444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Testing, inspection, and certification (TIC) services for the metals and minerals market represent a critical component of global industrial infrastructure, ensuring quality, safety, and regulatory compliance across mining, processing, and manufacturing operations. The TIC metals and minerals market encompasses comprehensive analytical services, quality assurance protocols, and certification processes that validate material properties, environmental compliance, and operational safety standards.

Market dynamics indicate robust growth driven by increasing regulatory requirements, quality standards evolution, and expanding global trade in metals and minerals. The sector demonstrates significant expansion with projected growth rates of 6.2% CAGR over the forecast period, reflecting heightened demand for reliable testing and certification services across diverse industrial applications.

Regional distribution shows concentrated activity in major mining regions, with Asia-Pacific commanding 38% market share, followed by North America and Europe. The market encompasses various service categories including chemical analysis, mechanical testing, non-destructive testing, and environmental compliance verification, serving industries from automotive to aerospace manufacturing.

Technological advancement continues reshaping service delivery through automated testing equipment, digital reporting systems, and real-time monitoring capabilities. These innovations enhance accuracy, reduce turnaround times, and improve overall service quality while addressing growing complexity in materials testing requirements.

The testing, inspection, and certification (TIC) for metals and minerals market refers to the comprehensive ecosystem of specialized services that evaluate, verify, and certify the quality, composition, safety, and compliance of metallic materials and mineral products throughout their lifecycle from extraction to end-use applications.

Core services encompass chemical composition analysis, mechanical property testing, metallurgical examination, environmental impact assessment, and regulatory compliance verification. These services ensure materials meet specified standards, regulatory requirements, and customer expectations while maintaining safety and quality benchmarks across global supply chains.

Service providers include independent testing laboratories, certification bodies, inspection agencies, and specialized consultancy firms offering expertise in materials science, analytical chemistry, and regulatory compliance. The market serves diverse stakeholders including mining companies, metal processors, manufacturers, traders, and regulatory authorities requiring reliable quality assurance services.

Market significance extends beyond basic quality control, encompassing risk mitigation, supply chain optimization, regulatory compliance, and market access facilitation. TIC services enable international trade, support product development, and ensure operational safety while building stakeholder confidence in materials quality and performance characteristics.

Strategic market analysis reveals the TIC metals and minerals sector experiencing sustained growth driven by regulatory complexity, quality standard evolution, and expanding global trade volumes. The market demonstrates resilience across economic cycles, supported by essential nature of quality assurance services in industrial operations and international commerce.

Key growth drivers include increasing environmental regulations with 72% of companies reporting enhanced compliance requirements, technological advancement in testing methodologies, and expanding applications in emerging materials sectors. Digital transformation initiatives are revolutionizing service delivery through automated systems, cloud-based reporting, and integrated quality management platforms.

Market segmentation shows diversified service offerings across testing types, end-user industries, and geographic regions. Chemical analysis services maintain dominant position, while mechanical testing and non-destructive evaluation segments demonstrate rapid growth. The automotive and aerospace sectors drive significant demand increases reflecting stringent quality requirements and safety standards.

Competitive landscape features established global players alongside regional specialists, creating dynamic market environment characterized by service innovation, geographic expansion, and strategic partnerships. Market consolidation trends continue as companies seek enhanced capabilities and broader service portfolios to meet evolving customer requirements.

Market intelligence reveals several critical insights shaping the TIC metals and minerals landscape:

According to MarkWide Research analysis, these insights collectively indicate market maturation while highlighting opportunities for innovation and service enhancement across traditional and emerging application areas.

Primary market drivers propelling TIC metals and minerals sector growth encompass regulatory, technological, and commercial factors creating sustained demand for quality assurance services.

Regulatory compliance requirements represent the strongest growth driver, with governments worldwide implementing stricter environmental, safety, and quality standards. Mining operations face increasing scrutiny regarding environmental impact, worker safety, and product quality, necessitating comprehensive testing and certification services to maintain operational licenses and market access.

