444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Thailand’s oil and gas upstream market plays a crucial role in the country’s energy sector. The term “upstream” refers to the exploration and production stages of the oil and gas industry. In Thailand, this sector encompasses activities such as surveying potential reserves, drilling wells, and extracting crude oil and natural gas from the earth’s subsurface. The upstream market is a key driver of economic growth, foreign investment, and energy security for the country.

Meaning

The Thailand oil and gas upstream market refers to the activities involved in the exploration and production of crude oil and natural gas reserves within the country’s territory and offshore areas. It includes the search for new reserves, drilling operations, and the extraction of hydrocarbons for further processing and distribution.

Executive Summary

The Thailand oil and gas upstream market has witnessed significant growth over the years, driven by the country’s abundant natural resources and favorable investment climate. The sector has attracted both domestic and international companies, contributing to the nation’s energy security and economic development. However, the market also faces challenges, including environmental concerns and fluctuating global oil prices. This report provides valuable insights into the key trends, drivers, restraints, opportunities, and future prospects of the Thailand oil and gas upstream market.

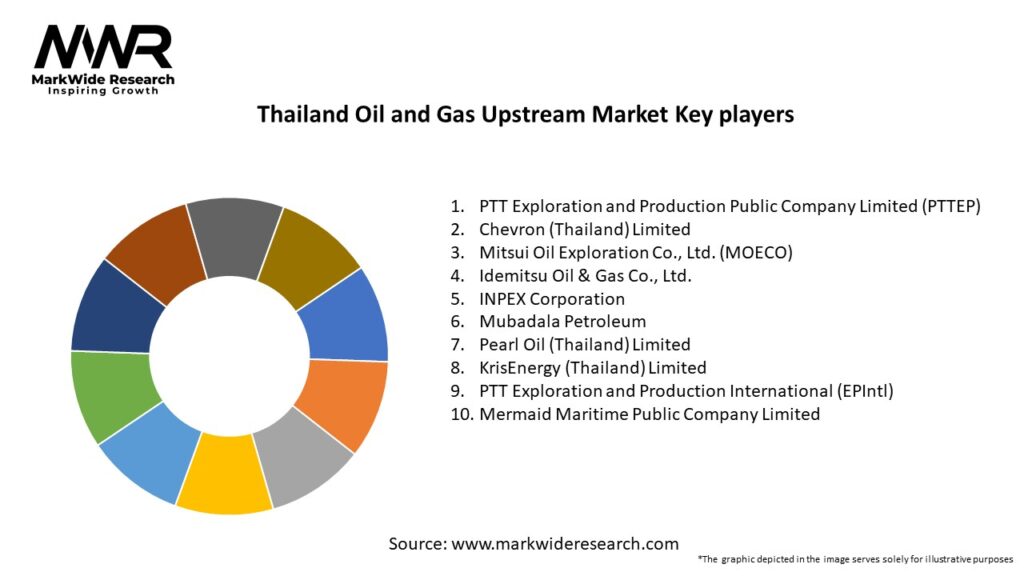

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

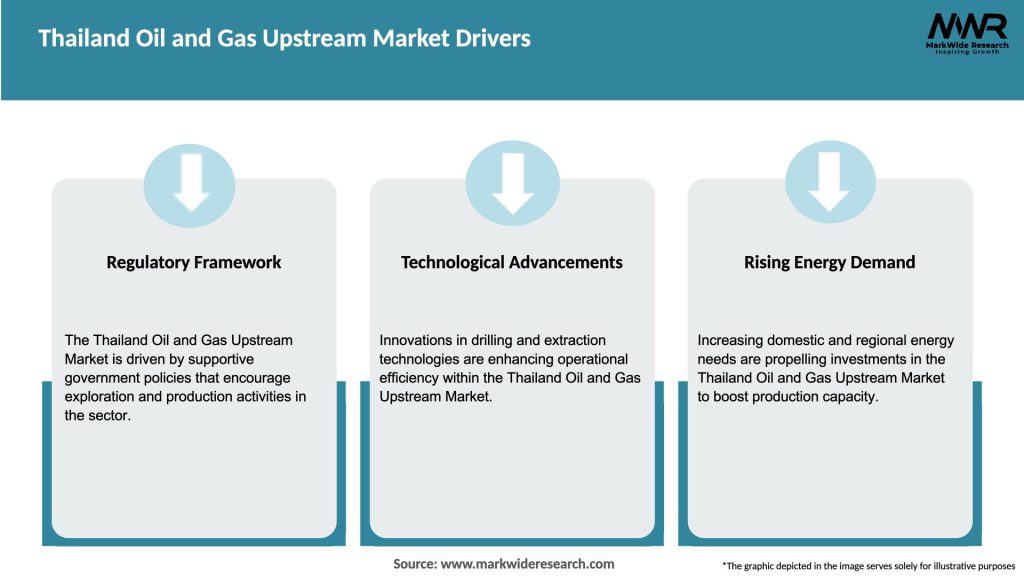

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Thailand oil and gas upstream market operates within a dynamic environment influenced by various factors, including government policies, global energy trends, technological advancements, and environmental concerns. The market dynamics are shaped by the interplay of supply and demand, investment patterns, geopolitical developments, and regulatory frameworks. Market participants must navigate these dynamics to maximize their operational efficiency, profitability, and long-term sustainability.

Regional Analysis

Thailand’s oil and gas upstream market encompasses both onshore and offshore activities. The country’s territorial waters and exclusive economic zone (EEZ) offer potential for exploration and production in the Gulf of Thailand, while onshore operations focus on various basins across the country. The market’s regional analysis involves assessing the geological characteristics, exploration history, production levels, infrastructure availability, and investment attractiveness of different regions within Thailand.

Competitive Landscape

Leading Companies in the Thailand Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

