444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Middle East and Africa data center water consumption market represents a critical intersection of technological advancement and environmental sustainability in one of the world’s most water-scarce regions. As digital transformation accelerates across MEA countries, the demand for data center infrastructure has surged dramatically, creating unprecedented challenges for water resource management. Data centers in this region consume substantial amounts of water for cooling systems, with consumption rates varying significantly based on climate conditions, cooling technologies, and operational efficiency measures.

Regional dynamics indicate that water consumption in MEA data centers has increased by approximately 23% annually over the past three years, driven by expanding cloud services, digital banking initiatives, and smart city developments. The market encompasses various cooling methodologies, from traditional water-intensive systems to innovative air-cooling and liquid immersion technologies designed to minimize water usage while maintaining optimal operational temperatures.

Climate considerations play a pivotal role in shaping water consumption patterns, with Gulf Cooperation Council countries experiencing higher cooling demands due to extreme temperatures, while North African regions face different challenges related to water availability and infrastructure limitations. The market’s evolution reflects growing awareness of environmental impact and the need for sustainable data center operations in water-stressed environments.

The Middle East and Africa data center water consumption market refers to the comprehensive ecosystem of water usage, management, and optimization strategies employed by data center facilities across the MEA region for cooling, humidification, and operational purposes. This market encompasses the technologies, services, and solutions designed to monitor, reduce, and efficiently manage water consumption while maintaining critical infrastructure performance standards.

Water consumption in data centers primarily occurs through cooling systems, including chilled water plants, cooling towers, evaporative cooling systems, and direct expansion units. The market includes both direct water usage for cooling processes and indirect consumption through utility-scale cooling infrastructure. Measurement parameters typically focus on Water Usage Effectiveness (WUE) ratios, which quantify the relationship between total facility water consumption and IT equipment energy consumption.

Scope definition extends beyond mere consumption tracking to encompass water recycling systems, alternative cooling technologies, smart monitoring solutions, and regulatory compliance frameworks. The market addresses the unique challenges of operating energy-intensive digital infrastructure in regions where water scarcity and extreme temperatures create complex operational requirements.

Market transformation in the Middle East and Africa data center water consumption sector reflects the region’s rapid digitalization amid growing environmental consciousness. The market has experienced significant evolution as operators seek to balance operational efficiency with sustainable water management practices. Technology adoption patterns show increasing preference for water-efficient cooling solutions, with approximately 34% of new installations incorporating advanced air-cooling or hybrid systems.

Regional variations demonstrate distinct consumption patterns, with UAE and Saudi Arabia leading in innovative cooling technology deployment, while South African facilities focus on water recycling and conservation measures. The market’s growth trajectory aligns with expanding hyperscale data center deployments and increasing regulatory pressure for environmental compliance.

Key developments include the emergence of liquid cooling solutions, implementation of AI-driven water management systems, and growing adoption of renewable water sources. Industry stakeholders are increasingly prioritizing Water Usage Effectiveness metrics, with leading facilities achieving WUE ratios below 1.2 liters per kWh. The market’s future direction emphasizes circular water economy principles and integration with broader sustainability initiatives across the MEA region.

Operational efficiency has become the primary driver of water consumption optimization, with data center operators implementing comprehensive monitoring systems to track usage patterns and identify reduction opportunities. The market demonstrates clear segmentation based on facility size, cooling technology, and geographic location, each presenting unique water management challenges and solutions.

Digital transformation initiatives across MEA countries serve as the primary catalyst for data center expansion, consequently driving water consumption considerations. Government digitalization programs, smart city projects, and increasing cloud adoption create sustained demand for data center infrastructure, necessitating comprehensive water management strategies. Economic diversification efforts in oil-dependent economies further accelerate technology sector growth and associated infrastructure requirements.

