444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand insulin drugs and delivery devices market represents a critical healthcare segment experiencing unprecedented growth driven by rising diabetes prevalence and advancing medical technologies. Thailand’s healthcare landscape has witnessed significant transformation in diabetes management, with insulin therapy becoming increasingly sophisticated through innovative delivery mechanisms and pharmaceutical formulations. The market encompasses traditional insulin formulations, modern biosimilar alternatives, and cutting-edge delivery devices including smart pens, continuous glucose monitors, and automated insulin delivery systems.

Market dynamics indicate robust expansion with the sector growing at approximately 8.2% CAGR over recent years, reflecting Thailand’s commitment to addressing the diabetes epidemic through improved healthcare infrastructure and patient access programs. The integration of digital health technologies with traditional insulin delivery methods has created new opportunities for enhanced patient outcomes and treatment adherence. Healthcare providers across Thailand are increasingly adopting comprehensive diabetes management approaches that combine pharmaceutical interventions with advanced monitoring and delivery technologies.

Government initiatives supporting diabetes care accessibility have significantly influenced market development, with national health insurance schemes expanding coverage for insulin therapies and associated devices. The market benefits from Thailand’s strategic position as a regional healthcare hub, attracting international pharmaceutical companies and medical device manufacturers seeking to establish manufacturing and distribution operations in Southeast Asia.

The Thailand insulin drugs and delivery devices market refers to the comprehensive healthcare sector encompassing pharmaceutical insulin products, biosimilar alternatives, and medical devices designed for diabetes management within Thailand’s healthcare system. This market includes rapid-acting, long-acting, and intermediate-acting insulin formulations alongside sophisticated delivery mechanisms such as insulin pens, pumps, continuous glucose monitoring systems, and emerging smart delivery technologies.

Market scope extends beyond traditional pharmaceutical products to include integrated diabetes management solutions that combine medication delivery with digital health monitoring, patient education platforms, and healthcare provider support systems. The sector represents the convergence of pharmaceutical innovation, medical device technology, and healthcare service delivery specifically tailored to Thailand’s unique demographic and healthcare infrastructure requirements.

Thailand’s insulin market demonstrates exceptional growth potential driven by increasing diabetes prevalence, aging population demographics, and expanding healthcare accessibility initiatives. The market has evolved from basic insulin formulations to comprehensive diabetes management ecosystems incorporating advanced delivery devices, continuous monitoring systems, and integrated digital health solutions. Key market drivers include rising Type 1 and Type 2 diabetes incidence rates, government healthcare reforms, and increasing patient awareness regarding modern diabetes management approaches.

Competitive landscape features established international pharmaceutical companies alongside emerging local manufacturers developing biosimilar insulin products and innovative delivery devices. The market benefits from Thailand’s favorable regulatory environment for medical device approval and pharmaceutical manufacturing, attracting significant foreign investment in research and development facilities. Patient adoption rates for advanced insulin delivery systems have increased by approximately 12% annually, indicating strong market acceptance of innovative diabetes management technologies.

Future market trajectory points toward continued expansion driven by technological advancement, healthcare infrastructure development, and increasing integration of artificial intelligence in diabetes management solutions. The sector’s growth aligns with Thailand’s broader healthcare modernization objectives and commitment to becoming a regional medical technology hub.

Market intelligence reveals several critical insights shaping Thailand’s insulin drugs and delivery devices sector:

Primary market drivers propelling Thailand’s insulin drugs and delivery devices sector include escalating diabetes prevalence, demographic transitions, and healthcare system modernization initiatives. The country’s diabetes epidemic reflects global trends while presenting unique regional characteristics that influence market development patterns. Lifestyle factors including urbanization, dietary changes, and reduced physical activity contribute to increasing Type 2 diabetes incidence across all age groups.

Government healthcare policies significantly impact market growth through expanded insurance coverage, subsidized medication programs, and infrastructure development investments. Thailand’s Universal Health Coverage scheme has improved insulin accessibility for millions of patients, creating sustainable demand for both pharmaceutical products and delivery devices. Healthcare infrastructure improvements include specialized diabetes clinics, enhanced diagnostic capabilities, and integrated care coordination systems.

Technological advancement drives market evolution through innovative insulin formulations, smart delivery devices, and integrated monitoring systems. Patient demand for convenient, discrete, and effective diabetes management solutions encourages continuous product innovation and market expansion. Healthcare provider education initiatives improve clinical expertise and patient support quality, contributing to better treatment outcomes and increased therapy adoption rates.

