444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Switzerland data center cooling market represents a critical segment of the nation’s rapidly expanding digital infrastructure ecosystem. As Switzerland continues to establish itself as a leading European hub for data centers, the demand for advanced cooling solutions has intensified significantly. The market encompasses various cooling technologies including air-based cooling systems, liquid cooling solutions, immersion cooling, and hybrid cooling approaches designed to maintain optimal operating temperatures in data center facilities.

Market dynamics indicate robust growth driven by increasing digitalization, cloud computing adoption, and the proliferation of edge computing facilities across Switzerland. The country’s strategic location, political stability, and excellent connectivity infrastructure have attracted major technology companies to establish data center operations, creating substantial demand for efficient cooling solutions. Energy efficiency has become a paramount concern, with cooling systems accounting for approximately 40% of total data center energy consumption.

Technological advancement in cooling solutions has accelerated, with innovative approaches such as free cooling, direct liquid cooling, and AI-driven cooling management systems gaining traction. Swiss data center operators are increasingly adopting sustainable cooling practices to align with the country’s environmental objectives and reduce operational costs. The market is experiencing a shift toward more energy-efficient solutions that can handle higher heat densities generated by modern computing equipment.

The Switzerland data center cooling market refers to the comprehensive ecosystem of technologies, systems, and services designed to maintain optimal temperature and humidity conditions within data center facilities across Switzerland. This market encompasses the design, manufacturing, installation, and maintenance of cooling infrastructure that ensures reliable operation of IT equipment while minimizing energy consumption and environmental impact.

Data center cooling involves the removal of heat generated by servers, storage systems, networking equipment, and other IT infrastructure components. The cooling market includes various solution categories such as computer room air conditioning (CRAC) units, computer room air handling (CRAH) systems, chilled water systems, direct expansion cooling, liquid cooling solutions, and emerging technologies like immersion cooling and two-phase cooling systems.

Switzerland’s unique position as a data center hub in Europe has created specific market characteristics, including stringent energy efficiency requirements, emphasis on renewable energy integration, and focus on sustainable cooling practices. The market serves hyperscale data centers, colocation facilities, enterprise data centers, and edge computing installations throughout the country.

Switzerland’s data center cooling market is experiencing unprecedented growth as the country solidifies its position as a premier European data center destination. The market is characterized by increasing adoption of energy-efficient cooling technologies, driven by both regulatory requirements and operational cost considerations. Liquid cooling solutions are gaining significant momentum, with adoption rates increasing by approximately 25% annually as organizations seek to address higher heat densities from advanced computing systems.

Key market drivers include the expansion of cloud services, growth in artificial intelligence and machine learning applications, and increasing demand for edge computing capabilities. Swiss data center operators are prioritizing cooling solutions that can deliver superior energy efficiency while maintaining reliability and scalability. The market is witnessing substantial investment in research and development of next-generation cooling technologies.

Competitive landscape features both international cooling technology providers and specialized Swiss companies offering innovative solutions tailored to local market requirements. The market is expected to continue its robust growth trajectory, supported by ongoing digital transformation initiatives and Switzerland’s commitment to sustainable technology infrastructure development.

Strategic insights reveal several critical trends shaping the Switzerland data center cooling market:

Digital transformation acceleration serves as the primary catalyst driving Switzerland’s data center cooling market growth. The country’s position as a leading financial and technology hub has resulted in exponential growth in data processing requirements, necessitating advanced cooling infrastructure. Cloud computing adoption continues to surge, with Swiss enterprises increasingly migrating workloads to cloud platforms, driving demand for scalable data center facilities and corresponding cooling solutions.

Artificial intelligence and machine learning applications are generating unprecedented computational demands, requiring specialized cooling systems capable of managing higher heat densities. The proliferation of GPU-intensive workloads has created specific cooling challenges that traditional air-based systems struggle to address effectively. Edge computing expansion is creating new cooling requirements as organizations deploy distributed computing infrastructure closer to end users.

