444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand garment industry market represents one of Southeast Asia’s most dynamic and established textile manufacturing sectors, serving as a critical pillar of the nation’s export-driven economy. Thailand’s textile sector has evolved from traditional manufacturing to sophisticated production capabilities, encompassing everything from basic apparel to high-end fashion garments for global brands. The industry demonstrates remarkable resilience and adaptability, with manufacturers increasingly focusing on sustainable production practices and technological innovation to maintain competitive advantages in the global marketplace.

Market dynamics indicate that Thailand’s garment sector continues to experience steady growth, driven by strong domestic consumption and robust export demand. The industry benefits from strategic geographic positioning, skilled workforce, and well-established supply chain networks that connect local manufacturers with international buyers. Recent data suggests the sector maintains a growth rate of approximately 4.2% annually, reflecting the industry’s ability to adapt to changing market conditions and consumer preferences.

Manufacturing capabilities span across diverse product categories, including casual wear, formal attire, sportswear, and specialized technical textiles. The industry’s strength lies in its ability to handle both large-scale production runs and smaller, customized orders for niche markets. Thailand’s garment manufacturers have successfully positioned themselves as reliable partners for international brands seeking quality production at competitive prices.

The Thailand garment industry market refers to the comprehensive ecosystem of textile and apparel manufacturing, distribution, and export activities within Thailand’s borders. This market encompasses all aspects of garment production, from raw material sourcing and fabric manufacturing to finished product assembly and international trade operations.

Industry scope includes traditional clothing manufacturing, fashion apparel production, technical textiles, and specialized garment categories such as workwear and protective clothing. The market represents the collective economic activities of thousands of manufacturers, suppliers, exporters, and supporting service providers who contribute to Thailand’s position as a significant player in the global textile trade.

Economic significance extends beyond direct manufacturing activities to include related sectors such as cotton farming, synthetic fiber production, dyeing and finishing services, and logistics operations. The industry serves both domestic consumption needs and international export markets, making it a crucial component of Thailand’s manufacturing sector and foreign exchange earnings.

Thailand’s garment industry continues to demonstrate strong performance across multiple market segments, with particular strength in export-oriented manufacturing and growing domestic consumption. The sector has successfully navigated global economic challenges while maintaining its position as a preferred manufacturing destination for international brands and retailers.

Key performance indicators reveal that the industry maintains healthy profit margins and steady employment levels, with approximately 85% of production directed toward export markets. The sector benefits from government support initiatives, infrastructure investments, and ongoing efforts to enhance manufacturing capabilities through technology adoption and workforce development programs.

Strategic positioning within the ASEAN economic community provides Thailand’s garment manufacturers with preferential access to regional markets and supply chain networks. The industry’s focus on quality improvement and sustainable manufacturing practices has strengthened relationships with international buyers and enhanced the country’s reputation as a reliable sourcing destination.

Future prospects remain positive, with industry stakeholders investing in automation technologies, sustainable production methods, and product diversification strategies. The sector’s ability to adapt to changing consumer preferences and global trade dynamics positions it well for continued growth and market expansion.

Market analysis reveals several critical insights that define Thailand’s garment industry landscape and future trajectory:

Industry trends indicate that Thailand’s garment sector is successfully transitioning toward higher-value production while maintaining cost competitiveness. The focus on quality enhancement and customer service excellence has strengthened long-term relationships with international buyers and opened new market opportunities.

Economic factors driving Thailand’s garment industry growth include favorable currency exchange rates, competitive labor costs, and strong government support for manufacturing sector development. The industry benefits from strategic geographic location that provides efficient access to both raw material suppliers and international markets.

Consumer demand patterns continue to support industry expansion, with growing global appetite for fashion apparel and increasing domestic consumption driven by rising disposable incomes. The trend toward fast fashion and frequent style changes creates consistent demand for flexible manufacturing capabilities that Thailand’s garment producers can effectively provide.

Trade relationships and preferential agreements enhance market access and reduce barriers to international commerce. Thailand’s participation in various free trade agreements provides manufacturers with competitive advantages in key export markets, particularly within the ASEAN region and through bilateral trade partnerships.

