444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Sweden rechargeable battery market represents a dynamic and rapidly evolving sector within the Nordic region’s clean energy ecosystem. Sweden’s commitment to sustainable energy solutions and carbon neutrality by 2045 has positioned the country as a leading hub for advanced battery technologies and energy storage systems. The market encompasses various battery chemistries including lithium-ion, nickel-metal hydride, and emerging solid-state technologies across multiple applications from consumer electronics to electric vehicles and grid-scale energy storage.

Market growth in Sweden has been particularly robust, driven by the country’s strong automotive industry transformation and ambitious renewable energy targets. The rechargeable battery sector is experiencing significant expansion with a projected compound annual growth rate (CAGR) of 12.8% through the forecast period. Swedish manufacturers and international companies have established substantial operations in the country, leveraging Sweden’s abundant renewable energy resources, skilled workforce, and supportive regulatory environment.

Government initiatives including substantial investments in battery research and development, coupled with favorable policies for electric vehicle adoption, have created a conducive environment for market expansion. The presence of major automotive manufacturers like Volvo and innovative battery companies has further strengthened Sweden’s position in the global rechargeable battery value chain.

The Sweden rechargeable battery market refers to the comprehensive ecosystem of secondary battery technologies that can be recharged and reused multiple times, encompassing manufacturing, distribution, and application across various sectors within Swedish territory. This market includes diverse battery chemistries such as lithium-ion, lithium-polymer, nickel-metal hydride, and emerging next-generation technologies designed for applications ranging from portable consumer devices to large-scale energy storage systems and electric vehicle powertrains.

Rechargeable batteries in the Swedish context represent critical components enabling the country’s transition toward electrification and renewable energy integration. These energy storage solutions facilitate the efficient utilization of Sweden’s abundant hydroelectric and wind power resources while supporting the decarbonization of transportation and industrial sectors. The market encompasses both domestic production capabilities and import activities, serving local demand while contributing to Sweden’s export economy through advanced battery technologies and components.

Sweden’s rechargeable battery market stands at the forefront of the Nordic region’s clean energy transformation, characterized by robust growth dynamics and strategic positioning within the global battery value chain. The market benefits from Sweden’s unique combination of abundant renewable energy resources, advanced manufacturing capabilities, and strong government support for sustainable technologies. Key market drivers include the accelerating adoption of electric vehicles, expanding renewable energy installations requiring storage solutions, and growing demand for portable electronic devices.

Market segmentation reveals diverse applications with automotive batteries representing the fastest-growing segment, driven by Sweden’s commitment to phasing out internal combustion engines. Consumer electronics continue to maintain a significant market share, while industrial and grid-scale applications are emerging as high-potential segments. Lithium-ion technology dominates the market with approximately 78% market share, though alternative chemistries are gaining traction for specific applications.

Competitive landscape features a mix of international battery manufacturers, Swedish technology companies, and emerging startups focused on next-generation battery solutions. The market outlook remains highly positive, supported by continued government investments, technological advancements, and Sweden’s strategic position as a gateway to the broader European market.

Strategic insights into Sweden’s rechargeable battery market reveal several critical trends shaping the industry’s trajectory:

Primary market drivers propelling Sweden’s rechargeable battery market forward encompass both regulatory and technological factors that create sustained demand across multiple sectors. Government policies supporting electric vehicle adoption through substantial subsidies and tax incentives have accelerated consumer acceptance and market penetration. Sweden’s ambitious climate targets, including achieving carbon neutrality by 2045, necessitate widespread electrification of transportation and energy storage solutions.

Automotive industry transformation represents the most significant driver, with major Swedish manufacturers like Volvo committing to all-electric vehicle lineups. This transition requires substantial battery capacity and has attracted international battery manufacturers to establish operations in Sweden. Consumer behavior changes toward sustainable transportation options, supported by expanding charging infrastructure, continue to drive electric vehicle adoption rates.

Renewable energy expansion creates substantial demand for grid-scale battery storage systems to manage intermittency and optimize energy distribution. Sweden’s abundant hydroelectric resources, combined with growing wind power installations, require sophisticated energy storage solutions to maximize efficiency and grid stability. Industrial electrification across mining, forestry, and manufacturing sectors is driving demand for high-performance battery systems in heavy-duty applications.

Technological advancements in battery chemistry, energy density, and charging speeds continue to expand application possibilities and market opportunities. The growing Internet of Things ecosystem and smart device proliferation maintain steady demand for consumer battery applications.

