444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand plastic market represents one of Southeast Asia’s most dynamic and rapidly evolving industrial sectors, driven by robust manufacturing capabilities and strategic geographic positioning. Thailand’s plastic industry has emerged as a critical component of the nation’s economic infrastructure, supporting diverse applications from automotive manufacturing to consumer goods production. The market demonstrates exceptional resilience and adaptability, with domestic consumption and export-oriented production creating a balanced ecosystem for sustainable growth.

Manufacturing excellence characterizes Thailand’s approach to plastic production, with state-of-the-art facilities and advanced processing technologies enabling competitive positioning in global markets. The country’s petrochemical infrastructure provides essential raw materials, while skilled workforce and government support policies foster innovation and expansion. Market dynamics indicate sustained growth momentum, with increasing demand from key sectors including packaging, construction, electronics, and automotive industries driving market expansion at a robust CAGR of approximately 6.2%.

Regional integration through ASEAN trade agreements enhances Thailand’s position as a plastic manufacturing hub, facilitating access to broader Southeast Asian markets. The country’s strategic location enables efficient distribution networks, while established supply chains support both domestic consumption and international export activities. Sustainability initiatives are increasingly shaping market development, with circular economy principles and environmental considerations influencing production strategies and consumer preferences.

The Thailand plastic market refers to the comprehensive ecosystem encompassing production, processing, distribution, and consumption of plastic materials and products within Thailand’s borders. This market includes various plastic types such as polyethylene, polypropylene, polyvinyl chloride, polystyrene, and engineering plastics, serving multiple industrial and consumer applications. Market scope extends from raw material production through finished product manufacturing, incorporating both domestic consumption and export-oriented activities that contribute significantly to Thailand’s industrial economy.

Industry definition encompasses upstream petrochemical production, midstream plastic resin manufacturing, and downstream processing into finished products. The market integrates traditional plastic manufacturing with emerging technologies including biodegradable plastics, recycled materials, and advanced polymer compounds. Value chain activities span from feedstock procurement through final product delivery, involving numerous stakeholders including chemical companies, plastic processors, manufacturers, distributors, and end-users across various sectors.

Economic significance of Thailand’s plastic market extends beyond direct manufacturing contributions, supporting employment, technological advancement, and export earnings. The market serves as a foundation for numerous downstream industries, enabling Thailand’s position as a regional manufacturing center. Strategic importance lies in the market’s role supporting key economic sectors while contributing to Thailand’s industrial competitiveness and economic diversification objectives.

Thailand’s plastic market demonstrates exceptional growth potential driven by strong domestic demand, expanding export opportunities, and continuous technological advancement. The market benefits from Thailand’s established petrochemical infrastructure, skilled manufacturing workforce, and strategic geographic location within Southeast Asia. Key growth drivers include increasing urbanization, rising consumer spending, expanding automotive production, and growing packaging requirements across various industries.

Market leadership is characterized by a mix of international corporations and domestic companies, creating a competitive landscape that fosters innovation and efficiency improvements. Major players leverage Thailand’s cost advantages, infrastructure capabilities, and market access to serve both regional and global customers. Technology adoption accelerates across the value chain, with approximately 78% of manufacturers implementing advanced processing technologies to enhance product quality and operational efficiency.

Sustainability trends increasingly influence market development, with growing emphasis on recyclable materials, biodegradable alternatives, and circular economy principles. Government policies support environmental responsibility while maintaining industrial competitiveness. Future prospects remain positive, with expanding applications in emerging sectors, continued infrastructure development, and increasing integration with regional supply chains supporting sustained market growth and development opportunities.

Strategic positioning of Thailand’s plastic market reflects the country’s advantages in raw material access, manufacturing capabilities, and regional connectivity. The market demonstrates remarkable diversity across applications and end-user segments, providing stability through balanced demand patterns. Critical insights reveal several key factors driving market development:

Market maturity varies across different plastic types and applications, with established segments demonstrating steady growth while emerging applications offer significant expansion opportunities. Competitive dynamics encourage continuous improvement in product quality, cost efficiency, and customer service capabilities.

