444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The testing, inspection, and certification for transportation market represents a critical infrastructure supporting the global mobility ecosystem. This comprehensive sector encompasses quality assurance services across automotive, aerospace, maritime, rail, and emerging transportation technologies. Market dynamics indicate robust expansion driven by stringent safety regulations, technological advancement, and increasing consumer demand for reliable transportation systems.

Transportation safety standards have evolved significantly, with regulatory bodies worldwide implementing more rigorous testing protocols. The market demonstrates 8.2% CAGR growth across key segments, reflecting heightened focus on vehicle safety, environmental compliance, and operational efficiency. Automotive testing services dominate the landscape, accounting for approximately 45% market share, while aerospace and maritime sectors contribute substantially to overall market expansion.

Technological integration continues reshaping service delivery methodologies, with digital testing platforms and automated inspection systems gaining prominence. The emergence of electric vehicles, autonomous transportation, and smart mobility solutions creates new testing paradigms requiring specialized certification processes. Regional variations in regulatory frameworks drive market segmentation, with North America and Europe maintaining leadership positions in advanced testing capabilities.

The testing, inspection, and certification for transportation market refers to the comprehensive ecosystem of quality assurance services ensuring transportation systems meet safety, performance, and regulatory standards. This market encompasses systematic evaluation processes for vehicles, components, infrastructure, and operational systems across all transportation modes.

Testing services involve rigorous evaluation of mechanical, electrical, and software systems to validate performance specifications and safety parameters. Inspection activities focus on systematic examination of transportation assets to identify potential defects, compliance gaps, and maintenance requirements. Certification processes provide formal validation that transportation systems meet established industry standards and regulatory requirements.

Market scope extends beyond traditional vehicle testing to include infrastructure assessment, operational certification, and emerging technology validation. The sector serves manufacturers, operators, regulatory bodies, and end-users requiring independent verification of transportation system reliability and safety compliance.

Market expansion in testing, inspection, and certification for transportation reflects increasing complexity in modern mobility systems and heightened regulatory scrutiny. The sector demonstrates resilient growth patterns driven by mandatory compliance requirements, technological innovation, and evolving safety standards across transportation modes.

Key growth drivers include electrification trends accounting for 35% of new testing requirements, autonomous vehicle development, and stricter environmental regulations. Service diversification encompasses traditional mechanical testing, advanced software validation, cybersecurity assessment, and sustainability certification. The market benefits from increasing outsourcing trends as manufacturers seek specialized expertise and regulatory compliance assurance.

Competitive dynamics feature established testing laboratories expanding service portfolios alongside specialized providers focusing on emerging technologies. Geographic expansion patterns show significant growth in Asia-Pacific regions, driven by manufacturing growth and regulatory harmonization efforts. The market demonstrates strong resilience to economic fluctuations due to mandatory nature of safety and compliance testing.

Market intelligence reveals several critical trends shaping the testing, inspection, and certification landscape for transportation systems:

Regulatory compliance serves as the primary market driver, with government agencies worldwide implementing increasingly stringent safety and environmental standards. Transportation authorities mandate comprehensive testing protocols for vehicle approval, operational licensing, and ongoing compliance monitoring. The regulatory landscape continues evolving to address emerging technologies and safety concerns.

Safety consciousness among consumers and operators drives demand for independent verification of transportation system reliability. High-profile accidents and recalls emphasize the importance of thorough testing and inspection processes. Insurance requirements often mandate certified testing documentation, creating additional market demand.

Technological advancement creates new testing requirements as transportation systems become more complex and interconnected. Electric powertrains, autonomous systems, and connected vehicle technologies require specialized testing protocols not covered by traditional automotive standards. The integration of software and hardware systems necessitates comprehensive validation processes.

Globalization trends drive standardization efforts and mutual recognition agreements, expanding market opportunities for certified testing providers. International trade requires harmonized testing standards and certification processes to facilitate cross-border transportation system deployment.

High capital requirements for establishing comprehensive testing facilities create barriers to market entry. Advanced testing equipment demands significant investment in specialized machinery, calibration systems, and facility infrastructure. The cost of maintaining accreditation and updating equipment to match evolving standards represents ongoing financial challenges.

Skilled workforce shortages limit market expansion as testing and inspection services require highly trained technicians and engineers. Specialized knowledge in emerging technologies like autonomous systems and electric powertrains remains scarce, constraining service capacity growth.

Regulatory fragmentation across different jurisdictions creates complexity and increases operational costs for testing providers. Varying standards between regions require multiple certifications and testing protocols, reducing efficiency and increasing time-to-market for transportation systems.