Market constraints affecting Sweden’s rechargeable battery sector include several challenges that may impact growth trajectories and market development. Raw material supply dependencies, particularly for lithium, cobalt, and rare earth elements, create potential supply chain vulnerabilities and price volatility concerns. Sweden’s reliance on imported battery materials and components exposes the market to geopolitical risks and trade disruptions.

High capital requirements for battery manufacturing facilities and research and development activities can limit market entry for smaller companies and slow capacity expansion. The complex regulatory environment surrounding battery safety, transportation, and disposal creates compliance challenges and additional costs for market participants. Technology standardization issues across different battery chemistries and applications can create market fragmentation and interoperability concerns.

Environmental concerns related to battery production, particularly mining activities for raw materials, face increasing scrutiny from environmental groups and regulatory bodies. Recycling infrastructure limitations pose challenges for end-of-life battery management and circular economy objectives. The rapid pace of technological change can lead to premature obsolescence of existing battery technologies and manufacturing investments.

Competition from alternative technologies such as hydrogen fuel cells and advanced capacitors may limit market expansion in certain applications. Consumer price sensitivity in some market segments can slow adoption rates despite improving battery performance and declining costs.

Significant opportunities exist within Sweden’s rechargeable battery market, driven by emerging applications and technological innovations that promise substantial growth potential. Grid-scale energy storage represents a major opportunity as Sweden continues expanding renewable energy capacity and requires sophisticated storage solutions for grid balancing and energy security. The development of vehicle-to-grid technologies creates new revenue streams for electric vehicle owners while supporting grid stability.

Battery recycling and second-life applications present substantial opportunities as the first generation of electric vehicle batteries reaches end-of-life status. Sweden’s expertise in sustainable technologies and circular economy principles positions the country well to develop advanced recycling capabilities and create value from used batteries. Industrial electrification across Sweden’s mining, forestry, and manufacturing sectors offers significant market expansion potential for specialized battery applications.

Export opportunities to neighboring Nordic and European countries leverage Sweden’s technological expertise and manufacturing capabilities. The development of solid-state battery technologies and next-generation chemistries could position Swedish companies as global leaders in advanced energy storage solutions. Smart city initiatives and Internet of Things applications create demand for diverse battery solutions across urban infrastructure and connected devices.

Collaboration opportunities with research institutions and international partners can accelerate technology development and market access. The growing marine electrification sector, including electric ferries and cargo vessels, represents an emerging application area where Sweden’s maritime expertise could drive battery innovation.

Market dynamics within Sweden’s rechargeable battery sector reflect complex interactions between technological innovation, regulatory frameworks, and evolving consumer preferences. Supply and demand equilibrium is influenced by rapid growth in electric vehicle adoption, which currently outpaces domestic battery production capacity, creating opportunities for both imports and local manufacturing expansion. The market exhibits strong seasonal variations, particularly in consumer electronics segments, with peak demand during holiday periods.

Price dynamics demonstrate a general downward trend in battery costs, with lithium-ion battery prices declining by approximately 15% annually over recent years. This cost reduction enables broader market adoption while pressuring manufacturers to achieve economies of scale and operational efficiencies. Technology cycles create periodic market disruptions as new battery chemistries and form factors emerge, requiring continuous adaptation by market participants.

Competitive dynamics feature intense competition between established international manufacturers and emerging Swedish technology companies. MarkWide Research analysis indicates that market consolidation trends are emerging as companies seek to achieve critical mass and vertical integration capabilities. Innovation cycles are accelerating, with new battery technologies moving from laboratory to commercial applications more rapidly than historically observed.

Regulatory dynamics continue evolving as government policies adapt to technological advances and environmental objectives. The interplay between European Union regulations and Swedish national policies creates both opportunities and compliance challenges for market participants.

Comprehensive research methodology employed for analyzing Sweden’s rechargeable battery market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with key industry stakeholders, including battery manufacturers, automotive companies, energy storage system integrators, and government officials responsible for energy policy development.

Secondary research encompasses extensive analysis of industry reports, government publications, patent filings, and academic research papers related to battery technologies and market trends. Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and competitive positioning based on historical data and identified trend patterns.

