444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Netherlands hospitality industry market represents one of Europe’s most dynamic and resilient service sectors, encompassing hotels, restaurants, cafes, bars, and various accommodation services. The Dutch hospitality landscape has demonstrated remarkable adaptability and innovation, particularly following the challenges of recent years. With Amsterdam and other major cities serving as international tourism hubs, the market continues to evolve with changing consumer preferences and technological advancements.

Market dynamics indicate robust recovery patterns with the industry experiencing a 12.5% annual growth rate in accommodation bookings and a 15.8% increase in restaurant revenues compared to previous periods. The sector benefits from the Netherlands’ strategic location, excellent infrastructure, and strong international business presence. Digital transformation has become a cornerstone of industry development, with establishments increasingly adopting smart technologies and sustainable practices.

Regional distribution shows concentrated activity in major urban centers, with North Holland accounting for approximately 35% of total industry activity, followed by South Holland at 22%. The market demonstrates strong seasonal patterns while maintaining year-round stability through business tourism and international conferences.

The Netherlands hospitality industry market refers to the comprehensive ecosystem of businesses and services dedicated to providing accommodation, food, beverage, and entertainment services to both domestic and international visitors. This market encompasses traditional hotels, boutique accommodations, restaurants, cafes, bars, catering services, and emerging hospitality concepts that cater to evolving consumer demands.

Industry scope includes various segments from luxury five-star establishments to budget-friendly hostels, fine dining restaurants to casual eateries, and specialized services such as event management and corporate hospitality. The market operates within a framework of strict quality standards, sustainability requirements, and innovative service delivery models that reflect Dutch values of efficiency, sustainability, and customer satisfaction.

The Netherlands hospitality industry demonstrates exceptional resilience and growth potential, driven by strategic location advantages, strong tourism infrastructure, and innovative business models. The market has successfully navigated recent challenges while emerging stronger with enhanced digital capabilities and sustainability focus. Key performance indicators show consistent improvement across all major segments, with accommodation services leading recovery efforts.

Strategic positioning within European tourism networks provides significant competitive advantages, while domestic market strength ensures stability during international fluctuations. The industry benefits from government support initiatives, favorable business climate, and strong consumer confidence. Technology adoption rates exceed 78% among major operators, indicating successful digital transformation efforts.

Market consolidation trends show increasing collaboration between traditional hospitality providers and technology companies, creating innovative service delivery models. The sector’s commitment to sustainability has resulted in 65% of establishments implementing green practices, positioning the Netherlands as a leader in sustainable hospitality.

Market intelligence reveals several critical insights shaping the Netherlands hospitality landscape. The industry demonstrates remarkable adaptability with operators successfully implementing flexible business models and diversified revenue streams.

Primary growth drivers propelling the Netherlands hospitality industry include strong international tourism demand, robust business travel sector, and increasing domestic leisure spending. The country’s reputation for quality, safety, and innovation attracts diverse visitor segments seeking authentic experiences.

Infrastructure excellence provides fundamental support with world-class airports, efficient transportation networks, and comprehensive digital connectivity. Schiphol Airport serves as a major European hub, facilitating international visitor access while domestic infrastructure supports seamless travel experiences.

Government initiatives promoting tourism and hospitality development include favorable tax policies, investment incentives, and marketing support for international promotion. Sustainability mandates drive innovation while creating competitive advantages for early adopters of green technologies and practices.

Cultural factors contribute significantly with the Netherlands’ reputation for tolerance, innovation, and quality of life attracting both leisure and business visitors. The country’s multilingual population and international business culture facilitate smooth service delivery for diverse guest populations.

Operational challenges facing the Netherlands hospitality industry include labor shortages, particularly in skilled positions, and increasing operational costs related to energy, real estate, and regulatory compliance. Staffing difficulties affect service quality and expansion capabilities across multiple segments.

Regulatory complexity presents ongoing challenges with evolving health and safety requirements, environmental regulations, and taxation policies. Compliance costs impact profitability while requiring continuous adaptation of operational procedures and staff training programs.

Market saturation in prime locations limits expansion opportunities while intensifying competition for premium sites. High real estate costs in major cities create barriers to entry for new operators and pressure existing businesses to optimize space utilization.

Economic sensitivity affects demand patterns with international economic conditions influencing business travel and leisure spending. Currency fluctuations and geopolitical factors create uncertainty in international visitor segments, requiring flexible pricing and marketing strategies.

