444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland kitchen appliances product market represents a sophisticated and highly developed sector characterized by premium quality products, innovative technology integration, and strong consumer preference for energy-efficient solutions. Swiss consumers demonstrate exceptional purchasing power and discerning taste preferences, driving demand for high-end kitchen appliances that combine functionality with aesthetic appeal. The market exhibits remarkable stability with consistent growth patterns, supported by robust household income levels and a culture that values culinary excellence.

Market dynamics indicate sustained expansion driven by urbanization trends, increasing disposable income, and growing emphasis on smart home technologies. The Swiss kitchen appliances market benefits from strong domestic manufacturing capabilities alongside strategic imports of premium international brands. Consumer preferences lean heavily toward energy-efficient appliances, with 78% of Swiss households prioritizing sustainability features when making purchasing decisions.

Regional distribution shows concentrated demand in major urban centers including Zurich, Geneva, and Basel, where modern housing developments and kitchen renovations drive consistent appliance replacement cycles. The market demonstrates resilience against economic fluctuations, maintaining steady growth rates of approximately 4.2% annually over recent years, reflecting the essential nature of kitchen appliances and Swiss consumers’ willingness to invest in quality products.

The Switzerland kitchen appliances product market refers to the comprehensive ecosystem of household cooking, food preparation, and kitchen-related electrical and electronic devices sold within Swiss borders. This market encompasses major appliances including refrigerators, dishwashers, ovens, cooktops, and range hoods, alongside small appliances such as coffee machines, food processors, blenders, and specialized cooking equipment.

Market scope includes both built-in and freestanding appliances, covering residential and commercial segments with primary focus on household consumption. The definition extends to smart kitchen technologies, energy-efficient models, and premium appliance categories that align with Swiss quality standards and consumer expectations for durability, performance, and design excellence.

Switzerland’s kitchen appliances market demonstrates exceptional strength characterized by premium product positioning, technological innovation, and sustainable growth trajectories. The market benefits from unique consumer characteristics including high disposable income, quality consciousness, and strong environmental awareness that drives demand for energy-efficient appliances.

Key market drivers include ongoing urbanization, kitchen renovation trends, and increasing adoption of smart home technologies. Swiss consumers show particular preference for German and Italian appliance brands, while also supporting domestic manufacturers known for precision engineering. The market exhibits 65% preference for built-in appliances, reflecting modern kitchen design trends and space optimization requirements in Swiss homes.

Competitive landscape features established international brands alongside specialized Swiss manufacturers, creating a diverse market environment that caters to various consumer segments. Premium positioning remains dominant, with 72% of sales concentrated in mid-to-high price categories, demonstrating Swiss consumers’ willingness to invest in quality appliances with extended lifespans.

Strategic market insights reveal several critical trends shaping the Switzerland kitchen appliances landscape:

Primary market drivers propelling growth in Switzerland’s kitchen appliances sector stem from multiple interconnected factors that create sustained demand momentum. Economic prosperity serves as the fundamental driver, with Swiss households maintaining among the highest disposable incomes globally, enabling premium appliance purchases without significant financial constraints.

Urbanization trends continue driving market expansion as increasing numbers of Swiss residents move to urban centers, requiring modern kitchen setups in new apartments and renovated properties. This demographic shift creates consistent replacement demand and drives preference for space-efficient, high-performance appliances that maximize functionality within limited kitchen spaces.

Environmental consciousness represents a powerful market driver, with Swiss consumers leading global trends in sustainability awareness. This environmental focus translates directly into demand for energy-efficient appliances, with 83% of consumers actively seeking products with superior energy ratings and reduced environmental impact throughout their operational lifecycle.

Technological advancement drives market evolution as consumers increasingly seek smart appliances that integrate with home automation systems. The growing adoption of IoT technologies and connected home solutions creates opportunities for appliance manufacturers to differentiate through innovative features and enhanced user experiences.

Market restraints affecting the Switzerland kitchen appliances sector include several challenging factors that may limit growth potential. High product costs associated with premium positioning create barriers for price-sensitive consumer segments, potentially limiting market expansion in certain demographic categories despite overall economic prosperity.

Extended product lifecycles characteristic of Swiss consumer behavior create natural market limitations, as quality-conscious consumers typically retain appliances for extended periods, reducing replacement frequency compared to markets with shorter replacement cycles. This consumer behavior pattern, while positive for sustainability, limits recurring sales opportunities.

