444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan Intensive Care Unit (ICU) beds and surfaces market represents a critical segment of the country’s healthcare infrastructure, experiencing substantial growth driven by demographic shifts, technological advancements, and evolving patient care standards. Taiwan’s healthcare system has consistently demonstrated excellence in medical care delivery, with ICU facilities playing a pivotal role in managing critically ill patients across the island nation.

Market dynamics indicate robust expansion fueled by an aging population, increasing prevalence of chronic diseases, and heightened awareness of infection control measures. The market encompasses various bed types including electric ICU beds, manual ICU beds, and specialized surfaces designed for pressure ulcer prevention and patient comfort. Healthcare facilities across Taiwan are increasingly investing in advanced ICU bed technologies that offer enhanced patient monitoring capabilities and improved clinical outcomes.

Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 6.2% over the forecast period, reflecting strong demand from both public and private healthcare institutions. Regional distribution shows concentrated demand in major metropolitan areas including Taipei, Taichung, and Kaohsiung, where large medical centers and teaching hospitals maintain extensive ICU facilities.

Technology integration has become a defining characteristic of the modern ICU bed market in Taiwan, with manufacturers incorporating smart monitoring systems, automated positioning features, and infection-resistant materials. The market benefits from Taiwan’s robust medical device manufacturing sector and strong regulatory framework that ensures product quality and safety standards.

The Taiwan Intensive Care Unit (ICU) beds and surfaces market refers to the comprehensive ecosystem of specialized medical beds, mattresses, and support surfaces designed specifically for critically ill patients requiring intensive medical monitoring and care within Taiwan’s healthcare facilities. This market encompasses both the physical infrastructure and technological components that enable optimal patient care in intensive care environments.

ICU beds in this context represent sophisticated medical devices that go beyond traditional hospital beds, incorporating advanced features such as electronic positioning controls, integrated monitoring systems, patient weighing capabilities, and specialized safety mechanisms. Surface technologies include pressure-relieving mattresses, alternating pressure systems, and antimicrobial surfaces designed to prevent healthcare-associated infections and pressure ulcers.

Market scope extends to encompass various healthcare settings including general hospitals, specialty medical centers, emergency departments, and long-term care facilities that maintain ICU-level care capabilities. The definition also includes associated accessories, replacement parts, and maintenance services that support the operational effectiveness of ICU bed systems throughout their lifecycle.

Taiwan’s ICU beds and surfaces market demonstrates remarkable resilience and growth potential, driven by the country’s commitment to healthcare excellence and technological innovation. The market has evolved significantly over recent years, with digital health integration becoming a primary driver of product development and adoption across healthcare facilities.

Key market characteristics include strong government support for healthcare infrastructure development, increasing private sector investment in medical facilities, and growing emphasis on patient safety and comfort standards. Demographic trends show that Taiwan’s rapidly aging population, with over 16% of citizens aged 65 and above, is creating sustained demand for ICU services and associated equipment.

Competitive landscape features both international medical device manufacturers and domestic companies that have established strong market presence through innovation and local market understanding. Product differentiation focuses on advanced monitoring capabilities, infection control features, and integration with hospital information systems.

Market challenges include budget constraints in public healthcare facilities, complex regulatory requirements, and the need for ongoing staff training on advanced bed technologies. However, these challenges are offset by strong market fundamentals and continued investment in healthcare modernization initiatives.

Strategic market analysis reveals several critical insights that shape the Taiwan ICU beds and surfaces market landscape. Technology adoption rates have accelerated significantly, with 78% of major hospitals now utilizing smart bed technologies that integrate with electronic health record systems.

Market maturity indicators suggest that while the basic ICU bed market is well-established, significant growth opportunities exist in advanced surface technologies and smart bed systems. Innovation cycles are shortening as manufacturers respond to evolving clinical needs and technological possibilities.

Primary market drivers propelling growth in Taiwan’s ICU beds and surfaces market stem from multiple interconnected factors that reflect broader healthcare trends and demographic realities. Population aging stands as the most significant long-term driver, with Taiwan experiencing one of the world’s most rapid demographic transitions.

