444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland used car market represents a sophisticated and well-established automotive ecosystem characterized by premium vehicle preferences, stringent quality standards, and robust consumer protection frameworks. Switzerland’s unique position as a high-income European nation with exceptional environmental consciousness has shaped a distinctive used car landscape that emphasizes quality, sustainability, and technological advancement over volume-driven transactions.

Market dynamics in Switzerland reflect the country’s affluent consumer base, with used car buyers demonstrating strong preferences for luxury brands, hybrid technologies, and vehicles with comprehensive service histories. The market experiences consistent growth driven by 15.2% annual increase in premium used vehicle transactions, supported by favorable financing conditions and sophisticated dealer networks throughout major urban centers including Zurich, Geneva, and Basel.

Digital transformation has significantly influenced Switzerland’s used car market, with online platforms capturing 68% of initial vehicle searches and mobile applications facilitating seamless price comparisons and vehicle history verification. This technological integration has enhanced market transparency while maintaining Switzerland’s traditionally high standards for vehicle condition and documentation.

Environmental regulations and sustainability initiatives continue to reshape market preferences, with hybrid and electric used vehicles experiencing 42% growth in consumer interest. Switzerland’s commitment to carbon neutrality by 2050 has accelerated demand for environmentally conscious transportation solutions, positioning the used car market as a crucial component in the country’s sustainable mobility transition.

The Switzerland used car market refers to the comprehensive ecosystem encompassing the sale, purchase, financing, and servicing of pre-owned passenger vehicles within Switzerland’s borders. This market includes authorized dealerships, independent retailers, online platforms, and private transactions, all operating within Switzerland’s stringent regulatory framework designed to protect consumers and maintain vehicle safety standards.

Market participants include established automotive dealerships representing major international brands, specialized used car retailers, online marketplaces, financial institutions providing vehicle financing, and individual consumers engaging in private sales. The market’s structure reflects Switzerland’s preference for quality over quantity, with emphasis on vehicle provenance, maintenance records, and compliance with evolving environmental standards.

Regulatory oversight ensures market integrity through mandatory vehicle inspections, standardized documentation requirements, and consumer protection laws that govern warranty provisions and return policies. This comprehensive framework has established Switzerland as a benchmark for used car market transparency and consumer confidence within the European automotive landscape.

Switzerland’s used car market demonstrates remarkable resilience and sophistication, driven by affluent consumer demographics, premium brand preferences, and increasing environmental consciousness. The market has evolved beyond traditional transaction models to embrace digital innovation while maintaining Switzerland’s characteristically high quality standards and comprehensive consumer protections.

Key market drivers include Switzerland’s stable economic environment, favorable financing conditions, and growing demand for sustainable transportation solutions. Premium and luxury vehicle segments dominate market activity, with 73% of transactions involving vehicles from established European manufacturers known for reliability and residual value retention.

Digital platforms have revolutionized market accessibility, enabling consumers to conduct comprehensive vehicle research, compare pricing across multiple dealers, and access detailed vehicle history reports. This technological integration has increased market efficiency while preserving Switzerland’s emphasis on transparency and consumer protection.

Future growth prospects remain positive, supported by Switzerland’s commitment to sustainable mobility, continued economic stability, and evolving consumer preferences toward hybrid and electric vehicle technologies. The market is positioned to benefit from increasing vehicle replacement cycles and growing acceptance of certified pre-owned programs offered by premium manufacturers.

Consumer behavior analysis reveals distinct preferences that differentiate Switzerland’s used car market from neighboring European countries. Swiss consumers prioritize vehicle reliability, comprehensive service histories, and environmental performance over purely price-driven considerations, creating a market environment that rewards quality and transparency.

Economic stability serves as the fundamental driver supporting Switzerland’s robust used car market, with consistent GDP growth, low unemployment rates, and high disposable income levels creating favorable conditions for vehicle purchases. Switzerland’s position as a global financial center ensures continued economic resilience, supporting consumer confidence in major purchase decisions including vehicle acquisitions.