Regulatory complexity surrounding energy efficiency standards, safety certifications, and environmental compliance creates barriers for new market entrants and increases operational costs for existing manufacturers. These regulatory requirements, while beneficial for consumer protection and environmental goals, may limit product variety and increase market entry barriers.

Space constraints in urban Swiss housing present ongoing challenges for appliance sizing and installation, particularly in older buildings where kitchen renovations face structural limitations. These physical constraints may limit adoption of larger appliances and create demand for specialized compact solutions.

Significant market opportunities emerge from evolving consumer preferences and technological advancement in Switzerland’s kitchen appliances sector. Smart home integration presents substantial growth potential as Swiss consumers increasingly adopt connected home technologies, creating demand for appliances that seamlessly integrate with home automation systems and provide enhanced user control and monitoring capabilities.

Sustainability innovation offers compelling opportunities for manufacturers to develop next-generation appliances that exceed current energy efficiency standards while incorporating sustainable materials and manufacturing processes. Swiss consumers’ environmental consciousness creates receptive market conditions for premium eco-friendly appliances that deliver superior performance alongside environmental benefits.

Customization services represent emerging opportunities as consumers seek personalized solutions that match specific kitchen designs and functional requirements. The trend toward bespoke kitchen solutions creates opportunities for manufacturers to offer customizable appliances and specialized installation services that command premium pricing.

Commercial crossover opportunities exist in bringing professional-grade features and performance to residential markets, catering to Swiss consumers’ appreciation for quality and functionality. This trend creates potential for specialized appliance categories that bridge commercial and residential applications.

Market dynamics in Switzerland’s kitchen appliances sector reflect complex interactions between consumer preferences, technological innovation, and competitive positioning. Consumer behavior patterns demonstrate strong brand loyalty combined with willingness to invest in premium products that deliver long-term value and superior performance.

Competitive dynamics feature established European manufacturers competing alongside emerging smart appliance specialists, creating market segmentation based on technology integration, price positioning, and brand heritage. This competitive environment drives continuous innovation while maintaining focus on quality and reliability that Swiss consumers expect.

Supply chain dynamics benefit from Switzerland’s central European location and strong trade relationships, enabling efficient distribution of both domestic and imported appliances. However, global supply chain disruptions and component shortages occasionally impact product availability and pricing stability.

Technological dynamics accelerate market evolution as manufacturers integrate artificial intelligence, IoT connectivity, and advanced materials into appliance designs. These technological advances create opportunities for differentiation while meeting Swiss consumers’ expectations for innovation and performance excellence.

Comprehensive research methodology employed in analyzing Switzerland’s kitchen appliances market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research includes structured surveys of Swiss consumers, in-depth interviews with industry stakeholders, and direct engagement with appliance retailers and distributors across major Swiss markets.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and manufacturer financial disclosures to establish market sizing, growth trends, and competitive positioning. This approach ensures comprehensive market understanding through triangulation of multiple data sources.

Market segmentation analysis utilizes demographic data, purchasing behavior studies, and regional consumption patterns to identify distinct consumer segments and their specific appliance preferences. This segmentation approach enables precise targeting and strategic positioning recommendations for market participants.

Competitive intelligence gathering includes analysis of manufacturer strategies, product positioning, pricing approaches, and distribution channels to provide comprehensive competitive landscape assessment. This intelligence supports strategic decision-making for both existing market participants and potential new entrants.

Regional market analysis reveals distinct consumption patterns and preferences across Switzerland’s diverse geographic and linguistic regions. German-speaking regions including Zurich, Basel, and Bern account for approximately 68% of market demand, driven by higher population density, urban development, and strong economic activity that supports premium appliance purchases.

French-speaking regions centered around Geneva and Lausanne demonstrate sophisticated consumer preferences with strong affinity for design-focused appliances and French culinary traditions. This region shows particular demand for specialized cooking appliances and wine storage solutions, reflecting cultural preferences and lifestyle characteristics.

Italian-speaking Ticino exhibits unique market characteristics with preferences for Italian appliance brands and Mediterranean cooking styles. This region demonstrates growing demand for outdoor kitchen appliances and specialized equipment for traditional Italian cooking methods.

Urban versus rural dynamics show concentrated demand in major metropolitan areas where modern housing developments and kitchen renovations drive consistent appliance replacement cycles. Rural areas demonstrate different preferences, favoring larger appliances and traditional cooking methods while maintaining quality expectations characteristic of Swiss consumers.

