444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The United Kingdom e-brokerage market represents a dynamic and rapidly evolving sector within the broader financial services landscape. This digital transformation has fundamentally reshaped how individual and institutional investors access financial markets, execute trades, and manage their investment portfolios. The market encompasses online trading platforms, mobile applications, and digital investment services that enable users to buy and sell securities, including stocks, bonds, ETFs, and other financial instruments through electronic channels.

Market dynamics in the UK e-brokerage sector are characterized by intense competition, technological innovation, and evolving regulatory frameworks. The sector has experienced remarkable growth, with digital adoption rates reaching approximately 78% among retail investors as traditional brick-and-mortar brokerage services continue to decline. This shift reflects changing consumer preferences toward convenience, cost-effectiveness, and real-time access to financial markets.

Key market participants include established financial institutions that have digitized their services, pure-play online brokers, and emerging fintech companies offering innovative trading solutions. The competitive landscape is further intensified by the entry of international players and the continuous development of new technologies such as artificial intelligence, machine learning, and blockchain integration.

Regulatory compliance remains a critical factor shaping market operations, with the Financial Conduct Authority (FCA) implementing stringent guidelines to protect investors while fostering innovation. The market is experiencing significant transformation driven by commission-free trading models, advanced analytical tools, and enhanced user experiences that cater to both novice and sophisticated investors.

The United Kingdom e-brokerage market refers to the comprehensive ecosystem of digital platforms and services that facilitate electronic trading of financial securities within the UK financial system. This market encompasses all online and mobile-based brokerage services that enable investors to execute trades, access market data, conduct research, and manage investment portfolios through digital channels without requiring traditional face-to-face interactions with human brokers.

E-brokerage services fundamentally transform the investment process by providing direct market access through sophisticated technology platforms. These services include real-time market data feeds, advanced charting tools, automated trading capabilities, portfolio management features, and educational resources designed to empower investors with comprehensive market insights and trading functionality.

Core components of the e-brokerage market include trading platforms, mobile applications, robo-advisory services, and integrated financial planning tools. The market serves diverse customer segments ranging from individual retail investors seeking cost-effective trading solutions to institutional clients requiring advanced execution capabilities and sophisticated risk management tools.

Strategic market positioning within the UK e-brokerage sector reveals a highly competitive environment driven by technological advancement and changing investor behavior patterns. The market has demonstrated exceptional resilience and growth potential, with mobile trading adoption increasing by approximately 45% year-over-year as investors increasingly prefer convenient, on-the-go access to financial markets.

Innovation drivers include the integration of artificial intelligence for personalized investment recommendations, enhanced cybersecurity measures, and the development of social trading features that allow users to follow and replicate successful trading strategies. These technological advancements have significantly improved user engagement and platform stickiness across the market.

Market consolidation trends are becoming increasingly apparent as larger financial institutions acquire innovative fintech startups to enhance their digital capabilities and expand market reach. This consolidation is creating more comprehensive service offerings while intensifying competition among remaining independent players.

Regulatory developments continue to shape market dynamics, with new guidelines focusing on investor protection, transparency in pricing, and enhanced disclosure requirements. These regulatory changes are driving operational improvements while ensuring sustainable market growth and consumer confidence.

Primary market insights reveal several critical trends shaping the UK e-brokerage landscape:

Customer behavior analysis indicates that modern investors prioritize platform reliability, competitive pricing, comprehensive research tools, and seamless user interfaces when selecting e-brokerage services. The market is witnessing increased demand for personalized investment solutions and real-time portfolio management capabilities.

Technological advancement serves as the primary catalyst driving e-brokerage market expansion in the UK. The proliferation of high-speed internet connectivity, sophisticated mobile devices, and cloud computing infrastructure has created an environment conducive to seamless digital trading experiences. These technological foundations enable real-time market access, instant trade execution, and comprehensive portfolio management capabilities that were previously available only to institutional investors.

Cost efficiency demands from investors have fundamentally reshaped the competitive landscape. Traditional brokerage fees and commissions have become increasingly unsustainable as e-brokerage platforms offer significantly reduced costs through automated processes and economies of scale. This cost advantage has democratized investment access and attracted a broader demographic of retail investors to participate in financial markets.

