444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland hair care market represents a sophisticated and premium segment within the European beauty industry, characterized by discerning consumers who prioritize quality, sustainability, and innovation. Swiss consumers demonstrate a strong preference for high-end hair care products that combine traditional craftsmanship with cutting-edge technology, creating a unique market dynamic that emphasizes both luxury and efficacy.

Market growth in Switzerland’s hair care sector has been consistently robust, driven by increasing consumer awareness about hair health, rising disposable income, and a growing trend toward premium personal care products. The market encompasses various product categories including shampoos, conditioners, styling products, hair treatments, and specialized solutions for different hair types and concerns.

Consumer behavior in Switzerland reflects a mature market where buyers are willing to invest in quality products that deliver visible results. The market is experiencing a significant shift toward natural and organic formulations, with approximately 68% of Swiss consumers actively seeking sulfate-free and paraben-free hair care solutions. This trend aligns with Switzerland’s broader commitment to environmental sustainability and health-conscious living.

Premium positioning dominates the Swiss hair care landscape, with luxury brands commanding substantial market share. The market benefits from Switzerland’s reputation for quality manufacturing and innovation, attracting both domestic and international brands seeking to establish a presence in this affluent market segment.

The Switzerland hair care market refers to the comprehensive ecosystem of hair care products, services, and solutions specifically tailored to Swiss consumers’ preferences and purchasing behaviors. This market encompasses all commercially available hair care products sold through various distribution channels including specialty beauty stores, pharmacies, department stores, and online platforms within Switzerland’s borders.

Market definition includes traditional hair care categories such as cleansing products, conditioning treatments, styling aids, and specialized therapeutic solutions designed to address specific hair concerns. The Swiss market is distinguished by its emphasis on premium quality, innovative formulations, and sustainable packaging solutions that resonate with environmentally conscious consumers.

Geographic scope covers all 26 cantons of Switzerland, with particular concentration in urban centers like Zurich, Geneva, Basel, and Bern where consumer spending power is highest. The market reflects Switzerland’s multilingual nature, with products marketed in German, French, Italian, and English to serve diverse linguistic communities.

Switzerland’s hair care market demonstrates exceptional resilience and growth potential, driven by affluent consumers who prioritize quality over price considerations. The market has evolved significantly over recent years, with natural and organic products capturing approximately 45% market share as consumers increasingly seek clean beauty alternatives.

Key market characteristics include strong brand loyalty, premium pricing acceptance, and sophisticated distribution networks that effectively serve both urban and rural populations. The market benefits from Switzerland’s strategic location in Europe, facilitating easy access to international brands while supporting domestic innovation in hair care technology.

Digital transformation has accelerated market evolution, with online sales channels experiencing remarkable growth. E-commerce platforms now account for a significant portion of hair care purchases, particularly among younger demographics who value convenience and product variety.

Sustainability initiatives have become central to market development, with brands investing heavily in eco-friendly packaging and sustainable ingredient sourcing. This trend reflects Swiss consumers’ environmental consciousness and willingness to support brands that align with their values.

Consumer preferences in Switzerland’s hair care market reveal several distinctive patterns that differentiate it from other European markets. The following insights highlight the most significant market characteristics:

Economic prosperity serves as the primary driver of Switzerland’s hair care market growth, with high disposable income levels enabling consumers to invest in premium beauty products. The country’s stable economy and strong currency provide a solid foundation for sustained market expansion.

Demographic trends significantly influence market dynamics, particularly the aging population’s increasing focus on hair health and appearance maintenance. Older consumers represent a growing segment seeking specialized products for age-related hair concerns, driving innovation in anti-aging hair care formulations.

Urbanization patterns contribute to market growth as city dwellers face environmental stressors that necessitate specialized hair care solutions. Urban pollution, hard water, and lifestyle factors create demand for protective and restorative hair care products.

Health and wellness consciousness has become a dominant market driver, with consumers increasingly viewing hair care as an extension of overall health maintenance. This trend supports the growth of products containing natural ingredients, vitamins, and therapeutic compounds.

Social media influence continues to drive market expansion by exposing consumers to new products, techniques, and beauty trends. Digital platforms facilitate product discovery and enable brands to reach target audiences more effectively than traditional marketing channels.

Professional salon industry growth indirectly benefits the retail hair care market as consumers seek to maintain salon results at home. This creates demand for professional-grade products available through retail channels.

High product costs represent a significant market restraint, particularly for price-sensitive consumer segments. While many Swiss consumers accept premium pricing, economic uncertainties can impact purchasing decisions and shift demand toward more affordable alternatives.