Competitive landscape in Switzerland’s kitchen appliances market features a diverse mix of international premium brands, specialized European manufacturers, and emerging smart appliance companies. Market leadership positions are held by established brands that have built strong reputations for quality, reliability, and innovation over decades of Swiss market presence.

Competitive strategies focus on product differentiation through technology integration, energy efficiency improvements, and design innovation. Market participants invest heavily in research and development to maintain competitive advantages in quality, performance, and feature sophistication.

Market segmentation analysis reveals distinct categories based on product type, price positioning, and consumer demographics. By Product Category, the market divides into major appliances including refrigeration, cooking appliances, dishwashers, and small appliances encompassing coffee machines, food processors, and specialized cooking equipment.

By Price Segment:

By Technology Integration:

By Installation Type: Built-in appliances dominate with 65% market preference, while freestanding models serve specific consumer segments and rental property markets.

Refrigeration category represents the largest segment within Switzerland’s kitchen appliances market, driven by essential functionality and frequent replacement cycles. Swiss consumers demonstrate strong preference for energy-efficient models with advanced temperature control and spacious storage solutions. Premium features including wine storage compartments and smart connectivity drive category growth.

Cooking appliances including ovens, cooktops, and range hoods show robust demand driven by Swiss culinary culture and home cooking trends. Induction cooking technology gains significant traction with 58% adoption rate among new installations, reflecting energy efficiency priorities and cooking performance advantages.

Dishwasher segment demonstrates steady growth with increasing household adoption and replacement demand. Swiss consumers prioritize water efficiency, quiet operation, and flexible loading configurations that accommodate diverse dishware and cookware requirements.

Small appliances category shows dynamic growth driven by coffee culture, health-conscious cooking trends, and convenience-focused lifestyle changes. Coffee machines represent particularly strong demand with Swiss consumers investing in premium espresso and specialty coffee equipment for home use.

Industry participants benefit from Switzerland’s kitchen appliances market through multiple value creation opportunities. Manufacturers gain access to affluent consumer base willing to pay premium prices for quality products, enabling higher profit margins and brand positioning strategies that emphasize excellence and innovation.

Retailers and distributors benefit from stable demand patterns and strong consumer loyalty that supports long-term business relationships and predictable revenue streams. The Swiss market’s preference for quality over price creates opportunities for value-added services including installation, maintenance, and extended warranties.

Technology providers find receptive market conditions for smart appliance innovations and connected home solutions. Swiss consumers’ early adoption of new technologies creates opportunities for companies developing IoT platforms, mobile applications, and home automation integration solutions.

Service providers including installation specialists, maintenance companies, and kitchen designers benefit from consistent demand for professional services that complement appliance sales. The premium nature of Swiss appliance market supports higher service pricing and comprehensive support offerings.

Strengths:

Weaknesses:

Opportunities:

Threats:

Dominant market trends shaping Switzerland’s kitchen appliances sector reflect evolving consumer lifestyles and technological advancement. Smart connectivity emerges as a primary trend with increasing consumer demand for appliances that integrate with home automation systems and provide remote monitoring capabilities.

Sustainability focus intensifies as Swiss consumers prioritize environmental impact in purchasing decisions. This trend drives demand for appliances with superior energy efficiency ratings, sustainable materials, and extended product lifecycles that minimize environmental footprint.

Design integration becomes increasingly important as consumers seek appliances that seamlessly blend with modern kitchen aesthetics. This trend favors built-in solutions, minimalist designs, and customizable finishes that complement contemporary interior design preferences.

Health and wellness emphasis influences appliance selection as consumers seek products that support healthy cooking methods and food preservation. This trend drives demand for steam ovens, vacuum sealers, and specialized cooking appliances that preserve nutritional value.

Professional features in residential appliances gain popularity as Swiss consumers seek restaurant-quality cooking capabilities at home. This trend creates opportunities for manufacturers to offer commercial-grade performance in residential-sized appliances.

Recent industry developments demonstrate dynamic evolution within Switzerland’s kitchen appliances market. Technology integration accelerates with major manufacturers launching comprehensive smart appliance portfolios that offer enhanced connectivity, artificial intelligence features, and predictive maintenance capabilities.

Sustainability initiatives expand as manufacturers invest in eco-friendly materials, energy-efficient technologies, and circular economy principles. These developments align with Swiss environmental priorities and create competitive advantages for companies demonstrating genuine sustainability commitment.