Environmental regulations and sustainability initiatives have emerged as powerful market drivers, encouraging consumers to transition toward more efficient and environmentally friendly vehicles. Switzerland’s carbon reduction commitments and urban emission restrictions create strong incentives for consumers to upgrade to hybrid and electric vehicles, driving demand in the used car segment.

Digital transformation has revolutionized market accessibility and transparency, enabling consumers to conduct comprehensive research, compare options, and complete transactions with unprecedented convenience. Online platforms and mobile applications have eliminated traditional barriers to market participation, expanding the potential customer base and increasing transaction efficiency.

Demographic trends including urbanization, changing mobility preferences, and generational shifts in vehicle ownership patterns continue to influence market dynamics. Younger consumers demonstrate increased openness to used vehicle purchases, particularly when supported by comprehensive warranty programs and certified pre-owned initiatives from established manufacturers.

Financing innovation has made vehicle ownership more accessible through flexible payment options, competitive interest rates, and innovative leasing arrangements. Financial institutions have developed specialized products for used car purchases, including extended warranty coverage and maintenance packages that reduce ownership risks and enhance consumer confidence.

High vehicle costs represent a significant market restraint, with Switzerland’s premium-focused market commanding prices that may limit accessibility for certain consumer segments. The emphasis on luxury and premium brands, while reflecting consumer preferences, creates pricing pressures that can restrict market participation among budget-conscious buyers.

Regulatory complexity and stringent inspection requirements, while ensuring quality standards, can create barriers for smaller dealers and private sellers. Compliance costs associated with mandatory inspections, documentation requirements, and warranty obligations may limit market entry for some participants and increase overall transaction costs.

Limited inventory availability in certain vehicle segments, particularly for popular hybrid and electric models, can constrain market growth and create pricing pressures. Switzerland’s relatively small market size compared to neighboring countries may result in limited selection for consumers seeking specific vehicle configurations or features.

Import restrictions and customs procedures can complicate cross-border vehicle transactions, potentially limiting inventory sources and increasing costs for dealers seeking to expand their offerings. Complex documentation requirements for imported vehicles may deter some market participants and reduce competitive pricing options.

Seasonal demand fluctuations create challenges for dealers managing inventory levels and cash flow, with winter months typically experiencing reduced transaction volumes. These cyclical patterns can impact dealer profitability and may influence pricing strategies throughout the year.

Electric vehicle adoption presents substantial growth opportunities as Switzerland accelerates its transition toward sustainable transportation. The expanding charging infrastructure and government incentives for electric vehicles create favorable conditions for used electric vehicle market development, particularly as lease returns from early adopters enter the secondary market.

Digital platform expansion offers opportunities for innovative service providers to enhance market efficiency and consumer experience. Advanced technologies including artificial intelligence, virtual reality showrooms, and blockchain-based vehicle history verification can differentiate market participants and attract tech-savvy consumers.

Cross-border market integration with neighboring European countries presents opportunities for inventory expansion and competitive pricing. Harmonized regulations and improved logistics networks could enable Swiss dealers to access broader vehicle selections while maintaining quality standards.

Subscription and mobility services represent emerging opportunities as consumer preferences evolve toward flexible vehicle access rather than traditional ownership models. Innovative service providers can capitalize on changing mobility patterns, particularly among urban consumers seeking convenient and sustainable transportation solutions.

Certified pre-owned programs from premium manufacturers offer opportunities to enhance consumer confidence and command premium pricing. These programs can differentiate participating dealers while providing manufacturers with additional revenue streams and customer touchpoints throughout the vehicle lifecycle.

Supply and demand equilibrium in Switzerland’s used car market reflects the country’s unique economic conditions and consumer preferences. Market dynamics are influenced by new vehicle sales patterns, lease return volumes, and cross-border trade flows that collectively determine inventory availability and pricing trends across different vehicle segments.

Price elasticity varies significantly across market segments, with luxury and premium vehicles demonstrating lower price sensitivity compared to economy segments. Swiss consumers’ willingness to pay premium prices for quality, reliability, and environmental performance creates distinct pricing dynamics that favor established brands with strong reputations.