Global trade expansion drives demand for internationally recognized testing and certification services. Cross-border commerce requires materials to meet diverse regulatory standards and customer specifications, creating opportunities for accredited testing laboratories and certification bodies. Trade agreements increasingly incorporate quality and safety provisions requiring third-party verification.

Technological advancement in materials science creates new testing requirements as industries develop advanced alloys, composites, and specialized materials. Aerospace, automotive, and electronics sectors demand sophisticated analytical capabilities to verify material properties and performance characteristics under extreme conditions.

Quality assurance emphasis intensifies across manufacturing sectors as companies recognize the cost implications of material failures and quality issues. Preventive testing and certification reduce warranty claims, product recalls, and reputation damage while supporting continuous improvement initiatives.

Supply chain risk management drives adoption of comprehensive testing services as companies seek to mitigate risks associated with material quality variations, supplier reliability, and regulatory compliance across global supply networks.

Market constraints affecting TIC metals and minerals sector growth include economic, technical, and operational challenges that may limit expansion opportunities and service adoption rates.

High service costs represent a significant constraint, particularly for smaller mining operations and manufacturers with limited budgets. Advanced testing equipment, specialized expertise, and accreditation requirements create substantial operational expenses that may deter some potential customers from utilizing comprehensive testing services.

Technical complexity in modern materials testing requires highly skilled personnel and sophisticated equipment, creating barriers to market entry and limiting service provider capacity. The shortage of qualified materials scientists and testing technicians constrains industry growth and may impact service quality and availability.

Economic cyclicality affects demand patterns as mining and manufacturing industries experience periodic downturns that reduce testing service requirements. Economic uncertainty may lead companies to defer non-essential testing activities, impacting service provider revenues and growth prospects.

Standardization challenges arise from varying international standards, regional regulations, and customer specifications that complicate service delivery and increase operational complexity. Harmonizing testing protocols across different markets requires significant investment and expertise.

Competition from in-house capabilities limits market growth as large mining companies and manufacturers develop internal testing facilities to reduce costs and improve control over quality assurance processes. This trend may reduce demand for external testing services in certain market segments.

Emerging opportunities in the TIC metals and minerals market reflect evolving industry needs, technological capabilities, and regulatory landscapes creating new avenues for service expansion and innovation.

Sustainability testing services represent a rapidly growing opportunity as companies face increasing pressure to demonstrate environmental responsibility and sustainable practices. Carbon footprint analysis, lifecycle assessment, and environmental impact evaluation create new revenue streams for service providers with appropriate capabilities.

Digital transformation initiatives offer opportunities for service enhancement through automated testing systems, artificial intelligence applications, and cloud-based reporting platforms. These technologies improve efficiency, reduce costs, and enable new service delivery models including remote monitoring and real-time quality assessment.

Emerging markets expansion provides significant growth potential as developing economies invest in infrastructure development and industrial capacity. Countries in Asia-Pacific and Latin America show 45% higher growth rates in testing service demand compared to mature markets, reflecting rapid industrialization and regulatory development.

Advanced materials testing creates opportunities as industries adopt new alloys, composites, and engineered materials requiring specialized analytical capabilities. Additive manufacturing, nanotechnology applications, and smart materials development drive demand for innovative testing methodologies.

Supply chain integration services offer expansion opportunities through comprehensive quality management solutions that extend beyond traditional testing to include supplier auditing, process optimization, and risk assessment services.

Market dynamics in the TIC metals and minerals sector reflect complex interactions between regulatory requirements, technological advancement, competitive pressures, and evolving customer expectations that shape industry development and strategic direction.

Regulatory evolution continues driving market transformation as governments implement stricter environmental standards, safety requirements, and quality specifications. The trend toward harmonized international standards creates opportunities for globally accredited service providers while challenging regional players to enhance capabilities and accreditation portfolios.

Technology integration accelerates across the sector with automation improving testing efficiency by 28% while reducing human error and operational costs. Advanced analytical instruments, robotics applications, and digital reporting systems transform service delivery capabilities and customer experience expectations.

Customer relationship evolution shifts from transactional testing services toward strategic partnerships encompassing consulting, training, and ongoing quality management support. Service providers increasingly function as trusted advisors supporting customer operations optimization and regulatory compliance strategies.

