444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The US artificial lift systems market represents a critical component of the nation’s oil and gas production infrastructure, encompassing technologies designed to enhance hydrocarbon extraction from wells with insufficient natural pressure. Market dynamics indicate substantial growth driven by increasing shale oil production, aging well infrastructure, and technological advancements in extraction methods. The sector has experienced remarkable expansion, with growth rates exceeding 8.5% annually as operators seek to maximize production from existing wells while minimizing operational costs.

Industry participants are witnessing unprecedented demand for sophisticated lift solutions across major oil-producing regions including the Permian Basin, Bakken Formation, and Eagle Ford Shale. The market encompasses various technologies including electrical submersible pumps, progressive cavity pumps, rod lift systems, and gas lift mechanisms, each serving specific well conditions and production requirements. Technological innovation continues to drive market evolution, with smart monitoring systems and IoT-enabled equipment gaining significant traction among operators seeking enhanced operational efficiency.

Regional distribution shows concentrated activity in Texas, North Dakota, Pennsylvania, and Oklahoma, where unconventional resource development has created substantial demand for artificial lift solutions. The market benefits from supportive regulatory frameworks, established infrastructure networks, and continuous investment in research and development initiatives focused on improving system reliability and performance.

The US artificial lift systems market refers to the comprehensive ecosystem of mechanical devices, equipment, and technologies designed to assist in lifting oil and gas from subsurface reservoirs to the surface when natural reservoir pressure is insufficient for economic production. These systems serve as essential production enhancement tools that enable operators to maintain or increase hydrocarbon flow rates from wells experiencing declining natural pressure.

Artificial lift technologies encompass various mechanical and electrical systems including sucker rod pumps, electrical submersible pumps, progressive cavity pumps, hydraulic pumps, and gas lift systems. Each technology addresses specific well conditions, fluid characteristics, and production requirements, providing operators with flexible solutions for optimizing extraction efficiency across diverse geological formations and operational environments.

Market fundamentals demonstrate robust growth trajectory supported by increasing unconventional oil production, technological advancement, and operational efficiency requirements. The sector has established itself as an indispensable component of domestic energy production, with adoption rates reaching 75% across mature oil fields where natural pressure depletion necessitates artificial lift intervention.

Key market drivers include expanding shale oil development, aging well infrastructure requiring production enhancement, and continuous technological innovation improving system performance and reliability. The market benefits from strong domestic demand, established supply chains, and significant investment in advanced monitoring and control technologies that enhance operational efficiency and reduce maintenance costs.

Competitive dynamics feature established industry leaders alongside emerging technology providers, creating a diverse ecosystem of solutions tailored to specific operational requirements. Market participants are increasingly focusing on integrated service offerings, predictive maintenance capabilities, and digital transformation initiatives that provide comprehensive value propositions to oil and gas operators.

Strategic analysis reveals several critical insights shaping market development and future growth prospects:

Primary growth drivers propelling market expansion include several interconnected factors that create sustained demand for artificial lift solutions across the domestic oil and gas sector.

Unconventional resource development continues to drive significant market demand as shale oil and tight gas formations require artificial lift systems earlier in their production lifecycle compared to conventional wells. The unique characteristics of unconventional reservoirs, including rapid initial production decline and complex fluid dynamics, necessitate sophisticated lift solutions that can adapt to changing well conditions over time.

Aging well infrastructure across traditional oil-producing regions creates substantial replacement and upgrade opportunities as operators seek to extend productive life and maintain economic viability. Wells experiencing natural pressure depletion require artificial lift intervention to sustain commercial production rates, driving consistent demand for both new installations and system upgrades.

Technological advancement in lift system design, materials science, and control systems enables operators to achieve higher production rates, improved reliability, and reduced operational costs. Innovations in pump design, motor efficiency, and monitoring capabilities provide compelling value propositions that justify investment in advanced artificial lift solutions.

Economic optimization pressures encourage operators to maximize production from existing wells rather than drilling new ones, creating strong demand for artificial lift systems that can enhance recovery rates and extend productive life. Cost-effective production enhancement through artificial lift often provides superior returns compared to new well development in many operational contexts.

