444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The testing, inspection, and certification for natural resources market represents a critical infrastructure supporting global resource extraction, processing, and distribution industries. This comprehensive market encompasses specialized services that ensure natural resources meet stringent quality, safety, and regulatory standards throughout their lifecycle. Market dynamics indicate robust growth driven by increasing environmental regulations, sustainability initiatives, and heightened focus on resource quality assurance.

Natural resources testing covers diverse sectors including mining, oil and gas, forestry, water resources, and renewable energy materials. The market has experienced significant expansion with a projected CAGR of 6.8% over the forecast period, reflecting growing demand for comprehensive quality assurance services. Regulatory compliance requirements continue to intensify globally, driving increased adoption of third-party testing and certification services.

Industry participants range from multinational testing laboratories to specialized regional service providers, each offering unique capabilities in natural resource analysis. The market demonstrates strong resilience with approximately 78% of companies reporting increased service demand over the past three years. Technological advancement in testing methodologies, including automated analysis systems and real-time monitoring capabilities, continues to reshape service delivery models and enhance accuracy standards.

The testing, inspection, and certification for natural resources market refers to the comprehensive ecosystem of specialized services that evaluate, verify, and certify the quality, composition, safety, and regulatory compliance of naturally occurring materials and resources. This market encompasses analytical testing services, physical inspection processes, and formal certification programs that validate natural resources meet specified standards and regulatory requirements.

Core services include chemical composition analysis, environmental impact assessment, quality verification, safety testing, and compliance certification across various natural resource categories. The market serves as a critical bridge between resource extraction operations and end-user industries, ensuring materials meet stringent quality and safety specifications. Service providers utilize advanced laboratory equipment, field testing capabilities, and specialized expertise to deliver comprehensive evaluation services.

Market scope extends beyond traditional testing to include consulting services, regulatory guidance, and ongoing monitoring programs that support sustainable resource management practices. This integrated approach addresses growing industry demands for transparency, accountability, and environmental stewardship in natural resource utilization.

Market performance in the testing, inspection, and certification sector for natural resources demonstrates exceptional growth momentum, driven by escalating regulatory requirements and increasing emphasis on sustainable resource management. The market benefits from diverse revenue streams across multiple natural resource categories, creating resilient business models for service providers.

Key growth drivers include stringent environmental regulations, corporate sustainability initiatives, and rising consumer awareness regarding resource quality and origin. Approximately 65% of market growth stems from enhanced regulatory compliance requirements, while technological advancement contributes an additional 23% growth factor. Geographic expansion into emerging markets presents significant opportunities for established service providers.

Competitive landscape features both global testing conglomerates and specialized regional providers, creating a dynamic market environment with diverse service offerings. Market consolidation trends indicate increasing merger and acquisition activity as companies seek to expand service capabilities and geographic reach. Innovation focus centers on automation, digitalization, and real-time monitoring solutions that enhance service efficiency and accuracy.

Future prospects remain highly favorable with projected sustained growth across all major market segments. The integration of artificial intelligence and machine learning technologies promises to revolutionize testing methodologies and service delivery models, creating new opportunities for market expansion and service differentiation.

Market segmentation reveals distinct growth patterns across different natural resource categories, with mining and minerals testing representing the largest service segment. The following key insights highlight critical market dynamics:

Market maturity varies significantly across geographic regions, with developed markets showing steady growth while emerging economies experience rapid expansion. Service providers increasingly focus on developing comprehensive testing portfolios that address multiple natural resource categories, creating operational synergies and enhanced customer value propositions.

Regulatory enforcement serves as the primary market driver, with governments worldwide implementing increasingly stringent quality and safety standards for natural resource extraction and processing. Environmental protection agencies continue expanding testing requirements, creating sustained demand for specialized analytical services. Compliance mandates now cover broader scope areas including environmental impact, worker safety, and community health protection.

Corporate sustainability initiatives drive significant market expansion as companies seek to demonstrate environmental responsibility and resource stewardship. Many organizations implement voluntary testing programs that exceed regulatory minimums, creating additional service demand. ESG reporting requirements increasingly include detailed natural resource quality and environmental impact data, necessitating comprehensive testing and certification services.

