444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The thin film materials market represents a dynamic and rapidly evolving sector within the advanced materials industry, serving as the backbone for numerous cutting-edge technologies across electronics, optics, energy, and industrial applications. Thin film materials are characterized by their ultra-thin layers, typically ranging from nanometers to micrometers in thickness, deposited onto various substrates to create functional coatings with specialized properties. This market encompasses a diverse range of materials including metals, semiconductors, oxides, and polymers that are engineered to deliver specific optical, electrical, magnetic, or mechanical characteristics.

Key market characteristics include:

The strategic importance of thin film materials has grown exponentially as industries increasingly demand miniaturization, enhanced performance, and energy efficiency in their products, making this market a cornerstone of technological advancement.

Thin film materials refer to layers of material ranging from fractions of a nanometer to several micrometers in thickness that are deposited onto substrates to create functional surfaces with desired properties. These materials are manufactured through various deposition techniques and serve as the foundation for countless modern technologies.

The fundamental aspects include:

Primary applications span:

The fundamental principle behind thin film technology lies in the ability to control material properties at the atomic or molecular level, enabling the creation of coatings that exhibit superior performance compared to bulk materials.

The global thin film materials market has demonstrated remarkable growth trajectory, driven by accelerating digitalization, renewable energy adoption, and the proliferation of advanced electronic devices. Market analysis indicates substantial expansion opportunities across key application segments including semiconductors, photovoltaics, displays, and optical coatings.

Market highlights include:

The industry benefits from continuous technological advancements in deposition techniques, material engineering, and manufacturing processes that enable cost-effective production of high-performance thin film solutions. However, market participants must navigate evolving regulatory landscapes, sustainability demands, and rapid technological changes while capitalizing on emerging opportunities in next-generation technologies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

The thin film materials market exhibits several critical insights that shape its competitive landscape and growth potential. Market valuation has reached significant milestones with projections indicating robust expansion driven by technological innovation and increasing application diversity.

Critical market metrics:

Emerging trends encompass:

Geographic distribution reveals Asia-Pacific as the dominant region, primarily driven by manufacturing hubs in China, South Korea, Taiwan, and Japan, while North America and Europe maintain strong positions in high-value applications and technological innovation.

Several powerful drivers propel the thin film materials market forward, creating sustained demand across multiple industry verticals and establishing strong growth foundations for the forecast period.

Primary Growth Catalysts:

1. Semiconductor Industry Evolution The relentless pursuit of device miniaturization and performance enhancement represents the primary market catalyst:

2. Renewable Energy Transition Global commitment to clean energy drives substantial photovoltaic demand:

3. Consumer Electronics Proliferation Expanding device ecosystem creates continuous material demand:

4. Automotive Industry Transformation Electrification and digitalization reshape automotive material requirements:

Despite robust growth prospects, the thin film materials market faces several significant restraints that could impact expansion potential and require strategic mitigation approaches.

Key Growth Limitations:

1. Capital Investment Barriers High financial requirements create entry and expansion challenges:

2. Raw Material Challenges Material supply vulnerabilities affect operational stability:

3. Manufacturing Complexity Technical requirements create operational challenges:

4. Regulatory and Compliance Pressures Increasing regulatory requirements impose operational constraints:

The thin film materials market presents numerous attractive opportunities for growth and innovation across emerging technology segments, creating substantial value creation potential for strategic participants.

Emerging Growth Areas:

1. Electric Vehicle Revolution Automotive electrification creates substantial new market opportunities:

2. Flexible Electronics Development Next-generation electronics demand flexible material solutions:

3. Internet of Things Expansion IoT proliferation drives demand for miniaturized solutions:

4. Healthcare Technology Innovation Medical device advancement creates high-value opportunities:

The thin film materials market operates within a complex ecosystem of technological, economic, and competitive forces that continuously reshape industry dynamics and competitive positioning strategies.

Industry Ecosystem Factors:

Supply Chain Evolution: Integration strategies have become increasingly important as manufacturers seek cost control and quality assurance through vertical integration approaches. Strategic partnerships between material suppliers and equipment manufacturers create comprehensive solution offerings for end customers.