Regulatory compliance requirements in Switzerland and the European Union create barriers for new market entrants and increase operational costs for existing brands. Stringent safety and labeling regulations, while protecting consumers, can limit product innovation speed and market accessibility.

Market saturation in certain product categories poses challenges for brands seeking to establish market presence or expand market share. The mature nature of the Swiss hair care market means that growth often comes at the expense of competitors rather than through market expansion.

Supply chain disruptions have periodically affected product availability and pricing, particularly for brands dependent on international ingredient sourcing. These disruptions can impact brand reputation and consumer loyalty when product availability becomes inconsistent.

Consumer skepticism toward marketing claims has increased, requiring brands to invest more heavily in clinical testing and transparent communication. This skepticism can slow new product adoption and increase marketing costs.

Environmental regulations regarding packaging and ingredient safety continue to evolve, requiring ongoing compliance investments that can strain smaller brands’ resources and limit their competitive ability.

Sustainable innovation presents substantial opportunities for brands willing to invest in environmentally friendly product development and packaging solutions. Swiss consumers’ strong environmental consciousness creates a receptive market for truly sustainable hair care alternatives.

Digital commerce expansion offers significant growth potential, particularly in subscription-based models and personalized product recommendations. The convenience of online shopping combined with Swiss consumers’ technology adoption creates opportunities for innovative e-commerce strategies.

Men’s grooming segment represents an underexplored opportunity with substantial growth potential. As male consumers become more interested in personal care, specialized men’s hair care products can capture significant market share.

Customization technology enables brands to offer personalized hair care solutions based on individual hair analysis and preferences. This approach aligns with Swiss consumers’ appreciation for precision and quality, creating opportunities for premium positioning.

Professional partnerships between retail brands and salon professionals can create new distribution channels and enhance product credibility. These collaborations can drive both professional and retail sales growth.

Anti-aging hair care represents a growing opportunity as Switzerland’s aging population seeks solutions for age-related hair concerns. Products addressing hair thinning, graying, and texture changes can command premium pricing in this demographic.

Competitive intensity in Switzerland’s hair care market remains high, with established international brands competing alongside emerging natural and organic alternatives. This competition drives continuous innovation and maintains pressure on pricing strategies across all market segments.

Consumer loyalty patterns demonstrate both stability and evolution, with traditional brand preferences being challenged by newer entrants offering superior sustainability credentials or innovative formulations. Brand switching rates have increased by approximately 15% over recent years as consumers become more experimental.

Distribution channel evolution reflects changing consumer shopping behaviors, with traditional retail maintaining importance while online channels gain significant traction. The integration of online and offline shopping experiences has become crucial for brand success.

Innovation cycles have accelerated as brands respond to rapidly changing consumer preferences and technological advances. Product development timelines have shortened, requiring more agile research and development processes.

Pricing dynamics reflect the premium nature of the Swiss market, with consumers generally accepting higher prices for perceived quality and innovation. However, value perception has become more sophisticated, requiring brands to clearly communicate product benefits.

Seasonal fluctuations create predictable demand patterns that brands must navigate effectively. Winter months typically see increased demand for moisturizing and protective products, while summer drives sales of UV protection and styling products.

Primary research for the Switzerland hair care market analysis involved comprehensive consumer surveys conducted across all major Swiss urban centers and representative rural areas. Data collection methods included structured interviews, focus groups, and online questionnaires designed to capture detailed insights into purchasing behaviors, brand preferences, and emerging trends.

Secondary research encompassed analysis of industry reports, trade publications, company financial statements, and regulatory filings to establish market size, competitive positioning, and growth trajectories. This research provided essential context for understanding market dynamics and competitive landscapes.

Market segmentation analysis utilized both demographic and psychographic variables to identify distinct consumer groups and their specific hair care needs. This segmentation approach enabled detailed analysis of market opportunities and competitive positioning strategies.

Retail channel analysis involved systematic evaluation of distribution networks, including specialty beauty stores, pharmacies, department stores, and online platforms. This analysis provided insights into channel performance, consumer preferences, and emerging distribution trends.

Expert interviews with industry professionals, including salon owners, distributors, and brand managers, provided qualitative insights that complemented quantitative research findings. These interviews offered valuable perspectives on market trends and future developments.

Data validation processes ensured research accuracy through triangulation of multiple data sources and verification of key findings through independent research channels. This rigorous approach maintained research integrity and reliability.