Climate challenges unique to the MEA region intensify the focus on water consumption optimization. Extreme temperatures in Gulf states require substantial cooling capacity, while water scarcity concerns across North Africa and parts of the Middle East mandate efficient usage practices. Environmental regulations increasingly require data center operators to demonstrate sustainable water management, driving investment in monitoring and optimization technologies.

Cost optimization pressures motivate operators to minimize water-related operational expenses, particularly in regions where water costs are rising due to scarcity. The growing emphasis on corporate sustainability commitments from multinational technology companies operating in the region creates additional momentum for water-efficient data center designs and operations.

Water scarcity represents the most significant constraint affecting data center water consumption strategies across the MEA region. Limited freshwater resources in many areas restrict expansion possibilities and increase operational costs, forcing operators to explore alternative cooling methods or water sources. Infrastructure limitations in certain regions create challenges for implementing advanced water management systems or accessing reliable water supplies.

High implementation costs associated with water-efficient cooling technologies can deter adoption, particularly for smaller data center operators with limited capital resources. The complexity of retrofitting existing facilities with advanced water management systems presents both technical and financial challenges. Regulatory uncertainty in some MEA countries creates hesitation around long-term water management investments.

Technical expertise shortages in specialized water management technologies limit the pace of advanced system deployment. The lack of standardized water consumption measurement and reporting frameworks across different countries complicates benchmarking and optimization efforts. Cultural and operational resistance to changing established cooling practices can slow the adoption of innovative water-efficient technologies.

Innovation potential in water-efficient cooling technologies presents substantial opportunities for market expansion and differentiation. The development of region-specific solutions that address unique climate and resource challenges can create competitive advantages for technology providers. Government incentives for sustainable infrastructure development offer financial support for water optimization initiatives.

Circular economy principles enable the development of water recycling and reuse systems that can significantly reduce consumption while creating new revenue streams. The integration of renewable energy sources with water management systems opens possibilities for comprehensive sustainability solutions. Cross-industry collaboration opportunities exist for sharing water resources and treatment facilities among multiple data centers or with other industrial users.

Technology convergence between IoT, AI, and water management systems creates opportunities for predictive optimization and automated efficiency improvements. The growing focus on edge computing deployments across the region necessitates distributed water management solutions, creating new market segments. International partnerships can facilitate knowledge transfer and technology adaptation from water-efficient data center operations in other regions.

Supply and demand dynamics in the MEA data center water consumption market reflect the tension between growing digital infrastructure needs and limited water resources. Demand continues to increase with data center expansion, while supply constraints drive innovation in efficiency and alternative sources. Competitive pressures among data center operators increasingly focus on sustainability metrics, including water usage effectiveness.

Technology evolution rapidly transforms market dynamics, with new cooling solutions and water management systems continuously entering the market. The pace of innovation accelerates as operators seek competitive advantages through operational efficiency and environmental compliance. Regulatory changes create shifting dynamics as governments implement new water usage restrictions or sustainability requirements.

Economic factors including water pricing, energy costs, and capital availability significantly influence market dynamics and technology adoption decisions. The interplay between local climate conditions and global technology standards creates unique regional market characteristics that require customized approaches to water consumption management.

Comprehensive analysis of the Middle East and Africa data center water consumption market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes extensive interviews with data center operators, technology providers, and regulatory officials across key MEA markets. Secondary research encompasses analysis of industry reports, government publications, and academic studies related to data center operations and water management.

Data collection methods incorporate facility audits, consumption monitoring data analysis, and technology assessment surveys. Quantitative analysis focuses on water usage effectiveness metrics, consumption trends, and efficiency improvements across different facility types and cooling technologies. Qualitative research explores operational challenges, regulatory impacts, and future planning considerations through stakeholder interviews.

Market validation processes include cross-referencing multiple data sources, expert panel reviews, and regional market specialist consultations. The methodology ensures representation across different country markets, facility sizes, and operational models within the MEA region. MarkWide Research analytical frameworks provide standardized approaches for comparing regional variations and identifying market trends.