Innovation Imperatives: Research and development investments remain critical for maintaining competitive advantages, with leading companies allocating substantial resources to material innovation and process optimization programs. Collaborative development initiatives between suppliers and customers accelerate new application development.

Customer Relationship Dynamics: The market has evolved toward strategic partnerships and joint development programs, particularly in high-value applications requiring customized solutions. Technical support services and application engineering capabilities have become key differentiators.

Competitive Landscape Evolution: Market consolidation continues as companies pursue acquisitions to expand technological capabilities and geographic reach. Patent portfolios serve as competitive moats while licensing agreements create additional revenue streams.

Sustainability Integration: Environmental considerations increasingly influence decision-making processes, driving investment in green manufacturing technologies and circular economy principles throughout the value chain. Regulatory compliance requirements continue expanding globally.

The global thin film materials market exhibits distinct regional characteristics reflecting local industrial strengths, technological capabilities, and market demand patterns across major geographic regions.

Asia-Pacific Dominance: The region commands over 50% of global market share, driven by:

Key country contributions:

North America Market Position: Strong market presence characterized by:

European Market Characteristics: Focus on specialized applications including:

Emerging Markets Potential: Latin America, Middle East, and Africa present growth opportunities through:

Leading companies in the Thin Film Materials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

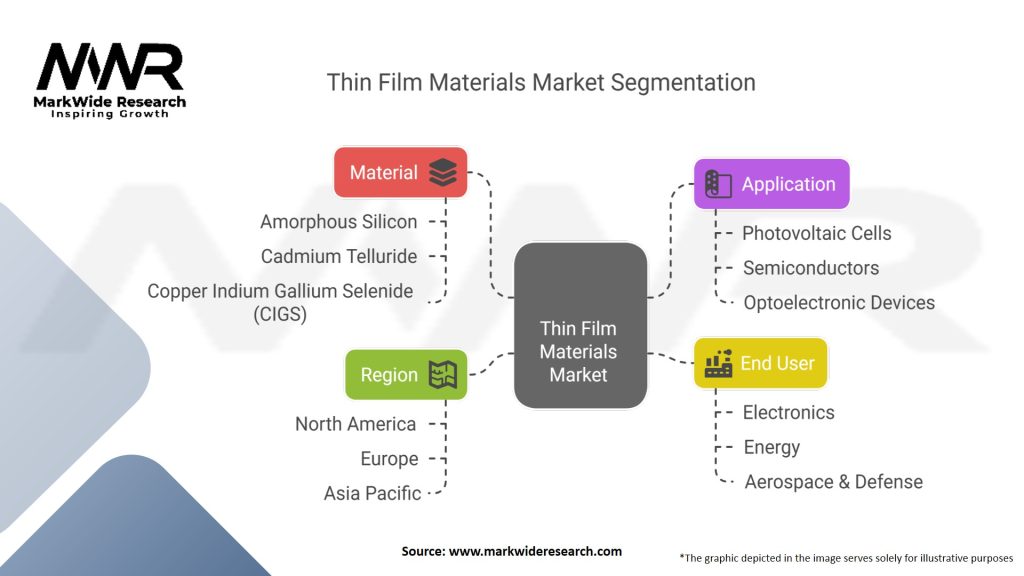

The thin film materials market demonstrates sophisticated segmentation across multiple dimensions, enabling targeted strategies and specialized solutions for diverse application requirements.

Material-Based Classification:

Metallic Materials:

Semiconductor Materials:

Oxide Materials:

Deposition Technology Segmentation:

Application-Based Classification:

Semiconductor Applications (35-40% Market Share): This category represents the most technologically demanding and highest-value segment of the thin film materials market. Applications include gate dielectrics, interconnect metals, and barrier layers in advanced processor and memory device manufacturing. The segment drives innovation in deposition techniques and material properties, with requirements for exceptional purity, uniformity, and electrical characteristics. Advanced semiconductor nodes require increasingly sophisticated material solutions, creating premium pricing opportunities for suppliers with cutting-edge capabilities.

