444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Thailand cold chain logistics market represents a rapidly expanding sector within Southeast Asia’s supply chain infrastructure, driven by increasing consumer demand for fresh and frozen products. Thailand’s strategic position as a regional hub for food processing and export has positioned the country as a critical player in the cold chain logistics industry. The market encompasses temperature-controlled storage, transportation, and distribution services that maintain product integrity from origin to final destination.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over recent years. This expansion is fueled by Thailand’s thriving food and beverage industry, pharmaceutical sector growth, and increasing e-commerce penetration. Cold storage facilities across the country have expanded significantly, with modern automated systems replacing traditional storage methods.

Regional distribution shows Bangkok and surrounding provinces commanding approximately 45% of market share, while industrial zones in Rayong, Chonburi, and Samut Prakan contribute substantially to the overall market landscape. The integration of advanced technologies, including IoT sensors, real-time monitoring systems, and automated storage solutions, has enhanced operational efficiency by 35% on average across major facilities.

The Thailand cold chain logistics market refers to the comprehensive network of temperature-controlled supply chain services that ensure the safe transportation, storage, and distribution of perishable goods throughout Thailand and neighboring regions. This specialized logistics sector maintains specific temperature ranges to preserve product quality, safety, and shelf life for various industries including food and beverages, pharmaceuticals, chemicals, and agricultural products.

Cold chain logistics encompasses multiple interconnected components including refrigerated warehouses, temperature-controlled transportation vehicles, specialized packaging solutions, and monitoring technologies. The system requires continuous temperature maintenance from the point of origin through various distribution channels until products reach end consumers. Thailand’s cold chain infrastructure serves both domestic consumption needs and export requirements, supporting the country’s position as a major food exporter in the region.

Thailand’s cold chain logistics sector demonstrates exceptional growth momentum, supported by expanding food processing industries, increasing pharmaceutical manufacturing, and rising consumer expectations for quality products. The market benefits from government initiatives promoting food safety standards and infrastructure development, creating favorable conditions for sustained expansion.

Key growth drivers include the rapid expansion of modern retail formats, increasing demand for imported frozen foods, and the growing pharmaceutical industry requiring temperature-sensitive storage solutions. E-commerce growth has contributed to a 28% increase in last-mile cold chain delivery services, while export-oriented businesses drive demand for large-scale cold storage facilities.

Investment trends show significant capital allocation toward automation technologies, energy-efficient cooling systems, and expansion of cold storage capacity. Major players are focusing on strategic partnerships and facility upgrades to capture market opportunities in emerging segments such as online grocery delivery and pharmaceutical distribution.

Strategic market insights reveal several critical factors shaping Thailand’s cold chain logistics landscape:

Primary market drivers propelling Thailand’s cold chain logistics sector include the country’s robust food processing industry, which accounts for a significant portion of manufacturing output. Consumer behavior changes toward premium and imported food products have increased demand for reliable cold chain services, with frozen food consumption rising by 15% annually in urban areas.

Government support through infrastructure development programs and food safety regulations has created a conducive environment for market expansion. The Thailand 4.0 initiative emphasizes modernization of logistics infrastructure, including cold chain capabilities, to support economic transformation and competitiveness.

Export market growth serves as another crucial driver, with Thailand’s agricultural and processed food exports requiring sophisticated cold chain logistics to maintain quality during international transportation. Pharmaceutical industry expansion has generated additional demand for temperature-controlled storage and distribution services, particularly for vaccines and biologics requiring strict temperature maintenance.

E-commerce proliferation has created new opportunities in last-mile cold chain delivery, with online grocery platforms and food delivery services driving innovation in urban cold chain solutions. Regional trade integration within ASEAN has increased cross-border movement of temperature-sensitive goods, requiring enhanced cold chain infrastructure and capabilities.

Significant market restraints include high capital investment requirements for establishing and maintaining cold chain infrastructure. Energy costs represent a substantial operational expense, with refrigeration systems consuming considerable electricity, impacting overall profitability and pricing competitiveness.

