444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Kingdom of Saudi Arabia hospitality industry market represents one of the most dynamic and rapidly evolving sectors in the Middle East, driven by the ambitious Vision 2030 initiative and substantial government investments in tourism infrastructure. Saudi Arabia’s hospitality sector has experienced unprecedented transformation, with the kingdom positioning itself as a premier destination for religious tourism, business travel, and leisure activities. The market encompasses hotels, resorts, restaurants, entertainment venues, and related hospitality services across major cities including Riyadh, Jeddah, Mecca, and emerging destinations along the Red Sea coast.

Market growth has been particularly robust, with the sector experiencing a compound annual growth rate of 8.2% over recent years. This expansion reflects the kingdom’s strategic diversification away from oil dependency and its commitment to developing a world-class tourism and hospitality infrastructure. Government initiatives such as the NEOM project, Red Sea Development, and Qiddiya entertainment city have created substantial opportunities for hospitality operators and investors.

International hotel chains have significantly increased their presence in Saudi Arabia, with major brands establishing flagship properties and expanding their portfolios across multiple market segments. The market benefits from strong domestic demand, growing international visitor arrivals, and increasing business travel activity. Religious tourism continues to serve as a cornerstone of the hospitality industry, with millions of pilgrims visiting annually for Hajj and Umrah ceremonies.

The Kingdom of Saudi Arabia hospitality industry market refers to the comprehensive ecosystem of accommodation, food service, entertainment, and tourism-related businesses operating within Saudi Arabia’s borders. This market encompasses traditional hotels and resorts, serviced apartments, restaurants, cafes, entertainment venues, event management companies, and supporting service providers that cater to both domestic and international visitors.

Hospitality services in Saudi Arabia extend beyond conventional accommodation to include specialized offerings for religious pilgrims, business travelers, leisure tourists, and local residents seeking dining and entertainment experiences. The market integrates traditional Arabian hospitality customs with modern international standards, creating unique value propositions that reflect the kingdom’s cultural heritage while meeting contemporary traveler expectations.

Market participants range from luxury international hotel chains and boutique properties to local restaurant operators and entertainment venues. The industry plays a crucial role in Saudi Arabia’s economic diversification strategy, contributing significantly to employment generation, foreign exchange earnings, and GDP growth while supporting the broader tourism and retail sectors.

Saudi Arabia’s hospitality industry stands at the forefront of the kingdom’s economic transformation, benefiting from unprecedented government support and strategic investments in tourism infrastructure. The market has demonstrated remarkable resilience and growth potential, with hotel occupancy rates reaching 68% annually across major metropolitan areas. Vision 2030 initiatives have accelerated market development, attracting international operators and investors while creating new opportunities for domestic hospitality businesses.

Key market drivers include the expansion of religious tourism facilities, development of new entertainment destinations, growth in business travel, and increasing domestic leisure spending. The kingdom’s strategic location as a gateway between Europe, Asia, and Africa positions it advantageously for international tourism growth. Government reforms including visa liberalization, entertainment sector development, and women’s participation in the workforce have broadened the market’s appeal and accessibility.

Market segmentation reveals strong performance across luxury, mid-scale, and economy segments, with particular strength in business hotels and religious accommodation facilities. The food service sector has experienced rapid expansion, with restaurant revenues growing by 12.5% annually, driven by changing consumer preferences and increased dining out frequency among Saudi residents.

Future prospects remain highly positive, supported by mega-project developments, international event hosting, and continued tourism promotion efforts. The market is expected to benefit from increased airline connectivity, enhanced digital infrastructure, and growing recognition of Saudi Arabia as an emerging tourism destination.

Strategic market insights reveal several critical trends shaping the Saudi Arabian hospitality landscape. The following key insights provide comprehensive understanding of market dynamics:

Market maturation is evident through improved service standards, increased competition, and enhanced guest satisfaction metrics. International recognition of Saudi Arabia’s hospitality offerings has grown substantially, with major travel publications and industry awards acknowledging the kingdom’s progress in tourism development.

Government Vision 2030 serves as the primary catalyst driving Saudi Arabia’s hospitality industry transformation. This comprehensive national strategy aims to diversify the economy and establish the kingdom as a leading global tourism destination. Massive infrastructure investments in airports, transportation networks, and tourism facilities have created unprecedented opportunities for hospitality sector growth.

