444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Power Sector Europe Gas Turbine MRO Market represents a critical component of the continent’s energy infrastructure, encompassing comprehensive maintenance, repair, and overhaul services for gas turbine systems across power generation facilities. European power sector operators increasingly rely on sophisticated MRO strategies to maximize turbine efficiency, extend operational lifespans, and ensure reliable electricity generation. The market demonstrates robust growth momentum driven by aging turbine fleets, technological advancement requirements, and stringent environmental regulations demanding optimal performance standards.

Market dynamics indicate substantial expansion opportunities as European utilities transition toward cleaner energy solutions while maintaining gas turbine reliability for grid stability. The sector experiences significant demand for specialized MRO services, particularly in countries with extensive gas-fired power generation capacity including Germany, United Kingdom, Italy, and the Netherlands. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, reflecting increasing investment in turbine modernization and performance optimization initiatives.

Regional market characteristics vary significantly across European nations, with Western European countries leading in advanced MRO technology adoption while Eastern European markets present emerging opportunities for service expansion. The market encompasses various turbine technologies including heavy-duty gas turbines, aeroderivative turbines, and industrial gas turbines, each requiring specialized maintenance approaches and technical expertise.

The Power Sector Europe Gas Turbine MRO Market refers to the comprehensive ecosystem of maintenance, repair, and overhaul services specifically designed for gas turbine systems operating within European power generation facilities. This specialized market encompasses preventive maintenance programs, corrective repair services, major overhaul operations, and component replacement activities essential for maintaining optimal turbine performance and reliability.

MRO services include routine inspections, component cleaning, parts replacement, system upgrades, performance monitoring, and emergency repair interventions. The market serves various stakeholders including independent power producers, utility companies, industrial power generators, and combined heat and power facilities throughout Europe. Service providers range from original equipment manufacturers to specialized third-party maintenance contractors offering comprehensive turbine lifecycle support.

Market scope extends beyond basic maintenance to include advanced services such as digital monitoring solutions, predictive maintenance technologies, and performance optimization consulting. The sector plays a vital role in ensuring European energy security by maintaining the reliability and efficiency of gas turbine infrastructure supporting grid stability and power supply continuity.

Strategic market analysis reveals the European gas turbine MRO sector as a dynamic and essential component of the continent’s energy infrastructure ecosystem. The market demonstrates consistent growth driven by increasing turbine fleet age, technological advancement requirements, and regulatory pressures for enhanced environmental performance. Key market drivers include the need for improved operational efficiency, extended equipment lifespans, and compliance with evolving emission standards.

Competitive landscape features established original equipment manufacturers alongside specialized service providers offering comprehensive MRO solutions. Major market participants include Siemens Energy, General Electric, Mitsubishi Power, and Ansaldo Energia, complemented by regional service specialists providing localized expertise. The market benefits from technological innovation in areas such as digital monitoring, predictive analytics, and advanced materials science.

Regional distribution shows Western European markets accounting for approximately 68% of total market activity, with Germany leading in absolute service demand followed by the United Kingdom and Italy. Market segmentation reveals heavy-duty gas turbines representing the largest service category, while aeroderivative turbines demonstrate the highest growth potential due to their increasing deployment in flexible power generation applications.

Future outlook indicates sustained market expansion supported by ongoing energy transition initiatives, grid modernization projects, and the strategic role of gas turbines in providing backup power and grid balancing services for renewable energy integration.

Market intelligence reveals several critical insights shaping the European gas turbine MRO landscape. The sector demonstrates increasing sophistication in service delivery approaches, with operators prioritizing comprehensive lifecycle management over traditional reactive maintenance strategies. Digital transformation emerges as a fundamental trend, with approximately 45% of major operators implementing advanced monitoring and predictive maintenance technologies.

Primary market drivers propelling European gas turbine MRO growth encompass multiple interconnected factors reflecting the evolving energy landscape and operational requirements. Aging turbine infrastructure represents the most significant driver, with many European facilities operating turbines installed during the 1990s and early 2000s requiring intensive maintenance to maintain performance standards.

