444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Philippines geothermal energy industry market stands as one of the most dynamic and rapidly evolving renewable energy sectors in Southeast Asia. Geothermal energy represents a cornerstone of the Philippines’ sustainable energy strategy, leveraging the country’s unique geological positioning along the Pacific Ring of Fire. The archipelago nation harnesses its abundant volcanic activity to generate clean, reliable electricity through sophisticated geothermal power plants and advanced extraction technologies.

Market dynamics indicate substantial growth potential driven by increasing government support for renewable energy initiatives and rising environmental consciousness among consumers and businesses. The Philippines currently maintains its position as the world’s second-largest geothermal energy producer, with geothermal capacity contributing approximately 12% of the country’s total electricity generation. This significant contribution underscores the strategic importance of geothermal resources in achieving energy security and reducing dependence on fossil fuel imports.

Industry stakeholders are witnessing unprecedented opportunities as technological advancements in drilling techniques, enhanced geothermal systems, and binary cycle power plants continue to expand the viable resource base. The market encompasses various segments including utility-scale power generation, distributed energy systems, and direct-use applications across industrial and residential sectors.

The Philippines geothermal energy industry market refers to the comprehensive ecosystem of companies, technologies, and infrastructure dedicated to harnessing the Earth’s internal heat for electricity generation and direct thermal applications within the Philippine archipelago. This market encompasses the entire value chain from geothermal exploration and resource assessment to power plant development, operation, and maintenance.

Geothermal energy systems in the Philippines utilize naturally occurring steam and hot water reservoirs beneath the Earth’s surface to drive turbines and generate electricity. The technology involves drilling production wells to access high-temperature geothermal fluids, which are then processed through power plants to produce clean, renewable electricity. Binary cycle systems and flash steam technologies represent the primary conversion methods employed across Philippine geothermal facilities.

Market participants include energy developers, equipment manufacturers, drilling contractors, engineering firms, and utility companies working collaboratively to expand geothermal capacity and improve operational efficiency. The industry also encompasses supporting services such as geological surveys, environmental consulting, and specialized maintenance operations.

Strategic positioning of the Philippines geothermal energy industry reflects the country’s commitment to achieving renewable energy targets while maintaining grid stability and affordability. The market demonstrates robust fundamentals supported by favorable government policies, abundant natural resources, and increasing private sector investment in clean energy infrastructure.

Key market drivers include the Renewable Energy Act of 2008, which provides comprehensive incentives for geothermal development, and the Department of Energy’s aggressive targets for renewable energy expansion. Feed-in tariff mechanisms and renewable energy certificates create attractive investment frameworks that encourage both domestic and international participation in geothermal projects.

Technological innovation continues to enhance the viability of geothermal resources previously considered uneconomical. Enhanced geothermal systems (EGS) and improved drilling techniques are expanding the geographical scope of viable geothermal development, particularly in regions with moderate-temperature resources. Digital transformation initiatives incorporating IoT sensors, predictive maintenance, and advanced monitoring systems are optimizing plant performance and reducing operational costs.

Market challenges include high upfront capital requirements, geological risks associated with exploration activities, and competition from other renewable energy sources such as solar and wind power. However, the baseload nature of geothermal energy provides distinct advantages in grid stability and reliability compared to intermittent renewable sources.

Fundamental market insights reveal the Philippines’ exceptional geothermal potential stems from its location along active tectonic plate boundaries, creating numerous high-temperature geothermal fields suitable for power generation. The following key insights shape market development:

Primary market drivers propelling the Philippines geothermal energy industry forward encompass regulatory support, environmental imperatives, and economic advantages that create compelling investment opportunities across the sector.

Government policy initiatives represent the most significant driver, with the Department of Energy implementing comprehensive frameworks to accelerate renewable energy deployment. The Renewable Energy Act provides attractive fiscal incentives including income tax holidays, duty-free importation of equipment, and accelerated depreciation allowances. Feed-in tariff programs guarantee long-term power purchase agreements that provide revenue certainty for geothermal developers.

Environmental regulations and climate change commitments drive increased adoption of clean energy technologies. The Philippines’ Nationally Determined Contribution under the Paris Agreement targets 75% reduction in greenhouse gas emissions by 2030, creating strong policy momentum for geothermal expansion. Carbon pricing mechanisms and environmental compliance requirements make geothermal energy increasingly cost-competitive compared to fossil fuel alternatives.

