444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand construction chemicals market represents a dynamic and rapidly evolving sector within the country’s robust construction industry. Construction chemicals encompass a diverse range of specialized products including concrete admixtures, waterproofing compounds, adhesives, sealants, and protective coatings that enhance the performance, durability, and sustainability of construction projects. Thailand’s strategic position as a manufacturing hub in Southeast Asia, combined with significant infrastructure development initiatives and urbanization trends, has positioned the construction chemicals sector for substantial growth.

Market dynamics in Thailand reflect the country’s ambitious infrastructure modernization programs, including the Eastern Economic Corridor (EEC) development, high-speed rail projects, and extensive urban development initiatives. The construction chemicals market benefits from growing demand across residential, commercial, and industrial construction segments, with particular emphasis on sustainable building practices and energy-efficient construction solutions. Recent market analysis indicates growth rates of approximately 8.5% annually, driven by increased construction activity and technological advancement adoption.

Regional development patterns show concentrated growth in major metropolitan areas including Bangkok, Chiang Mai, and emerging economic zones. The market demonstrates strong correlation with Thailand’s overall construction sector performance, which has experienced robust expansion supported by government infrastructure spending and private sector investment. Innovation trends focus on eco-friendly formulations, high-performance concrete additives, and advanced waterproofing solutions that address Thailand’s tropical climate challenges.

The Thailand construction chemicals market refers to the comprehensive ecosystem of specialized chemical products, solutions, and services designed to enhance construction processes, improve building performance, and extend structural longevity within Thailand’s construction industry. This market encompasses various product categories including concrete admixtures, waterproofing systems, adhesives, sealants, protective coatings, and repair materials that are essential for modern construction practices.

Construction chemicals serve critical functions in addressing specific challenges related to Thailand’s tropical climate, including high humidity, intense rainfall, and temperature fluctuations. These specialized products enable construction professionals to achieve superior concrete strength, enhanced durability, improved workability, and extended service life for buildings and infrastructure projects. The market includes both locally manufactured products and imported solutions from international manufacturers.

Market scope extends beyond traditional construction applications to include industrial maintenance, infrastructure rehabilitation, and specialty construction projects such as marine structures, bridges, and high-rise buildings. The definition encompasses raw materials, finished products, application services, and technical support provided by manufacturers and distributors throughout Thailand’s construction value chain.

Thailand’s construction chemicals market demonstrates exceptional growth potential driven by accelerating infrastructure development, urbanization trends, and increasing adoption of advanced construction technologies. The market benefits from Thailand’s position as a regional manufacturing hub and its strategic importance in Southeast Asian economic development initiatives. Key growth drivers include government infrastructure investment, private sector construction activity, and growing emphasis on sustainable building practices.

Market segmentation reveals diverse opportunities across concrete admixtures, waterproofing solutions, adhesives and sealants, and protective coatings. The concrete admixtures segment maintains the largest market share at approximately 35% of total market volume, reflecting Thailand’s extensive concrete construction practices. Waterproofing solutions represent the fastest-growing segment, driven by increased awareness of moisture-related building problems in Thailand’s humid climate.

Competitive landscape features a mix of international manufacturers and local producers, with increasing focus on product innovation, technical service capabilities, and sustainable formulations. Market leaders emphasize research and development investments to address specific regional requirements and environmental challenges. Future outlook indicates continued expansion supported by ongoing infrastructure projects, urban development initiatives, and evolving construction standards that prioritize performance and sustainability.

Strategic market insights reveal several critical factors shaping Thailand’s construction chemicals landscape. The market demonstrates strong correlation with overall construction sector performance, which has maintained consistent growth despite global economic uncertainties. Technology adoption rates show increasing preference for high-performance products that offer superior durability and environmental benefits.

Primary market drivers for Thailand’s construction chemicals sector stem from robust infrastructure development initiatives and sustained construction industry growth. The government’s commitment to infrastructure modernization, including the Eastern Economic Corridor development and transportation network expansion, creates substantial demand for high-performance construction chemicals. These projects require specialized products that can withstand Thailand’s challenging environmental conditions while meeting international quality standards.

Urbanization trends significantly impact market growth as Thailand experiences continued migration to urban centers and expansion of metropolitan areas. This demographic shift drives residential and commercial construction activity, creating sustained demand for construction chemicals across all product categories. Population growth and rising living standards contribute to increased housing demand and infrastructure requirements.

