444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The System In Package (SIP) Die Market represents a rapidly evolving segment within the semiconductor industry, characterized by innovative packaging technologies that integrate multiple dies into a single package. This market encompasses the manufacturing, design, and implementation of SIP die solutions across various applications including consumer electronics, automotive systems, telecommunications, and industrial automation. The technology enables significant space savings, improved performance, and enhanced functionality by combining different semiconductor components within a compact package structure.

Market dynamics indicate robust growth driven by increasing demand for miniaturization in electronic devices and the proliferation of Internet of Things (IoT) applications. The SIP die technology offers manufacturers the ability to integrate analog, digital, and mixed-signal components, creating more efficient and cost-effective solutions. Industry analysis reveals that the market is experiencing a compound annual growth rate (CAGR) of 8.2%, reflecting strong adoption across multiple sectors and geographical regions.

Regional distribution shows significant concentration in Asia-Pacific markets, particularly in countries with established semiconductor manufacturing capabilities. The technology’s versatility in addressing diverse application requirements has positioned it as a critical component in next-generation electronic systems, from smartphones and wearables to automotive electronics and industrial sensors.

The System In Package (SIP) Die Market refers to the commercial ecosystem surrounding the development, manufacturing, and distribution of semiconductor packaging solutions that integrate multiple dies or chips within a single package. This technology represents an advanced approach to semiconductor packaging that combines different functional components, including processors, memory, sensors, and passive components, into a unified system-level package.

SIP die technology fundamentally differs from traditional single-chip packages by enabling heterogeneous integration, where different semiconductor technologies and manufacturing processes can be combined within one package. This approach allows manufacturers to optimize each component independently while achieving system-level integration benefits such as reduced footprint, improved electrical performance, and enhanced thermal management.

The market encompasses various stakeholders including semiconductor manufacturers, packaging service providers, design houses, and end-user industries. It involves complex supply chains that integrate advanced materials, precision manufacturing equipment, and sophisticated design methodologies to deliver high-performance packaging solutions for modern electronic applications.

Market leadership in the SIP die sector is characterized by continuous technological innovation and strategic partnerships between semiconductor companies and packaging specialists. The industry has witnessed significant advancement in packaging density, with modern SIP solutions achieving remarkable miniaturization while maintaining high performance standards. Key market participants are investing heavily in research and development to address emerging challenges in thermal management, signal integrity, and manufacturing scalability.

Technology adoption rates vary significantly across different application segments, with consumer electronics leading in volume adoption while automotive and industrial applications drive premium segment growth. The market demonstrates strong resilience to economic fluctuations due to its critical role in enabling next-generation electronic systems. MarkWide Research analysis indicates that approximately 42% of market growth is attributed to increasing demand for compact, high-performance solutions in mobile and wearable devices.

Competitive dynamics reveal a landscape where traditional semiconductor companies are expanding their packaging capabilities while specialized packaging providers are developing advanced SIP technologies. The market structure supports both horizontal and vertical integration strategies, enabling companies to optimize their value chain positioning and technological capabilities.

Strategic insights from comprehensive market analysis reveal several critical factors shaping the SIP die market landscape:

Market penetration analysis shows varying adoption rates across different geographical regions and application segments, with developed markets leading in advanced packaging adoption while emerging markets focus on cost-effective solutions.

Primary growth drivers propelling the SIP die market include the relentless demand for device miniaturization across consumer electronics, automotive, and industrial applications. The proliferation of IoT devices requires compact, power-efficient solutions that can integrate multiple functions within space-constrained environments. This trend is particularly evident in wearable technology, where form factor limitations necessitate advanced packaging approaches.

Performance requirements in modern electronic systems drive adoption of SIP technology due to its ability to reduce signal propagation delays and improve overall system performance. The integration of different semiconductor technologies within a single package enables optimization of power consumption, processing speed, and functionality that cannot be achieved through traditional discrete component approaches.

Cost optimization pressures across various industries encourage adoption of SIP solutions as they reduce assembly complexity, minimize board space requirements, and streamline supply chain management. The technology enables manufacturers to achieve better economies of scale while maintaining design flexibility and performance standards.

Technological advancement in packaging materials, manufacturing processes, and design tools continues to expand the capabilities and applications of SIP die technology, creating new market opportunities and driving sustained growth across multiple industry segments.