Skilled workforce shortages pose challenges in operating sophisticated cold chain facilities and maintaining quality standards. Technical expertise in areas such as refrigeration technology, temperature monitoring, and cold chain management remains limited, constraining market development and operational efficiency.

Infrastructure limitations in rural areas and secondary cities restrict market penetration and service coverage. Transportation challenges including traffic congestion in major cities and inadequate cold chain vehicle availability affect service reliability and cost-effectiveness.

Regulatory complexity involving multiple government agencies and varying standards for different product categories creates compliance challenges for market participants. Competition from traditional logistics providers offering lower-cost alternatives, despite quality compromises, continues to pressure market pricing and adoption rates.

Emerging opportunities in Thailand’s cold chain logistics market include the rapidly growing pharmaceutical sector, which requires specialized temperature-controlled storage and distribution capabilities. Biotechnology advancement and increasing vaccine manufacturing present significant growth potential for cold chain service providers.

Rural market penetration offers substantial expansion opportunities as agricultural producers seek improved post-harvest handling and value-added processing capabilities. Cold chain integration with traditional farming communities could reduce food waste and improve farmer incomes while creating new revenue streams for logistics providers.

Cross-border trade expansion within ASEAN presents opportunities for developing regional cold chain networks. Digital transformation initiatives including blockchain technology for traceability and AI-powered optimization systems offer competitive advantages and operational improvements.

Sustainability focus creates opportunities for developing environmentally friendly cold chain solutions, including solar-powered refrigeration systems and natural refrigerants. Public-private partnerships for infrastructure development and food security initiatives provide additional growth avenues for market participants.

Market dynamics in Thailand’s cold chain logistics sector reflect the interplay between growing demand, technological advancement, and infrastructure development. Supply chain modernization efforts by major retailers and food processors drive adoption of advanced cold chain solutions, with efficiency improvements averaging 25% to 30% through technology integration.

Competitive pressures encourage innovation and service differentiation, with companies investing in value-added services such as packaging, quality testing, and inventory management. Customer expectations for transparency and traceability have led to implementation of comprehensive monitoring and reporting systems throughout the cold chain network.

Economic factors including currency fluctuations and commodity price volatility impact operational costs and investment decisions. Seasonal demand variations in agricultural products and holiday-related consumption patterns require flexible capacity management and strategic planning.

Technology adoption rates continue accelerating, with MarkWide Research indicating that automated systems and digital platforms are becoming standard requirements rather than competitive advantages. Regulatory evolution toward stricter food safety and pharmaceutical storage standards drives continuous improvement in cold chain capabilities and compliance measures.

Comprehensive research methodology employed for analyzing Thailand’s cold chain logistics market incorporates both primary and secondary research approaches to ensure accuracy and reliability of findings. Primary research includes structured interviews with industry executives, cold storage facility operators, logistics service providers, and key customers across various sectors.

Secondary research encompasses analysis of government statistics, industry reports, trade publications, and company financial statements to establish market trends and competitive positioning. Data validation processes involve cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market insights.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing facility capacities, service volumes, and industry growth rates to develop comprehensive market assessments. Qualitative analysis focuses on identifying market drivers, challenges, and opportunities through expert interviews and industry observation.

Regional analysis involves field visits to major cold storage facilities and distribution centers across Thailand’s key industrial zones. Technology assessment includes evaluation of current and emerging solutions in cold chain monitoring, automation, and energy efficiency to understand market evolution trends.

Regional distribution of Thailand’s cold chain logistics market shows significant concentration in the Greater Bangkok area, which accounts for approximately 45% of total market activity. Bangkok and surrounding provinces benefit from proximity to major ports, airports, and consumer markets, making them preferred locations for large-scale cold storage facilities and distribution centers.

Eastern Economic Corridor (EEC) provinces including Chonburi, Rayong, and Chachoengsao represent the second-largest market segment with roughly 25% market share. This region’s industrial focus and port connectivity support both domestic distribution and export-oriented cold chain operations.

Northern regions centered around Chiang Mai and Chiang Rai contribute approximately 15% of market activity, primarily serving agricultural processing and cross-border trade with neighboring countries. Southern provinces including Songkhla and Surat Thani account for 10% of market share, focusing on seafood processing and rubber industry applications.