Religious tourism expansion continues to fuel market demand, with ongoing developments in Mecca and Medina enhancing accommodation capacity and service quality. The Two Holy Mosques expansion projects have increased pilgrim capacity, directly benefiting hotels, restaurants, and service providers in these sacred cities. Year-round Umrah programs have extended the traditional seasonal patterns, providing more consistent revenue streams for hospitality operators.

Business travel growth reflects Saudi Arabia’s increasing integration into global commerce and investment flows. Foreign direct investment has surged, bringing international executives and business travelers who require high-quality accommodation and meeting facilities. Conference and exhibition venues have expanded significantly, supporting the MICE (Meetings, Incentives, Conferences, Exhibitions) segment of the hospitality market.

Entertainment sector development has created new demand generators for hospitality services. Theme parks, cultural attractions, and sports venues are attracting domestic and international visitors, extending average stay durations and increasing spending on accommodation and dining. Concert venues and entertainment districts have particularly benefited restaurants, cafes, and nearby hotels.

Demographic changes within Saudi society are driving hospitality consumption patterns. Young population segments demonstrate increased propensity for dining out, entertainment activities, and domestic travel experiences. Women’s workforce participation has expanded disposable income and changed family spending patterns, benefiting restaurants and leisure hospitality segments.

Cultural and regulatory constraints continue to influence hospitality operations in Saudi Arabia, requiring operators to navigate traditional customs while meeting international service standards. Alcohol restrictions limit certain hospitality offerings, particularly affecting luxury hotels and restaurants that typically rely on beverage sales for profitability. Gender segregation requirements in some contexts necessitate specialized facility designs and service protocols.

Skilled workforce shortages present ongoing challenges for hospitality operators seeking to maintain service quality while expanding operations. Saudization policies require increasing employment of Saudi nationals, necessitating substantial training investments and workforce development programs. Language barriers can affect service delivery, particularly in international hotel chains serving diverse guest populations.

Seasonal demand fluctuations create operational challenges, particularly for properties dependent on religious tourism. Hajj and Ramadan periods generate intense demand spikes followed by significant downturns, requiring sophisticated revenue management and staffing strategies. Summer heat affects outdoor dining and entertainment venues, limiting operational periods and guest comfort.

Infrastructure limitations in emerging tourism destinations can constrain hospitality development. Transportation connectivity to new resort areas and entertainment districts may require substantial investment before hospitality operations become viable. Utility capacity and telecommunications infrastructure must support hospitality operations’ intensive requirements.

Competition intensity has increased substantially as international brands enter the market, creating pressure on pricing and profitability. Market saturation risks exist in certain segments and locations, particularly in Riyadh’s business hotel sector. Economic sensitivity to oil price fluctuations can affect domestic spending patterns and business travel demand.

Mega-project developments across Saudi Arabia present extraordinary opportunities for hospitality industry expansion. NEOM smart city will require comprehensive hospitality infrastructure, from luxury resorts to business hotels and dining establishments. Red Sea Project aims to create a world-class tourism destination with significant accommodation and entertainment requirements. Qiddiya entertainment city will generate substantial demand for hotels, restaurants, and recreational facilities.

Medical tourism potential offers significant growth opportunities as Saudi Arabia develops world-class healthcare facilities. Specialized medical hotels and extended-stay facilities can serve international patients and their families. Wellness tourism segments are emerging, with opportunities for spa resorts and health-focused hospitality concepts.

Cultural tourism development presents opportunities to showcase Saudi Arabia’s rich heritage and traditions. UNESCO World Heritage sites including Al-Ula and Diriyah require supporting hospitality infrastructure. Cultural festivals and events create seasonal demand for accommodation and dining services. Desert tourism and adventure travel segments offer unique positioning opportunities for specialized hospitality operators.

Technology integration opportunities can enhance guest experiences and operational efficiency. Smart hotel technologies including mobile check-in, IoT systems, and AI-powered services can differentiate properties in competitive markets. Digital marketing platforms enable more effective customer acquisition and retention strategies.

Franchise expansion opportunities exist for both international brands entering Saudi Arabia and local concepts seeking to scale operations. Food service franchising has shown particular promise, with successful international restaurant chains expanding rapidly across major cities. Boutique hotel concepts can capture market segments seeking unique, culturally authentic experiences.