Market sizing methodology employs bottom-up and top-down approaches to validate market estimates and ensure consistency across different analytical perspectives. Competitive intelligence gathering includes analysis of company financial reports, product announcements, strategic partnerships, and investment activities within the Swedish battery ecosystem.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research findings accuracy and reliability. Trend analysis incorporates both quantitative metrics and qualitative insights to identify emerging patterns and future market directions. The methodology ensures comprehensive coverage of all major market segments, applications, and geographic regions within Sweden.

Regional distribution within Sweden’s rechargeable battery market reveals distinct geographic patterns influenced by industrial concentrations, population centers, and infrastructure development. Stockholm region dominates market activity with approximately 35% market share, driven by high concentrations of technology companies, research institutions, and affluent consumers adopting electric vehicles and advanced electronic devices.

Gothenburg area represents a significant market hub, accounting for roughly 28% of market activity, primarily due to the presence of major automotive manufacturers and related supply chain companies. The region’s strong industrial base and port facilities support both domestic consumption and export activities. Malmö and southern Sweden contribute approximately 18% of market demand, benefiting from proximity to European markets and cross-border economic activities.

Northern Sweden presents unique opportunities in mining and forestry applications, where battery-powered equipment adoption is accelerating due to environmental regulations and operational efficiency benefits. The region’s abundant renewable energy resources also support potential battery manufacturing operations. Central Sweden maintains steady market presence through diverse industrial applications and growing renewable energy storage installations.

Infrastructure development varies significantly across regions, with urban areas featuring extensive electric vehicle charging networks while rural areas present both challenges and opportunities for battery technology deployment. Regional specialization is emerging, with different areas focusing on specific battery applications and value chain components.

Competitive environment within Sweden’s rechargeable battery market features a diverse mix of international corporations, domestic technology companies, and innovative startups competing across different market segments and applications. Market leadership is distributed among several key players, each with distinct competitive advantages and strategic positioning.

Competitive strategies vary significantly, with some companies focusing on cost leadership while others emphasize technology differentiation and premium positioning. Strategic partnerships between battery manufacturers and automotive companies are increasingly common, creating integrated supply chains and shared development risks.

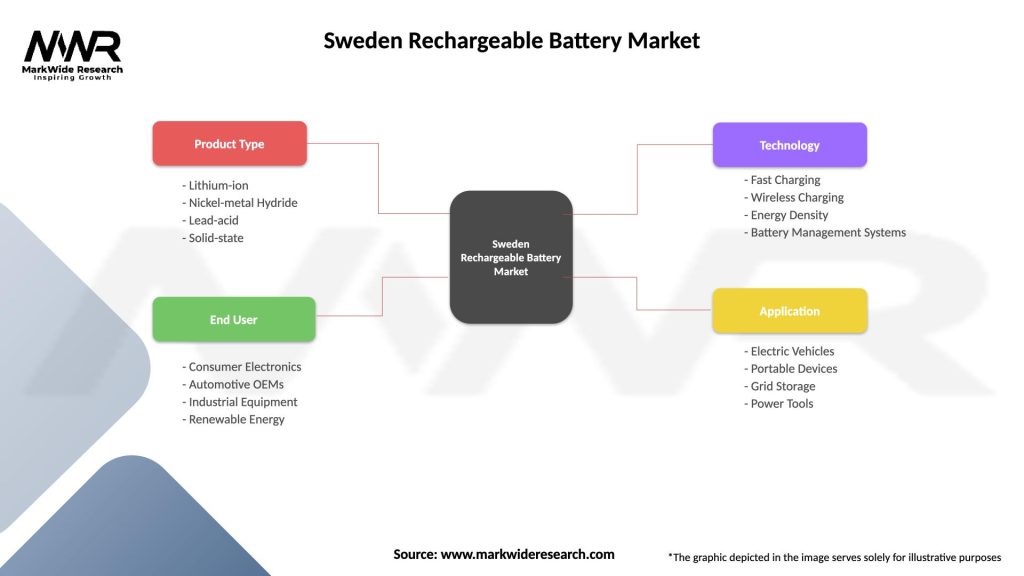

Market segmentation analysis reveals distinct categories within Sweden’s rechargeable battery market, each with unique characteristics, growth patterns, and competitive dynamics. By Technology:

By Application:

By Capacity Range:

Automotive battery category demonstrates exceptional growth momentum, driven by Sweden’s commitment to electric vehicle adoption and supportive government policies. Electric vehicle batteries require sophisticated thermal management systems and high energy density to meet Swedish climate conditions and consumer expectations for driving range. The segment benefits from substantial investments in charging infrastructure and favorable tax policies promoting electric vehicle ownership.