Northeastern regions show emerging potential with increasing agricultural processing activities and improved transportation infrastructure. Regional development initiatives aim to distribute cold chain capabilities more evenly across the country, reducing concentration in central regions and supporting rural economic development.

Competitive landscape in Thailand’s cold chain logistics market features a mix of international logistics giants, domestic players, and specialized cold storage operators. Market leadership is distributed among several key players, each focusing on different segments and service offerings.

Strategic partnerships and joint ventures are common, with international companies collaborating with local players to leverage market knowledge and regulatory compliance capabilities. Technology differentiation increasingly determines competitive positioning, with advanced monitoring and automation systems becoming key differentiators.

Market segmentation of Thailand’s cold chain logistics sector reveals distinct categories based on temperature requirements, industry applications, and service types. Temperature-based segmentation includes frozen storage (-18°C to -25°C), chilled storage (0°C to 8°C), and controlled ambient storage (12°C to 15°C), each serving specific product requirements.

By Application:

By Service Type:

Food and beverage segment dominates Thailand’s cold chain logistics market, accounting for approximately 70% of total demand. Processed food manufacturers require sophisticated cold storage and distribution networks to maintain product quality and extend shelf life, driving continuous investment in cold chain infrastructure.

Pharmaceutical segment represents the fastest-growing category, with demand increasing by 22% annually due to expanding healthcare infrastructure and increasing vaccine distribution requirements. Biotechnology products and specialty medications require ultra-low temperature storage capabilities, creating opportunities for specialized service providers.

Fresh produce category benefits from Thailand’s position as a major agricultural exporter, with cold chain services essential for maintaining quality during international transportation. Seafood processing represents a significant subcategory, leveraging Thailand’s coastal resources and export capabilities.

E-commerce fulfillment has emerged as a distinct category, requiring flexible cold chain solutions for online grocery delivery and meal kit services. Cross-border trade applications continue expanding, supporting regional food security and trade integration initiatives within ASEAN.

Industry participants in Thailand’s cold chain logistics market enjoy several strategic advantages, including access to a growing consumer base with increasing disposable income and changing consumption patterns. Food processors benefit from extended product shelf life, reduced waste, and expanded market reach through reliable cold chain services.

Retailers and distributors gain competitive advantages through improved product quality, reduced inventory losses, and enhanced customer satisfaction. Export-oriented businesses access international markets more effectively with reliable cold chain logistics supporting product integrity during long-distance transportation.

Pharmaceutical companies ensure regulatory compliance and product efficacy through specialized temperature-controlled storage and distribution services. Farmers and agricultural producers capture higher value for their products through improved post-harvest handling and access to premium markets.

Logistics service providers benefit from higher margins compared to ambient logistics services and opportunities for value-added service offerings. Technology suppliers find growing demand for monitoring systems, automation solutions, and energy-efficient refrigeration equipment.

Government stakeholders achieve food security objectives, export promotion goals, and economic development targets through a robust cold chain logistics infrastructure. Consumers ultimately benefit from improved food safety, product quality, and availability of diverse perishable products year-round.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation and digitalization represent the most significant trends transforming Thailand’s cold chain logistics market. IoT integration enables real-time monitoring of temperature, humidity, and other critical parameters throughout the supply chain, improving quality control and reducing product losses.

Sustainability initiatives are gaining momentum, with companies adopting natural refrigerants, energy-efficient cooling systems, and solar-powered facilities to reduce environmental impact. Green cold chain solutions are becoming competitive differentiators and regulatory requirements.

Last-mile innovation focuses on urban delivery solutions for temperature-sensitive products, including electric refrigerated vehicles and micro-fulfillment centers. Blockchain technology implementation provides enhanced traceability and transparency throughout the cold chain network.

Consolidation trends show larger players acquiring smaller operators to achieve economies of scale and expand service capabilities. Vertical integration strategies involve food processors and retailers developing in-house cold chain capabilities to ensure quality control and cost optimization.

Cross-border expansion continues as companies develop regional networks to serve ASEAN markets. Specialized services for pharmaceuticals, biotechnology, and high-value agricultural products are creating niche market opportunities with premium pricing potential.

