444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The temperature sensor in the aerospace & defense market represents a critical component ecosystem that ensures operational safety, performance optimization, and mission success across military and commercial aviation applications. These sophisticated sensing devices monitor thermal conditions in aircraft engines, avionics systems, spacecraft, defense equipment, and various aerospace subsystems where precise temperature measurement is essential for operational integrity.

Market dynamics indicate robust growth driven by increasing aircraft production, rising defense expenditures, and the growing complexity of aerospace systems requiring advanced thermal management. The integration of smart sensor technologies and the transition toward more electric aircraft architectures are creating substantial demand for high-precision temperature sensing solutions capable of operating in extreme environmental conditions.

Technological advancement in sensor miniaturization, wireless connectivity, and enhanced durability has expanded application possibilities across next-generation aircraft platforms, unmanned aerial vehicles, and space exploration missions. The market demonstrates strong growth momentum with projected expansion at a CAGR of 6.8% through the forecast period, reflecting the critical importance of thermal monitoring in aerospace and defense applications.

Regional distribution shows North America maintaining market leadership due to substantial defense spending and the presence of major aerospace manufacturers, while Asia-Pacific emerges as a rapidly growing market driven by expanding commercial aviation sectors and increasing defense modernization programs.

The temperature sensor in the aerospace & defense market refers to the specialized segment encompassing various thermal sensing technologies designed specifically for aviation, space, and military applications where extreme operating conditions, high reliability requirements, and mission-critical performance standards demand superior sensor capabilities.

These sensors include thermocouples, resistance temperature detectors (RTDs), thermistors, infrared sensors, and fiber optic temperature sensors engineered to withstand harsh aerospace environments including extreme temperatures, vibration, electromagnetic interference, and radiation exposure while maintaining exceptional accuracy and long-term stability.

Application scope encompasses engine temperature monitoring, cabin climate control, avionics thermal management, fuel system monitoring, brake temperature sensing, and structural health monitoring across commercial aircraft, military jets, helicopters, spacecraft, satellites, and ground-based defense systems.

The aerospace and defense temperature sensor market demonstrates exceptional growth potential driven by increasing aircraft deliveries, rising defense budgets, and the growing emphasis on predictive maintenance and system optimization. Advanced sensor technologies are becoming integral to next-generation aerospace platforms requiring sophisticated thermal management capabilities.

Key market drivers include the expansion of commercial aviation fleets, military modernization programs, space exploration initiatives, and the increasing adoption of electric and hybrid-electric aircraft propulsion systems. The market benefits from technological innovations in sensor accuracy, miniaturization, and integration with digital monitoring systems.

Competitive landscape features established sensor manufacturers, aerospace component suppliers, and specialized technology companies developing application-specific solutions. Market participants focus on product innovation, strategic partnerships, and expanding their presence in emerging aerospace markets to capture growth opportunities.

Regional analysis reveals North America as the dominant market, accounting for approximately 45% market share, followed by Europe and Asia-Pacific regions showing strong growth momentum driven by increasing aircraft production and defense spending initiatives.

Critical market insights reveal several transformative trends shaping the temperature sensor landscape in aerospace and defense applications:

Primary market drivers propelling growth in the aerospace and defense temperature sensor market encompass technological, regulatory, and operational factors creating sustained demand for advanced thermal sensing solutions.

Aircraft production growth represents a fundamental driver as commercial aviation continues expanding globally, with new aircraft deliveries requiring comprehensive temperature monitoring systems across engines, avionics, and structural components. The increasing complexity of modern aircraft systems necessitates more sophisticated sensor networks for optimal performance and safety assurance.

Defense modernization programs worldwide are driving significant investments in advanced military platforms, unmanned systems, and next-generation weapon technologies requiring high-performance temperature sensors capable of operating in extreme combat environments while maintaining exceptional reliability and accuracy standards.

Space exploration initiatives from government agencies and private companies are creating substantial demand for specialized temperature sensors designed for space applications, including satellites, spacecraft, and planetary exploration missions requiring sensors capable of functioning in the harsh conditions of space.

Regulatory compliance requirements in aerospace applications mandate comprehensive temperature monitoring for safety certification, operational approval, and maintenance scheduling, driving consistent demand for certified sensor solutions meeting stringent aerospace standards and specifications.

Market restraints present challenges that could potentially limit growth in the aerospace and defense temperature sensor market, requiring strategic approaches from industry participants to address these limitations effectively.