Market challenges affecting Thailand’s insulin sector include cost considerations, regulatory complexities, and healthcare infrastructure limitations in rural areas. Despite government insurance coverage improvements, out-of-pocket expenses for advanced insulin delivery devices remain significant barriers for many patients, particularly those requiring specialized monitoring equipment or premium insulin formulations.

Regulatory compliance requirements for medical device approval and pharmaceutical registration can delay market entry for innovative products, affecting competitive dynamics and patient access to cutting-edge technologies. The complexity of Thailand’s healthcare regulatory framework requires substantial investment in compliance infrastructure and local expertise development. Healthcare provider training requirements for advanced insulin delivery systems create implementation challenges in resource-constrained healthcare settings.

Supply chain vulnerabilities including import dependency for specialized components and raw materials expose the market to international trade disruptions and currency fluctuations. Rural healthcare access limitations restrict market penetration for advanced diabetes management solutions, creating disparities in treatment quality between urban and rural populations. Patient education gaps regarding modern insulin delivery methods can limit adoption rates and clinical effectiveness.

Significant opportunities exist within Thailand’s insulin market through technological innovation, market expansion, and healthcare system integration initiatives. The development of smart insulin delivery systems incorporating artificial intelligence and machine learning capabilities presents substantial growth potential, particularly for companies investing in research and development partnerships with Thai healthcare institutions.

Regional expansion opportunities leverage Thailand’s strategic position as a Southeast Asian healthcare hub, enabling companies to establish manufacturing and distribution operations serving broader regional markets. The country’s favorable business environment, skilled workforce, and established pharmaceutical infrastructure create competitive advantages for international companies seeking regional market entry. Biosimilar development represents significant opportunity for local pharmaceutical companies to reduce import dependency while providing cost-effective insulin alternatives.

Digital health integration offers transformative opportunities through telemedicine platforms, mobile health applications, and remote patient monitoring systems that complement traditional insulin delivery methods. Public-private partnerships with government healthcare agencies can accelerate market development while addressing public health objectives. The growing medical tourism sector creates additional demand for advanced diabetes management services and technologies.

Market dynamics within Thailand’s insulin sector reflect complex interactions between demographic trends, technological advancement, regulatory evolution, and healthcare system transformation. The interplay between increasing diabetes prevalence and improving treatment accessibility creates sustained growth momentum while presenting unique challenges for market participants. Competitive pressures drive continuous innovation in both pharmaceutical formulations and delivery device technologies.

Healthcare system evolution toward integrated diabetes management approaches influences product development priorities and market positioning strategies. The shift from episodic treatment models to comprehensive care coordination creates opportunities for companies offering holistic diabetes management solutions. Patient empowerment trends encourage development of user-friendly devices and educational resources that support self-management capabilities.

Economic factors including healthcare spending patterns, insurance coverage evolution, and cost-effectiveness considerations significantly influence market dynamics. The balance between innovation investment and affordability requirements shapes product development strategies and market entry approaches. Regulatory harmonization efforts with international standards facilitate market access while ensuring patient safety and product quality standards.

Comprehensive research methodology employed in analyzing Thailand’s insulin drugs and delivery devices market incorporates multiple data collection approaches, analytical frameworks, and validation techniques to ensure accuracy and reliability. Primary research includes extensive interviews with healthcare providers, diabetes specialists, pharmaceutical executives, medical device manufacturers, and patient advocacy groups to gather firsthand insights regarding market trends, challenges, and opportunities.

Secondary research encompasses analysis of government healthcare statistics, pharmaceutical industry reports, medical device registration data, and academic publications focusing on diabetes management in Thailand. MarkWide Research analytical frameworks incorporate quantitative modeling techniques, trend analysis, and comparative assessments to provide comprehensive market intelligence and strategic insights.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical verification methods to ensure research accuracy and reliability. Market sizing methodologies incorporate bottom-up and top-down approaches, considering healthcare infrastructure capacity, patient population dynamics, and treatment adoption patterns. Forecasting models integrate demographic projections, healthcare policy impacts, and technological advancement timelines to provide robust market outlook assessments.

Regional market distribution across Thailand reveals significant variations in diabetes prevalence, healthcare infrastructure, and treatment accessibility that influence insulin market dynamics. Bangkok metropolitan area accounts for approximately 35% of market share, reflecting concentrated healthcare facilities, higher income levels, and greater access to advanced diabetes management technologies. The capital region benefits from specialized diabetes centers, research institutions, and comprehensive insurance coverage programs.