Recent industry developments highlight significant investments in cold chain infrastructure expansion across Thailand. Major facility expansions include new automated cold storage warehouses in key industrial zones, incorporating advanced robotics and energy-efficient refrigeration systems.

Technology partnerships between logistics providers and technology companies are accelerating digital transformation initiatives. MWR analysis indicates that companies investing in advanced monitoring and automation systems achieve operational efficiency improvements of 30% or more.

Regulatory developments include updated food safety standards and pharmaceutical storage requirements, driving industry-wide compliance investments. Government infrastructure projects such as improved transportation networks and industrial zone development support cold chain market expansion.

International collaborations with global logistics companies bring advanced cold chain technologies and best practices to the Thai market. Sustainability certifications and green building standards are becoming requirements for new cold storage facility developments.

Merger and acquisition activity continues as companies seek to expand capabilities and market coverage. Strategic partnerships between cold chain providers and e-commerce platforms are creating new service models for online retail fulfillment.

Strategic recommendations for Thailand’s cold chain logistics market participants emphasize the importance of technology adoption and operational efficiency improvements. Investment priorities should focus on automation systems, energy-efficient refrigeration, and comprehensive monitoring capabilities to maintain competitive positioning.

Market expansion strategies should consider regional development opportunities, particularly in underserved areas with growing agricultural processing activities. Partnership approaches with local players can provide market access and regulatory compliance advantages for international companies.

Service differentiation through value-added offerings such as packaging, quality testing, and inventory management can command premium pricing and improve customer retention. Sustainability initiatives should be integrated into long-term planning to meet evolving regulatory requirements and customer expectations.

Workforce development programs addressing skilled labor shortages will be critical for operational success and expansion capabilities. Financial planning should account for high capital requirements and energy costs while identifying opportunities for operational optimization and cost reduction.

Risk management strategies should address potential disruptions from extreme weather, economic volatility, and regulatory changes. Digital transformation initiatives should prioritize customer-facing technologies and operational efficiency improvements to maintain competitive advantages.

Future prospects for Thailand’s cold chain logistics market remain highly positive, with continued growth expected across all major segments. Market expansion will be driven by increasing consumer demand for quality products, pharmaceutical industry growth, and regional trade integration within ASEAN.

Technology evolution will continue transforming operational capabilities, with artificial intelligence, machine learning, and advanced automation becoming standard features in cold chain operations. Sustainability requirements will drive adoption of environmentally friendly refrigeration systems and energy-efficient facility designs.

Regional connectivity improvements through infrastructure development and trade facilitation will expand market opportunities for cross-border cold chain services. E-commerce integration will create new service models and delivery capabilities, particularly in urban areas with high consumer density.

Investment flows are expected to continue supporting capacity expansion and technology upgrades, with both domestic and international capital participating in market development. Regulatory evolution toward stricter quality and safety standards will drive continuous improvement in cold chain capabilities.

Market maturation will lead to increased specialization and service differentiation, with companies focusing on specific industry segments or geographic regions. Long-term growth projections indicate sustained expansion potential, supported by Thailand’s economic development and regional integration objectives.

Thailand’s cold chain logistics market represents a dynamic and rapidly expanding sector with substantial growth potential driven by diverse industry demands and favorable market conditions. The combination of strong food processing capabilities, growing pharmaceutical requirements, and increasing consumer expectations for quality products creates a robust foundation for continued market development.

Strategic positioning as a regional hub for cold chain services offers significant opportunities for both domestic and international players willing to invest in advanced technologies and operational capabilities. Market challenges including high energy costs and skilled labor shortages require strategic planning and innovative solutions, but do not fundamentally undermine the positive growth trajectory.

Future success in Thailand’s cold chain logistics market will depend on companies’ ability to adapt to technological changes, meet evolving regulatory requirements, and deliver value-added services that differentiate their offerings. The market’s evolution toward greater automation, sustainability, and regional integration presents both opportunities and challenges that will shape competitive dynamics in the coming years.

What is Cold Chain Logistics?