Emerging opportunities within the Netherlands hospitality market include sustainable tourism development, technology-enhanced service delivery, and specialized niche markets. Green hospitality initiatives present significant growth potential as environmental consciousness drives consumer preferences and regulatory requirements.

Digital innovation creates opportunities for enhanced guest experiences through artificial intelligence, Internet of Things applications, and personalized service delivery. Smart building technologies offer operational efficiency improvements while reducing environmental impact and operating costs.

Market expansion opportunities exist in underserved regions and emerging segments such as wellness tourism, culinary experiences, and cultural immersion programs. Rural hospitality development can diversify offerings while supporting regional economic development initiatives.

Partnership opportunities with technology companies, local suppliers, and international hospitality brands enable access to new markets, enhanced capabilities, and shared resources. Collaborative approaches can accelerate innovation while reducing individual investment requirements.

Market dynamics in the Netherlands hospitality industry reflect complex interactions between supply and demand factors, regulatory influences, and technological developments. The sector demonstrates cyclical patterns influenced by seasonal tourism, business cycles, and external economic conditions.

Competitive dynamics show increasing differentiation strategies with operators focusing on unique value propositions, specialized services, and enhanced customer experiences. Brand loyalty programs and personalized services become critical differentiators in saturated market segments.

Supply chain optimization drives operational efficiency with local sourcing initiatives supporting sustainability goals while reducing costs. Revenue management sophistication increases with dynamic pricing models and advanced analytics improving profitability across market segments.

Consumer behavior evolution influences service delivery models with increasing demand for authentic experiences, sustainable practices, and technology-enabled convenience. Social media influence and online reviews significantly impact reputation management and marketing strategies.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes industry surveys, stakeholder interviews, and direct observation of market conditions across various segments and geographic regions.

Secondary research incorporates government statistics, industry reports, trade association data, and academic studies to provide comprehensive market context. MarkWide Research utilizes advanced analytical frameworks to synthesize diverse data sources and identify meaningful trends and patterns.

Quantitative analysis includes statistical modeling, trend analysis, and comparative studies across different market segments and time periods. Qualitative research methods capture nuanced insights regarding consumer preferences, operational challenges, and strategic opportunities.

Data validation processes ensure accuracy through cross-referencing multiple sources, expert review, and continuous monitoring of market developments. Regular updates incorporate emerging trends and changing market conditions to maintain research relevance and reliability.

Regional distribution across the Netherlands reveals distinct market characteristics and opportunities. North Holland, including Amsterdam, dominates with approximately 35% market share, driven by international tourism, business travel, and cultural attractions. The region benefits from Schiphol Airport proximity and extensive transportation infrastructure.

South Holland represents 22% of market activity with The Hague and Rotterdam serving as major business and cultural centers. Government presence and port activities drive consistent business travel demand while cultural attractions support leisure tourism.

Regional diversification shows growing opportunities in secondary cities and rural areas. Utrecht and Eindhoven demonstrate strong growth potential with technology sector development and improved accessibility. Coastal regions benefit from domestic tourism and seasonal visitor patterns.

Market penetration varies significantly by region with urban areas showing higher service density and competition levels. Rural regions offer expansion opportunities with lower competition but require different service models and marketing approaches to achieve profitability.

Competitive structure in the Netherlands hospitality industry includes international hotel chains, domestic operators, independent establishments, and emerging technology-enabled service providers. Market leadership positions vary by segment with different competitive dynamics in accommodation versus food service sectors.

Competitive strategies focus on differentiation through service quality, sustainability initiatives, and technology integration. Brand positioning emphasizes authentic Dutch hospitality while meeting international service standards and expectations.

Market consolidation trends show increasing cooperation between operators and strategic partnerships with technology providers. Independent operators leverage unique positioning and local knowledge to compete effectively against larger chains.

Market segmentation reveals diverse categories serving different customer needs and preferences. By Service Type, the market divides into accommodation services, food and beverage operations, and specialized hospitality services.

By Customer Segment:

By Price Segment:

Accommodation sector demonstrates strong performance with boutique hotels and design-focused properties showing particular growth. Urban locations benefit from consistent business travel demand while coastal and rural properties capitalize on leisure tourism patterns.

