444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland data center market represents one of Europe’s most sophisticated and strategically positioned digital infrastructure landscapes. Switzerland’s unique combination of political stability, robust regulatory framework, and advanced technological infrastructure has established the country as a premier destination for data center investments and operations. The market demonstrates exceptional resilience and growth potential, driven by increasing digitalization across industries and the nation’s commitment to maintaining its position as a global financial and technology hub.

Market dynamics in Switzerland are characterized by strong demand from financial services, healthcare, and multinational corporations seeking secure, reliable data storage and processing capabilities. The country’s strategic location in the heart of Europe, combined with its excellent connectivity to major European markets, makes it an ideal choice for organizations requiring low-latency access to both Western and Eastern European regions. Growth projections indicate the market is expanding at a compound annual growth rate (CAGR) of 8.2%, reflecting sustained investment in digital transformation initiatives.

Switzerland’s data center ecosystem benefits from the country’s commitment to renewable energy, with approximately 60% of data centers now powered by clean energy sources. This environmental focus aligns with global sustainability trends and attracts environmentally conscious enterprises. The market’s maturity is evidenced by the presence of both hyperscale facilities and specialized colocation providers, creating a diverse landscape that serves various customer segments from small businesses to large multinational corporations.

The Switzerland data center market refers to the comprehensive ecosystem of facilities, services, and infrastructure dedicated to housing, managing, and maintaining computer systems, servers, and associated components within Swiss territory. This market encompasses various types of data centers, including enterprise facilities, colocation centers, hyperscale installations, and edge computing nodes that collectively support the digital infrastructure needs of businesses, government entities, and service providers operating in or serving the Swiss market.

Data center operations in Switzerland involve the provision of critical services including server hosting, cloud computing resources, disaster recovery solutions, and managed IT services. These facilities are characterized by high levels of security, redundancy, and reliability, meeting stringent Swiss and international standards for data protection and operational excellence. The market includes both domestic and international operators who leverage Switzerland’s favorable business environment and strategic geographic position.

Switzerland’s data center market continues to demonstrate robust growth momentum, driven by accelerating digital transformation across key industries and increasing demand for secure, compliant data storage solutions. The market benefits from Switzerland’s reputation for political stability, strong privacy laws, and advanced telecommunications infrastructure, making it an attractive destination for both domestic and international data center investments.

Key market drivers include the growing adoption of cloud services, increasing data generation from IoT devices, and stringent data sovereignty requirements that favor local data storage solutions. The financial services sector, which represents approximately 35% of data center demand, continues to be a primary growth driver, along with expanding requirements from healthcare, manufacturing, and government sectors.

Technological advancement remains a cornerstone of market development, with operators increasingly investing in edge computing capabilities, artificial intelligence integration, and sustainable cooling technologies. The market’s competitive landscape features a mix of global hyperscale providers, regional specialists, and local operators, creating a dynamic environment that fosters innovation and service differentiation.

Strategic positioning within the European data center ecosystem has enabled Switzerland to capture significant market share in high-value segments. The following insights highlight critical market characteristics:

Digital transformation initiatives across Swiss enterprises continue to fuel substantial demand for data center services. Organizations are increasingly migrating critical workloads to professional data center facilities to benefit from enhanced security, reliability, and scalability. The acceleration of cloud adoption, particularly hybrid and multi-cloud strategies, has created sustained demand for colocation and managed services.

Regulatory compliance requirements serve as a significant market driver, with Swiss and European data protection regulations mandating specific data handling and storage practices. The General Data Protection Regulation (GDPR) and Swiss Federal Data Protection Act create compelling reasons for organizations to utilize local data center facilities that can ensure compliance with territorial data residency requirements.

Financial services expansion continues to drive premium data center demand, with banks, insurance companies, and fintech organizations requiring ultra-reliable infrastructure for mission-critical applications. The sector’s growth in digital banking, algorithmic trading, and real-time payment processing creates ongoing demand for low-latency, high-availability data center services.

Edge computing adoption represents an emerging driver as organizations seek to process data closer to end users and IoT devices. This trend is particularly relevant in manufacturing, healthcare, and smart city applications where real-time data processing capabilities are essential for operational efficiency and service delivery.