Supply and demand dynamics in Saudi Arabia’s hospitality market reflect the kingdom’s rapid tourism development and economic diversification efforts. Hotel supply growth has accelerated significantly, with new properties opening across all market segments and geographic regions. Demand generation has kept pace through government tourism promotion, visa liberalization, and entertainment sector development.

Pricing dynamics vary considerably across market segments and seasons. Religious tourism periods command premium pricing in Mecca and Medina, while business hotels in Riyadh maintain relatively stable year-round rates. Competitive pricing pressure has intensified as supply increases, particularly in the mid-scale segment where numerous international brands compete for market share.

Investment flows into the hospitality sector have reached unprecedented levels, with both government-backed projects and private sector developments driving market expansion. Public-private partnerships have become increasingly common, combining government vision with private sector expertise and capital. Foreign investment has grown substantially, with international hotel companies and investors recognizing Saudi Arabia’s market potential.

Operational efficiency improvements have become critical as competition intensifies. Technology adoption is enabling hotels to reduce costs while enhancing guest experiences. Staff productivity initiatives help address workforce challenges while maintaining service quality standards. Energy efficiency programs reduce operational costs and support sustainability objectives.

Customer behavior evolution reflects changing demographics and cultural shifts within Saudi society. Digital booking preferences have grown substantially, with online reservations accounting for 72% of hotel bookings in major cities. Social media influence on dining and entertainment choices has created new marketing opportunities and challenges for hospitality operators.

Comprehensive market research for Saudi Arabia’s hospitality industry employs multiple data collection and analysis methodologies to ensure accuracy and reliability. Primary research activities include structured interviews with hospitality industry executives, government officials, and tourism stakeholders across the kingdom. Survey methodologies capture quantitative data from hotel operators, restaurant owners, and service providers representing diverse market segments.

Secondary research sources encompass government publications, industry reports, trade association data, and academic studies focusing on Saudi Arabia’s tourism and hospitality sectors. Statistical databases from the Saudi Commission for Tourism and National Heritage, Ministry of Investment, and General Authority of Statistics provide official market data and trends analysis.

Field research activities include site visits to major hospitality developments, observation of operational practices, and assessment of service quality standards across different property types. Market monitoring systems track pricing trends, occupancy rates, and competitive dynamics in real-time across key markets including Riyadh, Jeddah, Mecca, and emerging destinations.

Data validation processes ensure research findings accuracy through cross-referencing multiple sources and expert review panels. Industry expert consultations provide qualitative insights and context for quantitative findings. Trend analysis methodologies identify emerging patterns and forecast future market developments based on historical data and current indicators.

Market segmentation analysis employs sophisticated statistical techniques to identify distinct customer groups, service categories, and geographic markets. Competitive intelligence gathering tracks major players’ strategies, expansion plans, and market positioning initiatives across the hospitality value chain.

Riyadh region dominates Saudi Arabia’s hospitality market, accounting for 35% of total hotel rooms and serving as the kingdom’s business and administrative center. Business hotels perform particularly well in Riyadh, benefiting from government activity, corporate headquarters, and international business travel. Luxury properties have expanded significantly, catering to high-end business travelers and affluent domestic guests. Restaurant diversity in Riyadh exceeds other Saudi cities, with international cuisines and fine dining establishments thriving.

Western region, anchored by Jeddah, represents the kingdom’s commercial gateway and accounts for 28% of hospitality market share. Jeddah’s hotels benefit from business travel, Umrah pilgrims, and Red Sea tourism development. Historic Jeddah offers unique cultural tourism opportunities, supporting boutique hotels and heritage-focused hospitality concepts. Red Sea coastline development is creating new luxury resort opportunities with international appeal.

Mecca and Medina constitute the religious tourism heartland, generating 25% of total hospitality revenues despite seasonal concentration. Hotel capacity expansion continues around the Two Holy Mosques, with properties designed specifically for pilgrim accommodation needs. Service standards have improved substantially, with international hotel chains bringing global expertise to religious tourism hospitality.

Eastern Province hospitality market benefits from oil industry activity and growing petrochemical sector business travel. Dammam and Al Khobar serve as regional business centers, supporting mid-scale and business hotels. Half Moon Bay and coastal areas offer leisure tourism potential, particularly for domestic travelers seeking beach destinations.

Emerging regions including Al-Ula, Tabuk, and Asir are experiencing rapid hospitality development driven by tourism mega-projects and cultural attractions. Al-Ula’s archaeological sites are attracting luxury eco-resorts and cultural tourism facilities. Mountain regions offer unique positioning for adventure tourism and seasonal escape destinations.