Economic growth serves as a fundamental driver for Thailand’s plastic market, with expanding GDP supporting increased consumption across residential, commercial, and industrial sectors. Urbanization trends create growing demand for plastic products in construction, infrastructure development, and consumer goods applications. Rising disposable income levels drive consumption of packaged goods, electronics, and automotive products, all requiring significant plastic content.

Industrial expansion across key sectors generates substantial demand for plastic materials and components. The automotive industry, representing a major economic pillar, requires diverse plastic applications for interior components, exterior panels, and functional parts. Electronics manufacturing growth creates demand for specialized engineering plastics and precision components. Construction sector development drives consumption of plastic pipes, fittings, insulation materials, and decorative products.

Export opportunities provide significant growth momentum, with Thailand’s competitive manufacturing capabilities enabling market penetration across regional and global markets. ASEAN integration facilitates trade expansion, while established relationships with international customers support sustained export growth. Government initiatives promoting industrial development and export competitiveness create favorable conditions for market expansion.

Technological advancement enables development of new applications and improved product performance, expanding market opportunities across various sectors. Innovation in materials science creates possibilities for enhanced functionality, durability, and environmental compatibility. Research and development investments by both companies and institutions support continuous market evolution and competitive positioning.

Raw material price volatility represents a significant challenge for Thailand’s plastic market, with petroleum-based feedstock costs subject to global commodity price fluctuations. Supply chain disruptions can impact production schedules and cost structures, particularly during periods of international market instability. Currency exchange rate variations affect both import costs for raw materials and export competitiveness in international markets.

Environmental regulations increasingly constrain traditional plastic production and usage patterns, requiring investments in cleaner technologies and alternative materials. Sustainability pressures from consumers, governments, and international customers demand development of eco-friendly alternatives, often involving higher costs and technical challenges. Waste management requirements and recycling mandates create additional operational complexities and expenses.

Competition from regional manufacturers intensifies pressure on pricing and market share, particularly from countries with lower labor costs or government subsidies. Technology requirements for advanced applications demand continuous investment in equipment upgrades and workforce training. International trade tensions and policy changes can affect export opportunities and supply chain stability.

Infrastructure limitations in certain regions may constrain market expansion and distribution efficiency. Skilled labor availability becomes increasingly important as technology complexity grows, requiring ongoing investment in training and development programs. Regulatory compliance costs and administrative requirements can impact operational efficiency and profitability, particularly for smaller market participants.

Sustainable plastic development presents substantial opportunities for market growth and differentiation, with increasing demand for biodegradable, recyclable, and bio-based plastic materials. Circular economy initiatives create new business models focused on plastic recycling, reprocessing, and waste-to-resource conversion. Companies investing in sustainable technologies can capture growing market segments while meeting environmental compliance requirements.

Advanced applications in emerging sectors offer significant expansion potential, including medical devices, renewable energy components, and smart technology applications. Engineering plastics demand grows with increasing sophistication in automotive, electronics, and industrial applications. Specialized materials for aerospace, marine, and defense applications provide high-value market opportunities.

Regional market expansion through ASEAN integration and broader Asian market access creates opportunities for increased export volumes and market diversification. Infrastructure development across Southeast Asia generates demand for construction-related plastic products. Growing middle-class populations in regional markets drive consumption of consumer goods requiring plastic components and packaging.

Technology partnerships and joint ventures with international companies can accelerate access to advanced technologies and global market channels. Government incentives for industrial development and environmental initiatives provide support for expansion and modernization investments. Digital transformation opportunities include smart manufacturing, supply chain optimization, and customer relationship management systems that enhance operational efficiency and market responsiveness.

Supply and demand balance in Thailand’s plastic market reflects complex interactions between domestic consumption patterns, export opportunities, and production capacity utilization. Market equilibrium demonstrates resilience through diversified demand sources and flexible production capabilities. Approximately 72% of production capacity currently serves domestic markets, while 28% supports export activities, creating balanced market dynamics that reduce dependency risks.

Price dynamics respond to multiple factors including raw material costs, energy prices, labor expenses, and competitive pressures. Market participants employ various strategies to manage cost pressures, including operational efficiency improvements, technology upgrades, and value-added product development. Long-term contracts and strategic partnerships help stabilize pricing relationships and ensure supply security.

