444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan data center physical security market represents a rapidly evolving sector driven by the island nation’s strategic position as a technology hub in Asia-Pacific. Taiwan’s data center infrastructure has experienced unprecedented growth, with physical security becoming a paramount concern for operators managing critical digital assets. The market encompasses comprehensive security solutions including biometric access controls, surveillance systems, perimeter protection, and environmental monitoring technologies specifically designed for data center facilities.

Market dynamics indicate robust expansion fueled by increasing digitalization across industries and Taiwan’s emergence as a preferred location for hyperscale data centers. The market is experiencing growth at a significant CAGR of 8.2%, reflecting the urgent need for advanced physical security measures. Key drivers include stringent regulatory compliance requirements, rising cyber threats, and the critical nature of data housed within these facilities.

Taiwan’s unique position as a semiconductor manufacturing powerhouse and its proximity to major Asian markets have attracted substantial investments in data center infrastructure. This growth trajectory has created corresponding demand for sophisticated physical security solutions that can protect against both traditional security threats and emerging risks associated with high-density computing environments.

The Taiwan data center physical security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect data center facilities from physical threats, unauthorized access, and environmental hazards. This market encompasses multiple layers of security infrastructure including perimeter defense systems, access control mechanisms, surveillance technologies, and environmental monitoring solutions specifically tailored for Taiwan’s data center landscape.

Physical security in this context extends beyond traditional security measures to include specialized systems that address the unique challenges of protecting high-value digital infrastructure. These solutions integrate advanced technologies such as artificial intelligence, machine learning, and IoT sensors to create comprehensive security frameworks that can detect, prevent, and respond to various physical threats targeting data center operations.

Taiwan’s data center physical security market is experiencing transformative growth driven by the nation’s strategic importance in global technology supply chains and increasing demand for secure digital infrastructure. The market demonstrates strong momentum with adoption rates reaching 72% among enterprise-grade facilities, indicating widespread recognition of physical security’s critical role in comprehensive data protection strategies.

Key market segments include access control systems, video surveillance solutions, perimeter security, fire suppression systems, and environmental monitoring technologies. The integration of artificial intelligence and machine learning capabilities has emerged as a significant trend, with AI-powered security solutions accounting for approximately 35% of new installations in recent deployments.

Regulatory compliance requirements continue to shape market development, with Taiwan’s data protection regulations and international standards driving demand for sophisticated security infrastructure. The market benefits from strong government support for digital infrastructure development and Taiwan’s position as a preferred location for multinational technology companies establishing regional data center operations.

Critical market insights reveal several transformative trends shaping Taiwan’s data center physical security landscape:

Primary market drivers propelling growth in Taiwan’s data center physical security sector reflect both local and global technology trends. Digital transformation initiatives across industries have created unprecedented demand for secure data storage and processing capabilities, with organizations requiring robust physical security measures to protect critical digital assets.

Regulatory compliance requirements serve as a significant growth catalyst, with Taiwan’s data protection laws and international standards mandating comprehensive security measures for facilities handling sensitive information. The implementation of GDPR compliance measures has increased security requirements by approximately 40% for data centers serving European clients.

Cybersecurity threat evolution has expanded beyond digital attacks to include physical security concerns, driving demand for integrated security solutions that address both cyber and physical vulnerabilities. Threat landscape complexity requires sophisticated security architectures capable of detecting and responding to diverse attack vectors targeting data center infrastructure.

Taiwan’s strategic location and government support for technology infrastructure development continue to attract international investments in data center facilities, creating corresponding demand for world-class physical security solutions that meet global standards and best practices.

Market growth constraints include several factors that may impact the pace of adoption and implementation of advanced physical security solutions. High implementation costs associated with comprehensive security infrastructure represent a significant barrier, particularly for smaller data center operators with limited capital resources.

Technical complexity of modern security systems requires specialized expertise for installation, configuration, and ongoing maintenance, creating challenges for organizations lacking internal technical capabilities. The shortage of qualified security professionals with data center expertise has created implementation bottlenecks affecting approximately 25% of planned deployments.

Integration challenges with existing infrastructure and legacy systems can complicate security upgrades, requiring significant planning and potentially disruptive installation processes. Compatibility issues between different security vendors and platforms may limit flexibility and increase total cost of ownership.

Regulatory uncertainty regarding emerging technologies and evolving compliance requirements can create hesitation among operators considering investments in cutting-edge security solutions, particularly those involving artificial intelligence and biometric data collection.