Operational challenges and market constraints present obstacles to growth and adoption across various segments of the artificial lift systems market.

Capital investment requirements for advanced artificial lift systems can be substantial, particularly for sophisticated electrical submersible pump installations or comprehensive gas lift systems. High upfront costs may deter smaller operators or limit adoption in marginal wells where economic justification becomes challenging.

Technical complexity associated with modern artificial lift systems requires specialized expertise for installation, operation, and maintenance. The shortage of qualified technicians and engineers familiar with advanced lift technologies can constrain market growth and increase operational costs for end users.

Well-specific requirements necessitate customized solutions that may increase costs and complexity compared to standardized equipment offerings. Diverse geological conditions, fluid characteristics, and operational parameters require tailored approaches that can limit economies of scale and increase project timelines.

Regulatory compliance and environmental considerations add complexity and cost to artificial lift system deployment, particularly in environmentally sensitive areas or regions with stringent operational requirements. Compliance costs and permitting delays can impact project economics and implementation schedules.

Emerging opportunities within the artificial lift systems market present significant potential for growth and innovation across multiple dimensions.

Digital transformation initiatives offer substantial opportunities for market participants to develop integrated solutions combining artificial lift hardware with advanced analytics, predictive maintenance, and automated control systems. The convergence of operational technology and information technology creates new value propositions focused on optimizing total system performance rather than individual component efficiency.

Enhanced oil recovery applications present expanding opportunities as operators seek to maximize production from mature fields through advanced artificial lift techniques combined with reservoir management strategies. Secondary and tertiary recovery projects increasingly rely on sophisticated lift systems to maintain economic production rates.

Renewable energy integration creates opportunities for artificial lift systems powered by solar, wind, or other renewable energy sources, particularly in remote locations where grid connectivity is limited or expensive. Hybrid power systems combining renewable generation with traditional power sources offer compelling economic and environmental benefits.

International expansion opportunities exist for US-based artificial lift system providers to leverage domestic expertise and technology leadership in global markets experiencing similar production challenges and technological requirements.

Complex market dynamics shape the artificial lift systems sector through interconnected forces influencing demand patterns, technology development, and competitive positioning.

Supply and demand equilibrium reflects the balance between oil and gas production requirements and available artificial lift capacity. Market dynamics respond to commodity price fluctuations, drilling activity levels, and well completion rates that directly impact demand for lift system installations and services.

Technology evolution cycles drive market dynamics as new innovations disrupt existing solutions and create opportunities for performance improvement and cost reduction. The pace of technological change influences replacement cycles, upgrade decisions, and competitive positioning among market participants.

Regulatory environment changes impact market dynamics through evolving safety standards, environmental requirements, and operational guidelines that influence technology selection and implementation approaches. Regulatory compliance costs and requirements shape market demand and technology development priorities.

Economic cycles in the oil and gas industry create fluctuating demand patterns for artificial lift systems, with investment levels responding to commodity prices, capital availability, and operator financial performance. Market dynamics adapt to cyclical industry conditions through flexible business models and scalable operations.

Comprehensive research methodology employed in analyzing the US artificial lift systems market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technology providers, service companies, and end-user operators to gather firsthand insights on market trends, challenges, and opportunities. Survey methodologies capture quantitative data on adoption rates, performance metrics, and investment priorities across different market segments.

Secondary research analysis encompasses review of industry publications, technical papers, regulatory filings, and company reports to validate primary research findings and identify additional market intelligence. Patent analysis and technology assessment provide insights into innovation trends and competitive positioning.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market projections and assess potential outcomes under different industry conditions. Quantitative models incorporate historical performance data, current market indicators, and forward-looking assumptions to generate reliable forecasts.

Regional market distribution across the United States reflects the geographic concentration of oil and gas production activities and the varying characteristics of different geological formations and operational environments.

Texas market dominance stems from extensive shale oil development in the Permian Basin and Eagle Ford formations, where regional market share exceeds 40% of total artificial lift system installations. The state’s mature oil infrastructure, supportive regulatory environment, and continuous drilling activity create sustained demand for advanced lift solutions across multiple operational contexts.

