444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland life insurance market represents one of Europe’s most sophisticated and mature financial services sectors, characterized by exceptional stability, innovative product offerings, and robust regulatory frameworks. Switzerland’s position as a global financial hub has fostered a highly competitive life insurance landscape that serves both domestic and international clients with comprehensive coverage solutions.

Market dynamics in Switzerland reflect the country’s unique demographic profile, with an aging population driving increased demand for retirement planning and wealth preservation products. The sector demonstrates remarkable resilience, maintaining steady growth rates of approximately 3.2% annually while adapting to evolving consumer preferences and regulatory requirements. Digital transformation initiatives have accelerated significantly, with insurers investing heavily in technology-driven solutions to enhance customer experience and operational efficiency.

Swiss life insurance providers benefit from the country’s political stability, strong currency, and sophisticated financial infrastructure. The market encompasses traditional life insurance products, unit-linked policies, and innovative hybrid solutions that combine insurance protection with investment opportunities. Premium penetration rates in Switzerland exceed 4.8% of GDP, positioning the country among the highest globally for life insurance adoption.

The Switzerland life insurance market refers to the comprehensive ecosystem of financial institutions, products, and services that provide life coverage, retirement planning, and wealth management solutions to Swiss residents and international clients. This market encompasses various insurance products designed to protect individuals and families against financial risks associated with death, disability, and longevity while offering investment and savings opportunities.

Life insurance products in Switzerland include term life policies, whole life insurance, endowment policies, and unit-linked insurance plans that combine protection with investment components. The market serves diverse customer segments, from individual policyholders seeking basic coverage to high-net-worth clients requiring sophisticated wealth transfer and tax optimization strategies.

Switzerland’s life insurance sector demonstrates exceptional market maturity and innovation, driven by demographic trends, regulatory excellence, and technological advancement. The market benefits from Switzerland’s reputation as a global financial center, attracting both domestic and international clients seeking reliable insurance solutions and investment opportunities.

Key market characteristics include high penetration rates, sophisticated product offerings, and strong regulatory oversight that ensures consumer protection and market stability. Digital transformation initiatives have gained momentum, with 65% of insurers implementing comprehensive digitization strategies to improve customer engagement and operational efficiency.

Competitive dynamics feature both established Swiss insurers and international players, creating a diverse marketplace that fosters innovation and competitive pricing. The sector’s focus on sustainability and ESG principles has intensified, with insurers increasingly incorporating environmental and social considerations into their investment strategies and product development processes.

Strategic market insights reveal several critical trends shaping Switzerland’s life insurance landscape:

Demographic pressures serve as the primary catalyst for Switzerland’s life insurance market growth, with an aging population creating increased demand for retirement income solutions and healthcare coverage. The country’s life expectancy continues rising, necessitating longer-term financial planning and protection strategies that life insurance products effectively address.

Wealth accumulation trends among Swiss residents drive demand for sophisticated insurance products that combine protection with investment opportunities. High-net-worth individuals increasingly seek tax-efficient wealth transfer solutions, positioning life insurance as an attractive vehicle for estate planning and intergenerational wealth preservation.

Regulatory stability and Switzerland’s reputation for financial excellence attract international clients seeking secure insurance solutions. The country’s political neutrality, strong currency, and robust legal framework create an environment conducive to long-term insurance commitments and cross-border business development.

Technological advancement enables insurers to develop innovative products and improve customer experience through digital platforms, automated underwriting, and personalized service delivery. These technological capabilities enhance operational efficiency while reducing costs and improving accessibility for diverse customer segments.

Low interest rate environments present significant challenges for life insurers, particularly those offering guaranteed return products. Prolonged periods of minimal yields on government bonds and high-grade corporate securities compress profit margins and complicate product pricing strategies for traditional life insurance offerings.

Regulatory complexity increases compliance costs and operational burdens for insurance providers, particularly smaller companies lacking extensive regulatory expertise. Enhanced capital requirements under Solvency II frameworks demand substantial financial resources and sophisticated risk management capabilities that may strain some market participants.

Market saturation in certain segments limits growth opportunities, as Switzerland’s mature insurance market exhibits high penetration rates that constrain new customer acquisition. Intense competition among established players creates pricing pressures that may impact profitability and limit investment in innovation initiatives.

Economic uncertainty and global market volatility affect consumer confidence and purchasing decisions, potentially delaying life insurance purchases or prompting policy lapses. Currency fluctuations and international economic instability may also impact cross-border business opportunities and investment returns.