Economic factors including rising electricity demand, volatile fossil fuel prices, and the need for energy security create favorable conditions for geothermal investment. The technology’s baseload generation capability provides grid stability benefits that command premium pricing in electricity markets. Job creation potential in rural areas aligns with government development priorities and social impact objectives.

Technological advancements continue to reduce development costs and expand the viable resource base. Improved drilling techniques, enhanced reservoir management, and digital monitoring systems increase project success rates and operational efficiency. Modular plant designs enable phased development approaches that reduce financial risks and accelerate project timelines.

Market restraints present significant challenges that industry participants must navigate to achieve successful project development and sustainable growth within the Philippines geothermal energy sector.

High capital requirements represent the primary barrier to market entry, with geothermal projects requiring substantial upfront investments for exploration, drilling, and power plant construction. Exploration risks associated with geological uncertainty can result in dry wells and project failures, creating financial exposure that deters some investors. The lengthy development timelines, often spanning 5-7 years from exploration to commercial operation, require patient capital and sophisticated project financing structures.

Technical challenges include complex reservoir management requirements, corrosive geothermal fluids that accelerate equipment degradation, and the need for specialized expertise in drilling and plant operations. Resource depletion risks in mature geothermal fields require careful reservoir management and potential reinjection strategies to maintain sustainable production levels.

Regulatory complexities involving multiple government agencies, environmental impact assessments, and community consultation processes can create project delays and increase development costs. Land acquisition challenges in densely populated areas or regions with complex ownership structures may impede project development timelines.

Competition from alternative energy sources including rapidly declining solar and wind costs creates pricing pressure on geothermal projects. Grid infrastructure limitations in remote areas where geothermal resources are located may require additional transmission investments that impact project economics.

Emerging opportunities within the Philippines geothermal energy industry present substantial potential for market expansion, technological innovation, and strategic partnerships that can drive sector growth and development.

Untapped resource development represents the most significant opportunity, with extensive geothermal potential remaining unexplored across the archipelago. Mindanao region offers particularly promising prospects with numerous identified geothermal prospects requiring systematic exploration and development. Enhanced geothermal systems technology enables development of resources in areas previously considered unviable, significantly expanding the addressable market.

Direct-use applications beyond electricity generation create new market segments including industrial process heating, agricultural drying, aquaculture, and district heating systems. Geothermal heat pumps for residential and commercial buildings represent an emerging market opportunity as energy efficiency awareness increases.

Export opportunities for Filipino geothermal expertise and technology are expanding as other countries in Southeast Asia and beyond seek to develop their own geothermal resources. Technical services including exploration, drilling, and plant operations provide revenue diversification opportunities for established industry players.

Hybrid renewable systems combining geothermal with solar, wind, or energy storage technologies can optimize resource utilization and improve project economics. Green hydrogen production using geothermal electricity represents a potential future market opportunity as hydrogen economies develop.

Carbon credit markets provide additional revenue streams for geothermal projects through verified emission reduction programs and international carbon trading mechanisms.

Market dynamics within the Philippines geothermal energy industry reflect complex interactions between technological innovation, regulatory frameworks, economic factors, and environmental considerations that shape sector evolution and competitive positioning.

Supply-demand dynamics indicate growing electricity demand driven by economic development and population growth, creating sustained market opportunities for geothermal capacity expansion. Grid modernization initiatives improve integration capabilities for renewable energy sources, enhancing the value proposition of geothermal power plants. The retirement of aging coal plants creates replacement demand that favors clean baseload technologies like geothermal energy.

Competitive dynamics involve established geothermal developers competing with new entrants and alternative renewable energy technologies. Consolidation trends among smaller developers create opportunities for larger players to acquire development portfolios and achieve economies of scale. Technology differentiation through advanced drilling techniques, plant efficiency improvements, and digital optimization creates competitive advantages.

Investment dynamics reflect increasing interest from international investors seeking exposure to Southeast Asian renewable energy markets. Development finance institutions and multilateral lenders provide concessional financing that improves project economics and reduces development risks. Green bond markets offer alternative financing mechanisms for geothermal projects meeting environmental criteria.

Regulatory dynamics continue evolving as government agencies refine policies to accelerate renewable energy deployment while maintaining grid reliability and affordability. Auction mechanisms for renewable energy capacity create competitive pricing environments that drive efficiency improvements across the industry.

