444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America gas turbine MRO market represents a critical component of the region’s power generation infrastructure, encompassing comprehensive maintenance, repair, and overhaul services for gas turbine systems across the United States, Canada, and Mexico. This specialized market serves as the backbone for ensuring optimal performance, reliability, and longevity of gas turbine equipment in power generation facilities, industrial applications, and aviation sectors.

Market dynamics indicate robust growth driven by aging power generation infrastructure, increasing demand for reliable electricity supply, and the transition toward cleaner energy sources. The market encompasses various service categories including scheduled maintenance, emergency repairs, component replacement, and complete overhaul services. Industry analysis reveals that the market is experiencing significant expansion at a CAGR of 6.2%, reflecting the critical importance of maintaining existing gas turbine assets while optimizing their operational efficiency.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 15%, and Mexico accounting for the remaining 7%. This distribution reflects the concentration of power generation facilities and industrial infrastructure across these territories. The market serves diverse end-users including utility companies, independent power producers, industrial manufacturers, and aviation operators, each requiring specialized MRO services tailored to their operational requirements.

The North America gas turbine MRO market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for gas turbine equipment operating across power generation, industrial, and aviation applications throughout the North American region. This market encompasses all activities related to preserving, restoring, and enhancing the performance of gas turbine systems to ensure optimal operational efficiency, reliability, and compliance with regulatory standards.

MRO services include preventive maintenance programs, corrective repairs, component refurbishment, complete overhauls, and performance optimization initiatives. These services are essential for maximizing equipment lifespan, minimizing unplanned downtime, and maintaining peak operational performance. The market involves specialized service providers, original equipment manufacturers, and independent maintenance organizations working collaboratively to support the extensive gas turbine infrastructure across North America.

Strategic analysis of the North America gas turbine MRO market reveals a dynamic and essential sector supporting critical power generation infrastructure across the region. The market demonstrates consistent growth patterns driven by increasing maintenance requirements for aging turbine fleets, technological advancements in maintenance methodologies, and growing emphasis on operational efficiency optimization.

Key market drivers include the substantial installed base of gas turbines requiring regular maintenance, increasing focus on extending equipment lifespan, and regulatory requirements for maintaining operational standards. The market benefits from technological innovations in predictive maintenance, advanced diagnostics, and digital monitoring systems that enhance service delivery capabilities and operational outcomes.

Service diversification represents a significant trend, with providers expanding their offerings to include comprehensive maintenance contracts, performance guarantees, and integrated digital solutions. The market shows strong resilience with consistent demand patterns, as gas turbine maintenance represents a non-discretionary expenditure for power generation facilities and industrial operators.

Competitive dynamics feature a mix of original equipment manufacturers, specialized service providers, and independent maintenance organizations competing across various service segments. Market participants are increasingly focusing on value-added services, long-term service agreements, and technology-enhanced maintenance solutions to differentiate their offerings and capture market share.

Market intelligence reveals several critical insights shaping the North America gas turbine MRO landscape:

Primary growth drivers propelling the North America gas turbine MRO market include the substantial installed base of gas turbine equipment requiring regular maintenance and the critical importance of maintaining reliable power generation capacity. The region’s extensive gas turbine infrastructure, accumulated over decades of power sector development, creates consistent demand for comprehensive maintenance services.

Aging infrastructure represents a significant driver, as many gas turbines installed during previous decades are reaching maturity phases requiring more intensive maintenance interventions. This demographic shift in equipment age profiles drives increased service frequency, component replacement needs, and overhaul requirements, creating sustained market growth opportunities.

Operational efficiency demands continue driving market expansion as power generators and industrial operators seek to maximize equipment performance while minimizing operational costs. Advanced maintenance practices, including predictive maintenance and condition-based monitoring, enable operators to optimize maintenance schedules and reduce unplanned downtime incidents.

Regulatory compliance requirements serve as important market drivers, with environmental regulations and safety standards necessitating regular maintenance activities and equipment upgrades. These requirements ensure consistent demand for specialized maintenance services and create opportunities for service providers offering compliance-focused solutions.

Technology advancement in maintenance methodologies drives market growth through improved service capabilities and enhanced value propositions. Digital technologies, advanced materials, and innovative maintenance techniques enable service providers to deliver superior outcomes while expanding their service offerings and market reach.