Regulatory pressures significantly influence market demand as European Union environmental directives mandate improved emission performance and operational efficiency. The Industrial Emissions Directive and national carbon reduction targets compel operators to invest in maintenance programs ensuring optimal turbine performance and environmental compliance. These regulations drive approximately 35% of maintenance spending toward emission-related upgrades and performance optimization.

Energy transition dynamics create unique maintenance challenges as gas turbines increasingly operate in flexible generation modes supporting renewable energy integration. This operational pattern requires specialized maintenance approaches addressing frequent start-stop cycles and variable load conditions. Grid stability requirements necessitate high turbine availability and rapid response capabilities, driving demand for comprehensive maintenance programs.

Technological advancement opportunities motivate operators to invest in modernization programs incorporating advanced monitoring systems, improved materials, and enhanced control technologies. Digitalization initiatives enable predictive maintenance strategies reducing unplanned outages and optimizing maintenance scheduling, creating substantial value for operators and driving service provider innovation.

Market constraints affecting European gas turbine MRO growth include several challenging factors that service providers and operators must navigate. High service costs represent a primary restraint, particularly for smaller independent power producers with limited maintenance budgets. Major overhaul operations can require substantial capital investment, creating financial pressure for operators managing multiple turbine assets.

Technical complexity of modern gas turbines demands highly specialized expertise and advanced diagnostic equipment, limiting the number of qualified service providers and potentially creating capacity constraints during peak maintenance seasons. Supply chain challenges for critical components and spare parts can extend maintenance schedules and increase operational risks, particularly for older turbine models with limited parts availability.

Regulatory uncertainty regarding long-term energy policy direction creates hesitation among operators considering major maintenance investments. Energy transition policies emphasizing renewable energy deployment raise questions about the long-term viability of gas turbine assets, potentially limiting investment in extensive maintenance programs.

Skilled workforce shortages in specialized turbine maintenance create capacity limitations and drive up service costs. The technical expertise required for advanced turbine systems requires extensive training and experience, creating barriers to market entry for new service providers. Competition from alternative technologies including battery storage and renewable energy systems may reduce long-term demand for gas turbine MRO services as the energy mix evolves.

Significant opportunities emerge within the European gas turbine MRO market as technological advancement and changing energy dynamics create new service categories and market segments. Digital transformation initiatives present substantial growth potential as operators seek advanced monitoring and predictive maintenance solutions. The integration of Internet of Things sensors, artificial intelligence, and cloud-based analytics creates opportunities for innovative service models and enhanced value propositions.

Retrofit and modernization services represent expanding opportunities as operators seek to extend turbine lifespans and improve performance without complete equipment replacement. Advanced materials applications including ceramic matrix composites and thermal barrier coatings enable performance improvements and extended maintenance intervals, creating specialized service niches.

Regional expansion opportunities exist in Eastern European markets where gas turbine deployment continues growing and local service capabilities remain limited. Service consolidation trends create opportunities for comprehensive lifecycle management contracts encompassing multiple facilities and extended service periods.

Environmental compliance services present growing opportunities as emission regulations become increasingly stringent. Specialized services addressing NOx reduction, carbon capture integration, and hydrogen fuel adaptation represent emerging market segments. Flexible operation optimization services supporting renewable energy integration create new technical challenges requiring specialized expertise and innovative maintenance approaches.

Market dynamics within the European gas turbine MRO sector reflect complex interactions between technological evolution, regulatory requirements, and changing energy market conditions. Supply and demand balance varies significantly across European regions, with mature Western European markets demonstrating stable demand patterns while Eastern European markets show higher growth volatility.

Competitive dynamics intensify as original equipment manufacturers expand service offerings while independent service providers develop specialized capabilities. This competition drives innovation in service delivery models, pricing strategies, and technical capabilities. Market consolidation trends emerge as larger service providers acquire specialized capabilities and regional expertise through strategic partnerships and acquisitions.

Technology adoption rates vary considerably across market segments, with larger utility operators leading in advanced maintenance technology implementation while smaller operators often rely on traditional maintenance approaches. Digital service penetration reaches approximately 52% of major European facilities, indicating substantial remaining growth potential for technology-enabled services.

