444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan data center cooling market represents a critical infrastructure segment experiencing unprecedented growth as the island nation positions itself as a major technology hub in the Asia-Pacific region. Taiwan’s strategic location and advanced technological capabilities have attracted significant investments from global cloud service providers, hyperscale operators, and enterprise organizations seeking reliable data center solutions. The market encompasses various cooling technologies including air-based cooling systems, liquid cooling solutions, immersion cooling technologies, and hybrid cooling approaches designed to maintain optimal operating temperatures in high-density computing environments.

Market dynamics indicate robust expansion driven by increasing digitalization across industries, growing demand for cloud services, and the proliferation of artificial intelligence and machine learning applications requiring substantial computational power. The cooling infrastructure represents approximately 40% of total data center energy consumption, making efficiency improvements a critical focus for operators seeking to reduce operational costs and environmental impact. Taiwan’s tropical climate presents unique challenges for data center cooling, necessitating advanced thermal management solutions capable of handling high ambient temperatures and humidity levels throughout the year.

Government initiatives supporting digital transformation and smart city development have accelerated data center construction across Taiwan, with major facilities concentrated in Taipei, Taichung, and Kaohsiung metropolitan areas. The market benefits from Taiwan’s reliable power grid and advanced telecommunications infrastructure, attracting international investments from hyperscale operators expanding their regional presence. Sustainability concerns and energy efficiency regulations are driving adoption of innovative cooling technologies, including free cooling systems, economizers, and advanced heat recovery solutions designed to minimize environmental impact while maintaining optimal performance standards.

The Taiwan data center cooling market refers to the comprehensive ecosystem of thermal management technologies, systems, and services designed to maintain optimal operating temperatures within data center facilities across Taiwan. This market encompasses all cooling infrastructure components including chillers, computer room air conditioning units, precision cooling systems, liquid cooling solutions, and supporting equipment necessary for effective heat dissipation in high-density computing environments.

Data center cooling systems serve the critical function of removing heat generated by servers, storage systems, networking equipment, and power infrastructure to prevent equipment failure, maintain performance reliability, and extend hardware lifespan. The cooling infrastructure must operate continuously to ensure uninterrupted service delivery while optimizing energy efficiency to control operational costs. Taiwan’s unique geographic and climatic conditions require specialized cooling approaches that account for high ambient temperatures, elevated humidity levels, and potential weather-related challenges including typhoons and seasonal temperature variations.

Modern cooling solutions in Taiwan’s data centers incorporate advanced technologies such as variable speed drives, intelligent controls, predictive maintenance systems, and energy recovery mechanisms to maximize efficiency while minimizing environmental impact. The market includes both traditional air-based cooling systems and emerging liquid cooling technologies designed to handle increasing heat densities associated with next-generation processors and high-performance computing applications.

Taiwan’s data center cooling market demonstrates exceptional growth potential driven by accelerating digital transformation initiatives, increasing cloud adoption, and expanding presence of international technology companies establishing regional operations. The market benefits from Taiwan’s strategic position as a technology manufacturing hub and gateway to broader Asian markets, attracting substantial investments in data center infrastructure from global hyperscale operators and enterprise organizations.

Key market drivers include growing demand for edge computing services, expansion of 5G networks requiring distributed computing infrastructure, and increasing adoption of artificial intelligence applications generating substantial heat loads. The market experiences strong momentum from government policies supporting digital economy development and smart city initiatives requiring robust data center capabilities. Energy efficiency improvements of up to 35% reduction in cooling costs are achievable through advanced cooling technologies, making modernization investments attractive for operators seeking to optimize operational expenses.

Competitive landscape features both international cooling technology providers and local system integrators offering customized solutions for Taiwan’s unique operating environment. Market participants focus on developing climate-appropriate cooling systems that deliver reliable performance while meeting stringent energy efficiency requirements. Innovation trends emphasize liquid cooling adoption, artificial intelligence-driven optimization, and integration of renewable energy sources to support sustainability objectives while maintaining operational excellence in Taiwan’s challenging thermal environment.

Critical market insights reveal several transformative trends shaping Taiwan’s data center cooling landscape. The following key developments demonstrate the market’s evolution toward more efficient and sustainable cooling solutions:

Market maturation reflects increasing sophistication in cooling system design and operation, with operators prioritizing total cost of ownership optimization over initial capital expenditure considerations. Technology convergence enables integrated cooling solutions that adapt dynamically to changing thermal loads while maintaining optimal energy efficiency across diverse operating conditions.