Market consolidation continues as larger manufacturers acquire specialized brands and technology companies to expand their product portfolios and technological capabilities. This consolidation trend creates more comprehensive appliance ecosystems while potentially reducing market competition.

Distribution channel evolution includes expansion of online sales platforms, virtual showrooms, and augmented reality tools that enable consumers to visualize appliances in their kitchens before purchase. These developments enhance customer experience while reducing traditional retail dependencies.

Strategic recommendations for market participants focus on leveraging Switzerland’s unique market characteristics while addressing evolving consumer expectations. MarkWide Research analysis suggests that manufacturers should prioritize smart technology integration while maintaining the quality and reliability standards that Swiss consumers expect.

Product development strategies should emphasize energy efficiency improvements and sustainable materials to align with Swiss environmental consciousness. Companies investing in next-generation eco-friendly technologies will likely gain competitive advantages in this environmentally aware market.

Market positioning recommendations include focusing on premium segments where Swiss consumers demonstrate willingness to pay for superior quality and innovative features. However, manufacturers should also consider mid-range offerings that provide quality and features at more accessible price points.

Distribution strategy suggestions include strengthening relationships with specialized kitchen retailers while developing online capabilities that complement traditional sales channels. The combination of expert consultation and convenient online access appeals to Swiss consumer preferences.

Future market outlook for Switzerland’s kitchen appliances sector indicates continued growth driven by technological innovation, sustainability priorities, and evolving consumer lifestyles. Market projections suggest sustained expansion with annual growth rates maintaining 4.5% to 5.2% over the next five years, supported by consistent replacement demand and new household formation.

Technology evolution will likely accelerate with artificial intelligence, machine learning, and advanced connectivity becoming standard features rather than premium options. These technological advances will create new value propositions while potentially disrupting traditional appliance categories and usage patterns.

Sustainability requirements are expected to intensify with stricter energy efficiency standards and increased consumer demand for environmentally responsible products. Manufacturers that proactively develop sustainable solutions will likely capture growing market share in this environmentally conscious market.

Market dynamics will continue favoring companies that successfully balance innovation with reliability, meeting Swiss consumers’ expectations for cutting-edge features delivered through proven quality standards. MWR analysis indicates that successful market participants will be those that can demonstrate clear value propositions combining technology, sustainability, and traditional Swiss quality expectations.

Switzerland’s kitchen appliances market represents a sophisticated and resilient sector characterized by premium positioning, technological innovation, and sustainable growth prospects. The market benefits from unique consumer characteristics including high disposable income, quality consciousness, and environmental awareness that create favorable conditions for premium appliance manufacturers and innovative technology providers.

Market fundamentals remain strong with consistent demand drivers including urbanization, kitchen renovation trends, and increasing adoption of smart home technologies. Swiss consumers’ willingness to invest in quality appliances with extended lifecycles creates stable market conditions that support long-term business planning and strategic investment.

Future success in this market will depend on manufacturers’ ability to balance innovation with reliability while addressing evolving consumer expectations for sustainability, connectivity, and design integration. Companies that can deliver superior quality products with advanced features and environmental benefits will likely capture the greatest opportunities in Switzerland’s dynamic kitchen appliances market.

What is Switzerland Kitchen Appliances?

Switzerland Kitchen Appliances refers to a range of devices and tools used in cooking and food preparation, including ovens, refrigerators, dishwashers, and small appliances like blenders and coffee makers.

