444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan data center storage market represents a critical component of the nation’s rapidly evolving digital infrastructure landscape. As one of Asia’s leading technology hubs, Taiwan has witnessed unprecedented growth in data center investments, driven by increasing digitalization, cloud adoption, and the surge in data-intensive applications. The market encompasses various storage technologies including traditional hard disk drives, solid-state drives, and emerging storage-class memory solutions that power the backbone of Taiwan’s digital economy.

Market dynamics in Taiwan reflect the country’s strategic position as a manufacturing powerhouse and technology innovation center. With major semiconductor companies and technology manufacturers establishing significant operations across the island, the demand for robust data storage infrastructure has grown exponentially. The market is experiencing a compound annual growth rate of 8.2%, positioning Taiwan as one of the fastest-growing data center storage markets in the Asia-Pacific region.

Government initiatives supporting digital transformation and smart city development have further accelerated market expansion. Taiwan’s commitment to becoming a regional data hub, combined with favorable regulatory frameworks and substantial infrastructure investments, creates an environment conducive to sustained growth in the data center storage sector.

The Taiwan data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services that enable data centers across Taiwan to store, manage, and retrieve digital information efficiently. This market encompasses various storage architectures including direct-attached storage, network-attached storage, and storage area networks, along with associated management software and professional services.

Storage solutions within this market range from traditional spinning disk drives to cutting-edge flash storage arrays and hybrid cloud storage systems. The market includes both primary storage for active data workloads and secondary storage for backup, archival, and disaster recovery purposes. Additionally, it covers emerging technologies such as software-defined storage and hyperconverged infrastructure that are reshaping how organizations approach data management.

Market participants include global storage vendors, local system integrators, cloud service providers, and managed service providers who collectively deliver comprehensive storage solutions to enterprises, government agencies, and service providers throughout Taiwan.

Taiwan’s data center storage market stands at the forefront of technological advancement, driven by the nation’s position as a global technology leader and manufacturing hub. The market demonstrates robust growth characteristics, with increasing adoption of flash storage technologies accounting for 42% of new storage deployments in enterprise environments. This shift reflects organizations’ growing emphasis on performance, reliability, and energy efficiency in their storage infrastructure.

Key market drivers include the proliferation of artificial intelligence and machine learning applications, the expansion of 5G networks, and the increasing adoption of edge computing architectures. These technological trends are creating unprecedented demands for high-performance storage solutions capable of handling diverse workload requirements with minimal latency.

Competitive landscape features a mix of established global vendors and emerging local players, with market consolidation occurring through strategic partnerships and acquisitions. The market is characterized by rapid innovation cycles, with vendors continuously introducing new storage technologies to address evolving customer requirements and maintain competitive advantages.

Future prospects remain highly favorable, with analysts projecting continued strong growth driven by digital transformation initiatives, cloud migration strategies, and the increasing importance of data analytics in business decision-making processes across various industry sectors.

Market segmentation reveals distinct patterns in storage technology adoption across different industry verticals and organization sizes. The following key insights characterize the current market landscape:

Digital transformation initiatives across Taiwan’s enterprise landscape serve as the primary catalyst for data center storage market growth. Organizations are modernizing their IT infrastructure to support digital business models, requiring scalable and high-performance storage solutions that can accommodate increasing data volumes and diverse application requirements.

Artificial intelligence and machine learning adoption is creating substantial demand for storage systems capable of handling large datasets and supporting intensive computational workloads. These applications require storage architectures that can deliver consistent high performance while maintaining cost-effectiveness at scale.

Government digitalization programs are driving significant investments in public sector IT infrastructure, including data center storage systems. Smart city initiatives, digital government services, and e-governance platforms require robust storage foundations to ensure reliable service delivery to citizens and businesses.

Manufacturing sector modernization continues to fuel storage demand as Industry 4.0 initiatives generate massive amounts of operational data requiring real-time processing and long-term retention. Smart manufacturing systems depend on reliable storage infrastructure to maintain operational continuity and enable data-driven decision making.

Cloud service expansion by both international and domestic providers is creating substantial demand for hyperscale storage solutions. The growing preference for cloud-based services among Taiwan enterprises is driving cloud providers to invest heavily in storage infrastructure to meet service level requirements.