Economic constraints present significant challenges for the North America gas turbine MRO market, particularly during periods of reduced capital expenditure and operational budget pressures. Power generators and industrial operators may defer non-critical maintenance activities during economic downturns, impacting service demand and market growth patterns.

Supply chain complexities create operational challenges, especially for specialized components and parts with long lead times. These constraints can delay maintenance projects, increase costs, and impact service delivery timelines, potentially affecting customer satisfaction and market competitiveness.

Skilled workforce shortages represent a persistent challenge, as gas turbine maintenance requires specialized technical expertise and certification. The limited availability of qualified technicians can constrain service capacity and impact market growth potential, particularly in regions with high maintenance demand.

Technology transition risks emerge as the power sector evolves toward renewable energy sources and newer generation technologies. This transition may impact long-term demand for traditional gas turbine MRO services, creating uncertainty for market participants and investment decisions.

Competitive pricing pressures intensify as market participants compete for contracts, potentially impacting service margins and profitability. These pressures may limit investment in advanced technologies and service capabilities, affecting long-term market development and innovation.

Digital transformation initiatives present substantial opportunities for market expansion through the integration of advanced technologies in maintenance operations. Internet of Things sensors, artificial intelligence, and predictive analytics enable service providers to offer enhanced value propositions and differentiated service capabilities.

Service contract evolution creates opportunities for innovative business models, including performance-based contracts, guaranteed availability agreements, and comprehensive asset management services. These models align service provider incentives with customer operational objectives while creating stable revenue streams.

Emerging market segments offer growth potential, particularly in industrial gas turbine applications and distributed power generation systems. These segments require specialized maintenance approaches and create opportunities for service providers to expand their market presence and service portfolios.

Technology upgrade services represent significant opportunities as operators seek to enhance existing equipment performance through retrofits, upgrades, and modernization projects. These services combine traditional MRO activities with technology enhancement initiatives, creating higher-value service opportunities.

Regional expansion possibilities exist within North America, particularly in underserved markets and emerging industrial sectors. Service providers can leverage their expertise and capabilities to capture market share in developing regions and specialized applications.

Market forces shaping the North America gas turbine MRO landscape reflect the complex interplay between operational requirements, technological advancement, and economic factors. The market demonstrates cyclical patterns influenced by power demand fluctuations, maintenance scheduling cycles, and capital investment patterns across the power generation sector.

Demand patterns show seasonal variations with peak maintenance activities typically occurring during planned outage periods and low-demand seasons. This cyclical nature requires service providers to maintain flexible capacity and resource allocation strategies to accommodate varying demand levels throughout the year.

Competitive dynamics continue evolving as market participants adapt to changing customer requirements and technological developments. The market features increasing consolidation among service providers seeking to achieve scale advantages and comprehensive service capabilities.

Technology integration drives fundamental changes in service delivery methodologies, with digital tools enabling more efficient maintenance planning, execution, and monitoring. These technological advances create opportunities for improved service outcomes while potentially disrupting traditional service models and competitive positions.

Customer relationship evolution reflects increasing emphasis on partnership-based approaches, with service providers and customers collaborating more closely on maintenance planning, performance optimization, and long-term asset management strategies. This trend creates opportunities for deeper customer engagement and value creation.

Comprehensive research approach employed for analyzing the North America gas turbine MRO market incorporates multiple data sources, analytical methodologies, and validation techniques to ensure accuracy and reliability of market insights. The methodology combines quantitative analysis with qualitative assessment to provide holistic market understanding.

Primary research activities include extensive interviews with industry participants, including service providers, equipment manufacturers, power generators, and industrial operators. These interviews provide firsthand insights into market trends, challenges, opportunities, and competitive dynamics affecting the gas turbine MRO sector.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technical publications to gather comprehensive market data and validate primary research findings. This approach ensures thorough coverage of market aspects and reliable data foundation.

Data validation processes involve cross-referencing information from multiple sources, conducting follow-up interviews for clarification, and applying statistical analysis techniques to ensure data accuracy and consistency. These processes enhance the reliability and credibility of research outcomes.

Analytical frameworks utilize established market research methodologies, including Porter’s Five Forces analysis, SWOT assessment, and competitive positioning analysis to provide structured evaluation of market dynamics and competitive landscape characteristics.