Food service category shows innovation in casual dining, specialty cuisines, and sustainable dining concepts. Local cuisine integration with international flavors creates unique positioning opportunities while supporting local supplier networks.

Event and conference services represent high-value segments with significant growth potential. Corporate hospitality services benefit from the Netherlands’ position as a European business hub and international conference destination.

Specialized services including wellness, culinary tourism, and cultural experiences show emerging growth opportunities. These segments command premium pricing while supporting broader tourism development objectives.

Industry participants benefit from the Netherlands’ stable economic environment, strong rule of law, and supportive business climate. Regulatory transparency and consistent policy implementation provide predictable operating conditions for long-term planning and investment.

Stakeholder advantages include access to skilled workforce, advanced infrastructure, and sophisticated consumer markets. Government support through tourism promotion, infrastructure investment, and favorable business policies enhances industry competitiveness.

Operational benefits encompass efficient supply chains, reliable utilities, and comprehensive transportation networks. Technology infrastructure supports advanced service delivery models and operational efficiency improvements.

Market access advantages include proximity to major European markets, excellent connectivity, and established international business relationships. The Netherlands serves as an ideal base for European operations and market expansion strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration represents the most significant trend shaping the Netherlands hospitality industry. Green building standards, renewable energy adoption, and waste reduction programs become standard operating procedures rather than optional initiatives.

Technology convergence drives operational efficiency and enhanced guest experiences. Artificial intelligence applications in customer service, predictive maintenance, and revenue optimization create competitive advantages while reducing operational costs.

Experience personalization becomes increasingly sophisticated with data analytics enabling customized service delivery. Guest preference tracking and predictive modeling support proactive service adjustments and targeted marketing efforts.

Local integration trends emphasize authentic cultural experiences and community connection. Partnerships with local artisans, suppliers, and cultural institutions create unique value propositions while supporting regional economic development.

Recent developments in the Netherlands hospitality industry include significant investments in sustainable infrastructure, technology upgrades, and workforce development programs. Major hotel groups announce expansion plans focused on sustainable properties and innovative service concepts.

Government initiatives support industry recovery and growth through tourism promotion campaigns, infrastructure investments, and regulatory streamlining. Digital transformation accelerates with public-private partnerships supporting technology adoption and innovation.

Industry consolidation continues with strategic mergers and acquisitions creating larger, more efficient operators. Technology partnerships between traditional hospitality companies and tech firms drive innovation in service delivery and operational efficiency.

Sustainability certifications become increasingly important with major operators achieving international environmental standards. Circular economy principles influence procurement, waste management, and resource utilization strategies across the industry.

Strategic recommendations for Netherlands hospitality industry participants emphasize sustainability leadership, technology integration, and market differentiation. MWR analysis suggests focusing on unique value propositions that leverage Dutch cultural strengths and innovation capabilities.

Investment priorities should include staff training and development, technology infrastructure, and sustainable operations. Long-term success requires balancing operational efficiency with exceptional guest experiences and environmental responsibility.

Market positioning strategies should emphasize authentic Dutch hospitality while meeting international service standards. Brand development opportunities exist in sustainable luxury, cultural immersion, and technology-enhanced convenience segments.

Partnership strategies can accelerate growth while sharing risks and resources. Collaboration opportunities include technology providers, local suppliers, cultural institutions, and international hospitality networks.

Future prospects for the Netherlands hospitality industry appear highly positive with projected growth rates of 8.5% annually over the next five years. Market expansion will be driven by sustainable tourism development, technology adoption, and innovative service concepts.

Long-term trends indicate continued emphasis on sustainability, personalization, and authentic experiences. MarkWide Research projects that establishments implementing comprehensive sustainability programs will achieve 25% higher profitability compared to traditional operators.

Technology integration will accelerate with artificial intelligence, Internet of Things, and blockchain applications becoming standard industry tools. Smart hospitality concepts will drive operational efficiency while enhancing guest satisfaction and environmental performance.

Market evolution will favor operators who successfully balance international standards with authentic local experiences. The industry’s future success depends on continued innovation, sustainability leadership, and exceptional service delivery that reflects Dutch values and hospitality traditions.

The Netherlands hospitality industry market demonstrates exceptional resilience, innovation, and growth potential within the European hospitality landscape. The sector’s successful integration of sustainability practices, technology adoption, and authentic cultural experiences positions it as a leader in hospitality industry evolution.