High implementation costs associated with advanced storage technologies pose significant challenges for small and medium-sized enterprises seeking to modernize their storage infrastructure. The substantial capital investment required for enterprise-grade storage systems can limit adoption rates among cost-sensitive organizations.

Technical complexity in storage system integration and management creates barriers for organizations lacking specialized IT expertise. The complexity of modern storage architectures requires skilled personnel and comprehensive training programs, which may not be readily available to all market participants.

Data sovereignty concerns and regulatory compliance requirements can complicate storage architecture decisions, particularly for organizations handling sensitive data or operating in regulated industries. Compliance with local data protection regulations may limit technology choices and increase implementation complexity.

Supply chain disruptions affecting storage hardware availability and pricing can impact market growth and technology adoption timelines. Global semiconductor shortages and geopolitical tensions may create uncertainty in storage system procurement and deployment schedules.

Legacy system integration challenges can slow storage modernization initiatives as organizations struggle to integrate new storage technologies with existing IT infrastructure. Compatibility issues and migration complexities may delay technology adoption and limit market growth potential.

Edge computing expansion presents significant opportunities for storage vendors to develop specialized solutions for distributed computing environments. The growing deployment of edge infrastructure across Taiwan creates demand for compact, reliable, and remotely manageable storage systems.

Sustainability initiatives are driving demand for energy-efficient storage solutions that can help organizations reduce their environmental footprint while maintaining performance requirements. Green data center initiatives create opportunities for vendors offering environmentally friendly storage technologies.

5G network deployment is creating new storage requirements for telecommunications infrastructure and enabling new applications that generate substantial data volumes. The rollout of 5G networks across Taiwan will drive demand for high-performance storage solutions in both core and edge locations.

Artificial intelligence integration in storage systems presents opportunities for vendors to differentiate their offerings through intelligent data management capabilities. AI-powered storage optimization, predictive maintenance, and automated data lifecycle management represent growing market segments.

Hybrid cloud adoption continues to create opportunities for storage solutions that seamlessly integrate on-premises and cloud environments. Organizations seeking flexible and scalable storage architectures represent a substantial market opportunity for innovative storage vendors.

Technological evolution drives continuous change in the Taiwan data center storage market, with vendors constantly introducing new storage architectures and capabilities to address emerging customer requirements. The rapid pace of innovation creates both opportunities and challenges for market participants seeking to maintain competitive positions.

Competitive intensity remains high as global storage vendors compete for market share in Taiwan’s growing data center market. Price competition, feature differentiation, and service quality are key factors influencing customer purchasing decisions and vendor market positioning.

Customer expectations continue to evolve, with organizations demanding higher performance, greater reliability, and more comprehensive management capabilities from their storage investments. These evolving requirements drive vendors to invest in research and development to meet market demands.

Partnership ecosystems play crucial roles in market dynamics, with storage vendors collaborating with system integrators, cloud providers, and technology partners to deliver comprehensive solutions. These partnerships enable vendors to expand their market reach and enhance their solution capabilities.

Regulatory influences shape market dynamics through data protection requirements, industry standards, and government procurement policies. Compliance with evolving regulations requires ongoing investment in security features and certification processes.

Primary research for this market analysis involved comprehensive interviews with key stakeholders across the Taiwan data center storage ecosystem, including storage vendors, system integrators, end-user organizations, and industry experts. These interviews provided valuable insights into market trends, customer requirements, and competitive dynamics.

Secondary research encompassed analysis of industry reports, financial statements, product announcements, and market intelligence from various sources. This research provided quantitative data on market size, growth rates, and technology adoption patterns across different market segments.

Market modeling techniques were employed to analyze historical trends and project future market development scenarios. Statistical analysis of market data helped identify key growth drivers and potential market constraints affecting the Taiwan data center storage market.

Expert validation processes ensured the accuracy and reliability of research findings through consultation with industry experts and market participants. This validation helped confirm market insights and refine growth projections based on expert knowledge and experience.

Data triangulation methods were used to cross-verify information from multiple sources and ensure the consistency and reliability of market intelligence. This approach helped minimize potential biases and improve the overall quality of market analysis.

