444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand hospitality industry market stands as one of Southeast Asia’s most dynamic and rapidly evolving sectors, driven by the country’s strategic position as a premier tourist destination and business hub. Thailand’s hospitality sector encompasses a comprehensive range of services including luxury resorts, boutique hotels, business accommodations, food and beverage establishments, and integrated entertainment complexes that cater to both domestic and international visitors.

Market dynamics indicate robust growth potential, with the industry experiencing a compound annual growth rate (CAGR) of 8.2% over the past five years. The sector benefits from Thailand’s reputation as the “Land of Smiles,” offering world-class service standards, cultural authenticity, and diverse hospitality experiences ranging from beachfront luxury resorts to urban business hotels and eco-friendly accommodations.

Digital transformation has become a cornerstone of the industry’s evolution, with approximately 73% of hospitality establishments implementing advanced booking systems, mobile check-in services, and personalized guest experience platforms. The integration of sustainable practices and eco-tourism initiatives has gained significant momentum, positioning Thailand as a leader in responsible hospitality development across the Asia-Pacific region.

The Thailand hospitality industry market refers to the comprehensive ecosystem of businesses and services dedicated to providing accommodation, dining, entertainment, and related experiences to travelers and guests within Thailand’s borders. This market encompasses traditional hotels, resorts, serviced apartments, restaurants, bars, event venues, and emerging hospitality concepts that collectively contribute to the country’s tourism and business travel infrastructure.

Hospitality services in Thailand extend beyond basic accommodation to include integrated experiences that showcase the country’s rich cultural heritage, natural beauty, and renowned service excellence. The market includes luxury international hotel chains, boutique properties, budget accommodations, food and beverage operations, spa and wellness centers, and specialized tourism services that cater to diverse visitor segments and preferences.

Market participants range from global hospitality giants to local family-owned establishments, creating a diverse competitive landscape that offers varied price points, service levels, and authentic experiences. The industry plays a crucial role in Thailand’s economic development, employment generation, and international reputation as a world-class destination for leisure and business travel.

Thailand’s hospitality industry demonstrates remarkable resilience and adaptability, positioning itself as a cornerstone of the nation’s economic growth strategy. The market has successfully navigated global challenges while maintaining its competitive edge through innovation, service excellence, and strategic diversification across multiple hospitality segments.

Key performance indicators reveal strong recovery momentum, with occupancy rates reaching 68% across major destinations and revenue per available room showing consistent improvement. The industry’s focus on sustainable tourism practices has attracted environmentally conscious travelers, with 45% of properties implementing green certification programs and eco-friendly operational standards.

Strategic initiatives include enhanced digital infrastructure, workforce development programs, and collaborative partnerships between government agencies and private sector stakeholders. The market benefits from Thailand’s visa facilitation policies, improved transportation connectivity, and ongoing infrastructure investments that support long-term growth objectives and international competitiveness.

Future prospects remain optimistic, with industry leaders projecting sustained growth driven by emerging market segments, technological innovation, and Thailand’s strengthening position as a regional business and leisure hub. The integration of artificial intelligence, contactless services, and personalized guest experiences continues to differentiate Thai hospitality offerings in the global marketplace.

Market intelligence reveals several critical insights that define Thailand’s hospitality landscape and future trajectory:

Tourism recovery momentum serves as the primary catalyst for Thailand’s hospitality industry growth, supported by government initiatives to restore international visitor confidence and streamline travel procedures. The country’s strategic marketing campaigns and destination branding efforts have successfully repositioned Thailand as a safe, welcoming, and diverse travel destination.

Infrastructure development continues to enhance accessibility and connectivity across key tourism regions. Major airport expansions, high-speed rail projects, and improved road networks facilitate easier movement between destinations, encouraging longer stays and multi-destination itineraries that benefit the broader hospitality ecosystem.

Digital transformation initiatives have revolutionized guest experiences and operational efficiency. Hotels and resorts are investing heavily in contactless technologies, mobile applications, and data analytics platforms that enable personalized service delivery and streamlined operations. These technological advances attract tech-savvy travelers and improve overall service quality.

Sustainable tourism practices have become increasingly important as environmentally conscious travelers seek responsible hospitality options. Properties implementing green initiatives, local community partnerships, and conservation programs are experiencing higher demand and premium pricing opportunities, driving industry-wide adoption of sustainable practices.

