444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Taiwan analog integrated circuits market represents a cornerstone of the global semiconductor industry, positioning the island nation as a critical hub for advanced analog chip manufacturing and design. Taiwan’s strategic importance in analog IC production stems from its robust semiconductor ecosystem, world-class foundries, and innovative design capabilities that serve diverse applications across consumer electronics, automotive, industrial automation, and telecommunications sectors.

Market dynamics indicate that Taiwan’s analog IC sector is experiencing robust expansion, driven by increasing demand for power management solutions, signal processing components, and mixed-signal integrated circuits. The market demonstrates exceptional growth potential with a projected CAGR of 8.2% through the forecast period, reflecting strong domestic manufacturing capabilities and export-oriented production strategies.

Taiwan’s competitive advantage in analog integrated circuits lies in its comprehensive supply chain integration, from wafer fabrication to assembly and testing services. Major foundries and design houses collaborate extensively to deliver cutting-edge analog solutions that meet stringent performance requirements across multiple industries. The market benefits from substantial government support for semiconductor development and continuous investment in research and development infrastructure.

Regional positioning places Taiwan as a dominant force in the Asia-Pacific analog IC landscape, with approximately 35% market share in regional production capacity. The island’s strategic location facilitates efficient distribution to key markets in China, Japan, South Korea, and Southeast Asia, while maintaining strong export relationships with North American and European customers.

The Taiwan analog integrated circuits market refers to the comprehensive ecosystem of companies, technologies, and manufacturing capabilities focused on designing, producing, and distributing analog semiconductor devices within Taiwan’s borders. This market encompasses a wide range of analog IC products including operational amplifiers, voltage regulators, power management integrated circuits, analog-to-digital converters, and mixed-signal processing solutions.

Analog integrated circuits differ from digital circuits by processing continuous signals rather than discrete binary data, making them essential components for interfacing between real-world analog signals and digital processing systems. Taiwan’s analog IC market specifically focuses on high-performance, cost-effective solutions that leverage the island’s advanced semiconductor manufacturing infrastructure and design expertise.

Market scope includes both fabless design companies that develop analog IC architectures and integrated device manufacturers that handle complete production cycles. Taiwan’s unique position combines world-class foundry services with innovative design capabilities, creating a vertically integrated ecosystem that serves global demand for sophisticated analog semiconductor solutions across multiple application domains.

Taiwan’s analog integrated circuits market demonstrates exceptional growth momentum, driven by increasing digitization across industries and rising demand for efficient power management solutions. The market benefits from Taiwan’s established semiconductor infrastructure, skilled workforce, and strategic partnerships with global technology leaders that position the island as a preferred destination for analog IC development and manufacturing.

Key growth drivers include expanding electric vehicle adoption, 5G network deployment, Internet of Things proliferation, and increasing automation in industrial applications. These trends create substantial demand for specialized analog components including power management ICs, RF amplifiers, sensor interface circuits, and high-speed data converters that leverage Taiwan’s manufacturing expertise.

Market segmentation reveals strong performance across multiple application areas, with consumer electronics representing the largest segment, followed by automotive, industrial, and telecommunications applications. Taiwan’s analog IC companies demonstrate particular strength in power management solutions, achieving approximately 42% market penetration in mobile device power management applications.

Competitive landscape features a mix of established multinational corporations and innovative local design houses that collaborate through Taiwan’s foundry ecosystem. The market benefits from continuous technology advancement, with companies investing heavily in next-generation analog architectures that support emerging applications in artificial intelligence, autonomous vehicles, and advanced communication systems.

Taiwan’s analog IC market reveals several critical insights that highlight the island’s strategic importance in global semiconductor supply chains. The market demonstrates remarkable resilience and adaptability, with companies successfully navigating supply chain challenges while maintaining technological leadership in key analog circuit categories.

Multiple factors contribute to the robust growth trajectory of Taiwan’s analog integrated circuits market, creating a favorable environment for continued expansion and technological advancement. These drivers reflect both global technology trends and Taiwan’s unique competitive advantages in semiconductor manufacturing and design.