Significant market opportunities exist within Taiwan’s data center physical security landscape, driven by technological advancement and evolving security requirements. Artificial intelligence integration presents substantial growth potential, with AI-powered security solutions offering enhanced threat detection capabilities and automated response mechanisms.

Edge computing expansion creates new market segments requiring distributed security solutions tailored for smaller, remote data center facilities. This trend represents a growing opportunity segment with deployment rates increasing by 45% annually as organizations implement edge infrastructure strategies.

Sustainability initiatives are driving demand for energy-efficient security solutions that align with green data center objectives. Environmental monitoring integration with security systems creates opportunities for comprehensive facility management platforms that address both security and sustainability requirements.

International expansion of Taiwan-based technology companies creates opportunities for security solution providers to develop expertise in multi-regional compliance requirements and cross-border data protection standards, positioning them for broader Asia-Pacific market penetration.

Market dynamics in Taiwan’s data center physical security sector reflect the interplay between technological innovation, regulatory requirements, and evolving threat landscapes. Technology convergence between physical and cybersecurity solutions is creating integrated platforms that provide comprehensive protection against diverse threat vectors.

Competitive pressures are driving continuous innovation in security solution capabilities, with vendors focusing on artificial intelligence, machine learning, and automation to differentiate their offerings. Market consolidation trends are evident as larger security providers acquire specialized companies to expand their data center security portfolios.

Customer expectations continue to evolve toward comprehensive security-as-a-service models that provide ongoing monitoring, maintenance, and threat response capabilities. This shift is reflected in service-based revenue models accounting for approximately 55% of total market value in recent deployments.

Technological advancement cycles are accelerating, with new security technologies and capabilities emerging regularly. Innovation adoption rates demonstrate that data center operators are increasingly willing to invest in cutting-edge security solutions that provide competitive advantages and enhanced protection capabilities.

Comprehensive research methodology employed in analyzing Taiwan’s data center physical security market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include extensive interviews with data center operators, security solution providers, and industry experts across Taiwan’s technology sector.

Secondary research components encompass analysis of industry reports, regulatory documentation, technology vendor publications, and academic research related to data center security trends and best practices. Market data validation processes ensure consistency and accuracy across multiple information sources.

Quantitative analysis techniques include statistical modeling, trend analysis, and market sizing methodologies specifically adapted for Taiwan’s unique market characteristics and regulatory environment. Qualitative research methods provide deeper insights into market dynamics, competitive positioning, and future growth opportunities.

Industry expert consultation ensures research findings reflect current market realities and emerging trends that may impact future market development. MarkWide Research methodology incorporates continuous market monitoring to capture evolving trends and emerging opportunities within the dynamic data center security landscape.

Regional market distribution within Taiwan demonstrates concentrated activity in key technology corridors and industrial zones. Northern Taiwan dominates the market with approximately 60% market share, driven by the concentration of technology companies, financial institutions, and government facilities in the Taipei metropolitan area.

Central Taiwan represents a growing market segment, accounting for 25% of regional activity, with increasing data center development in Taichung and surrounding areas. This region benefits from strategic location advantages and government incentives for technology infrastructure development.

Southern Taiwan contributes 15% of market activity, with Kaohsiung emerging as a significant data center hub supported by industrial development and port infrastructure advantages. The region’s growth potential is enhanced by government initiatives promoting technology sector expansion.

Cross-regional connectivity requirements drive demand for standardized security solutions that can provide consistent protection across distributed data center networks. Regional specialization trends are emerging, with different areas developing expertise in specific types of data center operations and corresponding security requirements.

Competitive dynamics in Taiwan’s data center physical security market feature a mix of international technology leaders and specialized local providers. Market leadership is distributed among companies offering comprehensive security solutions tailored for data center environments.