Central Thailand represents substantial market opportunity with growing urban populations and expanding healthcare infrastructure development. Industrial provinces surrounding Bangkok demonstrate increasing diabetes incidence rates correlated with lifestyle changes and economic development. Northern regions including Chiang Mai and surrounding provinces show growing market penetration for insulin delivery devices, supported by regional medical centers and healthcare accessibility improvements.

Southern Thailand presents unique market characteristics influenced by tourism industry development and cross-border healthcare services. The region’s strategic location facilitates medical device distribution and pharmaceutical supply chain operations. Northeastern provinces represent emerging market opportunities with government healthcare infrastructure investments and rural health program expansion creating improved access to diabetes management services.

Competitive environment within Thailand’s insulin drugs and delivery devices market features established international pharmaceutical companies, emerging local manufacturers, and specialized medical device companies competing across multiple market segments. Market leadership positions reflect companies’ ability to navigate regulatory requirements, establish distribution networks, and develop products suited to local market needs.

Key market participants include:

Competitive strategies focus on product innovation, market access improvement, healthcare provider partnerships, and patient education program development. Companies increasingly emphasize integrated diabetes management solutions combining pharmaceutical products with digital health technologies and comprehensive patient support services.

Market segmentation analysis reveals distinct categories within Thailand’s insulin drugs and delivery devices sector, each presenting unique growth characteristics and competitive dynamics. Product segmentation encompasses pharmaceutical insulin products, delivery devices, and integrated diabetes management systems serving diverse patient populations and clinical requirements.

By Insulin Type:

By Delivery Device:

Pharmaceutical insulin products represent the core market segment with established demand patterns and evolving formulation technologies. Rapid-acting insulin categories demonstrate strong growth driven by lifestyle compatibility and improved glycemic control outcomes. These formulations align with modern diabetes management approaches emphasizing flexible dosing schedules and enhanced patient quality of life.

Long-acting insulin segments benefit from once-daily dosing convenience and consistent glucose control profiles that appeal to both patients and healthcare providers. The category’s growth reflects increasing adoption of basal-bolus therapy regimens and improved patient adherence rates. Biosimilar insulin products gain market traction through cost advantages and local manufacturing capabilities that reduce import dependency.

Delivery device categories show rapid innovation and adoption rates, particularly for smart insulin pens and continuous glucose monitoring systems. Insulin pen devices maintain market leadership through convenience, accuracy, and patient preference factors. Advanced delivery systems incorporating connectivity features and data management capabilities represent high-growth segments attracting significant investment and development resources.

Industry participants in Thailand’s insulin drugs and delivery devices market benefit from multiple value creation opportunities and strategic advantages. Pharmaceutical companies gain access to growing patient populations, favorable regulatory environments, and regional manufacturing opportunities that support both local market development and export capabilities to neighboring countries.

Medical device manufacturers benefit from Thailand’s position as a regional healthcare hub with established distribution networks, skilled manufacturing workforce, and government support for medical technology development. The market offers opportunities for local partnership development, technology transfer initiatives, and cost-effective production operations serving broader Southeast Asian markets.

Healthcare providers benefit from expanded treatment options, improved patient outcomes, and enhanced clinical capabilities through access to advanced insulin delivery technologies and comprehensive diabetes management solutions. Patients gain access to innovative therapies, improved quality of life, and better long-term health outcomes through expanded insurance coverage and healthcare accessibility improvements.

Government stakeholders benefit from reduced healthcare costs through improved diabetes management, decreased complications, and enhanced population health outcomes. The sector’s development supports economic objectives including healthcare industry growth, technology transfer, and regional competitiveness enhancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend shaping Thailand’s insulin market through integration of pharmaceutical products with digital health technologies, artificial intelligence, and data analytics capabilities. Smart insulin delivery systems incorporating connectivity features, dose tracking, and predictive algorithms gain increasing market acceptance as patients and healthcare providers recognize their clinical and convenience benefits.

Personalized diabetes management trends drive development of customized insulin formulations, individualized delivery protocols, and patient-specific monitoring systems. This approach reflects growing understanding of diabetes heterogeneity and the need for tailored treatment strategies that optimize clinical outcomes while minimizing side effects and lifestyle disruptions.