Primary market drivers propelling Taiwan’s data center cooling market expansion include accelerating digital transformation across industries, increasing cloud service adoption, and growing demand for high-performance computing capabilities. Government digitalization initiatives supporting smart city development, e-governance platforms, and digital infrastructure modernization create substantial demand for reliable data center services requiring advanced cooling solutions.

Hyperscale expansion by major cloud service providers establishing regional presence in Taiwan drives significant cooling infrastructure investments. These operators require highly efficient cooling systems capable of supporting massive server deployments while minimizing operational costs and environmental impact. Edge computing proliferation associated with 5G network deployment creates demand for distributed cooling solutions supporting smaller, localized data center facilities serving low-latency applications.

Artificial intelligence and machine learning application growth generates substantial computational heat loads requiring advanced cooling technologies. High-performance processors and specialized AI accelerators produce concentrated heat densities exceeding traditional air cooling capabilities, driving adoption of liquid cooling solutions. Cryptocurrency mining operations and blockchain applications contribute additional cooling demand, particularly during periods of high digital asset valuations.

Energy cost optimization motivates data center operators to invest in efficient cooling technologies that reduce electricity consumption and operational expenses. Taiwan’s tropical climate necessitates year-round cooling operation, making efficiency improvements particularly valuable for controlling long-term operating costs. Regulatory compliance requirements related to energy efficiency and environmental protection encourage adoption of sustainable cooling technologies and practices.

Significant market restraints include high initial capital requirements for advanced cooling system implementation, particularly for liquid cooling technologies requiring substantial infrastructure modifications. Technical complexity associated with modern cooling solutions creates implementation challenges for operators lacking specialized expertise, potentially delaying adoption of more efficient technologies.

Space constraints in Taiwan’s densely populated urban areas limit data center expansion opportunities and complicate cooling system design requirements. Existing facility limitations may restrict cooling system upgrades, particularly in older data centers with insufficient power capacity or structural support for advanced cooling infrastructure. Maintenance complexity of sophisticated cooling systems requires specialized technical skills and training, increasing operational overhead and potential service disruption risks.

Climate challenges including high humidity levels, salt air exposure in coastal areas, and extreme weather events create additional operational considerations for cooling system design and maintenance. Typhoon season presents particular challenges for outdoor cooling equipment and backup system requirements. Water availability concerns may limit adoption of evaporative cooling technologies in certain regions, particularly during drought conditions.

Integration challenges with existing data center infrastructure can complicate cooling system upgrades and modernization projects. Vendor lock-in concerns may discourage adoption of proprietary cooling technologies, while standardization gaps between different cooling solutions can create compatibility issues. Skilled workforce shortages in specialized cooling system maintenance and operation may constrain market growth and service quality.

Substantial market opportunities emerge from Taiwan’s position as a regional technology hub and gateway to Asian markets, attracting international data center investments requiring advanced cooling solutions. Government support for digital infrastructure development creates favorable conditions for cooling technology innovation and deployment across various sectors.

Liquid cooling adoption presents significant growth opportunities as data centers transition to higher-density computing configurations requiring more efficient thermal management. Immersion cooling technologies offer potential for dramatic efficiency improvements and reduced space requirements, particularly attractive for high-performance computing applications. Hybrid cooling solutions combining multiple technologies provide opportunities for customized approaches optimized for Taiwan’s specific climate conditions.

Edge computing expansion creates demand for compact, efficient cooling solutions supporting distributed data center deployments. 5G network infrastructure requires numerous small cell sites and edge facilities, each needing appropriate cooling systems. Smart city initiatives generate opportunities for integrated cooling solutions supporting municipal data centers and IoT infrastructure.

Sustainability focus opens opportunities for heat recovery systems, renewable energy integration, and circular economy approaches to cooling system design. Artificial intelligence applications in cooling system optimization present opportunities for service providers offering predictive maintenance and performance optimization solutions. Retrofit market potential exists for upgrading existing data center cooling infrastructure to improve efficiency and reduce operational costs.

Market dynamics reflect the complex interplay between technological advancement, regulatory requirements, and economic factors shaping Taiwan’s data center cooling landscape. Supply chain considerations influence cooling system availability and pricing, particularly for specialized components and advanced technologies requiring international sourcing.