Innovation cycles drive market evolution through introduction of new materials, processing technologies, and application developments. Research and development investments by major players support continuous product improvement and market expansion. Collaboration between industry, academic institutions, and government agencies accelerates technology transfer and commercialization of innovative solutions.

Regulatory environment influences market dynamics through environmental standards, safety requirements, and trade policies. Policy changes regarding sustainability, waste management, and international trade affect strategic planning and investment decisions. Market participants actively engage with regulatory processes to ensure compliance while advocating for policies supporting industry development and competitiveness.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings regarding Thailand’s plastic market. Primary research includes extensive interviews with industry executives, manufacturers, suppliers, distributors, and end-users across various market segments. Survey data collection from key stakeholders provides quantitative insights into market trends, challenges, and opportunities.

Secondary research incorporates analysis of government statistics, industry reports, trade publications, and academic studies relevant to Thailand’s plastic industry. Data triangulation methods verify findings across multiple sources to ensure consistency and reliability. Historical data analysis identifies long-term trends and cyclical patterns affecting market development.

Market modeling techniques project future scenarios based on current trends, policy developments, and economic indicators. Quantitative analysis examines production data, trade statistics, consumption patterns, and price trends to identify market dynamics and growth drivers. Qualitative assessment evaluates competitive positioning, technology trends, and strategic developments affecting market evolution.

Expert consultation with industry specialists, academic researchers, and policy makers provides additional insights into market complexities and future prospects. Field research includes facility visits and direct observation of manufacturing operations, distribution networks, and end-user applications. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making.

Central Thailand dominates the plastic market landscape, accounting for approximately 65% of total production capacity and hosting major petrochemical complexes and manufacturing facilities. Bangkok metropolitan area serves as the commercial and logistics hub, facilitating distribution and export activities. The region benefits from excellent infrastructure, skilled workforce availability, and proximity to major ports supporting international trade.

Eastern Economic Corridor represents a rapidly growing region for plastic manufacturing, with government investment in infrastructure and industrial development attracting new facilities and expansion projects. Rayong and Chonburi provinces host significant petrochemical and plastic production capacity, benefiting from integrated supply chains and port access. The region’s focus on advanced manufacturing and technology development creates opportunities for high-value plastic applications.

Northern Thailand contributes approximately 15% of national production, with facilities serving both domestic markets and export to neighboring countries. Chiang Mai and surrounding provinces focus on specialized applications including electronics components and consumer goods manufacturing. The region’s lower labor costs and government incentives attract investment in labor-intensive plastic processing operations.

Southern Thailand accounts for roughly 12% of market activity, with production facilities serving local construction, agriculture, and marine applications. Regional specialization includes plastic products for rubber processing, fishing industry, and tourism-related applications. Cross-border trade with Malaysia creates additional market opportunities and competitive dynamics.

Northeastern Thailand represents an emerging market region with growing industrial development and infrastructure investment. Government initiatives promoting regional development create opportunities for plastic manufacturing expansion, particularly for agricultural and construction applications. The region’s strategic location provides access to Laos, Cambodia, and Vietnam markets through improved transportation networks.