Gulf Cooperation Council countries dominate the MEA data center water consumption market, with UAE and Saudi Arabia leading in both facility deployment and water management innovation. These markets demonstrate higher per-facility water consumption due to extreme climate conditions but also show the most advanced adoption of efficiency technologies. Qatar and Kuwait focus on integrated cooling solutions that minimize water usage while maintaining performance standards.

North African markets including Egypt, Morocco, and Tunisia present different consumption patterns influenced by Mediterranean climate conditions and varying water availability. These regions show approximately 28% lower water consumption per MW compared to Gulf states but face infrastructure challenges that limit optimization opportunities. South Africa represents the largest sub-Saharan market with established data center operations and growing focus on water conservation.

Emerging markets across East Africa, including Kenya and Nigeria, demonstrate rapid growth in data center development with increasing attention to sustainable water management from the outset. These markets benefit from learning from established regions while implementing more efficient technologies from initial deployment. Regional cooperation initiatives facilitate knowledge sharing and best practice adoption across different MEA markets.

Market leadership in the MEA data center water consumption sector encompasses both international technology providers and regional specialists offering customized solutions for local conditions. The competitive environment emphasizes innovation in cooling efficiency, water recycling capabilities, and integrated management systems.

Technology-based segmentation divides the market according to cooling methodologies and water management approaches. Traditional air-cooled systems represent the largest segment but show declining growth as operators shift toward more efficient alternatives. Liquid cooling solutions demonstrate the fastest growth rates, particularly in high-density computing environments.

By Cooling Technology:

By Facility Type:

Hyperscale operations demonstrate the most sophisticated water management practices, with leading facilities achieving WUE ratios below 1.1 liters per kWh through advanced monitoring and optimization systems. These facilities typically invest in comprehensive water recycling infrastructure and alternative cooling technologies to minimize environmental impact while maintaining operational excellence.

Colocation providers focus on tenant-specific water allocation and monitoring capabilities, enabling precise consumption tracking and billing. These facilities often implement modular cooling solutions that can adapt to varying tenant requirements while maintaining overall efficiency. Service differentiation increasingly includes water usage reporting and optimization consulting services.

Enterprise facilities prioritize cost optimization and regulatory compliance, often implementing phased upgrades to improve water efficiency without disrupting operations. These organizations typically focus on retrofit solutions and operational improvements rather than complete system replacements. Edge computing deployments emphasize minimal water requirements through air-cooling and passive thermal management approaches.

Operational cost reduction represents the primary benefit for data center operators implementing water consumption optimization strategies. Facilities achieving high water efficiency typically realize 15-25% reduction in cooling-related expenses while improving overall operational reliability. Environmental compliance benefits include meeting regulatory requirements and supporting corporate sustainability commitments.

Technology providers benefit from growing demand for innovative cooling solutions and water management systems specifically designed for MEA conditions. The market offers opportunities for product differentiation through climate-adapted designs and integrated monitoring capabilities. Service providers can develop specialized expertise in water optimization consulting and system maintenance.

Government stakeholders benefit from reduced pressure on water resources and improved environmental outcomes from critical digital infrastructure. The development of water-efficient data centers supports economic diversification goals while maintaining environmental sustainability. End users benefit from more reliable and sustainable digital services supported by optimized infrastructure operations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Liquid cooling adoption accelerates across the MEA region as operators seek maximum efficiency in high-density computing environments. This trend particularly impacts cryptocurrency mining operations and AI computing facilities where traditional cooling methods prove inadequate. Immersion cooling systems show growing adoption rates of approximately 18% annually in specialized applications.

AI-driven optimization transforms water management through predictive analytics and automated system adjustments. Machine learning algorithms analyze consumption patterns, weather data, and operational parameters to optimize cooling efficiency in real-time. Smart monitoring systems enable proactive maintenance and efficiency improvements that reduce water waste.