Regulatory support from UK financial authorities has created a favorable environment for e-brokerage innovation while maintaining appropriate investor protection standards. The Financial Conduct Authority’s balanced approach to fintech regulation has encouraged market entry by new players while ensuring established institutions adapt their digital offerings to remain competitive.

Demographic shifts toward digital-native generations are accelerating e-brokerage adoption rates. Younger investors, particularly millennials and Generation Z, demonstrate strong preferences for digital-first financial services, driving demand for intuitive mobile applications, social trading features, and gamified investment experiences that traditional brokerages struggle to provide.

Market volatility events have historically increased retail investor interest in active trading, with e-brokerage platforms experiencing significant user growth during periods of market uncertainty. These events demonstrate the resilience and scalability of digital trading infrastructure while highlighting the importance of reliable platform performance during high-volume trading periods.

Regulatory complexity presents significant challenges for e-brokerage operators navigating evolving compliance requirements. The need to maintain adherence to FCA regulations while innovating rapidly creates operational tensions that can limit platform development speed and increase compliance costs. These regulatory burdens particularly impact smaller fintech companies that lack extensive legal and compliance resources.

Cybersecurity concerns represent critical operational risks that can undermine customer confidence and platform viability. The increasing sophistication of cyber threats targeting financial services requires substantial ongoing investments in security infrastructure, monitoring systems, and incident response capabilities. High-profile security breaches in the financial sector have heightened customer awareness and expectations regarding platform security measures.

Market saturation challenges are becoming increasingly apparent as the number of e-brokerage platforms continues to grow while the total addressable market shows signs of maturation. This saturation is intensifying competition for customer acquisition and retention, leading to compressed profit margins and increased marketing expenditures across the industry.

Technology infrastructure costs associated with maintaining reliable, scalable, and secure trading platforms represent significant ongoing operational expenses. The need for redundant systems, real-time data feeds, and high-performance computing capabilities requires substantial capital investments that can strain smaller operators’ financial resources.

Customer acquisition expenses have escalated significantly as platforms compete for market share through aggressive marketing campaigns and promotional offers. The cost of acquiring new customers while maintaining profitability has become a critical challenge, particularly for platforms offering commission-free trading models with limited revenue streams.

Artificial intelligence integration presents substantial opportunities for e-brokerage platforms to differentiate their offerings through personalized investment recommendations, automated portfolio rebalancing, and predictive market analysis. AI-powered features can enhance user engagement while providing valuable insights that improve investment outcomes and customer satisfaction levels.

Cryptocurrency trading expansion offers significant growth potential as digital asset adoption continues to increase among UK investors. Platforms that successfully integrate cryptocurrency trading capabilities alongside traditional securities can capture additional market share and revenue streams while attracting younger, tech-savvy demographics interested in alternative investments.

Institutional client services represent an underexplored opportunity for e-brokerage platforms to expand beyond retail markets. Developing sophisticated tools and services tailored to institutional investors, including advanced order management systems, algorithmic trading capabilities, and comprehensive reporting features, can unlock substantial revenue potential.

International market access through global trading capabilities can significantly enhance platform value propositions. Offering access to international exchanges, foreign securities, and multi-currency trading functionality appeals to sophisticated investors seeking portfolio diversification opportunities beyond UK markets.

Financial education initiatives present opportunities to build customer loyalty while expanding the overall investor base. Comprehensive educational programs, webinars, and interactive learning tools can attract novice investors while positioning platforms as trusted financial partners rather than mere transaction facilitators.

Partnership opportunities with traditional financial institutions, fintech companies, and technology providers can accelerate platform development and market expansion. Strategic alliances can provide access to new customer segments, enhanced technological capabilities, and expanded service offerings without requiring significant internal development investments.

Competitive intensity within the UK e-brokerage market continues to escalate as established financial institutions, pure-play online brokers, and emerging fintech companies vie for market position. This competition is driving rapid innovation cycles, with platforms continuously enhancing features, reducing costs, and improving user experiences to maintain competitive advantages. The dynamic nature of this competition benefits consumers through improved services and lower costs while challenging operators to maintain profitability.