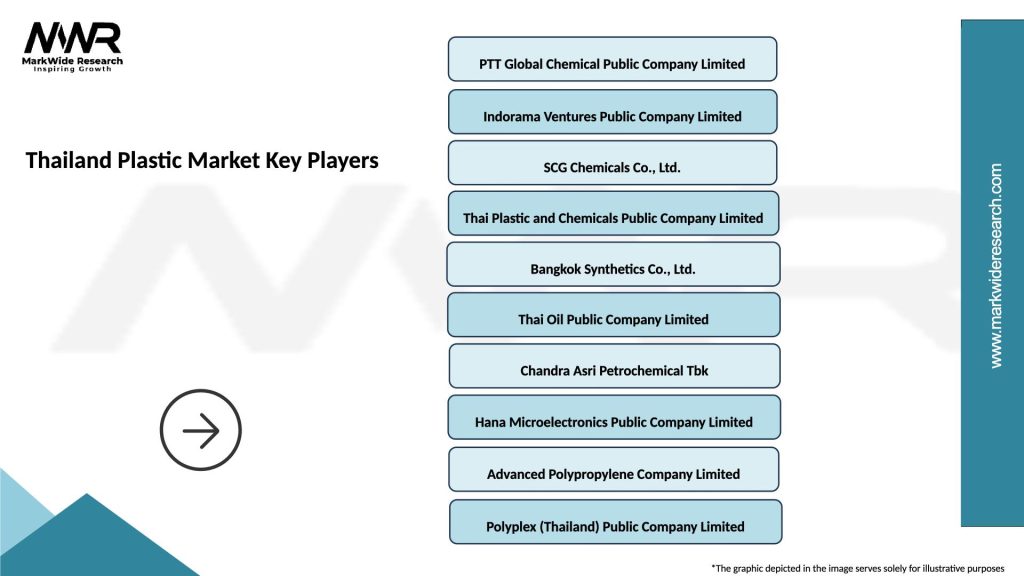

Market leadership in Thailand’s plastic industry features a diverse mix of multinational corporations, regional players, and specialized domestic companies. Competitive dynamics emphasize technological capability, operational efficiency, and customer service excellence. Major market participants include:

Strategic positioning varies among competitors, with some focusing on commodity plastics and high-volume production, while others emphasize specialty materials and value-added applications. Innovation capabilities and technology leadership increasingly differentiate market participants, particularly in advanced applications and sustainable materials development.

Market consolidation trends include strategic acquisitions, joint ventures, and partnerships aimed at expanding capabilities and market reach. Competitive advantages derive from factors including raw material access, production efficiency, technology capabilities, customer relationships, and geographic positioning.

Product-based segmentation of Thailand’s plastic market reveals diverse categories serving different applications and customer requirements. Market distribution across major plastic types demonstrates the industry’s comprehensive coverage of material needs:

By Plastic Type:

By Application Sector:

By End-User Industry:

Commodity plastics represent the largest market category, with polyethylene and polypropylene dominating production volumes and revenue generation. Market characteristics include high-volume production, competitive pricing, and established supply chains serving diverse applications. Approximately 68% of total production focuses on commodity grades, reflecting strong demand from packaging, construction, and consumer goods sectors.

Engineering plastics constitute a high-value category with specialized applications requiring superior performance characteristics. Growth potential remains strong driven by automotive lightweighting, electronics miniaturization, and industrial automation requirements. This segment commands premium pricing while requiring advanced technical capabilities and customer support services.

Sustainable plastics emerge as a rapidly growing category, including biodegradable materials, recycled content products, and bio-based alternatives. Market development responds to environmental regulations and consumer preferences for eco-friendly products. Investment in sustainable plastic technologies accelerates as companies position for future market requirements and competitive advantages.

Specialty applications create niche market opportunities with specific performance requirements and limited competition. Categories include medical-grade plastics, food-contact materials, flame-retardant compounds, and conductive plastics. These segments offer higher margins while requiring specialized knowledge, regulatory compliance, and quality assurance capabilities.

Value-added processing represents an important category where companies provide custom compounding, coloring, and modification services. Market trends favor integrated solutions combining material supply with technical services, creating stronger customer relationships and differentiated market positioning.

Manufacturers benefit from Thailand’s competitive advantages including cost-effective production, skilled workforce, and strategic market access. Operational efficiency improvements through advanced technologies and process optimization enhance profitability and market competitiveness. Access to regional supply chains and distribution networks supports business expansion and customer service capabilities.

Suppliers gain from stable demand patterns and long-term customer relationships in Thailand’s plastic market. Raw material providers benefit from integrated petrochemical infrastructure and established logistics networks. Technology suppliers find opportunities for equipment sales, upgrades, and service contracts supporting industry modernization and capacity expansion.

End-users receive advantages through reliable supply, competitive pricing, and continuous product innovation from Thailand’s plastic industry. Quality assurance and technical support services enhance customer satisfaction and application performance. Proximity to manufacturing facilities reduces transportation costs and delivery times for domestic customers.