Government support measures including tax incentives, infrastructure investments, and promotional campaigns provide substantial backing for industry growth. Policy initiatives focused on visa facilitation, tourism promotion, and hospitality workforce development create favorable operating conditions for both domestic and international operators.

Labor shortage challenges continue to impact the hospitality industry’s ability to maintain service standards and expand operations. Skilled workforce availability remains constrained, particularly in specialized roles such as culinary arts, guest relations, and hospitality management, leading to increased recruitment and training costs.

Rising operational costs present ongoing challenges for hospitality operators, particularly smaller establishments with limited economies of scale. Energy expenses, food and beverage costs, and regulatory compliance requirements have increased significantly, pressuring profit margins and requiring strategic cost management initiatives.

Economic uncertainty in key source markets affects travel demand patterns and booking behaviors. Currency fluctuations, inflation concerns, and changing consumer spending priorities influence international visitor arrivals and domestic travel patterns, creating revenue volatility for hospitality operators.

Regulatory complexity and compliance requirements add administrative burden and operational costs for hospitality businesses. Environmental regulations, safety standards, and licensing procedures require significant resources and expertise, particularly challenging for smaller operators with limited administrative capabilities.

Competition intensity from alternative accommodation platforms and new market entrants creates pricing pressure and market share challenges. The proliferation of vacation rentals, boutique properties, and innovative hospitality concepts requires established operators to continuously differentiate their offerings and value propositions.

Emerging market segments present significant growth opportunities for Thailand’s hospitality industry. Medical tourism, wellness retreats, and educational travel are expanding rapidly, offering operators chances to develop specialized services and capture higher-value guest segments with extended stay patterns and premium service requirements.

Technology integration opportunities enable hospitality operators to enhance guest experiences while improving operational efficiency. Artificial intelligence, Internet of Things (IoT) devices, and blockchain technologies offer innovative solutions for personalized service delivery, energy management, and secure transaction processing.

Sustainable tourism development creates opportunities for properties to differentiate themselves through environmental stewardship and community engagement. Eco-friendly accommodations, carbon-neutral operations, and local cultural preservation initiatives attract conscious travelers willing to pay premium rates for responsible hospitality experiences.

Regional expansion potential exists in secondary and tertiary destinations across Thailand. Developing hospitality infrastructure in emerging locations offers first-mover advantages and opportunities to capture growing domestic and international interest in authentic, off-the-beaten-path experiences.

Partnership and collaboration opportunities with technology providers, local communities, and government agencies can create innovative hospitality concepts and operational efficiencies. Strategic alliances enable resource sharing, market access, and collaborative marketing initiatives that benefit all stakeholders.

Supply and demand equilibrium in Thailand’s hospitality market reflects the complex interplay between visitor arrivals, accommodation capacity, and seasonal variations. The market demonstrates strong adaptability to changing demand patterns, with operators adjusting pricing strategies, service offerings, and capacity utilization to optimize revenue performance.

Competitive dynamics continue to evolve as international hotel chains expand their presence while local operators strengthen their market positions through unique value propositions and cultural authenticity. This competition drives innovation, service quality improvements, and market differentiation strategies that ultimately benefit consumers.

Pricing mechanisms reflect sophisticated revenue management practices that consider seasonal demand, special events, and market conditions. Dynamic pricing strategies enable operators to maximize revenue while maintaining competitive positioning across different market segments and booking channels.

Operational efficiency initiatives focus on cost optimization, technology integration, and workforce productivity improvements. Properties are implementing energy-efficient systems, automated processes, and data-driven decision-making tools that reduce operating expenses while maintaining service quality standards.

Market consolidation trends indicate ongoing industry maturation, with larger operators acquiring smaller properties to achieve economies of scale and market coverage. This consolidation creates opportunities for standardization, brand development, and operational excellence across property portfolios.

Comprehensive market analysis for Thailand’s hospitality industry employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research includes extensive interviews with industry executives, government officials, and hospitality professionals across various market segments and geographic regions.

Data collection processes incorporate both quantitative and qualitative research approaches. Statistical analysis of occupancy rates, revenue performance, and market trends provides measurable insights, while qualitative interviews and focus groups reveal underlying market dynamics, consumer preferences, and strategic considerations.

Industry surveys conducted among hospitality operators, travel agencies, and tourism boards provide firsthand perspectives on market conditions, challenges, and opportunities. These surveys capture real-time market sentiment and operational experiences that inform strategic recommendations and market projections.