Competitive pressures drive continuous innovation in cooling efficiency and cost optimization, with vendors developing Taiwan-specific solutions addressing local climate challenges and regulatory requirements. Technology convergence enables integrated cooling platforms combining multiple approaches for optimal performance across varying conditions. Market consolidation trends see larger cooling system providers acquiring specialized technology companies to expand solution portfolios.

Customer expectations increasingly emphasize total cost of ownership optimization, reliability, and environmental sustainability rather than solely focusing on initial capital costs. Service model evolution toward cooling-as-a-service offerings provides operators with alternative procurement approaches reducing upfront investments while ensuring ongoing optimization. Performance benchmarking becomes increasingly sophisticated, with operators demanding detailed efficiency metrics and comparative analysis.

Regulatory evolution continues shaping market requirements, with energy efficiency standards becoming more stringent and environmental reporting requirements expanding. International standards adoption facilitates technology transfer and best practice implementation across Taiwan’s data center industry. Market maturation leads to more sophisticated procurement processes and performance evaluation criteria, elevating the importance of proven track records and local support capabilities.

Comprehensive research methodology employed for analyzing Taiwan’s data center cooling market incorporates multiple data collection approaches ensuring accurate and reliable market insights. Primary research includes extensive interviews with data center operators, cooling system vendors, technology integrators, and industry experts providing firsthand market perspectives and operational insights.

Secondary research encompasses analysis of industry publications, government reports, regulatory filings, and company financial statements to establish market context and validate primary findings. Market sizing utilizes bottom-up analysis of data center capacity additions, cooling system specifications, and replacement cycles to develop accurate market assessments. Competitive analysis examines vendor market positioning, technology offerings, and strategic initiatives through public information and industry intelligence.

Data validation processes include cross-referencing multiple sources, expert review panels, and statistical analysis to ensure information accuracy and reliability. Trend analysis incorporates historical data patterns, current market indicators, and forward-looking assessments to identify emerging opportunities and challenges. Regional analysis considers Taiwan’s unique geographic, climatic, and regulatory characteristics affecting cooling system requirements and market development.

Technology assessment evaluates cooling solution performance characteristics, efficiency metrics, and suitability for Taiwan’s operating environment through technical analysis and case study review. Market forecasting employs multiple scenario modeling approaches considering various growth drivers and potential market constraints to develop realistic projections for market evolution.

Regional market distribution across Taiwan reflects concentration of data center facilities in major metropolitan areas, with Taipei metropolitan region commanding approximately 45% market share due to high enterprise density, excellent connectivity, and proximity to financial and technology sectors. Northern Taiwan benefits from established telecommunications infrastructure, reliable power supply, and access to skilled technical workforce supporting advanced cooling system deployment and maintenance.

Central Taiwan, particularly the Taichung area, represents approximately 25% of cooling market demand driven by manufacturing sector digitalization and government data center initiatives. Industrial transformation in central regions creates demand for enterprise data centers requiring efficient cooling solutions. Southern Taiwan, including Kaohsiung and Tainan, accounts for roughly 20% market share with growing importance due to port connectivity and emerging technology clusters.

Eastern Taiwan presents unique opportunities for data centers leveraging renewable energy resources and cooler mountain climates for natural cooling advantages. Coastal regions face specific challenges including salt air corrosion and typhoon exposure requiring specialized cooling system designs and protective measures. Urban heat island effects in major cities create additional cooling challenges, while rural areas offer opportunities for large-scale facilities with lower ambient temperatures.

Infrastructure development varies significantly across regions, with northern areas offering the most advanced power and telecommunications capabilities supporting sophisticated cooling systems. Government incentives for balanced regional development encourage data center investments in less developed areas, creating opportunities for cooling system providers in emerging markets. Climate variations across Taiwan’s diverse geography require region-specific cooling approaches optimized for local environmental conditions.

Competitive landscape in Taiwan’s data center cooling market features a diverse mix of international technology leaders and specialized local providers offering comprehensive thermal management solutions. Market leadership positions are held by established cooling system manufacturers with proven track records in challenging climate conditions and strong local support capabilities.

Competitive strategies emphasize local market knowledge, rapid response capabilities, and customized solutions addressing Taiwan’s specific climate challenges. Partnership approaches between international vendors and local integrators provide comprehensive market coverage and technical support. Innovation focus drives development of Taiwan-specific cooling solutions optimized for tropical climate conditions and local regulatory requirements.

Market segmentation analysis reveals diverse cooling technology categories serving different data center requirements and operational priorities. By Technology segmentation includes air-based cooling systems, liquid cooling solutions, immersion cooling technologies, and hybrid approaches combining multiple thermal management methods.