Investors find attractive opportunities in Thailand’s plastic market through stable returns, growth potential, and government support for industrial development. Market diversification across applications and customer segments reduces investment risks while providing multiple growth avenues. Infrastructure development and regional integration create additional value creation opportunities.

Government stakeholders benefit from economic contributions including employment generation, export earnings, and tax revenues. Industrial development supports broader economic objectives while technology advancement enhances national competitiveness. Environmental initiatives in the plastic industry contribute to sustainability goals and international commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping Thailand’s plastic market, with increasing focus on recyclable materials, biodegradable alternatives, and circular economy principles. Companies invest heavily in sustainable technologies and processes to meet environmental regulations and customer expectations. Approximately 45% of manufacturers have implemented sustainability initiatives, with plans for expanded programs addressing waste reduction and resource efficiency.

Digital integration accelerates across the plastic industry, with smart manufacturing technologies, IoT sensors, and data analytics enhancing operational efficiency and quality control. Industry 4.0 adoption enables predictive maintenance, real-time monitoring, and automated process optimization. Advanced planning systems improve supply chain coordination and customer responsiveness.

Advanced materials development focuses on high-performance plastics with enhanced properties for demanding applications. Innovation areas include lightweight composites, conductive polymers, and bio-based alternatives. Research partnerships between companies and universities accelerate technology development and commercialization of new materials.

Regional market integration through ASEAN trade facilitation and infrastructure development creates new opportunities for market expansion and supply chain optimization. Cross-border collaboration increases among manufacturers, suppliers, and customers seeking regional solutions and cost efficiencies.

Customization trends drive demand for specialized solutions tailored to specific customer requirements and applications. Value-added services including technical support, custom compounding, and application development become increasingly important for competitive differentiation and customer retention.

Major capacity expansions by leading producers demonstrate confidence in Thailand’s plastic market growth prospects. Recent investments include new production lines for specialty plastics, recycling facilities, and technology upgrades enhancing operational efficiency. These developments strengthen Thailand’s position as a regional manufacturing hub while supporting domestic market growth.

Strategic partnerships between international companies and local manufacturers accelerate technology transfer and market development. Joint ventures focus on advanced materials, sustainable solutions, and regional market expansion. Collaboration agreements enable access to new technologies while leveraging local market knowledge and infrastructure advantages.

Sustainability initiatives gain momentum across the industry, with companies launching recycling programs, developing biodegradable alternatives, and implementing circular economy principles. Government support for environmental initiatives includes incentives for clean technology adoption and waste reduction programs. Industry associations promote best practices and coordinate sustainability efforts.

Technology acquisitions and licensing agreements enable Thai companies to access advanced manufacturing processes and specialty material capabilities. Innovation investments focus on digitalization, automation, and new product development supporting competitive positioning and market expansion.

Regulatory developments include updated environmental standards, safety requirements, and trade policies affecting industry operations. Policy initiatives promote sustainable development while maintaining industrial competitiveness through balanced regulatory approaches and stakeholder consultation processes.

Strategic recommendations for Thailand’s plastic market participants emphasize the importance of sustainability integration, technology advancement, and regional market development. MarkWide Research analysis indicates that companies prioritizing environmental responsibility and innovation capabilities will achieve superior long-term performance and market positioning.

Investment priorities should focus on sustainable technology development, advanced manufacturing capabilities, and digital transformation initiatives. Companies benefit from balanced approaches combining operational efficiency improvements with new product development and market expansion strategies. Partnerships with technology providers and research institutions accelerate capability development and competitive advantages.

Market positioning strategies should emphasize differentiation through specialized solutions, technical expertise, and customer service excellence. Value creation opportunities exist in high-performance materials, sustainable alternatives, and integrated solutions combining products with services. Regional expansion through ASEAN markets provides growth opportunities while diversifying market exposure.

Risk management approaches should address raw material price volatility, environmental compliance requirements, and competitive pressures. Diversification strategies across products, markets, and applications reduce dependency risks while providing multiple growth avenues. Supply chain resilience becomes increasingly important given global uncertainties and trade complexities.

Innovation focus should align with market trends including sustainability, digitalization, and advanced applications. Research and development investments in new materials, processes, and technologies support long-term competitiveness and market leadership. Collaboration with customers, suppliers, and research institutions enhances innovation effectiveness and commercialization success.