Digital transformation initiatives across industries generate substantial demand for analog interface circuits that bridge physical sensors and digital processing systems. Taiwan’s analog IC companies benefit from this trend by developing sophisticated mixed-signal solutions that enable seamless integration between analog and digital domains in applications ranging from industrial automation to smart city infrastructure.

Electric vehicle adoption creates significant opportunities for Taiwan’s analog IC manufacturers, particularly in power management, battery management systems, and motor control applications. The automotive industry’s transition toward electrification requires advanced analog circuits capable of handling high voltages, currents, and temperatures while maintaining exceptional reliability and safety standards.

5G network deployment drives demand for high-frequency analog circuits, RF amplifiers, and signal processing components that enable next-generation wireless communication systems. Taiwan’s analog IC companies leverage advanced process technologies to develop solutions that meet stringent performance requirements for 5G base stations, mobile devices, and network infrastructure equipment.

Internet of Things expansion fuels growth in low-power analog circuits, sensor interface solutions, and wireless connectivity components. Taiwan’s design houses excel in developing ultra-low-power analog ICs that extend battery life in IoT devices while maintaining high performance and reliability standards required for industrial and consumer applications.

Several challenges impact the Taiwan analog integrated circuits market, requiring strategic responses from industry participants to maintain competitive positioning and growth momentum. These restraints reflect both global semiconductor industry dynamics and specific regional considerations affecting Taiwan’s market development.

Supply chain disruptions periodically affect raw material availability and component sourcing, creating production challenges for analog IC manufacturers. Taiwan’s companies must navigate complex global supply networks while managing inventory levels and maintaining customer delivery commitments during periods of supply constraint or geopolitical uncertainty.

Intense competition from international analog IC manufacturers creates pricing pressure and requires continuous innovation to maintain market share. Taiwan’s companies compete against established global players with substantial resources and broad product portfolios, necessitating focus on differentiated solutions and specialized market segments.

Technology complexity increases development costs and time-to-market for advanced analog circuits, particularly as applications demand higher performance and integration levels. Companies must balance investment in cutting-edge technologies with market demand and profitability requirements, creating resource allocation challenges for smaller design houses.

Regulatory compliance requirements across different markets add complexity and cost to product development and manufacturing processes. Taiwan’s analog IC companies must navigate varying standards and certification requirements for automotive, industrial, and consumer applications while maintaining competitive pricing and delivery schedules.

Emerging applications present substantial growth opportunities for Taiwan’s analog integrated circuits market, driven by technological advancement and evolving customer requirements across multiple industries. These opportunities align with Taiwan’s core competencies in analog circuit design and advanced manufacturing capabilities.

Artificial intelligence acceleration creates demand for specialized analog circuits that support AI processing systems, including high-speed data converters, precision voltage references, and low-noise amplifiers. Taiwan’s analog IC companies can leverage their design expertise to develop solutions that optimize AI system performance while meeting power efficiency requirements.

Autonomous vehicle development requires sophisticated analog circuits for sensor fusion, radar systems, and safety-critical applications. Taiwan’s automotive-qualified analog IC manufacturers are well-positioned to capture market share in this high-growth segment by developing solutions that meet stringent automotive reliability and safety standards.

Renewable energy systems demand advanced power management and conversion circuits that maximize energy efficiency and system reliability. Taiwan’s analog IC companies can expand their presence in solar inverters, wind power systems, and energy storage applications by developing specialized solutions that optimize renewable energy utilization.

Medical device innovation creates opportunities for precision analog circuits used in diagnostic equipment, patient monitoring systems, and therapeutic devices. Taiwan’s analog IC manufacturers can leverage their expertise in low-noise, high-precision circuits to serve the growing medical electronics market with specialized solutions that meet regulatory requirements.

Taiwan’s analog IC market operates within a complex ecosystem of technological, economic, and competitive forces that shape industry development and strategic decision-making. Understanding these dynamics provides insight into market evolution and future growth trajectories for industry participants and stakeholders.

Technology evolution drives continuous innovation in analog circuit architectures, with companies investing in advanced process nodes, novel device structures, and integrated solutions that combine multiple functions on single chips. This technological progression enables higher performance, lower power consumption, and reduced system costs that benefit end customers across diverse applications.