Circular water economy principles gain traction as facilities implement comprehensive recycling and reuse systems. Integration with municipal water treatment facilities and industrial water sharing arrangements create new operational models. Renewable water sources including treated wastewater and desalinated water become increasingly viable options for data center operations.

Technology partnerships between international cooling system providers and regional water management specialists create customized solutions for MEA market conditions. These collaborations focus on developing climate-adapted technologies that maximize efficiency while minimizing water consumption. Research initiatives supported by government funding explore innovative cooling methods specifically designed for arid climates.

Regulatory frameworks evolve to include specific water usage efficiency requirements for data center operations. Several MEA countries implement mandatory WUE reporting and establish efficiency benchmarks for new facilities. Industry standards development includes region-specific guidelines for water management best practices and measurement methodologies.

Infrastructure investments in water recycling facilities and alternative cooling systems demonstrate growing commitment to sustainable operations. Major data center operators announce substantial investments in water optimization technologies and circular economy initiatives. MarkWide Research analysis indicates that infrastructure modernization projects show average efficiency improvements of 35-40% compared to legacy systems.

Strategic planning should prioritize water efficiency considerations from the initial facility design phase rather than implementing optimization as an afterthought. Data center operators should conduct comprehensive water availability assessments and develop contingency plans for resource constraints. Technology selection should emphasize solutions specifically adapted for regional climate conditions and resource availability.

Investment priorities should focus on scalable water management systems that can adapt to changing operational requirements and regulatory environments. Organizations should consider phased implementation approaches that allow for gradual efficiency improvements without disrupting operations. Partnership strategies with local water management specialists can provide valuable expertise and regulatory navigation support.

Performance monitoring systems should incorporate comprehensive water usage tracking and benchmarking capabilities to identify optimization opportunities. Regular efficiency audits and system optimization reviews can maintain peak performance and identify emerging issues. Stakeholder engagement should include transparent reporting of water consumption metrics and sustainability initiatives to support corporate responsibility objectives.

Market evolution toward increasingly water-efficient data center operations appears inevitable as resource constraints intensify and regulatory requirements expand. The next five years will likely see widespread adoption of liquid cooling technologies and AI-driven optimization systems across the MEA region. Innovation acceleration in cooling technology development specifically for arid climates will create new efficiency benchmarks.

Regulatory landscape development will likely include mandatory water efficiency standards and comprehensive reporting requirements for data center operations. Government incentives for sustainable infrastructure development may accelerate the adoption of advanced water management technologies. Regional cooperation initiatives could facilitate resource sharing and best practice adoption across MEA markets.

Technology convergence between renewable energy systems, water management, and cooling technologies will create integrated sustainability solutions. The market expects to see continued growth in efficiency improvements with leading facilities potentially achieving WUE ratios below 1.0 through advanced optimization. MWR projections indicate that water consumption per unit of computing capacity could decrease by 40-50% over the next decade through technology advancement and operational optimization.

The Middle East and Africa data center water consumption market stands at a critical juncture where technological innovation meets environmental necessity. The region’s unique combination of rapid digital transformation and water scarcity challenges creates both significant obstacles and unprecedented opportunities for sustainable infrastructure development. Market dynamics increasingly favor solutions that balance operational efficiency with environmental responsibility.

Future success in this market will depend on continued innovation in cooling technologies, comprehensive water management strategies, and collaborative approaches to resource optimization. The growing emphasis on sustainability metrics and regulatory compliance will drive further investment in efficient systems and monitoring capabilities. Stakeholder alignment around water conservation goals creates a foundation for sustained market growth and technological advancement.

Strategic positioning for market participants requires deep understanding of regional variations, regulatory requirements, and emerging technology trends. The market’s evolution toward circular economy principles and integrated sustainability solutions presents opportunities for differentiation and competitive advantage. As the MEA region continues its digital transformation journey, water-efficient data center operations will become increasingly critical for supporting sustainable economic development and technological progress.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and IT equipment.