Long-term prospects for Thailand’s plastic market remain positive, supported by continued economic growth, industrial development, and regional integration. Market expansion is projected to continue at a steady pace, with growth rates of approximately 5.8% annually over the next five years. Demand drivers include urbanization, infrastructure development, and increasing consumer spending across various sectors.

Sustainability transformation will accelerate, with environmental considerations becoming central to product development, manufacturing processes, and business strategies. Circular economy principles will drive innovation in recycling technologies, biodegradable materials, and waste reduction initiatives. Companies successfully navigating this transformation will achieve competitive advantages and market leadership positions.

Technology advancement will continue reshaping the industry through digitalization, automation, and advanced materials development. Smart manufacturing capabilities will become standard requirements for competitive operations. Innovation in specialty plastics and high-performance materials will create new market opportunities and value creation potential.

Regional market integration through ASEAN development and infrastructure improvement will expand opportunities for Thai plastic manufacturers. Export growth potential remains strong, particularly in specialty applications and value-added products. Cross-border supply chain optimization will enhance efficiency and customer service capabilities.

Investment opportunities will focus on sustainable technologies, advanced manufacturing capabilities, and regional market expansion. MWR projections indicate that companies with strong sustainability credentials and innovation capabilities will outperform market averages. Government support for industrial development and environmental initiatives will continue providing favorable operating conditions for market participants.

Thailand’s plastic market represents a dynamic and evolving industry with strong fundamentals supporting continued growth and development. The market benefits from integrated infrastructure, strategic geographic positioning, and diversified demand patterns creating stability and expansion opportunities. Competitive advantages including cost-effective production, skilled workforce, and government support provide solid foundations for long-term success.

Sustainability transformation emerges as the defining trend shaping future market development, requiring strategic adaptation and investment in environmental solutions. Companies successfully integrating sustainability principles with operational excellence will achieve superior market positioning and customer relationships. Innovation capabilities in advanced materials, digital technologies, and sustainable solutions become critical success factors for market leadership.

Regional integration and export opportunities provide significant growth potential, while domestic market expansion supports balanced development strategies. Strategic partnerships, technology advancement, and customer-focused solutions will differentiate successful market participants. The industry’s evolution toward higher value applications and sustainable practices creates opportunities for enhanced profitability and competitive positioning in Thailand’s plastic market landscape.

What is Plastic?

Plastic refers to a wide range of synthetic or semi-synthetic materials that are used in various applications, including packaging, construction, and consumer goods. It is characterized by its malleability and ability to be molded into different shapes.

What are the key players in the Thailand Plastic Market?

Key players in the Thailand Plastic Market include PTT Global Chemical, SCG Chemicals, and Indorama Ventures, which are involved in the production and distribution of various plastic products. These companies contribute significantly to the market’s growth and innovation, among others.

What are the growth factors driving the Thailand Plastic Market?

The Thailand Plastic Market is driven by increasing demand in packaging, automotive, and construction sectors. Additionally, the rise in consumer goods and the push for lightweight materials are contributing to market expansion.

What challenges does the Thailand Plastic Market face?

The Thailand Plastic Market faces challenges such as environmental concerns regarding plastic waste and stringent regulations on plastic usage. These factors can hinder growth and require companies to innovate towards sustainable solutions.

What opportunities exist in the Thailand Plastic Market?

Opportunities in the Thailand Plastic Market include the development of biodegradable plastics and advancements in recycling technologies. The growing emphasis on sustainability presents avenues for innovation and new product development.

What trends are shaping the Thailand Plastic Market?

Trends in the Thailand Plastic Market include the increasing adoption of eco-friendly materials and the integration of smart technologies in plastic products. Additionally, the shift towards circular economy practices is influencing production and consumption patterns.

Thailand Plastic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Polyvinyl Chloride, Polystyrene |

| Application | Packaging, Automotive Components, Consumer Goods, Construction Materials |

| End User | Manufacturers, Retailers, Distributors, Exporters |

| Form | Films, Sheets, Bottles, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Plastic Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at