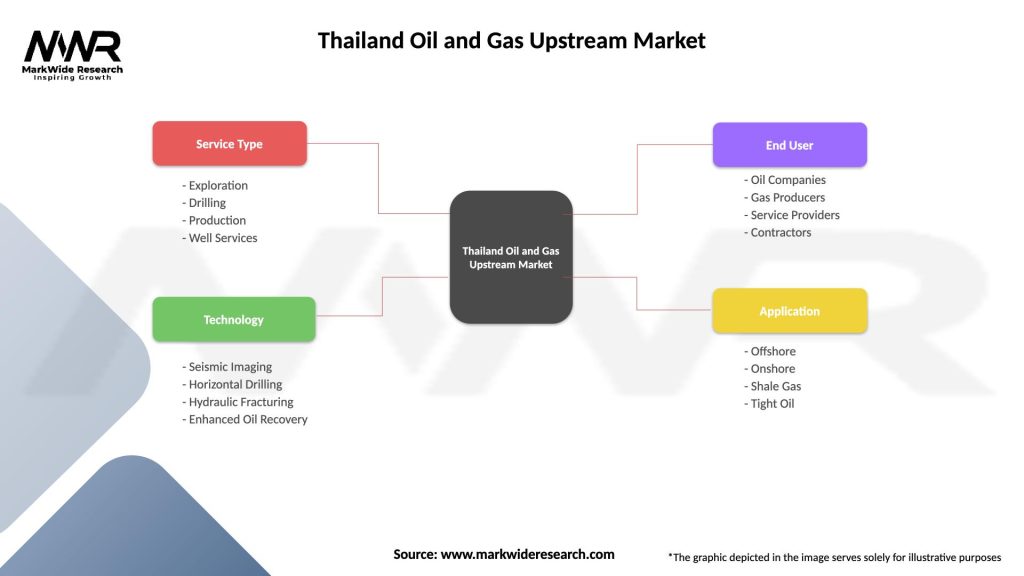

Segmentation

The Thailand oil and gas upstream market can be segmented based on various factors, including geographical regions, exploration blocks, production methods, and types of hydrocarbons. This segmentation provides a comprehensive understanding of the market dynamics, investment opportunities, and challenges associated with specific segments. It helps market participants tailor their strategies, optimize resource allocation, and identify niche markets within the broader upstream sector.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the Thailand oil and gas upstream market. The global economic slowdown and travel restrictions led to a decline in energy demand and a slump in oil prices. This affected investment decisions and exploration activities, as companies focused on cost-cutting measures and operational efficiency. However, the market demonstrated resilience, with the government implementing measures to support the industry and maintain stability. As the world recovers from the pandemic, the market is expected to gradually rebound, driven by pent-up energy demand and favorable investment conditions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Thailand oil and gas upstream market is positive, despite the challenges and uncertainties it faces. The market is expected to witness steady growth, driven by growing energy demand, favorable investment conditions, regional collaboration, and technological advancements. However, the sector must address environmental concerns, adapt to energy transition trends, and navigate geopolitical risks to ensure long-term sustainability and competitiveness. With proper planning, strategic partnerships, and investments in innovation, the Thailand oil and gas upstream market has the potential to contribute significantly to the country’s energy security and economic development.

Conclusion

The Thailand oil and gas upstream market is a vital component of the country’s energy sector, contributing to economic growth, energy security, and employment opportunities. The market offers substantial potential for both domestic and international companies, driven by abundant natural resources, favorable investment climate, and regional collaboration. However, the sector faces challenges such as fluctuating oil prices, environmental concerns, and geopolitical risks. To thrive in this dynamic market, industry participants should embrace technological advancements, diversify energy portfolios, strengthen sustainability practices, foster regional collaboration, and invest in talent development. With strategic planning and adaptability, the Thailand oil and gas upstream market can navigate the evolving energy landscape and secure a prosperous future.

