444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan furniture market represents a dynamic and evolving sector that combines traditional craftsmanship with modern manufacturing capabilities. Taiwan has established itself as a significant player in the global furniture industry, leveraging its strategic location, skilled workforce, and advanced manufacturing technologies to serve both domestic and international markets. The market encompasses a diverse range of furniture categories including residential furniture, office furniture, outdoor furniture, and specialized commercial furnishings.

Market dynamics in Taiwan’s furniture sector are characterized by strong export orientation, with approximately 75% of production being exported to international markets. The domestic market has shown resilience and growth, driven by urbanization trends, rising disposable incomes, and changing lifestyle preferences among Taiwanese consumers. The industry has successfully adapted to global trends including sustainability, smart furniture integration, and customization demands.

Manufacturing excellence remains a cornerstone of Taiwan’s furniture industry, with companies investing heavily in automation, quality control systems, and innovative design capabilities. The sector has demonstrated remarkable adaptability to market changes, including shifts in consumer preferences toward eco-friendly materials and multifunctional furniture solutions. Taiwan’s furniture manufacturers have maintained competitive advantages through continuous innovation, efficient supply chain management, and strong relationships with global retailers and distributors.

The Taiwan furniture market refers to the comprehensive ecosystem of furniture manufacturing, distribution, and retail activities within Taiwan’s borders, encompassing both domestic consumption and export-oriented production. This market includes traditional wooden furniture, modern modular systems, office furnishings, outdoor furniture, and specialized commercial applications serving various sectors including hospitality, healthcare, and education.

Market scope extends beyond simple manufacturing to include design innovation, material sourcing, quality assurance, and global distribution networks. Taiwan’s furniture market is characterized by its dual nature: serving local consumer needs while maintaining a strong export focus that positions Taiwanese manufacturers as key suppliers to major international furniture brands and retailers worldwide.

Industry definition encompasses small-scale artisanal workshops, medium-sized specialized manufacturers, and large-scale industrial operations that collectively contribute to Taiwan’s reputation for quality furniture production. The market includes both original equipment manufacturing (OEM) and original design manufacturing (ODM) capabilities, allowing Taiwanese companies to serve diverse client needs from basic production services to complete design and manufacturing solutions.

Taiwan’s furniture market demonstrates robust growth potential driven by technological advancement, design innovation, and strategic market positioning. The industry has successfully navigated global challenges while maintaining its competitive edge through continuous investment in manufacturing capabilities and market diversification strategies. Domestic demand continues to grow steadily, supported by urbanization trends and increasing consumer spending on home improvement and office furnishing.

Export performance remains exceptional, with Taiwan furniture manufacturers serving major markets across North America, Europe, and Asia-Pacific regions. The industry has achieved approximately 12% growth in export revenues over recent periods, reflecting strong international demand for Taiwanese furniture products. Key success factors include superior quality control, competitive pricing, and ability to meet diverse customer specifications and delivery requirements.

Innovation initiatives have positioned Taiwan as a leader in smart furniture development, sustainable manufacturing practices, and customized furniture solutions. The market benefits from strong government support for industry development, including research and development incentives, export promotion programs, and infrastructure investments that enhance manufacturing efficiency and global competitiveness.

Strategic positioning of Taiwan’s furniture market reveals several critical insights that define current market dynamics and future growth trajectories:

Economic prosperity in Taiwan has created favorable conditions for furniture market expansion, with rising disposable incomes enabling consumers to invest in higher-quality furniture and home improvement projects. The growing middle class demonstrates increasing willingness to spend on premium furniture products that offer superior design, functionality, and durability. This economic foundation supports both domestic market growth and provides resources for manufacturers to invest in advanced production capabilities.

Urbanization trends continue to drive furniture demand as more Taiwanese move to urban areas and require furnishing solutions for apartments, condominiums, and modern living spaces. The shift toward smaller living spaces has created demand for multifunctional, space-saving furniture designs that maximize utility while maintaining aesthetic appeal. Urban lifestyle preferences favor modern, minimalist furniture styles that align with contemporary living requirements.

Technological advancement has revolutionized furniture manufacturing processes, enabling greater precision, efficiency, and customization capabilities. Automation and digital manufacturing technologies have reduced production costs while improving quality consistency, allowing Taiwanese manufacturers to compete effectively in global markets. Smart furniture integration has opened new market segments and premium pricing opportunities for innovative products.