Northern Taiwan dominates the data center storage market, with the Taipei metropolitan area accounting for 45% of total market demand. This concentration reflects the region’s role as Taiwan’s economic and technology center, hosting numerous multinational corporations, financial institutions, and government agencies requiring sophisticated storage infrastructure.

Central Taiwan represents a growing market segment, driven by manufacturing sector expansion and technology park development. The region’s industrial concentration creates substantial demand for storage solutions supporting manufacturing operations and supply chain management systems.

Southern Taiwan shows strong growth potential, particularly in the Kaohsiung area, where port operations, petrochemical industries, and emerging technology sectors drive storage infrastructure investments. The region’s strategic importance for international trade creates unique storage requirements for logistics and supply chain applications.

Eastern Taiwan represents a smaller but strategically important market segment, with growing demand for storage solutions supporting tourism, agriculture, and renewable energy sectors. The region’s focus on sustainable development creates opportunities for energy-efficient storage technologies.

Market distribution patterns reflect Taiwan’s economic geography, with urban centers driving the majority of storage demand while rural areas present opportunities for edge computing and distributed storage deployments. Regional development policies and infrastructure investments continue to influence market dynamics across different areas.

Market leadership in Taiwan’s data center storage sector is characterized by intense competition among global technology giants and specialized storage vendors. The competitive landscape features both established players with comprehensive product portfolios and innovative companies focusing on specific market niches.

Competitive strategies focus on technology innovation, strategic partnerships, and customer service excellence. Vendors are investing heavily in artificial intelligence, software-defined storage, and cloud integration capabilities to differentiate their offerings and maintain market positions.

By Storage Type:

By Technology:

By End-User Industry:

Enterprise Storage Segment demonstrates the strongest growth momentum, with organizations investing heavily in high-performance storage solutions to support digital transformation initiatives. Flash storage adoption in this segment has reached 67% penetration rate, reflecting the growing emphasis on application performance and user experience.

Small and Medium Business (SMB) Segment shows increasing adoption of cloud-integrated storage solutions, with hybrid architectures gaining popularity among cost-conscious organizations. This segment values simplicity, affordability, and ease of management in storage solution selection.

Cloud Service Provider Segment requires hyperscale storage solutions capable of supporting massive data volumes and diverse customer workloads. This segment drives demand for software-defined storage architectures and automated management capabilities.

Edge Computing Segment represents an emerging category with unique requirements for compact, reliable, and remotely manageable storage solutions. This segment is expected to show rapid growth as edge computing deployments expand across Taiwan.

Backup and Archive Segment continues to evolve with the adoption of cloud-based backup services and modern data protection technologies. Organizations are seeking cost-effective solutions that provide reliable data protection and rapid recovery capabilities.

Technology Vendors benefit from Taiwan’s position as a regional technology hub and manufacturing center, providing access to a sophisticated customer base with advanced storage requirements. The market offers opportunities for technology innovation and partnership development with local system integrators and service providers.

System Integrators gain access to a growing market for storage integration and professional services, with increasing demand for expertise in modern storage architectures and cloud integration. The complexity of storage environments creates ongoing opportunities for consulting and managed services.

End-User Organizations benefit from a competitive vendor landscape that drives innovation and competitive pricing in storage solutions. The availability of diverse storage options enables organizations to select solutions that best match their specific requirements and budget constraints.

Cloud Service Providers can leverage Taiwan’s strategic location and advanced infrastructure to serve regional markets while benefiting from local expertise in manufacturing and technology development. The growing demand for cloud services creates opportunities for infrastructure expansion and service innovation.

Government Agencies benefit from improved digital service delivery capabilities and enhanced data management systems that support citizen services and administrative efficiency. Modern storage infrastructure enables government digitalization initiatives and smart city development programs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Flash Storage Acceleration continues to reshape the storage landscape, with organizations migrating from traditional hard drives to solid-state storage for improved performance and reliability. This trend is particularly pronounced in performance-critical applications and database environments where storage latency directly impacts user experience.