Customer requirements increasingly emphasize system-level optimization, requiring analog IC suppliers to develop comprehensive solutions that address complete application needs rather than individual component specifications. Taiwan’s companies respond by offering reference designs, development tools, and technical support that accelerate customer product development cycles.

Manufacturing scalability becomes critical as market demand fluctuates and new applications emerge. Taiwan’s foundry ecosystem provides flexible manufacturing capacity that enables analog IC companies to scale production efficiently while maintaining cost competitiveness and quality standards across different volume requirements.

Partnership strategies facilitate market expansion and technology development through collaboration between design houses, foundries, and system companies. These partnerships enable resource sharing, risk mitigation, and accelerated innovation that benefits the overall Taiwan analog IC ecosystem while strengthening competitive positioning in global markets.

Comprehensive market analysis of Taiwan’s analog integrated circuits sector employs multiple research methodologies to ensure accurate and actionable insights for industry stakeholders. The research approach combines quantitative data analysis with qualitative industry expertise to provide a complete market perspective.

Primary research activities include extensive interviews with key industry executives, technical experts, and market participants across the Taiwan analog IC value chain. These discussions provide firsthand insights into market trends, competitive dynamics, technology developments, and strategic priorities that shape industry evolution and investment decisions.

Secondary research sources encompass industry reports, company financial statements, patent databases, and technical publications that provide quantitative market data and technology trend analysis. This information supports market sizing, competitive benchmarking, and technology roadmap development for comprehensive market understanding.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review, and statistical analysis of market trends and projections. MarkWide Research employs rigorous validation methodologies to verify market data and provide reliable insights for strategic decision-making by industry participants and investors.

Taiwan’s geographic positioning provides strategic advantages for analog integrated circuits market development, with the island serving as a central hub for Asia-Pacific semiconductor activities while maintaining strong connections to global markets. Regional analysis reveals distinct market characteristics and growth opportunities across different geographic segments.

Domestic market dynamics reflect Taiwan’s advanced technology infrastructure and strong demand from local electronics manufacturers. The domestic analog IC market benefits from proximity to major system companies, enabling close collaboration in product development and rapid response to changing market requirements. Local demand represents approximately 22% of total production volume, with the remainder targeting export markets.

China market engagement represents a significant opportunity for Taiwan’s analog IC companies, despite ongoing geopolitical considerations. Chinese demand for analog circuits spans consumer electronics, automotive, and industrial applications, creating substantial revenue potential for Taiwan suppliers who can navigate regulatory requirements and competitive dynamics in this large market.

Southeast Asian expansion offers growth opportunities as regional countries develop their electronics manufacturing capabilities and infrastructure. Taiwan’s analog IC companies leverage their cost competitiveness and technical expertise to serve emerging markets in Vietnam, Thailand, Malaysia, and Indonesia, where demand for analog circuits continues expanding with industrial development.

Global market reach extends Taiwan’s analog IC presence to North America and Europe, where demand focuses on high-performance applications in automotive, industrial, and telecommunications sectors. Export markets account for the majority of Taiwan’s analog IC production, with North America representing 28% and Europe accounting for 18% of total shipments.

Taiwan’s analog IC market features a diverse competitive landscape combining global multinational corporations, established local companies, and innovative startup design houses. This competitive environment fosters innovation while providing customers with comprehensive solution options across different performance and cost requirements.

Competitive strategies emphasize technological differentiation, customer service excellence, and market segment specialization. Companies invest heavily in research and development to maintain technology leadership while building strong customer relationships through comprehensive technical support and rapid response to market requirements.