Biosimilar insulin adoption accelerates as local manufacturing capabilities improve and cost pressures increase throughout Thailand’s healthcare system. This trend supports healthcare accessibility objectives while creating opportunities for domestic pharmaceutical companies to compete with established international brands. Integrated care models combining insulin therapy with comprehensive diabetes management services, patient education, and lifestyle intervention programs become increasingly prevalent.

Digital health integration transforms traditional insulin delivery through mobile applications, telemedicine platforms, and remote monitoring systems that enhance patient engagement and clinical oversight. These technologies support improved treatment adherence, better glycemic control, and reduced healthcare costs through prevention of diabetes complications.

Recent industry developments within Thailand’s insulin drugs and delivery devices market reflect accelerating innovation, regulatory evolution, and market expansion initiatives. Regulatory approvals for next-generation insulin formulations and smart delivery devices have expanded treatment options while maintaining safety and efficacy standards. Thailand’s medical device registration processes have become more streamlined, facilitating faster market entry for innovative products.

Manufacturing investments by international pharmaceutical companies establish local production capabilities for insulin products and delivery devices, reducing costs and improving supply chain reliability. These developments support Thailand’s objectives of becoming a regional pharmaceutical manufacturing hub while providing economic benefits through job creation and technology transfer. Research partnerships between international companies and Thai healthcare institutions advance clinical research capabilities and product development expertise.

Healthcare infrastructure improvements include establishment of specialized diabetes centers, expansion of insurance coverage for advanced delivery devices, and implementation of comprehensive diabetes management programs. MWR analysis indicates that these developments significantly enhance market accessibility and patient outcomes while creating sustainable growth foundations for industry participants.

Strategic recommendations for market participants in Thailand’s insulin drugs and delivery devices sector emphasize the importance of local market adaptation, technology integration, and comprehensive patient support program development. Companies should prioritize development of cost-effective solutions that balance innovation with affordability requirements, particularly for delivery devices and monitoring systems that may not be fully covered by insurance programs.

Market entry strategies should emphasize partnership development with local healthcare providers, distribution networks, and government agencies to ensure effective market penetration and sustainable growth. Investment priorities should focus on digital health integration capabilities, patient education programs, and healthcare provider training initiatives that support successful product adoption and clinical outcomes improvement.

Product development strategies should consider Thailand’s unique demographic characteristics, healthcare infrastructure limitations, and cultural factors that influence diabetes management approaches. Regulatory compliance preparation and local expertise development are essential for successful market participation and long-term competitive positioning. Companies should also consider regional expansion opportunities leveraging Thailand’s strategic position and established healthcare infrastructure.

Future market trajectory for Thailand’s insulin drugs and delivery devices sector points toward sustained growth driven by demographic trends, technological advancement, and healthcare system evolution. Market expansion is projected to continue at approximately 8-10% annual growth rates over the next five years, supported by increasing diabetes prevalence, aging population demographics, and improving healthcare accessibility.

Technological innovation will increasingly define competitive advantages through smart insulin delivery systems, artificial intelligence integration, and personalized diabetes management solutions. MarkWide Research projects that connected insulin devices and digital health platforms will represent significant market segments, with adoption rates exceeding 25% of eligible patients within the next decade.

Market consolidation trends may emerge as smaller companies seek partnerships with larger pharmaceutical and medical device manufacturers to access distribution networks and regulatory expertise. Biosimilar insulin products are expected to capture increasing market share, potentially reaching 40% of total insulin consumption as local manufacturing capabilities mature and cost pressures intensify.

Regional integration opportunities will expand as Thailand’s role as a Southeast Asian healthcare hub strengthens, creating export opportunities for locally manufactured insulin products and delivery devices. The market’s evolution toward integrated diabetes management ecosystems will create new business models and value creation opportunities for innovative companies.

Thailand’s insulin drugs and delivery devices market represents a dynamic and rapidly evolving healthcare sector characterized by significant growth potential, technological innovation, and expanding patient access opportunities. The market’s development reflects broader trends in diabetes management, healthcare system modernization, and Thailand’s emergence as a regional medical technology hub. Key success factors for market participants include local market adaptation, technology integration, comprehensive patient support, and strategic partnership development.

Market outlook remains highly positive, supported by increasing diabetes prevalence, government healthcare initiatives, and continuous technological advancement in insulin delivery systems and monitoring technologies. The sector’s evolution toward integrated diabetes management solutions creates opportunities for companies offering comprehensive patient care approaches that combine pharmaceutical products with digital health technologies and educational resources.