United States market dominates the North America gas turbine MRO landscape, accounting for approximately 78% of regional market activity. This dominance reflects the country’s extensive power generation infrastructure, large industrial base, and mature gas turbine installed capacity. The U.S. market benefits from well-established service provider networks, advanced maintenance capabilities, and strong regulatory frameworks supporting equipment reliability and safety.

Regional distribution within the United States shows concentration in major industrial and power generation centers, including Texas, California, Florida, and the Northeast corridor. These regions feature high concentrations of gas turbine installations requiring regular maintenance services and creating substantial market opportunities for service providers.

Canadian market represents approximately 15% of regional activity, characterized by significant industrial gas turbine applications in oil and gas processing, mining, and power generation sectors. The Canadian market demonstrates strong growth potential driven by resource sector development and increasing focus on operational efficiency optimization.

Mexican market accounts for the remaining 7% of regional market share, showing rapid growth potential as the country modernizes its power generation infrastructure and expands industrial capacity. Mexico’s market benefits from increasing foreign investment, infrastructure development projects, and growing emphasis on reliable power supply.

Cross-border service delivery represents an important market characteristic, with major service providers operating across multiple countries and leveraging regional expertise and resources to serve customers throughout North America. This regional integration creates opportunities for service optimization and cost efficiency.

Market structure features a diverse competitive landscape with multiple categories of service providers competing across various market segments and service offerings. The competitive environment includes original equipment manufacturers, specialized service companies, and independent maintenance organizations, each bringing distinct capabilities and value propositions.

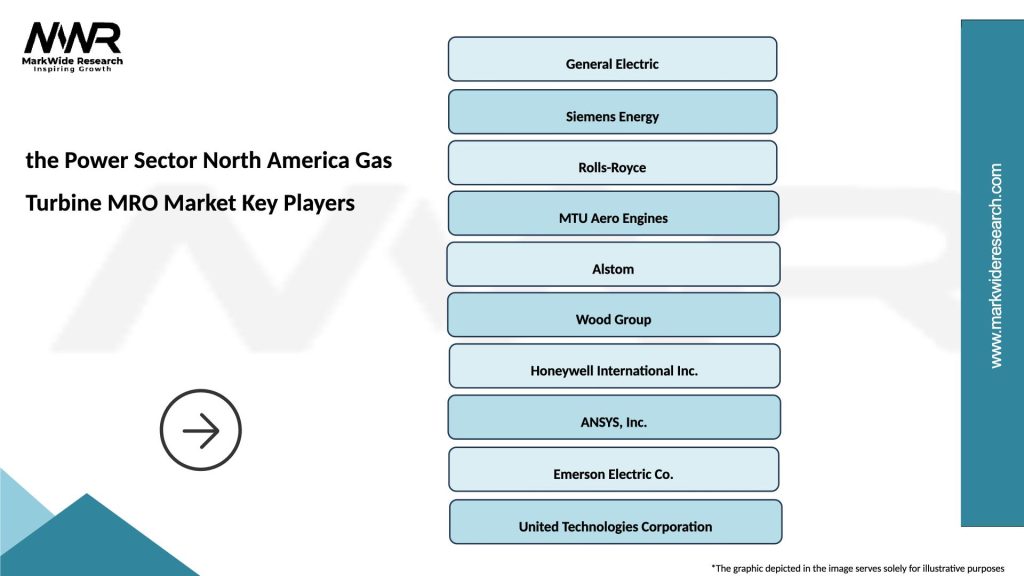

Leading market participants include:

Competitive strategies focus on service differentiation through technology integration, comprehensive service offerings, and long-term customer relationships. Market participants increasingly emphasize digital capabilities, predictive maintenance solutions, and performance guarantees to distinguish their service propositions.

Market consolidation trends continue as companies seek to achieve scale advantages, expand service capabilities, and enhance geographic coverage. These consolidation activities create opportunities for improved service delivery while potentially affecting competitive dynamics and market structure.