Software-Defined Infrastructure adoption is gaining momentum as organizations seek greater flexibility and scalability in their storage architectures. Software-defined storage solutions enable organizations to abstract storage resources from underlying hardware, providing improved resource utilization and simplified management.

Artificial Intelligence Integration is becoming increasingly important in storage systems, with AI-powered features enabling predictive maintenance, automated optimization, and intelligent data placement. These capabilities help organizations maximize storage performance while minimizing operational overhead.

Hybrid Cloud Architectures are becoming the preferred approach for many organizations, combining on-premises storage with cloud services to achieve optimal cost, performance, and flexibility. This trend drives demand for storage solutions that seamlessly integrate with public cloud platforms.

Edge Computing Expansion is creating new requirements for distributed storage architectures that can support applications and data processing at network edges. This trend is particularly relevant for IoT applications, content delivery, and real-time analytics use cases.

Sustainability Focus is influencing storage technology selection, with organizations increasingly considering energy efficiency and environmental impact in their purchasing decisions. Green data center initiatives are driving demand for energy-efficient storage solutions.

Strategic partnerships between global storage vendors and local system integrators are expanding market reach and enhancing solution delivery capabilities. These partnerships enable vendors to leverage local expertise while providing integrators with access to advanced storage technologies.

Technology innovations in storage-class memory and computational storage are creating new market opportunities and enabling novel application architectures. These developments are particularly relevant for AI and machine learning workloads that require high-performance data access.

Government initiatives supporting digital transformation and smart city development are driving public sector investments in storage infrastructure. MarkWide Research analysis indicates that government digitalization programs account for 18% of storage market growth in Taiwan.

Cloud service expansion by major international providers is creating substantial demand for hyperscale storage solutions and driving infrastructure investments across Taiwan. These expansions are positioning Taiwan as a regional cloud services hub.

Manufacturing sector modernization continues to drive storage demand as Industry 4.0 initiatives generate increasing volumes of operational data requiring real-time processing and long-term retention capabilities.

Technology vendors should focus on developing storage solutions that address specific requirements of Taiwan’s key industries, particularly manufacturing, technology, and financial services. Customization and local support capabilities will be crucial for success in this market.

Investment in partnerships with local system integrators and service providers is essential for vendors seeking to expand their market presence and improve customer relationships. These partnerships provide valuable market insights and enhance solution delivery capabilities.

Edge computing preparation should be a priority for storage vendors, as the expansion of edge infrastructure will create new market opportunities and requirements. Vendors should develop compact, reliable, and remotely manageable storage solutions for edge deployments.

Sustainability initiatives should be integrated into product development and marketing strategies, as environmental considerations are becoming increasingly important in customer purchasing decisions. Energy-efficient storage solutions will have competitive advantages in the market.

AI integration capabilities should be prioritized in storage system development, as artificial intelligence becomes increasingly important for storage optimization, predictive maintenance, and automated management. These capabilities will differentiate vendors in a competitive market.

Market growth prospects remain highly favorable for Taiwan’s data center storage market, with continued expansion expected across all major segments. MarkWide Research projects that the market will maintain strong growth momentum, driven by digital transformation initiatives and emerging technology adoption.

Technology evolution will continue to reshape the storage landscape, with flash storage, software-defined architectures, and AI-integrated solutions becoming increasingly dominant. Organizations will prioritize storage solutions that provide high performance, scalability, and intelligent management capabilities.

Edge computing expansion is expected to create significant new market opportunities, with distributed storage architectures becoming increasingly important for supporting IoT applications, content delivery, and real-time analytics use cases across various industries.

Sustainability considerations will play an increasingly important role in storage technology selection, with energy efficiency and environmental impact becoming key factors in purchasing decisions. Vendors focusing on green storage technologies will gain competitive advantages.

Regional integration opportunities will expand as Taiwan strengthens its position as a regional technology hub, with potential for serving broader Asia-Pacific markets from Taiwan-based infrastructure. This expansion will create additional growth opportunities for storage vendors and service providers.

Taiwan’s data center storage market represents a dynamic and rapidly evolving sector characterized by strong growth fundamentals, technological innovation, and increasing strategic importance in the regional digital economy. The market benefits from Taiwan’s position as a technology leader, favorable government policies, and robust demand from diverse industry sectors undergoing digital transformation.