Secondary research integration includes analysis of government tourism statistics, industry reports, and academic studies that provide historical context and comparative analysis. This comprehensive approach ensures research findings reflect both current market realities and long-term industry trends.

Validation procedures involve cross-referencing multiple data sources, expert consultations, and peer review processes to ensure research accuracy and reliability. Continuous monitoring and updates maintain research relevance and reflect evolving market conditions and industry developments.

Bangkok metropolitan area dominates Thailand’s hospitality landscape, accounting for approximately 40% of total industry revenue and serving as the primary gateway for international business and leisure travelers. The capital city offers diverse accommodation options from luxury international hotels to boutique properties and budget-friendly establishments.

Southern Thailand regions including Phuket, Koh Samui, and Krabi represent the country’s premier beach and resort destinations. These areas contribute significantly to luxury hospitality revenue, with resort properties achieving 15% higher average daily rates compared to urban accommodations due to their unique locations and comprehensive amenities.

Northern Thailand destinations such as Chiang Mai and Chiang Rai have emerged as cultural and adventure tourism hubs. The region’s hospitality sector focuses on authentic experiences, eco-tourism, and cultural immersion programs that attract travelers seeking unique and meaningful experiences beyond traditional beach destinations.

Eastern Thailand development benefits from proximity to Cambodia and Vietnam, creating opportunities for multi-country tourism circuits. The region’s hospitality infrastructure is expanding to accommodate growing regional tourism and business travel, with new property development increasing by 22% annually.

Central Thailand regions offer historical and cultural attractions that support specialized hospitality segments. Properties in these areas focus on heritage tourism, cultural experiences, and educational travel programs that differentiate them from beach and urban destinations while contributing to regional economic development.

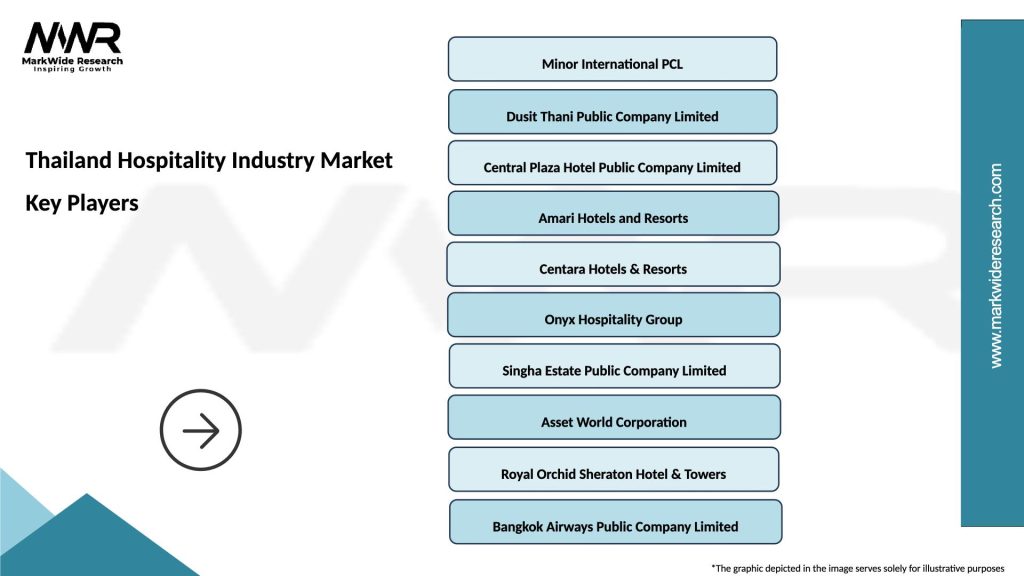

Market leadership in Thailand’s hospitality industry reflects a diverse mix of international hotel chains, regional operators, and local hospitality companies that compete across multiple segments and price points:

Competitive strategies emphasize brand differentiation, service excellence, and market-specific adaptations that cater to local preferences while maintaining international standards. Operators are investing in technology upgrades, sustainability initiatives, and workforce development programs to maintain competitive advantages.

By Property Type:

By Market Segment:

By Geographic Region:

Luxury hospitality segment demonstrates exceptional resilience and growth potential, with properties achieving premium pricing power of 25% above market averages. This category benefits from Thailand’s reputation for service excellence and unique cultural experiences that justify higher rates and longer stays among affluent travelers.

Business hotel category shows strong recovery momentum driven by returning corporate travel and MICE activities. Properties in this segment are investing heavily in technology infrastructure, meeting facilities, and health safety protocols to meet evolving business traveler expectations and requirements.