High operational costs present ongoing challenges for data center operators in Switzerland, with expensive real estate, elevated energy prices, and premium labor costs impacting overall profitability. These factors can limit market accessibility for price-sensitive customers and may drive some workloads to lower-cost European alternatives.

Limited land availability in prime locations constrains expansion opportunities for data center operators, particularly in major urban centers like Zurich and Geneva. Zoning restrictions and environmental regulations further complicate site selection and development processes, potentially limiting market growth in preferred locations.

Skilled labor shortages in specialized technical roles create operational challenges and increase recruitment costs. The competitive market for data center engineers, network specialists, and cybersecurity professionals can impact service quality and expansion capabilities for operators seeking to scale their operations.

Energy infrastructure limitations in certain regions may constrain the development of large-scale hyperscale facilities. While Switzerland has excellent overall energy infrastructure, specific locations may face capacity constraints that limit the size and scope of potential data center developments.

Sustainability leadership presents significant opportunities for Swiss data center operators to differentiate their services through environmental excellence. The country’s abundant renewable energy resources and commitment to carbon neutrality create competitive advantages for operators who can demonstrate superior environmental performance compared to alternatives in other European markets.

Edge computing expansion offers substantial growth potential as 5G networks deploy and IoT applications proliferate. Swiss operators are well-positioned to develop distributed edge infrastructure that serves both domestic and regional European markets, particularly in industrial automation and smart city applications.

Financial technology growth continues to create opportunities for specialized data center services tailored to fintech startups, cryptocurrency operations, and digital banking platforms. Switzerland’s favorable regulatory environment for financial innovation supports the development of niche data center services for these emerging sectors.

Cross-border connectivity opportunities exist for operators who can develop enhanced network connections to other European financial centers and emerging markets. Improved connectivity infrastructure can attract international customers seeking optimal access to multiple geographic regions from Swiss-based facilities.

Competitive intensity in the Switzerland data center market reflects the presence of both global hyperscale operators and specialized local providers. This dynamic creates a multi-tiered market structure where different operators compete in distinct segments based on service offerings, pricing models, and target customer profiles. Market consolidation trends indicate that approximately 45% of capacity is controlled by the top five operators, while numerous smaller providers serve niche markets and specialized requirements.

Technology evolution drives continuous market transformation as operators invest in next-generation infrastructure including liquid cooling systems, AI-optimized architectures, and software-defined networking capabilities. These technological advances enable improved efficiency, reduced environmental impact, and enhanced service capabilities that create competitive differentiation opportunities.

Customer behavior patterns show increasing sophistication in data center service procurement, with enterprises demanding comprehensive service level agreements, detailed compliance documentation, and flexible scaling options. This evolution requires operators to develop more sophisticated service delivery models and customer relationship management capabilities.

Pricing dynamics reflect the premium nature of the Swiss market, with customers generally willing to pay higher rates for superior security, compliance, and reliability. However, competitive pressure from alternative European locations creates ongoing pressure for operators to demonstrate clear value propositions that justify premium pricing structures.

Comprehensive market analysis for the Switzerland data center market employs multiple research methodologies to ensure accuracy and completeness of findings. Primary research includes direct interviews with data center operators, enterprise customers, and industry experts to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research components encompass analysis of public financial reports, regulatory filings, industry publications, and government statistics related to data center operations and digital infrastructure development. This approach provides quantitative foundations for market sizing and trend analysis while supporting qualitative insights from primary research activities.

Market validation processes include cross-referencing multiple data sources, conducting expert review sessions, and performing sensitivity analysis on key market assumptions. MarkWide Research employs rigorous quality control procedures to ensure research findings accurately reflect current market conditions and provide reliable foundations for strategic decision-making.

Forecasting methodologies combine statistical modeling techniques with expert judgment to project future market developments. Multiple scenario analyses account for various potential market outcomes, providing stakeholders with comprehensive perspectives on possible future market conditions and growth trajectories.

Zurich metropolitan area dominates the Swiss data center landscape, accounting for approximately 55% of total market capacity. The region’s concentration of financial services companies, multinational corporations, and technology firms creates substantial demand for premium data center services. Excellent international connectivity and proximity to major European business centers reinforce Zurich’s position as the primary data center hub.

Geneva region represents the second-largest market concentration, driven by international organizations, commodity trading companies, and luxury goods manufacturers. The area’s unique position as a global diplomatic and business center creates specialized requirements for secure, compliant data center services that serve international clientele.