Healthcare infrastructure expansion continues to drive demand as both public and private healthcare providers invest in modernizing their facilities. Government initiatives supporting healthcare digitization and quality improvement create favorable conditions for advanced ICU bed adoption. The National Health Insurance system provides stable funding mechanisms that support equipment procurement and upgrades.

Clinical outcome improvements associated with advanced ICU bed technologies motivate healthcare providers to invest in upgraded systems. Patient safety regulations increasingly mandate specific features such as fall prevention systems, pressure ulcer prevention capabilities, and infection control measures. These regulatory requirements create consistent demand for compliant equipment.

Technological convergence between medical devices and information systems drives adoption of smart bed technologies that integrate seamlessly with hospital workflows. Labor shortage concerns in healthcare motivate investment in automated systems that reduce nursing workload while maintaining high care standards.

Quality competition among healthcare facilities encourages investment in premium ICU equipment as a differentiating factor. Medical tourism potential also motivates hospitals to maintain world-class facilities that can attract international patients seeking high-quality care.

Market constraints affecting the Taiwan ICU beds and surfaces market primarily center around economic, regulatory, and operational challenges that healthcare facilities must navigate. Budget limitations in public healthcare institutions often restrict the pace of equipment upgrades and technology adoption, particularly for advanced systems with higher initial costs.

Regulatory complexity presents ongoing challenges as medical device approval processes require extensive documentation and testing, potentially delaying product launches and increasing development costs. Import dependencies for certain high-tech components expose the market to supply chain disruptions and currency fluctuation impacts.

Staff training requirements associated with advanced ICU bed technologies create additional costs and operational complexity for healthcare facilities. Maintenance and service considerations become more complex with sophisticated electronic systems, requiring specialized technical support that may not be readily available in all regions.

Space constraints in existing healthcare facilities can limit adoption of larger or more complex bed systems, particularly in older hospitals with fixed architectural layouts. Interoperability challenges between different manufacturers’ systems may create integration difficulties for hospitals seeking to standardize their ICU equipment.

Economic uncertainties can impact healthcare capital expenditure decisions, leading to delayed purchases or preference for lower-cost alternatives. Competition from refurbished equipment markets may pressure new equipment sales, particularly in price-sensitive segments.

Emerging opportunities in Taiwan’s ICU beds and surfaces market reflect evolving healthcare needs and technological capabilities that create new avenues for growth and innovation. Smart healthcare initiatives supported by government digitization programs present significant opportunities for bed manufacturers to develop integrated solutions that enhance patient monitoring and care coordination.

Telemedicine integration creates opportunities for ICU beds equipped with remote monitoring capabilities, enabling healthcare providers to extend specialist care to underserved regions. Artificial intelligence applications in patient monitoring and predictive analytics represent frontier opportunities for next-generation ICU bed systems.

Sustainability focus opens opportunities for manufacturers to develop environmentally friendly bed systems and surfaces that align with healthcare facilities’ environmental goals. Modular design approaches that allow for customization and upgradability present opportunities to serve diverse facility needs while extending product lifecycles.

Home healthcare expansion creates potential markets for portable or simplified ICU-level care equipment that can support patients in alternative care settings. Regional healthcare development in smaller cities and rural areas presents opportunities for market expansion beyond traditional metropolitan concentrations.

Public-private partnerships in healthcare infrastructure development create opportunities for innovative financing and service models. Export potential to other Asian markets leverages Taiwan’s medical device manufacturing capabilities and healthcare expertise.

Market dynamics in Taiwan’s ICU beds and surfaces sector reflect complex interactions between supply-side innovations, demand-side pressures, and regulatory influences that shape competitive positioning and growth trajectories. Supply chain resilience has become increasingly important following global disruptions, with manufacturers focusing on local sourcing and inventory management strategies.

Competitive intensity varies across different market segments, with premium technology segments experiencing rapid innovation cycles while basic bed markets show more stable competitive patterns. Price pressures from healthcare cost containment initiatives influence product development priorities and market positioning strategies.