Comprehensive research methodology employed in analyzing the Philippines geothermal energy industry market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with industry executives, government officials, technology providers, and financial institutions involved in geothermal development. Field visits to operational geothermal facilities provide firsthand insights into operational challenges, technological innovations, and performance metrics. Expert consultations with geological specialists, energy economists, and policy analysts contribute specialized knowledge and market perspectives.

Secondary research sources encompass government publications, industry reports, academic studies, and regulatory filings that provide quantitative data and market intelligence. Database analysis of project pipelines, capacity additions, and financial transactions creates comprehensive market tracking capabilities. Regulatory monitoring ensures current understanding of policy developments and their market implications.

Analytical frameworks include market sizing methodologies, competitive positioning analysis, technology assessment, and scenario modeling to evaluate different market development pathways. Statistical analysis of historical trends and performance metrics supports forecasting and trend identification. Cross-validation processes ensure data consistency and accuracy across multiple sources and analytical approaches.

Quality assurance measures include peer review processes, data triangulation, and sensitivity analysis to validate findings and conclusions. Continuous monitoring of market developments ensures research remains current and relevant to industry stakeholders.

Regional analysis of the Philippines geothermal energy industry reveals distinct geographical patterns of resource distribution, development activity, and market opportunities across the major island groups and administrative regions.

Luzon region dominates current geothermal capacity with approximately 60% of total installed capacity, primarily concentrated in the provinces of Batangas, Laguna, and Albay. The Makiling-Banahaw geothermal field represents one of the most productive areas, while the Tiwi geothermal complex demonstrates successful long-term reservoir management. Northern Luzon offers significant untapped potential with several identified prospects requiring systematic exploration and development.

Visayas region contributes approximately 25% of national geothermal capacity with major installations in Negros Island and Leyte. The Tongonan geothermal field in Leyte represents a flagship development showcasing advanced technology and environmental stewardship. Negros Island hosts multiple geothermal facilities that demonstrate successful community engagement and sustainable development practices.

Mindanao region presents the greatest growth potential with extensive unexplored geothermal resources and growing electricity demand. Current geothermal capacity represents less than 15% of the regional total, indicating substantial development opportunities. Mount Apo and surrounding volcanic areas offer promising prospects for future development, while improved grid infrastructure enhances project viability.

Regional development patterns reflect proximity to transmission infrastructure, geological favorability, and local government support for renewable energy projects. Island-specific considerations including grid isolation and diesel dependence create unique market dynamics that favor geothermal development in certain areas.

Competitive landscape analysis reveals a dynamic market structure characterized by established industry leaders, emerging developers, and international players seeking to capitalize on the Philippines’ geothermal potential.

Market positioning strategies vary among competitors, with some focusing on operational excellence and asset optimization while others emphasize aggressive expansion and new technology deployment. Strategic partnerships between local developers and international technology providers create competitive advantages through combined expertise and financial resources.

Competitive differentiation occurs through technological innovation, operational efficiency, environmental stewardship, and community engagement programs that enhance project acceptance and regulatory approval processes.

Market segmentation analysis provides detailed insights into the diverse components and applications within the Philippines geothermal energy industry, enabling targeted strategies and investment decisions across different market segments.

By Technology:

By Application:

By Capacity:

Category-wise insights reveal distinct market characteristics, growth drivers, and development patterns across different segments of the Philippines geothermal energy industry.

Utility-Scale Generation Category: This segment represents the largest market share and continues experiencing steady growth driven by grid expansion and baseload power demand. Large-scale projects benefit from economies of scale and established power purchase agreement frameworks. Technology preferences favor proven flash steam systems for high-temperature resources, while binary cycle adoption increases for moderate-temperature applications.

Direct-Use Applications Category: Industrial applications demonstrate strong growth potential as manufacturers seek cost-effective process heating solutions. Agricultural sector adoption increases as farmers recognize benefits for crop drying and greenhouse heating. Aquaculture applications show promise for maintaining optimal water temperatures in fish farming operations.

Enhanced Geothermal Systems Category: This emerging segment attracts significant research and development investment as technology advances enable development of previously unviable resources. Pilot projects demonstrate technical feasibility while commercial viability depends on continued cost reductions and performance improvements.