Pricing dynamics reflect increasing service sophistication and value-added capabilities, with operators willing to pay premium rates for comprehensive service packages delivering measurable performance improvements. Contract structures evolve toward performance-based agreements linking service payments to operational outcomes and availability guarantees, creating alignment between service providers and operators.

Comprehensive research methodology employed for analyzing the European gas turbine MRO market incorporates multiple data collection and analysis approaches ensuring robust market intelligence and reliable insights. Primary research activities include extensive interviews with industry executives, maintenance managers, and technical specialists across major European power generation companies and service providers.

Secondary research components encompass detailed analysis of industry reports, regulatory documents, company financial statements, and technical publications. Market data validation occurs through cross-referencing multiple information sources and conducting follow-up interviews with key market participants to verify findings and insights.

Quantitative analysis methods include statistical modeling of market trends, correlation analysis of driving factors, and projection modeling for future market development scenarios. Qualitative research techniques incorporate expert opinion synthesis, competitive landscape mapping, and regulatory impact assessment.

Data collection scope covers all major European markets including Germany, United Kingdom, France, Italy, Spain, Netherlands, Poland, and other significant gas turbine operating regions. Research timeframe encompasses historical data analysis from 2018-2023 and forward-looking projections through 2030, providing comprehensive temporal market perspective for strategic decision-making.

Regional market analysis reveals significant variations in gas turbine MRO demand patterns, service capabilities, and growth trajectories across European markets. Germany represents the largest individual market, accounting for approximately 24% of total European MRO activity, driven by extensive gas turbine capacity and sophisticated maintenance requirements. German operators demonstrate high adoption rates for advanced maintenance technologies and comprehensive service agreements.

United Kingdom maintains strong market position despite Brexit-related uncertainties, with approximately 18% market share supported by mature gas turbine fleets and established service provider networks. British operators increasingly focus on flexible operation capabilities supporting renewable energy integration, driving demand for specialized maintenance services.

Italy and France collectively represent 22% of regional market activity, with Italian markets showing particular strength in combined cycle power plant maintenance while French markets emphasize nuclear-gas hybrid operational strategies. Netherlands and Belgium demonstrate high service intensity due to extensive industrial gas turbine applications and sophisticated maintenance requirements.

Eastern European markets including Poland, Czech Republic, and Hungary show rapid growth potential with expanding gas turbine capacity and developing local service capabilities. These markets present opportunities for international service providers while local companies develop technical expertise. Nordic countries demonstrate unique maintenance challenges related to cold weather operations and seasonal demand variations, requiring specialized service approaches.

Competitive landscape within the European gas turbine MRO market features diverse participants ranging from global original equipment manufacturers to specialized regional service providers. Market leadership positions are held by established turbine manufacturers leveraging their technical expertise and parts availability advantages.

Competitive strategies emphasize service differentiation through advanced technology integration, comprehensive lifecycle management, and regional expertise development. Market participants increasingly invest in digital capabilities, predictive maintenance technologies, and specialized workforce development to maintain competitive advantages.

Market segmentation analysis reveals distinct categories within the European gas turbine MRO market based on turbine type, service category, end-user application, and geographic distribution. Turbine type segmentation represents the primary classification framework with heavy-duty gas turbines, aeroderivative turbines, and industrial gas turbines each requiring specialized maintenance approaches.

By Turbine Type:

By Service Type:

By End-User Application:

Heavy-duty gas turbine maintenance represents the most substantial market category, driven by extensive utility-scale power generation capacity across European markets. These large turbines require sophisticated maintenance programs incorporating advanced diagnostic technologies, specialized tooling, and highly trained technical personnel. Maintenance intervals typically range from 8,000 to 32,000 operating hours depending on operational patterns and environmental conditions.

Aeroderivative turbine services demonstrate the highest growth potential due to increasing deployment in flexible power generation applications supporting renewable energy integration. These turbines require more frequent maintenance intervals but offer advantages in rapid start-up capabilities and operational flexibility. Service demand grows at approximately 12% annually as operators prioritize grid stability and backup power capabilities.