Basel area demonstrates growing importance in the data center market, particularly for pharmaceutical and life sciences companies requiring specialized compliance and security capabilities. The region’s proximity to German and French markets creates opportunities for cross-border service delivery and regional hub development.

Emerging regional markets including Bern, Lausanne, and other urban centers show increasing data center activity as edge computing requirements grow and organizations seek distributed infrastructure solutions. These markets represent approximately 25% of total capacity and demonstrate strong growth potential as digital transformation accelerates across all Swiss regions.

Market leadership in the Switzerland data center sector is characterized by a diverse mix of international hyperscale operators, regional specialists, and local service providers. The competitive environment fosters innovation and service differentiation while maintaining high standards for security, reliability, and compliance.

By Service Type: The Switzerland data center market encompasses multiple service categories, each addressing specific customer requirements and use cases. Colocation services represent the largest segment, providing customers with secure facility space, power, and cooling while maintaining control over their IT infrastructure. Managed hosting services offer comprehensive infrastructure management, allowing customers to focus on core business activities while leveraging professional data center operations expertise.

By Industry Vertical: Financial services constitute the dominant customer segment, requiring ultra-reliable infrastructure for trading systems, payment processing, and regulatory compliance. Healthcare organizations represent a growing segment with specialized requirements for patient data protection and medical device connectivity. Manufacturing companies increasingly utilize data center services for industrial IoT applications and supply chain optimization.

By Facility Size: Enterprise data centers serve single organizations with dedicated infrastructure requirements, while hyperscale facilities support cloud service providers and large-scale computing operations. Edge data centers represent an emerging segment focused on low-latency applications and distributed computing requirements.

By Deployment Model: Private cloud deployments offer dedicated resources for security-sensitive applications, while hybrid cloud solutions combine on-premises and cloud resources for optimal flexibility and cost management. Multi-cloud strategies utilize multiple service providers to avoid vendor lock-in and optimize performance across different application requirements.

Hyperscale Data Centers: Large-scale facilities designed to support cloud service providers and hyperscale computing operations demonstrate strong growth potential in Switzerland. These facilities typically feature advanced automation, efficient cooling systems, and scalable architectures that can accommodate rapid capacity expansion. Hyperscale adoption in Switzerland shows approximately 15% annual growth as cloud providers expand their European presence.

Colocation Services: Traditional colocation remains the backbone of the Swiss data center market, providing customers with secure, reliable infrastructure while maintaining control over their IT assets. Premium colocation services in Switzerland command higher pricing due to superior security, compliance capabilities, and strategic location advantages.

Edge Computing Facilities: Distributed edge infrastructure represents the fastest-growing category, driven by 5G deployment, IoT proliferation, and real-time application requirements. Edge facilities in Switzerland focus on serving industrial automation, smart city applications, and content delivery networks that require ultra-low latency performance.

Managed Services: Comprehensive managed data center services show increasing demand as organizations seek to outsource complex infrastructure management while focusing on core business activities. These services include monitoring, maintenance, security management, and compliance support tailored to Swiss regulatory requirements.

Enterprise Customers benefit from access to world-class data center infrastructure without the substantial capital investments required for building and maintaining private facilities. Swiss data centers provide enhanced security, regulatory compliance, and operational reliability that enable organizations to focus resources on core business activities while ensuring critical IT infrastructure meets the highest standards.

Data Center Operators leverage Switzerland’s favorable business environment, political stability, and strategic location to build sustainable competitive advantages in the European market. The country’s commitment to renewable energy and environmental sustainability creates opportunities for operators to differentiate their services while meeting growing customer demands for environmentally responsible infrastructure.

Technology Vendors find opportunities to deploy cutting-edge solutions in Switzerland’s sophisticated data center ecosystem. The market’s emphasis on innovation and premium service quality creates demand for advanced cooling systems, security technologies, and automation solutions that can command premium pricing.

Government and Regulatory Bodies benefit from a thriving data center industry that supports economic development, attracts international investment, and strengthens Switzerland’s position as a global technology hub. The sector’s growth contributes to employment creation and tax revenue while supporting the country’s digital transformation objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration has emerged as a defining trend in the Switzerland data center market, with operators increasingly investing in renewable energy sources, efficient cooling technologies, and carbon-neutral operations. This trend aligns with Switzerland’s environmental commitments and creates competitive advantages for operators who can demonstrate superior environmental performance.