Competitive intensity increases as market participants expand service portfolios, enhance technological capabilities, and pursue geographic expansion strategies. Consolidation trends continue as companies seek scale advantages and comprehensive service offerings to compete effectively in global markets.

Value chain integration becomes increasingly important as customers seek streamlined service delivery, reduced complexity, and improved coordination across multiple testing and certification requirements. This trend favors providers offering comprehensive service portfolios and integrated quality management solutions.

Comprehensive research methodology employed for this market analysis encompasses multiple data collection approaches, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for stakeholders across the TIC metals and minerals sector.

Primary research activities include structured interviews with industry executives, service providers, end-users, and regulatory officials to gather firsthand insights regarding market trends, challenges, opportunities, and strategic priorities. Survey methodologies capture quantitative data regarding service utilization patterns, satisfaction levels, and future requirements across diverse customer segments.

Secondary research sources encompass industry publications, regulatory documents, company annual reports, trade association studies, and academic research to establish comprehensive market understanding and validate primary research findings. Data triangulation ensures consistency and reliability across multiple information sources.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop growth projections and market forecasts. Segmentation analysis identifies key growth drivers and market dynamics across different service categories, end-user industries, and geographic regions.

Expert validation processes involve industry specialists reviewing research findings, methodology approaches, and analytical conclusions to ensure accuracy and practical relevance. Peer review mechanisms maintain research quality standards and enhance credibility of market insights and recommendations.

Geographic market distribution reveals distinct regional characteristics, growth patterns, and competitive dynamics that influence TIC metals and minerals service demand and provider strategies across global markets.

Asia-Pacific region dominates market activity with 38% market share, driven by extensive mining operations, rapid industrialization, and expanding manufacturing capacity. Countries including China, India, and Australia represent major demand centers supported by large-scale infrastructure projects and export-oriented industries requiring comprehensive quality assurance services.

North American market maintains strong position with 28% regional share, characterized by advanced regulatory frameworks, sophisticated testing requirements, and emphasis on environmental compliance. The region benefits from established mining industries, advanced manufacturing sectors, and stringent quality standards driving consistent service demand.

European market accounts for 25% market share, distinguished by strict environmental regulations, advanced materials applications, and emphasis on sustainability testing services. The region leads in developing innovative testing methodologies and digital integration solutions while maintaining high service quality standards.

Latin American region shows rapid growth potential with expanding mining operations and increasing regulatory sophistication. Countries including Brazil, Chile, and Peru drive demand through large-scale mining projects and growing emphasis on environmental compliance and social responsibility.

Middle East and Africa represent emerging opportunities with developing mining industries and increasing infrastructure investment creating demand for quality assurance services and regulatory compliance support.

Market competition in the TIC metals and minerals sector features diverse participants ranging from global service providers to specialized regional laboratories, creating dynamic competitive environment characterized by service innovation, geographic expansion, and strategic partnerships.

