444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The global telematics in heavy equipment market is expected to reach USD 6.4 billion by 2025, growing at a CAGR of 14.4% during the forecast period (2021-2025). The increasing demand for telematics solutions in heavy equipment, such as construction, agriculture, and mining, is primarily driving the growth of the market. Telematics provides real-time monitoring, tracking, and reporting of equipment performance, fuel consumption, location, and other key metrics, helping companies to optimize their operations, reduce costs, and improve productivity.

Telematics refers to the use of wireless communication and information technology to collect, process, and transmit data from remote equipment, vehicles, or assets. In the context of heavy equipment, telematics typically involves the installation of sensors, GPS devices, and other monitoring tools that capture data on equipment performance, usage, and location. This data is then transmitted to a central server or cloud-based platform, where it can be analyzed, visualized, and acted upon in real-time.

Executive Summary

The global telematics in heavy equipment market is poised for significant growth in the coming years, driven by the increasing adoption of connected technologies in the construction, agriculture, and mining industries. Telematics provides a wide range of benefits, including improved equipment efficiency, reduced downtime, enhanced safety, and lower operating costs. Key market drivers include the growing demand for equipment rental services, the need to comply with regulatory requirements, and the increasing focus on data-driven decision making.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The increasing trend towards equipment rental services is driving the adoption of telematics solutions in heavy equipment. Rental companies use telematics to track equipment usage, location, and performance, enabling them to optimize fleet utilization, reduce downtime, and improve customer service.

The increasing number of regulations governing the use of heavy equipment is driving the adoption of telematics solutions. For example, the US Federal Motor Carrier Safety Administration (FMCSA) requires commercial vehicles to be equipped with electronic logging devices (ELDs) to track hours of service, while the European Union’s Machinery Directive mandates the use of telematics in certain types of construction equipment.

The need for real-time data and analytics to optimize operations and improve productivity is driving the adoption of telematics solutions in heavy equipment. Telematics provides detailed insights into equipment performance, fuel consumption, and other key metrics, enabling companies to make data-driven decisions and optimize their operations.

Market Restraints

maintenance is a significant barrier to the adoption of telematics in heavy equipment. This can be particularly challenging for small and medium-sized enterprises (SMEs) that may lack the financial resources to invest in these solutions.

The increasing reliance on telematics solutions raises concerns over data security and privacy. Equipment manufacturers and telematics service providers must ensure that the data collected and transmitted from heavy equipment is secure and protected from unauthorized access or use.

Market Opportunities

The integration of telematics with AI and ML technologies offers significant opportunities for the heavy equipment industry. AI and ML algorithms can analyze telematics data to identify patterns, predict equipment failures, and optimize performance, enabling companies to reduce downtime and improve productivity.

Telematics solutions can be used to monitor equipment usage and performance, enabling companies to schedule maintenance and servicing tasks proactively. This can help to reduce maintenance costs, extend equipment lifespan, and improve safety.

Market Dynamics

The telematics in heavy equipment market is highly competitive, with numerous vendors offering hardware, software, and services. The market is characterized by rapid technological advancements, evolving customer needs, and changing regulatory requirements. Key trends in the market include the increasing adoption of cloud-based telematics solutions, the integration of telematics with IoT and other emerging technologies, and the growing demand for predictive maintenance and servicing.

Regional Analysis

North America is expected to dominate the telematics in heavy equipment market, accounting for the largest share of the market due to the presence of major heavy equipment manufacturers and advanced infrastructure. Europe and Asia-Pacific are also expected to experience significant growth during the forecast period, driven by the increasing adoption of telematics solutions in construction, agriculture, and mining.

Competitive Landscape

Leading companies in the Telematics in Heavy Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