Technological advancement serves as a crucial growth driver, with construction companies increasingly adopting advanced materials and methods to improve project efficiency and quality. The integration of smart building technologies and sustainable construction practices requires specialized chemical solutions that support these innovations. Climate resilience requirements drive demand for products that can withstand extreme weather events and environmental stresses common in Southeast Asia.

Economic development initiatives, including foreign direct investment attraction and industrial zone expansion, create additional demand for construction chemicals in manufacturing facility construction and infrastructure development. The growth of Thailand’s tourism industry also contributes through hotel, resort, and entertainment facility construction projects that require specialized construction chemical solutions.

Market restraints in Thailand’s construction chemicals sector include several challenges that may limit growth potential and market expansion. Raw material cost volatility represents a significant constraint, as many construction chemicals depend on petroleum-based ingredients and specialized additives subject to global price fluctuations. This volatility affects product pricing and profit margins for manufacturers and distributors.

Regulatory compliance challenges emerge from evolving environmental regulations and safety standards that require continuous product reformulation and certification processes. Companies must invest substantially in research and development to ensure compliance with both local Thai regulations and international standards, particularly for exported products. Technical expertise limitations in proper application and handling of advanced construction chemicals can lead to performance issues and market resistance.

Economic uncertainties related to global market conditions and regional political developments can impact construction project funding and timeline execution. Currency fluctuations affect the cost of imported raw materials and finished products, creating pricing pressures for market participants. The seasonal nature of construction activity in Thailand, influenced by monsoon patterns, creates demand fluctuations that challenge inventory management and production planning.

Competition from alternative solutions and traditional construction methods may limit adoption of advanced construction chemicals, particularly in cost-sensitive market segments. Supply chain disruptions, as experienced during recent global events, highlight vulnerabilities in raw material sourcing and product distribution networks that can constrain market growth.

Significant market opportunities exist within Thailand’s construction chemicals sector, driven by emerging trends and evolving industry requirements. The growing emphasis on sustainable construction creates substantial opportunities for manufacturers developing eco-friendly formulations and green building solutions. MarkWide Research analysis indicates that sustainable construction chemicals represent one of the fastest-growing market segments with adoption rates increasing by approximately 12% annually.

Infrastructure modernization programs present extensive opportunities for specialized construction chemicals, particularly in transportation infrastructure, water management systems, and energy facilities. The development of smart cities and digital infrastructure requires advanced materials that support technology integration and long-term performance requirements. Retrofit and renovation markets offer growth potential as existing buildings require upgrades to meet modern performance standards.

Export opportunities emerge from Thailand’s strategic location and manufacturing capabilities, enabling companies to serve broader Southeast Asian markets. The country’s established supply chains and logistics infrastructure support regional distribution of construction chemicals. Technology partnerships with international companies create opportunities for knowledge transfer, product innovation, and market expansion.

Specialty applications in marine construction, industrial facilities, and high-performance buildings offer premium pricing opportunities for advanced construction chemicals. The growth of prefabricated construction methods creates demand for specialized adhesives, sealants, and assembly products. Digital transformation opportunities include development of smart construction chemicals with embedded sensors and monitoring capabilities.

Market dynamics in Thailand’s construction chemicals sector reflect complex interactions between supply and demand factors, technological innovation, and regulatory influences. Demand patterns show strong correlation with construction industry cycles, government infrastructure spending, and private sector investment levels. The market demonstrates resilience through diversification across multiple construction segments and applications.

Supply chain dynamics involve both domestic production and international sourcing, with manufacturers balancing cost efficiency and supply security. Local production capabilities have expanded significantly, reducing dependence on imports for basic construction chemicals while maintaining import relationships for specialized products and raw materials. Distribution networks have evolved to support both large-scale projects and smaller construction applications through diverse channel strategies.

Pricing dynamics reflect raw material costs, competitive pressures, and value-added service offerings. Market participants increasingly focus on total cost of ownership rather than initial product costs, emphasizing performance benefits and long-term value. Innovation cycles drive product development toward higher performance, environmental compliance, and application efficiency.