Export market expansion provides continuous growth opportunities as Taiwanese manufacturers successfully penetrate new geographic markets and establish relationships with international retailers. Strong reputation for quality and reliability has enabled market share gains in competitive global markets, while diversification strategies reduce dependence on any single export destination.

Raw material costs present ongoing challenges for Taiwan’s furniture manufacturers, particularly with fluctuating prices for wood, metals, and other essential materials. Global supply chain disruptions have created additional cost pressures and availability concerns, forcing manufacturers to develop alternative sourcing strategies and material substitutions. Rising material costs can impact profit margins and competitive positioning in price-sensitive market segments.

Labor shortage issues affect the furniture industry as Taiwan faces demographic changes and competition for skilled workers from other manufacturing sectors. The traditional craftsmanship skills required for high-quality furniture production require significant training and experience, making workforce development a critical concern. Aging workforce demographics compound these challenges as experienced craftsmen retire without sufficient replacement workers.

Environmental regulations have increased compliance costs and operational complexity for furniture manufacturers, requiring investments in emission control systems, waste management processes, and sustainable material sourcing. While these regulations promote industry sustainability, they create additional cost burdens and operational constraints that smaller manufacturers may struggle to manage effectively.

Global competition intensifies pressure on Taiwanese manufacturers as low-cost producers in other regions compete for market share in price-sensitive segments. Maintaining competitive advantages requires continuous investment in technology, design capabilities, and operational efficiency improvements that may strain financial resources for smaller companies.

Smart furniture development presents significant growth opportunities as consumers increasingly seek technology-integrated furniture solutions for modern homes and offices. The convergence of furniture design with IoT capabilities, wireless charging, and automated features creates premium market segments with higher profit margins. Taiwanese manufacturers can leverage their technology expertise to develop innovative smart furniture products that differentiate them from traditional competitors.

Sustainable furniture solutions offer expanding market opportunities as environmental consciousness grows among consumers and businesses. Demand for eco-friendly materials, recyclable designs, and sustainable manufacturing processes creates competitive advantages for companies that successfully implement green initiatives. Carbon-neutral production and circular economy principles can become key selling points in premium market segments.

E-commerce expansion enables direct-to-consumer sales channels that bypass traditional retail intermediaries and improve profit margins. Online platforms allow Taiwanese manufacturers to showcase design capabilities, offer customization options, and reach global customers directly. Digital marketing and virtual showroom technologies can enhance customer engagement and sales conversion rates.

Emerging market penetration provides growth opportunities as developing economies experience rising incomes and urbanization trends that drive furniture demand. Southeast Asian markets, Latin American countries, and African nations represent untapped potential for Taiwanese furniture exports, particularly in mid-range quality segments where Taiwan offers competitive advantages.

Supply chain evolution continues to reshape Taiwan’s furniture market as manufacturers adapt to global disruptions and seek greater resilience through diversification and localization strategies. MarkWide Research analysis indicates that companies investing in supply chain flexibility have achieved 20% better performance during market volatility periods. Integration of digital supply chain management systems has improved inventory optimization and demand forecasting capabilities.

Consumer behavior shifts toward online purchasing, customization preferences, and sustainability concerns are driving fundamental changes in how furniture companies operate and market their products. The rise of omnichannel retail strategies combines physical showrooms with digital platforms to provide comprehensive customer experiences. Social media influence and design trend awareness have accelerated product lifecycle changes and increased demand for fashionable, contemporary furniture styles.

Competitive landscape dynamics reflect increasing consolidation as larger manufacturers acquire smaller companies to gain scale advantages and expand capabilities. Strategic partnerships between Taiwanese manufacturers and international brands have created new collaboration models that leverage respective strengths in manufacturing and market access. Innovation competition has intensified as companies invest in design capabilities and technology integration to differentiate their offerings.

Regulatory environment continues evolving with stricter environmental standards, safety requirements, and trade regulations that impact manufacturing operations and export procedures. Compliance with international standards has become essential for market access, driving investments in quality systems and certification processes. Government support programs for industry development provide opportunities for technology upgrades and market expansion initiatives.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into Taiwan’s furniture market dynamics. Primary research included extensive interviews with industry executives, manufacturers, retailers, and key stakeholders across the furniture value chain. Survey data collection covered consumer preferences, purchasing behaviors, and market trend perceptions from representative samples of Taiwanese consumers and business buyers.