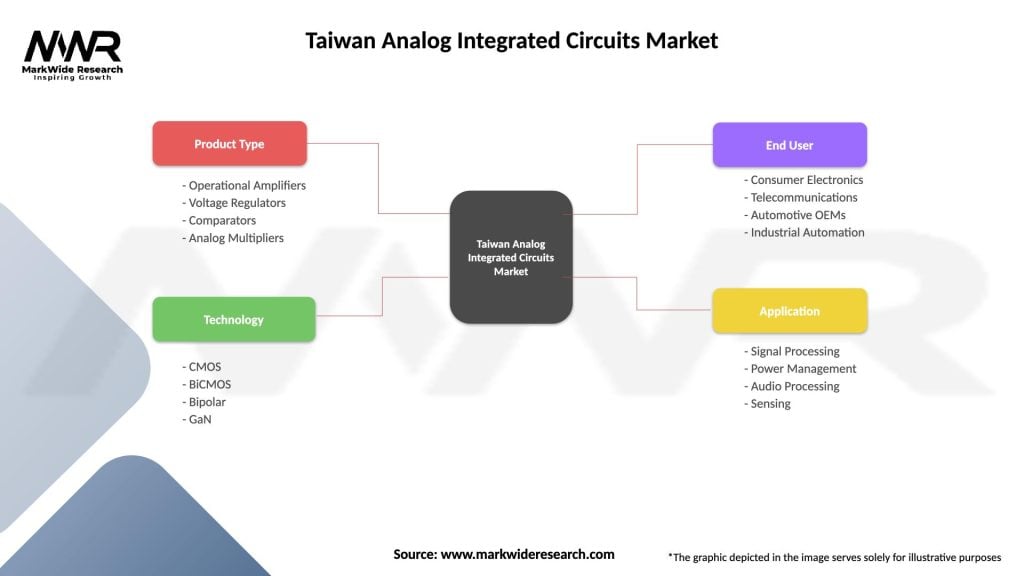

Market segmentation analysis reveals distinct characteristics and growth patterns across different product categories, applications, and end-user segments within Taiwan’s analog integrated circuits market. This segmentation provides insights into market opportunities and competitive dynamics across various market dimensions.

By Product Type:

By Application:

By End-User:

Power management ICs dominate Taiwan’s analog integrated circuits market, representing the largest product category by revenue and volume. This segment benefits from universal demand across all electronic systems for efficient power conversion, regulation, and management solutions. Taiwan’s companies excel in developing innovative power management architectures that optimize efficiency while minimizing solution size and cost.

Consumer electronics applications drive the highest volume demand for Taiwan’s analog ICs, with mobile devices, wearables, and smart home products requiring sophisticated power management and signal processing solutions. This category emphasizes cost optimization, miniaturization, and integration capabilities that align with Taiwan’s manufacturing strengths and design expertise.

Automotive segment growth accelerates as vehicle electrification and automation create demand for specialized analog circuits. Taiwan’s automotive-qualified analog IC suppliers focus on high-reliability solutions that meet stringent automotive standards while providing the performance characteristics required for advanced vehicle systems including electric powertrains and autonomous driving features.

Industrial applications require precision analog circuits that operate reliably in harsh environments while providing accurate measurement and control capabilities. Taiwan’s analog IC companies develop ruggedized solutions that withstand temperature extremes, electrical noise, and mechanical stress while maintaining calibrated performance over extended operating periods.

Telecommunications infrastructure demands high-performance analog circuits that support next-generation communication systems including 5G networks and fiber optic systems. This category requires advanced RF circuits, high-speed data converters, and precision timing solutions that leverage Taiwan’s capabilities in advanced process technologies and high-frequency circuit design.

Taiwan’s analog IC market provides substantial benefits for various industry participants and stakeholders through its comprehensive ecosystem, technological capabilities, and strategic market positioning. These benefits create value for companies throughout the semiconductor supply chain and end-user industries.

Design companies benefit from access to world-class foundry services, advanced process technologies, and comprehensive design support infrastructure. Taiwan’s ecosystem enables analog IC design houses to focus on innovation and customer relationships while leveraging proven manufacturing capabilities and supply chain partnerships that reduce time-to-market and development risks.

Manufacturing partners gain access to diverse customer bases, advanced technology nodes, and flexible production capabilities that optimize capacity utilization and revenue generation. Taiwan’s foundries serve multiple analog IC companies simultaneously, creating economies of scale and technology development synergies that benefit all participants in the ecosystem.

System customers receive comprehensive analog IC solutions with strong technical support, reliable supply chains, and competitive pricing. Taiwan’s analog IC suppliers provide reference designs, development tools, and application expertise that accelerate customer product development while ensuring optimal system performance and cost-effectiveness.