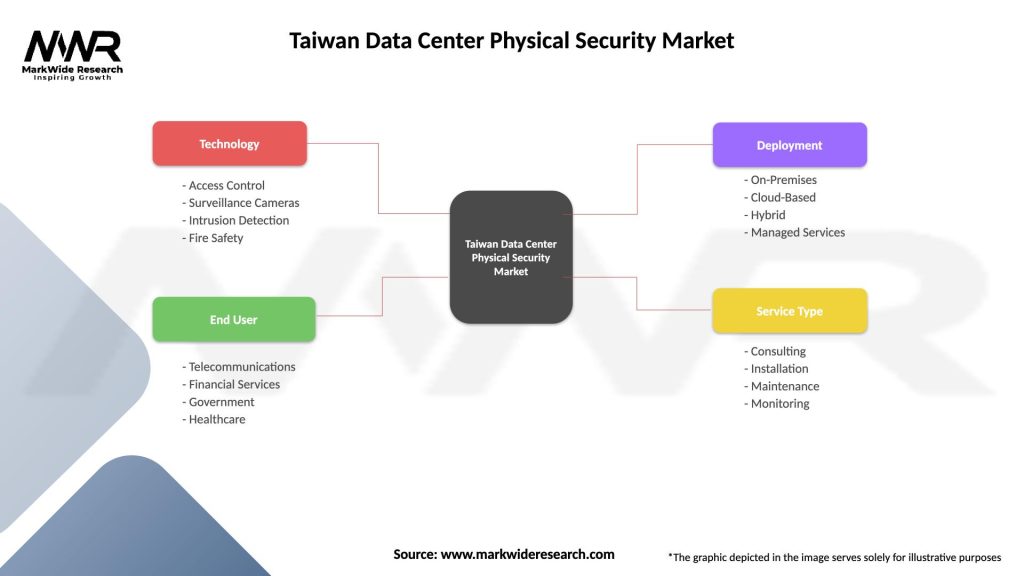

Market segmentation analysis reveals diverse categories of physical security solutions addressing specific data center protection requirements. By Technology:

By Application:

Access control systems represent the largest market segment, driven by the fundamental requirement for secure facility access management. Biometric authentication technologies are experiencing rapid adoption, with implementation rates increasing by 38% annually as organizations seek enhanced security and user convenience.

Video surveillance solutions continue evolving toward intelligent analytics and automated threat detection capabilities. AI-powered surveillance systems provide enhanced monitoring capabilities while reducing the burden on security personnel through automated alert generation and threat classification.

Environmental monitoring systems are gaining importance as data centers focus on operational efficiency and equipment protection. Integrated monitoring platforms that combine security and environmental oversight provide comprehensive facility management capabilities while optimizing operational costs.

Fire suppression technologies specifically designed for data center environments address unique challenges related to equipment protection and business continuity. Advanced suppression systems utilize clean agents and intelligent detection algorithms to minimize equipment damage while ensuring personnel safety.

Data center operators benefit from comprehensive physical security solutions through enhanced asset protection, regulatory compliance, and operational efficiency. Advanced security systems provide real-time monitoring capabilities that enable proactive threat detection and rapid incident response, minimizing potential business disruptions.

Technology vendors gain opportunities to develop specialized solutions addressing unique data center security challenges while building long-term customer relationships through ongoing service and support contracts. Solution integration capabilities allow vendors to differentiate their offerings and provide comprehensive security platforms.

End-user organizations achieve improved data protection, regulatory compliance, and business continuity through robust physical security infrastructure. Risk mitigation benefits include reduced likelihood of security incidents, lower insurance costs, and enhanced customer confidence in data protection capabilities.

Government stakeholders benefit from enhanced national security through improved protection of critical digital infrastructure and compliance with international security standards. Economic benefits include job creation in the security technology sector and increased foreign investment in Taiwan’s data center industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming Taiwan’s data center physical security market. AI-powered analytics enable predictive threat detection, automated response protocols, and enhanced operational efficiency through intelligent monitoring systems that can identify potential security issues before they escalate.

Zero-trust security architectures are gaining prominence as organizations implement comprehensive security frameworks that verify and authenticate all access requests regardless of location or user credentials. This approach requires multi-layered authentication systems and continuous monitoring capabilities.

Cloud-based security management platforms are enabling centralized oversight of distributed data center operations while providing scalable security solutions that can adapt to changing operational requirements. Remote monitoring capabilities have become essential, with adoption rates reaching 68% among major facilities.

Sustainability integration is driving development of energy-efficient security solutions that align with green data center initiatives. Environmental consciousness is influencing purchasing decisions, with organizations seeking security systems that minimize energy consumption while maintaining comprehensive protection capabilities.

Recent industry developments highlight the dynamic nature of Taiwan’s data center physical security market. Technology partnerships between international security vendors and local system integrators are creating comprehensive solution offerings tailored for Taiwan’s specific market requirements and regulatory environment.

Regulatory updates including enhanced data protection requirements and cybersecurity standards are driving adoption of more sophisticated security infrastructure. Compliance mandates are particularly influencing financial services and government sector deployments where security requirements are most stringent.