Secondary research incorporated analysis of government statistics, industry association reports, trade data, and economic indicators relevant to furniture market performance. Historical data analysis provided trend identification and market evolution patterns over multiple years. Competitive intelligence gathering included company financial analysis, product portfolio assessment, and strategic initiative evaluation for major market participants.

Market segmentation analysis utilized statistical modeling techniques to identify distinct customer segments, product categories, and geographic markets within Taiwan’s furniture industry. Price analysis and value chain mapping provided insights into cost structures, profit margins, and competitive positioning across different market segments. Technology impact assessment evaluated the influence of automation, digitalization, and smart furniture trends on market dynamics.

Validation processes included cross-referencing multiple data sources, expert review panels, and market participant feedback to ensure research accuracy and reliability. Quantitative analysis was supplemented with qualitative insights to provide comprehensive understanding of market drivers, challenges, and opportunities. Regular updates and monitoring ensure research findings remain current and relevant to market conditions.

Northern Taiwan dominates the furniture market landscape, with Taipei and surrounding metropolitan areas accounting for approximately 45% of domestic consumption. This region benefits from higher disposable incomes, urban lifestyle preferences, and concentration of design-conscious consumers who drive demand for premium furniture products. The presence of major retailers, showrooms, and design centers creates a competitive marketplace that encourages innovation and quality improvements.

Central Taiwan serves as the manufacturing heartland, hosting numerous furniture production facilities that leverage skilled workforce availability and established supply chain networks. This region contributes significantly to export production while maintaining 25% of domestic market share. Manufacturing clusters in Taichung and surrounding areas benefit from economies of scale, shared resources, and collaborative relationships between suppliers and manufacturers.

Southern Taiwan has emerged as a growing market for furniture consumption, driven by industrial development and population growth in cities like Kaohsiung and Tainan. The region represents approximately 20% of domestic demand and shows strong growth potential as economic development continues. Local preferences tend toward practical, value-oriented furniture solutions that balance quality with affordability.

Eastern Taiwan represents a smaller but distinctive market segment with unique preferences for traditional and artisanal furniture products. The region’s focus on cultural preservation and tourism creates demand for locally-crafted furniture that reflects Taiwanese heritage and craftsmanship traditions. While representing 10% of total market, this region offers premium pricing opportunities for specialized products.

Market leadership in Taiwan’s furniture industry is distributed among several categories of companies, each with distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly across market segments, with some companies focusing on cost leadership through efficient manufacturing, while others pursue differentiation through design innovation, quality excellence, or specialized market niches. Strategic partnerships and joint ventures have become common as companies seek to combine complementary strengths and expand market reach.

By Product Type:

By Material Type:

By Distribution Channel:

Residential Furniture Category represents the largest market segment, driven by housing market activity, lifestyle changes, and consumer spending on home improvement. This category benefits from steady replacement demand and trend-driven purchases as consumers update their living spaces. Premium subcategories show particular strength as affluent consumers invest in high-quality, designer furniture pieces that offer long-term value and aesthetic appeal.

Office Furniture Segment has experienced significant growth due to workplace evolution, remote work trends, and corporate investment in employee comfort and productivity. Ergonomic furniture solutions command premium pricing as health and wellness considerations become priorities for employers and employees. Flexible, modular office furniture systems gain popularity as companies adapt to changing work patterns and space utilization needs.

Smart Furniture Category represents the fastest-growing segment with 35% annual growth as technology integration becomes mainstream. Products featuring wireless charging, LED lighting, automated adjustments, and IoT connectivity appeal to tech-savvy consumers willing to pay premium prices for enhanced functionality. This category offers highest profit margins and differentiation opportunities for innovative manufacturers.

Sustainable Furniture Segment continues expanding as environmental consciousness influences purchasing decisions across all demographics. Eco-friendly materials, recyclable designs, and carbon-neutral production processes create competitive advantages and justify premium pricing. This category attracts environmentally conscious consumers and businesses seeking to demonstrate corporate social responsibility commitments.

Manufacturers benefit from Taiwan’s strategic advantages including skilled workforce, advanced manufacturing capabilities, and strong supply chain infrastructure that enable competitive production costs and superior quality standards. Access to both domestic and export markets provides revenue diversification and growth opportunities. Government support programs offer incentives for technology upgrades, research and development investments, and market expansion initiatives.