By Application segmentation encompasses enterprise data centers, colocation facilities, hyperscale operations, edge computing sites, and specialized high-performance computing installations. By Cooling Capacity categories range from small-scale edge deployments to large hyperscale facilities requiring massive cooling infrastructure. By End-User segments include cloud service providers, telecommunications companies, financial institutions, government agencies, and manufacturing organizations.

By Component analysis covers chillers, computer room air conditioning units, cooling distribution units, pumps, heat exchangers, and control systems. By Service categories include installation, maintenance, monitoring, optimization, and emergency repair services. By Efficiency Rating segments reflect varying performance standards from basic cooling to ultra-high efficiency systems meeting stringent sustainability requirements.

Geographic segmentation considers regional variations in climate conditions, infrastructure availability, and market maturity across Taiwan’s diverse regions. By Deployment Model segments include new construction installations, retrofit projects, and modular expansion deployments. By Ownership Model categories encompass owned systems, leased equipment, and cooling-as-a-service arrangements providing operational flexibility.

Air-based cooling systems continue dominating Taiwan’s data center market due to proven reliability, lower initial costs, and established maintenance expertise. Precision air conditioning units represent the largest segment, offering precise temperature and humidity control essential for sensitive computing equipment. Computer room air handlers provide efficient air distribution and filtration, particularly important in Taiwan’s dusty urban environments.

Liquid cooling technologies experience rapid growth driven by increasing heat densities and efficiency requirements. Direct-to-chip cooling solutions offer superior thermal performance for high-performance processors and AI accelerators. Immersion cooling presents emerging opportunities for ultra-high density deployments, though adoption remains limited by technical complexity and infrastructure requirements.

Hybrid cooling approaches gain traction as operators seek optimized solutions combining multiple technologies for different zones or seasonal conditions. Free cooling systems utilizing ambient air during cooler periods provide significant energy savings, particularly valuable in Taiwan’s variable climate. Economizer systems automatically adjust cooling approaches based on external conditions, maximizing efficiency while maintaining reliability.

Edge cooling solutions represent a growing segment supporting distributed computing infrastructure. Compact cooling units designed for small spaces and remote operation address unique edge computing requirements. Modular cooling systems enable rapid deployment and scalability for evolving edge infrastructure needs. Smart cooling controls provide remote monitoring and optimization capabilities essential for distributed deployments with limited on-site technical support.

Data center operators benefit from advanced cooling technologies through reduced operational costs, improved reliability, and enhanced sustainability performance. Energy efficiency improvements of up to 30% reduction in cooling costs are achievable through modern cooling system implementations, directly impacting profitability and competitive positioning. Predictive maintenance capabilities minimize unplanned downtime and extend equipment lifespan, reducing total cost of ownership.

Technology vendors gain opportunities for market expansion and innovation through Taiwan’s dynamic data center environment. Local partnerships provide market access and technical support capabilities essential for success in Taiwan’s unique operating conditions. Customization opportunities enable vendors to develop specialized solutions addressing specific climate and regulatory requirements, creating competitive differentiation.

System integrators benefit from growing demand for specialized cooling system installation and maintenance services. Technical expertise in advanced cooling technologies creates valuable service opportunities and long-term customer relationships. Training and certification programs develop skilled workforce capabilities supporting market growth and service quality improvement.

End-user organizations achieve improved IT infrastructure reliability, reduced operational costs, and enhanced sustainability performance through advanced cooling solutions. Business continuity improvements reduce risk of service disruptions and associated business impacts. Compliance benefits support regulatory requirements and corporate sustainability objectives while maintaining operational excellence.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend revolutionizing cooling system optimization and predictive maintenance capabilities. Machine learning algorithms analyze thermal patterns, equipment performance, and environmental conditions to optimize cooling efficiency automatically. Predictive analytics enable proactive maintenance scheduling and performance optimization, reducing operational costs and improving reliability.

Liquid cooling mainstream adoption accelerates as data centers transition to higher-density computing configurations requiring more efficient thermal management. Direct liquid cooling solutions provide superior heat removal capabilities for processors generating concentrated thermal loads. Immersion cooling technologies offer potential for dramatic space and energy savings, though adoption remains gradual due to implementation complexity.

Sustainability emphasis drives development of environmentally responsible cooling solutions incorporating renewable energy, heat recovery, and circular economy principles. Heat recovery systems capture waste thermal energy for beneficial use in building heating or industrial processes. Renewable energy integration powers cooling systems with solar, wind, or other clean energy sources reducing carbon footprint.