Consumer electronics category maintains steady growth, supported by continuous device innovation and replacement cycles. Smartphone batteries represent the largest volume segment, while laptop and tablet applications drive higher-value opportunities. Swedish consumers demonstrate strong preference for premium devices with advanced battery performance and fast-charging capabilities.

Energy storage systems category is experiencing rapid expansion as Sweden integrates increasing amounts of renewable energy into the grid. Residential storage systems are gaining popularity among homeowners seeking energy independence and cost optimization. Commercial and industrial storage applications provide grid services and demand management capabilities.

Industrial equipment category shows significant potential in Sweden’s mining and forestry sectors, where environmental regulations and operational efficiency drive electrification trends. Heavy-duty applications require specialized battery designs capable of withstanding harsh operating conditions while delivering reliable performance.

Industry participants in Sweden’s rechargeable battery market enjoy numerous strategic advantages and benefits that enhance competitive positioning and growth opportunities. Government support through research grants, tax incentives, and favorable regulations creates a conducive business environment for battery manufacturers and technology developers. Sweden’s commitment to carbon neutrality provides long-term market visibility and investment security.

Access to renewable energy at competitive rates enables cost-effective battery manufacturing operations while supporting sustainability objectives. Sweden’s skilled workforce and strong educational institutions provide access to qualified engineers and researchers essential for battery technology development. Strategic location within Europe facilitates market access to neighboring countries and efficient supply chain management.

Stakeholder benefits extend beyond direct industry participants to include:

Innovation ecosystem benefits include knowledge sharing, technology transfer, and collaborative development opportunities that accelerate market advancement and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping Sweden’s rechargeable battery market reflect broader technological evolution and changing consumer preferences across multiple sectors. Solid-state battery development represents a significant technological shift promising improved safety, energy density, and charging speeds. Swedish research institutions and companies are actively pursuing solid-state technologies with potential commercial applications within the next decade.

Circular economy integration is becoming increasingly important as Sweden emphasizes sustainable manufacturing and end-of-life battery management. Battery recycling capabilities are expanding rapidly, with new facilities planned to process growing volumes of spent batteries and recover valuable materials. Second-life applications for automotive batteries are gaining traction in stationary energy storage markets.

Digitalization and smart battery management systems are enhancing battery performance, safety, and lifespan through advanced monitoring and control capabilities. Artificial intelligence integration enables predictive maintenance and optimization of battery operations across various applications. Vehicle-to-grid technologies are emerging as electric vehicles become mobile energy storage assets supporting grid stability.

Sustainability focus is driving demand for ethically sourced materials and carbon-neutral manufacturing processes. MWR research indicates that 65% of Swedish consumers consider environmental impact when making battery-powered device purchases. Fast-charging technologies continue advancing, with ultra-rapid charging capabilities becoming standard expectations across applications.

Recent industry developments within Sweden’s rechargeable battery market demonstrate accelerating innovation and strategic positioning for future growth. Northvolt’s expansion of manufacturing capacity represents the largest battery production investment in European history, with plans to supply major automotive manufacturers across the continent. The company’s focus on sustainable manufacturing using renewable energy aligns with Sweden’s environmental objectives.

Strategic partnerships between Swedish companies and international battery manufacturers are creating technology transfer opportunities and market access advantages. Volvo’s battery development initiatives include substantial investments in next-generation battery technologies and manufacturing capabilities. Government funding programs have allocated significant resources to battery research and development projects at Swedish universities and research institutions.

Infrastructure developments include expansion of electric vehicle charging networks and grid-scale energy storage installations supporting renewable energy integration. Recycling facility investments are establishing Sweden as a regional hub for battery material recovery and circular economy applications. International collaborations with European partners are advancing battery technology standardization and supply chain coordination.

Regulatory developments include updated safety standards, environmental regulations, and support policies for electric vehicle adoption and energy storage deployment. Innovation hubs and incubator programs are fostering startup development in battery technologies and related applications.

Strategic recommendations for stakeholders in Sweden’s rechargeable battery market emphasize the importance of positioning for long-term growth while addressing current market challenges. Investment priorities should focus on developing domestic supply chain capabilities, particularly in critical material processing and battery recycling infrastructure. Companies should leverage Sweden’s renewable energy advantages to establish cost-competitive and sustainable manufacturing operations.