Technology evolution is fundamentally reshaping market dynamics through the introduction of advanced trading algorithms, machine learning capabilities, and blockchain integration. These technological advances are creating new service categories while obsoleting traditional approaches to brokerage operations. Platforms that successfully leverage emerging technologies gain significant competitive advantages in terms of operational efficiency and customer value delivery.

Customer expectations are continuously evolving as users become more sophisticated and demanding regarding platform capabilities, user interface design, and service quality. Modern investors expect institutional-grade tools, real-time market data, comprehensive research resources, and seamless mobile experiences as standard offerings rather than premium features.

Regulatory evolution continues to influence market dynamics through new compliance requirements, consumer protection measures, and operational guidelines. According to MarkWide Research analysis, regulatory changes have contributed to approximately 23% of operational cost increases across the industry, while simultaneously improving market stability and consumer confidence levels.

Market consolidation pressures are intensifying as smaller players struggle to compete with well-funded competitors offering comprehensive service suites. This consolidation trend is creating opportunities for strategic acquisitions while reducing overall market fragmentation and improving operational efficiencies across the industry.

Primary research methodologies employed in analyzing the UK e-brokerage market include comprehensive surveys of platform users, in-depth interviews with industry executives, and detailed analysis of platform features and pricing structures. These primary research activities provide direct insights into customer preferences, market trends, and competitive positioning strategies across the industry.

Secondary research components encompass analysis of regulatory filings, financial statements, industry reports, and market data from authoritative sources. This secondary research provides quantitative foundations for market analysis while offering historical context and trend identification capabilities essential for comprehensive market understanding.

Data validation processes ensure research accuracy through cross-referencing multiple sources, conducting follow-up interviews, and employing statistical analysis techniques to identify and correct potential data inconsistencies. These validation procedures maintain research integrity while providing confidence in analytical conclusions and market projections.

Analytical frameworks utilize both quantitative and qualitative research methodologies to provide comprehensive market insights. Quantitative analysis focuses on market metrics, user adoption rates, and financial performance indicators, while qualitative research explores customer satisfaction levels, feature preferences, and strategic positioning effectiveness.

Industry expert consultation provides additional validation and insight into market dynamics through discussions with platform executives, regulatory specialists, and technology providers. These expert perspectives enhance research depth while ensuring analytical conclusions reflect practical market realities and industry best practices.

London metropolitan area dominates the UK e-brokerage market, accounting for approximately 42% of total platform users due to its concentration of financial professionals, high-income households, and technology-savvy demographics. The region’s sophisticated investor base drives demand for advanced trading features, comprehensive research tools, and premium service offerings that generate higher revenue per user for platform operators.

Southeast England represents the second-largest regional market, with strong adoption rates among affluent suburban communities and commuter populations. This region demonstrates particular interest in mobile trading capabilities and automated investment services that accommodate busy professional lifestyles and long commuting patterns.

Northern England regions including Manchester, Leeds, and Liverpool are experiencing rapid growth in e-brokerage adoption as digital financial services penetrate traditional banking strongholds. These areas show increasing demand for cost-effective trading solutions and educational resources that support first-time investors entering financial markets.

Scotland and Wales markets demonstrate unique characteristics with strong preferences for platforms offering comprehensive customer support and educational resources. These regions show higher adoption rates for robo-advisory services and automated investment tools compared to more traditional trading-focused platforms popular in London and Southeast England.

Rural and remote areas across the UK are increasingly accessing e-brokerage services through mobile applications, with mobile usage rates reaching approximately 67% in rural communities compared to desktop-based trading. This trend reflects the importance of mobile-first platform design in capturing geographically dispersed customer segments.

Market leadership in the UK e-brokerage sector is distributed among several key categories of competitors, each bringing distinct advantages and strategic approaches to market competition:

Competitive differentiation strategies focus on pricing models, technology capabilities, customer service quality, and specialized market segments. Leading platforms are investing heavily in mobile application development, artificial intelligence integration, and comprehensive educational resources to maintain competitive advantages.

Market positioning varies significantly across competitors, with some platforms targeting cost-conscious retail investors through commission-free models while others focus on sophisticated traders requiring advanced analytical tools and global market access. This segmentation allows multiple players to coexist while serving distinct customer needs and preferences.