Infrastructure development supports industry growth through improved transportation networks, modern port facilities, and enhanced logistics capabilities. These improvements reduce production costs and delivery times, making Thailand more attractive to international buyers seeking efficient supply chain partners.

Competitive pressures from other regional manufacturing centers create ongoing challenges for Thailand’s garment industry, particularly from countries offering lower labor costs. The industry faces pricing competition that requires continuous efficiency improvements and value-added service offerings to maintain market position.

Labor market dynamics present challenges as skilled workers increasingly seek opportunities in higher-paying sectors, creating potential workforce shortages in traditional manufacturing roles. The industry must invest in training programs and competitive compensation packages to attract and retain qualified personnel.

Raw material costs fluctuations impact profit margins and pricing strategies, particularly for cotton and synthetic fiber inputs that represent significant production expenses. Supply chain disruptions can affect material availability and increase procurement costs, requiring manufacturers to develop more resilient sourcing strategies.

Regulatory compliance requirements, particularly related to environmental standards and labor practices, increase operational costs and complexity. Manufacturers must invest in compliance systems and sustainable production technologies to meet evolving international standards and buyer requirements.

Sustainable manufacturing presents significant opportunities as global brands increasingly prioritize environmental responsibility and ethical production practices. Thailand’s garment manufacturers can differentiate themselves by investing in eco-friendly technologies and obtaining relevant sustainability certifications that appeal to conscious consumers and responsible brands.

Technical textiles and specialized garment categories offer higher-margin opportunities beyond traditional apparel manufacturing. The growing demand for performance fabrics, protective clothing, and medical textiles creates new market segments where Thailand’s manufacturing expertise can command premium pricing.

Digital transformation opportunities include implementing Industry 4.0 technologies, automated production systems, and data-driven manufacturing processes. These investments can improve operational efficiency, reduce production costs, and enhance quality control capabilities while positioning manufacturers for future market demands.

Regional market expansion within ASEAN and emerging markets provides growth opportunities as middle-class populations expand and consumer spending increases. Thailand’s manufacturers can leverage their regional expertise and cultural understanding to capture growing domestic and regional demand for quality garments.

Supply chain evolution continues to reshape Thailand’s garment industry as manufacturers adapt to changing global trade patterns and buyer requirements. The industry demonstrates remarkable flexibility in adjusting production capabilities and supply chain relationships to meet diverse customer needs and market conditions.

Technology adoption accelerates across the sector as manufacturers recognize the importance of automation and digital systems for maintaining competitiveness. Investment in modern equipment and production technologies enables higher efficiency levels and improved product quality while reducing dependence on manual labor.

Market consolidation trends see larger manufacturers expanding their capabilities through acquisitions and strategic partnerships. This consolidation creates more efficient operations and enhanced service offerings while providing smaller manufacturers with opportunities to specialize in niche market segments or become integrated suppliers within larger networks.

Customer relationship management becomes increasingly important as buyers seek long-term partnerships with reliable suppliers who can provide consistent quality, competitive pricing, and responsive service. Thailand’s manufacturers invest in customer service capabilities and relationship-building activities to strengthen their market position.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Thailand’s garment industry market. Primary research activities include direct interviews with industry executives, manufacturer surveys, and on-site facility assessments to gather firsthand information about market conditions and operational practices.

Secondary research incorporates analysis of government trade statistics, industry association reports, and international trade data to validate primary findings and provide broader market context. This approach ensures data triangulation and enhances the reliability of market insights and trend analysis.

Quantitative analysis focuses on production volumes, export statistics, employment data, and financial performance metrics to establish baseline market measurements and identify growth patterns. Statistical modeling techniques help project future market trends and identify potential growth opportunities within specific industry segments.

Qualitative assessment examines market dynamics, competitive positioning, and strategic initiatives through expert interviews and industry stakeholder consultations. This methodology provides deeper insights into market drivers, challenges, and emerging opportunities that quantitative data alone cannot capture.

Bangkok metropolitan area serves as the industry’s commercial and administrative center, hosting major garment manufacturers, trading companies, and international buyer offices. The region benefits from excellent infrastructure, skilled workforce availability, and proximity to international airports and shipping facilities that facilitate global trade operations.