International hotel chains have established strong market presence across Saudi Arabia’s major cities and tourism destinations. The competitive landscape features both global hospitality leaders and regional operators competing across multiple market segments:

Local hospitality companies maintain significant market share, particularly in religious tourism and traditional accommodation segments. Domestic restaurant chains compete effectively with international franchises by offering authentic local cuisine and cultural experiences. Independent operators continue to serve niche markets and specialized customer segments.

Competitive strategies focus on differentiation through service quality, cultural authenticity, and technology integration. Brand loyalty programs and corporate partnerships have become increasingly important for customer retention and revenue optimization.

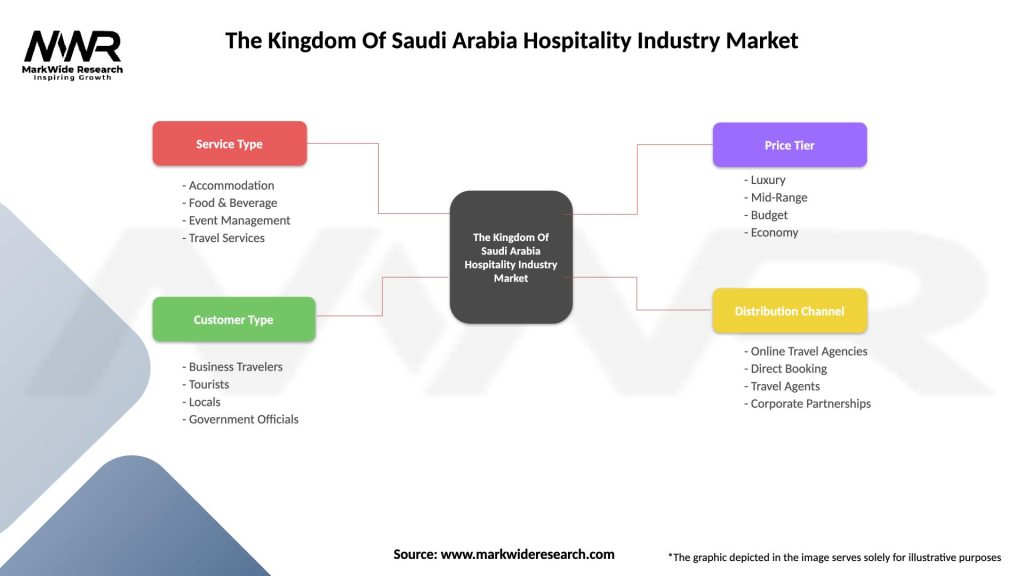

Market segmentation in Saudi Arabia’s hospitality industry reflects diverse customer needs, service categories, and price points. Accommodation segmentation encompasses luxury hotels, upper-upscale properties, mid-scale hotels, economy lodging, and specialized religious accommodation facilities. Service segmentation includes full-service hotels, limited-service properties, extended-stay facilities, and boutique concepts.

Customer segmentation reveals distinct market groups with specific preferences and spending patterns:

Geographic segmentation distinguishes between major metropolitan markets, religious tourism centers, emerging destinations, and coastal resort areas. Seasonal segmentation accounts for religious calendar impacts, business travel patterns, and leisure tourism cycles.

Food service segmentation includes fine dining restaurants, casual dining chains, quick-service establishments, coffee shops, and specialized cuisine categories. Entertainment segmentation encompasses family entertainment centers, cultural venues, sports facilities, and nightlife establishments operating within cultural guidelines.

Luxury Hotels Category demonstrates exceptional performance in Saudi Arabia, driven by high-end business travel and affluent domestic demand. Occupancy rates in luxury properties average 75% annually, significantly above global benchmarks. Average daily rates remain strong, particularly during peak business periods and religious seasons. Luxury amenities including spas, fine dining restaurants, and executive services command premium pricing and high guest satisfaction scores.

Business Hotels Category serves as the market backbone, accommodating corporate travelers, government officials, and conference attendees. Meeting and conference facilities generate substantial ancillary revenue, with many properties reporting 40% of total revenue from meetings and events. Technology infrastructure and business services differentiate successful properties in this competitive segment.