Edge computing proliferation creates demand for compact, efficient cooling solutions supporting distributed infrastructure deployments. Micro data centers require specialized cooling approaches optimized for small spaces and remote operation. 5G infrastructure expansion drives cooling requirements for numerous small cell sites and edge computing facilities serving low-latency applications.

Recent industry developments demonstrate accelerating innovation and investment in Taiwan’s data center cooling sector. Major hyperscale operators announce significant facility expansions requiring advanced cooling infrastructure, driving market growth and technology adoption. Government initiatives supporting digital transformation and smart city development create additional demand for data center cooling solutions.

Technology partnerships between international cooling system vendors and local integrators enhance market coverage and technical support capabilities. Research collaborations between universities, technology companies, and government agencies advance cooling system innovation and efficiency improvements. Pilot projects demonstrate emerging cooling technologies including immersion cooling, liquid cooling, and AI-driven optimization systems.

Regulatory developments establish more stringent energy efficiency standards and environmental reporting requirements affecting cooling system selection and operation. Industry standards evolution provides clearer guidelines for cooling system performance evaluation and comparison. Certification programs develop technical expertise and ensure proper installation and maintenance of advanced cooling systems.

Investment announcements by cooling technology vendors indicate confidence in Taiwan market growth potential and commitment to local market development. Acquisition activities consolidate market participants and expand technology portfolios serving diverse customer requirements. Innovation centers established in Taiwan focus on developing climate-specific cooling solutions optimized for tropical operating conditions.

Market participants should prioritize development of Taiwan-specific cooling solutions addressing unique climate challenges including high humidity, elevated temperatures, and extreme weather events. MarkWide Research analysis indicates that customized approaches optimized for local conditions provide significant competitive advantages and customer value propositions.

Investment focus should emphasize liquid cooling technologies and AI-driven optimization systems representing the highest growth potential segments. Partnership strategies with local system integrators and service providers enable effective market penetration and ongoing customer support. Training programs developing specialized technical expertise ensure proper system installation, maintenance, and optimization.

Sustainability initiatives incorporating heat recovery, renewable energy integration, and circular economy principles align with market trends and regulatory requirements. Edge computing preparation through development of compact, efficient cooling solutions positions vendors for emerging distributed infrastructure opportunities. Service model innovation including cooling-as-a-service offerings provides customers with operational flexibility and vendors with recurring revenue streams.

Technology roadmap development should anticipate future cooling requirements associated with quantum computing, advanced AI processors, and other emerging high-heat density applications. Regional expansion strategies leveraging Taiwan as a gateway to broader Asian markets maximize investment returns and market presence. Regulatory compliance preparation ensures continued market access and competitive positioning as standards evolve.

Future market outlook for Taiwan’s data center cooling sector remains exceptionally positive, driven by continued digital transformation, expanding cloud adoption, and growing artificial intelligence applications. Market growth is projected to maintain robust momentum with compound annual growth rates exceeding 8% through the forecast period, supported by increasing data center investments and cooling system modernization requirements.

Technology evolution toward liquid cooling solutions and AI-driven optimization systems will reshape market dynamics, creating opportunities for innovative vendors and service providers. Edge computing expansion associated with 5G deployment and IoT proliferation generates additional cooling demand across distributed infrastructure deployments. Sustainability requirements drive continued innovation in energy-efficient cooling technologies and renewable energy integration.

Market maturation leads to more sophisticated procurement processes emphasizing total cost of ownership optimization and long-term performance guarantees. Service model evolution toward outcome-based contracts and cooling-as-a-service arrangements provides operational flexibility while ensuring optimal performance. Regional integration positions Taiwan as a hub for broader Asian market expansion by cooling technology providers.

Regulatory evolution continues shaping market requirements through increasingly stringent energy efficiency standards and environmental reporting obligations. MWR projections indicate that liquid cooling adoption rates will reach 25% market penetration within five years, driven by high-density computing requirements and efficiency mandates. Innovation acceleration in cooling technologies ensures continued market dynamism and growth opportunities for prepared market participants.

Taiwan’s data center cooling market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by digital transformation, technological advancement, and strategic geographic advantages. The market benefits from Taiwan’s role as a regional technology hub attracting significant international investments in data center infrastructure requiring sophisticated cooling solutions.