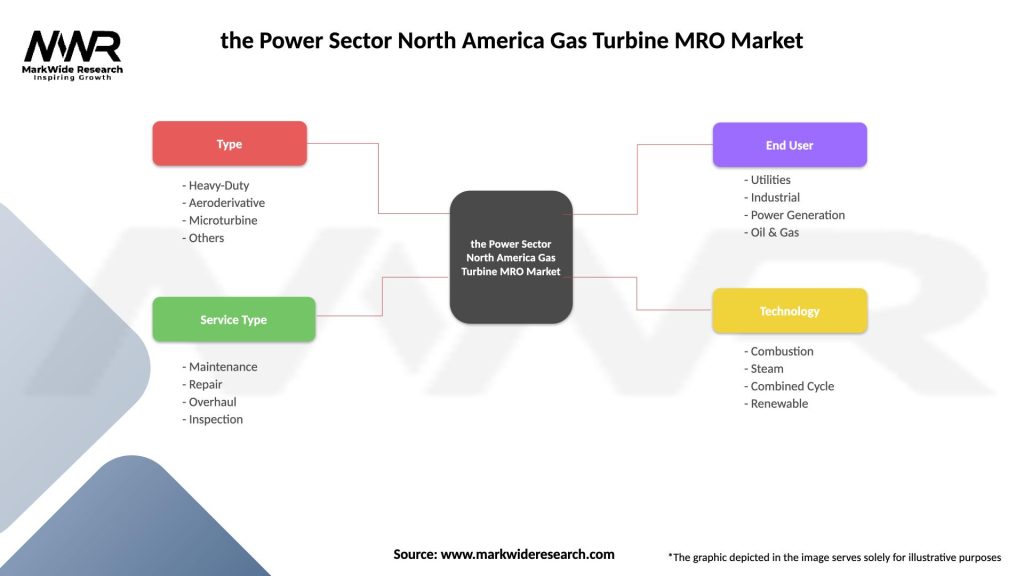

Service type segmentation divides the market into distinct categories based on maintenance activity types and service complexity levels:

Application segmentation categorizes the market based on end-use applications and operational requirements:

Technology segmentation reflects different gas turbine technologies and their specific maintenance requirements:

By Service Type: Preventive maintenance services dominate market activity, representing the largest segment due to the critical importance of scheduled maintenance in ensuring equipment reliability and performance. This segment benefits from predictable demand patterns and long-term service contracts that provide stable revenue streams for service providers.

Overhaul services represent the highest-value segment, with comprehensive refurbishment projects generating substantial revenue per engagement. These services require specialized expertise, extensive facilities, and significant parts inventory, creating barriers to entry and supporting premium pricing for qualified service providers.

By Application: Power generation applications account for the largest market share, driven by the extensive utility infrastructure and critical importance of maintaining reliable electricity supply. This segment demonstrates consistent growth with annual service demand increasing by 4.8% as aging power plant infrastructure requires more intensive maintenance interventions.

Industrial applications show strong growth potential, particularly in manufacturing and processing sectors where gas turbines provide critical power and process support. These applications often require customized maintenance approaches and specialized expertise, creating opportunities for service differentiation and premium pricing.

By Technology: Heavy-duty gas turbine maintenance represents the largest revenue segment, reflecting the substantial installed base and high-value maintenance requirements of utility-scale equipment. These turbines require extensive maintenance resources and specialized expertise, supporting strong market positions for qualified service providers.

Aeroderivative turbine services demonstrate rapid growth, driven by increasing deployment in industrial applications and peaking power plants. These turbines offer unique maintenance characteristics and service requirements, creating opportunities for specialized service providers and innovative maintenance approaches.

Equipment Owners benefit significantly from professional MRO services through enhanced equipment reliability, extended operational lifespan, and optimized performance characteristics. Professional maintenance services help maximize return on capital investments while minimizing operational risks and unplanned downtime incidents.

Operational advantages include improved equipment availability, enhanced fuel efficiency, and reduced emissions through proper maintenance practices. These benefits translate directly into operational cost savings and improved environmental performance, supporting both economic and sustainability objectives.

Service Providers benefit from stable market demand, recurring revenue opportunities, and potential for long-term customer relationships. The essential nature of maintenance services creates resilient business models with predictable cash flows and opportunities for service expansion and value creation.

Technology advancement opportunities enable service providers to differentiate their offerings through innovative maintenance approaches, digital solutions, and enhanced service capabilities. These advancements create competitive advantages and support premium pricing for superior service delivery.