Competitive intensity has increased with digital platform proliferation, enabling consumers to easily compare options across multiple dealers and regions. This transparency has compressed margins in some segments while rewarding dealers who provide superior service, comprehensive warranties, and unique value propositions.

Technology integration continues to reshape market dynamics, with data analytics enabling more precise inventory management, dynamic pricing strategies, and personalized customer experiences. Dealers leveraging advanced technologies demonstrate 23% higher customer satisfaction rates compared to traditional operators.

Regulatory evolution influences market dynamics through changing emission standards, safety requirements, and consumer protection laws. Adapting to regulatory changes requires ongoing investment in compliance systems and staff training, creating competitive advantages for well-resourced market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights. Primary research includes extensive surveys of consumers, dealers, and industry experts, providing firsthand perspectives on market trends, challenges, and opportunities within Switzerland’s unique automotive landscape.

Secondary research incorporates analysis of government statistics, industry reports, and regulatory filings to establish baseline market data and identify long-term trends. This approach ensures comprehensive coverage of market dynamics while maintaining objectivity and analytical rigor throughout the research process.

Data validation procedures include cross-referencing multiple sources, conducting expert interviews, and employing statistical analysis to verify findings and eliminate potential biases. This methodological approach ensures that market insights accurately reflect current conditions and provide reliable foundations for strategic decision-making.

Quantitative analysis utilizes advanced statistical techniques to identify correlations, trends, and predictive indicators within large datasets. This analytical approach enables identification of subtle market patterns and emerging opportunities that might not be apparent through qualitative research alone.

Industry collaboration with key market participants, including dealers, manufacturers, and regulatory bodies, provides insider perspectives and validates research findings against real-world market conditions. This collaborative approach ensures research relevance and practical applicability for industry stakeholders.

German-speaking regions including Zurich, Basel, and Bern represent the largest segment of Switzerland’s used car market, accounting for 65% of total transactions. These areas demonstrate strong preferences for German premium brands, with consumers prioritizing engineering excellence, reliability, and comprehensive service networks when making purchase decisions.

French-speaking regions centered around Geneva and Lausanne exhibit distinct preferences for French and Italian luxury brands, reflecting cultural affinities and proximity to neighboring countries. This region shows 38% higher adoption of hybrid and electric vehicles compared to the national average, driven by environmental consciousness and urban emission restrictions.

Italian-speaking Ticino demonstrates unique market characteristics influenced by proximity to Italy and distinct consumer preferences. The region shows strong demand for luxury sports cars and premium Italian brands, with transaction values typically 20% higher than the national average due to affluent consumer demographics.

Urban centers across all regions share common characteristics including higher demand for compact vehicles, hybrid technologies, and advanced connectivity features. City consumers prioritize fuel efficiency, parking convenience, and environmental performance, creating distinct market segments within each linguistic region.

Rural areas maintain preferences for larger vehicles, SUVs, and traditional powertrains, reflecting different mobility needs and lifestyle requirements. These regions demonstrate 45% higher demand for all-wheel-drive vehicles and utility-focused configurations, creating opportunities for specialized dealers and service providers.

Market leadership is distributed among several key player categories, each serving distinct consumer segments and geographic regions. The competitive landscape reflects Switzerland’s preference for quality and service excellence, with successful participants demonstrating strong brand reputations and comprehensive customer support capabilities.

Competitive differentiation occurs through service quality, warranty programs, financing options, and digital innovation. Leading players invest heavily in customer experience enhancement, staff training, and technology integration to maintain competitive advantages in Switzerland’s quality-focused market environment.

Market consolidation trends favor larger, well-capitalized dealers capable of investing in digital transformation and comprehensive service offerings. However, specialized boutique dealers continue to thrive by serving niche markets and providing personalized service experiences that appeal to discerning Swiss consumers.

Vehicle category segmentation reveals distinct market dynamics across different vehicle types, with premium and luxury segments dominating transaction volumes and values. Each segment demonstrates unique characteristics regarding consumer preferences, pricing patterns, and growth trajectories within Switzerland’s sophisticated automotive market.