Competitive dynamics feature increasing consolidation among suppliers and growing importance of technical service capabilities. Companies differentiate through application expertise, customer support, and integrated solution offerings. Market share distribution shows approximately 60% international companies and 40% domestic manufacturers, with local companies gaining market presence through specialized products and regional expertise.

Research methodology for analyzing Thailand’s construction chemicals market employs comprehensive data collection and analysis techniques to ensure accurate market insights and projections. Primary research involves extensive interviews with industry stakeholders including manufacturers, distributors, contractors, and end-users to gather firsthand market intelligence and validate market trends.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and historical trends. Data triangulation methods ensure accuracy by cross-referencing multiple information sources and validating findings through different analytical approaches.

Market sizing methodology utilizes bottom-up and top-down approaches to establish comprehensive market dimensions and segment analysis. Bottom-up analysis aggregates data from individual market participants and product categories, while top-down analysis examines overall construction industry performance and construction chemicals penetration rates.

Forecasting models incorporate multiple variables including economic indicators, construction activity projections, regulatory changes, and technology adoption trends. Scenario analysis evaluates different growth trajectories based on various market conditions and external factors. Expert validation ensures research findings align with industry expertise and market realities through consultation with recognized industry professionals and technical specialists.

Regional analysis of Thailand’s construction chemicals market reveals distinct patterns of demand and growth across different geographical areas. Bangkok metropolitan area dominates market consumption, accounting for approximately 45% of total market demand, driven by intensive urban development, commercial construction, and infrastructure projects. The capital region benefits from concentrated construction activity and proximity to major suppliers and distributors.

Eastern region demonstrates the highest growth rates, supported by the Eastern Economic Corridor development initiative and industrial expansion. This region shows increasing demand for specialized construction chemicals used in manufacturing facilities, logistics centers, and transportation infrastructure. Northern regions including Chiang Mai and surrounding provinces show steady growth driven by tourism-related construction and regional development programs.

Southern regions present unique market characteristics influenced by marine environments and tourism infrastructure development. Coastal areas require specialized waterproofing solutions and corrosion-resistant products due to salt exposure and high humidity conditions. Central plains regions focus primarily on residential construction and agricultural facility development, creating demand for standard construction chemicals and cost-effective solutions.

Border provinces benefit from cross-border trade and regional connectivity projects, driving demand for infrastructure-related construction chemicals. Regional distribution networks have evolved to serve diverse market requirements, with approximately 70% of products distributed through Bangkok-based channels and 30% through regional distributors. Market penetration rates vary significantly by region, with urban areas showing higher adoption of advanced construction chemicals compared to rural markets.

Competitive landscape in Thailand’s construction chemicals market features a diverse mix of international corporations and domestic manufacturers competing across multiple product segments and market channels. Market leadership positions are held by established international companies with strong brand recognition and comprehensive product portfolios.

Competitive strategies emphasize product innovation, technical service capabilities, and integrated solution offerings. Companies invest heavily in research and development to address specific regional requirements and environmental challenges. Market consolidation trends show increasing partnerships and acquisitions as companies seek to expand product portfolios and market coverage.

Market segmentation of Thailand’s construction chemicals sector reveals diverse product categories and application areas that serve different construction requirements and market segments. Product-based segmentation provides insights into market dynamics and growth opportunities across various chemical categories.

By Product Type:

By Application:

By End-User:

Category-wise analysis reveals distinct market characteristics and growth patterns across different construction chemical segments. Concrete admixtures maintain market leadership with consistent demand driven by Thailand’s extensive use of concrete in construction projects. This category benefits from ongoing infrastructure development and increasing adoption of high-performance concrete formulations.

Waterproofing chemicals demonstrate the strongest growth trajectory, with market expansion rates of approximately 10% annually, driven by increased awareness of moisture-related building problems and stricter building codes. Membrane waterproofing systems show particular strength in commercial and infrastructure applications, while liquid waterproofing solutions gain popularity in residential markets.

Adhesives and sealants category benefits from growing adoption of prefabricated construction methods and curtain wall systems in commercial buildings. Structural adhesives show increasing demand in high-rise construction and specialized applications requiring superior bonding performance. Weather sealing products maintain steady demand driven by Thailand’s climate requirements.

Protective coatings segment demonstrates resilience through diverse applications including marine structures, industrial facilities, and infrastructure maintenance. Anti-corrosion coatings show particular strength due to Thailand’s humid climate and coastal exposure challenges. Fire-resistant coatings gain importance with evolving safety regulations and building codes.