Geothermal Heat Pump Category: Residential adoption remains limited but shows growth potential as energy efficiency awareness increases and installation costs decline. Commercial applications in hotels, hospitals, and office buildings demonstrate attractive payback periods and operational benefits.

Industry participants and stakeholders realize substantial benefits from engagement in the Philippines geothermal energy market, creating value across multiple dimensions including financial returns, environmental impact, and social development.

For Energy Developers:

For Equipment Manufacturers:

For Local Communities:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the Philippines geothermal energy industry reflect technological evolution, changing regulatory landscapes, and shifting investor preferences toward sustainable energy solutions.

Digital Transformation: Smart monitoring systems incorporating IoT sensors, artificial intelligence, and predictive analytics optimize plant performance and reduce maintenance costs. Digital twin technology enables virtual modeling of geothermal reservoirs for improved resource management and production forecasting. Remote monitoring capabilities enhance operational efficiency and reduce the need for on-site personnel.

Enhanced Geothermal Systems (EGS): Advanced drilling techniques and reservoir stimulation technologies expand the geographical scope of viable geothermal development. Pilot projects demonstrate commercial potential for EGS technology in areas previously considered unsuitable for geothermal development. Research partnerships between industry and academic institutions accelerate technology development and deployment.

Hybrid Renewable Systems: Integration strategies combining geothermal with solar, wind, or energy storage optimize resource utilization and improve grid stability. Flexible operation modes enable geothermal plants to provide grid services beyond baseload generation. System optimization through advanced control systems maximizes overall renewable energy output.

Sustainable Development Focus: Environmental stewardship practices including zero liquid discharge and biodiversity conservation become standard industry practices. Community engagement programs emphasize local benefit sharing and stakeholder participation in project development. ESG compliance requirements drive improved environmental and social performance across the industry.

Recent industry developments demonstrate the dynamic nature of the Philippines geothermal energy market and highlight significant milestones in technology advancement, project development, and policy evolution.

Project Development Milestones: Major capacity additions across multiple regions expand national geothermal generation capability and demonstrate continued investor confidence in the sector. Successful exploration programs identify new geothermal resources and expand the pipeline of future development opportunities. Plant rehabilitation projects extend the operational life of existing facilities and improve generation efficiency.

Technology Innovations: Advanced drilling technologies reduce exploration costs and improve success rates for geothermal well development. Binary cycle implementations enable utilization of lower-temperature resources previously considered uneconomical. Modular plant designs accelerate construction timelines and reduce project development risks.

Policy Developments: Renewable energy auction mechanisms create competitive frameworks for capacity allocation and price discovery. Grid code modifications improve integration capabilities for renewable energy sources and enhance system reliability. Environmental regulations establish clear standards for geothermal development while protecting sensitive ecosystems.

Investment Activities: International partnerships bring advanced technology and financial resources to Philippine geothermal projects. Green financing initiatives provide access to concessional funding for sustainable energy developments. Strategic acquisitions consolidate market position and create operational synergies among industry participants.

Strategic recommendations from MarkWide Research analysis provide actionable insights for industry participants seeking to optimize their market positioning and capitalize on emerging opportunities within the Philippines geothermal energy sector.

For Energy Developers: Portfolio diversification across multiple regions and technology types reduces concentration risk and maximizes development opportunities. Strategic partnerships with international technology providers enhance technical capabilities and access to advanced equipment. Community engagement programs should be prioritized early in project development to ensure social license and regulatory approval. Digital transformation investments in monitoring and optimization systems provide competitive advantages through improved operational efficiency.

For Equipment Manufacturers: Local manufacturing capabilities development reduces costs and improves market competitiveness while supporting government localization objectives. Service-oriented business models focusing on long-term maintenance and optimization contracts create recurring revenue streams. Technology adaptation for Philippine geological conditions and operational requirements enhances product performance and customer satisfaction.

For Investors: Due diligence processes should emphasize geological risk assessment, regulatory compliance, and community acceptance factors. Portfolio approaches spreading investment across multiple projects and development stages optimize risk-return profiles. ESG compliance requirements increasingly influence investment decisions and should be integrated into project evaluation criteria.

For Policymakers: Regulatory streamlining initiatives can reduce development timelines and costs while maintaining environmental protection standards. Grid infrastructure investments in remote areas enhance project viability and accelerate renewable energy deployment. Research and development support for emerging technologies like EGS can expand the country’s geothermal resource base.

