic and functional outcomes.

Executive Summary: The tissue level implant market is experiencing steady growth driven by the rising demand for dental implant procedures and implant-supported restorations worldwide. Key market players are investing in research and development to enhance implant design, surface technology, and treatment protocols to improve clinical outcomes and patient satisfaction. With the increasing focus on esthetics, long-term success, and patient-centered care, the market for tissue level implants is expected to continue expanding in the foreseeable future.

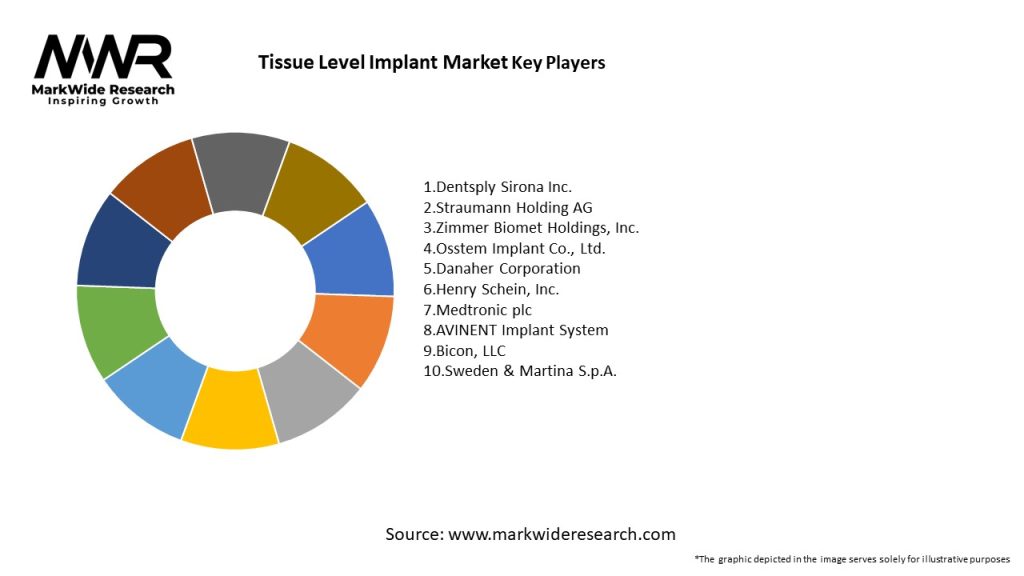

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The tissue level implant market is characterized by dynamic interactions between technological advancements, clinical research, regulatory standards, and patient preferences. Market players need to balance innovation with evidence-based practice, ensuring that new implant technologies and treatment modalities meet the highest standards of safety, efficacy, and patient-centered care.

Regional Analysis: The tissue level implant market exhibits regional variations influenced by factors such as healthcare infrastructure, professional training, patient demographics, and regulatory environments. North America and Europe dominate the market due to high levels of implant treatment adoption, reimbursement coverage, and research activity. Emerging markets in Asia Pacific, Latin America, and the Middle East offer significant growth opportunities driven by rising dental awareness, economic development, and increasing access to implant dentistry.

Competitive Landscape:

Leading Companies in Tissue Level Implant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