Technical challenges represent significant barriers to widespread SIP die adoption, particularly in thermal management and signal integrity optimization. The integration of multiple dies within a single package creates complex thermal environments that require sophisticated cooling solutions and careful thermal design considerations. These challenges become more pronounced in high-power applications where heat dissipation can significantly impact system reliability and performance.

Manufacturing complexity associated with SIP die production requires specialized equipment, advanced process control, and highly skilled technical personnel. The multi-step assembly processes, precision alignment requirements, and quality control procedures increase manufacturing costs and complexity compared to traditional packaging approaches. This complexity can limit the number of qualified suppliers and create potential supply chain bottlenecks.

Design challenges in SIP development include electromagnetic interference management, power distribution optimization, and mechanical stress considerations. The close proximity of different functional blocks within the package can create interference issues that require careful design optimization and potentially limit performance in sensitive applications.

Cost considerations for low-volume applications can make SIP solutions less attractive compared to discrete component approaches, particularly when development costs and tooling investments are factored into the total cost of ownership equation.

Emerging applications in artificial intelligence, edge computing, and 5G communications present substantial growth opportunities for SIP die technology. These applications require high-performance, compact solutions that can integrate processing, memory, and communication functions within space and power-constrained environments. The AI acceleration market particularly benefits from SIP approaches that combine specialized processing units with high-bandwidth memory interfaces.

Automotive electrification and autonomous driving systems create significant demand for advanced packaging solutions that can withstand harsh environmental conditions while delivering high performance and reliability. SIP technology enables the integration of sensor interfaces, processing units, and communication modules required for modern automotive applications.

Healthcare and medical device applications represent a growing opportunity segment where SIP technology enables the development of compact, battery-powered devices with advanced sensing and processing capabilities. The aging global population and increasing focus on personalized healthcare drive demand for sophisticated medical electronics that benefit from SIP integration approaches.

Industrial automation and Industry 4.0 initiatives require intelligent sensor systems and edge computing solutions that can be efficiently implemented using SIP technology, creating opportunities for specialized packaging solutions tailored to industrial requirements.

Supply chain dynamics in the SIP die market reflect the complex interdependencies between semiconductor manufacturers, packaging service providers, and end-user industries. The market structure supports both integrated device manufacturers who control the entire value chain and fabless companies that rely on specialized packaging partners. This diversity creates competitive dynamics that drive innovation while providing flexibility for different business models.

Technology evolution continues to reshape market dynamics through the introduction of new packaging architectures, advanced materials, and improved manufacturing processes. The transition toward heterogeneous integration and chiplet-based designs is creating new opportunities for SIP technology while challenging traditional packaging approaches. Industry data indicates that advanced packaging adoption rates are increasing by approximately 15% annually across key application segments.

Customer requirements are becoming increasingly sophisticated, demanding higher performance, better reliability, and more cost-effective solutions. This trend drives continuous innovation in SIP technology and creates opportunities for companies that can deliver differentiated packaging solutions. The market responds to these demands through collaborative development programs and customized packaging solutions.

Regulatory considerations and environmental requirements influence market dynamics through requirements for lead-free materials, RoHS compliance, and sustainability initiatives that impact packaging material selection and manufacturing processes.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research involves direct engagement with industry participants including semiconductor manufacturers, packaging service providers, equipment suppliers, and end-user companies across different geographical regions and application segments.

Secondary research incorporates analysis of industry publications, technical papers, patent filings, and company financial reports to understand technology trends, competitive positioning, and market development patterns. This approach provides historical context and identifies emerging trends that may impact future market development.

Quantitative analysis utilizes statistical modeling and forecasting techniques to project market growth trends, segment performance, and regional development patterns. The methodology incorporates economic indicators, technology adoption curves, and industry-specific factors to generate reliable market projections.

Expert validation through industry interviews and advisory panel discussions ensures that research findings accurately reflect market realities and incorporate insights from experienced industry professionals. This validation process helps identify potential market disruptions and emerging opportunities that may not be apparent through quantitative analysis alone.

Asia-Pacific dominance in the SIP die market reflects the region’s established semiconductor manufacturing infrastructure and proximity to major electronics assembly operations. Countries including Taiwan, South Korea, and China account for approximately 68% of global SIP die production capacity, benefiting from integrated supply chains and specialized technical expertise. The region’s competitive advantages include cost-effective manufacturing, advanced packaging capabilities, and strong relationships with major electronics brands.