High development costs associated with aerospace-grade temperature sensors create barriers for market entry and product innovation. The extensive testing, certification, and qualification processes required for aerospace applications result in significant investment requirements that may limit participation from smaller technology companies.

Stringent certification requirements in aerospace and defense applications create lengthy approval processes that can delay product launches and increase development timelines. Meeting various international aerospace standards and military specifications requires substantial resources and expertise that may constrain market growth.

Long product lifecycles in aerospace applications mean that once sensors are integrated into aircraft or defense systems, replacement cycles can extend over decades, potentially limiting recurring revenue opportunities and creating challenges for technology upgrade adoption.

Supply chain complexity in aerospace manufacturing can create challenges for sensor suppliers, particularly regarding material sourcing, quality control, and delivery scheduling that must align with aircraft production timelines and defense program requirements.

Significant market opportunities are emerging across the aerospace and defense temperature sensor landscape, driven by technological advancement, expanding applications, and evolving industry requirements creating new growth avenues for market participants.

Electric aircraft development presents substantial opportunities as the aviation industry transitions toward more electric and hybrid-electric propulsion systems requiring advanced thermal management solutions. These next-generation aircraft platforms demand innovative temperature sensing technologies for battery monitoring, electric motor management, and power electronics thermal control.

Unmanned systems expansion across military and commercial applications creates growing demand for lightweight, compact temperature sensors suitable for drones, autonomous aircraft, and unmanned ground vehicles. The increasing deployment of these systems in various missions requires specialized sensor solutions optimized for unmanned platform requirements.

Space commercialization initiatives from private companies are driving demand for cost-effective, reliable temperature sensors for satellite constellations, space tourism, and commercial space missions. This expanding market segment offers opportunities for sensor manufacturers to develop solutions tailored for commercial space applications.

Predictive maintenance integration with advanced analytics and artificial intelligence systems creates opportunities for smart sensor solutions that provide enhanced diagnostic capabilities, enabling proactive maintenance scheduling and operational optimization across aerospace and defense platforms.

Market dynamics in the aerospace and defense temperature sensor sector reflect the complex interplay of technological innovation, regulatory requirements, and operational demands shaping industry evolution and competitive positioning.

Technological convergence between traditional sensing technologies and digital connectivity is creating new possibilities for integrated thermal management systems. The incorporation of wireless communication, edge computing, and advanced signal processing capabilities is transforming temperature sensors from simple measurement devices into intelligent monitoring systems.

Supply chain resilience has become increasingly important following global disruptions, with aerospace manufacturers and defense contractors emphasizing supplier diversification and domestic sourcing capabilities. This trend is creating opportunities for regional sensor manufacturers and driving investments in local production capabilities.

Sustainability initiatives in aerospace are influencing sensor development priorities, with emphasis on energy-efficient designs, recyclable materials, and extended operational lifespans. Environmental considerations are becoming integral to product development strategies and customer selection criteria.

According to MarkWide Research analysis, the integration of artificial intelligence and machine learning capabilities with temperature sensing systems is expected to drive 30% improvement in predictive maintenance effectiveness, creating significant value propositions for aerospace operators seeking operational optimization.

Comprehensive research methodology employed in analyzing the aerospace and defense temperature sensor market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, aerospace engineers, defense procurement specialists, and technology developers across the temperature sensor value chain. These discussions provide firsthand insights into market trends, technological developments, and customer requirements driving industry evolution.

Secondary research analysis encompasses detailed examination of industry reports, technical publications, patent filings, regulatory documents, and company financial statements to establish comprehensive understanding of market structure, competitive dynamics, and growth drivers affecting the aerospace and defense temperature sensor market.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify potential growth opportunities. The methodology incorporates both quantitative analysis and qualitative assessment to provide balanced market perspectives.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research findings accurately reflect market realities and provide reliable foundation for strategic decision-making by industry participants.

Regional market analysis reveals distinct patterns in aerospace and defense temperature sensor adoption, driven by local aerospace industries, defense spending levels, and technological capabilities across major geographic markets.

North America maintains market leadership with approximately 45% market share, supported by the presence of major aerospace manufacturers, substantial defense budgets, and advanced technology development capabilities. The region benefits from strong commercial aviation demand, military modernization programs, and space exploration initiatives driving consistent sensor demand.

Europe represents the second-largest market with 28% market share, characterized by established aerospace industries, collaborative defense programs, and emphasis on environmental sustainability. European markets demonstrate strong demand for advanced sensor technologies supporting next-generation aircraft development and military modernization initiatives.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 8.5% CAGR, driven by expanding commercial aviation sectors, increasing defense expenditures, and growing aerospace manufacturing capabilities. Countries including China, India, and Japan are investing heavily in domestic aerospace industries and military modernization programs.