By Vehicle Type:

By Price Range:

By Age and Mileage:

Premium luxury vehicles continue to dominate Switzerland’s used car market, with German brands maintaining 52% market share across all luxury segments. These vehicles demonstrate superior residual value retention and attract consumers seeking prestige, advanced technology, and comprehensive dealer support networks throughout Switzerland.

Hybrid and electric vehicles represent the fastest-growing category, experiencing 67% annual growth in transaction volumes as Swiss consumers embrace sustainable transportation solutions. Early lease returns and corporate fleet renewals provide increasing inventory availability, while government incentives support continued adoption growth.

Compact and urban vehicles show strong performance in metropolitan areas, with consumers prioritizing fuel efficiency, parking convenience, and advanced connectivity features. This category benefits from Switzerland’s urban density and environmental consciousness, particularly among younger demographics seeking practical transportation solutions.

SUVs and crossover vehicles maintain steady demand driven by lifestyle preferences and Switzerland’s mountainous terrain requirements. All-wheel-drive capability remains a key purchasing criterion, with consumers willing to pay premiums for vehicles offering enhanced traction and versatility.

Sports and performance vehicles constitute a specialized but lucrative market segment, with Switzerland’s affluent consumer base supporting strong demand for high-performance vehicles. This category demonstrates exceptional value retention and attracts collectors and enthusiasts seeking unique driving experiences.

Dealers and retailers benefit from Switzerland’s stable economic environment, affluent consumer base, and preference for quality over price competition. The market’s emphasis on service excellence and comprehensive warranties creates opportunities for sustainable profit margins and long-term customer relationships built on trust and reliability.

Financial institutions enjoy favorable lending conditions with low default rates and strong collateral values supporting used vehicle financing programs. Switzerland’s economic stability and consumer creditworthiness create attractive risk profiles for automotive lending, enabling competitive interest rates and flexible financing terms.

Consumers benefit from comprehensive regulatory protections, transparent pricing, and extensive vehicle selection across all market segments. Switzerland’s quality standards ensure vehicle reliability while competitive financing options and warranty programs reduce ownership risks and enhance overall satisfaction.

Manufacturers leverage certified pre-owned programs to maintain customer relationships throughout the vehicle lifecycle while capturing additional revenue streams. These programs enhance brand loyalty and provide manufacturers with valuable market intelligence regarding vehicle performance and consumer preferences.

Technology providers find opportunities to enhance market efficiency through digital platforms, data analytics, and innovative customer experience solutions. Switzerland’s tech-savvy consumer base and dealer willingness to invest in technology create favorable conditions for innovation adoption and market penetration.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration has become a dominant trend shaping consumer preferences and dealer strategies throughout Switzerland’s used car market. Environmental consciousness drives increasing demand for hybrid and electric vehicles, while dealers adapt inventory strategies to meet evolving consumer expectations regarding carbon footprint reduction and sustainable transportation solutions.

Digital-first customer journeys represent a fundamental shift in how consumers research, evaluate, and purchase used vehicles. Online platforms now facilitate 78% of initial vehicle searches, with consumers expecting comprehensive digital experiences including virtual showrooms, detailed vehicle histories, and seamless financing applications.

Subscription and flexible ownership models are gaining traction among urban consumers seeking alternatives to traditional vehicle ownership. These innovative approaches appeal particularly to younger demographics who prioritize access over ownership, creating new business models and revenue opportunities for forward-thinking market participants.

Data-driven personalization enables dealers to provide customized recommendations, targeted marketing, and personalized service experiences based on individual consumer preferences and behavior patterns. Advanced analytics help optimize inventory management, pricing strategies, and customer relationship management throughout the sales process.

Quality certification programs from manufacturers and third-party providers are becoming increasingly important for consumer confidence and dealer differentiation. These programs provide standardized quality assurance, comprehensive warranties, and transparent vehicle histories that reduce purchase risks and enhance overall market credibility.

Regulatory framework evolution continues to shape market dynamics through updated emission standards, safety requirements, and consumer protection laws. Recent developments include enhanced vehicle inspection protocols, standardized warranty requirements, and improved transparency mandates that strengthen consumer confidence while ensuring market integrity.