North American markets demonstrate strength in high-value applications including automotive electronics, aerospace systems, and advanced computing applications. The region’s focus on innovation and advanced technology development creates demand for sophisticated SIP solutions that command premium pricing. United States companies lead in design and intellectual property development while leveraging global manufacturing partnerships for volume production.

European markets show particular strength in automotive and industrial applications, driven by the region’s leadership in automotive technology and industrial automation. European companies focus on high-reliability applications and specialized packaging solutions that meet stringent quality and environmental requirements.

Emerging markets in Latin America, Middle East, and Africa represent growing opportunities for SIP die adoption, particularly in consumer electronics and telecommunications infrastructure applications where cost-effective solutions are prioritized.

Market leadership in the SIP die sector is distributed among several categories of companies, each bringing distinct capabilities and competitive advantages:

Competitive strategies focus on technology differentiation, manufacturing scale, and customer relationship development. Leading companies invest heavily in research and development to advance packaging technologies while building strategic partnerships with semiconductor companies and end-user industries.

Technology segmentation of the SIP die market reveals distinct categories based on packaging architecture and integration approach:

By Package Type:

By Application Segment:

By End-User Industry:

Consumer Electronics Category represents the largest volume segment for SIP die applications, driven by continuous demand for device miniaturization and performance enhancement. This category benefits from high-volume production economies and rapid technology adoption cycles. Smartphone applications particularly drive innovation in SIP technology, requiring integration of processors, memory, sensors, and RF components within extremely compact form factors.

Automotive Electronics Category demonstrates the highest growth potential, with automotive SIP adoption increasing at approximately 22% annually due to vehicle electrification and autonomous driving technology development. This segment demands high reliability, extended temperature operation, and long-term availability that create opportunities for specialized SIP solutions.

Telecommunications Category focuses on high-performance applications requiring advanced signal processing and communication capabilities. The deployment of 5G networks and edge computing infrastructure drives demand for sophisticated SIP solutions that integrate baseband processing, RF functions, and power management within compact packages.

Industrial and Healthcare Categories represent emerging opportunities where SIP technology enables new product capabilities and improved system integration. These segments value reliability, customization capabilities, and long product lifecycles that align well with SIP technology advantages.

Semiconductor Manufacturers benefit from SIP die technology through enhanced product differentiation, improved system-level performance, and opportunities for value-added packaging services. The technology enables companies to offer complete system solutions rather than individual components, creating stronger customer relationships and higher margins.

Electronics OEMs gain significant advantages through reduced board space requirements, simplified assembly processes, and improved system reliability. SIP solutions enable faster time-to-market for new products while reducing overall system costs and complexity. The integration approach also provides better supply chain management through reduced component count and supplier base.

End Users benefit from enhanced device performance, improved battery life, and more compact product designs enabled by SIP technology. The integration approach often results in better electromagnetic compatibility and reduced system noise compared to discrete component implementations.

Packaging Service Providers can leverage SIP technology to offer higher-value services and develop long-term customer partnerships. The technology requires specialized capabilities that create competitive barriers and enable premium pricing for advanced packaging solutions.

Supply Chain Partners including materials suppliers and equipment manufacturers benefit from increased demand for advanced packaging materials, specialized assembly equipment, and testing solutions required for SIP die production.

Strengths:

Weaknesses:

Opportunities:

Threats:

Heterogeneous Integration represents a fundamental trend driving SIP die market evolution, enabling the combination of different semiconductor technologies, process nodes, and functional blocks within single packages. This approach allows optimization of each component independently while achieving system-level benefits that cannot be obtained through traditional monolithic integration approaches.

Chiplet Architecture adoption is transforming SIP design methodologies by enabling modular approaches to system integration. This trend allows companies to mix and match different functional blocks from various suppliers, creating more flexible and cost-effective solutions while reducing development time and risk.

Advanced Materials development continues to expand SIP capabilities through improved thermal management, better electrical performance, and enhanced reliability. New substrate materials, thermal interface materials, and encapsulation compounds enable more sophisticated packaging architectures and higher performance levels.

AI and Edge Computing applications are driving demand for specialized SIP solutions that integrate processing units, memory, and interface functions optimized for machine learning and artificial intelligence workloads. These applications require unique packaging approaches that balance performance, power efficiency, and thermal management.