Central Thailand provinces contain significant manufacturing capacity with established industrial parks and specialized textile zones. These areas offer cost-effective production environments while maintaining good transportation links to major ports and urban centers. Manufacturing concentration in this region accounts for approximately 45% of total production capacity.

Northern Thailand regions, particularly around Chiang Mai and Chiang Rai, focus on specialized garment categories and artisanal production. These areas leverage traditional textile skills and cultural heritage to produce unique products for niche markets and premium brands seeking authentic Thai craftsmanship.

Eastern seaboard industrial zones benefit from modern infrastructure and proximity to major ports, making them attractive locations for export-oriented manufacturers. The region’s industrial development programs and government incentives support continued expansion of garment manufacturing capabilities and attract international investment.

Market leadership in Thailand’s garment industry is distributed among several major manufacturers and numerous smaller specialized producers. The competitive environment encourages innovation, quality improvement, and customer service excellence as companies strive to differentiate themselves in global markets.

Key industry players include:

Competitive strategies focus on operational efficiency, product quality, customer service excellence, and sustainable manufacturing practices. Companies invest in technology upgrades, workforce development, and supply chain optimization to maintain competitive advantages and meet evolving market demands.

Product category segmentation reveals diverse manufacturing capabilities across Thailand’s garment industry:

By Product Type:

By Market Destination:

By Manufacturing Scale:

Casual wear manufacturing dominates Thailand’s garment production, benefiting from established supply chains, efficient production processes, and strong relationships with international retailers. This category demonstrates consistent demand and offers opportunities for volume-based growth and operational efficiency improvements.

Formal wear production requires higher skill levels and quality standards, enabling manufacturers to command premium pricing and develop specialized expertise. The segment benefits from Thailand’s reputation for quality craftsmanship and attention to detail, particularly in shirt manufacturing and tailored garments.

Sportswear and activewear represent growing market opportunities as health consciousness and fitness trends drive global demand. Thai manufacturers are investing in technical capabilities and performance fabric expertise to capture market share in this higher-margin segment.

Technical textiles and specialized garments offer the highest growth potential and profit margins. These categories require advanced manufacturing capabilities and specialized knowledge but provide opportunities for market differentiation and reduced price competition.

Sustainable and eco-friendly garment categories gain importance as environmental consciousness increases among consumers and brands. Manufacturers investing in sustainable production technologies and certifications position themselves for future market opportunities and premium pricing.

Manufacturers benefit from Thailand’s established infrastructure, skilled workforce, and government support programs that reduce operational costs and enhance production capabilities. The industry’s mature supply chain networks provide efficient access to raw materials, components, and supporting services necessary for competitive manufacturing operations.

International buyers gain access to reliable production partners who can deliver consistent quality, competitive pricing, and flexible manufacturing capabilities. Thailand’s manufacturers offer comprehensive services including design support, quality control, and logistics coordination that simplify sourcing operations for global brands.

Local communities benefit from employment opportunities, skills development programs, and economic development that garment manufacturing brings to rural and urban areas. The industry provides stable employment for hundreds of thousands of workers and supports numerous related businesses and service providers.

Government stakeholders benefit from foreign exchange earnings, tax revenues, and industrial development that strengthen Thailand’s economic foundation. The garment industry contributes to export diversification and manufacturing sector growth that supports broader economic development objectives.

Supply chain partners including textile producers, logistics providers, and equipment suppliers benefit from consistent demand and opportunities for business expansion. The industry’s growth creates multiplier effects that support related sectors and contribute to overall economic development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with manufacturers increasingly adopting eco-friendly production processes, sustainable material sourcing, and waste reduction initiatives. This trend reflects growing consumer awareness and brand responsibility requirements that influence purchasing decisions and supplier selection criteria.

Digital transformation accelerates across the industry as manufacturers implement automated production systems, data analytics, and digital quality control technologies. These investments improve operational efficiency by approximately 25-30% while enhancing product quality and reducing production lead times.

Customization capabilities become increasingly important as brands seek flexible manufacturing partners who can handle smaller batch sizes and personalized products. Thai manufacturers are developing agile production systems that can efficiently switch between different product specifications and order requirements.