Preventive maintenance services account for the largest service category by volume, encompassing routine inspections, component cleaning, minor repairs, and performance monitoring activities. Advanced monitoring technologies enable condition-based maintenance scheduling, optimizing service intervals and reducing unnecessary maintenance activities while ensuring reliable operation.

Major overhaul services represent the highest value category per transaction, involving comprehensive turbine refurbishment including hot gas path component replacement, rotor balancing, and control system upgrades. These services typically occur every 4-6 years for heavy-duty turbines and require extensive planning and specialized facilities.

Digital maintenance services emerge as a rapidly growing category incorporating remote monitoring, predictive analytics, and performance optimization consulting. Technology adoption reaches 41% of European facilities with continued expansion expected as operators recognize value in data-driven maintenance strategies.

Industry participants across the European gas turbine MRO ecosystem realize substantial benefits from market participation and strategic service investments. Power generation operators achieve improved turbine reliability, extended equipment lifespans, and optimized operational efficiency through comprehensive maintenance programs. These benefits translate to enhanced grid stability, reduced unplanned outages, and improved financial performance.

Service providers benefit from stable revenue streams, long-term customer relationships, and opportunities for technological innovation and market expansion. Comprehensive service agreements provide predictable cash flows while enabling investment in advanced capabilities and workforce development. The market offers opportunities for specialization in emerging areas such as digital maintenance and environmental compliance services.

Equipment manufacturers leverage MRO services to maintain customer relationships beyond initial equipment sales while generating recurring revenue streams. Aftermarket services typically provide higher profit margins than equipment sales and create competitive differentiation through technical expertise and parts availability.

End-users and utilities realize significant operational benefits including:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as the most significant trend reshaping the European gas turbine MRO landscape. Advanced analytics platforms enable predictive maintenance strategies that optimize service scheduling, reduce unplanned outages, and extend component lifespans. Approximately 47% of major European operators have implemented or are implementing digital monitoring solutions, with adoption rates accelerating across all market segments.

Service consolidation represents another major trend as operators seek comprehensive lifecycle management partnerships rather than transactional maintenance relationships. Long-term service agreements spanning 10-15 years provide operators with predictable maintenance costs while enabling service providers to invest in advanced capabilities and regional infrastructure.

Flexible operation optimization becomes increasingly important as gas turbines operate in variable load patterns supporting renewable energy integration. This operational shift requires specialized maintenance approaches addressing frequent start-stop cycles, rapid load changes, and extended low-load operation periods. Maintenance strategies evolve to accommodate these challenging operational patterns while maintaining reliability standards.

Environmental compliance focus intensifies as European emission regulations become more stringent. Specialized services addressing NOx reduction, carbon footprint optimization, and potential hydrogen fuel integration create new market segments and technical challenges for service providers.

Regional service localization trends emerge as operators prefer local service capabilities for rapid response and reduced logistics costs. This trend drives international service providers to establish regional facilities and partnerships while creating opportunities for local service specialists.

Recent industry developments demonstrate the dynamic nature of the European gas turbine MRO market with significant technological advancement and strategic initiatives shaping future market direction. Digital platform launches by major service providers enable remote monitoring and predictive maintenance capabilities, transforming traditional service delivery models.

Strategic partnerships between original equipment manufacturers and independent service providers create comprehensive service networks combining technical expertise with regional capabilities. These collaborations enable enhanced service coverage while optimizing resource utilization and technical specialization.

Advanced materials adoption accelerates as service providers integrate ceramic matrix composites, thermal barrier coatings, and other high-performance materials into maintenance programs. These materials enable extended maintenance intervals and improved turbine performance, creating value for operators and service providers.

Workforce development initiatives address skilled technician shortages through specialized training programs, apprenticeship opportunities, and technical certification processes. Industry associations collaborate with educational institutions to develop curricula addressing advanced turbine maintenance requirements.

Regulatory compliance services expand as European environmental regulations evolve. Service providers develop specialized capabilities addressing emission monitoring, performance optimization, and potential future requirements for hydrogen fuel integration and carbon capture compatibility.