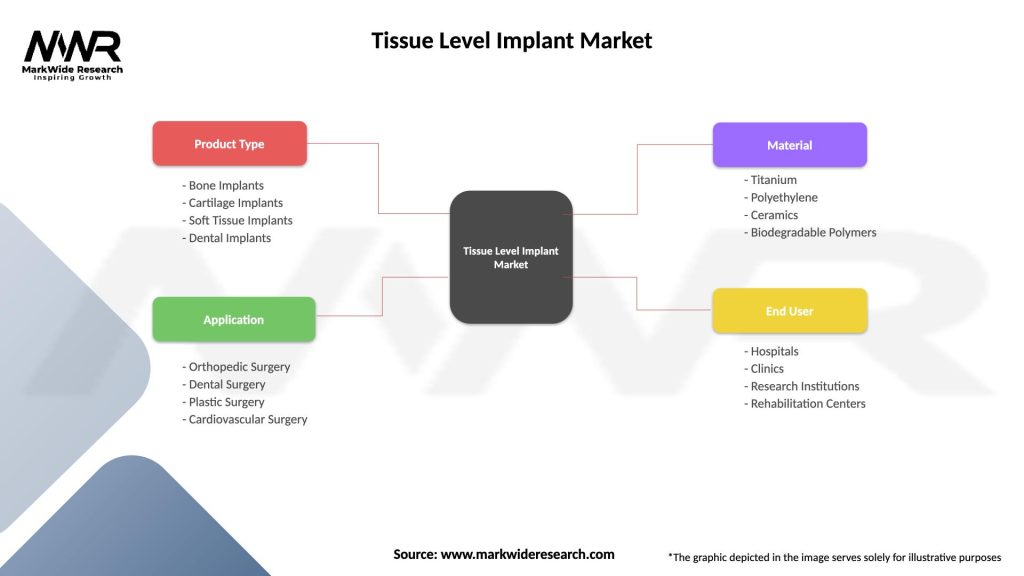

Segmentation: The tissue level implant market can be segmented based on implant type, material composition, surface characteristics, and end-user. Implant types include single-tooth implants, multi-unit implants, and implant-supported overdentures. Common implant materials include titanium, titanium alloys, zirconia, and ceramic materials. Surface treatments such as sandblasting, acid etching, and plasma spraying enhance implant osseointegration and soft tissue attachment. End-users encompass dental clinics, hospitals, academic institutions, and dental laboratories.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has disrupted dental implant treatment protocols, leading to temporary closures of dental practices, elective procedure cancellations, and reduced patient volumes. However, the crisis has also accelerated digital transformation in dentistry, driving adoption of teledentistry, virtual consultations, and remote monitoring solutions. As dental practices adapt to the new normal, tissue level implants remain a key treatment modality for restoring oral health and function in the post-pandemic era.

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The tissue level implant market is poised for continued growth and innovation driven by advances in biomaterials, digital technology, and regenerative therapies. With an aging population, increasing dental awareness, and rising demand for esthetic dentistry, tissue level implants will play an integral role in meeting the evolving needs of patients seeking durable, natural-looking tooth replacement solutions. By embracing interdisciplinary collaboration, evidence-based practice, and patient-centered care, dental professionals can maximize the clinical benefits and societal impact of tissue level implant therapy in the years to come.

Conclusion: Tissue level implants represent a cornerstone of modern implant dentistry, offering predictable, esthetic, and functional solutions for patients with missing teeth or edentulism. With their ability to support natural-looking restorations and promote long-term oral health, tissue level implants have become an indispensable treatment modality in contemporary dental practice. By staying at the forefront of technological innovation, clinical research, and patient care, dental professionals can ensure that tissue level implants continue to fulfill their promise of restoring smiles and transforming lives for generations to come.

What is Tissue Level Implant?

Tissue Level Implant refers to a type of dental implant that is designed to integrate with the surrounding tissue, providing a stable foundation for dental prosthetics. These implants are often used in restorative dentistry to support crowns, bridges, and dentures.

What are the key players in the Tissue Level Implant Market?

Key players in the Tissue Level Implant Market include Straumann, Nobel Biocare, Dentsply Sirona, and Zimmer Biomet, among others. These companies are known for their innovative products and technologies in the field of dental implants.

What are the growth factors driving the Tissue Level Implant Market?

The growth of the Tissue Level Implant Market is driven by increasing dental tourism, rising awareness about oral health, and advancements in implant technology. Additionally, the growing geriatric population and demand for cosmetic dentistry are contributing to market expansion.

What challenges does the Tissue Level Implant Market face?

The Tissue Level Implant Market faces challenges such as high costs associated with implant procedures and the risk of complications during surgery. Additionally, the lack of skilled professionals in certain regions can hinder market growth.

What opportunities exist in the Tissue Level Implant Market?

Opportunities in the Tissue Level Implant Market include the development of new materials and technologies that enhance implant success rates. Furthermore, expanding into emerging markets presents significant growth potential for companies in this sector.

What trends are shaping the Tissue Level Implant Market?

Trends in the Tissue Level Implant Market include the increasing use of digital technologies for planning and executing implant surgeries, as well as the rise of minimally invasive procedures. Additionally, there is a growing focus on biocompatible materials that promote better integration with human tissue.

Tissue Level Implant Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bone Implants, Cartilage Implants, Soft Tissue Implants, Dental Implants |

| Application | Orthopedic Surgery, Dental Surgery, Plastic Surgery, Cardiovascular Surgery |

| Material | Titanium, Polyethylene, Ceramics, Biodegradable Polymers |

| End User | Hospitals, Clinics, Research Institutions, Rehabilitation Centers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Tissue Level Implant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at