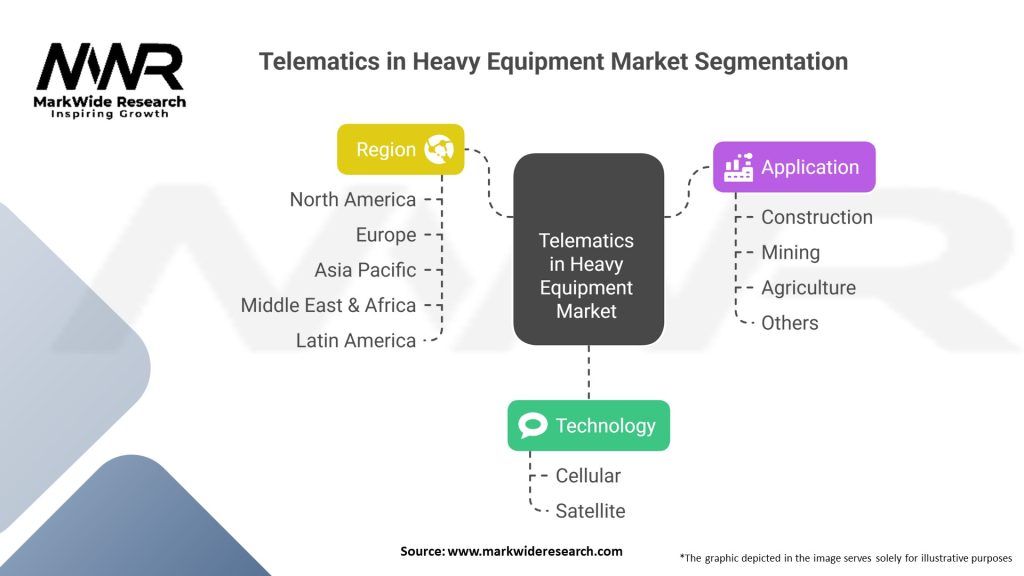

Segmentation

The global telematics in heavy equipment market can be segmented based on component, end-user, and region. By component, the market can be divided into hardware, software, and services. By end-user, the market can be divided into construction, agriculture, mining, and others.

Category-wise Insights

Hardware is expected to be the largest segment of the telematics in heavy equipment market, followed by software and services. The construction industry is expected to be the largest end-user segment, followed by agriculture and mining.

Key Benefits for Industry Participants and Stakeholders

Telematics solutions enable companies to monitor equipment performance, fuel consumption, and other key metrics, helping to optimize operations, reduce downtime, and improve productivity.

Telematics solutions can be used to monitor equipment usage and performance, enabling companies to schedule maintenance and servicing tasks proactively. This can help to reduce maintenance costs and extend equipment lifespan.

Telematics solutions provide real-time monitoring and reporting of equipment location, usage, and performance, enabling companies to improve safety and compliance with regulatory requirements.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The adoption of cloud-based telematics solutions is increasing, driven by the growing demand for real-time monitoring, tracking, and reporting of equipment performance, fuel consumption, and location.

The integration of telematics with IoT and other emerging technologies, such as AI and ML, is becoming increasingly important, enabling companies to leverage data analytics to optimize operations, reduce costs, and improve productivity.

The use of telematics solutions for predictive maintenance and servicing is growing, driven by the need to reduce maintenance costs, extend equipment lifespan, and improve safety.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the telematics in heavy equipment market, with many construction, agriculture, and mining operations experiencing disruptions and delays. However, the pandemic has also highlighted the importance of telematics solutions in enabling remote monitoring and management of equipment, reducing the need for on-site personnel, and improving safety and compliance.

Key Industry Developments

Analyst Suggestions

Vendors in the telematics in heavy equipment market should focus on developing advanced solutions that provide real-time monitoring, tracking, and reporting of equipment performance, fuel consumption, location, and other key metrics.

To remain competitive in the market, vendors should invest in R&D to leverage emerging technologies, such as AI, ML, and IoT, to provide more sophisticated and integrated telematics solutions.

Future Outlook

The telematics in heavy equipment market is expected to continue to grow in the coming years, driven by the increasing adoption of connected technologies in the construction, agriculture, and mining industries. The integration of telematics with AI, ML, and other emerging technologies is expected to provide significant opportunities for vendors and end-users, enabling companies to optimize their operations, reduce costs, and improve productivity.

Conclusion

Telematics solutions are transforming the heavy equipment industry, enabling companies to monitor equipment performance, fuel consumption, and other key metrics in real-time. The market for telematics in heavy equipment is expected to continue to grow in the coming years, driven by the increasing adoption of connected technologies and the need for data-driven decision making. Vendors in the market should focus on developing advanced solutions that leverage emerging technologies and provide more sophisticated and integrated telematics solutions.

What is telematics in heavy equipment?

Telematics in heavy equipment refers to the integration of telecommunications and monitoring systems to track and manage equipment performance, location, and usage. This technology enables real-time data collection and analysis, enhancing operational efficiency and decision-making.

What are the key companies in the telematics in heavy equipment market?

Key companies in the telematics in heavy equipment market include Caterpillar, John Deere, and Trimble, which provide advanced telematics solutions for equipment management and monitoring, among others.

What are the main drivers of growth in the telematics in heavy equipment market?

The main drivers of growth in the telematics in heavy equipment market include the increasing demand for operational efficiency, the need for real-time data analytics, and the rising adoption of IoT technologies in construction and mining industries.

What challenges does the telematics in heavy equipment market face?

Challenges in the telematics in heavy equipment market include data privacy concerns, the high cost of implementation, and the need for skilled personnel to analyze and interpret the data collected.

What opportunities exist in the telematics in heavy equipment market?

Opportunities in the telematics in heavy equipment market include the expansion of smart construction technologies, the integration of AI for predictive maintenance, and the growing trend of sustainability in equipment management.

What trends are shaping the telematics in heavy equipment market?

Trends shaping the telematics in heavy equipment market include the increasing use of cloud-based solutions, advancements in sensor technology, and the growing emphasis on data-driven decision-making in fleet management.

Telematics in Heavy Equipment Market

| Segmentation Details | Description |

|---|---|

| By Technology | Cellular, Satellite |

| By Application | Construction, Mining, Agriculture, Others |

| By Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Telematics in Heavy Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at