Energy cost optimization remains a critical driver, with cooling systems representing a significant portion of operational expenses. Swiss data center operators are actively seeking solutions that can reduce energy consumption while maintaining optimal performance levels. Regulatory compliance requirements related to energy efficiency and environmental impact are compelling organizations to invest in advanced cooling technologies that meet stringent standards.

Hyperscale data center development in Switzerland is driving demand for large-scale, efficient cooling solutions. Major technology companies establishing operations in the country require cooling infrastructure capable of supporting massive computational workloads while adhering to sustainability commitments.

High capital investment requirements present significant barriers to market growth, particularly for advanced cooling technologies such as liquid cooling and immersion cooling systems. The initial costs associated with implementing next-generation cooling solutions can be substantial, creating hesitation among smaller data center operators. Technical complexity of modern cooling systems requires specialized expertise for design, installation, and maintenance, limiting adoption among organizations lacking technical resources.

Infrastructure compatibility challenges arise when upgrading existing data centers with new cooling technologies. Legacy facilities may require extensive modifications to accommodate advanced cooling systems, increasing implementation costs and complexity. Maintenance requirements for sophisticated cooling systems can be demanding, requiring specialized technicians and potentially increasing operational overhead.

Space constraints in urban Swiss locations limit the deployment of certain cooling technologies that require additional floor space or external equipment. Regulatory complexity surrounding environmental standards and building codes can create implementation challenges for cooling system installations. Risk aversion among some organizations may limit adoption of newer cooling technologies due to concerns about reliability and proven performance.

Supply chain dependencies for specialized cooling components can create vulnerabilities, particularly for advanced liquid cooling systems that rely on specific materials and components. Skills shortage in specialized cooling system design and maintenance can constrain market growth and increase operational costs.

Sustainability initiatives present substantial opportunities for innovative cooling solution providers. Switzerland’s commitment to carbon neutrality and environmental stewardship creates demand for eco-friendly cooling technologies that minimize environmental impact. Waste heat recovery systems offer opportunities to capture and utilize heat generated by data centers for district heating or other applications, creating additional value streams.

Liquid cooling technology advancement represents a significant growth opportunity as organizations seek solutions for high-density computing environments. The increasing deployment of artificial intelligence and high-performance computing workloads creates specific cooling requirements that liquid cooling systems can address more effectively than traditional air cooling. Immersion cooling technologies are emerging as viable solutions for specific applications, offering opportunities for specialized providers.

Edge computing proliferation creates opportunities for compact, efficient cooling solutions designed for distributed data center environments. Modular cooling systems that can scale with growing computational demands offer flexibility advantages that appeal to dynamic business environments. Smart cooling management systems incorporating artificial intelligence and IoT technologies present opportunities for enhanced efficiency and predictive maintenance capabilities.

Retrofit and modernization projects in existing data centers create substantial market opportunities as operators seek to improve efficiency and capacity. Hybrid cooling solutions that combine multiple technologies offer optimization opportunities for diverse operational requirements.

Market dynamics in Switzerland’s data center cooling sector are characterized by rapid technological evolution and increasing performance demands. The interplay between energy efficiency requirements, computational density growth, and sustainability objectives is reshaping cooling solution preferences. Innovation cycles are accelerating as cooling technology providers compete to deliver solutions that address multiple market requirements simultaneously.

Competitive pressures are intensifying as data center operators seek cooling solutions that provide competitive advantages through improved efficiency, reliability, and scalability. The market is experiencing consolidation as larger cooling technology providers acquire specialized companies to expand their solution portfolios. Customer expectations are evolving toward comprehensive cooling solutions that integrate seamlessly with existing infrastructure while providing advanced monitoring and management capabilities.

Technology convergence is creating new market dynamics as cooling systems integrate with broader data center infrastructure management platforms. Service model evolution is shifting toward comprehensive cooling-as-a-service offerings that include design, installation, maintenance, and optimization services. Partnership strategies between cooling technology providers and data center operators are becoming more strategic and long-term focused.

Market maturation is evident in the standardization of certain cooling technologies while emerging solutions continue to disrupt traditional approaches. Regional specialization is developing as Swiss market requirements create unique solution characteristics that differ from other European markets.