Investors and stakeholders benefit from Taiwan’s stable business environment, skilled workforce, and government support for semiconductor industry development. The market offers attractive growth opportunities with manageable risks, supported by strong intellectual property protection, established infrastructure, and proven track record of successful technology commercialization.

Strengths:

Weaknesses:

Opportunities:

Threats:

Integration and miniaturization represent dominant trends in Taiwan’s analog integrated circuits market, with customers demanding more functionality in smaller form factors while maintaining or improving performance characteristics. This trend drives innovation in circuit architectures, packaging technologies, and system-level optimization approaches that leverage Taiwan’s advanced manufacturing capabilities.

Power efficiency optimization becomes increasingly critical as battery-powered devices proliferate and energy costs rise across all applications. Taiwan’s analog IC companies focus on developing ultra-low-power circuits, advanced power management architectures, and energy harvesting solutions that extend battery life while maintaining system performance requirements.

Artificial intelligence integration creates new requirements for analog circuits that support AI processing systems, including high-speed data acquisition, precision signal conditioning, and adaptive power management. Taiwan’s companies invest in developing AI-optimized analog solutions that enhance system performance while meeting power and cost constraints.

Automotive electrification drives demand for specialized analog circuits capable of handling high voltages, currents, and temperatures while meeting automotive reliability standards. This trend creates opportunities for Taiwan’s analog IC manufacturers to develop solutions for electric vehicle powertrains, charging systems, and advanced driver assistance systems.

5G and connectivity expansion requires advanced RF circuits, high-frequency amplifiers, and precision timing solutions that enable next-generation wireless communication systems. Taiwan’s analog IC companies leverage their RF design expertise and advanced process capabilities to serve this high-growth market segment with innovative solutions.

Recent industry developments highlight Taiwan’s continued innovation and market expansion in analog integrated circuits, with companies announcing new product launches, technology breakthroughs, and strategic partnerships that strengthen competitive positioning and market reach.

Advanced process adoption accelerates as Taiwan’s analog IC companies migrate to smaller geometry nodes to achieve higher performance and integration levels. Several companies have announced successful development of analog circuits using advanced process technologies, enabling new product categories and improved cost-effectiveness for existing applications.

Automotive qualification achievements demonstrate Taiwan’s growing presence in the automotive analog IC market, with multiple companies receiving automotive quality certifications and design wins for electric vehicle applications. These developments position Taiwan as a reliable supplier for the rapidly growing automotive electronics market.

Strategic partnerships between Taiwan’s analog IC companies and global technology leaders create opportunities for technology sharing, market expansion, and joint product development. Recent partnership announcements focus on emerging applications including AI acceleration, 5G infrastructure, and renewable energy systems.

Capacity expansion investments by Taiwan’s foundries and analog IC companies support growing market demand while maintaining technological leadership. These investments include new fabrication facilities, advanced packaging capabilities, and expanded testing infrastructure that enhance Taiwan’s competitive position in global markets.

Market positioning strategies should emphasize Taiwan’s unique strengths in analog circuit design and manufacturing while addressing competitive challenges through innovation and customer relationship development. MarkWide Research analysis indicates that companies achieving the strongest growth focus on specialized market segments where technical expertise creates sustainable competitive advantages.

Technology investment priorities should align with emerging application requirements, particularly in automotive, AI, and 5G markets where demand for advanced analog circuits continues expanding. Companies should balance investment in cutting-edge technologies with market demand to optimize return on investment while maintaining competitive positioning.

Partnership development offers opportunities for market expansion and risk mitigation through collaboration with global technology leaders and system companies. Strategic partnerships can provide access to new markets, shared development costs, and complementary technologies that enhance competitive positioning and growth potential.

Supply chain resilience requires diversification of supplier relationships and inventory management strategies to mitigate disruption risks while maintaining cost competitiveness. Companies should develop flexible supply chain approaches that balance efficiency with resilience to navigate uncertain global trade environments.

Talent development remains critical for maintaining Taiwan’s technological leadership in analog circuit design and manufacturing. Companies should invest in workforce development, university partnerships, and knowledge transfer programs that ensure continued access to skilled engineers and technical expertise required for innovation and growth.