Future outlook for the Philippines geothermal energy industry indicates sustained growth potential driven by favorable market fundamentals, technological advancement, and supportive policy frameworks that position the sector for continued expansion and development.

Capacity expansion projections suggest significant growth opportunities as untapped geothermal resources undergo systematic exploration and development. MWR analysis indicates the potential for substantial capacity additions over the next decade, particularly in Mindanao and other underexplored regions. Technology improvements in drilling efficiency and plant performance continue reducing development costs and improving project economics.

Market evolution trends point toward increased integration with other renewable energy sources and grid modernization initiatives that enhance system flexibility and reliability. Direct-use applications are expected to experience accelerated growth as industrial and agricultural sectors recognize the economic benefits of geothermal heating systems. Export opportunities for Philippine geothermal expertise and technology are expanding as regional markets develop their own renewable energy programs.

Investment climate improvements through enhanced regulatory frameworks, international financing mechanisms, and risk mitigation instruments support continued capital deployment in geothermal projects. Green financing markets provide access to concessional funding that improves project economics and accelerates development timelines. Carbon pricing mechanisms create additional revenue streams that enhance the competitiveness of clean energy technologies.

Technology roadmap developments including enhanced geothermal systems, advanced materials, and digital optimization platforms promise to expand the viable resource base and improve operational performance across the industry. Research collaborations between industry, government, and academic institutions accelerate innovation and technology transfer.

The Philippines geothermal energy industry market represents a cornerstone of the country’s renewable energy strategy, leveraging abundant natural resources, established technical expertise, and supportive policy frameworks to drive sustainable energy development. Market fundamentals remain robust with significant untapped potential, growing electricity demand, and increasing recognition of geothermal energy’s unique advantages as a reliable, baseload renewable energy source.

Strategic positioning of the Philippines as a global leader in geothermal energy creates opportunities for technology export, knowledge transfer, and regional market expansion. Industry maturation through technological advancement, operational optimization, and enhanced environmental stewardship practices strengthens the sector’s competitive position and sustainability credentials.

Future prospects indicate continued growth driven by policy support, technological innovation, and increasing investor interest in clean energy infrastructure. The Philippines geothermal energy industry is well-positioned to play an increasingly important role in the country’s energy security, economic development, and climate change mitigation efforts while serving as a model for sustainable geothermal development in the broader Southeast Asian region.

What is Geothermal Energy?

Geothermal energy refers to the heat that comes from the sub-surface of the earth, which can be found in the form of steam or hot water. This renewable energy source is harnessed for various applications, including electricity generation and direct heating, making it a significant component of the energy landscape in the Philippines.

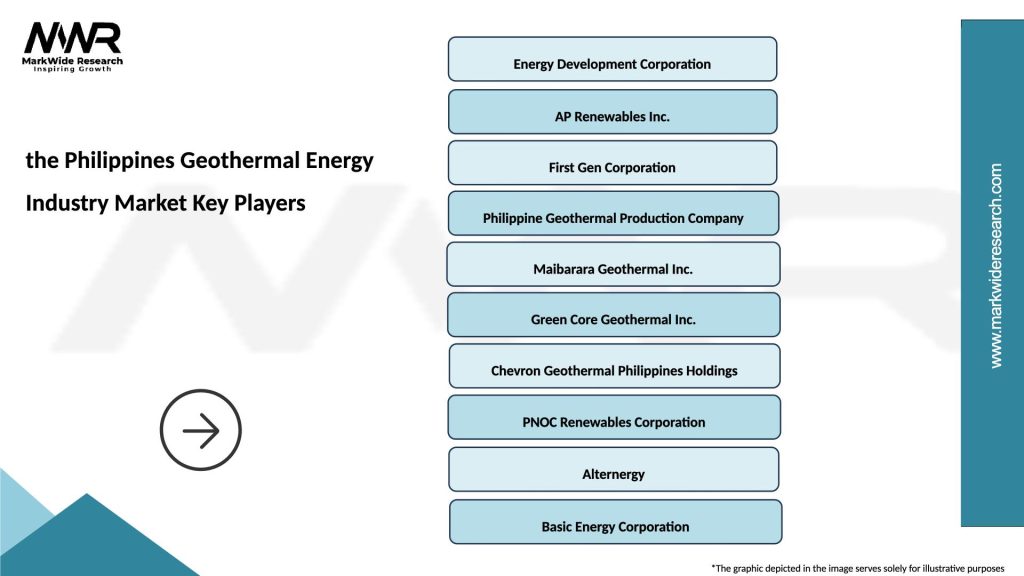

What are the key players in the Philippines Geothermal Energy Industry Market?