Retailers gain from diverse product sourcing options, competitive wholesale pricing, and reliable supply chain relationships with Taiwanese manufacturers. The industry’s focus on quality and innovation provides retailers with differentiated product offerings that command premium pricing and customer loyalty. Strong brand reputation of Taiwanese furniture supports retail marketing and customer confidence.

Consumers enjoy access to high-quality furniture products at competitive prices, with extensive selection across all categories and price points. Local manufacturing provides shorter delivery times, better customer service, and easier warranty support compared to imported alternatives. Innovation in design and functionality offers consumers cutting-edge furniture solutions that enhance lifestyle and productivity.

Export partners benefit from reliable supply relationships, consistent quality standards, and flexible manufacturing capabilities that accommodate diverse market requirements. Taiwanese manufacturers’ ability to handle both OEM and ODM arrangements provides international partners with comprehensive sourcing solutions. Strong logistics infrastructure and export experience ensure efficient global distribution and customer satisfaction.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation is reshaping how furniture companies operate, market, and sell their products. Virtual reality showrooms, augmented reality visualization tools, and online customization platforms are becoming standard offerings that enhance customer experience and reduce sales cycle times. Digital manufacturing technologies including 3D printing and automated cutting systems improve production efficiency while enabling mass customization capabilities.

Sustainability integration has evolved from niche concern to mainstream requirement as consumers and businesses prioritize environmental responsibility. Circular economy principles drive design decisions toward recyclable materials, modular construction, and end-of-life product recovery programs. Carbon footprint reduction initiatives influence material sourcing, manufacturing processes, and transportation logistics throughout the supply chain.

Workspace evolution continues influencing furniture design as hybrid work models, collaborative spaces, and wellness-focused environments become standard workplace features. Flexible furniture solutions that adapt to multiple uses and configurations gain popularity as organizations optimize space utilization and employee satisfaction. Biophilic design elements incorporating natural materials and forms address wellness trends in both office and residential settings.

Customization demand grows as consumers seek furniture solutions tailored to specific spaces, preferences, and functional requirements. Mass customization technologies enable manufacturers to offer personalized options without significant cost penalties. Direct-to-consumer sales models facilitate custom order processing and customer communication throughout the design and production process.

Technology partnerships between furniture manufacturers and technology companies have accelerated smart furniture development and market introduction. Recent collaborations focus on integrating IoT sensors, wireless charging capabilities, and automated adjustment systems into traditional furniture designs. These partnerships combine furniture expertise with technology innovation to create differentiated products that command premium pricing.

Sustainability certifications have become increasingly important as manufacturers seek third-party validation of environmental claims and practices. Forest Stewardship Council (FSC) certification, GREENGUARD emissions standards, and carbon-neutral manufacturing certifications provide competitive advantages in environmentally conscious market segments. Investment in sustainable practices has reached 40% of total capital expenditure for leading manufacturers.

Market expansion initiatives include establishment of new manufacturing facilities, acquisition of complementary companies, and strategic partnerships with international distributors. MWR data indicates that companies pursuing geographic diversification have achieved 15% higher revenue growth compared to those focusing solely on traditional markets. Export market development programs supported by government agencies facilitate entry into new international markets.

Innovation investments in research and development have increased substantially as companies compete for technology leadership and design differentiation. Advanced materials research, ergonomic studies, and user experience optimization drive product development priorities. Collaboration with design schools and research institutions provides access to emerging trends and innovative concepts that influence future product development.

Strategic recommendations for Taiwan furniture market participants emphasize the importance of balancing traditional manufacturing strengths with emerging market opportunities and technological advancement. Companies should prioritize investment in automation and digital manufacturing capabilities that improve efficiency while maintaining quality standards. Developing proprietary design capabilities and brand recognition will become increasingly important for long-term competitive positioning.

Market positioning strategies should focus on premium and mid-premium segments where Taiwan’s quality advantages provide sustainable competitive differentiation. Companies competing primarily on cost will face increasing pressure from lower-cost producers, making value-added services and product innovation essential for market success. Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs.

Export diversification remains critical for reducing dependence on traditional markets and capturing growth opportunities in emerging economies. Companies should develop market-specific product adaptations and distribution strategies that address local preferences and requirements. Building direct relationships with end customers through e-commerce and digital marketing can reduce dependence on intermediaries and improve profit margins.