Technology evolution pace challenges testing providers to continuously update capabilities and methodologies. Rapid innovation in transportation technologies can render existing testing equipment and procedures obsolete, requiring frequent reinvestment in new capabilities.

Emerging transportation technologies create substantial opportunities for specialized testing and certification services. Electric aircraft, hyperloop systems, and autonomous delivery vehicles require entirely new testing paradigms and certification frameworks. Early market entrants can establish competitive advantages in these high-growth segments.

Digital transformation opportunities include development of remote testing capabilities, AI-powered inspection systems, and blockchain-based certification tracking. Virtual testing methodologies can reduce costs and accelerate certification timelines while maintaining safety standards.

Sustainability focus opens new service categories including lifecycle assessment, carbon footprint certification, and circular economy compliance testing. Environmental regulations increasingly require comprehensive sustainability documentation throughout transportation system lifecycles.

Market consolidation opportunities exist as smaller testing providers seek partnerships or acquisition by larger organizations with broader geographic reach and service capabilities. Strategic alliances can expand service portfolios and market access while sharing investment costs for new testing capabilities.

Supply-demand dynamics in the testing, inspection, and certification market reflect the mandatory nature of safety compliance and the specialized expertise required for comprehensive evaluation services. Demand patterns closely correlate with transportation industry production cycles and regulatory implementation timelines.

Pricing mechanisms vary significantly across service categories, with routine testing services experiencing competitive pressure while specialized emerging technology testing commands premium rates. Service differentiation increasingly focuses on speed, accuracy, and comprehensive reporting capabilities rather than basic compliance verification.

Technology adoption drives market evolution as digital testing platforms and automated inspection systems improve efficiency and reduce human error. Data analytics integration enables predictive maintenance recommendations and trend analysis, adding value beyond basic compliance verification.

Customer relationships evolve toward long-term partnerships as transportation manufacturers seek integrated testing solutions throughout product development and lifecycle management. Service bundling becomes more common as clients prefer comprehensive solutions from trusted providers rather than managing multiple vendor relationships.

Market analysis employs comprehensive primary and secondary research methodologies to ensure accurate representation of testing, inspection, and certification market dynamics. Primary research includes structured interviews with industry executives, regulatory officials, and end-users across major transportation sectors.

Secondary research encompasses analysis of regulatory filings, industry publications, patent databases, and financial reports from key market participants. Data triangulation methods validate findings across multiple sources to ensure reliability and accuracy of market insights.

Quantitative analysis utilizes statistical modeling techniques to project market trends and growth patterns. Qualitative assessment provides context for numerical data through expert opinions and industry trend analysis. The methodology ensures comprehensive coverage of market segments while maintaining analytical rigor.

Regional analysis incorporates local regulatory frameworks, economic conditions, and industry development patterns to provide accurate geographic market assessments. Competitive intelligence gathering includes analysis of service portfolios, pricing strategies, and market positioning across major testing providers.

North America maintains market leadership with approximately 35% global market share, driven by stringent regulatory frameworks and advanced automotive manufacturing. United States dominates through comprehensive federal and state-level testing requirements, while Canada contributes significantly through aerospace and automotive sectors.

Europe represents the second-largest market with 30% market share, characterized by harmonized EU regulations and strong emphasis on environmental compliance. Germany leads in automotive testing services, while the United Kingdom maintains strength in aerospace certification. Nordic countries demonstrate leadership in sustainable transportation testing.

Asia-Pacific shows the fastest growth trajectory with 12% annual expansion, led by China’s massive automotive production and Japan’s technological innovation. India emerges as a significant market driven by manufacturing growth and regulatory modernization efforts. Southeast Asian markets demonstrate increasing demand for transportation infrastructure testing.

Latin America and Middle East & Africa represent emerging opportunities with growing transportation infrastructure investments and evolving regulatory frameworks. Brazil and Mexico lead Latin American demand, while UAE and South Africa drive Middle Eastern and African market development respectively.

Market competition features a mix of global testing conglomerates, specialized service providers, and regional players offering comprehensive testing, inspection, and certification services across transportation sectors.

By Service Type:

By Transportation Mode:

By Technology:

Automotive Testing dominates market share with comprehensive requirements spanning safety, emissions, performance, and durability testing. Electric vehicle testing shows 55% annual growth as manufacturers transition to electrified powertrains. Traditional internal combustion engine testing remains significant but shows declining growth rates.

Aerospace Certification maintains premium pricing due to stringent safety requirements and complex regulatory frameworks. Commercial aviation drives steady demand while military and space applications offer specialized high-value opportunities. Emerging urban air mobility creates new certification categories.

Maritime Inspection benefits from international shipping growth and environmental regulations requiring comprehensive vessel certification. Offshore renewable energy projects create additional demand for specialized marine testing services. Port infrastructure testing gains importance with increasing cargo volumes.