Taiwan’s analog integrated circuits market demonstrates strong growth prospects driven by expanding applications in emerging technologies and continued demand from traditional electronics markets. The market outlook reflects positive trends in key application segments combined with Taiwan’s sustained competitive advantages in analog circuit development and manufacturing.

Technology evolution will continue driving market expansion as new applications emerge requiring sophisticated analog circuits. Artificial intelligence, autonomous vehicles, renewable energy systems, and advanced communication networks create substantial demand for specialized analog solutions that leverage Taiwan’s design expertise and manufacturing capabilities.

Market expansion opportunities exist in both geographic and application dimensions, with emerging markets offering growth potential while new applications create demand for innovative analog circuit solutions. Taiwan’s companies are well-positioned to capture these opportunities through their established technology capabilities and flexible manufacturing infrastructure.

Competitive positioning remains strong due to Taiwan’s comprehensive semiconductor ecosystem, skilled workforce, and government support for industry development. The market benefits from continuous technology advancement and strategic partnerships that enhance global competitiveness while maintaining cost-effectiveness and quality leadership.

Long-term projections indicate sustained growth with the market expected to maintain robust expansion rates exceeding 7% annually through the next decade. This growth trajectory reflects both organic market expansion and Taiwan’s ability to capture increasing market share through technological innovation and customer relationship development across diverse application segments.

Taiwan’s analog integrated circuits market represents a dynamic and rapidly growing sector that plays a crucial role in the global semiconductor industry. The market benefits from Taiwan’s unique combination of advanced manufacturing capabilities, innovative design expertise, and comprehensive supply chain infrastructure that creates sustainable competitive advantages across multiple application segments.

Market fundamentals remain strong with robust demand drivers including digital transformation, automotive electrification, 5G deployment, and IoT expansion creating substantial opportunities for growth and innovation. Taiwan’s analog IC companies are well-positioned to capitalize on these trends through their technological capabilities and established customer relationships in key markets worldwide.

Strategic positioning emphasizes Taiwan’s role as a critical hub for analog IC development and manufacturing, serving both domestic and international markets with high-quality, cost-effective solutions. The market’s continued evolution toward higher integration, improved performance, and specialized applications aligns with Taiwan’s core competencies and investment priorities.

Future success will depend on continued innovation, strategic partnerships, and adaptation to evolving market requirements while maintaining Taiwan’s competitive advantages in manufacturing excellence and design expertise. The Taiwan analog integrated circuits market is poised for sustained growth and technological leadership in the global semiconductor landscape.

What is Analog Integrated Circuits?

Analog Integrated Circuits are electronic circuits that process continuous signals. They are widely used in applications such as audio processing, signal amplification, and sensor interfacing.

What are the key players in the Taiwan Analog Integrated Circuits Market?

Key players in the Taiwan Analog Integrated Circuits Market include companies like MediaTek, NXP Semiconductors, and Texas Instruments, among others.

What are the growth factors driving the Taiwan Analog Integrated Circuits Market?

The growth of the Taiwan Analog Integrated Circuits Market is driven by the increasing demand for consumer electronics, advancements in automotive applications, and the rise of IoT devices.

What challenges does the Taiwan Analog Integrated Circuits Market face?

Challenges in the Taiwan Analog Integrated Circuits Market include the rapid pace of technological change, supply chain disruptions, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the Taiwan Analog Integrated Circuits Market?

Opportunities in the Taiwan Analog Integrated Circuits Market include the expansion of smart home technologies, growth in renewable energy applications, and the increasing integration of AI in electronic devices.

What trends are shaping the Taiwan Analog Integrated Circuits Market?

Trends in the Taiwan Analog Integrated Circuits Market include the miniaturization of components, the shift towards energy-efficient designs, and the growing importance of mixed-signal ICs in various applications.

Taiwan Analog Integrated Circuits Market

| Segmentation Details | Description |

|---|---|

| Product Type | Operational Amplifiers, Voltage Regulators, Comparators, Analog Multipliers |

| Technology | CMOS, BiCMOS, Bipolar, GaN |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Signal Processing, Power Management, Audio Processing, Sensing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Taiwan Analog Integrated Circuits Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at