444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The telecom service provider investment (CAPEX) analysis market refers to the examination and evaluation of the capital expenditure activities undertaken by companies operating in the telecommunications industry. Telecom service providers make significant investments in infrastructure, equipment, technology, and network expansion to enhance their service offerings and meet the growing demands of consumers.

Meaning

Telecom service provider investment analysis involves assessing the capital expenditure plans and strategies implemented by companies in the telecommunications sector. It aims to understand the investment patterns, market trends, and factors influencing the investment decisions of these service providers.

Executive Summary

The telecom service provider investment (CAPEX) analysis market is witnessing significant growth due to the increasing demand for advanced communication services, such as 5G, IoT, and cloud-based solutions. Service providers are investing heavily in upgrading their networks, deploying new technologies, and expanding their coverage to cater to the evolving needs of businesses and consumers.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

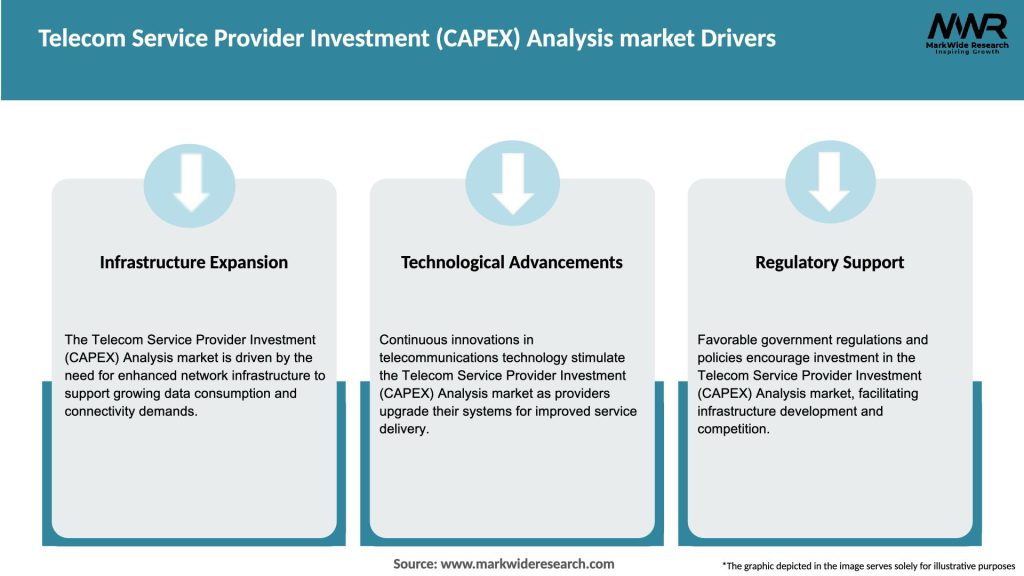

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The telecom service provider investment (CAPEX) analysis market is characterized by dynamic factors that influence investment decisions and shape the industry landscape. The market dynamics include technological advancements, changing consumer demands, regulatory frameworks, competitive pressures, and market trends.

Regional Analysis

The telecom service provider investment market exhibits regional variations due to factors such as economic development, infrastructure requirements, population demographics, and government policies. Key regions include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its own unique market dynamics and investment opportunities.

Competitive Landscape

Leading Companies in the Telecom Service Provider Investment (CAPEX) Analysis Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

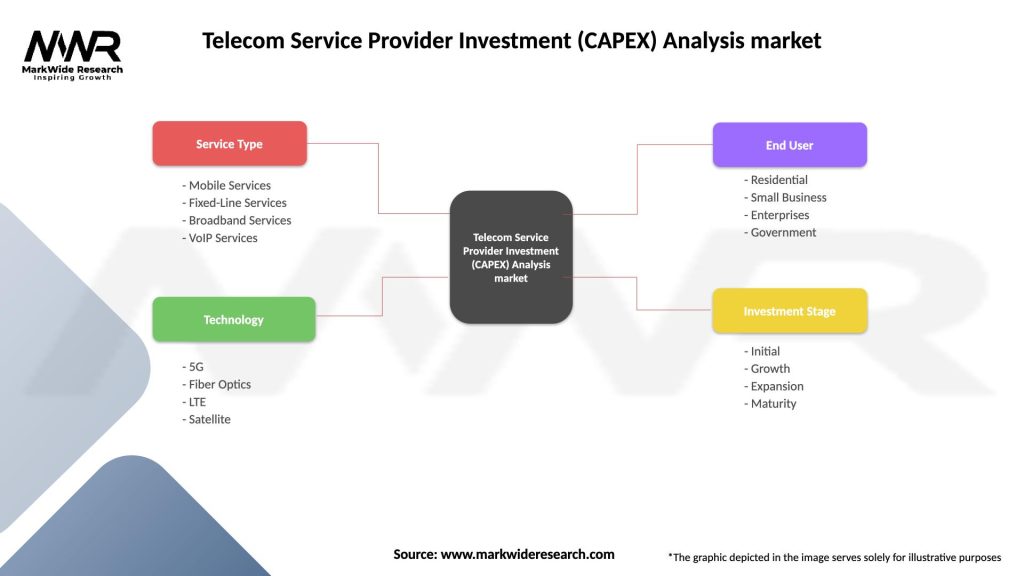

Segmentation

The market can be segmented based on various parameters such as technology (5G, IoT, fiber optics), service type (wireless, fixed-line), investment type (network infrastructure, equipment, software), and region. Segmenting the market helps in understanding specific investment trends, opportunities, and challenges associated with each segment.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

High Capital Investments: Telecom service providers are making significant investments in network infrastructure, particularly in 5G deployment and fiber-optic networks, creating a strong demand for CAPEX analysis services.