Comprehensive market analysis for the Switzerland data center cooling market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research involves extensive interviews with key stakeholders including data center operators, cooling technology providers, system integrators, and industry experts. Direct engagement with market participants provides real-time insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling techniques to project market trends and identify growth patterns. Qualitative assessment provides deeper understanding of market dynamics, competitive positioning, and strategic implications.

Data triangulation methods ensure research accuracy by cross-referencing information from multiple sources and validating findings through different analytical approaches. Expert validation processes involve review of research findings by industry specialists to confirm accuracy and relevance. Continuous monitoring of market developments ensures research remains current and reflects evolving market conditions.

Technology assessment includes evaluation of emerging cooling technologies and their potential market impact. Regulatory analysis examines current and proposed regulations affecting data center cooling requirements in Switzerland.

Switzerland’s data center cooling market exhibits distinct regional characteristics driven by geographic, economic, and infrastructure factors. Zurich region dominates the market with approximately 45% market share, benefiting from its status as Switzerland’s financial capital and major technology hub. The area’s concentration of multinational corporations, financial institutions, and technology companies creates substantial demand for advanced data center cooling solutions.

Geneva region represents the second-largest market segment, accounting for approximately 25% of market activity. The area’s international organizations, research institutions, and growing technology sector drive demand for sophisticated cooling infrastructure. Basel region contributes approximately 15% of market share, supported by pharmaceutical and chemical industries requiring specialized data center capabilities.

Central Switzerland is emerging as a significant market segment, with regions around Lucerne and Zug experiencing rapid data center development. The area’s strategic location and favorable business environment are attracting data center investments, creating new cooling infrastructure requirements. Eastern Switzerland markets are developing steadily, driven by manufacturing industries and growing technology adoption.

Climate considerations vary across regions, influencing cooling solution preferences and efficiency potential. Northern regions benefit from cooler ambient temperatures that enhance free cooling opportunities, while southern areas may require more intensive mechanical cooling systems. Infrastructure availability and energy costs also vary regionally, affecting cooling technology selection and implementation strategies.

Switzerland’s data center cooling market features a diverse competitive landscape combining international technology leaders with specialized regional providers. Market leadership is distributed among several key players, each offering distinct technological advantages and market positioning strategies.

Competitive strategies focus on energy efficiency, sustainability, and technological innovation. Companies are investing heavily in research and development to create next-generation cooling solutions that address evolving market requirements. Strategic partnerships between cooling providers and data center operators are becoming increasingly common, enabling customized solution development and long-term collaboration.

Technology segmentation of Switzerland’s data center cooling market reveals diverse solution categories addressing different operational requirements:

By Cooling Type:

By Application:

By Component:

Air-based cooling systems continue to dominate the Switzerland market despite growing competition from liquid cooling technologies. Precision air conditioning units remain the standard for most data center applications, offering proven reliability and established maintenance practices. However, efficiency limitations are driving gradual migration toward more advanced solutions, particularly in high-density computing environments.

Liquid cooling technologies are experiencing rapid growth, with direct liquid cooling systems gaining particular traction in artificial intelligence and high-performance computing applications. Immersion cooling is emerging as a viable solution for specific use cases, offering superior cooling efficiency and reduced energy consumption. The technology category is expected to achieve 35% annual growth as organizations seek solutions for increasingly dense computing workloads.

Free cooling systems leverage Switzerland’s favorable climate conditions to reduce mechanical cooling requirements. Economizer technology integration is becoming standard practice, with many facilities achieving significant energy savings through intelligent free cooling management. Hybrid approaches combining free cooling with mechanical systems are optimizing efficiency across varying seasonal conditions.

Smart cooling management systems incorporating artificial intelligence and machine learning are gaining adoption for predictive maintenance and optimization capabilities. IoT integration enables real-time monitoring and automated adjustment of cooling parameters based on computational demands and environmental conditions.

Data center operators benefit significantly from advanced cooling solutions through reduced operational costs and improved reliability. Energy efficiency improvements can reduce cooling-related energy consumption by 30-50% compared to traditional systems, resulting in substantial cost savings and environmental impact reduction. Enhanced reliability from modern cooling systems minimizes downtime risks and ensures consistent performance of critical IT infrastructure.