By Customer Type:

By Platform Type:

By Asset Class:

Retail investor segment represents the largest and fastest-growing category within the UK e-brokerage market. This segment demonstrates strong preference for mobile-first platforms offering commission-free trading, educational resources, and simplified investment processes. User engagement rates in this category have increased by approximately 38% annually as platforms enhance gamification features and social trading capabilities.

High net worth segment demands sophisticated platform capabilities including advanced portfolio analytics, alternative investment access, and personalized advisory services. This segment generates significantly higher revenue per user while requiring substantial platform investment in premium features and dedicated customer support capabilities.

Institutional segment focuses on execution quality, regulatory compliance, and comprehensive reporting capabilities. These clients require robust API connectivity, advanced order management systems, and institutional-grade security measures that differentiate professional-focused platforms from retail-oriented services.

Day trading segment prioritizes platform performance, real-time data accuracy, and advanced technical analysis tools. This segment demonstrates high platform loyalty when service quality meets expectations but quickly switches providers when performance issues arise, making reliability and speed critical competitive factors.

Robo-advisory category is experiencing rapid growth as investors seek automated portfolio management solutions. This category appeals particularly to younger demographics and first-time investors who prefer hands-off investment approaches with professional oversight and automatic rebalancing capabilities.

For Platform Operators:

For Investors:

For Financial Ecosystem:

Strengths:

Weaknesses:

Opportunities:

Threats:

Commission-free trading models have become the dominant trend reshaping competitive dynamics across the UK e-brokerage market. This trend has forced traditional fee-based platforms to restructure their pricing models while creating new challenges around revenue generation and profitability maintenance. The shift toward zero-commission trading has democratized market access while intensifying competition for customer acquisition and retention.

Mobile-first platform design represents a critical trend as mobile trading activity now accounts for approximately 72% of total platform interactions. This trend reflects changing user preferences toward convenient, on-the-go trading capabilities and has driven substantial investment in mobile application development and optimization across the industry.

Social trading integration is gaining significant momentum as platforms incorporate community features, copy trading capabilities, and social networking elements. This trend appeals particularly to younger demographics while creating new engagement models that increase platform stickiness and user retention rates.

Artificial intelligence adoption is accelerating across the industry as platforms leverage AI for personalized investment recommendations, automated portfolio management, and predictive market analysis. This trend is enhancing user experiences while creating competitive differentiation opportunities for technologically advanced platforms.

Cryptocurrency integration has become essential for platforms seeking to attract younger, tech-savvy investors interested in digital asset trading alongside traditional securities. This trend is expanding addressable markets while creating new revenue opportunities and customer acquisition channels.

Robo-advisory services are experiencing rapid adoption as investors seek automated portfolio management solutions. This trend is particularly strong among first-time investors and busy professionals who prefer hands-off investment approaches with professional oversight and automatic rebalancing capabilities.

Regulatory framework evolution has significantly impacted industry operations through enhanced consumer protection measures, transparency requirements, and operational guidelines. The Financial Conduct Authority’s updated regulations have improved market stability while requiring platforms to invest substantially in compliance infrastructure and processes.

Technology infrastructure advancement has enabled platforms to offer increasingly sophisticated features including real-time market data, advanced charting tools, and automated trading capabilities. These technological improvements have raised customer expectations while creating competitive pressures for continuous platform enhancement and innovation.

Strategic partnerships and acquisitions have reshaped the competitive landscape as established financial institutions acquire fintech startups while technology companies partner with traditional brokerages. These developments are creating more comprehensive service offerings while accelerating innovation cycles across the industry.

International expansion initiatives by UK-based platforms are creating new growth opportunities while introducing additional competitive pressures from global players entering the UK market. These developments are increasing market sophistication while providing customers with enhanced service options and competitive pricing.

Cybersecurity enhancement programs have become critical industry priorities following high-profile security incidents in the financial services sector. Platforms are investing heavily in advanced security measures, monitoring systems, and incident response capabilities to maintain customer trust and regulatory compliance.