Repair and rehabilitation products represent an emerging growth category as Thailand’s infrastructure ages and requires maintenance. MWR analysis indicates this segment shows growth potential of approximately 8% annually as building maintenance becomes increasingly important.

Industry participants in Thailand’s construction chemicals market enjoy numerous benefits from market participation and strategic positioning. Manufacturers benefit from Thailand’s strategic location as a regional manufacturing hub, enabling cost-effective production and distribution throughout Southeast Asia. Access to skilled labor, established supply chains, and supportive government policies create favorable operating conditions.

Distributors and retailers benefit from growing market demand and expanding construction activity across multiple segments. The diverse product portfolio requirements create opportunities for specialized distribution services and technical support capabilities. Regional expansion opportunities enable distributors to serve emerging markets throughout Southeast Asia.

Construction companies benefit from access to advanced construction chemicals that improve project quality, reduce construction time, and enhance long-term building performance. Technical support services provided by suppliers help contractors optimize product usage and achieve superior results. Cost efficiency improvements through proper product selection and application contribute to project profitability.

End-users and building owners benefit from improved building performance, reduced maintenance requirements, and enhanced durability provided by advanced construction chemicals. Energy efficiency improvements and environmental benefits align with sustainability goals and green building certifications. Long-term value creation through reduced lifecycle costs and improved building performance provides substantial returns on investment.

Government stakeholders benefit from improved infrastructure quality and longevity, reducing long-term maintenance costs and supporting economic development objectives. Environmental benefits from sustainable construction chemicals support national sustainability goals and international commitments.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Thailand’s construction chemicals sector reflect evolving industry requirements and technological advancement. Sustainability focus represents the most significant trend, with increasing demand for eco-friendly formulations and products that support green building certifications. Market adoption of sustainable construction chemicals shows growth rates of approximately 15% annually, driven by environmental awareness and regulatory requirements.

Digital integration emerges as a transformative trend, with construction chemicals incorporating smart technologies and IoT capabilities for performance monitoring and optimization. Predictive maintenance applications using embedded sensors and data analytics create new value propositions for construction chemical suppliers. Application automation through robotic systems and precision application equipment improves efficiency and consistency.

Performance enhancement trends focus on developing higher-strength, faster-curing, and more durable construction chemicals that enable accelerated construction schedules and improved building performance. Multi-functional products that combine multiple properties in single formulations gain popularity for their convenience and cost-effectiveness.

Customization trends show increasing demand for project-specific formulations and tailored solutions that address unique construction requirements and environmental conditions. Service integration trends emphasize comprehensive support including technical consultation, application training, and performance guarantees. Supply chain optimization through local sourcing and regional manufacturing reduces costs and improves responsiveness to market demands.

Recent industry developments in Thailand’s construction chemicals market demonstrate dynamic innovation and strategic positioning by market participants. Manufacturing expansion initiatives by international companies establish local production capabilities to serve regional markets more effectively. Several major manufacturers have announced significant investments in Thai production facilities to support Southeast Asian market growth.

Product innovation developments focus on addressing specific regional challenges including tropical climate resistance, rapid-setting formulations for monsoon season construction, and enhanced durability for coastal applications. Research partnerships between international companies and local universities advance product development and technical expertise.

Sustainability initiatives include development of bio-based construction chemicals and recycled content formulations that reduce environmental impact. Certification programs for green building products gain importance as Thailand adopts international sustainability standards. Digital platform development enables better customer service, technical support, and product selection assistance.

Strategic acquisitions and partnerships reshape the competitive landscape as companies seek to expand product portfolios and market coverage. Distribution network expansion improves market access and customer service capabilities throughout Thailand and neighboring countries. Training programs for contractors and applicators enhance proper product usage and market development.

Industry analysts recommend several strategic approaches for success in Thailand’s construction chemicals market. Local manufacturing investment emerges as a critical success factor, enabling companies to reduce costs, improve supply chain reliability, and respond quickly to market demands. Companies should prioritize establishing or expanding Thai production capabilities to serve both domestic and regional markets effectively.

Product portfolio optimization should focus on developing solutions specifically designed for Thailand’s tropical climate and construction practices. Technical service capabilities represent a key differentiator, with successful companies investing in local technical teams and application support services. Sustainability integration becomes increasingly important as environmental regulations evolve and green building practices gain adoption.