Digital transformation initiatives present substantial opportunities for market expansion and operational improvement. Insurers investing in artificial intelligence, machine learning, and automated processes can enhance customer experience, reduce costs, and develop innovative products that meet evolving consumer preferences and expectations.

Sustainable finance trends create opportunities for insurers to develop ESG-focused products that appeal to environmentally conscious consumers. Green insurance products and sustainable investment options within life insurance policies can differentiate providers and attract new customer segments committed to responsible investing.

Cross-border market expansion offers growth potential for Swiss insurers leveraging the country’s reputation for financial excellence. International clients seeking stable, well-regulated insurance solutions present opportunities for premium growth and market diversification beyond domestic boundaries.

Product innovation opportunities include developing hybrid solutions that combine insurance protection with modern investment strategies, cryptocurrency exposure, and alternative asset classes. These innovative products can attract younger demographics and high-net-worth clients seeking sophisticated financial planning tools.

Competitive intensity within Switzerland’s life insurance market drives continuous innovation and service improvement as established players and new entrants compete for market share. This dynamic environment benefits consumers through improved product offerings, competitive pricing, and enhanced customer service standards across the industry.

Technological disruption reshapes traditional business models, with insurtech companies introducing innovative solutions that challenge conventional approaches to product distribution, underwriting, and customer engagement. Established insurers respond by investing in digital capabilities and forming strategic partnerships with technology providers.

Regulatory evolution continues influencing market structure and operational practices, with authorities balancing consumer protection objectives against industry competitiveness. Recent regulatory changes have strengthened capital requirements while promoting innovation and market access for qualified providers.

Customer expectations evolve rapidly, driven by digital experiences in other industries and generational preferences for convenient, transparent, and personalized services. Insurers must adapt their offerings and delivery methods to meet these changing expectations while maintaining regulatory compliance and profitability.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Switzerland’s life insurance sector. Primary research includes extensive interviews with industry executives, regulatory officials, and market participants to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research components encompass analysis of regulatory filings, financial statements, industry reports, and statistical data from Swiss insurance authorities and international organizations. This approach provides quantitative foundations for market assessments and trend analysis while ensuring data accuracy and reliability.

Market modeling techniques incorporate econometric analysis, demographic projections, and scenario planning to forecast market developments and assess potential impacts of various factors on industry growth. These analytical approaches enable robust projections and strategic recommendations for market participants.

Validation processes include cross-referencing multiple data sources, expert consultations, and peer review procedures to ensure research quality and minimize analytical bias. Regular updates and monitoring of market developments maintain research relevance and accuracy over time.

German-speaking regions dominate Switzerland’s life insurance market, accounting for approximately 68% of total premium volume due to higher population density and economic activity concentration. These areas benefit from proximity to major financial centers and established insurance distribution networks that facilitate market penetration and customer service delivery.

French-speaking cantons represent a significant market segment with distinct preferences for certain product types and distribution channels. This region demonstrates strong demand for retirement planning solutions and cross-border insurance products, reflecting cultural and economic ties with neighboring France and international business activities.

Italian-speaking areas constitute a smaller but important market segment with unique characteristics influenced by proximity to Italy and specific demographic patterns. These regions show growing interest in innovative insurance products and digital service delivery methods that enhance accessibility and convenience.

Urban centers including Zurich, Geneva, and Basel drive market innovation and premium growth through concentrated high-net-worth populations and international business activities. These metropolitan areas serve as testing grounds for new products and distribution strategies that subsequently expand to other regions.