Technology adoption cycles demonstrate accelerating pace as healthcare facilities seek to maximize return on investment through advanced features that improve operational efficiency. Customer relationship dynamics emphasize long-term partnerships between manufacturers and healthcare providers, extending beyond initial equipment sales to include service, training, and upgrade programs.

Regulatory evolution continues to shape market dynamics as authorities adapt standards to address emerging technologies and changing clinical practices. Market consolidation trends may emerge as smaller manufacturers seek partnerships or acquisition opportunities to compete effectively in increasingly sophisticated market segments.

Innovation diffusion patterns show that successful technologies typically gain initial adoption in major medical centers before spreading to smaller facilities, creating predictable market development cycles that manufacturers can leverage for strategic planning.

Research approach for analyzing Taiwan’s ICU beds and surfaces market employed comprehensive methodological frameworks combining quantitative data analysis with qualitative insights from industry stakeholders. Primary research activities included structured interviews with healthcare facility administrators, ICU nursing staff, and medical device procurement specialists across Taiwan’s major healthcare institutions.

Secondary research components encompassed analysis of government healthcare statistics, medical device registration databases, and industry association reports to establish market sizing and trend identification. Data triangulation methods ensured accuracy and reliability by cross-referencing multiple information sources and validating findings through expert consultations.

Market segmentation analysis utilized both top-down and bottom-up approaches to accurately assess market size and growth patterns across different product categories and end-user segments. Competitive intelligence gathering included analysis of manufacturer product portfolios, pricing strategies, and market positioning approaches.

Trend analysis methodologies incorporated time-series data evaluation and predictive modeling to identify emerging patterns and forecast future market developments. Regional analysis employed geographic information systems and demographic data to understand spatial market distribution patterns and growth opportunities.

Quality assurance protocols included peer review processes and expert validation to ensure research findings meet professional standards for accuracy and relevance to market stakeholders.

Regional market distribution across Taiwan reveals distinct patterns reflecting population density, healthcare infrastructure concentration, and economic development levels. Northern Taiwan, anchored by the Taipei metropolitan area, commands approximately 45% of total market share due to the concentration of major medical centers, teaching hospitals, and specialty care facilities.

Central Taiwan, including Taichung and surrounding areas, represents roughly 25% of market activity, driven by significant healthcare infrastructure development and growing population centers. Southern Taiwan, centered around Kaohsiung and Tainan, accounts for approximately 22% of market demand, supported by major medical institutions and industrial healthcare needs.

Eastern Taiwan and offshore islands comprise the remaining 8% of market share, presenting unique challenges related to logistics and service delivery but also opportunities for specialized solutions adapted to remote healthcare delivery needs. Regional healthcare policies influence market dynamics, with some areas receiving targeted government support for healthcare infrastructure development.

Urban-rural disparities create different market segments with varying requirements for ICU bed technologies and service levels. Transportation infrastructure affects product distribution and service delivery capabilities, influencing manufacturer strategies for market coverage and customer support.

Regional specialization trends show certain areas developing expertise in specific medical fields, creating concentrated demand for specialized ICU equipment. Economic development patterns correlate with healthcare investment levels and technology adoption rates across different regions.

Competitive dynamics in Taiwan’s ICU beds and surfaces market feature a diverse mix of international manufacturers and domestic companies, each leveraging distinct competitive advantages to capture market share. Market leadership is distributed among several key players who have established strong relationships with healthcare providers through quality products and comprehensive service offerings.

Competitive strategies emphasize product differentiation through technology integration, comprehensive service offerings, and local market adaptation. Partnership approaches with healthcare providers often extend beyond equipment sales to include training, maintenance, and upgrade programs that create long-term customer relationships.