Technology providers gain competitive advantages through innovative cooling solutions that address evolving market requirements. Market differentiation opportunities arise from developing specialized solutions for specific applications such as artificial intelligence, edge computing, or hyperscale environments. Service revenue potential increases through comprehensive cooling-as-a-service offerings that provide ongoing value to customers.

End users benefit from improved application performance and reduced infrastructure costs. Scalability advantages enable organizations to expand computational capacity without proportional increases in cooling infrastructure investment. Sustainability benefits align with corporate environmental objectives and regulatory compliance requirements.

System integrators capitalize on growing demand for complex cooling system design and implementation services. Expertise development in advanced cooling technologies creates competitive advantages and premium service opportunities. Long-term relationships with data center operators provide stable revenue streams through maintenance and optimization services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Liquid cooling adoption represents the most significant trend transforming Switzerland’s data center cooling market. Direct liquid cooling systems are becoming mainstream for high-performance computing applications, with adoption rates increasing rapidly as organizations seek solutions for GPU-intensive workloads. Immersion cooling is gaining attention for specific applications requiring maximum cooling efficiency and minimal space utilization.

Artificial intelligence integration in cooling management systems is revolutionizing operational efficiency. Predictive analytics enable proactive maintenance scheduling and optimization of cooling parameters based on computational demand patterns. Machine learning algorithms continuously improve cooling system performance through automated adjustments and pattern recognition.

Sustainability focus is driving adoption of eco-friendly cooling solutions and waste heat recovery systems. Carbon neutrality commitments from major data center operators are accelerating investment in renewable energy-powered cooling systems. Circular economy principles are influencing cooling system design to maximize resource efficiency and minimize environmental impact.

Modular cooling architectures are gaining popularity for their scalability and flexibility advantages. Containerized cooling solutions enable rapid deployment and easy capacity expansion. Edge computing proliferation is creating demand for compact, efficient cooling solutions designed for distributed environments.

Recent industry developments highlight the dynamic nature of Switzerland’s data center cooling market. Major technology providers have announced significant investments in liquid cooling technology development, with several companies launching new product lines specifically designed for high-density computing applications. Strategic partnerships between cooling technology providers and data center operators are becoming more common, enabling collaborative development of customized solutions.

Regulatory developments include updated energy efficiency standards and environmental regulations affecting data center cooling requirements. Government initiatives supporting digital infrastructure development are creating favorable conditions for cooling technology investment and innovation. Research collaborations between universities and industry participants are advancing cooling technology capabilities.

Market consolidation activities include acquisitions of specialized cooling technology companies by larger infrastructure providers. Technology breakthroughs in areas such as two-phase cooling and advanced heat exchanger design are creating new market opportunities. Sustainability certifications and green building standards are influencing cooling system selection criteria.

Investment announcements from major data center operators include commitments to advanced cooling infrastructure as part of facility expansion plans. Innovation centers and testing facilities are being established to accelerate cooling technology development and validation.

Market participants should prioritize investment in liquid cooling technologies to address growing demand for high-density computing solutions. MarkWide Research analysis indicates that organizations investing early in liquid cooling capabilities will gain significant competitive advantages as market adoption accelerates. Technology providers should focus on developing integrated solutions that combine cooling efficiency with intelligent management capabilities.

Data center operators should evaluate hybrid cooling approaches that optimize efficiency across diverse workload requirements. Sustainability integration should be prioritized in cooling system selection to align with environmental objectives and regulatory requirements. Partnership strategies with specialized cooling providers can accelerate access to advanced technologies and expertise.

Investment focus should emphasize solutions that address multiple market requirements simultaneously, including energy efficiency, scalability, and reliability. Skills development in advanced cooling technologies should be prioritized to address market talent shortages. Regulatory compliance capabilities should be integrated into solution development to ensure market access and acceptance.

Innovation investment in emerging technologies such as immersion cooling and AI-driven management systems will create future market opportunities. Service model evolution toward comprehensive cooling-as-a-service offerings can provide competitive differentiation and recurring revenue streams.