Technology infrastructure expansion has accelerated with major investments in electric vehicle charging networks, digital platform capabilities, and data analytics systems. These developments support the transition toward sustainable transportation while enhancing market efficiency and customer experience across all transaction channels.

Industry consolidation trends have resulted in larger, more sophisticated dealer groups with enhanced capabilities for digital innovation, customer service, and inventory management. MarkWide Research indicates that consolidation has improved market efficiency while maintaining competitive dynamics through specialized service offerings.

Cross-border collaboration initiatives with neighboring European countries have improved inventory access, standardized documentation procedures, and enhanced competitive pricing options. These developments benefit consumers through expanded vehicle selection while creating operational efficiencies for participating dealers.

Financing innovation has introduced new products including extended warranty packages, maintenance contracts, and flexible payment options that reduce ownership costs and risks. Financial institutions have developed specialized programs for electric vehicle purchases, supporting market transition toward sustainable transportation solutions.

Strategic positioning recommendations emphasize the importance of quality differentiation and comprehensive service offerings in Switzerland’s premium-focused market environment. Successful participants should prioritize customer experience excellence, transparent pricing, and innovative service delivery to maintain competitive advantages in an increasingly sophisticated marketplace.

Digital transformation investments are essential for long-term competitiveness, with particular emphasis on mobile-optimized platforms, data analytics capabilities, and integrated customer relationship management systems. MWR analysis suggests that dealers investing in digital capabilities demonstrate significantly higher customer satisfaction and retention rates.

Sustainability integration should become a core strategic priority, with dealers developing expertise in hybrid and electric vehicle technologies, expanding charging infrastructure partnerships, and educating staff on evolving environmental regulations. Early movers in sustainable transportation solutions are positioned to capture growing market segments.

Partnership development with financial institutions, technology providers, and manufacturer certified pre-owned programs can enhance competitive positioning while providing additional revenue streams. Strategic alliances enable smaller dealers to access advanced capabilities and compete effectively against larger market participants.

Market expansion opportunities exist through geographic diversification, segment specialization, and innovative service offerings. Dealers should consider cross-border opportunities, niche market development, and subscription-based services to drive growth and differentiation in Switzerland’s evolving automotive landscape.

Market evolution projections indicate continued growth driven by Switzerland’s economic stability, environmental consciousness, and technological advancement. The market is expected to experience sustained growth rates supported by increasing vehicle replacement cycles, expanding electric vehicle adoption, and innovative financing solutions that enhance accessibility across diverse consumer segments.

Technology integration will accelerate with artificial intelligence, blockchain verification systems, and virtual reality showrooms becoming standard market features. These innovations will enhance transaction efficiency, improve customer experience, and provide competitive advantages for early adopters willing to invest in advanced technological capabilities.

Sustainability transformation will reshape market dynamics as Switzerland progresses toward carbon neutrality goals. Electric and hybrid vehicles are projected to represent majority market share within the next decade, requiring significant adaptations in dealer expertise, service capabilities, and inventory management strategies.

Consumer behavior evolution toward flexible ownership models, subscription services, and mobility-as-a-service solutions will create new market opportunities while challenging traditional business models. Successful market participants will adapt service offerings to meet changing consumer preferences while maintaining Switzerland’s characteristic quality standards.

Regulatory development will continue influencing market structure through evolving environmental standards, safety requirements, and consumer protection enhancements. MarkWide Research anticipates that regulatory changes will favor well-capitalized dealers capable of adapting to compliance requirements while maintaining operational efficiency and customer service excellence.

Switzerland’s used car market represents a sophisticated and resilient automotive ecosystem characterized by premium positioning, quality emphasis, and environmental consciousness. The market’s unique characteristics, including affluent consumer demographics, stringent regulatory frameworks, and advanced technology adoption, create distinctive opportunities and challenges for industry participants.

Future success in this market will require strategic focus on digital transformation, sustainability integration, and customer experience excellence. Market participants must adapt to evolving consumer preferences while maintaining Switzerland’s traditional emphasis on quality, reliability, and comprehensive service offerings that differentiate the market from neighboring countries.