German-speaking regions dominate Switzerland’s hair care market, accounting for approximately 65% of total consumption due to higher population density and economic activity. Cities like Zurich and Basel demonstrate particularly strong demand for premium hair care products, with consumers showing high brand loyalty and willingness to invest in quality solutions.

French-speaking areas, primarily centered around Geneva and Lausanne, represent approximately 25% of market share and exhibit distinct preferences for French beauty brands and luxury formulations. This region shows strong affinity for products emphasizing elegance and sophistication, often preferring established European beauty houses.

Italian-speaking regions in southern Switzerland contribute a smaller but significant portion of market demand, with consumers demonstrating preferences for Mediterranean-inspired formulations and natural ingredients. This region shows growing interest in organic and artisanal hair care products.

Urban versus rural consumption patterns reveal interesting dynamics, with urban areas driving innovation adoption and premium product sales, while rural regions maintain stronger loyalty to traditional brands and formulations. Urban centers account for approximately 78% of new product launches and premium segment growth.

Cross-border shopping influences regional market dynamics, particularly in areas near German, French, and Italian borders where consumers may seek products unavailable domestically or take advantage of price differences. This behavior affects local market sizing and competitive dynamics.

Tourism impact on regional markets varies significantly, with tourist-heavy areas like ski resorts and lake regions experiencing seasonal demand spikes for specific product categories, particularly travel-sized and luxury items purchased by international visitors.

Market leadership in Switzerland’s hair care sector is shared among several key players, each bringing distinct competitive advantages and market positioning strategies:

Competitive strategies vary significantly among market players, with established brands focusing on innovation and brand heritage while newer entrants emphasize sustainability and personalization. The competitive landscape continues evolving as consumer preferences shift toward more conscious consumption patterns.

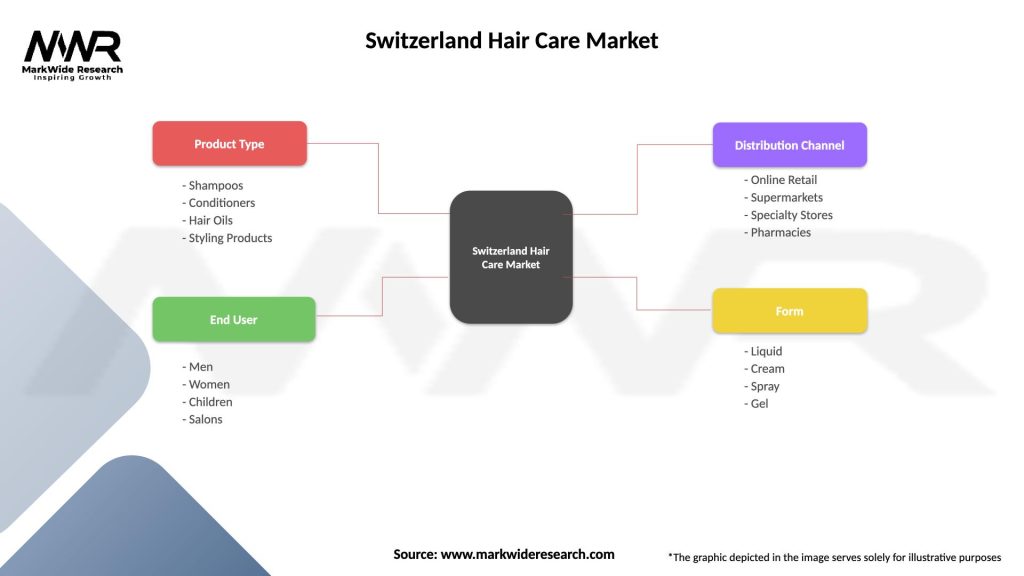

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Shampoo category dominates the Swiss hair care market with sophisticated formulations addressing specific hair types and concerns. Sulfate-free formulations have captured approximately 52% of premium shampoo sales, reflecting consumer preference for gentle cleansing solutions. The category shows strong innovation in areas like color protection, volume enhancement, and scalp health.

Conditioning products have evolved beyond basic moisturizing to include specialized treatments for damaged, colored, or chemically treated hair. Leave-in conditioners and deep conditioning masks represent the fastest-growing subsegments, driven by increased awareness of hair health maintenance.

Styling products reflect Swiss consumers’ preference for natural-looking styles and long-lasting hold without stiffness or residue. Heat protection products have become essential as styling tool usage increases, creating opportunities for multi-functional formulations.

