444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Thailand’s power generation market has been experiencing significant growth in recent years. The country’s increasing population, rapid urbanization, and expanding industrial sector have contributed to the rising demand for electricity. To meet this demand, Thailand has been focusing on developing its power generation infrastructure through Engineering, Procurement, and Construction (EPC) projects. The EPC market in Thailand’s power generation sector plays a vital role in ensuring the smooth operation and expansion of the country’s power generation capacity.

Meaning

Engineering, Procurement, and Construction (EPC) in the power generation sector refers to a comprehensive approach that involves the design, procurement, and construction of power generation facilities. In Thailand, EPC companies are responsible for managing and executing the entire project, from the initial planning stage to the final commissioning of the power plants. They oversee the engineering design, procure the necessary equipment and materials, and handle the construction and installation of the power generation facilities.

Executive Summary

The Thailand power generation EPC market has witnessed steady growth in recent years due to the increasing demand for electricity in the country. The government’s efforts to enhance the power generation infrastructure and attract foreign investments have further fueled the market’s growth. EPC companies in Thailand play a crucial role in ensuring the timely and efficient completion of power generation projects, contributing to the overall development of the country’s power sector.

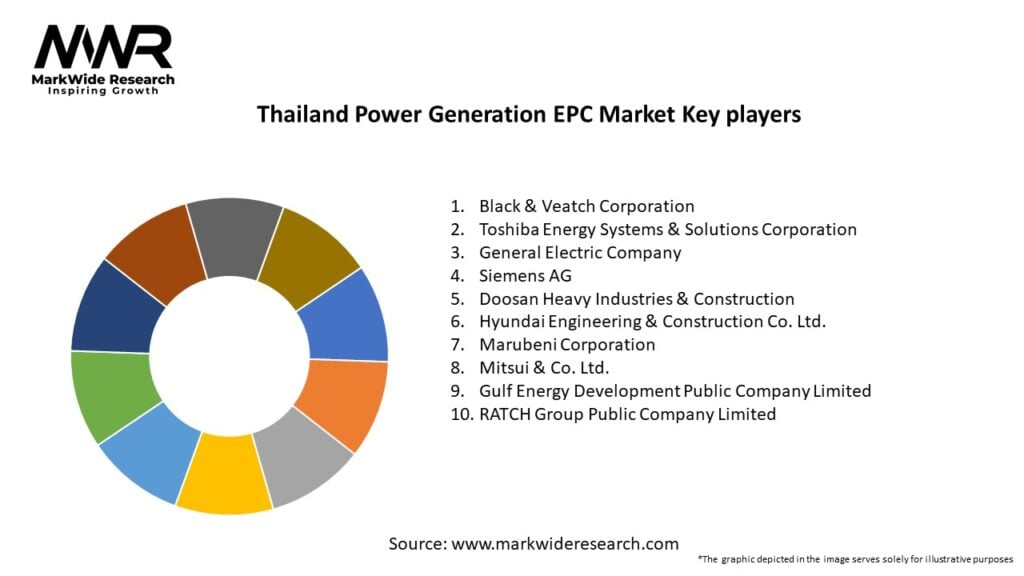

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

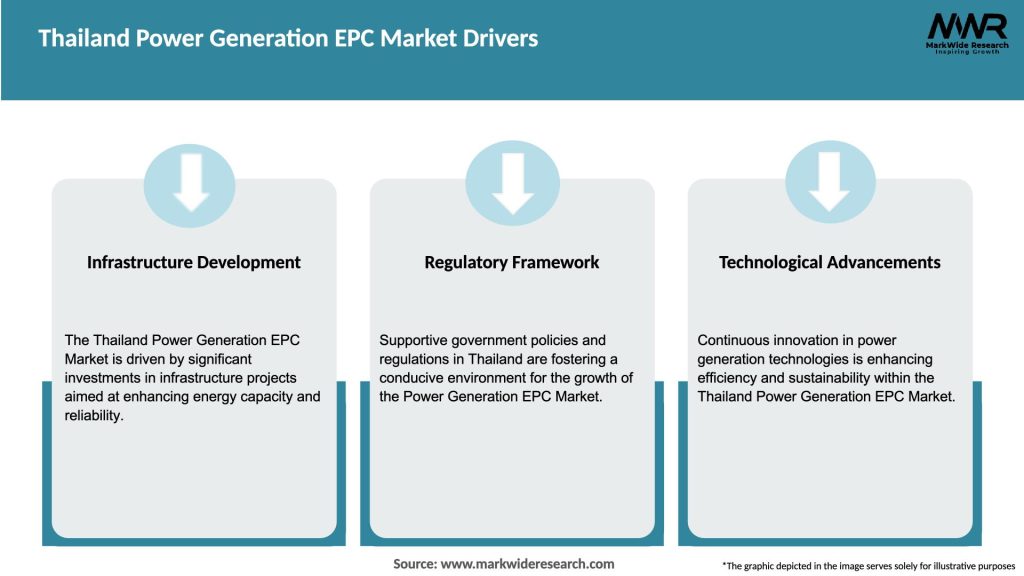

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Thailand power generation EPC market is driven by various dynamics, including government initiatives, increasing power demand, environmental concerns, and technological advancements. The market is highly competitive, with both domestic and international players vying for project contracts. Collaboration, innovation, and the ability to deliver projects on time and within budget are key factors determining the success of EPC companies in the market.

Regional Analysis

Thailand’s power generation EPC market is spread across different regions, each with its unique characteristics and opportunities. The central region, including Bangkok, is the country’s economic and industrial hub, driving the demand for electricity and power generation projects. The eastern region, encompassing the EEC project, offers significant opportunities for EPC companies due to its focus on industrial and infrastructure development. The northern and northeastern regions also present potential for renewable energy projects, including biomass and hydropower.