Technology adoption should focus on solutions that provide clear customer value and competitive advantages rather than technology for its own sake. Smart furniture development should prioritize user experience and practical functionality over complex features that may not justify premium pricing. Digital transformation initiatives should enhance operational efficiency and customer engagement while supporting business growth objectives.

Growth projections for Taiwan’s furniture market indicate continued expansion driven by domestic consumption growth, export market development, and technology integration opportunities. The market is expected to maintain steady growth momentum with 6-8% annual expansion over the next five years, supported by favorable economic conditions and industry innovation initiatives. Smart furniture segments are projected to achieve 25% annual growth as technology adoption accelerates across consumer and commercial markets.

Industry transformation will continue as manufacturers adapt to changing consumer preferences, environmental requirements, and competitive pressures. Companies that successfully integrate sustainability practices, digital capabilities, and customer-centric approaches will capture disproportionate market share and profitability. Traditional manufacturing models will evolve toward more flexible, responsive operations that can accommodate customization and rapid market changes.

Export opportunities are expected to expand as global furniture demand grows and Taiwan’s reputation for quality and innovation strengthens international market position. Emerging markets in Southeast Asia, Latin America, and Africa present significant growth potential for Taiwanese manufacturers willing to invest in market development and local partnerships. E-commerce platforms will facilitate direct access to global customers and reduce dependence on traditional distribution channels.

Innovation leadership will become increasingly important as the industry matures and competition intensifies. Companies investing in research and development, design capabilities, and technology integration will establish competitive advantages that support premium pricing and market share growth. Collaboration with technology partners, design institutions, and international brands will accelerate innovation and market access opportunities.

Taiwan’s furniture market stands at a pivotal point in its evolution, combining traditional manufacturing excellence with emerging opportunities in technology integration, sustainability, and global market expansion. The industry has demonstrated remarkable resilience and adaptability, successfully navigating global challenges while maintaining competitive advantages in quality, innovation, and customer service. Strong domestic demand growth, coupled with expanding export opportunities, provides a solid foundation for continued market development.

Strategic positioning for future success requires balanced investment in manufacturing capabilities, technology adoption, and market development initiatives. Companies that embrace digital transformation, sustainability practices, and customer-centric approaches will be best positioned to capture growth opportunities and maintain competitive advantages. The industry’s focus on innovation and quality differentiation provides sustainable competitive positioning against low-cost competitors while opening premium market segments.

Market outlook remains positive with multiple growth drivers supporting continued expansion across all major segments. Smart furniture development, sustainability trends, and e-commerce adoption create new revenue opportunities while traditional strengths in manufacturing and export provide stable business foundations. Success in this evolving market will depend on companies’ ability to adapt to changing customer needs while leveraging Taiwan’s inherent advantages in quality, innovation, and manufacturing excellence.

What is Taiwan Furniture?

Taiwan Furniture refers to the various types of furniture produced and sold in Taiwan, including residential, office, and commercial furniture. The market is known for its craftsmanship, innovative designs, and a blend of traditional and modern styles.