Switzerland’s data center cooling market is positioned for sustained growth driven by accelerating digital transformation and increasing computational demands. Market expansion is expected to continue at a robust pace, with liquid cooling technologies achieving mainstream adoption across diverse applications. Technology evolution will focus on enhanced efficiency, sustainability, and intelligent management capabilities.

Liquid cooling adoption is projected to reach 60% of new data center installations within the next five years as organizations seek solutions for AI and high-performance computing workloads. Free cooling integration will become standard practice, leveraging Switzerland’s climate advantages for energy efficiency optimization. Edge computing growth will create new market segments requiring specialized cooling solutions.

Sustainability requirements will increasingly influence cooling technology selection, with carbon-neutral solutions becoming market differentiators. Artificial intelligence integration in cooling management will advance significantly, enabling autonomous optimization and predictive maintenance capabilities. Modular architectures will gain popularity for their flexibility and scalability advantages.

Market consolidation is expected to continue as larger providers acquire specialized technologies and capabilities. Innovation acceleration will focus on breakthrough technologies such as quantum cooling and advanced materials applications. Service model evolution toward comprehensive managed cooling services will reshape competitive dynamics and customer relationships.

Switzerland’s data center cooling market represents a dynamic and rapidly evolving sector driven by technological advancement, sustainability requirements, and growing computational demands. The market’s transformation from traditional air-based cooling toward advanced liquid cooling solutions reflects the broader evolution of data center infrastructure to support next-generation applications and workloads.

Key success factors for market participants include technological innovation, sustainability integration, and comprehensive service capabilities. The market’s future growth will be supported by continued digital transformation, edge computing proliferation, and increasing adoption of artificial intelligence applications requiring specialized cooling solutions. Strategic positioning in liquid cooling technologies and intelligent management systems will be critical for long-term competitive success.

Market opportunities remain substantial across multiple segments, from hyperscale data centers to edge computing facilities. The combination of Switzerland’s strategic advantages, technological capabilities, and commitment to sustainability creates favorable conditions for continued market expansion and innovation. Organizations that successfully navigate the evolving technology landscape while addressing sustainability and efficiency requirements will be best positioned to capitalize on the market’s growth potential.

What is Data Center Cooling?

Data Center Cooling refers to the methods and technologies used to maintain optimal temperature and humidity levels in data centers, ensuring the efficient operation of servers and IT equipment. Effective cooling is crucial for preventing overheating and ensuring reliability in data center operations.

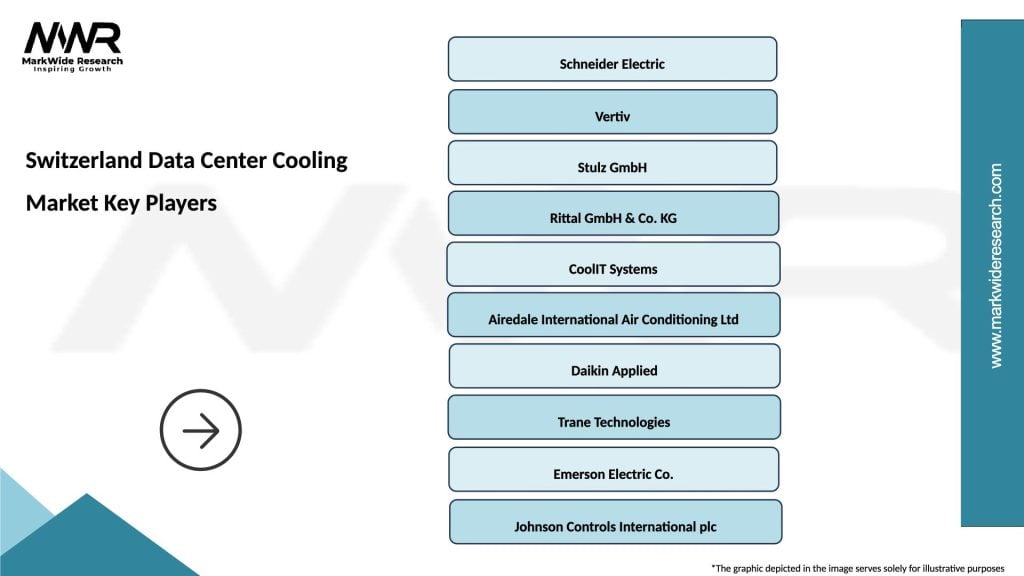

What are the key players in the Switzerland Data Center Cooling Market?