What is Oil and Gas Upstream?

Oil and Gas Upstream refers to the exploration and production segment of the oil and gas industry, focusing on locating and extracting crude oil and natural gas from the earth. This includes activities such as drilling, well completion, and production operations.

What are the key players in the Thailand Oil and Gas Upstream Market?

Key players in the Thailand Oil and Gas Upstream Market include PTTEP, Chevron Thailand Exploration and Production, and Shell Thailand, among others. These companies are involved in various aspects of exploration, drilling, and production in the region.

What are the growth factors driving the Thailand Oil and Gas Upstream Market?

The growth of the Thailand Oil and Gas Upstream Market is driven by increasing energy demand, advancements in extraction technologies, and the discovery of new oil and gas reserves. Additionally, government policies supporting energy independence play a significant role.

What challenges does the Thailand Oil and Gas Upstream Market face?

The Thailand Oil and Gas Upstream Market faces challenges such as fluctuating oil prices, regulatory hurdles, and environmental concerns. These factors can impact investment decisions and operational costs for companies in the sector.

What opportunities exist in the Thailand Oil and Gas Upstream Market?

Opportunities in the Thailand Oil and Gas Upstream Market include the potential for offshore exploration, partnerships with international firms, and the adoption of innovative technologies. These factors can enhance production efficiency and resource recovery.

What trends are shaping the Thailand Oil and Gas Upstream Market?

Trends in the Thailand Oil and Gas Upstream Market include a shift towards digitalization, increased focus on sustainability, and the integration of renewable energy sources. Companies are also investing in advanced data analytics to optimize operations.

Thailand Oil and Gas Upstream Market

| Segmentation Details | Description |

|---|---|

| Service Type | Exploration, Drilling, Production, Well Services |

| Technology | Seismic Imaging, Horizontal Drilling, Hydraulic Fracturing, Enhanced Oil Recovery |

| End User | Oil Companies, Gas Producers, Service Providers, Contractors |

| Application | Offshore, Onshore, Shale Gas, Tight Oil |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Thailand Oil and Gas Upstream Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at