Edge Computing Proliferation represents a transformative trend as organizations seek to process data closer to end users and connected devices. Swiss operators are developing distributed edge infrastructure to support 5G applications, IoT deployments, and real-time analytics requirements across various industry sectors.

Artificial Intelligence Integration is becoming increasingly prevalent in data center operations, with AI-powered systems optimizing cooling, predicting maintenance requirements, and enhancing security monitoring. These technologies enable improved operational efficiency and reduced environmental impact while supporting more sophisticated customer service offerings.

Hybrid Cloud Adoption continues to drive demand for flexible data center services that can seamlessly integrate with public cloud platforms. Swiss operators are developing hybrid-ready infrastructure and services that enable customers to optimize workload placement across on-premises and cloud environments.

Infrastructure Expansion initiatives by major operators demonstrate continued confidence in the Swiss market’s growth potential. Recent facility developments focus on hyperscale capabilities, enhanced connectivity options, and sustainable operations that meet evolving customer requirements while supporting market expansion objectives.

Technology Partnerships between data center operators and cloud service providers are creating new service delivery models and expanding market opportunities. These collaborations enable Swiss operators to offer integrated solutions that combine local infrastructure advantages with global cloud platform capabilities.

Regulatory Compliance Enhancements reflect the industry’s commitment to meeting evolving data protection and privacy requirements. Operators are investing in advanced security systems, compliance monitoring tools, and staff training programs to ensure continued adherence to Swiss and European regulatory standards.

Sustainability Initiatives include major investments in renewable energy procurement, energy-efficient cooling systems, and carbon offset programs. MWR analysis indicates that approximately 70% of Swiss data center operators have committed to carbon-neutral operations by 2030, reflecting the industry’s environmental leadership.

Strategic positioning recommendations for data center operators include focusing on high-value market segments where Switzerland’s unique advantages create sustainable competitive differentiation. Operators should emphasize security, compliance, and reliability capabilities while developing specialized services for financial services, healthcare, and government sectors that require premium infrastructure solutions.

Investment priorities should focus on edge computing infrastructure development, sustainability enhancements, and advanced connectivity options that support emerging customer requirements. Operators who can successfully combine traditional colocation services with edge computing capabilities will be well-positioned for future growth opportunities.

Customer engagement strategies should emphasize consultative selling approaches that help customers understand the value proposition of Swiss data center services compared to alternatives in other European markets. Education about compliance benefits, security advantages, and operational reliability can justify premium pricing structures.

Technology adoption recommendations include investing in AI-powered operations management, advanced cooling technologies, and software-defined infrastructure that enables flexible service delivery. These investments can improve operational efficiency while supporting more sophisticated customer service offerings that command premium pricing.

Long-term growth prospects for the Switzerland data center market remain positive, supported by continued digital transformation, increasing data generation, and Switzerland’s strategic advantages in the European market. MarkWide Research projections indicate sustained growth momentum with the market expected to maintain its 8.2% CAGR over the next five years, driven by edge computing adoption and hyperscale expansion.

Technology evolution will continue to shape market development, with quantum computing, advanced AI applications, and next-generation networking technologies creating new infrastructure requirements. Swiss operators who invest in future-ready infrastructure will be well-positioned to capture emerging opportunities in these high-growth technology segments.

Sustainability leadership will become increasingly important as customers prioritize environmental responsibility in their infrastructure decisions. Swiss operators who can demonstrate superior environmental performance while maintaining operational excellence will gain competitive advantages in both domestic and international markets.

Market consolidation trends may accelerate as smaller operators seek partnerships or acquisition opportunities to compete effectively with larger international providers. This consolidation could create opportunities for well-positioned operators to expand their market presence and service capabilities through strategic acquisitions.

Switzerland’s data center market represents a mature, sophisticated ecosystem that successfully combines premium service delivery with strategic geographic advantages and regulatory excellence. The market’s continued growth reflects Switzerland’s unique position as a stable, secure, and well-connected hub for digital infrastructure in the heart of Europe.

Key success factors for market participants include leveraging Switzerland’s regulatory advantages, investing in sustainable operations, and developing specialized services that serve the country’s concentration of high-value industries. The market’s emphasis on security, compliance, and reliability creates opportunities for operators who can deliver premium services that justify higher pricing compared to alternatives in other European markets.