Technological advancement in testing methodologies enables more precise analysis and faster turnaround times, making comprehensive testing more accessible and cost-effective. Advanced analytical equipment can detect contaminants and quality variations at previously unachievable levels, supporting enhanced product quality and safety standards. Automation technologies reduce testing costs while improving consistency and reliability.

Global trade expansion requires standardized testing and certification to facilitate international commerce in natural resources. Export markets often mandate specific quality certifications, creating demand for accredited testing services. Supply chain transparency initiatives require detailed documentation of resource quality and origin, supported by comprehensive testing and certification programs.

High service costs represent a significant market restraint, particularly for smaller resource extraction operations with limited budgets. Comprehensive testing programs require substantial investment in analytical equipment and specialized personnel, creating barriers to market entry for new service providers. Cost sensitivity among customers often leads to reduced testing frequency or scope, potentially limiting market growth.

Technical complexity of advanced testing methodologies requires highly specialized expertise and sophisticated equipment, creating operational challenges for service providers. The need for continuous technology upgrades and staff training increases operational costs and complexity. Quality assurance requirements for testing laboratories demand significant investment in accreditation and compliance systems.

Geographic limitations restrict service accessibility in remote resource extraction locations, particularly in developing regions with limited infrastructure. Transportation costs and logistical challenges for sample collection and analysis can significantly impact service economics. Regional expertise gaps may limit service availability in specialized natural resource categories.

Regulatory complexity across different jurisdictions creates compliance challenges for service providers operating in multiple markets. Varying standards and requirements necessitate diverse testing capabilities and certifications, increasing operational complexity and costs. Regulatory changes require continuous adaptation of testing methodologies and quality systems, creating ongoing compliance burdens.

Emerging market expansion presents substantial growth opportunities as developing economies increase natural resource extraction activities and implement enhanced regulatory frameworks. These markets often lack established testing infrastructure, creating opportunities for international service providers to establish local operations. Infrastructure development in emerging regions supports market accessibility and service delivery capabilities.

Technology integration opportunities include artificial intelligence applications for predictive analysis, blockchain systems for certification tracking, and IoT sensors for continuous monitoring. These technologies can enhance service value propositions while reducing operational costs. Digital transformation initiatives create new service models including remote monitoring and cloud-based reporting systems.

Renewable energy resources represent a rapidly expanding market segment requiring specialized testing and certification services. Solar panel materials, wind turbine components, and energy storage systems require comprehensive quality assurance programs. Green technology adoption drives demand for environmental impact assessment and sustainability certification services.

Vertical integration opportunities allow service providers to expand into consulting, training, and ongoing monitoring services, creating comprehensive customer relationships and recurring revenue streams. Many clients seek integrated service providers capable of addressing multiple aspects of natural resource quality assurance. Service diversification reduces market risk while enhancing customer value propositions.

Supply and demand dynamics in the testing, inspection, and certification market reflect the complex interplay between regulatory requirements, technological capabilities, and economic factors. Service demand demonstrates strong correlation with natural resource extraction activity levels and regulatory enforcement intensity. Market equilibrium varies significantly across different resource categories and geographic regions.

Competitive dynamics feature intense competition among established players while creating opportunities for specialized niche providers. Large multinational testing companies leverage economies of scale and comprehensive service portfolios, while smaller firms compete through specialized expertise and personalized service. Market consolidation trends indicate ongoing merger and acquisition activity as companies seek to expand capabilities and market reach.

Technology adoption drives significant changes in service delivery models and competitive positioning. Companies investing in advanced analytical equipment and automation technologies gain competitive advantages through improved accuracy and efficiency. Innovation cycles create opportunities for market disruption while requiring continuous investment in technology upgrades.

Customer relationship dynamics emphasize long-term partnerships and integrated service delivery models. Clients increasingly prefer comprehensive service providers capable of addressing multiple testing requirements through single-source relationships. Service customization becomes increasingly important as customers seek tailored solutions addressing specific operational requirements and regulatory obligations.