Educational initiative expansion reflects industry recognition of the importance of investor education in driving sustainable market growth. MWR data indicates that platforms offering comprehensive educational resources experience 34% higher customer retention rates compared to transaction-focused competitors.

Platform differentiation strategies should focus on developing unique value propositions that extend beyond pricing competition. Successful platforms will need to identify specific customer segments and develop tailored features, services, and user experiences that create sustainable competitive advantages in an increasingly crowded marketplace.

Technology investment priorities should emphasize mobile optimization, artificial intelligence integration, and cybersecurity enhancement. Platforms that successfully leverage emerging technologies while maintaining robust security measures will be best positioned to capture market share and maintain customer loyalty in the evolving digital landscape.

Customer acquisition strategies must balance cost-effectiveness with quality user acquisition to ensure sustainable growth. Platforms should focus on educational content marketing, referral programs, and strategic partnerships rather than relying solely on expensive advertising campaigns that may not generate long-term customer value.

Revenue diversification initiatives are essential for platforms operating commission-free trading models. Successful operators should explore subscription services, premium features, robo-advisory offerings, and data monetization opportunities to create multiple revenue streams and reduce dependence on traditional transaction-based income.

Regulatory compliance preparation should be viewed as a competitive advantage rather than merely a cost center. Platforms that proactively exceed regulatory requirements while maintaining operational efficiency will build stronger customer trust and market positioning compared to reactive competitors.

International expansion considerations should evaluate market entry strategies that leverage existing platform capabilities while adapting to local regulatory requirements and customer preferences. Successful expansion requires careful market selection and localization strategies that respect regional differences in investor behavior and regulatory frameworks.

Market evolution trajectory indicates continued growth and innovation within the UK e-brokerage sector, driven by technological advancement, changing demographics, and evolving investor preferences. The market is expected to experience sustained expansion with projected annual growth rates of approximately 12-15% over the next five years as digital adoption continues to accelerate across all investor segments.

Technology integration trends will likely focus on artificial intelligence, machine learning, and blockchain technologies that enhance platform capabilities while improving operational efficiency. These technological advances will enable more sophisticated personalization, automated advisory services, and enhanced security measures that differentiate leading platforms from competitors.

Competitive landscape consolidation is expected to continue as smaller players struggle to compete with well-funded competitors offering comprehensive service suites. This consolidation will likely result in fewer but more sophisticated platforms that can invest substantially in technology development and customer acquisition while maintaining profitability.

Regulatory development impacts will continue shaping market dynamics through enhanced consumer protection measures and operational guidelines. Future regulations are likely to focus on algorithmic trading oversight, data privacy protection, and cross-border transaction monitoring that will require substantial platform investment in compliance infrastructure.

Customer expectation evolution will drive demand for increasingly sophisticated platform features including real-time personalization, comprehensive educational resources, and seamless integration with other financial services. According to MarkWide Research projections, customer satisfaction requirements will increase by approximately 25% annually as users become more sophisticated and demanding regarding platform capabilities.

International market integration opportunities will expand as platforms develop capabilities to serve global customer bases while navigating complex regulatory environments. Successful platforms will likely offer multi-currency trading, international market access, and localized services that appeal to increasingly sophisticated investor requirements.

The United Kingdom e-brokerage market represents a dynamic and rapidly evolving sector that has fundamentally transformed how investors access and interact with financial markets. Through comprehensive analysis of market dynamics, competitive landscapes, and emerging trends, it becomes clear that this industry will continue experiencing substantial growth driven by technological innovation, changing demographics, and evolving customer expectations.

Key success factors for market participants include maintaining technological leadership, developing differentiated value propositions, ensuring robust cybersecurity measures, and adapting to evolving regulatory requirements. Platforms that successfully balance innovation with reliability while providing exceptional user experiences will be best positioned to capture market share and achieve sustainable growth in this competitive environment.

Future market development will likely be characterized by continued consolidation, increased sophistication in service offerings, and enhanced integration of emerging technologies such as artificial intelligence and blockchain. The industry’s trajectory suggests that successful platforms will need to continuously evolve their capabilities while maintaining focus on customer needs and regulatory compliance to thrive in this dynamic marketplace.