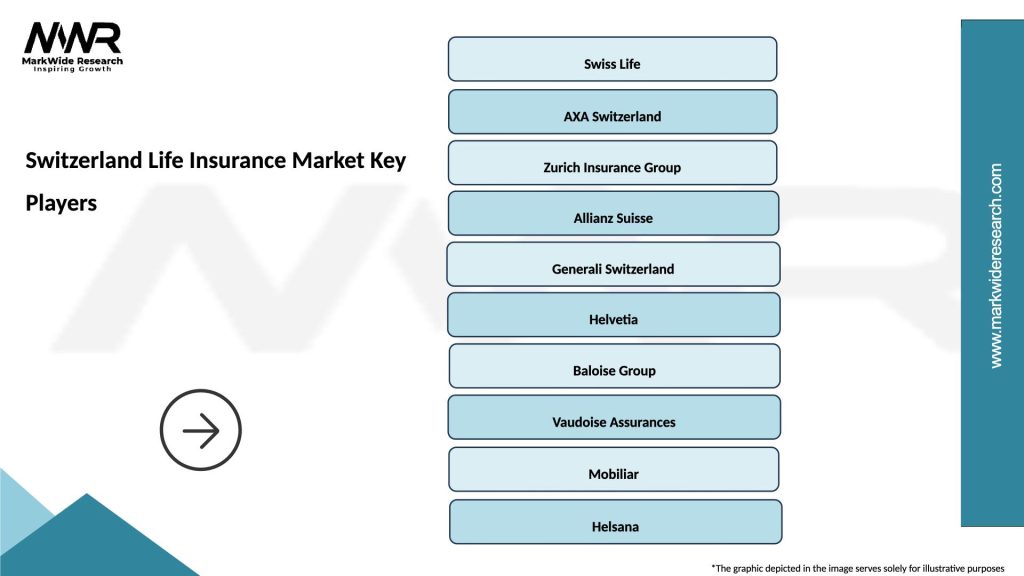

Market leadership in Switzerland’s life insurance sector features several prominent players with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on digital transformation, product innovation, and customer experience enhancement as key differentiators in the mature Swiss market. Companies invest heavily in technology platforms, data analytics, and personalized service delivery to maintain competitive advantages and attract new customers.

Product segmentation within Switzerland’s life insurance market encompasses diverse categories serving different customer needs and risk profiles:

By Product Type:

By Distribution Channel:

Individual life insurance represents the largest market segment, driven by personal financial planning needs and wealth protection objectives. This category benefits from Switzerland’s high-income population and sophisticated understanding of insurance benefits, resulting in strong demand for comprehensive coverage solutions.

Group life insurance through employer-sponsored programs provides significant market volume, with approximately 78% of Swiss workers covered through workplace benefits. These programs offer cost-effective coverage while providing employers with valuable employee benefits that enhance recruitment and retention capabilities.

Investment-linked products gain popularity among affluent clients seeking combination insurance and investment solutions. These products appeal to customers desiring market participation while maintaining life insurance protection, reflecting Switzerland’s sophisticated investor base and wealth management culture.

Retirement planning solutions experience robust demand as demographic trends create increased focus on longevity risk and income replacement needs. These products integrate with Switzerland’s pension system to provide comprehensive retirement security for individuals and families.

Insurance companies benefit from Switzerland’s stable regulatory environment, sophisticated customer base, and strong economic fundamentals that support sustainable business growth and profitability. The market’s maturity provides predictable demand patterns while offering opportunities for innovation and differentiation.

Policyholders enjoy comprehensive protection options, competitive pricing, and robust consumer protections that ensure fair treatment and claims satisfaction. Switzerland’s regulatory framework prioritizes consumer interests while maintaining market competitiveness and innovation incentives.

Distribution partners access diverse product portfolios, competitive compensation structures, and professional development opportunities that support successful insurance sales careers. The market’s sophistication demands high-quality intermediaries who receive appropriate support and training from insurance providers.

Regulatory authorities maintain market stability and consumer confidence through effective oversight while promoting innovation and competition. Switzerland’s regulatory approach balances prudential supervision with market development objectives, creating sustainable industry growth conditions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration transforms customer interactions, policy administration, and claims processing through advanced technology platforms. Insurers invest heavily in artificial intelligence, machine learning, and automated systems to enhance operational efficiency while improving customer experience and reducing processing times.

Personalization trends drive demand for customized insurance solutions that address individual risk profiles, financial objectives, and lifestyle preferences. Advanced data analytics enable insurers to develop tailored products and pricing strategies that better serve diverse customer segments and improve satisfaction levels.

Sustainability integration becomes increasingly important as insurers incorporate ESG principles into investment strategies, product development, and business operations. Climate risk considerations influence underwriting practices and portfolio management decisions, reflecting growing awareness of environmental impacts on long-term business sustainability.

Hybrid product development combines traditional insurance protection with modern investment opportunities, cryptocurrency exposure, and alternative asset classes. These innovative solutions appeal to younger demographics and sophisticated investors seeking comprehensive financial planning tools that adapt to changing market conditions.

Regulatory modernization initiatives enhance market efficiency while maintaining consumer protection standards. Recent developments include streamlined licensing procedures, digital-first regulatory processes, and updated solvency requirements that reflect modern risk management practices and technological capabilities.

Strategic partnerships between traditional insurers and technology companies accelerate innovation and improve competitive positioning. These collaborations enable rapid deployment of advanced capabilities while sharing development costs and risks associated with digital transformation initiatives.

Market consolidation activities reshape competitive dynamics as companies seek scale advantages and operational synergies. Merger and acquisition transactions focus on combining complementary capabilities, expanding geographic reach, and achieving cost efficiencies in increasingly competitive market conditions.