Strategic advantages including prime location, excellent infrastructure, skilled workforce, and supportive business environment create sustainable competitive benefits. The industry’s commitment to environmental responsibility and social impact aligns with evolving consumer expectations and regulatory requirements.

Future success will depend on continued innovation, strategic partnerships, and maintaining the delicate balance between international standards and authentic Dutch hospitality culture. The market’s trajectory indicates sustained growth opportunities for operators who embrace change while preserving the unique characteristics that define Netherlands hospitality excellence.

What is the Netherlands Hospitality Industry?

The Netherlands Hospitality Industry encompasses a range of services including accommodation, food and beverage, and entertainment. It plays a crucial role in the country’s economy by attracting tourists and providing jobs.

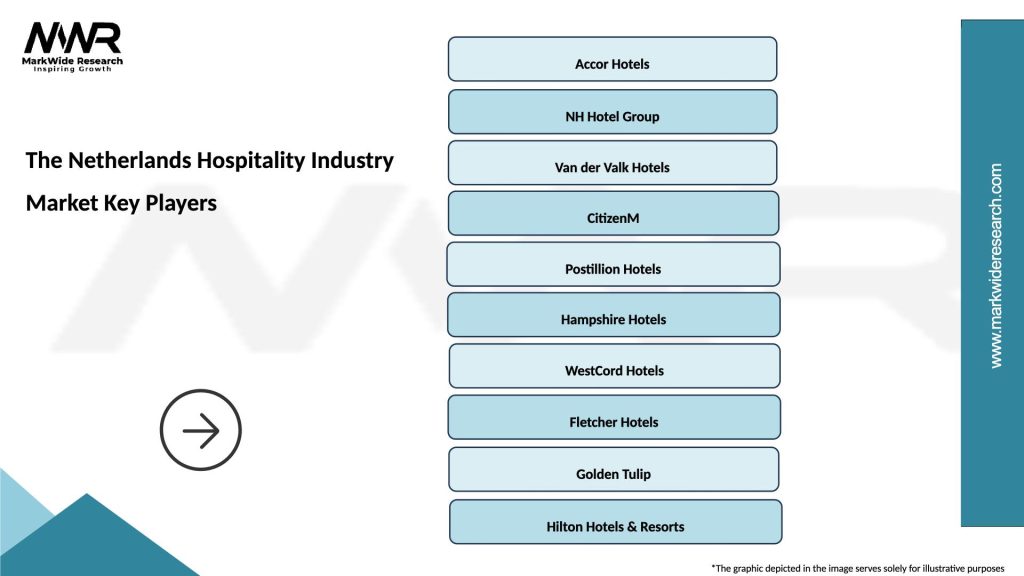

What are the key players in The Netherlands Hospitality Industry Market?

Key players in The Netherlands Hospitality Industry Market include Accor Hotels, Hilton Worldwide, and NH Hotel Group, among others. These companies operate various hotel brands and restaurants, contributing significantly to the sector’s growth.

What are the growth factors driving The Netherlands Hospitality Industry Market?

The growth of The Netherlands Hospitality Industry Market is driven by increasing tourism, a rise in business travel, and the expansion of online booking platforms. Additionally, cultural events and festivals attract more visitors, boosting demand for hospitality services.

What challenges does The Netherlands Hospitality Industry Market face?

The Netherlands Hospitality Industry Market faces challenges such as labor shortages, rising operational costs, and competition from alternative accommodation options like Airbnb. These factors can impact service quality and profitability.

What opportunities exist in The Netherlands Hospitality Industry Market?

Opportunities in The Netherlands Hospitality Industry Market include the growth of eco-friendly accommodations, the rise of experiential travel, and the increasing demand for personalized services. These trends can lead to innovative offerings and enhanced customer experiences.

What trends are shaping The Netherlands Hospitality Industry Market?

Trends shaping The Netherlands Hospitality Industry Market include the integration of technology in guest services, a focus on sustainability, and the rise of health and wellness tourism. These trends are influencing how businesses operate and cater to evolving consumer preferences.

The Netherlands Hospitality Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Hotels, Restaurants, Cafés, Bars |

| Customer Type | Business Travelers, Tourists, Locals, Event Attendees |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

| Distribution Channel | Online Travel Agencies, Direct Booking, Travel Agents, Corporate Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the The Netherlands Hospitality Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at