Strategic positioning within this market requires understanding of local healthcare dynamics, regulatory requirements, and patient needs while maintaining focus on innovation, affordability, and clinical effectiveness. Companies that successfully navigate these requirements while contributing to Thailand’s healthcare objectives will be well-positioned to capture significant value from this growing and strategically important market segment.

What is Insulin Drugs And Delivery Devices?

Insulin Drugs And Delivery Devices refer to the medications and tools used to manage diabetes by delivering insulin to patients. This includes various forms of insulin, such as rapid-acting and long-acting types, as well as delivery devices like syringes, pens, and pumps.

What are the key players in the Thailand Insulin Drugs And Delivery Devices Market?

Key players in the Thailand Insulin Drugs And Delivery Devices Market include Sanofi, Novo Nordisk, and Eli Lilly, which are known for their innovative insulin formulations and delivery technologies, among others.

What are the growth factors driving the Thailand Insulin Drugs And Delivery Devices Market?

The growth of the Thailand Insulin Drugs And Delivery Devices Market is driven by the increasing prevalence of diabetes, advancements in insulin delivery technologies, and rising awareness about diabetes management among patients.

What challenges does the Thailand Insulin Drugs And Delivery Devices Market face?

Challenges in the Thailand Insulin Drugs And Delivery Devices Market include high costs of advanced delivery devices, regulatory hurdles for new products, and the need for patient education on proper insulin usage.

What opportunities exist in the Thailand Insulin Drugs And Delivery Devices Market?

Opportunities in the Thailand Insulin Drugs And Delivery Devices Market include the development of smart insulin delivery systems, increasing investment in diabetes care, and potential collaborations between pharmaceutical companies and technology firms.

What trends are shaping the Thailand Insulin Drugs And Delivery Devices Market?

Trends in the Thailand Insulin Drugs And Delivery Devices Market include the rise of personalized medicine, the integration of digital health solutions for diabetes management, and the growing demand for biosimilar insulin products.

Thailand Insulin Drugs And Delivery Devices Market

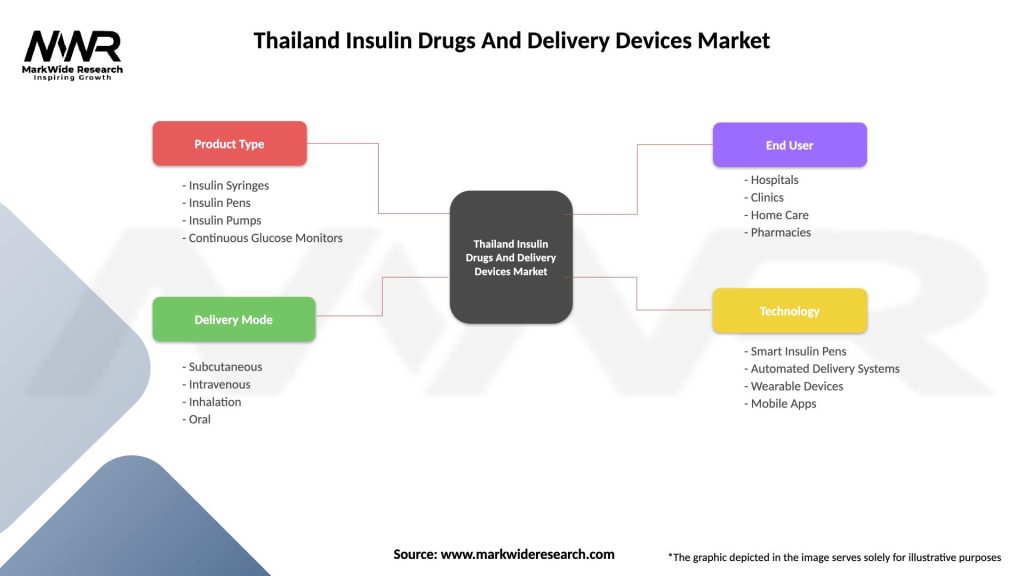

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Syringes, Insulin Pens, Insulin Pumps, Continuous Glucose Monitors |

| Delivery Mode | Subcutaneous, Intravenous, Inhalation, Oral |

| End User | Hospitals, Clinics, Home Care, Pharmacies |

| Technology | Smart Insulin Pens, Automated Delivery Systems, Wearable Devices, Mobile Apps |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Insulin Drugs And Delivery Devices Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at