Sustainability Initiatives are influencing SIP die development through requirements for environmentally friendly materials, energy-efficient manufacturing processes, and recyclable packaging solutions. Industry analysis shows that sustainable packaging adoption is increasing by approximately 18% annually across major market segments.

Technology Advancement initiatives across the industry focus on developing next-generation SIP architectures that support higher integration density, improved performance, and better cost-effectiveness. Leading companies are investing in advanced packaging technologies including through-silicon via (TSV) integration, embedded die packaging, and fan-out wafer-level packaging approaches.

Capacity Expansion projects by major packaging service providers reflect growing market demand and the need for advanced manufacturing capabilities. These investments include new production facilities, equipment upgrades, and technology platform development to support emerging SIP applications and higher volume requirements.

Strategic Partnerships between semiconductor companies, packaging specialists, and end-user industries are creating collaborative development programs focused on application-specific SIP solutions. These partnerships enable faster technology development, risk sharing, and market access for innovative packaging approaches.

Acquisition Activity in the packaging industry reflects consolidation trends and the strategic importance of advanced packaging capabilities. Companies are acquiring specialized packaging technologies, manufacturing assets, and technical expertise to strengthen their competitive positions in the SIP die market.

Standards Development efforts by industry organizations focus on establishing common specifications, testing methodologies, and qualification procedures for SIP die technology, facilitating broader market adoption and interoperability between different suppliers and applications.

Strategic Focus recommendations for market participants emphasize the importance of developing differentiated technology capabilities that address specific application requirements rather than pursuing generic packaging solutions. MWR analysis indicates that companies with specialized SIP capabilities achieve premium margins of 25-30% compared to standard packaging providers.

Investment Priorities should focus on advanced manufacturing capabilities, design automation tools, and technical talent development to support the complex requirements of SIP die technology. Companies should also consider strategic partnerships and collaborative development programs to share risks and accelerate technology development.

Market Positioning strategies should emphasize application-specific expertise and customer collaboration rather than purely cost-based competition. The most successful companies in the SIP die market develop deep understanding of customer requirements and provide comprehensive solutions that address system-level challenges.

Technology Development efforts should focus on emerging applications including AI acceleration, automotive electronics, and IoT devices where SIP technology can provide significant value propositions. Companies should also invest in sustainability initiatives and environmentally friendly packaging solutions to address growing market requirements.

Geographic Expansion opportunities exist in emerging markets where electronics manufacturing is growing and local packaging capabilities are limited. However, companies should carefully evaluate market requirements and competitive dynamics before making significant investments in new geographical regions.

Long-term growth prospects for the SIP die market remain highly positive, driven by continued demand for device miniaturization, performance enhancement, and system integration across multiple application segments. The technology’s ability to address fundamental challenges in electronics design positions it as a critical enabler for next-generation electronic systems.

Technology evolution will continue toward more sophisticated integration approaches including 3D packaging architectures, advanced interconnect technologies, and intelligent packaging solutions that incorporate sensing and communication capabilities. These developments will expand the addressable market and create new application opportunities.

Market maturation is expected to result in more standardized packaging platforms, improved design tools, and reduced development costs that will accelerate adoption across broader application segments. The establishment of industry standards and qualification procedures will facilitate market growth and customer acceptance.

Application diversification will drive market expansion beyond traditional electronics segments into emerging areas including healthcare devices, environmental monitoring, and smart infrastructure applications. These new markets will require specialized SIP solutions tailored to specific performance and reliability requirements.

Competitive landscape evolution will likely result in further industry consolidation as companies seek to achieve scale advantages and comprehensive technology capabilities. However, opportunities will remain for specialized providers that focus on specific application segments or unique technology approaches.

The System In Package (SIP) Die Market represents a dynamic and rapidly evolving segment of the semiconductor industry, characterized by continuous technological innovation and expanding application opportunities. The market’s growth trajectory reflects the fundamental industry trends toward miniaturization, performance optimization, and system-level integration that drive demand for advanced packaging solutions.

Key success factors for market participants include developing differentiated technology capabilities, building strong customer relationships, and maintaining operational excellence in complex manufacturing processes. The market rewards companies that can deliver comprehensive solutions addressing specific application requirements rather than generic packaging services.