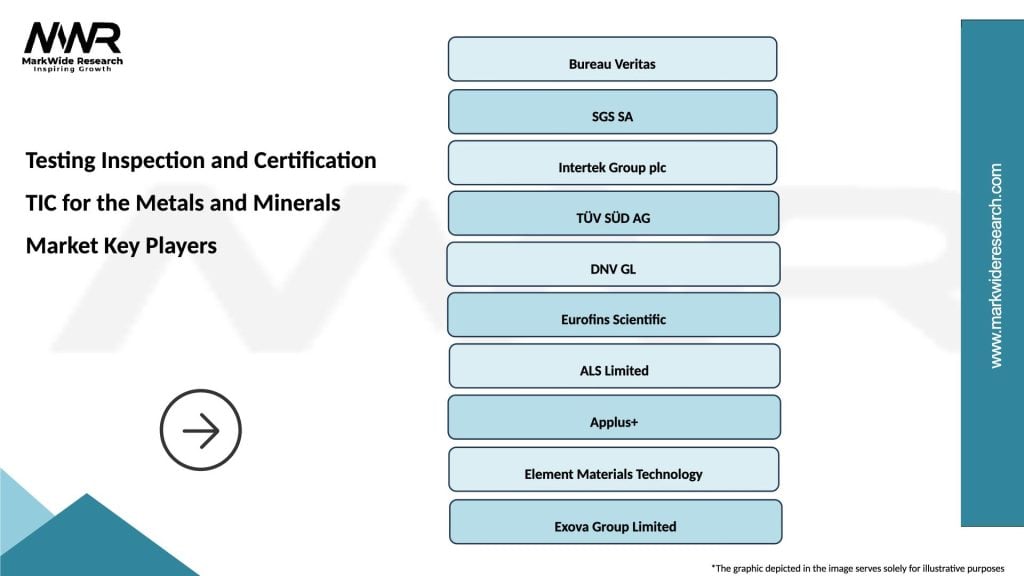

Leading market participants include:

Competitive strategies emphasize service portfolio expansion, technological advancement, geographic diversification, and customer relationship development to maintain market position and drive growth in evolving market conditions.

Market segmentation analysis reveals diverse service categories, application areas, and customer segments that define the TIC metals and minerals market structure and growth opportunities.

By Service Type:

By End-User Industry:

By Application:

Chemical analysis services maintain market leadership position due to fundamental importance in material characterization and quality verification. This category encompasses elemental analysis, compositional testing, and trace element detection services essential for material specification compliance and process optimization. Advanced analytical techniques including ICP-MS, XRF, and atomic absorption spectroscopy drive service sophistication and accuracy improvements.

Mechanical testing segment demonstrates strong growth driven by increasing emphasis on material performance verification and safety assurance. Services include tensile testing, hardness measurement, impact testing, and fatigue analysis supporting product development and quality control requirements across diverse industrial applications.

Non-destructive testing category experiences rapid expansion with technology adoption rates increasing 42% as industries seek to evaluate material integrity without compromising product usability. Advanced techniques including computed tomography, phased array ultrasonics, and digital radiography enhance inspection capabilities and detection sensitivity.

Environmental testing services show accelerating growth reflecting increasing regulatory requirements and sustainability focus across mining and manufacturing operations. Services encompass contamination assessment, environmental impact evaluation, and compliance verification supporting corporate responsibility initiatives and regulatory adherence.

Metallurgical analysis services support advanced materials development and process optimization through microstructure examination, phase identification, and material characterization. This specialized segment serves research and development activities while supporting quality control and failure analysis requirements across critical applications.

Industry participants across the TIC metals and minerals value chain realize significant benefits through comprehensive testing, inspection, and certification services that enhance operational efficiency, risk management, and market competitiveness.

Mining companies benefit through improved ore characterization, process optimization, and environmental compliance support that enhances operational efficiency and regulatory adherence. Testing services enable resource evaluation, extraction optimization, and product quality assurance while supporting sustainable mining practices and stakeholder confidence.

Metal processors gain enhanced quality control capabilities, process monitoring support, and product certification services that improve manufacturing efficiency and customer satisfaction. Comprehensive testing enables process optimization, yield improvement, and consistent product quality while reducing waste and operational costs.

Manufacturers achieve reliable material qualification, supplier verification, and quality assurance support that reduces production risks and enhances product performance. Testing services enable informed material selection, supplier evaluation, and continuous improvement initiatives while supporting regulatory compliance and customer requirements.

Regulatory authorities benefit from independent verification services that support compliance monitoring, safety assurance, and environmental protection objectives. Third-party testing and certification enhance regulatory effectiveness while reducing administrative burden and enforcement costs.

End customers receive enhanced product quality, safety assurance, and performance reliability through comprehensive testing and certification programs. These services build consumer confidence, reduce product liability risks, and support informed purchasing decisions across diverse application areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping TIC metals and minerals services through automation, artificial intelligence, and cloud-based platforms. Service providers increasingly adopt digital reporting systems, automated testing equipment, and data analytics capabilities to enhance efficiency and customer experience while reducing operational costs and turnaround times.

Sustainability integration becomes increasingly important as customers demand environmental testing, carbon footprint analysis, and sustainability certification services. This trend reflects growing corporate responsibility focus and regulatory requirements for environmental compliance across mining and manufacturing operations.