Religious Accommodation Category requires specialized understanding of pilgrim needs and cultural sensitivities. Properties near Haram areas command premium rates during Hajj and Umrah seasons. Service adaptations include prayer facilities, halal dining options, and multilingual staff capabilities. Seasonal revenue concentration necessitates sophisticated yield management strategies.

Resort and Leisure Category is experiencing rapid growth as domestic tourism expands and international leisure travel develops. Red Sea coastal properties attract both domestic and international guests seeking beach and water sports experiences. Desert resorts offer unique cultural and adventure tourism experiences, particularly popular with international visitors.

Food Service Category shows remarkable diversity and growth, with restaurant revenues increasing 15% annually in major cities. International franchise expansion continues rapidly, while local concepts gain popularity among Saudi consumers. Delivery and takeaway services have grown substantially, particularly accelerated by digital platform adoption.

Hotel operators benefit from Saudi Arabia’s supportive business environment, growing tourism demand, and government infrastructure investments. Revenue diversification opportunities exist through multiple market segments, reducing dependence on single customer types. Brand recognition advantages help international chains establish market presence and attract loyal customers. Operational efficiency gains result from modern infrastructure and technology adoption.

Restaurant operators enjoy expanding customer bases as dining out becomes more prevalent among Saudi consumers. Franchise opportunities provide proven business models and brand support for rapid market entry. Delivery platform integration expands market reach and revenue potential beyond traditional dine-in services. Cultural adaptation capabilities enable successful localization of international concepts.

Investors benefit from attractive returns supported by strong market fundamentals and government backing. Portfolio diversification across hospitality segments reduces investment risk while capturing growth opportunities. Exit strategy options include public offerings, strategic sales, and real estate investment trust structures. Tax incentives and regulatory support enhance investment attractiveness.

Employees gain access to expanding career opportunities as the hospitality sector grows and professionalizes. Skills development programs supported by international operators enhance career advancement prospects. Competitive compensation packages reflect the industry’s growth and talent competition. Cultural exchange opportunities arise from working with diverse international teams and guests.

Local communities benefit from job creation, economic development, and infrastructure improvements associated with hospitality projects. Small business opportunities emerge through supply chain participation and complementary services. Cultural preservation and promotion occur through heritage tourism development and authentic hospitality experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Saudi Arabia’s hospitality industry. Mobile technology adoption has accelerated rapidly, with guests expecting seamless digital experiences from booking through checkout. Contactless services have gained permanent acceptance, with hotels implementing mobile check-in, digital room keys, and app-based service requests. Artificial intelligence applications are enhancing customer service through chatbots, personalized recommendations, and predictive maintenance systems.

Sustainability initiatives are becoming increasingly important as environmental consciousness grows among consumers and operators. Green building certifications are sought for new hospitality developments, while existing properties implement energy efficiency and waste reduction programs. Local sourcing practices support community development while reducing environmental impact and enhancing authentic guest experiences.

Experiential hospitality is gaining prominence as travelers seek unique, memorable experiences beyond traditional accommodation and dining. Cultural immersion programs allow guests to engage with Saudi heritage and traditions. Adventure tourism offerings capitalize on the kingdom’s diverse landscapes and outdoor recreation opportunities. Wellness tourism is emerging as health-conscious travelers seek spa services, fitness facilities, and wellness-focused accommodations.

Food and beverage innovation reflects changing consumer preferences and cultural evolution. Fusion cuisine concepts blend international flavors with traditional Saudi ingredients and preparations. Healthy dining options respond to growing health consciousness among consumers. Specialty coffee culture has expanded rapidly, with artisanal coffee shops becoming popular social gathering places.

Personalization technologies enable hospitality operators to deliver customized experiences based on guest preferences and behavior patterns. Data analytics platforms help properties optimize pricing, staffing, and service delivery. Loyalty program evolution incorporates experiential rewards and personalized benefits beyond traditional point systems.

Major hotel openings have accelerated across Saudi Arabia, with international brands launching flagship properties in key markets. Luxury resort developments along the Red Sea coast are attracting global attention and establishing new benchmarks for hospitality excellence. Business hotel expansion in Riyadh and Jeddah reflects growing corporate travel demand and conference activity.

Technology partnerships between hospitality operators and tech companies are driving innovation in guest services and operational efficiency. Smart hotel implementations showcase cutting-edge technology integration, from IoT sensors to AI-powered concierge services. Digital payment solutions have expanded rapidly, supporting cashless transactions and enhanced security.