Primary research methodologies employed in analyzing the testing, inspection, and certification for natural resources market include comprehensive surveys of industry participants, in-depth interviews with key stakeholders, and direct observation of testing facilities and operations. Research teams conduct structured interviews with laboratory managers, quality assurance professionals, and regulatory compliance specialists to gather detailed insights into market trends and operational challenges.

Secondary research incorporates analysis of industry reports, regulatory documents, financial statements, and technical publications to develop comprehensive market understanding. Data sources include government regulatory agencies, industry associations, academic research institutions, and specialized trade publications. Information validation processes ensure data accuracy and reliability through multiple source verification and expert review.

Quantitative analysis utilizes statistical modeling techniques to identify market trends, growth patterns, and correlation relationships among various market factors. Advanced analytical tools process large datasets to extract meaningful insights and develop predictive models. Data triangulation methods combine multiple data sources to enhance accuracy and reduce research bias.

Market segmentation analysis employs clustering techniques and demographic analysis to identify distinct market segments and customer groups. Research methodologies include geographic analysis, service category evaluation, and customer behavior assessment. Competitive intelligence gathering utilizes public information analysis, expert interviews, and market observation to develop comprehensive competitor profiles and strategic positioning analysis.

North American markets demonstrate mature testing infrastructure with established regulatory frameworks and comprehensive service provider networks. The region accounts for approximately 35% of global market share, driven by stringent environmental regulations and advanced technology adoption. United States operations benefit from extensive natural resource extraction activities and robust quality assurance requirements across multiple industry sectors.

European markets emphasize environmental sustainability and regulatory compliance, creating strong demand for comprehensive testing and certification services. The region represents roughly 28% of market activity, with particular strength in renewable energy resource testing and environmental impact assessment. EU regulatory harmonization facilitates cross-border service delivery while maintaining high quality standards.

Asia-Pacific regions experience the fastest market growth rates, driven by rapid industrialization and increasing regulatory enforcement. The region shows approximately 25% market share with projected growth exceeding global averages. China and India represent particularly dynamic markets with expanding natural resource extraction activities and evolving quality assurance requirements.

Emerging markets in Latin America, Africa, and the Middle East present significant growth opportunities despite current infrastructure limitations. These regions collectively account for the remaining 12% of market activity but demonstrate strong growth potential. Infrastructure development and regulatory framework evolution support expanding service demand and market accessibility.

Market leadership in the testing, inspection, and certification sector features several multinational corporations with comprehensive service portfolios and global operational networks. The competitive landscape demonstrates clear segmentation between large integrated service providers and specialized niche companies focusing on specific natural resource categories or geographic regions.

Competitive strategies emphasize geographic expansion, technology investment, and service portfolio diversification. Companies pursue strategic acquisitions to enhance capabilities and market presence while investing heavily in advanced analytical equipment and automation technologies. Market positioning varies from comprehensive full-service providers to highly specialized niche companies focusing on specific testing methodologies or industry sectors.

By Service Type: The market segments into distinct service categories addressing different aspects of natural resource quality assurance and regulatory compliance.

By Natural Resource Category: Market segmentation reflects diverse natural resource sectors requiring specialized testing expertise.

By End-User Industry: Service demand originates from diverse industry sectors with varying testing requirements and regulatory obligations.

Mining and Minerals Testing represents the largest market segment, driven by extensive global mining operations and stringent quality requirements for mineral products. This category demonstrates steady growth with approximately 42% of total market activity, supported by increasing demand for rare earth elements and critical minerals. Advanced analytical techniques enable precise compositional analysis and contamination detection at parts-per-million levels.

Oil and Gas Testing maintains strong market position despite industry volatility, with services expanding beyond traditional petroleum analysis to include environmental compliance and safety assessment. The segment benefits from regulatory requirements for pipeline integrity testing and environmental impact monitoring. Technological advancement in testing methodologies supports enhanced safety and environmental protection standards.

Water Resources Testing experiences rapid growth driven by increasing water scarcity concerns and stringent quality regulations. Municipal water systems, industrial operations, and agricultural users require comprehensive testing programs to ensure water safety and regulatory compliance. Emerging contaminants including pharmaceuticals and microplastics create new testing requirements and service opportunities.