North Dakota operations in the Bakken formation represent significant market activity focused on unconventional oil production requiring specialized artificial lift solutions adapted to harsh climate conditions and unique reservoir characteristics. The region’s emphasis on operational efficiency and technology adoption drives demand for advanced monitoring and control systems.

Pennsylvania and Ohio markets benefit from extensive shale gas development and associated oil production, creating demand for artificial lift systems optimized for gas-oil ratio management and liquid handling in unconventional wells. Regional market dynamics reflect the integration of artificial lift systems with comprehensive well completion and production optimization strategies.

Western states including Colorado, Wyoming, and New Mexico contribute substantial market activity through diverse geological formations requiring customized artificial lift solutions. Regional market characteristics emphasize environmental compliance, operational efficiency, and integration with existing infrastructure networks.

Market competition features established industry leaders alongside specialized technology providers and emerging companies developing innovative artificial lift solutions.

Market segmentation analysis reveals distinct categories based on technology type, application, and operational characteristics that define specific market dynamics and growth opportunities.

By Technology Type:

By Application:

By Well Type:

Technology category analysis provides detailed insights into performance characteristics, market adoption patterns, and growth prospects for different artificial lift system types.

Electrical Submersible Pump Category: Dominates high-volume production applications with superior efficiency and reliability characteristics. ESP systems demonstrate operational efficiency improvements of 25% compared to alternative technologies in suitable applications. Market growth driven by technological advancement in motor design, pump materials, and control systems that enhance performance and reduce maintenance requirements.

Rod Lift System Category: Maintains strong market position through versatility, reliability, and cost-effectiveness across diverse operational conditions. These systems excel in applications requiring variable production rates and adaptability to changing well conditions. Innovation focuses on smart monitoring, automated control, and predictive maintenance capabilities that reduce operational costs and improve system reliability.

Progressive Cavity Pump Category: Serves specialized applications involving heavy oil, high-viscosity fluids, and challenging production environments. Market growth supported by expanding heavy oil production and enhanced oil recovery projects requiring specialized pumping solutions. Technology development emphasizes materials science, seal design, and monitoring systems that improve performance in demanding applications.

Gas Lift System Category: Provides cost-effective production enhancement for wells with adequate gas supply and appropriate reservoir characteristics. Market adoption driven by operational simplicity, lower maintenance requirements, and flexibility in production optimization. Innovation trends include intelligent gas lift valves, automated control systems, and integration with reservoir management strategies.

Comprehensive benefits delivered by artificial lift systems create value for multiple stakeholder groups across the oil and gas value chain.

For Oil and Gas Operators:

For Service Companies:

For Equipment Manufacturers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the artificial lift systems market reflect technological advancement, operational optimization, and evolving industry requirements.

Digital Transformation Integration represents a fundamental shift toward connected artificial lift systems incorporating IoT sensors, real-time monitoring, and predictive analytics capabilities. This trend enables operators to optimize production performance, reduce maintenance costs, and improve operational efficiency through data-driven decision making. Digital adoption rates have increased significantly, with smart monitoring systems becoming standard features in new installations.

Automation and Remote Operation capabilities are becoming increasingly important as operators seek to reduce personnel requirements and improve safety in artificial lift operations. Automated control systems, remote monitoring capabilities, and unmanned operation features provide compelling value propositions for operators managing distributed production assets.

Energy Efficiency Focus drives development of artificial lift systems with improved power consumption characteristics and integration with renewable energy sources. Operators prioritize solutions that reduce operational costs while supporting environmental sustainability objectives through reduced energy consumption and carbon footprint.

Predictive Maintenance Evolution utilizes advanced analytics and machine learning to optimize maintenance schedules, reduce unplanned downtime, and extend equipment life. This trend transforms traditional reactive maintenance approaches into proactive strategies that improve system reliability and reduce total cost of ownership.

Recent industry developments demonstrate the dynamic nature of the artificial lift systems market and ongoing innovation across technology, business models, and operational approaches.