Investment announcements from major cloud service providers establishing Taiwan operations are creating substantial demand for world-class physical security solutions. Hyperscale deployments require advanced security architectures that can protect large-scale infrastructure investments while meeting international compliance standards.

Innovation initiatives focusing on artificial intelligence, machine learning, and IoT integration are advancing the capabilities of physical security solutions. MarkWide Research analysis indicates that technology advancement cycles are accelerating, with new security capabilities emerging regularly to address evolving threat landscapes.

Strategic recommendations for market participants emphasize the importance of developing comprehensive security solutions that address both current requirements and future growth opportunities. Technology integration capabilities should be prioritized to provide customers with unified security platforms that can evolve with changing operational needs.

Investment priorities should focus on artificial intelligence and machine learning capabilities that can differentiate security offerings while providing enhanced threat detection and response capabilities. Automation features are becoming increasingly important as organizations seek to optimize security operations while managing cost pressures.

Partnership strategies with local system integrators and technology providers can enhance market penetration while providing customers with comprehensive support capabilities. Local expertise is essential for understanding Taiwan’s unique regulatory environment and customer requirements.

Service model development should emphasize ongoing support, monitoring, and maintenance capabilities that provide customers with comprehensive security-as-a-service solutions. Recurring revenue models offer stability while ensuring continuous customer engagement and system optimization.

Future market prospects for Taiwan’s data center physical security sector remain highly positive, driven by continued digital transformation and increasing recognition of physical security’s critical role in comprehensive data protection strategies. Growth projections indicate sustained expansion with the market expected to maintain robust growth rates exceeding 8% annually through the forecast period.

Technology evolution will continue driving market development, with artificial intelligence, machine learning, and IoT integration creating new capabilities and market opportunities. Edge computing expansion is expected to create additional market segments requiring distributed security solutions tailored for smaller, remote facilities.

Regulatory development will likely strengthen security requirements while creating opportunities for solution providers that can demonstrate compliance capabilities and help customers navigate evolving regulatory landscapes. International standards adoption will continue influencing market development as Taiwan maintains its position as a preferred location for global technology operations.

MWR projections suggest that sustainability considerations will become increasingly important in security solution selection, with energy efficiency and environmental impact becoming key differentiating factors. Innovation cycles are expected to accelerate, requiring continuous investment in research and development to maintain competitive positioning.

Taiwan’s data center physical security market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by digital transformation, regulatory requirements, and technological advancement. The market demonstrates strong fundamentals with robust demand from diverse customer segments and continuous innovation in security solution capabilities.

Key success factors for market participants include technology integration capabilities, local market expertise, and comprehensive service offerings that address evolving customer requirements. The integration of artificial intelligence and machine learning technologies is creating new opportunities while enhancing the effectiveness of traditional security measures.

Strategic positioning in this market requires understanding of Taiwan’s unique regulatory environment, customer requirements, and competitive dynamics while maintaining capabilities to adapt to rapid technological change. Future growth prospects remain positive, supported by continued investment in data center infrastructure and increasing recognition of physical security’s critical importance in comprehensive data protection strategies.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

What are the key players in the Taiwan Data Center Physical Security Market?

Key players in the Taiwan Data Center Physical Security Market include companies like Hikvision, Axis Communications, and Johnson Controls, which provide various security solutions such as video surveillance and access control systems, among others.

What are the main drivers of growth in the Taiwan Data Center Physical Security Market?

The main drivers of growth in the Taiwan Data Center Physical Security Market include the increasing need for data protection due to rising cyber threats, the expansion of cloud services, and the growing awareness of regulatory compliance regarding data security.

What challenges does the Taiwan Data Center Physical Security Market face?

Challenges in the Taiwan Data Center Physical Security Market include the high costs associated with advanced security technologies, the complexity of integrating various security systems, and the need for continuous updates to counter evolving security threats.

What opportunities exist in the Taiwan Data Center Physical Security Market?

Opportunities in the Taiwan Data Center Physical Security Market include the adoption of AI and machine learning for enhanced security analytics, the growth of smart data centers, and the increasing demand for integrated security solutions that combine physical and cybersecurity.

What trends are shaping the Taiwan Data Center Physical Security Market?

Trends shaping the Taiwan Data Center Physical Security Market include the rise of biometric access controls, the integration of IoT devices for real-time monitoring, and the shift towards cloud-based security management systems that offer scalability and flexibility.

Taiwan Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Technology | Access Control, Surveillance Cameras, Intrusion Detection, Fire Safety |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Service Type | Consulting, Installation, Maintenance, Monitoring |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at