Key players in the Switzerland Data Center Cooling Market include companies like Schneider Electric, Vertiv, and Stulz, which provide innovative cooling solutions tailored for data centers. These companies focus on energy efficiency and advanced cooling technologies, among others.

What are the main drivers of the Switzerland Data Center Cooling Market?

The main drivers of the Switzerland Data Center Cooling Market include the increasing demand for data storage and processing, the rise of cloud computing, and the need for energy-efficient cooling solutions. Additionally, the growth of big data analytics is pushing the need for advanced cooling technologies.

What challenges does the Switzerland Data Center Cooling Market face?

Challenges in the Switzerland Data Center Cooling Market include the high costs associated with advanced cooling technologies and the complexity of integrating these systems into existing infrastructures. Furthermore, regulatory pressures regarding energy consumption can also pose challenges.

What opportunities exist in the Switzerland Data Center Cooling Market?

Opportunities in the Switzerland Data Center Cooling Market include the development of sustainable cooling solutions and the integration of AI and IoT technologies for smarter cooling management. Additionally, the increasing focus on green data centers presents significant growth potential.

What trends are shaping the Switzerland Data Center Cooling Market?

Trends shaping the Switzerland Data Center Cooling Market include the adoption of liquid cooling technologies, the use of modular cooling systems, and the emphasis on energy efficiency. These trends are driven by the need for higher performance and lower operational costs in data centers.

Switzerland Data Center Cooling Market

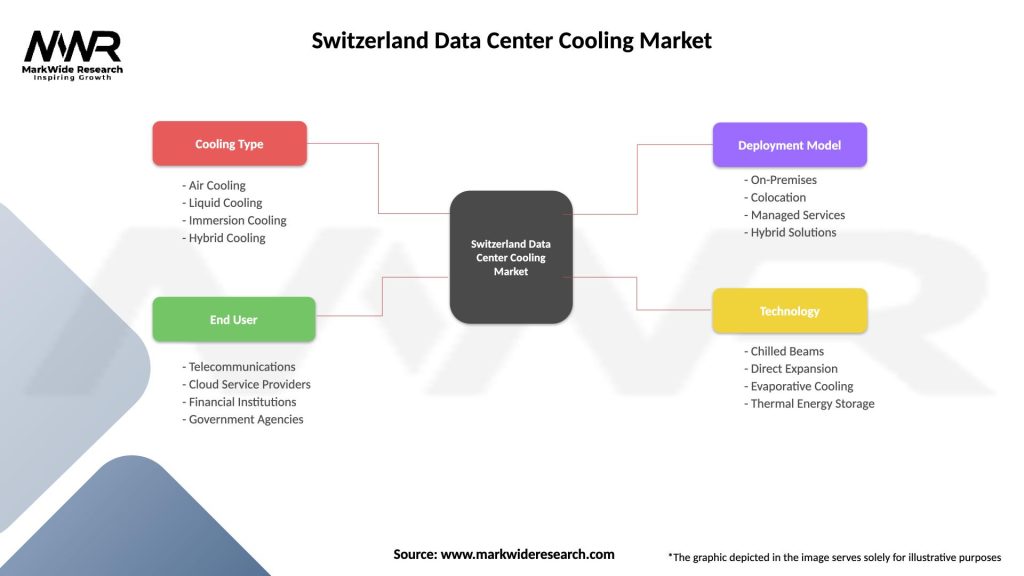

| Segmentation Details | Description |

|---|---|

| Cooling Type | Air Cooling, Liquid Cooling, Immersion Cooling, Hybrid Cooling |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Deployment Model | On-Premises, Colocation, Managed Services, Hybrid Solutions |

| Technology | Chilled Beams, Direct Expansion, Evaporative Cooling, Thermal Energy Storage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Switzerland Data Center Cooling Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at