Resort and leisure properties continue to lead market recovery with innovative experience packages, wellness programs, and sustainable tourism initiatives. These properties successfully command premium rates through comprehensive amenities, unique locations, and personalized service offerings that create memorable guest experiences.

Budget accommodation segment serves growing domestic tourism and cost-conscious international travelers. This category focuses on operational efficiency, strategic locations, and essential amenities while maintaining competitive pricing structures that appeal to value-seeking guests.

Boutique and specialty properties carve out niche market positions through unique design concepts, local cultural integration, and personalized experiences. These establishments often achieve higher guest satisfaction scores and loyalty rates despite smaller scale operations and limited amenities compared to larger properties.

Hotel operators benefit from Thailand’s strong destination brand, government support initiatives, and diverse market segments that provide multiple revenue streams and risk diversification opportunities. The country’s established tourism infrastructure and service culture create favorable operating conditions for hospitality businesses.

International investors find attractive opportunities in Thailand’s hospitality market through stable political environment, growing middle class, and strategic geographic location. The market offers various investment vehicles including direct property ownership, management contracts, and franchise opportunities across different risk-return profiles.

Local communities gain significant economic benefits through employment opportunities, local supplier partnerships, and cultural preservation initiatives supported by hospitality operators. The industry’s focus on sustainable tourism creates long-term value for communities while preserving natural and cultural resources.

Government stakeholders achieve economic development objectives through hospitality industry growth, including foreign exchange earnings, tax revenue generation, and employment creation. The sector’s contribution to Thailand’s international reputation and soft power projection provides additional strategic benefits.

Technology providers find expanding opportunities to serve hospitality operators with innovative solutions for guest experience enhancement, operational efficiency, and revenue optimization. The industry’s digital transformation creates sustained demand for technology products and services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable hospitality practices have become mainstream requirements rather than optional initiatives. Properties are implementing comprehensive environmental programs, local community partnerships, and resource conservation measures that appeal to environmentally conscious travelers while reducing operational costs and regulatory compliance risks.

Technology-driven personalization enables hospitality operators to deliver customized experiences based on guest preferences, historical data, and real-time behavior patterns. Artificial intelligence and machine learning applications enhance service delivery while improving operational efficiency and revenue optimization capabilities.

Wellness tourism integration reflects growing traveler interest in health and well-being experiences. Hotels and resorts are incorporating spa services, fitness facilities, healthy dining options, and mindfulness programs that cater to guests seeking holistic travel experiences beyond traditional leisure activities.

Contactless service delivery has evolved from pandemic necessity to permanent operational enhancement. Mobile check-in, digital room keys, contactless payments, and virtual concierge services provide convenience and safety while reducing operational costs and improving guest satisfaction scores.

Local experience emphasis drives hospitality operators to partner with local communities, artisans, and cultural organizations to provide authentic experiences that differentiate their properties. These initiatives support community development while creating unique value propositions that attract experience-seeking travelers.

Major hotel chain expansions continue across Thailand’s secondary and tertiary markets, with international operators recognizing growth opportunities beyond traditional primary destinations. These expansions bring standardized service quality and brand recognition to emerging tourism areas while creating employment and economic development opportunities.

Sustainability certification programs have gained widespread adoption, with MarkWide Research indicating that certified properties achieve higher guest satisfaction scores and premium pricing power. Industry associations and government agencies collaborate to promote environmental standards and responsible tourism practices.

Digital transformation initiatives accelerate across all property segments, with operators investing in integrated technology platforms that enhance guest experiences while improving operational efficiency. These investments include property management systems, customer relationship management tools, and revenue optimization platforms.

Workforce development programs address skills shortages through partnerships between hospitality operators, educational institutions, and government agencies. These initiatives focus on technical skills training, language proficiency, and service excellence standards that maintain Thailand’s competitive advantages in hospitality service delivery.

Infrastructure investments by government and private sector stakeholders continue to enhance destination accessibility and attractiveness. Airport expansions, transportation improvements, and utility infrastructure upgrades support hospitality industry growth while improving overall visitor experiences.

Strategic diversification across market segments and geographic regions provides hospitality operators with risk mitigation and growth opportunities. Companies should consider balanced portfolios that include business and leisure properties, urban and resort locations, and various price points to optimize revenue stability and market coverage.