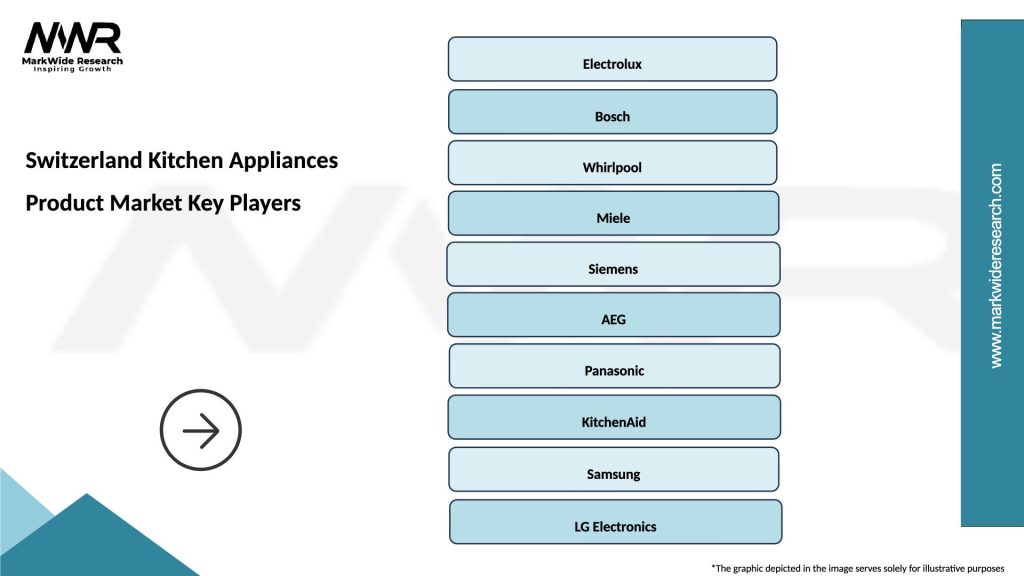

What are the key companies in the Switzerland Kitchen Appliances Product Market?

Key companies in the Switzerland Kitchen Appliances Product Market include Electrolux, Miele, Bosch, and Siemens, among others.

What are the growth factors driving the Switzerland Kitchen Appliances Product Market?

The growth of the Switzerland Kitchen Appliances Product Market is driven by increasing consumer demand for energy-efficient appliances, advancements in smart technology, and a growing trend towards home cooking and gourmet food preparation.

What challenges does the Switzerland Kitchen Appliances Product Market face?

Challenges in the Switzerland Kitchen Appliances Product Market include high competition among brands, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Switzerland Kitchen Appliances Product Market?

Opportunities in the Switzerland Kitchen Appliances Product Market include the rising popularity of smart home technologies, increasing demand for sustainable and eco-friendly appliances, and the potential for expansion into emerging markets.

What trends are shaping the Switzerland Kitchen Appliances Product Market?

Trends shaping the Switzerland Kitchen Appliances Product Market include the integration of IoT technology in appliances, a focus on energy efficiency, and the growing popularity of multifunctional kitchen devices.

Switzerland Kitchen Appliances Product Market

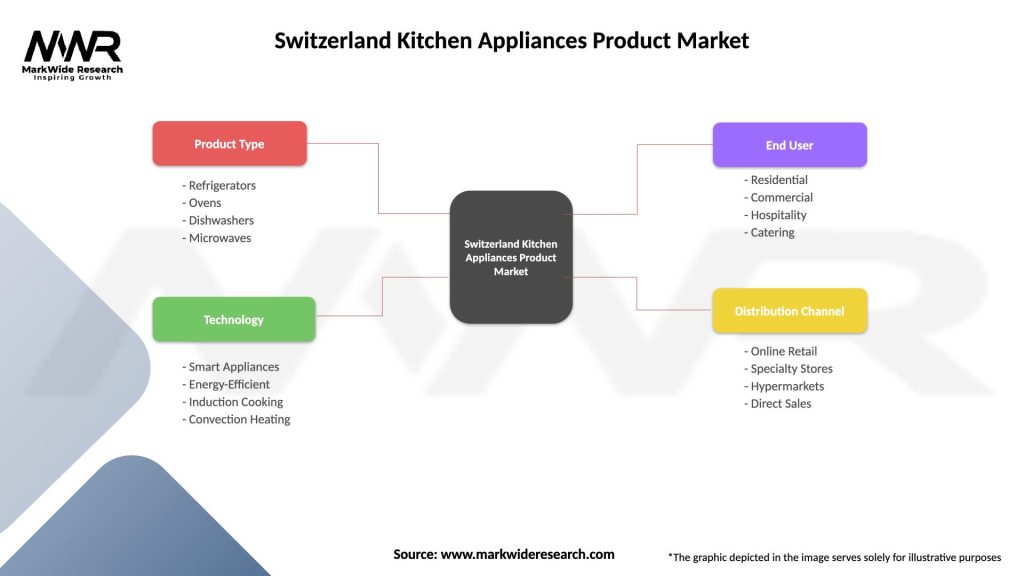

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Ovens, Dishwashers, Microwaves |

| Technology | Smart Appliances, Energy-Efficient, Induction Cooking, Convection Heating |

| End User | Residential, Commercial, Hospitality, Catering |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Kitchen Appliances Product Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at