Distribution strategy should emphasize both direct relationships with major contractors and comprehensive dealer networks to serve diverse market segments. Digital transformation investments in customer service platforms, technical support tools, and supply chain optimization provide competitive advantages. Regional expansion opportunities should leverage Thailand’s manufacturing capabilities and strategic location.

Partnership strategies with local companies, research institutions, and government agencies can accelerate market development and technology transfer. Training and education programs for construction professionals enhance market development and proper product utilization. Quality assurance and certification compliance ensure market access and customer confidence in an increasingly regulated environment.

Future outlook for Thailand’s construction chemicals market indicates continued robust growth driven by sustained infrastructure development and evolving construction industry requirements. MarkWide Research projections suggest the market will maintain strong growth momentum with expansion rates of approximately 9% annually over the next five years, supported by government infrastructure commitments and private sector construction activity.

Technology evolution will drive market transformation through smart construction chemicals, automated application systems, and integrated building performance solutions. Sustainability requirements will increasingly influence product development and market demand, with eco-friendly formulations expected to capture approximately 25% market share within the next decade.

Regional integration opportunities will expand as Thailand’s role as a manufacturing and distribution hub strengthens throughout Southeast Asia. Infrastructure mega-projects including high-speed rail networks, smart city developments, and renewable energy facilities will create substantial demand for specialized construction chemicals.

Market consolidation trends will continue as companies seek scale advantages and comprehensive solution capabilities. Innovation focus will emphasize performance enhancement, environmental compliance, and application efficiency. Digital integration will become standard practice, enabling predictive maintenance, performance optimization, and enhanced customer service.

Regulatory evolution will drive higher performance standards and environmental compliance requirements, creating opportunities for advanced product formulations. Skills development and technical expertise enhancement will become critical success factors as construction methods become more sophisticated and demanding.

Thailand’s construction chemicals market represents a dynamic and rapidly evolving sector with substantial growth potential driven by infrastructure development, urbanization trends, and technological advancement. The market benefits from Thailand’s strategic position as a regional manufacturing hub and its commitment to infrastructure modernization through ambitious government programs and private sector investment.

Market dynamics reflect strong fundamentals including consistent construction industry growth, increasing adoption of advanced construction methods, and growing emphasis on sustainability and performance. The diverse product portfolio spanning concrete admixtures, waterproofing solutions, adhesives, and protective coatings serves multiple construction segments and applications, providing resilience and growth opportunities.

Competitive landscape features established international manufacturers and emerging local companies competing through product innovation, technical service capabilities, and integrated solution offerings. Future success will depend on companies’ ability to adapt to evolving market requirements, invest in local capabilities, and develop solutions that address Thailand’s unique environmental and construction challenges while supporting regional expansion opportunities throughout Southeast Asia.

What is Construction Chemicals?

Construction chemicals are specialized chemical formulations used in construction processes to enhance the performance and durability of structures. They include products like adhesives, sealants, and concrete admixtures that improve the quality and longevity of construction materials.