Renewable Energy Materials represents the fastest-growing segment with exceptional expansion potential as global renewable energy adoption accelerates. Solar panel materials, wind turbine components, and energy storage systems require specialized testing protocols to ensure performance and safety standards. Innovation focus centers on developing testing methodologies for emerging renewable energy technologies.

Forestry Products Testing emphasizes sustainable harvesting practices and product quality verification, supporting certification programs for responsible forest management. The segment benefits from increasing consumer awareness regarding sustainable sourcing and environmental impact. Certification programs create ongoing service demand for monitoring and verification activities.

Resource Extraction Companies benefit from comprehensive testing services that ensure product quality, regulatory compliance, and market acceptance. Testing and certification services provide risk mitigation through early contamination detection and quality verification, preventing costly product recalls and regulatory penalties. Operational efficiency improvements result from optimized extraction processes based on detailed resource analysis and quality feedback.

Processing Industries gain significant advantages through raw material quality assurance and process optimization support. Testing services enable precise material specification and quality control, reducing processing costs and improving final product quality. Supply chain integration benefits include enhanced supplier relationships and reduced quality-related disruptions.

Regulatory Agencies utilize independent testing and certification services to support enforcement activities and policy development. Third-party testing provides objective data for regulatory decision-making while reducing government testing infrastructure requirements. Public safety protection benefits from comprehensive monitoring and assessment programs that identify potential health and environmental risks.

Financial Institutions rely on testing and certification data for investment risk assessment and due diligence processes. Comprehensive quality assurance documentation supports lending decisions and project financing for natural resource operations. ESG compliance requirements increasingly depend on detailed environmental and social impact assessment data provided through testing services.

End Consumers benefit from enhanced product safety and quality assurance through comprehensive testing programs. Certification services provide transparency regarding product origin, quality, and environmental impact, supporting informed purchasing decisions. Health protection results from rigorous contamination testing and safety verification processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Automation Integration represents a transformative trend reshaping testing laboratory operations and service delivery models. Advanced robotic systems and automated analytical equipment reduce human error while increasing testing throughput and consistency. Laboratory automation enables 24/7 operations and faster turnaround times, creating competitive advantages for early adopters.

Real-time Monitoring technologies enable continuous assessment of natural resource quality and environmental conditions, moving beyond traditional batch testing approaches. IoT sensors and wireless communication systems support remote monitoring capabilities, particularly valuable for mining and extraction operations in remote locations. Continuous monitoring provides early warning systems for quality deviations and environmental concerns.

Sustainability Certification programs gain increasing importance as companies seek to demonstrate environmental responsibility and sustainable resource management practices. Third-party certification services verify compliance with sustainability standards and support ESG reporting requirements. Green certification becomes a market differentiator and competitive advantage for resource companies.

Digital Reporting Systems transform data delivery and customer interaction through cloud-based platforms and mobile applications. Digital transformation enables real-time result access, historical data analysis, and integrated reporting capabilities. Data analytics services provide additional value through trend analysis and predictive insights.

Blockchain Technology applications in certification and traceability create tamper-proof documentation systems for natural resource quality and origin verification. Distributed ledger systems support supply chain transparency and regulatory compliance documentation. Immutable records enhance trust and reliability in certification processes.

Regulatory Evolution continues reshaping market requirements with new environmental protection standards and enhanced safety regulations. Recent developments include expanded testing requirements for emerging contaminants and stricter limits for traditional pollutants. International harmonization efforts promote standardized testing protocols across different jurisdictions.

Technology Advancement in analytical instrumentation enables detection of contaminants at previously unachievable levels while reducing analysis time and costs. Mass spectrometry, chromatography, and spectroscopy technologies continue advancing in sensitivity and automation capabilities. Portable testing equipment enables field analysis and reduces sample transportation requirements.

Market Consolidation activity includes strategic acquisitions and mergers as companies seek to expand service capabilities and geographic reach. Recent transactions focus on acquiring specialized expertise and advanced technology capabilities. Vertical integration strategies combine testing services with consulting and monitoring capabilities.

Accreditation Expansion includes new standards for emerging testing categories and enhanced quality assurance requirements. International accreditation bodies continue developing standards for renewable energy materials and environmental assessment services. Quality system evolution emphasizes continuous improvement and customer satisfaction metrics.