Photovoltaic Applications (25-30% Market Share): Solar energy applications focus on cost-effective materials that enhance conversion efficiency while maintaining manufacturing scalability. Key materials include transparent conductive oxides, absorber layers, and protective coatings. This segment benefits from global renewable energy policies and declining solar installation costs. Growth drivers include utility-scale solar projects in emerging markets and distributed solar adoption in developed economies.

Display Technologies (15-20% Market Share): The display segment encompasses both traditional LCD technologies and emerging OLED applications, demanding materials with excellent optical and electrical properties. Key applications include transparent conductive films, color filters, and protective coatings. Market growth is driven by increasing display sizes, resolution improvements, and emerging applications in automotive and industrial sectors.

Optical Coatings (10-15% Market Share): Precision optical applications require materials with carefully engineered refractive indices and optical properties. Applications include anti-reflective coatings, mirrors, filters, and beam splitters for telecommunications, defense, and consumer electronics. This segment values technical expertise and customization capabilities over volume production.

Other Applications (10-15% Market Share): Diverse applications including protective coatings, decorative finishes, magnetic storage media, and emerging quantum technologies. This category offers opportunities for material suppliers to develop specialized solutions for niche applications with premium pricing potential.

For Materials Manufacturers: Strategic participation in the thin film materials market provides access to high-growth technology sectors with substantial value creation potential:

For Equipment Suppliers: Thin film equipment manufacturers benefit from market growth through:

For End-User Industries: Industries utilizing thin film materials gain competitive advantages through:

For Investors and Stakeholders: Financial participants benefit from market exposure through:

Strengths: The thin film materials market benefits from several fundamental strengths that support sustainable competitive advantages:

Weaknesses: Market participants face inherent weaknesses requiring strategic mitigation:

Opportunities: Emerging opportunities provide substantial growth potential:

Threats: External threats require continuous monitoring and strategic responses:

Technology and Innovation Trends:

Sustainability Integration: Environmental considerations have become central to market development, with increasing focus on eco-friendly materials, energy-efficient manufacturing processes, and circular economy principles. Companies are investing in recyclable thin film materials and green deposition technologies to meet regulatory requirements and customer preferences.

Digitalization and Industry 4.0: Advanced manufacturing technologies including IoT integration, predictive maintenance, and real-time quality monitoring are transforming production capabilities. Artificial intelligence applications in material design and process optimization are accelerating development cycles and improving manufacturing efficiency.

Miniaturization and Performance Enhancement: Continuous demand for thinner films with enhanced properties drives innovation in deposition techniques and material engineering. Atomic layer deposition technologies are gaining adoption for applications requiring precise thickness control and superior uniformity.

Flexibility and Conformability: Growing demand for flexible electronics drives development of materials suitable for curved, bendable, and stretchable applications. This trend supports emerging applications in wearable devices, flexible displays, and conformable sensors.

Market and Business Model Trends:

Customization and Specialization: Markets are evolving toward application-specific solutions requiring close collaboration between suppliers and customers. Technical support services and application engineering capabilities are becoming key competitive differentiators.

Vertical Integration: Supply chain consolidation continues as companies seek greater control over material quality, costs, and delivery schedules. Strategic partnerships between material suppliers and equipment manufacturers create comprehensive solution offerings.

Geographic Diversification: Companies are expanding manufacturing presence in multiple regions to serve local markets and reduce supply chain risks. Emerging markets present significant growth opportunities as technology adoption accelerates.

Technological Breakthroughs: Recent innovations demonstrate the dynamic nature of thin film materials technology:

Advanced Deposition Technologies: Atomic layer deposition techniques have achieved breakthrough capabilities for next-generation semiconductor manufacturing, enabling precise control of film thickness at the atomic level for 3-nanometer and smaller device nodes.