Market opportunities span multiple technology segments including traditional air-based systems, emerging liquid cooling solutions, and innovative hybrid approaches optimized for Taiwan’s unique climate conditions. Competitive dynamics favor vendors offering customized solutions, strong local support capabilities, and proven track records in challenging operating environments. Sustainability focus and energy efficiency requirements drive continued innovation and market evolution toward more environmentally responsible cooling technologies.

Future success in Taiwan’s data center cooling market requires strategic focus on emerging technologies, local market expertise, and comprehensive service capabilities. Market participants positioned to address evolving customer requirements through innovative cooling solutions, sustainable practices, and operational excellence will capture the most significant growth opportunities in this expanding market segment.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data center operations.

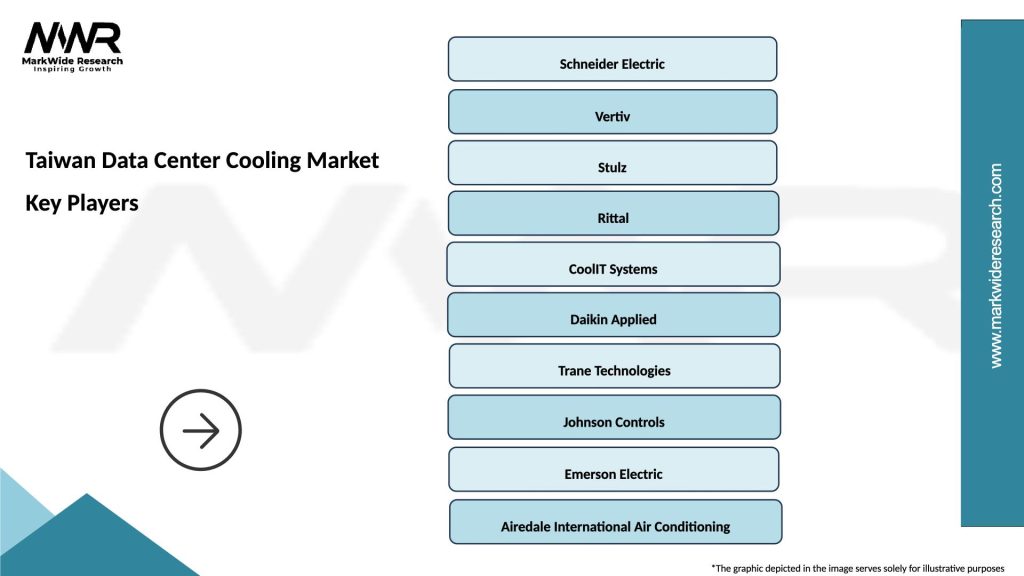

What are the key players in the Taiwan Data Center Cooling Market?

Key players in the Taiwan Data Center Cooling Market include companies like Schneider Electric, Vertiv, and Rittal, which provide innovative cooling solutions and technologies. These companies focus on energy efficiency and advanced cooling systems to meet the growing demands of data centers, among others.

What are the main drivers of the Taiwan Data Center Cooling Market?

The main drivers of the Taiwan Data Center Cooling Market include the increasing demand for data storage and processing, the rise of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the growth of IoT and big data analytics contributes to the expansion of data centers, necessitating advanced cooling technologies.

What challenges does the Taiwan Data Center Cooling Market face?

The Taiwan Data Center Cooling Market faces challenges such as high energy consumption and operational costs associated with cooling systems. Additionally, the rapid pace of technological advancements requires continuous investment in upgrading cooling infrastructure to keep up with evolving data center needs.

What opportunities exist in the Taiwan Data Center Cooling Market?

Opportunities in the Taiwan Data Center Cooling Market include the development of sustainable cooling technologies and the integration of AI for predictive maintenance. Furthermore, the increasing focus on green data centers presents avenues for innovation in energy-efficient cooling solutions.

What trends are shaping the Taiwan Data Center Cooling Market?

Trends shaping the Taiwan Data Center Cooling Market include the adoption of liquid cooling solutions and the use of modular cooling systems. Additionally, there is a growing emphasis on smart cooling technologies that leverage IoT for real-time monitoring and optimization of cooling efficiency.

Taiwan Data Center Cooling Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Cooling Towers, Air Conditioners, Heat Exchangers |

| Technology | Liquid Cooling, Air Cooling, Evaporative Cooling, Immersion Cooling |

| End User | Telecommunications, Cloud Service Providers, Enterprises, Colocation Facilities |

| Installation | On-Premises, Modular, Centralized, Distributed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at