Franchise agreements continue to proliferate as international restaurant chains recognize Saudi Arabia’s market potential. Local brand development is gaining momentum, with Saudi entrepreneurs creating hospitality concepts that reflect cultural preferences and values. Food delivery platform expansion has transformed restaurant operations and customer access patterns.

Workforce development initiatives address skills shortages through partnerships between hospitality operators and educational institutions. Training programs focus on service excellence, cultural sensitivity, and technology proficiency. Career advancement pathways are being established to attract and retain Saudi nationals in hospitality careers.

Sustainability certifications are being pursued by leading hospitality operators as environmental responsibility becomes a competitive differentiator. Energy efficiency projects reduce operational costs while supporting environmental objectives. Waste reduction programs demonstrate corporate responsibility and appeal to environmentally conscious consumers.

Market entry strategies should prioritize understanding Saudi cultural nuances and regulatory requirements while maintaining international service standards. MarkWide Research analysis indicates that successful operators invest significantly in cultural training and local partnership development. Location selection requires careful consideration of target customer segments, transportation accessibility, and competitive dynamics.

Technology investment priorities should focus on guest-facing applications that enhance convenience and personalization while improving operational efficiency. Mobile platform development is essential for reaching tech-savvy Saudi consumers who expect seamless digital experiences. Data analytics capabilities enable better decision-making and competitive positioning in dynamic market conditions.

Workforce development strategies must address both immediate staffing needs and long-term Saudization requirements. Training program investments should emphasize service excellence, language skills, and cultural competency. Career development pathways help attract and retain talented Saudi employees while building organizational capabilities.

Revenue diversification approaches reduce dependence on single market segments while maximizing property utilization. Food and beverage operations can generate substantial revenue beyond room sales. Meeting and event services provide high-margin opportunities, particularly in business-focused properties.

Sustainability integration should be viewed as both operational necessity and marketing advantage. Environmental programs reduce costs while appealing to conscious consumers. Community engagement initiatives build local support and enhance brand reputation in Saudi markets.

Long-term growth prospects for Saudi Arabia’s hospitality industry remain exceptionally positive, supported by continued government commitment to tourism development and economic diversification. Vision 2030 implementation will drive sustained investment in tourism infrastructure and destination marketing. Mega-project completion over the next decade will create substantial new hospitality demand and establish Saudi Arabia as a premier global destination.

Market expansion is expected to continue across all segments, with particular strength in luxury resorts, business hotels, and experiential hospitality concepts. International visitor growth projections suggest annual increases of 12-15% as destination awareness builds and accessibility improves. Domestic tourism will remain a crucial market driver as Saudi residents increasingly engage in leisure travel and dining experiences.

Technology evolution will fundamentally transform hospitality operations and guest experiences. Artificial intelligence integration will enable unprecedented personalization and operational efficiency. Virtual and augmented reality applications will enhance marketing and guest engagement capabilities. Blockchain technology may revolutionize loyalty programs and secure transactions.

Sustainability requirements will become increasingly stringent, driving innovation in green building design and operational practices. Circular economy principles will influence hospitality development and operations. Carbon neutrality goals will require substantial investment in renewable energy and efficiency technologies.

Market maturation will bring increased competition and service standardization while creating opportunities for differentiation through unique experiences and cultural authenticity. MWR projections indicate that successful operators will be those who effectively balance international standards with local cultural values and preferences.

Saudi Arabia’s hospitality industry stands at a transformative juncture, benefiting from unprecedented government support, massive infrastructure investments, and evolving consumer preferences. The market has demonstrated remarkable resilience and growth potential, establishing itself as one of the Middle East’s most dynamic hospitality destinations. Vision 2030 initiatives continue to drive fundamental changes in market structure, competitive dynamics, and growth opportunities.

Market fundamentals remain exceptionally strong, with diverse demand generators including religious tourism, business travel, entertainment development, and emerging leisure segments. International recognition of Saudi Arabia’s hospitality offerings has grown substantially, attracting global hotel chains, restaurant operators, and investors seeking exposure to this rapidly expanding market.

Future success in Saudi Arabia’s hospitality market will require operators to balance international service standards with cultural authenticity, invest in technology and workforce development, and maintain operational flexibility to capitalize on emerging opportunities. The Kingdom of Saudi Arabia hospitality industry market represents one of the most compelling growth stories in global hospitality, offering substantial opportunities for stakeholders who understand and adapt to its unique characteristics and requirements.