Partnership Development between testing companies and technology providers creates integrated service offerings and enhanced capabilities. Collaborative relationships support innovation in testing methodologies and service delivery models. Strategic alliances enable access to specialized expertise and advanced technology platforms.

MarkWide Research analysis indicates that companies should prioritize technology investment and automation adoption to maintain competitive positioning in the evolving market landscape. Organizations investing in advanced analytical equipment and automated systems demonstrate superior growth performance and customer satisfaction levels. Technology leadership becomes increasingly critical for long-term market success.

Geographic expansion strategies should focus on emerging markets with developing regulatory frameworks and expanding natural resource activities. Companies establishing early market presence in these regions benefit from first-mover advantages and relationship development opportunities. Local partnership strategies facilitate market entry and regulatory compliance in new jurisdictions.

Service portfolio diversification recommendations include expanding into complementary areas such as environmental consulting, regulatory compliance support, and ongoing monitoring services. Integrated service offerings create stronger customer relationships and recurring revenue opportunities. Value-added services command premium pricing and enhance competitive differentiation.

Digital transformation initiatives should emphasize customer experience enhancement through improved reporting systems, data analytics capabilities, and mobile access platforms. Companies providing superior digital experiences demonstrate higher customer retention and satisfaction levels. Data monetization opportunities include predictive analytics and trend analysis services.

Sustainability positioning becomes increasingly important as customers prioritize environmental responsibility and sustainable practices. Companies demonstrating clear environmental commitments and sustainable service delivery models attract environmentally conscious customers and premium pricing opportunities. Green technology adoption supports both operational efficiency and market positioning objectives.

Market growth prospects remain highly favorable with projected expansion across all major segments and geographic regions. The testing, inspection, and certification market for natural resources benefits from multiple growth drivers including regulatory expansion, technology advancement, and increasing sustainability focus. Long-term trends support sustained market development over the forecast period.

Technology integration will continue reshaping service delivery models with artificial intelligence, machine learning, and automation technologies becoming standard operational components. Advanced analytics capabilities will enable predictive testing and proactive quality management services. Innovation cycles accelerate as companies compete through technology differentiation and service enhancement.

Regulatory evolution toward more comprehensive environmental protection and safety standards will drive continued service demand expansion. New regulations addressing climate change, environmental justice, and sustainable development create additional testing requirements and service opportunities. Global standardization efforts promote market harmonization and cross-border service delivery.

Market consolidation trends will likely continue as companies seek scale advantages and comprehensive service capabilities. Strategic acquisitions and partnerships will reshape competitive dynamics while creating opportunities for specialized service providers. Industry maturation supports stable growth patterns and predictable market development.

Emerging opportunities in renewable energy, environmental remediation, and sustainable resource management will create new market segments and service requirements. Companies positioning for these growth areas through capability development and strategic partnerships will benefit from first-mover advantages. MWR projections indicate sustained market expansion with growth rates exceeding 7.2% annually over the next five years.

The testing, inspection, and certification for natural resources market demonstrates exceptional growth potential driven by regulatory expansion, technology advancement, and increasing sustainability focus across global industries. Market dynamics favor companies investing in advanced capabilities, geographic expansion, and comprehensive service portfolios that address evolving customer requirements and regulatory obligations.

Competitive positioning increasingly depends on technology leadership, service integration, and customer experience enhancement through digital transformation initiatives. Companies successfully navigating market evolution through strategic investments and operational excellence will capture disproportionate growth opportunities and market share expansion. Innovation leadership becomes critical for long-term competitive advantage and market success.

Future market development will be shaped by continued regulatory evolution, technology integration, and expanding service requirements across emerging natural resource categories. The market outlook remains highly favorable with multiple growth drivers supporting sustained expansion across all major segments and geographic regions. Strategic positioning for emerging opportunities in renewable energy and environmental services will determine long-term market leadership and profitability.

What is Testing, Inspection, and Certification for Natural Resources?

Testing, Inspection, and Certification for Natural Resources refers to the processes and services that ensure the quality, safety, and compliance of natural resources such as minerals, oil, and gas. These services help in verifying that resources meet regulatory standards and industry specifications.