Rail Transportation shows steady growth driven by urban transit expansion and high-speed rail development. Safety certification remains paramount with comprehensive testing protocols for rolling stock and infrastructure systems. Digitalization creates new testing requirements for smart rail systems.

Manufacturers benefit from independent validation of product safety and performance, reducing liability risks and facilitating market access. Regulatory compliance assurance enables global market entry while comprehensive testing identifies potential issues before market launch.

Operators gain confidence in transportation system reliability through certified inspection and testing services. Insurance benefits include reduced premiums and coverage availability based on certified safety documentation. Predictive maintenance insights extend asset lifecycles and reduce operational costs.

Regulators leverage independent testing services to ensure transportation system safety without maintaining extensive in-house capabilities. Standardization efforts benefit from industry expertise and testing data to develop effective regulatory frameworks.

End Users receive enhanced safety assurance through comprehensive testing and certification processes. Quality confidence in transportation systems reduces safety concerns and supports adoption of new technologies. Environmental benefits include verified emissions compliance and sustainability certification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization trends reshape testing methodologies through virtual simulation, remote monitoring, and automated inspection systems. Artificial intelligence integration enables predictive analysis and pattern recognition in testing data, improving accuracy and efficiency. Digital certification platforms streamline documentation and tracking processes.

Sustainability emphasis drives development of environmental testing protocols and lifecycle assessment services. Carbon footprint certification becomes mandatory across transportation sectors, creating new service opportunities. Circular economy principles influence testing requirements for recyclability and material sustainability.

Cybersecurity focus emerges as connected and autonomous vehicles require comprehensive security testing. Software validation gains equal importance to traditional hardware testing as transportation systems become increasingly software-defined. Over-the-air update capabilities require new certification frameworks.

Modular testing approaches enable faster certification processes through component-level validation and system integration testing. Standardization efforts across regions reduce duplicative testing requirements and accelerate global market access for transportation systems.

Regulatory harmonization initiatives create mutual recognition agreements between major markets, reducing duplicative testing requirements. International standards organizations develop unified protocols for emerging transportation technologies, facilitating global deployment.

Technology partnerships between testing providers and technology companies accelerate development of specialized testing capabilities. Collaborative research programs advance testing methodologies for autonomous systems, electric powertrains, and connected vehicle technologies.

Facility expansion projects include construction of specialized testing centers for electric vehicle validation and autonomous system certification. Geographic expansion sees major testing providers establishing presence in high-growth markets across Asia-Pacific and Latin America.

Acquisition activity consolidates market participants as larger organizations seek to expand service portfolios and geographic coverage. Strategic alliances enable smaller providers to access advanced testing capabilities while maintaining independence.

MarkWide Research analysis indicates that testing providers should prioritize investment in emerging technology capabilities, particularly electric vehicle and autonomous system testing. Digital transformation initiatives should focus on automation and data analytics to improve service efficiency and customer value.

Geographic expansion strategies should target high-growth markets in Asia-Pacific while maintaining leadership positions in established North American and European markets. Service portfolio diversification should include sustainability testing and cybersecurity validation to capture emerging demand.

Partnership strategies with technology companies and research institutions can accelerate capability development while sharing investment costs. Talent acquisition and training programs should address skilled workforce shortages in specialized testing areas.

Regulatory engagement remains critical as testing providers should actively participate in standard development processes to influence future requirements. Customer relationship management should evolve toward long-term partnerships providing comprehensive lifecycle support rather than transactional testing services.

Market projections indicate sustained growth driven by transportation electrification, autonomous system deployment, and increasing regulatory stringency. Technology evolution will create new testing categories while traditional services maintain steady demand through regulatory requirements.

Electric vehicle testing is expected to show 60% growth over the next five years as manufacturers accelerate electrification programs. Autonomous system certification will emerge as a major service category requiring specialized capabilities and regulatory frameworks.

Regional growth patterns favor Asia-Pacific markets with 15% annual expansion expected through 2030. MWR projections suggest North America and Europe will maintain steady growth while emerging markets accelerate rapidly.

Service evolution will emphasize integrated solutions combining testing, inspection, and certification with consulting and lifecycle support services. Digital platforms will enable remote testing capabilities and real-time monitoring services, transforming traditional service delivery models.

The testing, inspection, and certification for transportation market demonstrates robust growth prospects driven by regulatory requirements, technological advancement, and safety consciousness across transportation sectors. Market dynamics favor providers with comprehensive capabilities, geographic reach, and expertise in emerging technologies.