Service consolidation continues as customers seek comprehensive solutions from fewer providers to reduce complexity and improve coordination. This trend drives market participants to expand service portfolios, enhance capabilities, and develop integrated quality management solutions addressing diverse customer requirements.

Real-time monitoring capabilities gain adoption with implementation rates growing 33% as industries seek continuous quality assurance and process optimization support. Advanced sensor technologies, IoT integration, and remote monitoring systems enable proactive quality management and immediate response to quality deviations.

Regulatory harmonization progresses across international markets as governments work to align standards and requirements, creating opportunities for globally accredited service providers while simplifying compliance management for multinational customers.

Advanced analytics integration enhances service value through predictive modeling, trend analysis, and performance optimization recommendations that extend beyond traditional testing and certification to include strategic consulting and advisory services.

Recent industry developments highlight ongoing evolution in the TIC metals and minerals sector through technological advancement, regulatory changes, and strategic initiatives that shape market dynamics and competitive positioning.

Technology investments accelerate across leading service providers as companies deploy advanced analytical instruments, automated testing systems, and digital platforms to enhance service capabilities and operational efficiency. These investments support capacity expansion while improving service quality and customer satisfaction levels.

Accreditation expansion continues as service providers seek recognition across multiple international standards and regional requirements to support global customer operations and market access initiatives. Enhanced accreditation portfolios enable comprehensive service delivery and competitive differentiation in diverse markets.

Strategic partnerships develop between testing laboratories, technology providers, and industry associations to enhance service capabilities, expand market reach, and develop innovative solutions addressing evolving customer requirements and regulatory challenges.

Regulatory updates across major markets introduce new testing requirements, environmental standards, and safety specifications that create opportunities for service expansion while requiring adaptation of existing capabilities and procedures.

Market consolidation activities include mergers, acquisitions, and strategic alliances as companies seek enhanced scale, expanded capabilities, and improved geographic coverage to compete effectively in global markets and serve multinational customers.

Sustainability initiatives gain prominence as service providers develop environmental testing capabilities, carbon footprint analysis services, and sustainability certification programs responding to increasing customer demand and regulatory requirements.

Strategic recommendations for TIC metals and minerals market participants emphasize capability enhancement, technology adoption, and market positioning strategies to capitalize on growth opportunities while addressing competitive challenges and evolving customer requirements.

Technology investment should prioritize automation, digital integration, and advanced analytical capabilities to improve service efficiency, quality, and customer experience. Companies should develop comprehensive digitization strategies encompassing laboratory automation, cloud-based reporting, and data analytics capabilities to maintain competitive advantage.

Service portfolio expansion into sustainability testing, environmental compliance, and advanced materials analysis represents critical growth opportunities. MWR analysis suggests companies developing these capabilities early will capture disproportionate market share as demand accelerates across diverse industry segments.

Geographic diversification into emerging markets offers significant growth potential, particularly in Asia-Pacific and Latin American regions experiencing rapid industrialization and regulatory development. Companies should establish local presence and partnerships to effectively serve these expanding markets.

Customer relationship development should evolve from transactional service delivery toward strategic partnerships encompassing consulting, training, and ongoing quality management support. This approach enhances customer loyalty while creating opportunities for service expansion and premium pricing.

Accreditation strategy must encompass multiple international standards and regional requirements to support global customer operations and market access initiatives. Companies should prioritize accreditation investments based on customer requirements and market opportunities.

Talent development programs addressing skilled labor shortages should include technical training, professional development, and retention strategies to maintain service quality and support capacity expansion initiatives.

Future market prospects for TIC metals and minerals services remain highly positive, supported by fundamental growth drivers including regulatory evolution, technology advancement, and expanding global trade that create sustained demand for quality assurance and compliance services.

Growth projections indicate continued market expansion with projected CAGR of 6.8% over the next five years, driven by increasing regulatory requirements, advanced materials development, and emerging market industrialization. This growth trajectory reflects the essential nature of testing and certification services in supporting industrial operations and international commerce.