Future market development will be shaped by emerging applications in artificial intelligence, automotive electronics, and IoT devices that require sophisticated packaging solutions. The industry’s continued investment in technology development, manufacturing capabilities, and talent development positions it well to address these growing market opportunities while maintaining competitive advantages in established application segments.

What is System In Package (SIP) Die?

System In Package (SIP) Die refers to a packaging technology that integrates multiple semiconductor dies into a single package, allowing for compact design and improved performance. This technology is widely used in applications such as mobile devices, IoT devices, and high-performance computing.

What are the key companies in the System In Package (SIP) Die Market?

Key companies in the System In Package (SIP) Die Market include Intel, TSMC, ASE Group, and Amkor Technology, among others. These companies are known for their advanced packaging solutions and innovations in semiconductor technology.

What are the growth factors driving the System In Package (SIP) Die Market?

The growth of the System In Package (SIP) Die Market is driven by the increasing demand for miniaturized electronic devices, the rise of IoT applications, and the need for enhanced performance in computing systems. Additionally, advancements in packaging technologies are contributing to market expansion.

What challenges does the System In Package (SIP) Die Market face?

The System In Package (SIP) Die Market faces challenges such as the complexity of manufacturing processes, high costs associated with advanced packaging technologies, and the need for stringent quality control. These factors can hinder the adoption of SIP solutions in certain applications.

What opportunities exist in the System In Package (SIP) Die Market?

Opportunities in the System In Package (SIP) Die Market include the growing demand for high-performance computing, the expansion of 5G technology, and the increasing use of SIP in automotive applications. These trends are expected to drive innovation and investment in the market.

What trends are shaping the System In Package (SIP) Die Market?

Trends shaping the System In Package (SIP) Die Market include the integration of heterogeneous components, the shift towards more compact designs, and the adoption of advanced materials for better thermal management. These trends are influencing the future direction of packaging technologies.

System In Package (SIP) Die Market

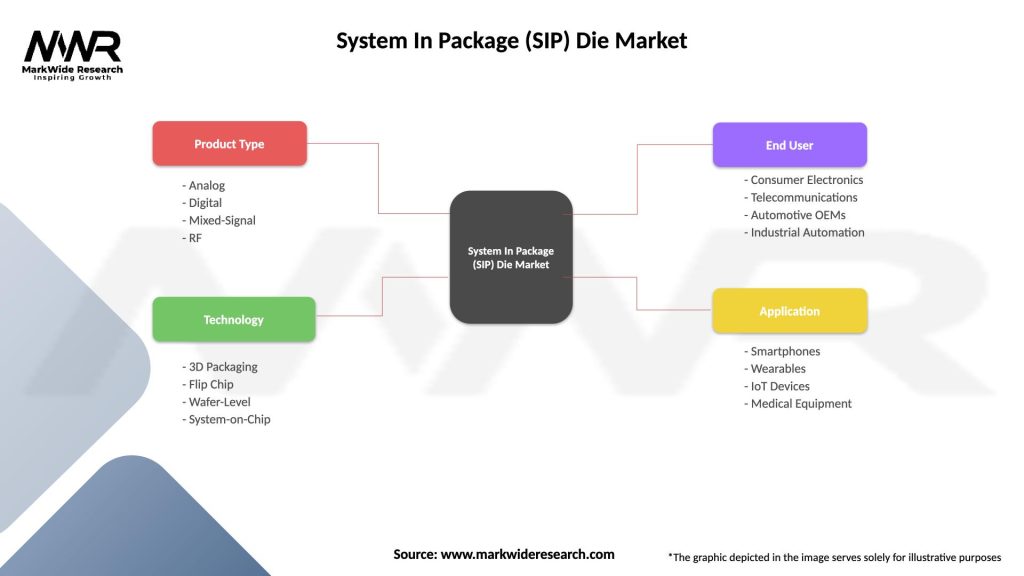

| Segmentation Details | Description |

|---|---|

| Product Type | Analog, Digital, Mixed-Signal, RF |

| Technology | 3D Packaging, Flip Chip, Wafer-Level, System-on-Chip |

| End User | Consumer Electronics, Telecommunications, Automotive OEMs, Industrial Automation |

| Application | Smartphones, Wearables, IoT Devices, Medical Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the System In Package (SIP) Die Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at