Supply chain localization trends see manufacturers developing closer relationships with regional suppliers and customers to reduce transportation costs and improve responsiveness. This approach enhances supply chain resilience and provides competitive advantages in rapidly changing market conditions.

Quality certification and compliance standards become more stringent as international buyers require comprehensive documentation and verification of production practices. Manufacturers invest in certification programs and quality management systems to meet evolving customer requirements and maintain market access.

Technology investments across the sector focus on automation equipment, digital manufacturing systems, and quality control technologies that enhance production capabilities. Major manufacturers are implementing Industry 4.0 solutions that integrate production planning, inventory management, and quality assurance into comprehensive digital platforms.

Sustainability initiatives include adoption of renewable energy systems, water recycling technologies, and sustainable material sourcing programs. According to MarkWide Research analysis, manufacturers implementing comprehensive sustainability programs report 15-20% improvement in operational efficiency and enhanced customer relationships.

Market expansion activities see Thai manufacturers establishing production facilities in neighboring countries and developing strategic partnerships with regional suppliers and distributors. These initiatives enhance market reach and provide access to new customer segments while maintaining cost competitiveness.

Product diversification efforts focus on technical textiles, performance fabrics, and specialized garment categories that offer higher profit margins and reduced price competition. Manufacturers are investing in research and development capabilities to support innovation and product differentiation strategies.

Workforce development programs address skill shortages and prepare workers for advanced manufacturing technologies. Industry associations and government agencies collaborate on training initiatives that enhance worker capabilities and support industry modernization efforts.

Strategic recommendations for Thailand’s garment industry focus on enhancing competitiveness through technology adoption, sustainability initiatives, and market diversification. Industry participants should prioritize operational efficiency improvements and value-added service development to maintain competitive advantages in global markets.

Investment priorities should emphasize automation technologies, sustainable production systems, and workforce development programs that support long-term industry growth. Manufacturers can achieve significant returns by implementing comprehensive modernization strategies that address both operational efficiency and market positioning requirements.

Market positioning strategies should focus on quality differentiation, customer service excellence, and specialized capabilities that justify premium pricing. Thai manufacturers can leverage their established reputation and manufacturing expertise to capture higher-value market segments and reduce dependence on price-based competition.

Partnership development with international brands, regional suppliers, and technology providers can enhance capabilities and market access. Strategic alliances enable resource sharing and risk distribution while providing opportunities for knowledge transfer and capability enhancement.

Sustainability integration should be viewed as a strategic imperative rather than a compliance requirement, as environmental responsibility becomes increasingly important for market access and customer relationships. Early adoption of sustainable practices provides competitive advantages and positions manufacturers for future market opportunities.

Growth projections for Thailand’s garment industry remain positive, with the sector expected to maintain steady expansion driven by domestic consumption growth and continued export demand. MWR forecasts indicate the industry will achieve sustained growth rates of 3.5-4.5% annually over the next five years, supported by ongoing modernization efforts and market diversification strategies.

Technology adoption will accelerate as manufacturers recognize the importance of automation and digital systems for maintaining competitiveness. Investment in advanced manufacturing technologies is expected to increase production efficiency by 20-25% while improving product quality and reducing labor dependency.

Market evolution toward higher-value products and specialized manufacturing capabilities will create new opportunities for differentiation and premium pricing. The industry’s focus on technical textiles and sustainable production is expected to generate significant growth in emerging market segments.

Regional integration within ASEAN markets will provide expanded opportunities for trade and investment, while closer supply chain relationships enhance operational efficiency and market responsiveness. Thailand’s manufacturers are well-positioned to benefit from regional economic growth and increasing consumer spending in neighboring countries.

Sustainability requirements will become increasingly important for market access and customer relationships, driving continued investment in eco-friendly production technologies and sustainable business practices. Manufacturers embracing environmental responsibility will gain competitive advantages and access to premium market segments.

Thailand’s garment industry demonstrates remarkable resilience and adaptability in navigating global market challenges while maintaining its position as a significant player in international textile trade. The sector’s combination of established manufacturing capabilities, skilled workforce, and strategic geographic positioning provides a strong foundation for continued growth and market expansion.