What are the key players in The Middle East And Africa Study Of Data Center Water Consumption Market?

Key players in The Middle East And Africa Study Of Data Center Water Consumption Market include companies like Equinix, Digital Realty, and NTT Communications, which are known for their significant investments in data center infrastructure and sustainability practices, among others.

What are the growth factors driving The Middle East And Africa Study Of Data Center Water Consumption Market?

The growth of The Middle East And Africa Study Of Data Center Water Consumption Market is driven by the increasing demand for cloud services, the expansion of digital infrastructure, and the need for efficient cooling solutions in data centers to manage rising temperatures.

What challenges does The Middle East And Africa Study Of Data Center Water Consumption Market face?

Challenges in The Middle East And Africa Study Of Data Center Water Consumption Market include water scarcity in certain regions, regulatory pressures regarding water usage, and the high costs associated with implementing sustainable water management practices.

What opportunities exist in The Middle East And Africa Study Of Data Center Water Consumption Market?

Opportunities in The Middle East And Africa Study Of Data Center Water Consumption Market include the development of innovative cooling technologies, investment in water recycling systems, and partnerships with local governments to promote sustainable practices.

What trends are shaping The Middle East And Africa Study Of Data Center Water Consumption Market?

Trends shaping The Middle East And Africa Study Of Data Center Water Consumption Market include the adoption of green building standards, increased focus on water conservation technologies, and the integration of AI for optimizing water usage in data centers.

The Middle East And Africa Study Of Data Center Water Consumption Market

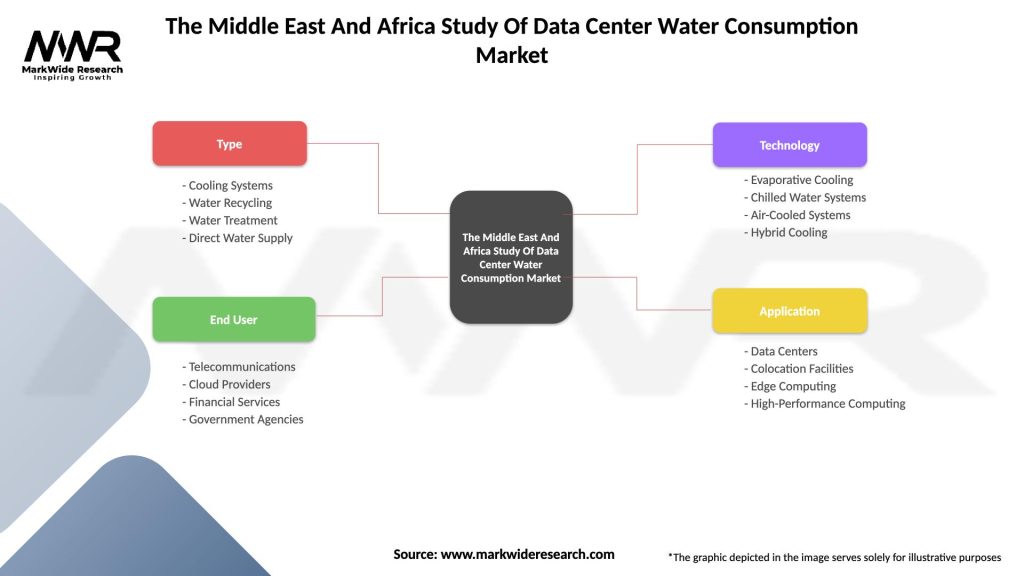

| Segmentation Details | Description |

|---|---|

| Type | Cooling Systems, Water Recycling, Water Treatment, Direct Water Supply |

| End User | Telecommunications, Cloud Providers, Financial Services, Government Agencies |

| Technology | Evaporative Cooling, Chilled Water Systems, Air-Cooled Systems, Hybrid Cooling |

| Application | Data Centers, Colocation Facilities, Edge Computing, High-Performance Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the The Middle East And Africa Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at