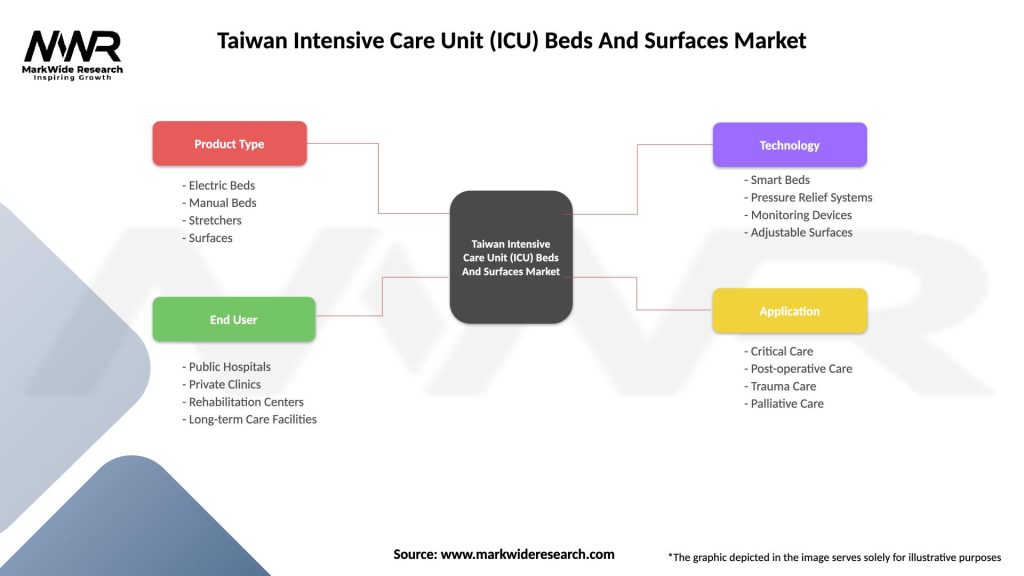

Market segmentation analysis reveals distinct categories based on product type, technology level, end-user facility type, and application requirements. Product-based segmentation provides the primary framework for understanding market structure and competitive dynamics across different ICU bed categories.

By Product Type:

By Technology Level:

By End User:

Electric ICU beds dominate the market landscape, accounting for approximately 68% of total unit sales due to their comprehensive feature sets and clinical benefits. Advanced positioning capabilities reduce nursing workload while improving patient comfort and clinical outcomes. These systems typically incorporate fall prevention features, integrated scales, and electronic medical record connectivity.

Smart bed technologies represent the fastest-growing segment, with adoption rates increasing by 15% annually as healthcare facilities prioritize data-driven care approaches. Integrated monitoring systems enable continuous patient assessment and early warning capabilities that improve clinical decision-making and patient safety outcomes.

Specialty ICU beds serve niche markets with specific requirements, including bariatric care, pediatric applications, and specialized medical procedures. Customization capabilities allow manufacturers to address unique clinical needs while maintaining cost-effectiveness through modular design approaches.

Surface technology categories include pressure-relieving mattresses, alternating pressure systems, and antimicrobial surfaces that address specific patient care challenges. Pressure ulcer prevention remains a primary concern, driving demand for advanced surface technologies that reduce skin breakdown risks.

Service and maintenance categories represent growing revenue streams as healthcare facilities seek comprehensive support for increasingly complex bed systems. Preventive maintenance programs help ensure equipment reliability and extend operational lifecycles while reducing total cost of ownership.

Healthcare providers benefit from advanced ICU bed technologies through improved patient outcomes, enhanced operational efficiency, and reduced liability risks. Clinical benefits include better patient monitoring capabilities, reduced pressure ulcer incidence, and improved infection control measures that directly impact patient safety and satisfaction scores.

Operational advantages for hospitals include reduced nursing workload through automated positioning systems, integrated patient weighing capabilities, and streamlined documentation processes. Cost benefits emerge through reduced length of stay, fewer complications, and improved staff productivity that offset initial equipment investments.

Manufacturers benefit from growing market demand driven by demographic trends and technology adoption cycles. Innovation opportunities in smart bed technologies and integrated healthcare systems create competitive advantages and premium pricing opportunities for advanced products.

Patients and families experience improved comfort, safety, and care quality through advanced bed technologies. Safety features such as fall prevention systems and pressure ulcer prevention capabilities directly impact patient well-being and recovery outcomes.

Healthcare systems benefit from improved resource utilization, better patient flow management, and enhanced quality metrics that support accreditation and regulatory compliance requirements. Data collection capabilities enable evidence-based care improvements and operational optimization.