Middle East and Africa show moderate growth potential driven by defense modernization programs, expanding commercial aviation infrastructure, and increasing space program investments. The region demonstrates growing demand for advanced sensor technologies supporting military and civilian aerospace applications.

The competitive landscape in the aerospace and defense temperature sensor market features a diverse mix of established sensor manufacturers, aerospace component suppliers, and specialized technology companies competing through innovation, quality, and customer relationships.

Competitive strategies focus on technological innovation, strategic partnerships with aerospace manufacturers, and expansion into emerging markets. Companies invest heavily in research and development to maintain technological leadership and meet evolving customer requirements.

Market segmentation analysis provides detailed insights into various categories within the aerospace and defense temperature sensor market, enabling targeted strategies and identifying specific growth opportunities across different application areas and technology types.

By Sensor Type:

By Application:

By Platform:

Engine monitoring applications represent the largest market segment, accounting for approximately 35% market share, driven by critical safety requirements and performance optimization needs in aircraft propulsion systems. These applications demand sensors capable of operating at extreme temperatures while maintaining exceptional accuracy and reliability.

Commercial aircraft platforms demonstrate the strongest growth momentum with projected expansion rates of 7.2% CAGR, supported by increasing passenger traffic, fleet expansion programs, and next-generation aircraft deliveries requiring advanced temperature monitoring capabilities across multiple systems.

Thermocouple technology maintains dominance in high-temperature applications, particularly in engine monitoring, due to its ability to operate in extreme thermal environments. However, fiber optic sensors are gaining traction for applications requiring electromagnetic interference immunity and distributed temperature sensing capabilities.

Military applications show consistent demand driven by defense modernization programs and the development of next-generation weapon systems requiring advanced thermal management solutions. These applications typically require sensors meeting stringent military specifications and capable of operating in combat environments.

Space applications represent a high-growth niche segment with specialized requirements for radiation hardening, extreme temperature operation, and long-term reliability. The increasing number of satellite launches and space exploration missions is driving demand for space-qualified temperature sensors.

Industry participants in the aerospace and defense temperature sensor market benefit from multiple value propositions that support business growth, technological advancement, and market positioning in this specialized sector.

Aerospace manufacturers gain access to advanced temperature sensing technologies that enhance aircraft safety, improve operational efficiency, and support predictive maintenance programs. These sensors enable comprehensive thermal management across aircraft systems, contributing to reduced maintenance costs and improved fleet availability.

Defense contractors benefit from specialized sensor solutions that meet stringent military requirements while providing enhanced operational capabilities for defense platforms. Advanced temperature sensors support mission-critical applications where system reliability and performance are paramount for mission success.

Sensor manufacturers access high-value market opportunities with strong barriers to entry, long-term customer relationships, and premium pricing for specialized aerospace-grade products. The market offers opportunities for technological differentiation and sustainable competitive advantages through innovation and quality excellence.

Airlines and operators realize operational benefits including improved maintenance scheduling, enhanced safety margins, and optimized fuel efficiency through advanced temperature monitoring systems. These benefits translate into reduced operational costs and improved aircraft utilization rates.

Technology integrators find opportunities to develop comprehensive thermal management systems combining sensors with advanced analytics, enabling value-added services and system-level solutions for aerospace and defense customers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends are reshaping the aerospace and defense temperature sensor market, driven by technological advancement, changing customer requirements, and evolving industry dynamics that create new opportunities and challenges for market participants.

Wireless sensor integration is gaining momentum as aerospace manufacturers seek to reduce wiring complexity and enable more flexible system architectures. Wireless temperature sensors offer installation advantages and enable real-time monitoring capabilities that support predictive maintenance and operational optimization initiatives.

Miniaturization and weight reduction continue as critical trends, with aerospace applications demanding smaller, lighter sensors that maintain performance while contributing to overall aircraft weight reduction goals. Advanced materials and manufacturing techniques enable sensor designs that meet these challenging requirements.

Smart sensor capabilities incorporating edge computing, self-diagnostics, and advanced signal processing are becoming increasingly important. These intelligent sensors provide enhanced functionality beyond basic temperature measurement, offering diagnostic capabilities and integration with digital aircraft systems.