Cold chain logistics refers to the temperature-controlled supply chain that is essential for transporting perishable goods such as food, pharmaceuticals, and chemicals. It ensures that products are kept within specific temperature ranges to maintain their quality and safety throughout the distribution process.

What are the key players in the Thailand Cold Chain Logistics Market?

Key players in the Thailand Cold Chain Logistics Market include SCG Logistics, Kerry Logistics, and Thai Cold Chain. These companies provide various services such as refrigerated transportation, warehousing, and distribution solutions tailored to the needs of different industries, among others.

What are the main drivers of the Thailand Cold Chain Logistics Market?

The main drivers of the Thailand Cold Chain Logistics Market include the increasing demand for fresh food products, the growth of the pharmaceutical sector, and the rising consumer awareness regarding food safety. Additionally, advancements in technology and infrastructure are enhancing logistics efficiency.

What challenges does the Thailand Cold Chain Logistics Market face?

The Thailand Cold Chain Logistics Market faces challenges such as high operational costs, inadequate infrastructure in certain regions, and regulatory compliance issues. These factors can hinder the efficiency and reliability of cold chain operations.

What opportunities exist in the Thailand Cold Chain Logistics Market?

Opportunities in the Thailand Cold Chain Logistics Market include the expansion of e-commerce, which requires efficient cold chain solutions for home delivery, and the increasing demand for organic and health-conscious food products. Additionally, investments in technology can improve tracking and monitoring capabilities.

What trends are shaping the Thailand Cold Chain Logistics Market?

Trends shaping the Thailand Cold Chain Logistics Market include the adoption of IoT and automation technologies for better temperature monitoring, the rise of sustainable practices in logistics, and the growing emphasis on traceability in food supply chains. These trends are driving innovation and efficiency in cold chain operations.

Thailand Cold Chain Logistics Market

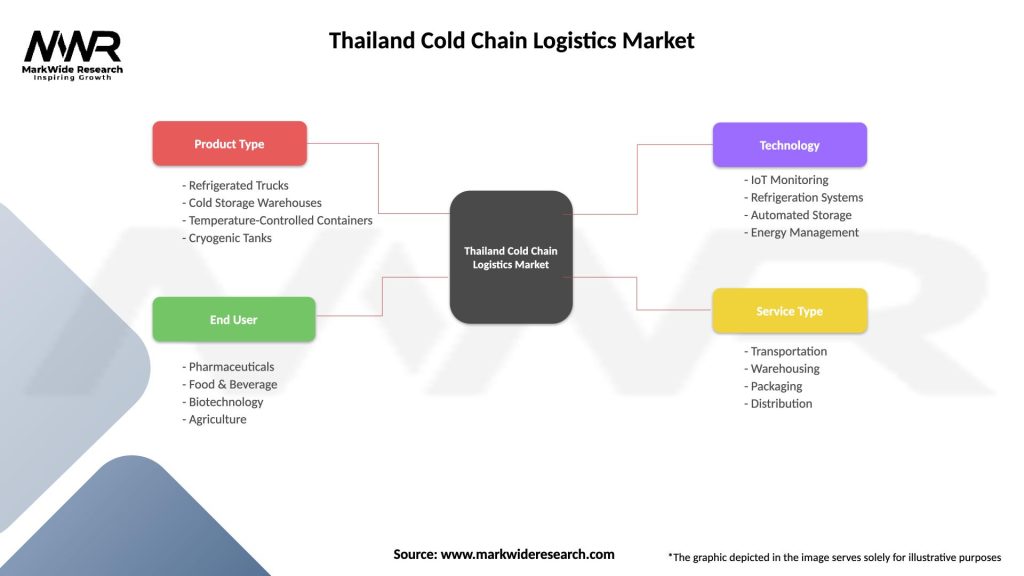

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerated Trucks, Cold Storage Warehouses, Temperature-Controlled Containers, Cryogenic Tanks |

| End User | Pharmaceuticals, Food & Beverage, Biotechnology, Agriculture |

| Technology | IoT Monitoring, Refrigeration Systems, Automated Storage, Energy Management |

| Service Type | Transportation, Warehousing, Packaging, Distribution |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Thailand Cold Chain Logistics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at