Economic stakeholders including investors and healthcare real estate developers benefit from stable demand patterns and growth opportunities in healthcare infrastructure development. Export opportunities for Taiwanese manufacturers leverage local expertise and manufacturing capabilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Taiwan’s ICU beds and surfaces market, with healthcare facilities increasingly adopting connected technologies that integrate with electronic health records and hospital information systems. Internet of Things (IoT) integration enables real-time monitoring and predictive maintenance capabilities that improve operational efficiency.

Artificial intelligence applications are emerging in patient monitoring and risk assessment, with smart beds incorporating algorithms that can predict patient deterioration and alert clinical staff. Machine learning capabilities enable continuous improvement in patient care protocols and equipment performance optimization.

Sustainability initiatives are driving demand for environmentally responsible bed systems and surfaces, with manufacturers developing products using recycled materials and energy-efficient technologies. Circular economy principles influence product design and end-of-life management strategies.

Personalized care approaches are creating demand for customizable bed systems that can adapt to individual patient needs and preferences. Modular design concepts allow healthcare facilities to configure beds for specific applications while maintaining upgrade flexibility.

Infection control emphasis continues to influence product development, with antimicrobial surfaces and easy-to-clean designs becoming standard features. Touchless operation capabilities reduce infection transmission risks while improving user experience.

Remote monitoring capabilities support telemedicine initiatives and enable specialist consultation for patients in remote locations. Data analytics integration provides insights for clinical decision-making and operational optimization.

Recent industry developments highlight the dynamic nature of Taiwan’s ICU beds and surfaces market, with significant investments in technology advancement and market expansion initiatives. Product launches featuring advanced monitoring capabilities and smart technology integration demonstrate manufacturers’ commitment to innovation and market leadership.

Strategic partnerships between international manufacturers and local distributors have strengthened market presence and service capabilities across Taiwan. Technology licensing agreements enable local manufacturers to incorporate advanced features while maintaining cost competitiveness.

Regulatory approvals for new bed technologies and surface materials have expanded product options available to healthcare providers. MarkWide Research analysis indicates that regulatory streamlining initiatives have reduced approval timelines while maintaining safety standards.

Healthcare facility expansions and renovations have created significant demand for modern ICU equipment, with several major hospitals completing comprehensive ICU upgrades. Government healthcare investment programs have supported infrastructure development in underserved regions.

Research and development initiatives focus on next-generation bed technologies incorporating artificial intelligence and advanced materials science. Clinical studies demonstrating improved patient outcomes with advanced bed systems support adoption decisions and reimbursement policies.

Export market development by Taiwanese manufacturers has expanded international presence and created economies of scale that benefit domestic market pricing. Quality certifications and international standards compliance have enhanced market credibility and competitive positioning.

Strategic recommendations for market participants emphasize the importance of technology integration and customer relationship development in Taiwan’s evolving ICU beds and surfaces market. Manufacturers should prioritize smart bed technologies and connectivity features that align with healthcare digitization trends while maintaining cost-effectiveness for price-sensitive segments.

Healthcare providers should develop comprehensive equipment evaluation criteria that consider total cost of ownership, including maintenance, training, and upgrade costs, rather than focusing solely on initial purchase prices. Pilot programs for new technologies can help validate benefits before large-scale implementations.

Investment priorities should focus on technologies that demonstrate clear clinical benefits and operational efficiency improvements. Staff training programs are essential for maximizing return on investment from advanced bed systems and ensuring proper utilization of available features.

Partnership strategies between manufacturers and healthcare providers should extend beyond equipment sales to include ongoing support, training, and technology updates. Service excellence becomes increasingly important as bed systems become more complex and mission-critical.

Market entry strategies for new participants should consider local partnerships and gradual market development approaches that build credibility and understanding of Taiwan’s unique healthcare environment. Regulatory compliance and quality certifications are essential prerequisites for market success.

Innovation focus areas should address specific challenges in Taiwan’s healthcare system, including staff shortages, aging population needs, and cost containment pressures. Customization capabilities can provide competitive advantages in serving diverse facility requirements.