Regional Economic Impact includes job creation in specialized technical fields, support for local supply chains, and contribution to energy infrastructure reliability. The MRO sector supports skilled employment opportunities and contributes to regional economic development through specialized service capabilities.

Industry Ecosystem Benefits encompass improved overall sector efficiency, enhanced safety standards, and accelerated technology adoption. Professional MRO services contribute to industry best practices and support continuous improvement in maintenance methodologies and operational performance.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the North America gas turbine MRO market, with service providers increasingly adopting Internet of Things sensors, artificial intelligence, and predictive analytics to enhance maintenance capabilities. This technological evolution enables more precise maintenance scheduling, improved diagnostic capabilities, and enhanced operational outcomes.

Predictive maintenance adoption continues accelerating, with implementation rates increasing by 23% annually as operators recognize the value of condition-based maintenance approaches. These technologies enable early problem detection, optimized maintenance scheduling, and reduced unplanned downtime incidents, creating significant value for equipment owners and service providers.

Service contract evolution toward performance-based agreements and comprehensive asset management models reflects changing customer preferences and service provider capabilities. These contracts align service provider incentives with customer operational objectives while providing more predictable outcomes and cost structures.

Sustainability focus drives increasing emphasis on maintenance practices that enhance environmental performance, including emissions reduction, fuel efficiency optimization, and waste minimization. Service providers are developing specialized capabilities to support customer sustainability objectives while maintaining operational excellence.

Workforce development initiatives address skilled labor shortages through enhanced training programs, certification processes, and technology-assisted maintenance procedures. These initiatives help ensure adequate technical expertise while supporting career development in specialized maintenance fields.

Supply chain optimization efforts focus on improving parts availability, reducing inventory costs, and enhancing service delivery efficiency. Advanced inventory management systems and strategic partnerships help minimize maintenance-related delays while optimizing working capital requirements.

Technology integration initiatives continue advancing across the industry, with major service providers investing significantly in digital capabilities and advanced maintenance technologies. These investments enhance service delivery capabilities while creating competitive advantages and improved customer value propositions.

Strategic partnerships between equipment manufacturers and independent service providers create opportunities for enhanced service capabilities and expanded market reach. These collaborations combine manufacturing expertise with specialized service capabilities to deliver comprehensive maintenance solutions.

Facility expansion projects reflect growing market demand and service provider confidence in long-term market prospects. New maintenance facilities and capability enhancements support increased service capacity while improving geographic coverage and customer accessibility.

Regulatory developments continue shaping market requirements, with evolving environmental standards and safety regulations influencing maintenance practices and service specifications. These developments create opportunities for specialized compliance services while ensuring continued focus on operational excellence.

Market consolidation activities include strategic acquisitions and partnerships designed to enhance service capabilities, expand geographic coverage, and achieve operational efficiencies. These activities reshape competitive dynamics while creating opportunities for improved service delivery and customer value creation.

Innovation investments focus on advanced materials, maintenance techniques, and digital solutions that enhance service outcomes while reducing costs and environmental impact. These investments support long-term market development and competitive positioning for forward-thinking service providers.

MarkWide Research analysis indicates that market participants should prioritize digital transformation initiatives to remain competitive in the evolving gas turbine MRO landscape. Companies investing in predictive maintenance technologies and data analytics capabilities are positioned to capture disproportionate market share and achieve superior operational outcomes.

Strategic recommendations include developing comprehensive service portfolios that combine traditional maintenance activities with advanced digital solutions and performance guarantees. This approach enables service providers to differentiate their offerings while creating stronger customer relationships and more stable revenue streams.

Geographic expansion opportunities exist within North America, particularly in underserved markets and emerging industrial sectors. Service providers should evaluate regional expansion strategies that leverage existing capabilities while addressing local market requirements and competitive dynamics.

Partnership development represents a critical success factor, with collaborative relationships enabling enhanced service capabilities and improved customer value propositions. Strategic alliances between service providers, technology companies, and equipment manufacturers create opportunities for innovation and market leadership.

Workforce investment should remain a priority, with companies developing comprehensive training programs and retention strategies to address skilled labor shortages. Investment in human capital development supports long-term competitive positioning while ensuring service quality and customer satisfaction.