Industry transformation toward sustainable production, technology integration, and higher-value manufacturing creates opportunities for differentiation and competitive advantage. Manufacturers who embrace these changes while maintaining their commitment to quality and customer service are well-positioned to capture emerging market opportunities and achieve long-term success.

Future success will depend on the industry’s ability to balance cost competitiveness with value-added capabilities, environmental responsibility, and technological advancement. Thailand’s garment manufacturers have demonstrated their capacity for adaptation and innovation, suggesting a positive outlook for continued market leadership and sustainable growth in the global textile industry.

What is Thailand Garment?

Thailand Garment refers to the production and export of clothing and textile products in Thailand, which includes a variety of apparel such as shirts, trousers, and dresses, as well as textile materials used in fashion and home furnishings.

What are the key players in the Thailand Garment Industry Market?

Key players in the Thailand Garment Industry Market include companies like Thai Garment Manufacturers Association, Saha Group, and Sritrang Group, among others.

What are the growth factors driving the Thailand Garment Industry Market?

The growth of the Thailand Garment Industry Market is driven by factors such as increasing demand for sustainable fashion, the rise of e-commerce platforms, and Thailand’s strategic location for textile exports.

What challenges does the Thailand Garment Industry Market face?

The Thailand Garment Industry Market faces challenges such as rising labor costs, competition from neighboring countries, and fluctuating raw material prices, which can impact profitability.

What opportunities exist in the Thailand Garment Industry Market?

Opportunities in the Thailand Garment Industry Market include the potential for growth in eco-friendly clothing lines, expansion into international markets, and the adoption of advanced manufacturing technologies.

What trends are shaping the Thailand Garment Industry Market?

Trends shaping the Thailand Garment Industry Market include a shift towards digitalization in retail, increased consumer interest in sustainable practices, and the integration of smart textiles in garment production.

Thailand Garment Industry Market

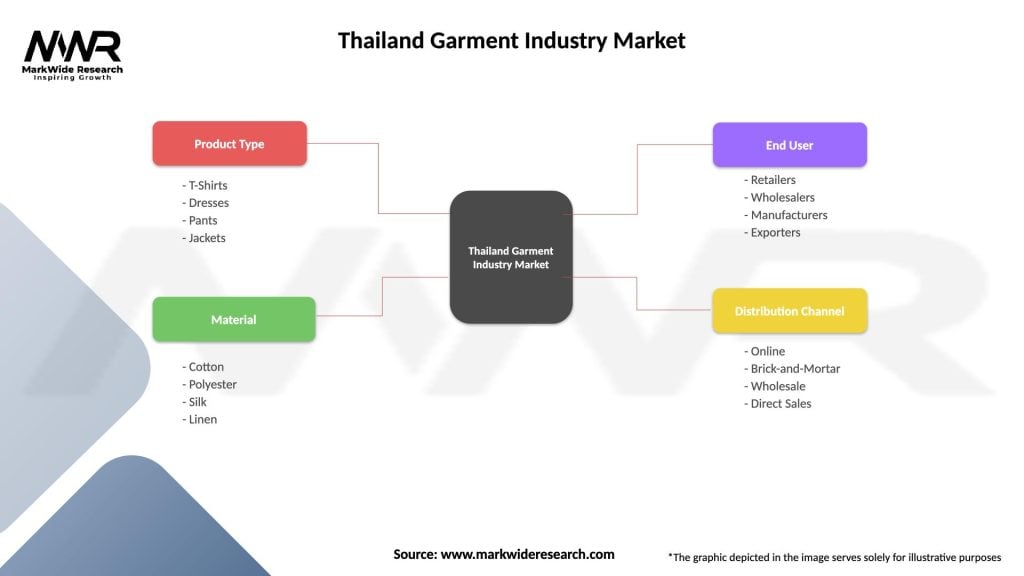

| Segmentation Details | Description |

|---|---|

| Product Type | T-Shirts, Dresses, Pants, Jackets |

| Material | Cotton, Polyester, Silk, Linen |

| End User | Retailers, Wholesalers, Manufacturers, Exporters |

| Distribution Channel | Online, Brick-and-Mortar, Wholesale, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Garment Industry Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at