Technology integration will accelerate service transformation through artificial intelligence, machine learning, and IoT applications that enhance analytical capabilities, improve efficiency, and enable new service delivery models. Digital platforms will become standard infrastructure supporting customer interaction, reporting, and quality management processes.

Sustainability focus will intensify as environmental regulations strengthen and corporate responsibility requirements expand. Environmental testing, carbon footprint analysis, and sustainability certification services will experience above-average growth rates exceeding 9% as companies seek to demonstrate environmental compliance and social responsibility.

Market consolidation trends will continue as companies pursue scale advantages, enhanced capabilities, and comprehensive service portfolios to compete effectively in global markets. Strategic partnerships and acquisitions will reshape competitive landscape while creating opportunities for service innovation and market expansion.

Emerging applications in advanced materials, additive manufacturing, and smart materials will create new testing requirements and service opportunities. Companies investing in these capabilities early will establish competitive advantages in high-growth market segments.

The TIC metals and minerals market represents a dynamic and essential sector supporting global industrial operations through comprehensive testing, inspection, and certification services. Market analysis reveals sustained growth prospects driven by regulatory evolution, technological advancement, and expanding global trade that create consistent demand for quality assurance services across diverse industry applications.

Key success factors include technology adoption, service portfolio expansion, geographic diversification, and customer relationship development that enable market participants to capitalize on growth opportunities while addressing competitive challenges. The sector’s evolution toward digital integration, sustainability focus, and strategic partnerships creates new opportunities for innovation and market expansion.

Strategic positioning requires balancing traditional testing capabilities with emerging service areas including environmental compliance, advanced materials analysis, and digital solutions that address evolving customer requirements and regulatory landscapes. Companies successfully navigating this transition will capture disproportionate market share and establish sustainable competitive advantages.

Future market development will be characterized by continued growth, technology integration, and service innovation that enhance value delivery while supporting industrial development and international commerce. The TIC metals and minerals market remains well-positioned for sustained expansion, offering attractive opportunities for established players and new entrants with appropriate capabilities and strategic focus.

What is Testing Inspection and Certification TIC for the Metals and Minerals?

Testing Inspection and Certification (TIC) for the Metals and Minerals refers to the processes that ensure the quality, safety, and compliance of metal and mineral products. This includes various assessments and certifications that verify materials meet industry standards and regulations.

What are the key companies in Testing Inspection and Certification TIC for the Metals and Minerals Market?

Key companies in the Testing Inspection and Certification TIC for the Metals and Minerals Market include SGS, Bureau Veritas, Intertek, and TUV Rheinland, among others.

What are the growth factors driving Testing Inspection and Certification TIC for the Metals and Minerals Market?

Growth factors for Testing Inspection and Certification TIC in this sector include increasing demand for high-quality materials, stringent regulatory requirements, and the rising need for sustainability in mining practices.

What challenges does the Testing Inspection and Certification TIC for the Metals and Minerals Market face?

Challenges in the Testing Inspection and Certification TIC for the Metals and Minerals Market include the complexity of regulatory compliance, the need for advanced testing technologies, and the fluctuating prices of raw materials.

What opportunities exist in the Testing Inspection and Certification TIC for the Metals and Minerals Market?

Opportunities in this market include the expansion of green mining initiatives, advancements in testing technologies, and the growing focus on supply chain transparency and traceability.

What trends are shaping the Testing Inspection and Certification TIC for the Metals and Minerals Market?

Trends influencing the Testing Inspection and Certification TIC for the Metals and Minerals Market include the adoption of digital technologies for remote inspections, increased emphasis on environmental compliance, and the integration of artificial intelligence in testing processes.

Testing Inspection and Certification TIC for the Metals and Minerals Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ferrous Metals, Non-Ferrous Metals, Precious Metals, Alloys |

| Grade | High Purity, Standard Grade, Low Grade, Specialty Grade |

| Application | Construction, Aerospace, Automotive Components, Electronics |

| End User | Manufacturers, Distributors, Retailers, Mining Companies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Testing Inspection and Certification TIC for the Metals and Minerals Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at