Competitive Landscape

Leading Companies in the Thailand Power Generation EPC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

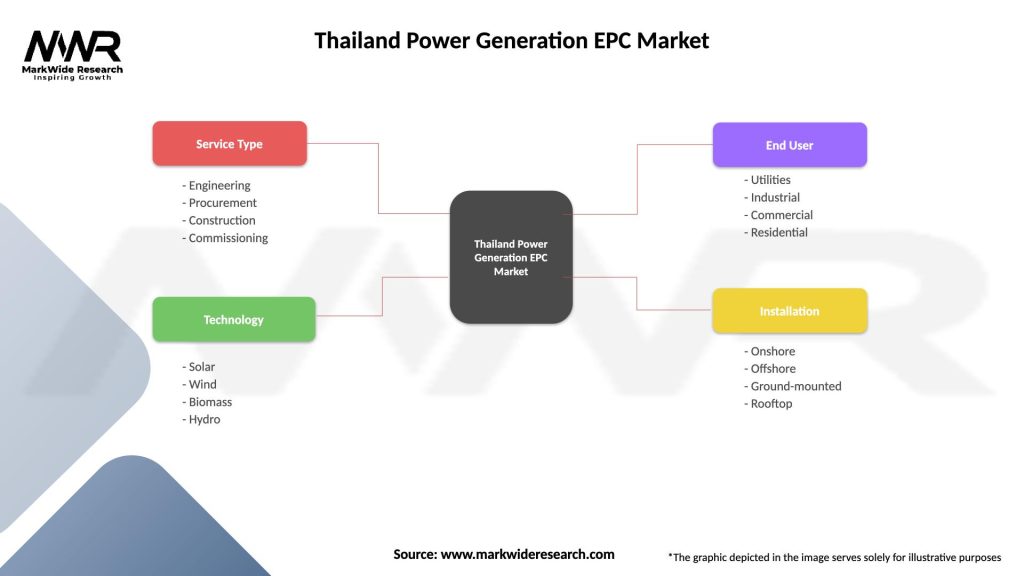

Segmentation

The Thailand power generation EPC market can be segmented based on the type of power generation sources, including thermal, renewable, and hydroelectric power projects. The market can also be segmented based on the scale of projects, such as large-scale power plants, small-scale distributed generation, and off-grid solutions. Additionally, the market can be segmented based on the regions or provinces in Thailand.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has affected the Thailand power generation EPC market, causing disruptions in project timelines and supply chains. The implementation of lockdowns and travel restrictions led to delays in project execution and mobilization of equipment and personnel. However, the government’s stimulus packages and efforts to revive the economy have provided some support to the market. EPC companies have adopted safety measures and remote working practices to mitigate the impact of the pandemic on project operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Thailand power generation EPC market is promising. The government’s focus on renewable energy, infrastructure development, and attracting investments will continue to drive the market’s growth. EPC companies that can adapt to market trends, leverage technological advancements, and offer comprehensive solutions will be well-positioned to capitalize on the opportunities in the evolving power generation landscape.

Conclusion

The Thailand power generation EPC market is witnessing steady growth due to the increasing demand for electricity, government initiatives, and the shift towards renewable energy sources. EPC companies play a crucial role in the design, procurement, and construction of power generation facilities, ensuring the timely and efficient completion of projects. The market presents opportunities for companies involved in thermal, renewable, and hydroelectric power projects, as well as small-scale and off-grid solutions. By embracing digitalization, innovation, and collaboration, EPC companies can navigate the competitive landscape and contribute to Thailand’s sustainable development goals in the power sector.

What is Power Generation EPC?

Power Generation EPC refers to the Engineering, Procurement, and Construction services involved in the development of power generation facilities. This includes the design, sourcing of materials, and construction of power plants, which can utilize various energy sources such as fossil fuels, renewables, and nuclear energy.

What are the key players in the Thailand Power Generation EPC Market?

Key players in the Thailand Power Generation EPC Market include companies like Siemens, Mitsubishi Heavy Industries, and Chiyoda Corporation, which are known for their expertise in large-scale power projects. These companies provide comprehensive solutions from design to execution, ensuring efficient power generation.

What are the growth factors driving the Thailand Power Generation EPC Market?

The Thailand Power Generation EPC Market is driven by increasing energy demand, government initiatives for renewable energy, and investments in infrastructure development. Additionally, the push for energy security and sustainability is prompting more projects in this sector.

What challenges does the Thailand Power Generation EPC Market face?

Challenges in the Thailand Power Generation EPC Market include regulatory hurdles, environmental concerns, and the need for skilled labor. These factors can delay project timelines and increase costs, impacting overall market growth.

What opportunities exist in the Thailand Power Generation EPC Market?

Opportunities in the Thailand Power Generation EPC Market include the expansion of renewable energy projects, such as solar and wind, and the modernization of existing power plants. The government’s commitment to reducing carbon emissions also opens avenues for innovative technologies and sustainable practices.

What trends are shaping the Thailand Power Generation EPC Market?

Trends in the Thailand Power Generation EPC Market include the integration of smart grid technologies, increased use of energy storage solutions, and a shift towards decentralized power generation. These trends are enhancing efficiency and reliability in power supply.

Thailand Power Generation EPC Market

| Segmentation Details | Description |

|---|---|

| Service Type | Engineering, Procurement, Construction, Commissioning |

| Technology | Solar, Wind, Biomass, Hydro |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Onshore, Offshore, Ground-mounted, Rooftop |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Thailand Power Generation EPC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at