Novel Materials Development: Two-dimensional materials including graphene and transition metal dichalcogenides are transitioning from research laboratories to commercial applications, offering unique electrical and optical properties for next-generation electronic devices.

Quantum Materials: Quantum dot technologies are achieving commercial viability in display applications and advancing toward quantum computing applications, requiring specialized deposition techniques and ultra-pure materials.

Manufacturing Innovations: Process improvements are reducing costs and improving material quality:

Strategic Market Developments: Industry consolidation and partnership activities are reshaping the competitive landscape:

Strategic Recommendations for Market Leaders:

Innovation Leadership: Maintain technological differentiation through sustained research and development investment, focusing on next-generation materials for emerging applications including quantum computing, advanced AI hardware, and flexible electronics. Develop proprietary technologies creating competitive moats and licensing opportunities.

Market Diversification: Expand beyond traditional semiconductor and display applications into high-growth sectors including automotive electronics, healthcare devices, and renewable energy systems. Geographic diversification reduces market risks while capturing growth in emerging economies.

Partnership Strategy: Develop strategic alliances with key customers for collaborative technology development, ensuring alignment with future application requirements. Equipment manufacturer partnerships create integrated solution offerings and shared development costs.

Sustainability Focus: Invest in environmentally sustainable materials and manufacturing processes to meet regulatory requirements and customer preferences. Green chemistry initiatives and circular economy principles will become competitive necessities.

Recommendations for Emerging Players:

Niche Specialization: Focus on specific applications or technologies where specialized expertise creates competitive advantages. Target high-value, low-volume applications requiring customized solutions and technical support services.

Technology Differentiation: Develop unique material properties or manufacturing processes that address unmet customer needs. Patent protection and trade secret development create barriers to entry for larger competitors.

Customer Intimacy: Build strong technical relationships with key customers through application engineering support and collaborative development programs. Deep customer understanding enables customized solutions and long-term partnerships.

Agile Operations: Maintain operational flexibility to respond quickly to market changes and customer requirements. Lean manufacturing approaches and scalable production capabilities enable efficient growth.

General Market Strategies:

Supply Chain Optimization: Develop resilient supply networks with multiple suppliers and geographic diversity. Strategic inventory management balances cost optimization with supply security requirements.

Digital Transformation: Implement Industry 4.0 technologies for operational excellence, including predictive maintenance, real-time quality monitoring, and automated process control systems.

Talent Development: Invest in workforce capabilities through training programs and university partnerships. Skilled technical personnel are critical for maintaining competitive advantages in complex manufacturing environments.

Market Intelligence: Maintain comprehensive competitive analysis and technology monitoring capabilities to identify emerging opportunities and threats. Customer relationship management systems enable proactive account management and business development.

Market Growth Trajectory: The thin film materials market outlook appears highly promising, supported by multiple technological megatrends and expanding application opportunities across diverse industry sectors.

Quantitative Projections:

Technology Development Drivers: Advanced technology applications will create substantial new market opportunities requiring specialized thin film materials with unique performance characteristics:

Quantum Computing Revolution: Quantum devices require materials with extraordinary purity and precisely controlled properties, creating high-value niche markets for specialized suppliers with advanced capabilities.

Artificial Intelligence Hardware: Next-generation AI processors demand materials enabling higher computational density and energy efficiency, driving innovation in semiconductor thin films and neuromorphic computing materials.

Next-Generation Communications: 6G wireless infrastructure will require advanced materials for high-frequency electronics, optical communications, and antenna systems, creating new application categories.

Space Technology Expansion: Growing satellite deployment and space exploration initiatives demand radiation-resistant materials and lightweight solutions, offering premium pricing opportunities for qualified suppliers.

Application Evolution Trends:

Automotive Transformation: Vehicle electrification and autonomous driving capabilities will drive substantial demand growth for sensor materials, power electronics, and advanced display technologies integrated throughout vehicle systems.

Healthcare Innovation: Medical device advancement and diagnostic equipment development create opportunities for biocompatible materials and precision optical components requiring specialized manufacturing capabilities.