Technology investment priorities should focus on guest experience enhancement and operational efficiency improvements. Revenue management systems, mobile applications, and data analytics platforms offer measurable returns on investment while positioning properties for future market requirements and competitive advantages.

Sustainability integration requires comprehensive approaches that address environmental impact, community engagement, and economic sustainability. Properties implementing holistic sustainability programs achieve better financial performance, regulatory compliance, and brand differentiation in increasingly competitive markets.

Workforce development investments are essential for maintaining service quality and operational excellence. Training programs, career development opportunities, and competitive compensation packages help address labor shortages while building organizational capabilities for long-term success.

Partnership strategies with local communities, technology providers, and government agencies create value-added opportunities that benefit all stakeholders. Collaborative approaches enable resource sharing, market access, and innovative solutions that individual operators cannot achieve independently.

Long-term growth prospects for Thailand’s hospitality industry remain highly favorable, supported by the country’s strategic advantages, government commitment, and industry innovation capabilities. MWR analysis projects sustained growth driven by emerging market segments, technology adoption, and sustainable tourism development initiatives.

Market evolution trends indicate continued premiumization, with travelers increasingly willing to pay higher rates for unique experiences, personalized services, and sustainable hospitality options. This trend benefits operators who invest in service excellence, facility upgrades, and innovative guest experience programs.

Technology integration will accelerate across all market segments, with artificial intelligence, Internet of Things, and blockchain technologies becoming standard operational tools. Early adopters of these technologies will achieve competitive advantages through enhanced efficiency, improved guest satisfaction, and optimized revenue performance.

Sustainability requirements will become increasingly stringent, with environmental and social responsibility becoming essential competitive factors rather than optional differentiators. Properties that proactively implement comprehensive sustainability programs will be better positioned for long-term success and regulatory compliance.

Regional expansion opportunities will continue to emerge as infrastructure development and government promotion efforts open new destinations to tourism development. First-mover advantages in emerging markets provide significant growth potential for hospitality operators with appropriate risk tolerance and development capabilities.

Thailand’s hospitality industry market demonstrates exceptional resilience, adaptability, and growth potential that positions it as a leading destination for both travelers and hospitality investors. The market’s comprehensive ecosystem of luxury resorts, business hotels, boutique properties, and emerging accommodation concepts provides diverse opportunities across multiple segments and price points.

Strategic advantages including Thailand’s established destination brand, service excellence culture, geographic location, and government support create favorable conditions for sustained industry growth. The successful integration of technology, sustainability practices, and authentic cultural experiences differentiates Thai hospitality offerings in an increasingly competitive global marketplace.

Future success will depend on continued innovation, strategic adaptation to changing traveler preferences, and collaborative approaches that benefit all industry stakeholders. Operators who embrace digital transformation, sustainable practices, and community partnerships will be best positioned to capitalize on emerging opportunities and navigate evolving market challenges while contributing to Thailand’s continued prominence as a world-class hospitality destination.

What is Thailand Hospitality Industry?

The Thailand Hospitality Industry encompasses a range of services including accommodation, food and beverage, and tourism-related activities that cater to travelers and locals alike.

What are the key players in the Thailand Hospitality Industry Market?

Key players in the Thailand Hospitality Industry Market include companies like Minor International, Accor Hotels, and Hilton Worldwide, among others.

What are the main drivers of growth in the Thailand Hospitality Industry Market?

The main drivers of growth in the Thailand Hospitality Industry Market include the increasing number of international tourists, the expansion of luxury accommodations, and the rise of domestic travel.

What challenges does the Thailand Hospitality Industry Market face?

Challenges in the Thailand Hospitality Industry Market include fluctuating tourist numbers due to global events, competition from alternative lodging options like Airbnb, and rising operational costs.

What opportunities exist in the Thailand Hospitality Industry Market?

Opportunities in the Thailand Hospitality Industry Market include the growth of eco-tourism, the development of wellness retreats, and the increasing demand for unique cultural experiences.

What trends are shaping the Thailand Hospitality Industry Market?

Trends shaping the Thailand Hospitality Industry Market include the integration of technology in guest services, a focus on sustainability practices, and the rise of personalized travel experiences.

Thailand Hospitality Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Hotels, Resorts, Restaurants, Cafes |

| Customer Type | Business Travelers, Tourists, Locals, Event Planners |

| Price Tier | Luxury, Mid-Range, Budget, Economy |

| Distribution Channel | Online Travel Agencies, Direct Booking, Travel Agents, Corporate Partnerships |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Hospitality Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at