MWR data indicates that the adoption of digital twin technology in aerospace applications is driving demand for comprehensive sensor networks that provide detailed thermal mapping and modeling capabilities, supporting virtual aircraft development and optimization programs.

Sustainability focus is influencing sensor development with emphasis on energy-efficient designs, recyclable materials, and extended operational lifespans that align with aerospace industry environmental goals and regulatory requirements.

Recent industry developments highlight the dynamic nature of the aerospace and defense temperature sensor market, with significant technological advances, strategic partnerships, and market expansion initiatives shaping competitive dynamics and growth trajectories.

Advanced material integration has enabled the development of sensors capable of operating at higher temperatures and in more challenging environments. Silicon carbide and other advanced materials are expanding the operational envelope for aerospace temperature sensors, enabling applications previously considered impossible.

Artificial intelligence integration with temperature sensing systems is creating new possibilities for predictive maintenance and system optimization. Machine learning algorithms analyze temperature patterns to predict component failures and optimize maintenance scheduling, delivering significant operational benefits.

Strategic acquisitions and partnerships among sensor manufacturers, aerospace companies, and technology firms are accelerating innovation and market expansion. These collaborations combine complementary capabilities to develop comprehensive thermal management solutions for next-generation aerospace platforms.

Certification achievements for new sensor technologies and applications continue expanding market opportunities. Recent approvals for wireless sensors, fiber optic systems, and advanced materials are enabling broader adoption across aerospace and defense applications.

Space-qualified sensor development has accelerated with the growth of commercial space activities. New sensor designs specifically engineered for space applications are addressing the unique requirements of satellite constellations, space tourism, and deep space exploration missions.

Strategic recommendations for aerospace and defense temperature sensor market participants focus on leveraging emerging opportunities while addressing market challenges through innovation, partnerships, and market expansion initiatives.

Investment in wireless technology development should be prioritized as aerospace manufacturers increasingly adopt wireless sensor networks to reduce installation complexity and enable more flexible system architectures. Companies developing robust wireless solutions for aerospace applications will capture significant market share.

Space market expansion represents a high-growth opportunity requiring specialized product development and certification efforts. Companies should consider developing space-qualified sensor lines to participate in the rapidly expanding commercial space sector and government space programs.

Predictive maintenance integration offers opportunities to create value-added services beyond traditional sensor sales. Developing analytics capabilities and partnering with software companies can create comprehensive solutions that provide ongoing revenue streams and stronger customer relationships.

Regional market development in Asia-Pacific and other emerging aerospace markets should be pursued through local partnerships, manufacturing capabilities, and customer support infrastructure. These markets offer substantial growth potential as domestic aerospace industries expand.

Sustainability initiatives should be integrated into product development strategies to align with aerospace industry environmental goals and regulatory requirements. Sensors designed for energy efficiency and recyclability will have competitive advantages in future market selections.

The future outlook for the aerospace and defense temperature sensor market appears highly promising, with multiple growth drivers converging to create sustained expansion opportunities across various application segments and geographic regions.

Technological evolution will continue driving market growth as sensors become more intelligent, connected, and capable of operating in increasingly challenging environments. The integration of artificial intelligence, edge computing, and advanced materials will create new possibilities for aerospace thermal management applications.

Market expansion is expected to accelerate with projected growth rates of 6.8% CAGR through the forecast period, driven by increasing aircraft production, defense modernization programs, and the emergence of new aerospace platforms including electric aircraft and commercial space vehicles.

Application diversification will create new market segments as aerospace technology evolves. Urban air mobility, autonomous aircraft, and advanced space exploration missions will require specialized temperature sensing solutions tailored for these emerging applications.

According to MarkWide Research projections, the integration of temperature sensors with comprehensive digital aircraft systems will reach 75% adoption rates by the end of the forecast period, reflecting the industry’s transition toward fully connected and intelligent aerospace platforms.

Regional growth patterns will see Asia-Pacific markets achieving the highest growth rates while North America maintains market leadership through technological innovation and defense spending. European markets will focus on sustainability and next-generation aircraft development initiatives.

The aerospace and defense temperature sensor market represents a dynamic and growing sector characterized by technological innovation, expanding applications, and strong growth fundamentals driven by increasing aircraft production, defense modernization, and space exploration initiatives.

Market opportunities are abundant across multiple segments including electric aircraft development, commercial space expansion, predictive maintenance integration, and emerging aerospace platforms. Companies positioned to capitalize on these trends through innovation, strategic partnerships, and market expansion will achieve significant competitive advantages.