What are the key companies in the Testing, Inspection, and Certification for Natural Resources Market?

Key companies in the Testing, Inspection, and Certification for Natural Resources Market include SGS, Bureau Veritas, Intertek, and DNV GL, among others. These firms provide essential services that support various sectors, including mining, oil and gas, and environmental management.

What are the growth factors driving the Testing, Inspection, and Certification for Natural Resources Market?

The growth of the Testing, Inspection, and Certification for Natural Resources Market is driven by increasing regulatory requirements, the need for quality assurance in resource extraction, and rising environmental concerns. Additionally, the demand for sustainable practices in resource management is influencing market expansion.

What challenges does the Testing, Inspection, and Certification for Natural Resources Market face?

Challenges in the Testing, Inspection, and Certification for Natural Resources Market include the complexity of regulatory frameworks, the need for advanced technology to conduct accurate assessments, and the potential for fluctuating demand based on global economic conditions. These factors can impact service delivery and operational efficiency.

What opportunities exist in the Testing, Inspection, and Certification for Natural Resources Market?

Opportunities in the Testing, Inspection, and Certification for Natural Resources Market include the growing emphasis on sustainability and environmental compliance, advancements in testing technologies, and the expansion of renewable energy resources. These trends are likely to create new service demands and market niches.

What trends are shaping the Testing, Inspection, and Certification for Natural Resources Market?

Trends shaping the Testing, Inspection, and Certification for Natural Resources Market include the integration of digital technologies for data analysis, increased focus on ESG (Environmental, Social, and Governance) criteria, and the rise of automation in testing processes. These trends are enhancing efficiency and accuracy in resource management.

Testing, Inspection, and Certification for Natural Resources Market

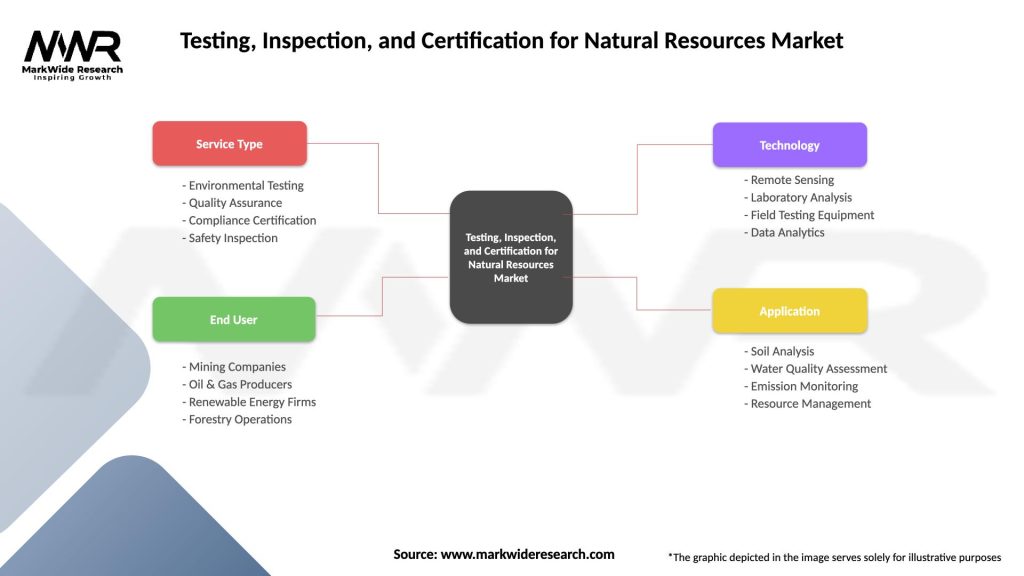

| Segmentation Details | Description |

|---|---|

| Service Type | Environmental Testing, Quality Assurance, Compliance Certification, Safety Inspection |

| End User | Mining Companies, Oil & Gas Producers, Renewable Energy Firms, Forestry Operations |

| Technology | Remote Sensing, Laboratory Analysis, Field Testing Equipment, Data Analytics |

| Application | Soil Analysis, Water Quality Assessment, Emission Monitoring, Resource Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Testing, Inspection, and Certification for Natural Resources Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at