Strategic opportunities exist in electric vehicle testing, autonomous system certification, and sustainability validation as transportation systems evolve toward cleaner and smarter technologies. Digital transformation initiatives will reshape service delivery while maintaining the fundamental importance of independent safety and compliance verification.

Success factors include continuous investment in advanced testing capabilities, skilled workforce development, and strategic partnerships with technology innovators. Market leaders will differentiate through comprehensive service portfolios, rapid adaptation to regulatory changes, and customer-centric solution development that addresses evolving transportation industry needs.

What is Testing, Inspection, and Certification for Transportation?

Testing, Inspection, and Certification for Transportation refers to the processes and services that ensure vehicles, infrastructure, and transportation systems meet safety, quality, and regulatory standards. This includes evaluating compliance with safety regulations, performance testing, and certification of various transportation components.

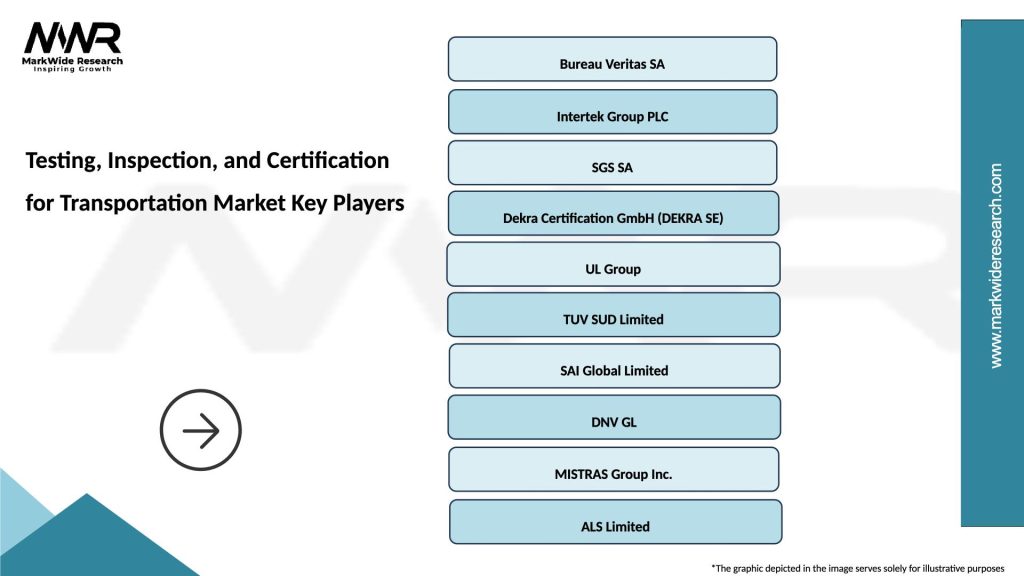

What are the key companies in the Testing, Inspection, and Certification for Transportation Market?

Key companies in the Testing, Inspection, and Certification for Transportation Market include SGS, Bureau Veritas, and Intertek, which provide a range of services from safety inspections to compliance testing, among others.

What are the growth factors driving the Testing, Inspection, and Certification for Transportation Market?

The growth of the Testing, Inspection, and Certification for Transportation Market is driven by increasing safety regulations, the rise in vehicle production, and the growing emphasis on sustainable transportation solutions. Additionally, advancements in technology are enhancing testing methodologies.

What challenges does the Testing, Inspection, and Certification for Transportation Market face?

Challenges in the Testing, Inspection, and Certification for Transportation Market include the complexity of regulatory compliance, the need for skilled personnel, and the rapid pace of technological advancements that require continuous adaptation of testing methods.

What opportunities exist in the Testing, Inspection, and Certification for Transportation Market?

Opportunities in the Testing, Inspection, and Certification for Transportation Market include the expansion of electric and autonomous vehicles, which require new testing standards, and the increasing demand for sustainable practices in transportation. Additionally, emerging markets present growth potential.

What trends are shaping the Testing, Inspection, and Certification for Transportation Market?

Trends in the Testing, Inspection, and Certification for Transportation Market include the integration of digital technologies such as IoT for real-time monitoring, the focus on environmental sustainability, and the adoption of automated testing processes to improve efficiency and accuracy.

Testing, Inspection, and Certification for Transportation Market

| Segmentation Details | Description |

|---|---|

| Service Type | Quality Assurance, Compliance Testing, Safety Inspection, Certification Services |

| End User | Logistics Providers, Fleet Operators, Public Transport Authorities, Automotive Manufacturers |

| Technology | Non-Destructive Testing, IoT Solutions, Automated Inspection, Data Analytics |

| Application | Vehicle Safety, Infrastructure Assessment, Regulatory Compliance, Performance Evaluation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Testing, Inspection, and Certification for Transportation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at