Technology development efforts should concentrate on next-generation battery chemistries, particularly solid-state technologies and advanced lithium-ion variants offering improved performance characteristics. Strategic partnerships with international companies can provide access to established markets and manufacturing expertise while maintaining Swedish innovation capabilities.

Market expansion strategies should target high-growth applications including electric vehicles, energy storage systems, and industrial equipment electrification. Export opportunities within Europe present significant potential for Swedish battery technologies and components. Sustainability positioning should be emphasized as a competitive differentiator in global markets increasingly focused on environmental responsibility.

Risk management strategies should address supply chain vulnerabilities through diversification and strategic stockpiling of critical materials. Regulatory compliance capabilities must be developed to navigate evolving safety and environmental standards across multiple markets.

Future prospects for Sweden’s rechargeable battery market remain exceptionally positive, supported by favorable market dynamics, technological advancement, and strong policy support. Market growth is projected to accelerate through the forecast period, with electric vehicle adoption driving the majority of demand expansion. MarkWide Research projections indicate that the automotive battery segment will achieve compound annual growth rates exceeding 18% as Sweden transitions toward electric mobility.

Technology evolution will continue reshaping market dynamics, with solid-state batteries expected to achieve commercial viability within the next five to seven years. Energy storage applications will expand significantly as Sweden integrates increasing amounts of renewable energy and develops smart grid capabilities. Industrial electrification trends will create new market opportunities in mining, forestry, and marine applications.

Manufacturing capacity expansion will reduce Sweden’s dependence on imported batteries while creating export opportunities to neighboring European markets. Circular economy development will establish Sweden as a leader in sustainable battery lifecycle management and material recovery. Innovation ecosystem growth will attract international investment and talent, further strengthening Sweden’s competitive position.

Market consolidation may occur as companies seek scale advantages and vertical integration opportunities. Government support is expected to continue through the energy transition period, providing stability and investment confidence for market participants.

Sweden’s rechargeable battery market represents a dynamic and rapidly evolving sector positioned at the forefront of the global energy transition. The market benefits from unique advantages including abundant renewable energy resources, strong government support, skilled workforce, and strategic location within Europe. Growth prospects remain exceptionally strong, driven by accelerating electric vehicle adoption, expanding renewable energy storage requirements, and increasing industrial electrification across key Swedish sectors.

Market challenges including raw material dependencies, intense international competition, and technology disruption risks require strategic responses and continuous innovation. However, Sweden’s commitment to sustainability, technological excellence, and circular economy principles provides a solid foundation for long-term market success. Industry participants who leverage Sweden’s competitive advantages while addressing market challenges through strategic partnerships and technology development will be well-positioned for future growth.

The rechargeable battery market in Sweden will continue playing a crucial role in the country’s transition toward carbon neutrality while contributing to economic development and technological leadership. Future success will depend on maintaining innovation momentum, developing sustainable supply chains, and capitalizing on emerging opportunities in next-generation battery technologies and applications.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

Who are the key players in the Sweden Rechargeable Battery Market?

Key players in the Sweden Rechargeable Battery Market include Northvolt, A123 Systems, and Samsung SDI, among others. These companies are involved in the production and development of advanced battery technologies for various applications.

What are the main drivers of the Sweden Rechargeable Battery Market?

The main drivers of the Sweden Rechargeable Battery Market include the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology that enhance performance and efficiency.

What challenges does the Sweden Rechargeable Battery Market face?

The Sweden Rechargeable Battery Market faces challenges such as supply chain disruptions, high production costs, and environmental concerns related to battery disposal and recycling.

What opportunities exist in the Sweden Rechargeable Battery Market?

Opportunities in the Sweden Rechargeable Battery Market include the expansion of electric vehicle infrastructure, innovations in battery recycling technologies, and the increasing integration of batteries in renewable energy systems.

What trends are shaping the Sweden Rechargeable Battery Market?

Trends shaping the Sweden Rechargeable Battery Market include the shift towards solid-state batteries, the rise of battery-as-a-service models, and the growing focus on sustainability and eco-friendly battery solutions.

Sweden Rechargeable Battery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Automotive OEMs, Industrial Equipment, Renewable Energy |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Electric Vehicles, Portable Devices, Grid Storage, Power Tools |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Sweden Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at