Treatment products represent the highest-margin category, with consumers willing to invest in specialized solutions for specific concerns. Hair masks, scalp treatments, and repair serums command premium pricing and demonstrate strong growth potential.

Natural and organic categories continue expanding across all product types, with consumers seeking certified organic ingredients and sustainable packaging. This trend has created opportunities for both established brands and new market entrants.

Men’s hair care has emerged as a distinct category with specialized formulations and marketing approaches. Products designed specifically for men’s hair and scalp needs are gaining traction, particularly in urban markets.

Brand manufacturers benefit from Swiss consumers’ willingness to pay premium prices for quality products, enabling higher profit margins and sustainable business models. The market’s stability and predictable growth patterns facilitate long-term strategic planning and investment decisions.

Retailers advantage from strong consumer loyalty and consistent demand patterns that support inventory planning and promotional strategies. The premium nature of the market enables healthy margins across distribution channels, particularly for specialty beauty retailers.

Consumers benefit from extensive product variety, high quality standards, and innovative formulations that address specific hair care needs. The competitive market environment ensures continuous product improvement and value enhancement.

Salon professionals benefit from strong retail market performance that supports professional product sales and creates opportunities for education and partnership with retail brands. The market’s emphasis on quality aligns with professional standards and expertise.

Ingredient suppliers benefit from growing demand for premium and natural ingredients, creating opportunities for specialized suppliers and innovative ingredient development. The market’s focus on sustainability drives demand for ethically sourced materials.

Investment community benefits from the market’s stability and growth potential, with hair care representing a defensive consumer goods category that maintains demand across economic cycles. The premium positioning of the Swiss market provides attractive investment opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean beauty movement continues gaining momentum in Switzerland, with consumers increasingly scrutinizing ingredient lists and seeking products free from controversial chemicals. This trend has driven reformulation efforts across major brands and created opportunities for clean beauty specialists.

Personalization technology is transforming how consumers select and use hair care products, with brands investing in diagnostic tools and customized formulations. AI-powered recommendations and personalized product creation are becoming competitive differentiators in the premium market segment.

Sustainable packaging has evolved from a nice-to-have feature to a consumer expectation, with brands investing heavily in recyclable, refillable, and biodegradable packaging solutions. This trend reflects Switzerland’s strong environmental consciousness and regulatory environment.

Multi-functional products are gaining popularity as time-conscious consumers seek efficient solutions that combine multiple benefits. Products that cleanse, condition, and protect in single formulations are particularly appealing to busy urban professionals.

Professional-grade home care continues expanding as consumers seek salon-quality results from retail products. This trend has blurred traditional boundaries between professional and consumer products, creating opportunities for premium positioning.

Digital influence on product discovery and purchase decisions has intensified, with social media platforms and beauty influencers playing crucial roles in trend creation and product adoption. Influencer partnerships now drive approximately 42% of new product awareness among younger demographics.

Sustainability initiatives have accelerated across the industry, with major brands announcing ambitious environmental goals and investing in sustainable ingredient sourcing and packaging solutions. These initiatives reflect both consumer demand and regulatory pressure for environmental responsibility.

Digital transformation has accelerated, particularly following global events that shifted consumer shopping behaviors toward online channels. Brands have invested heavily in e-commerce capabilities, virtual consultations, and digital marketing strategies to maintain customer engagement.

Innovation partnerships between beauty brands and technology companies have increased, focusing on personalization tools, ingredient research, and sustainable packaging solutions. These collaborations are driving next-generation product development and consumer experiences.

Regulatory developments in the European Union continue impacting the Swiss market, with new requirements for ingredient safety, packaging sustainability, and product labeling affecting all market participants. Brands must continuously adapt to evolving regulatory landscapes.

Merger and acquisition activity has intensified as brands seek to expand market presence, acquire innovative technologies, or gain access to sustainable ingredient sources. This consolidation trend is reshaping competitive dynamics across the industry.

Professional channel evolution has seen increased collaboration between salon professionals and retail brands, creating hybrid distribution models and educational partnerships that benefit both professional and consumer markets.

MarkWide Research recommends that brands prioritize sustainability initiatives as a core competitive strategy, given Swiss consumers’ strong environmental consciousness and willingness to pay premium prices for sustainable products. Investment in eco-friendly packaging and ethically sourced ingredients will become increasingly important for market success.

Digital commerce capabilities require immediate attention and investment, as online channels continue gaining market share and consumer preference. Brands should develop comprehensive omnichannel strategies that integrate online and offline experiences seamlessly.