Increasing Data Traffic: Rising data consumption and the proliferation of mobile devices increase the need for telecom service providers to upgrade and expand their infrastructure, supporting market growth.

Technological Advancements: The transition to 5G networks and the growing adoption of IoT and smart devices further fuel the demand for effective CAPEX analysis services.

Weaknesses:

High Investment Requirements: The capital-intensive nature of telecom network expansion requires large investments, which may limit the ability of smaller service providers to compete effectively.

Regulatory Compliance: Telecom operators face complex regulatory frameworks that can delay the approval and implementation of new infrastructure projects.

Operational Costs: High operational and maintenance costs associated with upgrading telecom networks may impact the profitability of service providers.

Opportunities:

5G Network Deployment: The rollout of 5G networks presents significant opportunities for CAPEX analysis services, as telecom providers invest in new infrastructure and technologies.

Expanding IoT Ecosystem: The growing demand for connected devices and smart technologies offers new revenue streams and CAPEX analysis opportunities for telecom providers.

Regional Expansion: The increasing telecom infrastructure investment in emerging markets, where mobile networks are still developing, presents opportunities for CAPEX analysis services.

Threats:

Intense Competition: The telecom industry is highly competitive, with several players vying for market share, which may put pressure on profit margins for CAPEX analysis service providers.

Economic Slowdowns: Economic uncertainties and downturns could lead to reduced telecom infrastructure investments, slowing the demand for CAPEX analysis services.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the telecom service provider investment market. The increased reliance on remote work, online learning, telemedicine, and digital entertainment during lockdowns and social distancing measures has driven the demand for robust and reliable connectivity. Service providers have accelerated their investments in network capacity and coverage to meet the surging data demands and ensure uninterrupted services.

However, the pandemic also presented challenges, such as supply chain disruptions, delays in infrastructure deployments, and financial uncertainties. The economic downturn and reduced business activities in certain sectors may have influenced investment decisions, leading to a shift in priorities and cautious spending.

Key Industry Developments

Analyst Suggestions

Future Outlook

The telecom service provider investment (CAPEX) analysis market is expected to witness sustained growth in the coming years. Factors such as the increasing demand for high-speed connectivity, the deployment of 5G networks, and the expansion of IoT applications will continue to drive investments in telecom infrastructure. The growing digitalization of industries, the emergence of smart cities, and the rise of connected devices will further contribute to the market’s growth.

However, challenges related to regulatory frameworks, capital intensity, and market saturation in certain regions will need to be addressed. The market’s future outlook is also dependent on factors like geopolitical dynamics, economic conditions, and technological advancements.

Conclusion

The telecom service provider investment (CAPEX) analysis market is undergoing significant transformation as service providers invest in upgrading their networks, deploying new technologies, and expanding their service offerings. Factors such as the adoption of 5G, IoT applications, and digital transformation initiatives are driving substantial investments in telecom infrastructure. While the market presents numerous opportunities for growth and innovation, service providers face challenges such as regulatory compliance, capital intensity, and market saturation. However, strategic investments, collaborative partnerships, and a customer-centric approach can enable telecom service providers to navigate these challenges and capitalize on the evolving market landscape. As the telecom industry continues to evolve, investments in network infrastructure, equipment, software, and emerging technologies will be crucial for service providers to stay competitive, deliver superior services, and meet the ever-increasing demands of businesses and consumers.

What is Telecom Service Provider Investment (CAPEX) Analysis?

Telecom Service Provider Investment (CAPEX) Analysis refers to the evaluation of capital expenditures made by telecom companies to enhance their infrastructure, technology, and services. This analysis helps in understanding spending patterns, investment strategies, and the overall financial health of telecom providers.

What are the key players in the Telecom Service Provider Investment (CAPEX) Analysis market?

Key players in the Telecom Service Provider Investment (CAPEX) Analysis market include companies like AT&T, Verizon, and Deutsche Telekom, which are known for their significant investments in network expansion and technology upgrades, among others.

What are the main drivers of the Telecom Service Provider Investment (CAPEX) Analysis market?

The main drivers of the Telecom Service Provider Investment (CAPEX) Analysis market include the increasing demand for high-speed internet, the rollout of 5G technology, and the need for network modernization to support growing data consumption.

What challenges does the Telecom Service Provider Investment (CAPEX) Analysis market face?

Challenges in the Telecom Service Provider Investment (CAPEX) Analysis market include regulatory hurdles, high costs associated with infrastructure development, and competition among service providers that can limit profitability.

What opportunities exist in the Telecom Service Provider Investment (CAPEX) Analysis market?

Opportunities in the Telecom Service Provider Investment (CAPEX) Analysis market include the expansion of IoT applications, the potential for partnerships with technology firms, and the increasing focus on sustainable and green technologies in telecom infrastructure.

What trends are shaping the Telecom Service Provider Investment (CAPEX) Analysis market?

Trends shaping the Telecom Service Provider Investment (CAPEX) Analysis market include the shift towards cloud-based services, the integration of artificial intelligence for network management, and the growing emphasis on enhancing customer experience through advanced technologies.

Telecom Service Provider Investment (CAPEX) Analysis market

| Segmentation Details | Description |

|---|---|

| Service Type | Mobile Services, Fixed-Line Services, Broadband Services, VoIP Services |

| Technology | 5G, Fiber Optics, LTE, Satellite |

| End User | Residential, Small Business, Enterprises, Government |

| Investment Stage | Initial, Growth, Expansion, Maturity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Telecom Service Provider Investment (CAPEX) Analysis Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at