Growth prospects remain positive, supported by economic stability, technological advancement, and increasing environmental awareness among Swiss consumers. The transition toward electric and hybrid vehicles, combined with innovative financing solutions and digital platform development, positions the market for continued expansion and evolution in the coming years.

What is Switzerland Used Car?

Switzerland Used Car refers to pre-owned vehicles available for sale in Switzerland, encompassing various makes, models, and conditions. The market includes cars sold through dealerships, private sellers, and online platforms.

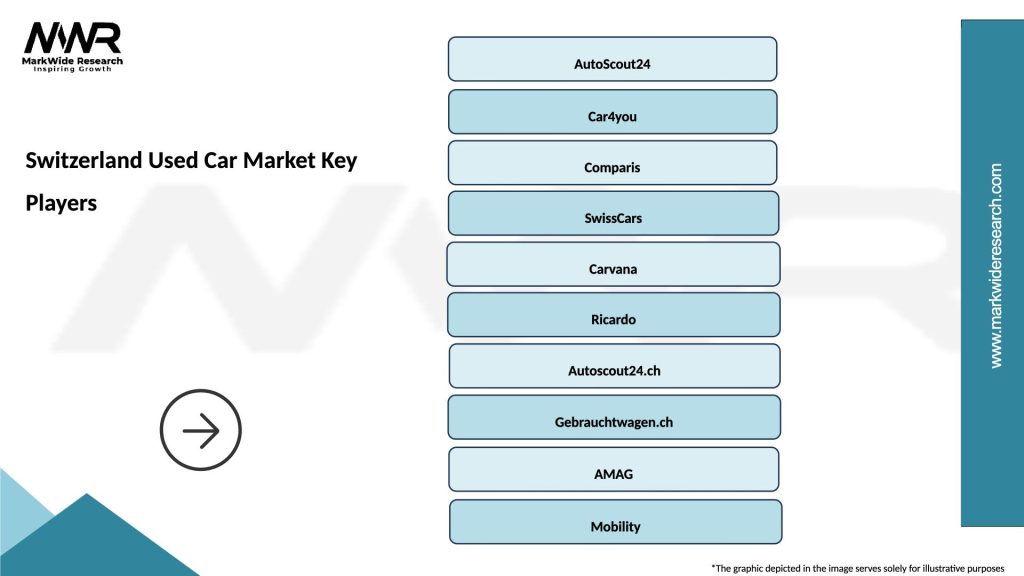

What are the key players in the Switzerland Used Car Market?

Key players in the Switzerland Used Car Market include AutoScout24, Car4you, and Comparis, which provide platforms for buying and selling used vehicles. These companies facilitate transactions and offer various services to consumers, among others.

What are the growth factors driving the Switzerland Used Car Market?

The growth of the Switzerland Used Car Market is driven by factors such as increasing consumer demand for affordable transportation, the rising popularity of online car sales platforms, and the growing awareness of sustainability in vehicle ownership.

What challenges does the Switzerland Used Car Market face?

The Switzerland Used Car Market faces challenges such as fluctuating vehicle prices, regulatory compliance regarding emissions and safety standards, and competition from new car sales, which can impact consumer choices.

What opportunities exist in the Switzerland Used Car Market?

Opportunities in the Switzerland Used Car Market include the potential for growth in electric and hybrid vehicle sales, the expansion of online marketplaces, and the increasing trend of car subscriptions, which cater to changing consumer preferences.

What trends are shaping the Switzerland Used Car Market?

Trends shaping the Switzerland Used Car Market include the rise of digital platforms for buying and selling cars, a growing focus on vehicle history transparency, and the increasing integration of technology in vehicles, enhancing consumer experience.

Switzerland Used Car Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | Sedan, SUV, Hatchback, Coupe |

| Fuel Type | Petrol, Diesel, Electric, Hybrid |

| Age Category | New, 1-3 Years, 4-6 Years, 7+ Years |

| Sales Channel | Dealerships, Online Platforms, Auctions, Private Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Used Car Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at