Product launches introduce innovative solutions addressing emerging customer needs and market opportunities. Recent developments include parametric insurance products, usage-based coverage options, and integrated financial planning platforms that combine insurance, investment, and banking services.

MarkWide Research recommends that insurance companies prioritize digital transformation investments to remain competitive in Switzerland’s evolving market landscape. Companies should focus on developing omnichannel customer experiences, automated underwriting capabilities, and data-driven product development processes that enhance operational efficiency and customer satisfaction.

Strategic diversification into adjacent markets and product categories can help insurers mitigate risks associated with market saturation and demographic challenges. Companies should consider expanding into health insurance, property coverage, and wealth management services that leverage existing customer relationships and distribution capabilities.

Innovation partnerships with insurtech companies, technology providers, and academic institutions can accelerate product development and capability enhancement. These collaborations enable traditional insurers to access cutting-edge technologies and innovative approaches while sharing development risks and costs.

Sustainability initiatives should become integral to business strategy, encompassing ESG investment policies, climate risk management, and sustainable product development. Companies demonstrating genuine commitment to environmental and social responsibility can differentiate themselves and attract environmentally conscious customers and investors.

Market growth prospects remain positive despite mature market conditions, with demographic trends and technological innovation driving continued expansion. MWR analysis projects steady growth rates of approximately 2.8% annually over the next five years, supported by increasing demand for retirement planning solutions and innovative insurance products.

Technology adoption will accelerate significantly, with artificial intelligence, blockchain, and Internet of Things technologies transforming traditional insurance operations. These technological advances will enable more accurate risk assessment, personalized pricing, and efficient claims processing while improving customer experience and operational efficiency.

Regulatory evolution will continue balancing consumer protection objectives with innovation promotion, creating frameworks that support technological advancement while maintaining market stability. Future regulations may address cryptocurrency integration, data privacy, and cross-border insurance activities as markets become increasingly interconnected.

Competitive dynamics will intensify as traditional boundaries between insurance, banking, and investment services blur. Companies offering integrated financial solutions and superior customer experiences will gain competitive advantages, while those failing to adapt may face market share erosion and profitability challenges.

Switzerland’s life insurance market represents a sophisticated and resilient sector characterized by strong regulatory frameworks, innovative product offerings, and exceptional market stability. The industry successfully balances traditional insurance principles with modern technological capabilities, creating comprehensive solutions that serve diverse customer needs while maintaining financial strength and regulatory compliance.

Future success in this market will depend on insurers’ ability to embrace digital transformation, develop innovative products, and maintain customer-centric approaches while navigating demographic challenges and competitive pressures. Companies that invest in technology, sustainability, and customer experience enhancement will be best positioned to capitalize on emerging opportunities and achieve sustainable growth in Switzerland’s dynamic insurance landscape.

What is Life Insurance?

Life insurance is a financial product that provides a monetary benefit to beneficiaries upon the death of the insured individual. It serves as a safety net for families, ensuring financial stability in the event of a loss.

What are the key players in the Switzerland Life Insurance Market?

Key players in the Switzerland Life Insurance Market include Zurich Insurance Group, Swiss Life Holding, and Helvetia Holding, among others. These companies offer a range of life insurance products tailored to meet the needs of consumers.

What are the growth factors driving the Switzerland Life Insurance Market?

The Switzerland Life Insurance Market is driven by factors such as an aging population, increasing awareness of financial planning, and a growing demand for retirement products. These elements contribute to the expansion of life insurance offerings.

What challenges does the Switzerland Life Insurance Market face?

Challenges in the Switzerland Life Insurance Market include regulatory changes, low interest rates affecting investment returns, and increasing competition from alternative financial products. These factors can impact profitability and market dynamics.

What opportunities exist in the Switzerland Life Insurance Market?

Opportunities in the Switzerland Life Insurance Market include the development of innovative insurance products, the integration of technology for better customer service, and the potential for expanding into underserved market segments. These trends can enhance market growth.

What trends are shaping the Switzerland Life Insurance Market?

Trends in the Switzerland Life Insurance Market include the rise of digital insurance platforms, personalized insurance solutions, and a focus on sustainability in product offerings. These trends reflect changing consumer preferences and technological advancements.

Switzerland Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Universal Life, Endowment |

| Customer Type | Individuals, Families, Corporates, High Net Worth |

| Distribution Channel | Direct Sales, Brokers, Banks, Online Platforms |

| Policy Features | Riders, Premium Waiver, Cash Value, Guaranteed Renewability |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at