Future market prospects for Taiwan’s ICU beds and surfaces market remain highly positive, supported by fundamental demographic trends, technological advancement, and continued healthcare system investment. Long-term growth projections indicate sustained expansion driven by population aging and increasing chronic disease prevalence.

Technology evolution will continue to reshape market dynamics, with artificial intelligence, robotics, and advanced materials creating new product categories and capabilities. Smart healthcare integration will become standard rather than premium features, fundamentally changing customer expectations and competitive requirements.

Market consolidation may occur as smaller manufacturers seek partnerships or acquisition opportunities to compete effectively in increasingly sophisticated market segments. MarkWide Research projections suggest that successful companies will be those that can balance innovation with cost-effectiveness while providing comprehensive customer support.

Regulatory evolution will likely address emerging technologies and safety considerations, potentially creating new compliance requirements but also establishing clearer frameworks for innovation. International harmonization of standards may facilitate export opportunities for Taiwanese manufacturers.

Sustainability requirements will become increasingly important, influencing product design, manufacturing processes, and end-of-life management strategies. Circular economy principles may create new business models focused on equipment leasing and refurbishment services.

Regional market expansion opportunities may emerge as healthcare infrastructure develops in smaller cities and rural areas, creating demand for cost-effective solutions adapted to local needs. Export market development could leverage Taiwan’s manufacturing expertise and healthcare technology capabilities to serve broader Asian markets.

Taiwan’s ICU beds and surfaces market represents a dynamic and growing sector within the country’s healthcare ecosystem, characterized by strong fundamentals, technological innovation, and evolving customer needs. The market benefits from Taiwan’s excellent healthcare infrastructure, aging population demographics, and government support for healthcare modernization initiatives.

Key success factors for market participants include technology integration capabilities, comprehensive customer service offerings, and adaptation to local market requirements. Growth opportunities exist across multiple segments, from basic bed systems to advanced smart technologies that integrate with digital healthcare initiatives.

Market challenges related to budget constraints, regulatory complexity, and competitive intensity require strategic approaches that balance innovation with cost-effectiveness. Successful companies will be those that can demonstrate clear value propositions through improved patient outcomes and operational efficiency.

Future market development will be shaped by continued technological advancement, demographic trends, and evolving healthcare delivery models. Strategic positioning for long-term success requires investment in innovation, customer relationships, and market understanding that addresses Taiwan’s unique healthcare environment and requirements.

What is Intensive Care Unit (ICU) Beds And Surfaces?

Intensive Care Unit (ICU) Beds And Surfaces refer to specialized medical equipment designed for critically ill patients. These beds are equipped with advanced features to support patient care, including adjustable positions, pressure relief surfaces, and integrated monitoring systems.

What are the key players in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market?

Key players in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market include companies like Hill-Rom, Stryker, and Getinge, which are known for their innovative healthcare solutions and advanced ICU bed technologies, among others.

What are the growth factors driving the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market?

The growth of the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market is driven by an increasing prevalence of chronic diseases, a rising aging population, and advancements in medical technology that enhance patient care and comfort.

What challenges does the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market face?

The Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market faces challenges such as high costs of advanced ICU beds, limited healthcare budgets, and the need for regular maintenance and training for healthcare staff.

What opportunities exist in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market?

Opportunities in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market include the development of smart beds with integrated technology, increasing investments in healthcare infrastructure, and a growing focus on patient-centered care.

What trends are shaping the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market?

Trends in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market include the adoption of telemedicine, the integration of IoT devices for real-time monitoring, and a shift towards more ergonomic and patient-friendly bed designs.

Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Beds, Manual Beds, Stretchers, Surfaces |

| End User | Public Hospitals, Private Clinics, Rehabilitation Centers, Long-term Care Facilities |

| Technology | Smart Beds, Pressure Relief Systems, Monitoring Devices, Adjustable Surfaces |

| Application | Critical Care, Post-operative Care, Trauma Care, Palliative Care |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Intensive Care Unit (ICU) Beds And Surfaces Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at