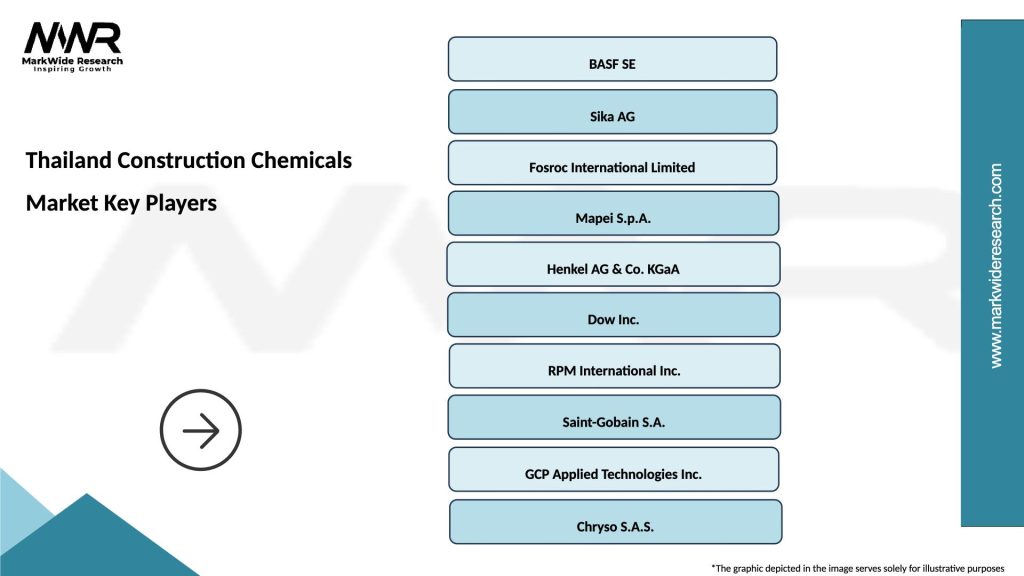

What are the key players in the Thailand Construction Chemicals Market?

Key players in the Thailand Construction Chemicals Market include BASF, Sika, and Dow Chemical, which provide a range of products for construction applications such as waterproofing, flooring, and concrete repair, among others.

What are the growth factors driving the Thailand Construction Chemicals Market?

The Thailand Construction Chemicals Market is driven by increasing urbanization, infrastructure development, and a growing demand for sustainable building materials. Additionally, the rise in construction activities in both residential and commercial sectors contributes to market growth.

What challenges does the Thailand Construction Chemicals Market face?

Challenges in the Thailand Construction Chemicals Market include fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit the availability of certain chemical products.

What opportunities exist in the Thailand Construction Chemicals Market?

Opportunities in the Thailand Construction Chemicals Market include the increasing adoption of green building practices and the development of innovative products that enhance energy efficiency. The growing focus on sustainable construction methods presents a significant opportunity for market expansion.

What trends are shaping the Thailand Construction Chemicals Market?

Trends in the Thailand Construction Chemicals Market include the rising demand for eco-friendly products and advancements in technology that improve product performance. Additionally, the integration of smart materials in construction is gaining traction, influencing product development.

Thailand Construction Chemicals Market

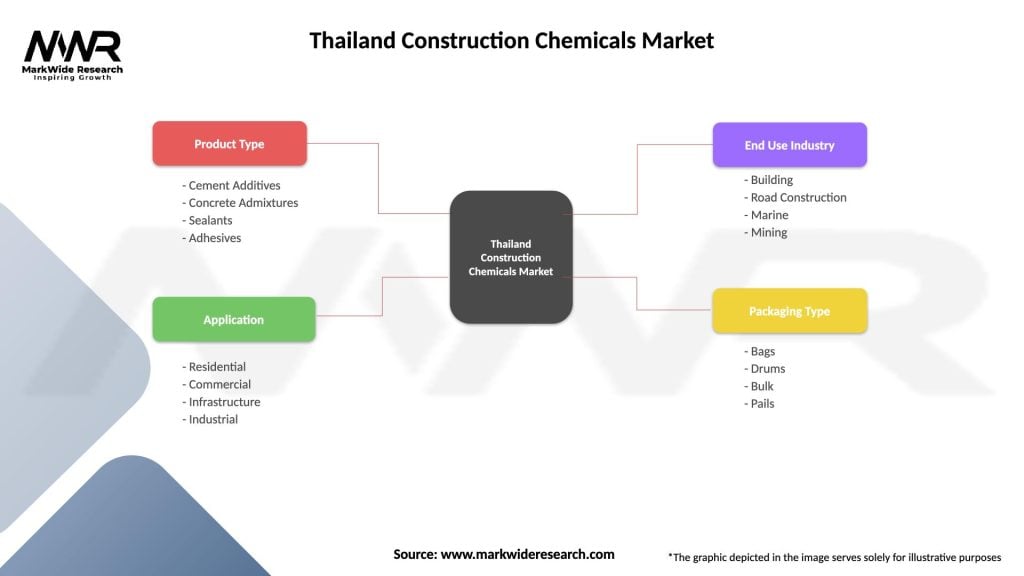

| Segmentation Details | Description |

|---|---|

| Product Type | Cement Additives, Concrete Admixtures, Sealants, Adhesives |

| Application | Residential, Commercial, Infrastructure, Industrial |

| End Use Industry | Building, Road Construction, Marine, Mining |

| Packaging Type | Bags, Drums, Bulk, Pails |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Construction Chemicals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at