Personalization technology presents significant opportunities for differentiation and premium positioning. Brands should invest in diagnostic tools, customization capabilities, and data analytics to deliver personalized hair care solutions that command higher prices and build stronger customer loyalty.

Men’s market development represents an underexplored opportunity with substantial growth potential. Brands should develop specialized products and marketing strategies targeting male consumers’ specific needs and preferences.

Professional partnerships can create valuable distribution channels and enhance brand credibility. Collaboration with salon professionals can drive both professional and retail sales while providing valuable consumer insights and product feedback.

Innovation focus should prioritize multi-functional products that address time-conscious consumers’ needs for efficiency without compromising quality. Products that combine multiple benefits in single formulations can command premium pricing and drive market differentiation.

Market evolution in Switzerland’s hair care sector will be driven by continued premiumization, sustainability focus, and digital transformation. MWR analysis indicates that the market will maintain steady growth with increasing emphasis on personalized solutions and environmental responsibility.

Consumer preferences will continue shifting toward clean, sustainable, and personalized products, creating opportunities for brands that can effectively address these evolving needs. The trend toward conscious consumption will intensify, requiring brands to demonstrate authentic commitment to sustainability and social responsibility.

Technology integration will accelerate, with artificial intelligence, augmented reality, and personalization tools becoming standard features in the hair care shopping experience. Brands that successfully integrate technology with traditional beauty expertise will gain competitive advantages.

Distribution channel evolution will continue, with online platforms gaining market share while physical retail adapts to provide enhanced customer experiences and services. The integration of digital and physical channels will become crucial for brand success.

Innovation cycles will accelerate as brands respond to rapidly changing consumer preferences and competitive pressures. Product development timelines will continue shortening, requiring more agile research and development processes and faster market response capabilities.

Market growth is projected to maintain a steady trajectory, with premium segments outperforming mass market categories. The market’s resilience and Swiss consumers’ commitment to quality will support continued expansion despite potential economic uncertainties.

Switzerland’s hair care market represents a sophisticated and resilient segment within the European beauty industry, characterized by discerning consumers who prioritize quality, sustainability, and innovation. The market’s premium positioning and stable growth trajectory create attractive opportunities for brands willing to invest in quality formulations and sustainable practices.

Key success factors in this market include understanding Swiss consumers’ unique preferences for premium products, environmental consciousness, and willingness to invest in quality solutions. Brands that can effectively combine innovation with sustainability while maintaining Swiss quality standards will be best positioned for long-term success.

Future growth will be driven by continued premiumization, digital transformation, and the evolution of consumer preferences toward personalized and sustainable solutions. The market’s maturity requires sophisticated strategies that emphasize differentiation, innovation, and authentic brand positioning to capture and maintain market share in this competitive landscape.

What is Hair Care?

Hair care refers to the practices and products used to maintain and enhance the health and appearance of hair. This includes a variety of products such as shampoos, conditioners, treatments, and styling products tailored for different hair types and concerns.

What are the key companies in the Switzerland Hair Care Market?

Key companies in the Switzerland Hair Care Market include L’Oréal, Procter & Gamble, Henkel, and Coty, among others. These companies offer a wide range of hair care products catering to various consumer needs and preferences.

What are the growth factors driving the Switzerland Hair Care Market?

The growth of the Switzerland Hair Care Market is driven by increasing consumer awareness about hair health, rising demand for organic and natural hair care products, and the influence of social media on beauty trends. Additionally, innovations in product formulations are attracting more consumers.

What challenges does the Switzerland Hair Care Market face?

The Switzerland Hair Care Market faces challenges such as intense competition among brands, changing consumer preferences towards sustainable products, and regulatory compliance regarding product safety and ingredients. These factors can impact market dynamics and brand positioning.

What opportunities exist in the Switzerland Hair Care Market?

Opportunities in the Switzerland Hair Care Market include the growing trend of personalized hair care solutions, the rise of e-commerce platforms for product distribution, and increasing interest in eco-friendly packaging. Brands that adapt to these trends may capture a larger market share.

What trends are shaping the Switzerland Hair Care Market?

Trends shaping the Switzerland Hair Care Market include the shift towards clean beauty, the popularity of multifunctional hair care products, and the increasing use of technology in product development. Consumers are also gravitating towards products that promote scalp health and sustainability.

Switzerland Hair Care Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoos, Conditioners, Hair Oils, Styling Products |

| End User | Men, Women, Children, Salons |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Form | Liquid, Cream, Spray, Gel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Hair Care Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at