Technology Advancement Initiatives include development of next-generation electrical submersible pumps with enhanced materials, improved motor efficiency, and integrated monitoring capabilities. These developments address operator requirements for higher reliability, reduced maintenance, and improved performance in challenging operational environments.

Strategic Partnership Formation between artificial lift system providers and technology companies creates integrated solutions combining hardware, software, and analytics capabilities. These partnerships enable comprehensive value propositions addressing production optimization, operational efficiency, and digital transformation requirements.

Service Model Innovation includes introduction of performance-based contracts, equipment-as-a-service offerings, and comprehensive production optimization agreements that align service provider incentives with operator performance objectives. These developments transform traditional equipment sales models into outcome-focused service relationships.

Sustainability Integration encompasses development of artificial lift systems designed for reduced environmental impact, improved energy efficiency, and integration with renewable energy sources. Industry participants increasingly prioritize solutions supporting environmental stewardship and regulatory compliance objectives.

Strategic recommendations for market participants focus on positioning for sustained growth and competitive advantage in the evolving artificial lift systems market.

Technology Investment Priorities should emphasize digital integration capabilities, predictive analytics, and automation features that deliver measurable value to operators. MarkWide Research analysis indicates that companies investing in digital transformation capabilities achieve superior market positioning and customer retention rates compared to traditional equipment-focused competitors.

Service Portfolio Expansion represents a critical success factor as operators increasingly seek comprehensive solutions rather than standalone equipment purchases. Market participants should develop integrated service offerings combining equipment provision, installation, maintenance, and performance optimization services that create recurring revenue streams and strengthen customer relationships.

Geographic Market Development opportunities exist in emerging shale plays and international markets where US artificial lift expertise and technology leadership provide competitive advantages. Strategic expansion should focus on regions with supportive regulatory environments, established infrastructure, and growing unconventional resource development.

Partnership Strategy Development should prioritize relationships with technology providers, service companies, and operators that enable comprehensive solution delivery and market access. Collaborative approaches create value propositions exceeding individual company capabilities while sharing investment requirements and market risks.

Market projections indicate continued growth and evolution driven by technological advancement, operational optimization requirements, and expanding unconventional oil production across the United States.

Technology Evolution Trajectory points toward increasingly sophisticated artificial lift systems incorporating artificial intelligence, machine learning, and autonomous operation capabilities. Future systems will provide self-optimizing performance, predictive maintenance, and integration with comprehensive field management platforms that maximize production efficiency across entire operations.

Market Growth Sustainability reflects fundamental industry trends including aging well infrastructure, unconventional resource development, and operational efficiency requirements that create sustained demand for artificial lift solutions. MWR projections suggest continued market expansion with growth rates maintaining 7-9% annually through the forecast period, supported by technology innovation and expanding application opportunities.

Industry Transformation Patterns indicate evolution toward service-oriented business models, digital integration, and outcome-based value propositions that align artificial lift system providers with operator performance objectives. This transformation creates opportunities for market participants willing to invest in comprehensive solution capabilities and long-term customer relationships.

Regulatory Environment Evolution will likely emphasize environmental performance, safety standards, and operational efficiency requirements that favor advanced artificial lift technologies over traditional alternatives. Market participants should anticipate increasing regulatory complexity while recognizing opportunities for technology solutions that exceed compliance requirements.

The US artificial lift systems market demonstrates robust fundamentals and promising growth prospects driven by expanding unconventional oil production, technological innovation, and operational optimization requirements across the domestic energy sector. Market dynamics reflect the critical role of artificial lift systems in maximizing hydrocarbon recovery, extending well productive life, and improving overall field economics for operators facing challenging reservoir conditions and economic pressures.

Technology advancement continues to reshape market opportunities through digital integration, automation capabilities, and performance optimization features that deliver measurable value to operators. The convergence of artificial lift hardware with advanced analytics, IoT connectivity, and predictive maintenance capabilities creates comprehensive solutions addressing production optimization, cost reduction, and operational efficiency objectives.