Energy Storage Evolution: Advanced battery technologies and supercapacitor development require specialized electrode materials and separators, creating new market segments for thin film suppliers.

Flexible Electronics Proliferation: Wearable devices, flexible displays, and conformable sensors will drive demand for materials suitable for curved and stretchable applications, requiring innovative material properties and deposition techniques.

Market Structure Transformation: Industry structure will continue evolving through consolidation activities and strategic partnerships:

The thin film materials market represents a critical enabler of technological advancement across multiple industries, offering substantial growth opportunities for strategic market participants who can navigate the complex interplay of technological innovation, market dynamics, and competitive pressures.

Market Position and Growth Potential: The market’s robust fundamentals are supported by diverse application segments, continuous technological evolution, and expanding end-user requirements across electronics, energy, automotive, and emerging technology sectors. Strong growth projections reflect the essential role of thin film materials in enabling next-generation technologies and supporting global trends toward digitalization, electrification, and sustainability.

Success Factors for Market Participants: Companies that will thrive in this sophisticated market environment must balance multiple strategic imperatives:

Strategic Imperatives for Future Success: The market’s sophisticated and rapidly evolving nature demands strategic approaches that combine technological expertise with business acumen:

Technology Development: Companies must invest in next-generation materials and manufacturing processes while maintaining excellence in existing product lines. Patent portfolios and proprietary technologies create sustainable competitive advantages.

Customer Relationships: Success requires deep technical collaboration with key customers, understanding their future requirements, and participating in their product development processes. Application engineering capabilities become key differentiators.

Geographic Strategy: Global market participation requires manufacturing presence in key regions while maintaining supply chain resilience and operational flexibility. Emerging markets offer substantial growth potential for companies with appropriate market entry strategies.

Sustainability Integration: Environmental compliance and sustainable business practices are becoming competitive necessities rather than optional initiatives. Companies that proactively address sustainability challenges will gain competitive advantages.

The thin film materials market stands at the intersection of multiple technological revolutions, offering exceptional opportunities for companies that can successfully combine innovation leadership, operational excellence, and strategic vision. Market participants who invest in technological capabilities, build strong customer relationships, and maintain strategic flexibility will be positioned to capitalize on the substantial growth opportunities that lie ahead in this dynamic and essential industry.

What are thin film materials in the context of the Thin Film Materials Market?

Thin film materials refer to layers of material ranging from fractions of a nanometer to several micrometers in thickness. They are widely used in applications such as electronics, optics, and solar cells.

Who are the key players in the Thin Film Materials Market?

Key players in the Thin Film Materials Market include companies like Corning Inc., 3M Company, and Applied Materials, among others. These companies lead in innovation and supply a variety of thin film solutions across different industries.

What are the growth factors driving the Thin Film Materials Market?

The Thin Film Materials Market is driven by the increasing demand for lightweight and efficient materials in electronics and renewable energy sectors. Advances in technology also contribute to the growing applications in areas like flexible displays and sensors.

What challenges does the Thin Film Materials Market face?

Challenges in the Thin Film Materials Market include the high production costs and the complexity of manufacturing processes. Additionally, competition from alternative materials can hinder market growth.

What future opportunities exist in the Thin Film Materials Market?

Future opportunities in the Thin Film Materials Market include the development of innovative materials for flexible electronics and enhanced photovoltaic cells. The increasing focus on sustainability is also likely to drive demand for eco-friendly thin film solutions.

What are the latest trends in the Thin Film Materials Market?

Recent trends in the Thin Film Materials Market include the rise of nanotechnology and the integration of smart materials. These innovations are enhancing the performance and functionality of thin films in various applications, including medical devices and energy storage.

Thin Film Materials Market

| Segmentation | Details |

|---|---|

| Material | Amorphous Silicon, Cadmium Telluride, Copper Indium Gallium Selenide (CIGS), Others |

| Application | Photovoltaic Cells, Semiconductors, Optoelectronic Devices, Others |

| End User | Electronics, Energy, Aerospace & Defense, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thin Film Materials Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at