What is the Kingdom Of Saudi Arabia Hospitality Industry?

The Kingdom Of Saudi Arabia Hospitality Industry encompasses a range of services including accommodation, food and beverage, and entertainment aimed at catering to both domestic and international travelers. It plays a crucial role in the country’s economy and cultural exchange.

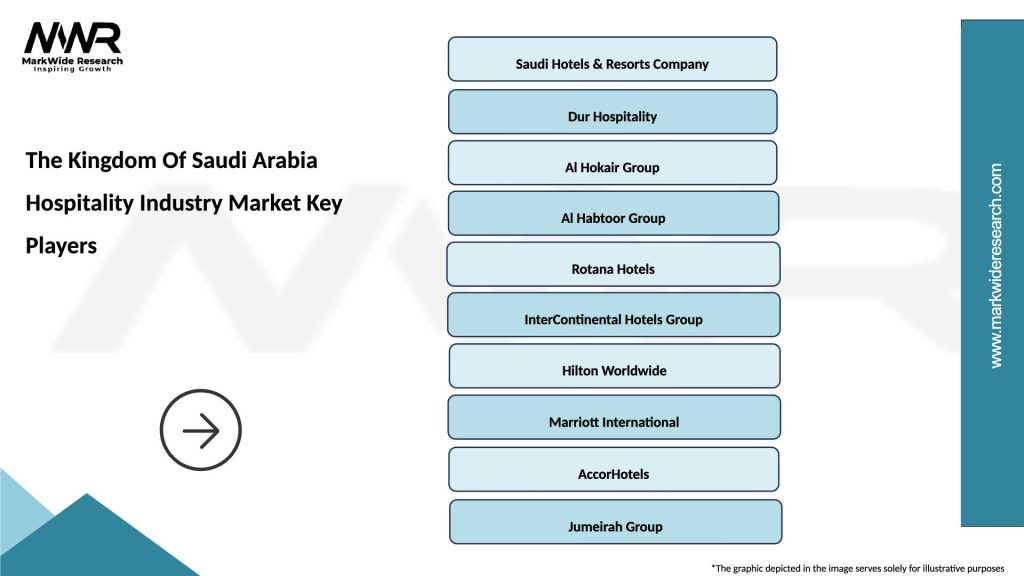

What are the key players in The Kingdom Of Saudi Arabia Hospitality Industry Market?

Key players in The Kingdom Of Saudi Arabia Hospitality Industry Market include major hotel chains like Accor, Hilton, and Marriott, as well as local companies such as Al Habtoor Group and Saudi Hotels and Resorts Company. These companies contribute significantly to the growth and development of the hospitality sector in the region.

What are the growth factors driving The Kingdom Of Saudi Arabia Hospitality Industry Market?

The growth of The Kingdom Of Saudi Arabia Hospitality Industry Market is driven by factors such as increasing tourism, government initiatives to promote the sector, and the expansion of entertainment options. Additionally, the Vision 2030 plan aims to diversify the economy and enhance the tourism experience.

What challenges does The Kingdom Of Saudi Arabia Hospitality Industry Market face?

The Kingdom Of Saudi Arabia Hospitality Industry Market faces challenges such as fluctuating oil prices, competition from neighboring countries, and the need for skilled labor. These factors can impact the overall growth and sustainability of the industry.

What opportunities exist in The Kingdom Of Saudi Arabia Hospitality Industry Market?

Opportunities in The Kingdom Of Saudi Arabia Hospitality Industry Market include the development of new tourist attractions, investment in luxury accommodations, and the promotion of cultural tourism. The government’s focus on enhancing the visitor experience presents further avenues for growth.

What trends are shaping The Kingdom Of Saudi Arabia Hospitality Industry Market?

Trends shaping The Kingdom Of Saudi Arabia Hospitality Industry Market include the rise of eco-friendly accommodations, the integration of technology in guest services, and a growing emphasis on local experiences. These trends reflect changing consumer preferences and the industry’s adaptation to modern demands.

The Kingdom Of Saudi Arabia Hospitality Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Accommodation, Food & Beverage, Event Management, Travel Services |

| Customer Type | Business Travelers, Tourists, Locals, Government Officials |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

| Distribution Channel | Online Travel Agencies, Direct Booking, Travel Agents, Corporate Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the The Kingdom Of Saudi Arabia Hospitality Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at