Technology adoption strategies should focus on solutions that demonstrate clear return on investment while enhancing service capabilities. Selective technology implementation based on customer requirements and operational benefits enables sustainable competitive advantages without excessive capital investment.

Market trajectory for the North America gas turbine MRO sector indicates continued growth driven by aging infrastructure, technological advancement, and increasing focus on operational efficiency. The market is projected to maintain steady expansion with compound annual growth rates of 6.2% over the forecast period, reflecting the essential nature of maintenance services and growing service sophistication.

Technology evolution will continue reshaping service delivery methodologies, with artificial intelligence, machine learning, and advanced diagnostics becoming standard components of maintenance operations. These technologies will enable more precise maintenance planning, improved problem detection, and enhanced operational outcomes for equipment owners.

Service model transformation toward comprehensive asset management and performance-based contracts will accelerate, creating opportunities for service providers to develop deeper customer relationships while providing more predictable outcomes. This evolution supports both customer objectives and service provider business model optimization.

Regional market development will continue with particular growth potential in Mexico and underserved segments within the United States and Canada. Infrastructure development and industrial expansion create opportunities for market expansion and service provider growth.

Competitive landscape evolution will feature continued consolidation among service providers seeking scale advantages and enhanced capabilities. This consolidation will create opportunities for improved service delivery while potentially affecting market structure and competitive dynamics.

Sustainability integration will become increasingly important, with maintenance services contributing to environmental performance objectives through enhanced efficiency, emissions reduction, and waste minimization. Service providers developing sustainability-focused capabilities will capture growing market opportunities while supporting customer environmental objectives.

The North America gas turbine MRO market represents a vital and dynamic sector supporting critical power generation and industrial infrastructure across the region. Market analysis reveals consistent growth potential driven by aging equipment demographics, technological advancement, and increasing focus on operational excellence. The market demonstrates resilience through essential service characteristics while offering opportunities for innovation and value creation.

Strategic positioning for market success requires comprehensive service capabilities, technology integration, and strong customer relationships. Service providers that invest in digital transformation, workforce development, and innovative service models are positioned to capture disproportionate market opportunities while delivering superior customer value.

Future market development will be characterized by continued technological evolution, service model innovation, and geographic expansion opportunities. The market outlook remains positive with steady growth prospects supported by fundamental infrastructure requirements and evolving customer expectations for enhanced service delivery and operational outcomes.

What is Power Sector Gas Turbine MRO?

Power Sector Gas Turbine MRO refers to the maintenance, repair, and overhaul services for gas turbines used in power generation. These services ensure the efficient operation and longevity of gas turbines, which are critical for electricity production.

What are the key players in the Power Sector North America Gas Turbine MRO Market?

Key players in the Power Sector North America Gas Turbine MRO Market include General Electric, Siemens, and Mitsubishi Power, among others. These companies provide a range of services from routine maintenance to major overhauls.

What are the growth factors driving the Power Sector North America Gas Turbine MRO Market?

The growth of the Power Sector North America Gas Turbine MRO Market is driven by the increasing demand for electricity, the aging infrastructure of gas turbines, and the need for enhanced efficiency and reliability in power generation.

What challenges does the Power Sector North America Gas Turbine MRO Market face?

Challenges in the Power Sector North America Gas Turbine MRO Market include the high costs associated with maintenance and repair, the complexity of modern gas turbine technology, and the shortage of skilled technicians.

What opportunities exist in the Power Sector North America Gas Turbine MRO Market?

Opportunities in the Power Sector North America Gas Turbine MRO Market include advancements in digital technologies for predictive maintenance, the growing trend towards renewable energy integration, and the potential for expanding service offerings to include retrofitting and upgrades.

What trends are shaping the Power Sector North America Gas Turbine MRO Market?

Trends in the Power Sector North America Gas Turbine MRO Market include the adoption of condition-based monitoring systems, increased focus on sustainability practices, and the integration of artificial intelligence for optimizing maintenance schedules.

the Power Sector North America Gas Turbine MRO Market

| Segmentation Details | Description |

|---|---|

| Type | Heavy-Duty, Aeroderivative, Microturbine, Others |

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Utilities, Industrial, Power Generation, Oil & Gas |

| Technology | Combustion, Steam, Combined Cycle, Renewable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the the Power Sector North America Gas Turbine MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at