Technological advancement continues reshaping the market landscape with wireless connectivity, artificial intelligence integration, and advanced materials enabling new applications and enhanced performance capabilities. These developments create opportunities for differentiation and value creation across the aerospace and defense sensor ecosystem.

Strategic success in this market requires balancing innovation with regulatory compliance, developing specialized expertise for aerospace applications, and building strong relationships with aerospace manufacturers and defense contractors. Companies that excel in these areas will capture the substantial growth opportunities available in this critical market segment.

What is a Temperature Sensor?

A temperature sensor is a device that measures temperature and converts it into a readable format. In the aerospace and defense sectors, these sensors are critical for monitoring environmental conditions, ensuring equipment safety, and enhancing operational efficiency.

What are the key players in the Temperature Sensor in the Aerospace & Defense Market?

Key players in the temperature sensor in the aerospace & defense market include Honeywell, Raytheon Technologies, TE Connectivity, and Northrop Grumman, among others.

What are the growth factors for the Temperature Sensor in the Aerospace & Defense Market?

Growth factors for the temperature sensor in the aerospace & defense market include the increasing demand for advanced avionics systems, the need for reliable monitoring in harsh environments, and the expansion of military applications requiring precise temperature measurements.

What challenges does the Temperature Sensor in the Aerospace & Defense Market face?

Challenges in the temperature sensor in the aerospace & defense market include stringent regulatory requirements, the high cost of advanced sensor technologies, and the need for continuous innovation to meet evolving defense standards.

What future opportunities exist for the Temperature Sensor in the Aerospace & Defense Market?

Future opportunities for the temperature sensor in the aerospace & defense market include the integration of smart sensor technologies, advancements in materials that enhance sensor durability, and the growing trend towards automation in military operations.

What trends are shaping the Temperature Sensor in the Aerospace & Defense Market?

Trends shaping the temperature sensor in the aerospace & defense market include the adoption of IoT-enabled sensors for real-time data transmission, the development of miniaturized sensors for space applications, and increased focus on energy efficiency in sensor design.

Temperature Sensor in the Aerospace & Defense Market

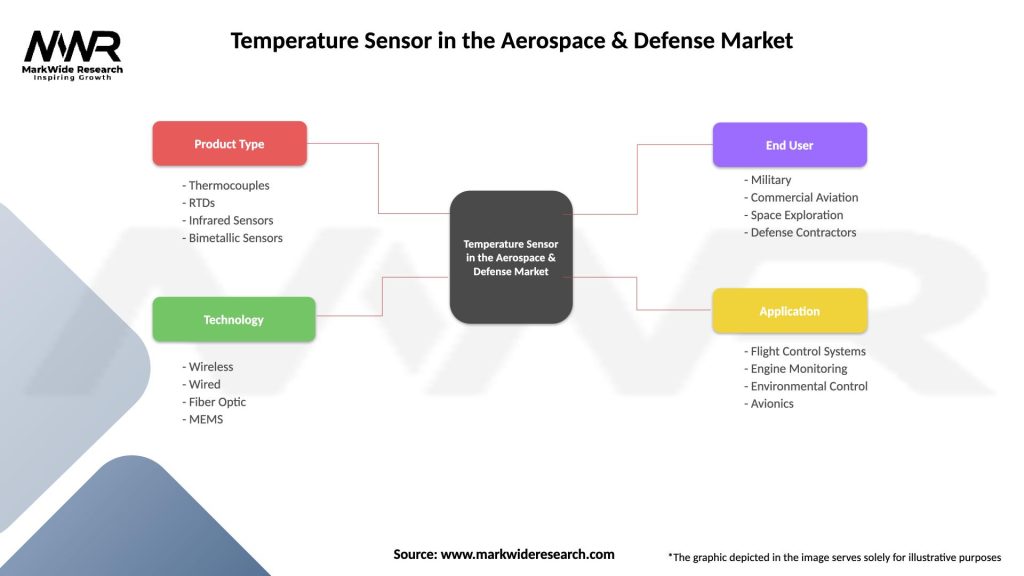

| Segmentation Details | Description |

|---|---|

| Product Type | Thermocouples, RTDs, Infrared Sensors, Bimetallic Sensors |

| Technology | Wireless, Wired, Fiber Optic, MEMS |

| End User | Military, Commercial Aviation, Space Exploration, Defense Contractors |

| Application | Flight Control Systems, Engine Monitoring, Environmental Control, Avionics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Temperature Sensor in the Aerospace & Defense Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at