Market participants positioned for success will emphasize technology leadership, service integration, and customer-focused value propositions that align with evolving operator requirements. The transition toward outcome-based business models, comprehensive service offerings, and digital transformation capabilities represents both challenge and opportunity for companies seeking sustained competitive advantage in this dynamic market environment. Future market development will reward participants who successfully combine technological innovation with operational excellence and strategic customer relationships to deliver superior value in the evolving US artificial lift systems market.

What is Artificial Lift Systems?

Artificial Lift Systems are mechanisms used to enhance the extraction of hydrocarbons from wells, particularly in oil and gas production. They are essential in situations where natural reservoir pressure is insufficient to bring fluids to the surface.

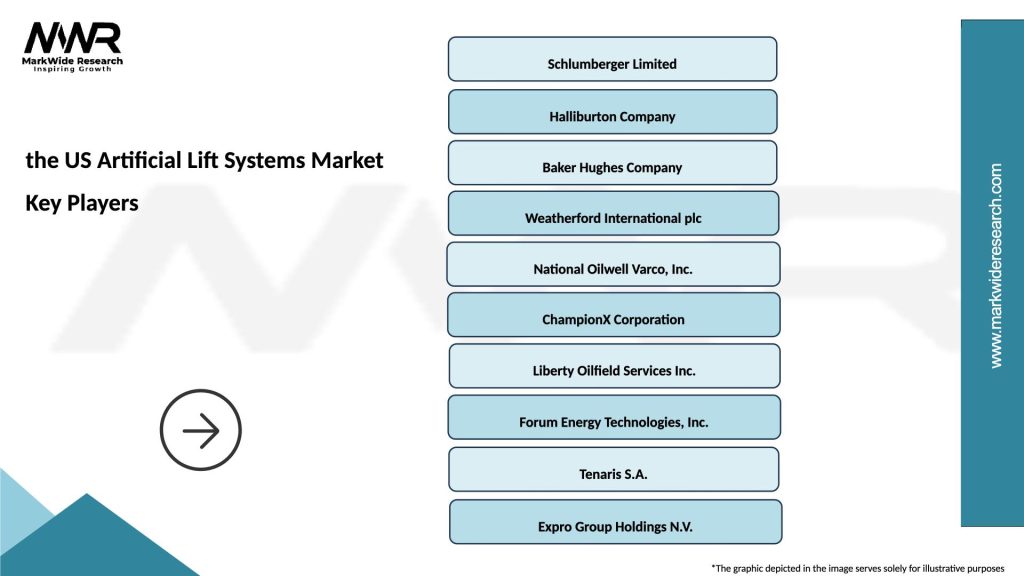

What are the key players in the US Artificial Lift Systems Market?

Key players in the US Artificial Lift Systems Market include Schlumberger, Halliburton, and Baker Hughes, among others. These companies provide a range of artificial lift technologies such as rod pumps, gas lift systems, and electric submersible pumps.

What are the growth factors driving the US Artificial Lift Systems Market?

The growth of the US Artificial Lift Systems Market is driven by increasing oil and gas production activities, the need for enhanced recovery techniques, and advancements in technology that improve efficiency and reduce operational costs.

What challenges does the US Artificial Lift Systems Market face?

The US Artificial Lift Systems Market faces challenges such as fluctuating oil prices, the high cost of installation and maintenance, and the need for skilled labor to operate and maintain these systems effectively.

What opportunities exist in the US Artificial Lift Systems Market?

Opportunities in the US Artificial Lift Systems Market include the growing demand for energy, the expansion of unconventional oil and gas resources, and the development of smart technologies that enhance monitoring and control of artificial lift systems.

What trends are shaping the US Artificial Lift Systems Market?

Trends in the US Artificial Lift Systems Market include the increasing adoption of digital technologies for real-time monitoring, the integration of renewable energy sources, and the focus on sustainability practices to minimize environmental impact.

the US Artificial Lift Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rod Lift, Gas Lift, Electric Submersible Pump, Progressive Cavity Pump |

| Technology | Hydraulic, Pneumatic, Mechanical, Electrical |

| End User | Oil & Gas Producers, Mining Companies, Water Utilities, Geothermal Operators |

| Installation | Onshore, Offshore, Subsea, Surface |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the the US Artificial Lift Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at