Future market development will be driven by edge computing expansion, continued digital transformation across industries, and Switzerland’s commitment to environmental sustainability. Operators who can successfully navigate the balance between premium service delivery and competitive pricing while investing in next-generation technologies will be well-positioned for continued success in this dynamic and growing market.

What is Data Center?

A data center is a facility used to house computer systems and associated components, such as telecommunications and storage systems. It is essential for managing and storing large amounts of data, providing services like cloud computing, data processing, and hosting applications.

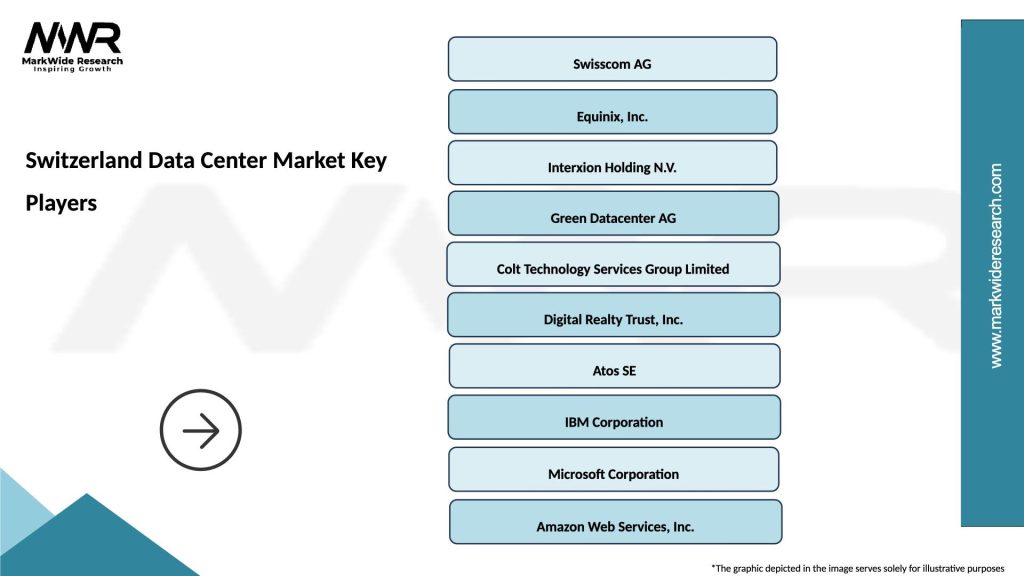

What are the key players in the Switzerland Data Center Market?

Key players in the Switzerland Data Center Market include Swisscom, Equinix, and Interxion, which provide various services such as colocation, cloud services, and managed hosting. These companies are crucial in supporting the growing demand for data storage and processing capabilities in the region, among others.

What are the growth factors driving the Switzerland Data Center Market?

The Switzerland Data Center Market is driven by factors such as the increasing demand for cloud services, the rise of big data analytics, and the need for enhanced data security. Additionally, the growth of e-commerce and digital services is contributing to the expansion of data center facilities.

What challenges does the Switzerland Data Center Market face?

The Switzerland Data Center Market faces challenges such as high energy costs, stringent regulations regarding data privacy, and the need for sustainable practices. These factors can impact operational efficiency and the overall growth of data center facilities in the region.

What opportunities exist in the Switzerland Data Center Market?

Opportunities in the Switzerland Data Center Market include the expansion of edge computing, the increasing adoption of artificial intelligence, and the growth of hybrid cloud solutions. These trends are expected to enhance service offerings and attract more investments in data center infrastructure.

What trends are shaping the Switzerland Data Center Market?

Trends shaping the Switzerland Data Center Market include the shift towards green data centers, the integration of advanced cooling technologies, and the rise of automation in data management. These innovations are aimed at improving efficiency and reducing the environmental impact of data center operations.

Switzerland Data Center Market

| Segmentation Details | Description |

|---|---|

| Type | Colocation, Managed Hosting, Cloud Services, Hybrid Solutions |

| End User | Telecommunications, Financial Services, Healthcare, E-commerce |

| Technology | Virtualization, Edge Computing, AI Integration, Network Security |

| Service Type | Disaster Recovery, Data Backup, Network Management, Compliance Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Data Center Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at