According to MarkWide Research analysis, these developments indicate market maturation toward technology-enabled, comprehensive service models that deliver enhanced value for all market participants while addressing evolving operational and regulatory requirements.

Strategic recommendations for market participants emphasize the importance of digital transformation adoption and comprehensive service capability development. Service providers should prioritize investment in advanced monitoring technologies, predictive analytics platforms, and specialized workforce development to maintain competitive advantages in an evolving market landscape.

Market entry strategies for new participants should focus on specialized service niches or regional expertise development rather than attempting to compete directly with established comprehensive service providers. Partnership approaches with existing market participants can provide access to technical expertise and customer relationships while enabling gradual capability development.

Technology investment priorities should emphasize digital capabilities, advanced diagnostic tools, and specialized equipment supporting emerging service categories such as flexible operation optimization and environmental compliance. Research and development investments in advanced materials and maintenance techniques can create competitive differentiation and premium service positioning.

Geographic expansion strategies should prioritize Eastern European markets where gas turbine capacity continues growing while local service capabilities remain limited. Regional partnerships can provide market access and local expertise while minimizing investment requirements and regulatory complexities.

Customer relationship management should emphasize long-term partnership development through comprehensive service agreements that align service provider and operator interests. Performance-based contracting models create value alignment while enabling premium pricing for superior service delivery.

Future market prospects for the European gas turbine MRO sector remain positive despite energy transition challenges, with sustained growth expected through technological advancement and evolving operational requirements. Market projections indicate continued expansion at a compound annual growth rate of 5.8% through 2030, driven by aging turbine fleets, digital service adoption, and flexible operation requirements.

Technology evolution will fundamentally transform service delivery models as artificial intelligence, machine learning, and advanced sensors enable autonomous maintenance optimization and predictive intervention strategies. Digital service penetration is expected to reach 75% of European facilities by 2028, creating substantial opportunities for technology-enabled service providers.

Energy transition impacts will create both challenges and opportunities as gas turbines assume critical roles in grid stability and renewable energy integration support. Flexible operation capabilities become increasingly valuable, driving demand for specialized maintenance services addressing variable load patterns and rapid response requirements.

Regional market development will continue with Eastern European markets showing the strongest growth potential as gas turbine capacity expands and local service capabilities develop. Western European markets will emphasize service sophistication and technology integration while maintaining stable demand levels.

MWR projections suggest the market will evolve toward comprehensive lifecycle management models with service providers assuming greater responsibility for turbine performance and availability outcomes. This evolution will drive consolidation among service providers while creating opportunities for specialized technology and regional expertise development.

The Power Sector Europe Gas Turbine MRO Market represents a critical and evolving component of the continent’s energy infrastructure, demonstrating resilience and growth potential despite energy transition challenges. Market fundamentals remain strong with aging turbine fleets, technological advancement opportunities, and regulatory compliance requirements driving sustained demand for sophisticated maintenance services.

Digital transformation emerges as the defining trend reshaping service delivery models and creating new value propositions for market participants. The integration of advanced monitoring, predictive analytics, and autonomous maintenance optimization technologies will fundamentally change how turbine maintenance is planned, executed, and optimized throughout equipment lifecycles.

Competitive dynamics favor service providers that successfully combine technical expertise, digital capabilities, and comprehensive service offerings while maintaining regional presence and customer relationships. The market rewards innovation, specialization, and partnership approaches that deliver measurable value improvements for power generation operators.

Future success in the European gas turbine MRO market will depend on adaptability to changing energy market conditions, investment in advanced technologies, and development of specialized capabilities addressing emerging operational requirements. Market participants that embrace digital transformation, develop comprehensive service capabilities, and maintain focus on customer value creation will be best positioned for sustained growth and market leadership in this essential sector of European energy infrastructure.

What is Power Sector Europe Gas Turbine MRO?

Power Sector Europe Gas Turbine MRO refers to the maintenance, repair, and overhaul services specifically for gas turbines used in the power generation sector across Europe. This includes activities aimed at ensuring the efficiency and reliability of gas turbines in various applications such as electricity generation and industrial processes.