Key players in the Philippines Geothermal Energy Industry Market include Energy Development Corporation, Philippine Geothermal Production Company, and Chevron Geothermal, among others. These companies are involved in the exploration, development, and operation of geothermal power plants across the country.

What are the growth factors driving the Philippines Geothermal Energy Industry Market?

The growth of the Philippines Geothermal Energy Industry Market is driven by the increasing demand for renewable energy, government support for sustainable energy initiatives, and the country’s rich geothermal resources. Additionally, the need for energy security and reduced reliance on fossil fuels further propels market expansion.

What challenges does the Philippines Geothermal Energy Industry Market face?

The Philippines Geothermal Energy Industry Market faces challenges such as high initial capital costs, regulatory hurdles, and environmental concerns related to land use and water management. These factors can hinder the development and expansion of geothermal projects in the region.

What opportunities exist in the Philippines Geothermal Energy Industry Market?

Opportunities in the Philippines Geothermal Energy Industry Market include advancements in drilling technology, potential for enhanced geothermal systems, and increasing investments in renewable energy infrastructure. These factors can lead to new projects and increased capacity in the geothermal sector.

What trends are shaping the Philippines Geothermal Energy Industry Market?

Trends shaping the Philippines Geothermal Energy Industry Market include the integration of geothermal energy with other renewable sources, the adoption of innovative technologies for efficiency improvements, and a growing focus on sustainability and environmental impact assessments. These trends are crucial for the future development of the industry.

the Philippines Geothermal Energy Industry Market

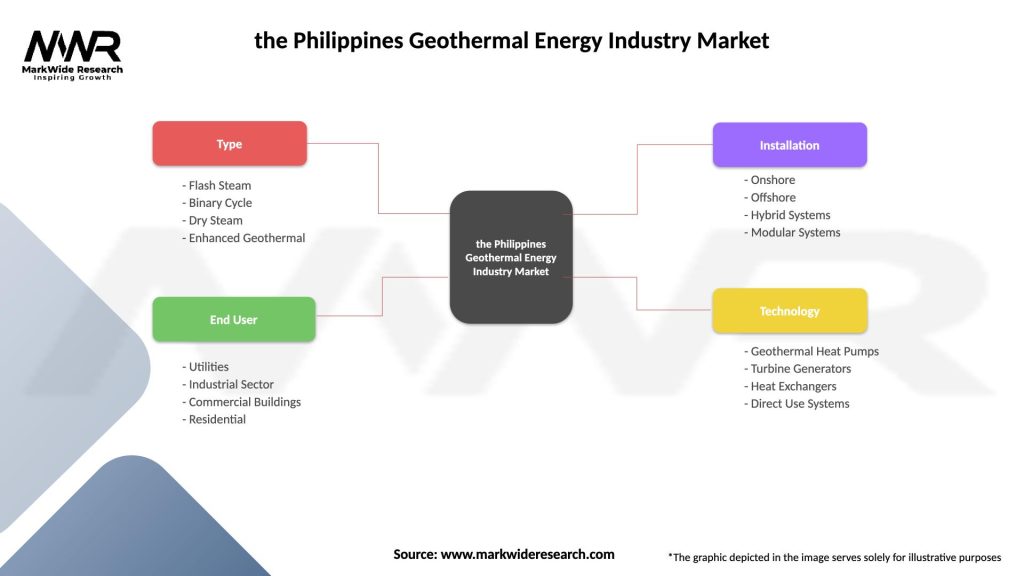

| Segmentation Details | Description |

|---|---|

| Type | Flash Steam, Binary Cycle, Dry Steam, Enhanced Geothermal |

| End User | Utilities, Industrial Sector, Commercial Buildings, Residential |

| Installation | Onshore, Offshore, Hybrid Systems, Modular Systems |

| Technology | Geothermal Heat Pumps, Turbine Generators, Heat Exchangers, Direct Use Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the the Philippines Geothermal Energy Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at