The UK e-brokerage market outlook remains highly positive, with substantial opportunities for growth, innovation, and value creation across all market segments. As digital transformation continues reshaping financial services, e-brokerage platforms that successfully navigate competitive challenges while delivering superior customer value will establish strong market positions and drive industry evolution for years to come.

What is E-Brokerage?

E-Brokerage refers to the online platforms that facilitate the buying and selling of financial securities, such as stocks and bonds, through electronic means. These platforms provide investors with access to market data, trading tools, and account management features.

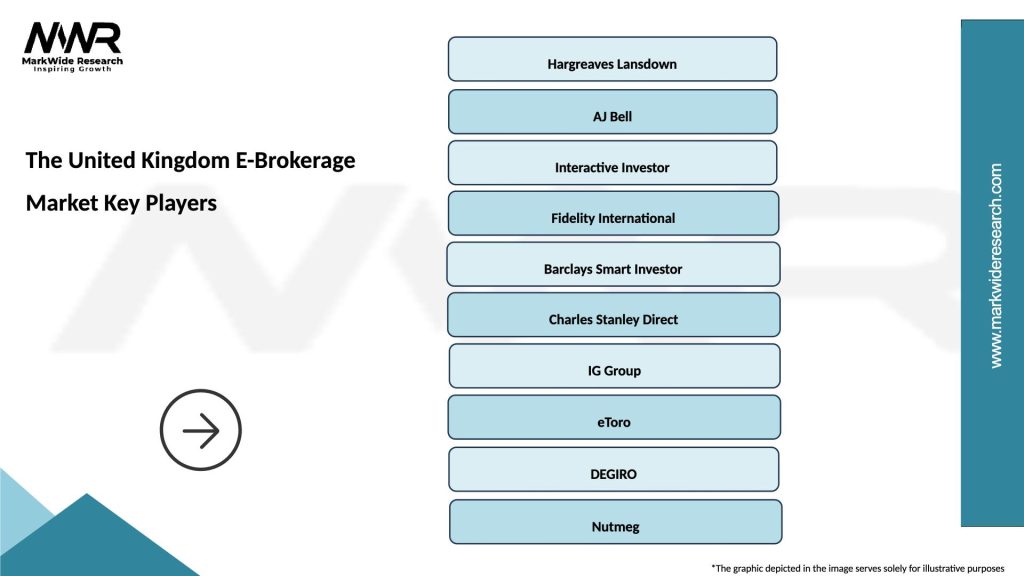

What are the key players in The United Kingdom E-Brokerage Market?

Key players in The United Kingdom E-Brokerage Market include companies like Hargreaves Lansdown, IG Group, and Interactive Investor, which offer various trading services and investment products to retail and institutional clients, among others.

What are the growth factors driving The United Kingdom E-Brokerage Market?

The growth of The United Kingdom E-Brokerage Market is driven by increasing internet penetration, a growing number of retail investors, and the rising popularity of mobile trading applications. Additionally, advancements in technology have made trading more accessible and efficient.

What challenges does The United Kingdom E-Brokerage Market face?

The United Kingdom E-Brokerage Market faces challenges such as regulatory compliance, market volatility, and intense competition among platforms. These factors can impact profitability and user retention for e-brokerage firms.

What opportunities exist in The United Kingdom E-Brokerage Market?

Opportunities in The United Kingdom E-Brokerage Market include the expansion of cryptocurrency trading, the integration of artificial intelligence for personalized investment advice, and the potential for partnerships with fintech companies to enhance service offerings.

What trends are shaping The United Kingdom E-Brokerage Market?

Trends shaping The United Kingdom E-Brokerage Market include the rise of commission-free trading, increased focus on sustainable investing, and the growing use of robo-advisors. These trends reflect changing investor preferences and technological advancements.

The United Kingdom E-Brokerage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Equities, Forex, Options, Futures |

| Customer Type | Retail Investors, Institutional Investors, High Net Worth Individuals, Day Traders |

| Service Type | Full-Service Brokerage, Discount Brokerage, Robo-Advisory, Direct Market Access |

| Technology | Mobile Trading Platforms, Algorithmic Trading, Cloud-Based Solutions, Blockchain Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the The United Kingdom E-Brokerage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at