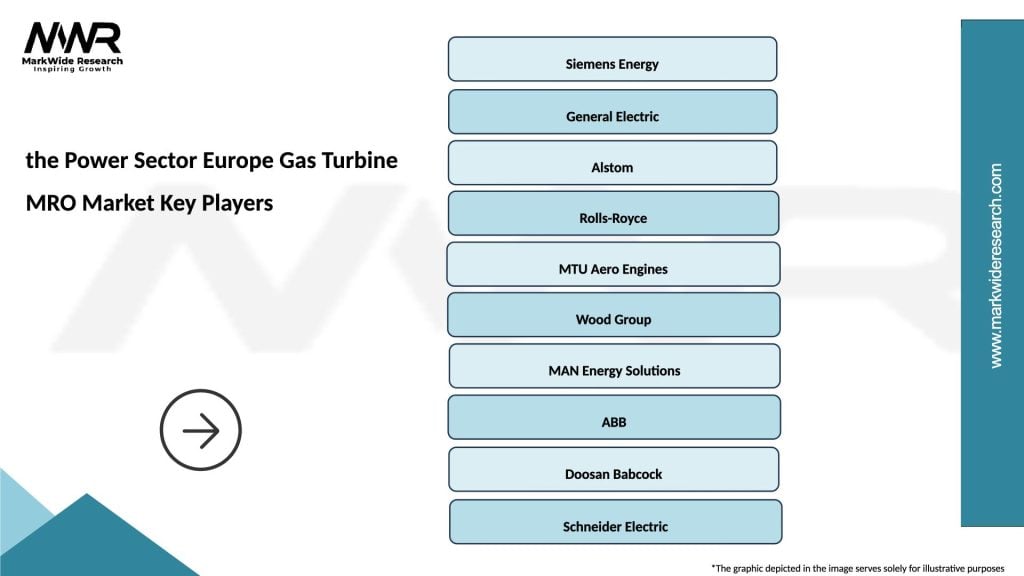

What are the key players in the Power Sector Europe Gas Turbine MRO Market?

Key players in the Power Sector Europe Gas Turbine MRO Market include Siemens Energy, General Electric, and Mitsubishi Power, among others. These companies provide a range of services from routine maintenance to major overhauls, ensuring optimal performance of gas turbines.

What are the growth factors driving the Power Sector Europe Gas Turbine MRO Market?

The growth of the Power Sector Europe Gas Turbine MRO Market is driven by increasing energy demand, the need for efficient power generation, and the aging infrastructure of existing gas turbines. Additionally, advancements in technology and a focus on reducing emissions are also contributing to market growth.

What challenges does the Power Sector Europe Gas Turbine MRO Market face?

The Power Sector Europe Gas Turbine MRO Market faces challenges such as high operational costs, the complexity of modern gas turbine systems, and regulatory compliance issues. These factors can hinder the efficiency and effectiveness of maintenance and repair operations.

What opportunities exist in the Power Sector Europe Gas Turbine MRO Market?

Opportunities in the Power Sector Europe Gas Turbine MRO Market include the integration of digital technologies for predictive maintenance and the growing trend towards renewable energy sources. Additionally, the expansion of gas turbine applications in various industries presents further growth potential.

What trends are shaping the Power Sector Europe Gas Turbine MRO Market?

Trends shaping the Power Sector Europe Gas Turbine MRO Market include the adoption of advanced analytics and IoT for monitoring turbine performance, as well as a shift towards more sustainable practices in maintenance operations. Furthermore, there is an increasing focus on enhancing the lifespan and efficiency of gas turbines.

the Power Sector Europe Gas Turbine MRO Market

| Segmentation Details | Description |

|---|---|

| Service Type | Maintenance, Repair, Overhaul, Inspection |

| End User | Utilities, Industrial, Power Generation, Renewable Energy |

| Technology | Combined Cycle, Open Cycle, Aeroderivative, Heavy Duty |

| Product Type | Gas Turbines, Components, Spare Parts, Accessories |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the the Power Sector Europe Gas Turbine MRO Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at