Key success factors for market participants include technology innovation, strategic partnerships, customer service excellence, and the ability to address specific requirements of Taiwan’s unique market environment. Vendors that can combine global expertise with local market knowledge will be best positioned for long-term success.

Future opportunities are substantial, with emerging technologies such as artificial intelligence, edge computing, and 5G networks creating new storage requirements and market segments. The continued evolution toward hybrid cloud architectures and software-defined infrastructure will drive ongoing demand for innovative storage solutions that provide flexibility, scalability, and intelligent management capabilities.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store, manage, and retrieve data in data centers. This includes various storage solutions such as hard disk drives, solid-state drives, and cloud storage services that support enterprise applications and data management needs.

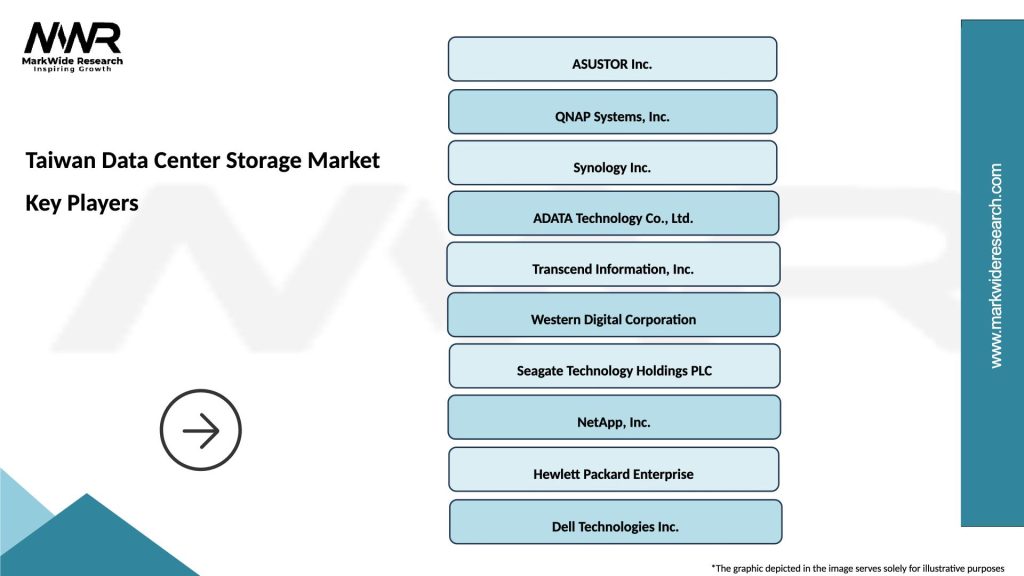

What are the key players in the Taiwan Data Center Storage Market?

Key players in the Taiwan Data Center Storage Market include companies like Dell Technologies, Hewlett Packard Enterprise, and NetApp, which provide a range of storage solutions and services tailored for data centers, among others.

What are the growth factors driving the Taiwan Data Center Storage Market?

The Taiwan Data Center Storage Market is driven by the increasing demand for data storage due to the rise of cloud computing, big data analytics, and the Internet of Things (IoT). Additionally, the need for enhanced data security and disaster recovery solutions is contributing to market growth.

What challenges does the Taiwan Data Center Storage Market face?

Challenges in the Taiwan Data Center Storage Market include the high costs associated with advanced storage technologies and the complexity of data management. Additionally, the rapid pace of technological change can make it difficult for companies to keep up with the latest innovations.

What opportunities exist in the Taiwan Data Center Storage Market?

Opportunities in the Taiwan Data Center Storage Market include the growing adoption of artificial intelligence and machine learning for data management, as well as the expansion of edge computing. These trends are expected to create new avenues for storage solutions that cater to evolving data needs.

What trends are shaping the Taiwan Data Center Storage Market?

Trends shaping the Taiwan Data Center Storage Market include the shift towards hybrid cloud storage solutions and the increasing use of software-defined storage. Additionally, there is a growing emphasis on sustainability and energy efficiency in data center operations.

Taiwan Data Center Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Hybrid Cloud, Public Cloud, Private Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at