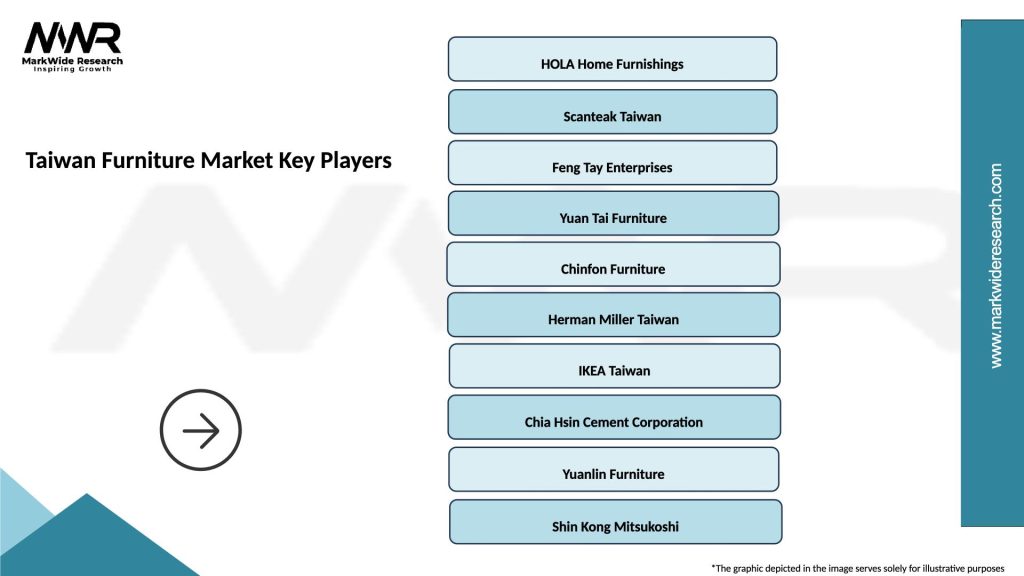

What are the key players in the Taiwan Furniture Market?

Key players in the Taiwan Furniture Market include companies like Hualong Furniture, Hsin Yi Furniture, and Hualien Furniture, which are known for their diverse product offerings and quality. These companies compete in various segments such as home furnishings, office furniture, and custom designs, among others.

What are the growth factors driving the Taiwan Furniture Market?

The Taiwan Furniture Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing demand for sustainable and eco-friendly furniture. Additionally, the trend towards home improvement and interior design is boosting market growth.

What challenges does the Taiwan Furniture Market face?

The Taiwan Furniture Market faces challenges such as intense competition from international brands, fluctuating raw material prices, and changing consumer preferences. These factors can impact profitability and market share for local manufacturers.

What opportunities exist in the Taiwan Furniture Market?

Opportunities in the Taiwan Furniture Market include the expansion of e-commerce platforms, increasing demand for smart furniture, and the potential for export growth to emerging markets. Additionally, there is a rising interest in custom and modular furniture solutions.

What trends are shaping the Taiwan Furniture Market?

Trends shaping the Taiwan Furniture Market include a focus on sustainable materials, the integration of technology in furniture design, and a shift towards minimalist and multifunctional furniture. These trends reflect changing consumer lifestyles and preferences.

Taiwan Furniture Market

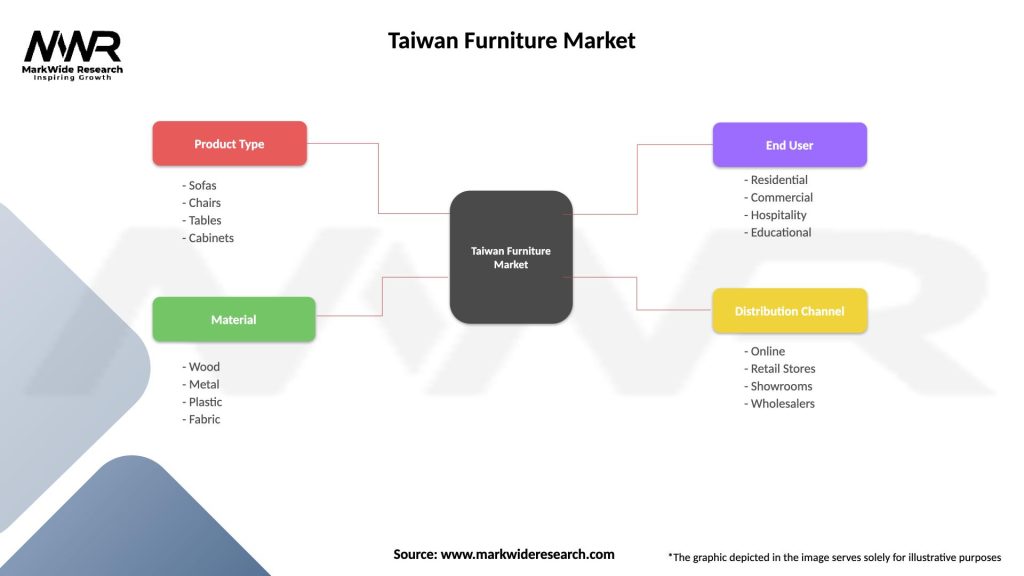

| Segmentation Details | Description |

|---|---|

| Product Type | Sofas, Chairs, Tables, Cabinets |

| Material | Wood, Metal, Plastic, Fabric |

| End User | Residential, Commercial, Hospitality, Educational |

| Distribution Channel | Online, Retail Stores, Showrooms, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Furniture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at